Global Telemedicine Market Size, Share, Trends & Growth Forecast Report Segmented By Type (Technology and Service), Application (Tele-Cardiology, Tele-Radiology, Tele-Pathology, Tele-Dermatology, Tele-Neurology, Emergency Care, Home Health and Others), Delivery Mode (Web-based, Cloud-based and Others), End User & Region, Industry Analysis From 2025 to 2033

Global Telemedicine Market Size

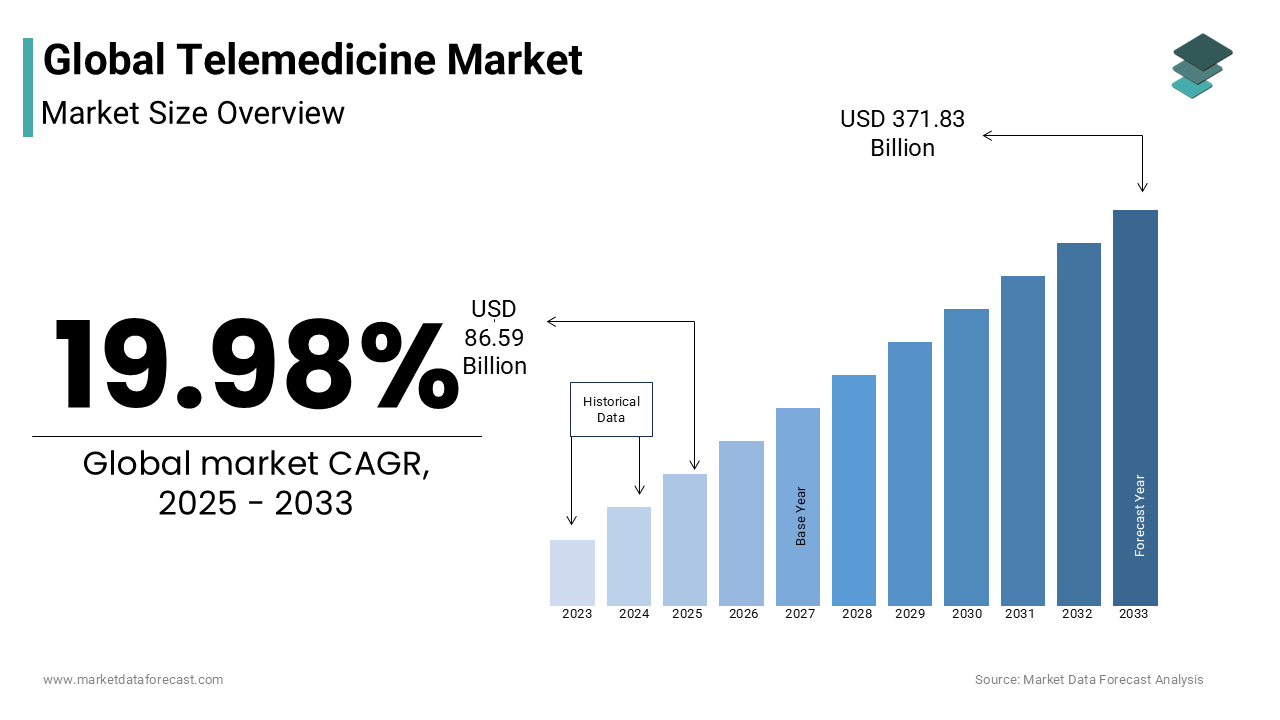

The global telemedicine market was worth USD 72.17 billion in 2024. The global telemedicine market is predicted to be worth USD 86.59 billion in 2025 and USD 371.83 billion by 2033. The global telemedicine market is expected to witness a healthy CAGR of 19.98% from 2025 to 2033.

Telemedicine is the practice of providing healthcare services remotely through digital communication technologies, including video consultations, mobile health apps, and remote patient monitoring. This approach enhances healthcare accessibility, particularly for individuals in rural and underserved regions, and reduces the burden on healthcare facilities. Telemedicine encompasses various medical fields, including general consultations, mental health services, dermatology, radiology, and chronic disease management.

The demand for telemedicine has surged significantly in recent years owing to the technological advancements and the need for efficient healthcare solutions. According to the World Health Organization (WHO), over 58% of countries have adopted national telemedicine policies to integrate digital health solutions into mainstream healthcare systems. Furthermore, the American Medical Association (AMA) reported that telehealth visits in the U.S. increased by 1,500% between 2019 and 2021, with approximately 85% of physicians now using telemedicine as part of their practice. Additionally, the American Psychiatric Association noted that 75% of patients using telepsychiatry services preferred remote consultations over in-person visits due to ease of access and privacy considerations.

