Global Telecom Expense Management Market Size, Share, Trends & Growth Forecast Report Segmented By Solution (Dispute Management, Invoice Management, Ordering and Provisioning Management, Sourcing Management, Usage Management, and Others), Service, Deployment, Enterprise, Industry Vertical, and Region (North America, Europe, Asia Pacific, Latin America, and Middle East & Africa), Industry Analysis From 2024 to 2033

Global Telecom Expense Management Market Size

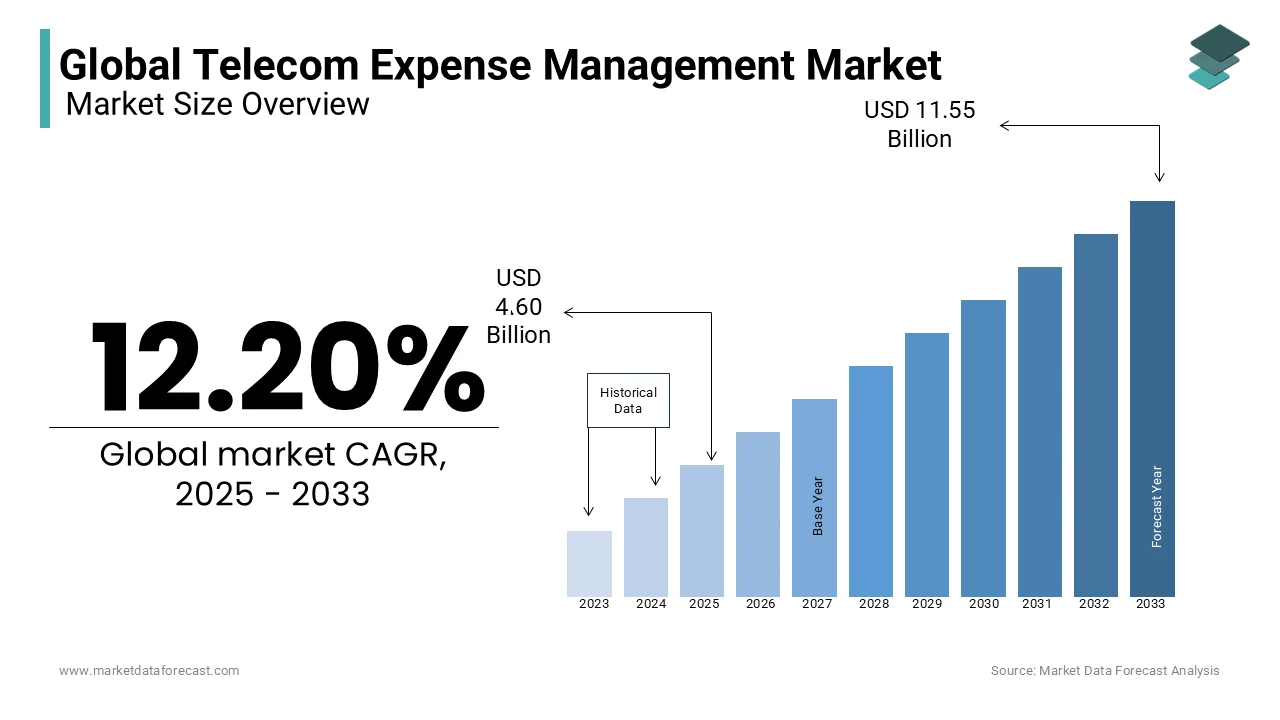

The global telecom expense management market, worth USD 4.10 billion in 2024, Projected to expand from USD 4.60 billion in 2025 to USD 11.55 billion in 2033, maintaining a CAGR of 12.20% throughout 2025 to 2033.

Telecom expense management (TEM) is a major component of modern business operations that enables organizations to monitor, control, and optimize their telecommunications expenditures. TEM solutions provide tools for managing mobile and fixed-line services, tracking usage, auditing invoices, and ensuring compliance with telecom contracts. With the increasing complexity of telecom networks and the growing reliance on digital communication, businesses are turning to TEM to eliminate inefficiencies, reduce costs, and improve visibility into their telecom spend.