MARKET DRIVERS

Rising Prevalence of Chronic Diseases

The increasing incidence of chronic diseases necessitates continuous medical attention, which telemedicine effectively provides. According to the Centers for Disease Control and Prevention (CDC), six in ten adults in the U.S. have a chronic disease, and four in ten have two or more. Telemedicine offers a convenient platform for regular monitoring and management of these conditions, reducing the need for frequent in-person visits. The CDC emphasizes that effective management of chronic diseases through telehealth can lead to improved patient outcomes and reduced healthcare costs. This capability is particularly beneficial for patients in remote areas or those with mobility challenges by ensuring consistent and timely care.

Shortage of Healthcare Professionals

A shortage of healthcare professionals, especially in rural and underserved regions, has heightened the demand for telemedicine services. The Association of American Medical Colleges projects a potential shortfall of up to 139,000 physicians by 2033. Telemedicine bridges this gap by enabling healthcare providers to extend their reach beyond traditional clinical settings by offering consultations and follow-ups remotely. This approach maximizes the utilization of available medical expertise and ensures that patients receive necessary care without the constraints of geographical limitations. The Health Resources and Services Administration supports telehealth initiatives to mitigate provider shortages and enhance healthcare accessibility nationwide.

MARKET RESTRAINTS

Regulatory and Licensing Challenges

The expansion of the telemedicine market is often hindered by complex regulatory frameworks and licensing requirements. In the United States, healthcare providers must obtain licenses in each state where they intend to practice telemedicine by creating administrative burdens and limiting cross-state medical consultations. The U.S. Department of Health and Human Services acknowledges that licensing requirements and interstate compacts pose challenges to telemedicine adoption. Initiatives like the Interstate Medical Licensure Compact, which includes 37 participating states aim to streamline the process, but significant barriers remain. Additionally, varying state regulations regarding the prescription of controlled substances via telemedicine add complexity, as highlighted by the National Center for Biotechnology Information. These regulatory hurdles can deter healthcare providers from fully embracing telemedicine, thereby restricting its growth potential.

Technological Barriers and Digital Divide

The effectiveness of telemedicine is heavily reliant on patients' access to reliable internet services and digital literacy. However, disparities in broadband availability and technological proficiency create significant obstacles. The U.S. Department of Health and Human Services reports that telehealth use rates were lowest among uninsured individuals (9.4%), young adults aged 18 to 24 (17.6%), and residents of the Midwest (18.7%) indicating a digital divide. Furthermore, individuals from lower-income households and those with less education are less likely to utilize video telehealth services, often due to limited access to necessary technology or a lack of digital skills. These technological barriers disproportionately affect rural and underserved communities, limiting the reach and effectiveness of telemedicine services.

MARKET OPPORTUNITIES

Integration of Telemedicine in Mental Health Services

The incorporation of telemedicine into mental health care has the potential to significantly improve access to services, particularly for individuals in remote or underserved areas. According to the Centers for Disease Control and Prevention (CDC), in 2021, 37.0% of adults used telemedicine in the past 12 months, with higher usage among women (42.0%) compared to men (31.7%). This trend indicates a growing acceptance of remote consultations for mental health concerns. The convenience and privacy offered by telemedicine can encourage more individuals to seek help, thereby addressing gaps in mental health care accessibility.

Expansion of Telemedicine in Chronic Disease Management

Telemedicine offers a valuable platform for the ongoing management of chronic diseases, enabling regular monitoring and timely interventions. The CDC reports that six in ten adults in the U.S. have a chronic disease, and four in ten have two or more. By facilitating remote consultations and continuous health monitoring, telemedicine can help manage these conditions more effectively, reducing the need for frequent in-person visits and potentially lowering healthcare costs. This approach not only enhances patient convenience but also allows healthcare providers to address health concerns, thereby improving patient outcomes promptly.

MARKET CHALLENGES

Financial Constraints and Reimbursement Issues

The financial viability of telemedicine is often challenged by inconsistent reimbursement policies across various payers. The U.S. Department of Health and Human Services notes that disparities in telehealth utilization persist across different insurance types, indicating uneven reimbursement structures. This inconsistency can deter healthcare providers from offering telemedicine services, as the financial return may not justify the investment in necessary technology and training. Additionally, the lack of standardized reimbursement rates across states and insurance plans adds complexity, potentially limiting the expansion of telemedicine services.

Cultural and Behavioral Barriers

The adoption of telemedicine is also impeded by cultural and behavioral factors among both patients and healthcare providers. The National Center for Biotechnology Information identifies "adoption" as one of the "seven deadly barriers" to telemedicine, highlighting resistance due to a lack of familiarity or trust in remote care modalities. Patients may prefer traditional face-to-face consultations, perceiving them as more personal and trustworthy. Similarly, some healthcare providers may be reluctant to integrate telemedicine into their practice due to concerns about its efficacy or a lack of training in digital tools. Overcoming these cultural and behavioral barriers is essential for the broader acceptance and utilization of telemedicine services.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

Segments Covered |

By Type, Application, Delivery Mode, End-User, and Region |

|

Various Analyses Covered |

Global, Regional, & Country Level Analysis; Segment-Level Analysis, Drivers, Restraints, Opportunities, Challenges, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview of Investment Opportunities |

|

Regions Covered |

North America, Europe, Asia Pacific, Latin America, Middle East, and Africa |

|

Key Market Players

|

AMD Global Telemedicine, Honeywell Life Care Solutions, Philips Healthcare, Cerner Corporation, Medtronic, Inc., GE Company, Lifewatch, McKesson Corporation and InTouch Technologies |

SEGMENTAL ANALYSIS

By Type Insights

In the global telemedicine market, the services segment dominated the market by accounting for 47.2% in 2024. This prominence is due to the widespread adoption of teleconsultation, tele-monitoring, and tele-education services, which enhance healthcare accessibility and efficiency. The COVID-19 pandemic significantly accelerated the utilization of these services with the Centers for Disease Control and Prevention noting a 154% increase in telehealth visits during the last week of March 2020 compared to the same period in 2019. This surge underscores the critical role of telemedicine services in maintaining healthcare continuity during crises.

On the other hand, the software segment is showing rapid growth and is likely to experience a CAGR of 24.3% from 2025 to 2033. This rapid expansion is driven by technological advancements and the increasing integration of digital health solutions in healthcare systems. The adoption of electronic health records (EHRs), telehealth platforms, and mobile health applications enhances patient care by facilitating seamless communication and efficient data management. The U.S. Department of Health and Human Services highlights that the use of telehealth services has increased significantly, with 37.0% of adults utilizing telemedicine in 2021, which indicates the growing importance of software solutions in the telemedicine market.

By Application Insights

The telecardiology segment led the telemedicine market and accounted for 25.8% of the global market share in 2024. The domination of the segment is primarily attributed to the rising prevalence of cardiovascular diseases (CVDs), which account for nearly 17.9 million deaths annually, according to the World Health Organization. The integration of advanced technologies like remote ECG monitoring and AI-driven diagnostics has enhanced patient outcomes by making it indispensable. The growing elderly population is coupled with the need for continuous cardiac monitoring, which further solidifies its importance.

On the other side, the teledermatology segment is growing impressively and is expected to witness the fastest CAGR of 22.5% from 2025 to 2033. This growth is driven by the increasing incidence of skin disorders, with over 85 million Americans affected annually, according to the American Academy of Dermatology. The convenience of remote consultations with advancements in AI-based image analysis has made it a preferred choice for both patients and providers. Additionally, the COVID-19 pandemic accelerated its adoption, highlighting its role in reducing healthcare disparities, particularly in rural areas.

By Delivery Mode Insights

The web-based segment held 56.7% of the global telemedicine market share in 2024 and emerged as the top performer. The widespread accessibility, ease of use, and cost-effectiveness of web-based solutions have majorly aided the segment in registering domination. Web-based platforms are particularly popular for remote consultations, especially in rural and underserved areas where healthcare infrastructure is limited. The U.S. Centers for Medicare & Medicaid Services reported a 154% increase in telehealth visits during the COVID-19 pandemic, where the importance of web-based solutions is expanding healthcare access. Additionally, the affordability and minimal hardware requirements of web-based platforms make them a preferred choice for both patients and healthcare providers. This segment's dominance is further reinforced by the growing adoption of digital health tools and the increasing penetration of internet services globally.