A key driver of TEM adoption is the exponential growth in data consumption and connectivity demands. For instance, global mobile data traffic is expected to surpass 300 exabytes per month by 2028, according to Ericsson's Mobility Report. This surge underscores the need for effective expense management as businesses grapple with rising telecom costs. Additionally, the proliferation of remote work has amplified the importance of TEM, with over 60% of organizations now operating hybrid or fully remote work models, as reported by Gartner. These trends highlight the growing relevance of TEM in ensuring cost-effective and efficient telecom operations.

MARKET DRIVERS

Increasing Complexity of Telecom Networks

The growing complexity of telecom networks is a significant driver of the Telecom Expense Management (TEM) market. Businesses are increasingly adopting advanced technologies such as 5G, IoT, and cloud-based communication systems, which have expanded the scope of telecom infrastructure. According to the International Telecommunication Union, global mobile broadband subscriptions have surpassed 5.4 billion by highlighting the widespread reliance on telecom services. This expansion has resulted in higher operational costs and inefficiencies by prompting organizations to implement TEM solutions for better oversight and cost optimization. TEM tools enable businesses to monitor usage, detect billing discrepancies, and streamline contracts where they only pay for essential services while avoiding unnecessary expenses.

Rise in Remote and Hybrid Work Models

The shift toward remote and hybrid work models has significantly boosted the demand for TEM solutions. The U.S. Bureau of Labor Statistics reports that nearly 30% of the workforce now operates remotely either partially or fully. This trend has led to a surge in the use of mobile and internet services, driving up telecom expenses for businesses. TEM solutions provide centralized control over dispersed communication networks by allowing companies to manage costs effectively while maintaining seamless connectivity. Organizations can optimize their telecom spend by ensuring operational efficiency in an increasingly remote-driven work environment.

MARKET RESTRAINTS

Complexity of Telecom Infrastructures

Modern telecommunications infrastructures have evolved into intricate networks encompassing a multitude of devices, services, and carriers. This complexity poses substantial challenges for TEM solutions in terms of accurate tracking, monitoring, and management of expenses. The European Commission highlights that advanced technologies are including the deployment of 5G networks which play a crucial role in cost reduction for telecommunication operators. However, the integration and management of these technologies add layers of complexity to existing systems by making expense management increasingly challenging.

Regulatory Compliance and Security Concerns

Telecom operators must navigate a complex landscape of regulatory requirements and security protocols, which vary across regions and services. Ensuring compliance with these regulations necessitates continuous monitoring and adaptation, increasing the operational burden on TEM solutions. The UK's National Cyber Security Centre emphasizes the risks associated with managed service access and third-party support by noting that these can present significant vulnerabilities to telecom networks. Managing these risks requires robust security measures and compliance strategies which can complicate expense management efforts.

MARKET OPPORTUNITIES

Adoption of 5G Technology

The rollout of 5G technology presents a significant opportunity for the Telecom Expense Management (TEM) market. According to the Federal Communications Commission, 5G networks are expected to cover nearly 80% of the U.S. population by 2025 which is driving increased data usage and telecom complexity. As businesses adopt 5G to enhance connectivity and support IoT applications, the need for TEM solutions to manage escalating costs and optimize usage will grow. TEM tools can help organizations monitor 5G-related expenses, identify inefficiencies, and ensure cost-effective utilization of this advanced technology, positioning TEM providers to capitalize on this transformative shift in telecom infrastructure.

Expansion of Cloud-Based TEM Solutions

The growing preference for cloud-based solutions offers a substantial opportunity for the TEM market. The U.S. Department of Commerce highlights that cloud computing adoption has increased by over 50% in the past five years which is driven by its scalability and cost-efficiency. Cloud-based TEM solutions enable businesses to manage telecom expenses remotely, providing real-time insights and reducing the need for on-premise infrastructure. This trend aligns with the rise of remote work and digital transformation by making cloud-based TEM an attractive option for organizations seeking flexible and scalable expense management tools. This shift opens new avenues for TEM providers to expand their offerings and reach a broader customer base.

MARKET CHALLENGES

Lack of Awareness Among SMEs

A major challenge for the Telecom Expense Management (TEM) market is the lack of awareness among small and medium-sized enterprises (SMEs). According to the U.S. Small Business Administration, SMEs account for over 99% of all businesses in the U.S. whereas many remain unaware of the benefits of TEM solutions. These businesses often rely on manual processes or outdated systems to manage telecom expenses, leading to inefficiencies and overspending. Without proper education on how TEM can reduce costs and improve operational efficiency, SMEs are hesitant to invest in these solutions. This lack of awareness limits market penetration and growth potential in a segment that represents a significant portion of the business landscape.

Rapidly Evolving Telecom Technologies

The rapid evolution of telecom technologies poses a significant challenge for the TEM market. The National Institute of Standards and Technology highlights those advancements such as 5G, IoT, and edge computing are transforming telecom infrastructure at an unprecedented pace. TEM providers must continuously update their solutions to keep up with these changes, which requires substantial investment in research and development. Additionally, businesses struggle to adapt their expense management strategies to align with new technologies, creating a gap between TEM capabilities and user needs. This dynamic environment makes it difficult for TEM providers to deliver solutions that remain relevant and effective in the long term.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

12.20% |

|

Segments Covered |

By Solution, Service, Deployment, Enterprise, Industry Vertical, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regions Covered |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Market Leaders Profiled |

The major players in the global telecom expense management market include Tangoe, Calero Software, ValuD, Cass Information Systems, Brightfin, Ezwim, Asignet, Happiest Minds, Saaswedo, and Tellennium. |

SEGMENTAL ANALYSIS

By Solution Insights

The invoice management segment had the largest share of 35.9% in the global market in 2024. The domination of invoice management segment in the global market is driven by the critical need for businesses to accurately process and audit telecom invoices, which often contain errors or overcharges. According to the Federal Communications Commission, billing disputes and inaccuracies cost businesses billions annually by making invoice management a top priority. Automated TEM solutions streamline invoice processing, reduce errors, and ensure compliance with contracts by helping organizations save significant costs. Its importance lies in providing transparency and control over telecom expenses by making it indispensable for businesses aiming to optimize their telecom spend.

The usage management segment is likely to grow at a CAGR of 12.5% during the forecast period due to the exponential increase in data consumption and the adoption of advanced technologies like 5G and IoT. The U.S. Department of Energy reports that data usage has tripled in the past five years which is driven by remote work and digital transformation. Usage Management tools help businesses monitor and optimize telecom usage, preventing overages and ensuring cost efficiency. The importance of Usage Management continues to rise as organizations seek to manage escalating data demands which is making it a key driver of TEM market expansion.

By Service Insights

The managed services led the market by holding 60.8% of the global market share in 2024. The lead of the managed services segment is majorly driven by the growing demand for outsourced expertise in managing complex telecom environments. According to the U.S. Bureau of Labor Statistics, businesses increasingly prefer outsourcing to reduce operational burdens and focus on core activities. Managed Services provide end-to-end TEM solutions with invoice processing, dispute resolution, and usage monitoring by ensuring cost efficiency and compliance. Their importance lies in offering specialized knowledge and scalability by making them indispensable for organizations seeking to optimize telecom expenses without investing in in-house resources.

The hosted services segment is graining traction and is projected to progress at a CAGR of 14.4% over the forecast period due to the rising adoption of cloud-based solutions and the need for flexible and scalable TEM tools. The U.S. Department of Commerce reports that cloud adoption has increased by over 50% in the past five years by reflecting a shift toward digital transformation. Hosted Services enable businesses to access TEM solutions remotely by reducing infrastructure costs and providing real-time insights. Their importance lies in supporting remote work models and ensuring seamless telecom expense management by making them a critical driver of market expansion.

By Deployment Insights

The cloud segment dominated the telecom expense management market by holding a share of 65% in the global market in 2024. This dominance is driven by the increasing adoption of cloud-based solutions due to their scalability, cost-efficiency, and remote accessibility. According to the U.S. Department of Commerce, cloud computing adoption has grown by over 50% in the past five years by reflecting its widespread acceptance across industries. Cloud-based TEM solutions enable businesses to manage telecom expenses in real-time to reduce infrastructure costs, and support remote work models. Its importance lies in providing flexibility and seamless integration with existing systems by making it the preferred choice for modern enterprises.

In addition to that, the cloud segment is also expected to continue dominating the market by registering the fastest CAGR of 15.8% over the forecast period. This rapid growth is fueled by the ongoing digital transformation and the shift toward remote work. The Federal Communications Commission highlights that over 60% of businesses now operate hybrid or fully remote work models by increasing the demand for cloud-based TEM solutions. These solutions offer real-time expense tracking, scalability, and reduced operational costs, making them essential for businesses adapting to dynamic telecom environments. The importance of cloud deployment lies in its ability to support evolving business needs by driving its accelerated adoption and market expansion.