However, the cloud-based segment is predicted to show domination in the global market in the coming years and is projected to exhibit a remarkable CAGR of 30.99% from 2025 to 2033, owing to the scalability, real-time data access, and enhanced security offered by cloud-based solutions. Cloud platforms enable healthcare providers to store and manage large volumes of patient data efficiently, facilitating seamless telehealth services. The integration of advanced technologies like AI and IoT into cloud-based telemedicine systems has further accelerated adoption. According to the World Health Organization, cloud-based telemedicine is critical for managing large-scale patient data and enabling remote diagnostics, especially in developing regions. The COVID-19 pandemic also highlighted the importance of cloud-based solutions in supporting virtual care delivery, with healthcare providers increasingly relying on these platforms to ensure continuity of care. The growing emphasis on data security and interoperability in healthcare systems is expected to drive further growth in this segment.

By End-user Insights

The tele-hospitals segment led the telemedicine market in 2024 by occupying 65.6% of the global market share. The domination of the segment is primarily due to the widespread adoption of telemedicine by hospitals and clinics to enhance patient care, reduce costs, and improve operational efficiency. Tele-hospitals enable remote consultations, diagnostics, and monitoring, particularly for chronic disease management and post-operative care. The Centers for Medicare & Medicaid Services reported that over 80% of U.S. hospitals have adopted telemedicine services which is driven by the need to expand access to care and reduce hospital readmissions. This segment's dominance is further supported by government initiatives and reimbursement policies promoting telehealth adoption in hospital settings.

The tele-homes segment is anticipated to grow faster and register a CAGR of 25.8% from 2025 to 2033 due to the increasing demand for home-based healthcare solutions, especially among aging populations and patients with chronic conditions. Tele-homes allow patients to receive care in the comfort of their homes by reducing the need for frequent hospital visits. According to the World Health Organization, the aging population and the rising prevalence of chronic diseases are key drivers of this segment's growth. The COVID-19 pandemic further accelerated the adoption of tele-home services, with a 50% increase in remote patient monitoring reported by the U.S. Centers for Disease Control and Prevention. The convenience, cost-effectiveness, and patient-centric approach of tele-homes make this segment vital for the future of healthcare delivery.