By Enterprise Insights

The large size enterprises segment held the leading share of 70.8% in the global market in 2024. This segment leads due to the complexity and scale of their telecom operations which require advanced TEM solutions to manage high volumes of invoices, contracts, and usage data. According to the U.S. Census Bureau, large enterprises account for a significant portion of telecom spending by exceeding millions annually. TEM solutions help these organizations optimize costs, ensure compliance, and streamline operations. Their importance lies in providing centralized control and actionable insights by enabling large enterprises to maintain efficiency and reduce unnecessary telecom expenditures.

The small and medium-sized enterprises (SMEs) segment is growing rapidly and is estimated to witness the highest CAGR of 13.88% over the forecast period. This growth is driven by increasing awareness of TEM benefits and the need for cost optimization in smaller businesses. The U.S. Small Business Administration reports that SMEs represent over 99% of all businesses in the U.S. with many still rely on manual processes for telecom management. TEM solutions offer SMEs tools to track expenses, avoid billing errors, and improve operational efficiency. Their importance lies in enabling SMEs to compete effectively by reducing overhead costs and enhancing financial control.

By Industry Vertical Insights

The IT and telecom segment held the major share of 31.2% of the global telecom Expense Management (TEM) market in 2024. The heavy reliance of IT and telecom on telecom infrastructure and the need to manage vast networks efficiently are propelling the growth of the segment in the global market. According to the Federal Communications Commission, the telecom sector accounts for a significant portion of global data traffic with billions of dollars spent annually on connectivity and services. TEM solutions are critical for this industry to monitor usage, control costs, and ensure compliance with regulatory requirements. Their importance lies in enabling seamless operations and reducing unnecessary expenditures in a highly competitive market.

The healthcare segment is anticipated to register a CAGR of 14.68% over the forecast period owing to the increasing adoption of telemedicine, IoT-enabled devices, and digital health solutions. The U.S. Department of Health and Human Services reports that telehealth usage has increased by over 150% since 2020 by significantly raising telecom expenses for healthcare providers. TEM solutions help these organizations manage costs, optimize usage, and ensure compliance with data privacy regulations. Their importance lies in supporting the digital transformation of healthcare while maintaining cost efficiency and operational transparency.

REGIONAL ANALYSIS

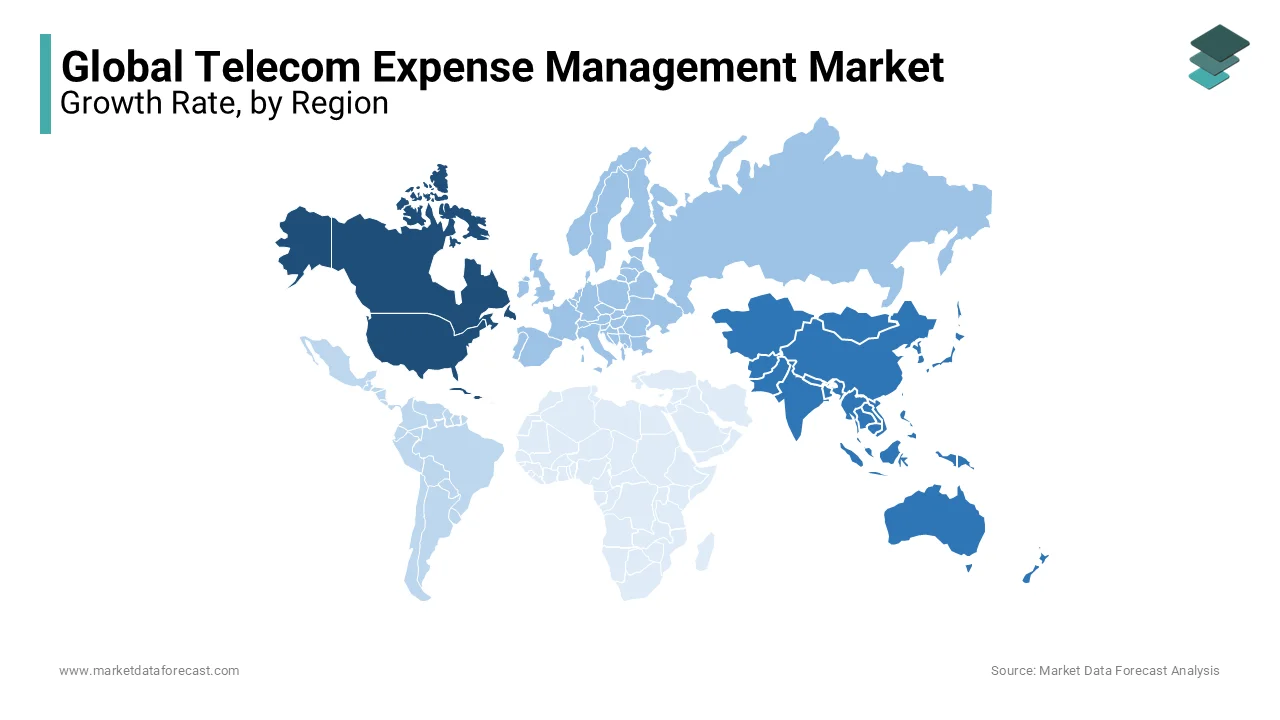

North America played the major role in the global market in 2024 and accounted for 40.3% of the global market share in 2024. The region's dominance is attributed to its advanced IT infrastructure, high adoption of cloud-based technologies, and the presence of leading telecom providers. According to the U.S. Federal Communications Commission (FCC), the total telecom spending in the United States surpassed $1.5 trillion in 2022 which is driven by the increasing demand for data services, 5G deployment, and enterprise mobility. Additionally, the FCC highlights that businesses in the U.S. are increasingly adopting telecom expense management solutions to optimize costs, ensure regulatory compliance, and streamline operations. The region's focus on innovation and cost efficiency further cements its leadership in this market.

The Asia-Pacific region is swiftly emerging and is estimated to register a CAGR of 12.5% from 2025 to 2033. This growth is fueled by rapid digital transformation, increasing smartphone penetration, and rising telecom expenditures in emerging economies such as India and China. The ITU reports that mobile broadband subscriptions in Asia-Pacific grew by 15% in 2022 to reach 2.8 billion users. Government initiatives, such as India's Digital India program and China's push for 5G infrastructure are accelerating the adoption of telecom expense management solutions. These factors make Asia-Pacific a critical growth engine for the telecom expense management market.

Europe is expected to experience steady growth in the telecom expense management market, driven by stringent regulatory frameworks and the rapid adoption of advanced technologies. The European Commission reports that telecom revenues in the European Union reached €150 billion in 2022, with businesses increasingly focusing on cost optimization and compliance. The implementation of the General Data Protection Regulation (GDPR) has compelled organizations to adopt telecom expense management solutions to ensure data security and regulatory adherence. Additionally, the rollout of 5G networks across the region is accelerating demand. According to the European Telecommunications Network Operators' Association (ETNO), 5G coverage in Europe reached 81% of the population in 2023, further boosting the need for efficient telecom expense management. Countries like Germany, the UK, and France are leading this growth due to their robust telecom infrastructure and high enterprise adoption rates.

Latin America is poised for moderate growth in the telecom expense management market by improving telecom infrastructure and increasing mobile connectivity. The World Bank highlights that mobile penetration in the region reached 73% in 2022 with countries like Brazil and Mexico driving demand. The region's growing emphasis on digital transformation and enterprise mobility is creating opportunities for telecom expense management solutions. For instance, Brazil's National Telecommunications Agency (Anatel) reported that telecom revenues in the country grew by 6% in 2022 by reaching $30 billion. However, challenges such as economic volatility and uneven digital adoption in rural areas may slow growth in some countries. Government initiatives to expand broadband access and 4G/5G networks are expected to fuel market growth in the coming years.

The Middle East & Africa is emerging as a promising market for telecom expense management, driven by rapid digitalization and government-led initiatives to enhance connectivity. Countries like the UAE and Saudi Arabia are at the forefront of this growth, with their ambitious smart city projects and 5G deployments. The UAE's Telecommunications and Digital Government Regulatory Authority (TDRA) reported that 5G coverage in the country reached 90% in 2023 by making it one of the most connected nations globally. Additionally, the region's focus on reducing operational costs and improving efficiency in sectors like oil & gas, healthcare, and finance is driving the adoption of telecom expense management solutions. Countries like South Africa, Nigeria, and Kenya are leading this growth, supported by government initiatives to improve digital infrastructure. For example, the Nigerian Communications Commission (NCC) reported that telecom revenues in Nigeria grew by 10% in 2022, reaching $9 billion. However, challenges such as limited infrastructure in rural areas and affordability issues may hinder growth in some regions. Despite these challenges, the increasing adoption of mobile money services and the rollout of 4G networks are expected to drive demand for telecom expense management solutions in the coming years.