REGIONAL ANALYSIS

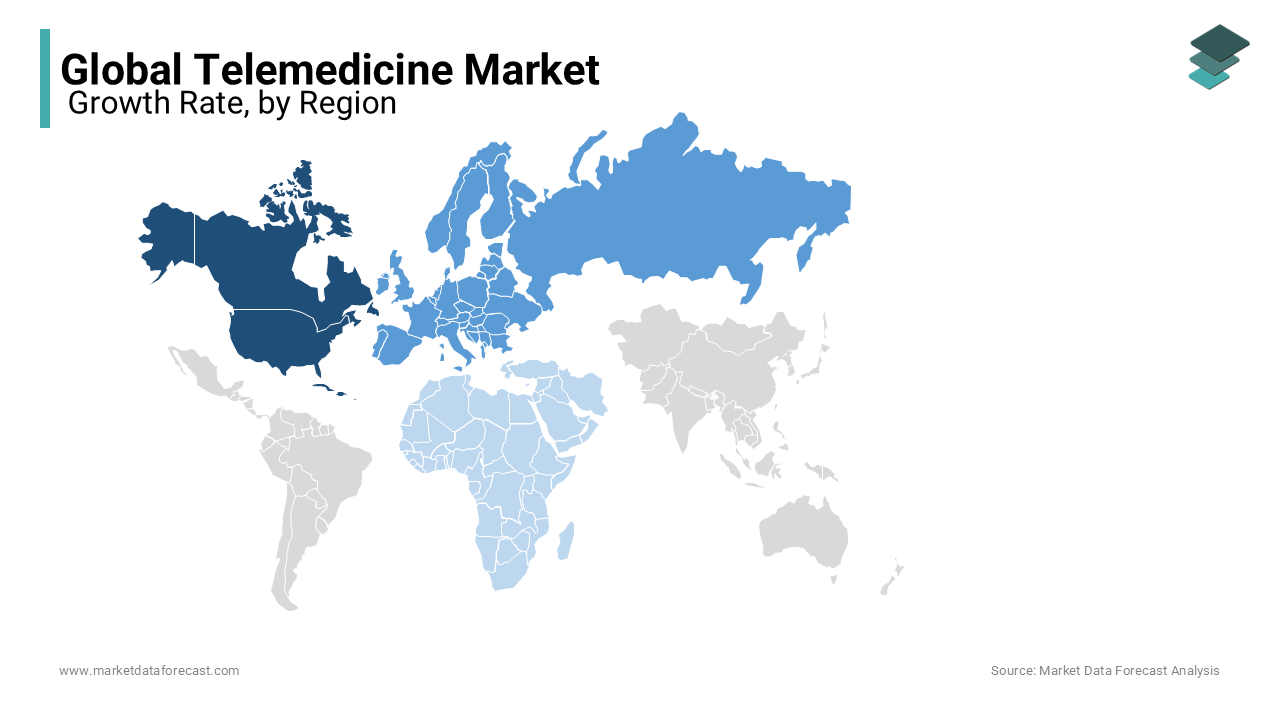

North America led the telemedicine market worldwide in 2024 by accounting for 47.98% of the global market share in 2024. This leading position is attributed to the region's advanced healthcare infrastructure, widespread adoption of digital health technologies, and supportive government policies. The U.S. Department of Health and Human Services highlights that 37% of adults utilized telemedicine services in 2021, reflecting the high acceptance and integration of telehealth in routine care. Additionally, the presence of key market players and substantial investments in telemedicine platforms contribute to North America's market dominance.

The Asia-Pacific region is experiencing the fastest growth in the global telemedicine market and is estimated to witness a CAGR of 17.2% during the forecast period. This rapid expansion is driven by increasing internet penetration, a large patient population, and rising demand for accessible healthcare services. Governments in countries like India and China are actively promoting telemedicine to bridge healthcare gaps in rural and urban areas. For instance, the Indian government's eSanjeevani platform has facilitated millions of teleconsultations, enhancing healthcare accessibility. The World Health Organization notes that telemedicine initiatives in the Asia-Pacific region have been pivotal in managing healthcare delivery, especially during the COVID-19 pandemic.

The European market is poised for substantial growth. The growth of the European market is driven by increasing government support and the adoption of digital health solutions. The European Commission's Digital Health Strategy aims to enhance healthcare delivery through telemedicine, promoting cross-border health services and data exchange. The European Centre for Disease Prevention and Control emphasizes the role of telemedicine in managing chronic diseases and improving healthcare accessibility across member states.

In Latin America, the telemedicine market is expanding due to efforts to improve healthcare access in remote areas. The Pan American Health Organization highlights telemedicine as a tool to strengthen health systems, particularly in underserved regions. Countries like Brazil and Mexico are investing in telehealth infrastructure to address healthcare disparities and enhance service delivery.

The telemedicine market in Middle East and Africa is driven by initiatives to overcome healthcare access challenges in remote areas. The World Health Organization supports telemedicine projects in these regions to improve healthcare delivery and address the shortage of medical professionals. Investments in telehealth are expected to enhance healthcare outcomes and system efficiency in the coming years.

KEY MARKET PARTICIPANTS AND COMPETITIVE LANDSCAPE

Companies like AMD Global Telemedicine, Honeywell Life Care Solutions, Philips Healthcare, Cerner Corporation, Medtronic, Inc., GE Company, Lifewatch, McKesson Corporation, InTouch Technologies, Teladoc Health, Global Med and others are playing a pivotal role in the telemedicine market.

The telemedicine market is highly competitive, with major players striving to expand their global footprint through technological advancements, strategic partnerships, and acquisitions. Key companies include Teladoc Health, Amwell, MDLIVE, Doctor on Demand, and eClinicalWorks, among others. These firms focus on enhancing artificial intelligence (AI)-driven diagnostics, remote patient monitoring, and integration with electronic health records (EHRs) to improve service efficiency. Competition is further intensified by the presence of healthcare technology firms, telecommunications providers, and startups entering the market with innovative solutions. Companies are investing in cloud-based platforms, AI chatbots, and mobile health applications to differentiate themselves. The rise of telepsychiatry, remote chronic disease management, and virtual primary care has expanded the scope of market rivalry. Regulatory support and reimbursement policies vary by region, influencing market entry and competitive dynamics. In the U.S., government-backed Medicare and Medicaid reimbursement expansions have provided opportunities for growth. Similarly, emerging markets in Asia-Pacific and Latin America are witnessing new entrants capitalizing on increasing internet penetration and government telehealth initiatives.

The telemedicine market has experienced significant growth, with key players such as Teladoc Health, Amwell, and Doximity leading the market. These companies have not only advanced telehealth services but have also integrated financial technology (fintech) solutions to enhance healthcare delivery.

As a pioneer in virtual healthcare, Teladoc Health offers a comprehensive platform that includes telemedicine, mental health services, and chronic condition management. The company has integrated fintech solutions to streamline billing and payment processes, ensuring a seamless experience for both patients and providers. By leveraging fintech, Teladoc enhances accessibility and affordability, contributing to the broader adoption of telehealth services.

Amwell provides a telehealth platform connecting patients with healthcare professionals across various specialties. The company has embraced fintech innovations to facilitate efficient payment systems, insurance claims processing, and revenue cycle management. This integration simplifies financial transactions within the healthcare ecosystem, reducing administrative burdens and improving patient satisfaction.

Serving as a digital platform for U.S. medical professionals, Doximity offers tools for collaboration, patient care coordination, and virtual visits. The platform includes features that support financial transactions, such as secure billing and payment processing, enabling healthcare providers to manage their practices more effectively. By incorporating fintech elements, Doximity enhances the efficiency of healthcare delivery and financial management.

TOP STRATEGIES ADOPTED BY THE KEY MARKET PARTICIPANTS

Technological Advancements and AI Integration

Companies are increasingly integrating Artificial Intelligence (AI), Machine Learning (ML), and Big Data analytics to enhance telemedicine services. AI-driven chatbots, predictive analytics, and automated diagnostics improve patient engagement and streamline healthcare workflows. Philips Healthcare has developed AI-powered remote monitoring solutions that enhance chronic disease management. Similarly, Teladoc Health uses AI algorithms to personalize treatment plans and optimize virtual consultations.

Strategic Partnerships and Collaborations

Leading telemedicine firms collaborate with hospitals, insurers, and tech providers to expand their reach. Amwell partnered with Google Cloud in 2020 to improve virtual healthcare infrastructure and data security. Medtronic collaborated with the American Diabetes Association to advance remote diabetes management solutions. These partnerships enhance service capabilities and ensure seamless healthcare delivery.

Mergers and Acquisitions for Market Expansion

Acquisitions play a key role in expanding service offerings and increasing market share. Teladoc Health acquired Livongo Health in 2020 for $18.5 billion, integrating remote monitoring and virtual consultations. Amwell acquired SilverCloud Health in 2021 to strengthen its digital mental health services.

Expansion of Remote Patient Monitoring (RPM) and Specialty Telemedicine

Companies are focusing on chronic disease management, mental health services, and post-operative care through Remote Patient Monitoring (RPM). Medtronic has launched advanced RPM solutions for cardiovascular patients, while Doximity has enhanced telehealth services for physicians specializing in neurology and cardiology.

Geographic Expansion and Regulatory Compliance

Leading firms are expanding into emerging markets while ensuring compliance with local healthcare regulations. Teladoc Health has expanded into Latin America and Europe, adapting to region-specific telehealth regulations. Amwell has extended its reach in the Asia-Pacific market, leveraging government initiatives promoting digital health.

RECENT HAPPENINGS IN THE MARKET

- In June 2024, Digital Health Acquisition Corp. merged with VSee Lab, Inc. and iDoc Virtual Telehealth Solutions, Inc., forming VSee Health, Inc. This merger enhanced telehealth service offerings through a unified platform.In April 2024, Thirty Madison partnered with Talkspace to expand care access for migraines and women’s health. This partnership integrated mental health services into Thirty Madison’s telemedicine platform.

- In early 2023, Humana acquired remote consultation provider Heal for $100 million, expanding its telemedicine offerings. This acquisition strengthened Humana’s ability to provide home-based virtual care.

- In April 2022, Access TeleCare was acquired by Patient Square Capital, providing resources to invest in clinical capabilities and expand its telehealth footprint. This deal supported Access TeleCare’s long-term growth strategy.

MARKET SEGMENTATION

This research report on the global telemedicine market has been segmented and sub-segmented based on type, application, delivery mode, end-user, and region.

By Type

- Technology

- Hardware

- Software

- Telecommunications

- Service

- Remote Patient Monitoring

- Store-and-Forward

- Real-Time Interactive

By Application

- Tele-Cardiology

- Tele-Radiology

- Tele-Pathology

- Tele-Dermatology

- Tele-Neurology

- Emergency Care

- Home Health

- Others

By Delivery Mode

- Web-based

- Cloud-based

- Others

By End-User

- Tele-Hospitals

- Tele-Homes

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

Frequently Asked Questions

How big is the telemedicine market worldwide?

The global telemedicine industry size is predicted to reach USD 371.83 billion by 2033, registering at a CAGR of 19.98% during the forecast period.

Based on application, which segment is expected to lead the telemedicine market in the future?

The basis of application, the teleradiology segment is expected to dominate the global telemedicine market during the forecast period.

which country led the global telemedicine market in 2024?

The U.S. led the global telemedicine market in 2024 accounting for more than 30% share.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2500

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]