KEY MARKET PLAYERS

The major players in the global telecom expense management market include Tangoe, Calero Software, ValuD, Cass Information Systems, Brightfin, Ezwim, Asignet, Happiest Minds, Saaswedo, and Tellennium.

Top 3 Players in the Market

Tangoe

Tangoe is a market leader, renowned for its comprehensive Technology Expense Management (TEM) solutions. The company manages over $45 billion in annual telecom and technology expenses, serving more than 1,000 enterprise clients across industries such as healthcare, finance, and retail. Tangoe’s platform integrates with over 1,500 carriers and service providers, offering real-time visibility and cost optimization. Its strong presence in North America and Europe is bolstered by its focus on compliance, automation, and managed services with a trusted partner for enterprises seeking to streamline telecom and IT expenses.

Calero Software

Calero Software is another key player by managing over $15 billion in annual telecom and technology expenses and serving more than 3,000 customers along with Fortune 500 companies and government agencies. Calero’s user-friendly platform and customer-centric approach have made it a preferred choice in regulated industries like healthcare and education. The company has a strong foothold in North America, Europe, and Asia-Pacific with a growing presence in emerging markets. Calero’s solutions emphasize invoice automation, auditing, and SaaS expense management by helping organizations achieve significant cost savings and operational efficiency.

ValuD

ValuD completes the top three, managing over $10 billion in annual telecom and technology expenses and serving more than 1,200 enterprise clients. Known for its innovative approach, ValuD specializes in Managed Mobility Services (MMS) and IoT expense management, catering to industries like retail, manufacturing, and logistics. The company has a strong presence in North America and Europe, with expanding operations in Asia-Pacific and Latin America. ValuD’s focus on delivering measurable cost savings and optimizing complex telecom environments has positioned it as a critical player in the global TEM market.

Top Strategies Used by the Key Market Participants

Strategic Partnerships and Collaborations

Key players in the TEM market are forming strategic partnerships with telecom providers, technology vendors, and system integrators to expand their service offerings and reach. For example, companies like Tangoe and Calero Software have partnered with leading telecom operators to integrate their TEM solutions with carrier billing systems, enabling seamless expense tracking and optimization. These collaborations help TEM providers deliver end-to-end solutions, improve customer satisfaction, and gain access to new markets.

Product Innovation and Technology Integration

Innovation is a cornerstone strategy for TEM providers. Companies are investing heavily in advanced technologies such as Artificial Intelligence (AI), Machine Learning (ML), and blockchain to enhance their platforms. For instance, AI-driven analytics are being used to identify cost-saving opportunities and predict telecom usage patterns. Additionally, TEM providers are integrating their solutions with Enterprise Resource Planning (ERP) and Customer Relationship Management (CRM) systems to offer a unified platform for managing telecom expenses. This technological edge helps companies differentiate themselves and attract enterprise clients.

Expansion into Emerging Markets

To capitalize on growing demand, TEM providers are expanding their presence in emerging markets such as Asia-Pacific, Latin America, and Africa. These regions are experiencing rapid digital transformation and increased adoption of telecom services, creating a significant opportunity for TEM solutions. Companies like Vodafone Global Enterprise and Brightfin have established regional offices and localized their offerings to cater to the unique needs of these markets. This expansion strategy allows TEM providers to tap into new revenue streams and diversify their customer base.

Focus on Cloud-Based TEM Solutions

With the shift toward cloud computing, TEM providers are increasingly offering Software-as-a-Service (SaaS)-based solutions. Cloud-based TEM platforms provide scalability, flexibility, and real-time expense management capabilities, making them highly attractive to enterprises. For example, Cass Information Systems has developed a cloud-native TEM platform that allows businesses to manage telecom expenses from anywhere. This strategy aligns with the growing demand for remote work solutions and positions TEM providers as modern, forward-thinking partners.

Acquisitions and Mergers

Mergers and acquisitions (M&A) are a common strategy among TEM providers to consolidate their market position and acquire new capabilities. For instance, in 2022, Calero Software acquired MDSL, a leading provider of telecom expense and usage management solutions, to expand its product portfolio and global footprint. Such acquisitions enable TEM providers to offer more comprehensive solutions, enter new markets, and eliminate competition.

COMPETITIVE LANDSCAPE

The Telecom Expense Management (TEM) market is highly competitive, characterized by the presence of both established players and emerging startups vying for market share. Key players such as Tangoe, Calero Software, Vodafone Global Enterprise, and Cass Information Systems dominate the market, offering comprehensive solutions for managing telecom expenses, optimizing costs, and ensuring compliance. These companies compete on the basis of technological innovation, service quality, and customer support, constantly enhancing their platforms with advanced features like AI-driven analytics, cloud-based solutions, and integration with enterprise systems.

The competition is further intensified by the entry of niche players and regional providers, who cater to specific industries or geographic markets. For instance, companies like Brightfin and Valicom focus on delivering tailored solutions for small and medium-sized enterprises (SMEs), while others target large multinational corporations. Strategic partnerships with telecom operators and technology vendors are also a common tactic to expand service offerings and gain a competitive edge.

Additionally, mergers and acquisitions are prevalent in the TEM market, as companies seek to consolidate their position and acquire new capabilities. For example, Calero Software’s acquisition of MDSL in 2022 strengthened its global footprint and product portfolio. Overall, the TEM market’s competitive landscape is dynamic is driven by the need for cost optimization, regulatory compliance, and the growing demand for advanced and scalable solutions in an increasingly digital world.

RECENT HAPPENINGS IN THE MARKET

- In April 2024, Calero Software, a leading Telecom Expense Management (TEM) provider, acquired MDSL, a prominent player in telecom expense and usage management solutions. This acquisition is anticipated to allow Calero Software to expand its product portfolio, enhance its global footprint, and offer more comprehensive TEM solutions, strengthening its market presence.

- In March 2023, Tangoe, a key player in the TEM market, partnered with Microsoft Azure to integrate its TEM platform with cloud-based enterprise systems. This collaboration is expected to enable Tangoe to deliver advanced, scalable solutions for managing telecom expenses in hybrid work environments, solidifying its competitive edge.

- In September 2023, Vodafone Global Enterprise launched a new AI-driven analytics module for its TEM platform. This innovation is projected to help businesses optimize telecom costs and improve compliance, further enhancing Vodafone’s position as a market leader.

- In January 2024, Brightfin expanded its operations into the Asia-Pacific region, opening new offices in Singapore and India. This strategic move is anticipated to allow Brightfin to tap into the growing demand for TEM solutions in emerging markets, driving its global growth.

- In June 2023, Cass Information Systems introduced a cloud-native TEM platform designed for small and medium-sized enterprises (SMEs). This development is expected to help Cass capture a larger share of the SME market, diversifying its customer base and boosting revenue.

MARKET SEGMENTATION

This research report on the global telecom expense management market is segmented and sub-segmented into the following categories.

By Solution

- Dispute Management

- Invoice Management

- Ordering and Provisioning Management

- Sourcing Management

- Usage Management

- Others

By Service

- Hosted Services

- Managed Services

By Deployment

- Cloud

- On-premise

By Enterprise

- Large Size Enterprises

- Small and Medium Sized Enterprises (SMEs)

By Industry Vertical

- BFSI

- Consumer Goods & Retail

- Healthcare

- IT and Telecom

- Manufacturing & Automotive

- Others

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

Frequently Asked Questions

What are the key drivers of the TEM market?

The primary drivers include increasing enterprise telecom expenses, the adoption of cloud-based solutions, growing mobile workforce demands, and the need for cost optimization in global organizations. Compliance regulations and the complexity of multi-vendor telecom environments also contribute to market growth.

Which industries benefit the most from TEM solutions?

TEM solutions are widely adopted in industries such as IT and telecom, BFSI, healthcare, retail, government, and manufacturing, where telecom and network services play a crucial role in operations.

What is the role of AI and automation in TEM?

AI and automation enhance TEM solutions by enabling predictive analytics, automated invoice audits, contract compliance monitoring, and intelligent recommendations for cost savings, reducing manual effort and improving accuracy.

What is the future outlook for the TEM market?

The TEM market is expected to grow as enterprises continue to adopt cloud-based communications, expand their global operations, and seek more advanced analytics-driven cost optimization solutions.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2500

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]