Global Switchgear Monitoring Market Size, Share, Trends & Growth Forecast Report - Segmentation By Type (GIS and AIS), voltage (High and Medium), Component (Hardware, Software and Services), Monitoring (Temperature, PD, Gas and other), End-user (Utilities, Industries and Commercial), and Region (North America, Europe, Asia Pacific, Latin America, and Middle East & Africa) - Industry Analysis (2024 to 2032)

Global Switchgear Monitoring Market Size (2024 to 2032):

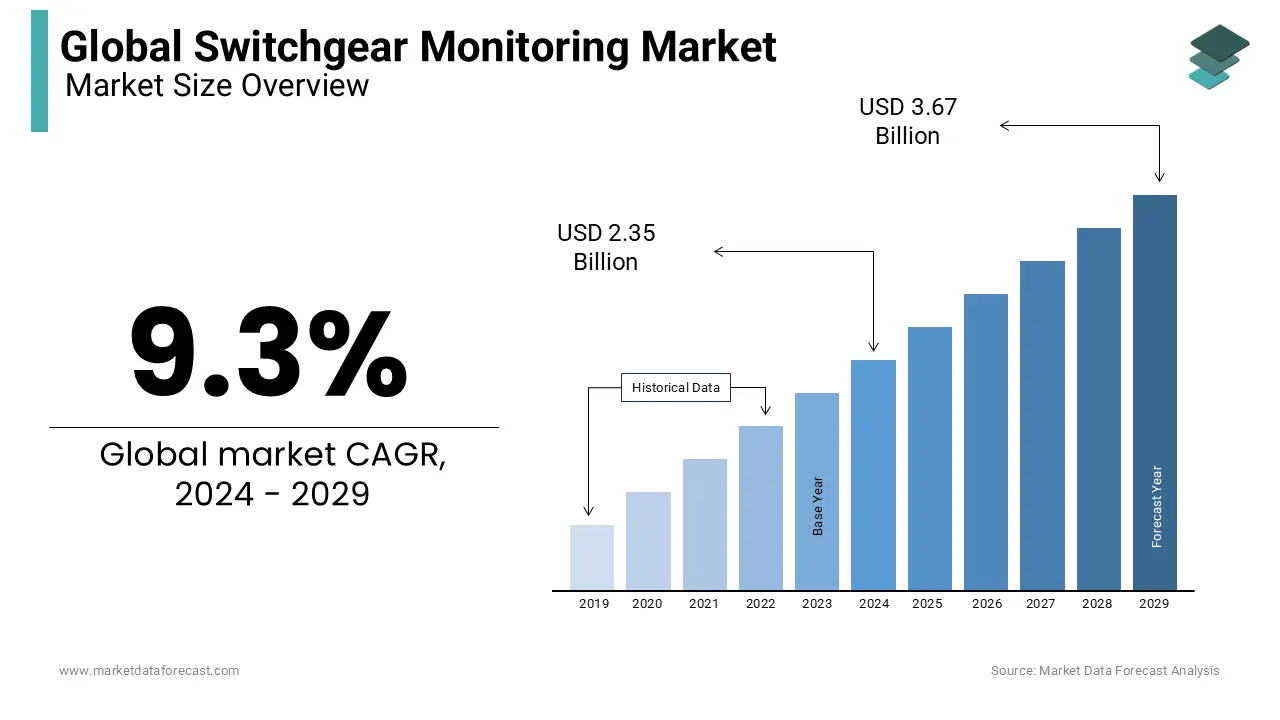

The size of the global switchgear monitoring market was worth USD 2.15 billion in 2023. The global market is anticipated to grow at a CAGR of 9.3% from 2024 to 2032 and be worth USD 4.79 billion by 2032 from USD 2.35 billion in 2024.

MARKET DRIVERS

The escalating demand to upgrade the existing power grid in accordance with the regulatory and tax reorganization in large-scale industries are propelling the growth of the switchgear monitoring market. The lack of reliable and efficient energy infrastructure in developing regions, together with a growing trend of the advancement of the dominant grid infrastructure in developed countries further boost the global market growth.

With the escalating call for electricity, utilities are highly focused on maximizing the reliability of electrical assets to minimize downtime while simultaneously reducing financial losses. The switchgear is one of the most vulnerable links in the electrical network infrastructure since it includes devices associated with the control and protection of the electrical system, such as switches, fuses, circuit breakers, and relays that are employed. However, in some cases, the board is subject to overheating due to excessive loads, normal wear and tear, and harsh environmental conditions. If left unattended, it can cause breakdowns that lead to damage to switchgear and surrounding equipment, loss of energy production and, in extreme cases, can even pose a risk to human life.

A smart grid is a digital technology that focuses on modernizing power grids by providing two-way communication between the utility company and its customers. Worldwide power companies are increasingly investing in smart grid technologies to detect and eliminate blackouts before a blackout occurs through automatic monitoring of electrical equipment. At the end-user level, smart grids can enable call flexibility and consumer participation in power system operations through distributed generation and storage.

MARKET RESTRAINTS

The electricity call curve has taken new forms, mainly in countries where the impact of the pandemic is high. The drop in electricity calls is due to blockades between countries to mitigate the spread of the virus, which is likely to have a negative impact on the entire market. Furthermore, investments for the modernization of the network are also predicted to decrease during the foreseen period. Home appliance monitoring systems are foreseen to see a downfall in 2023 due to the COVID-19 pandemic. Siemens has seen a sharp drop in calls from China, Germany, and Italy, where the impact of COVID-19 is high. This loss of call will ultimately have an impact on overall business revenue. However, the software market is estimated to have a low to moderate impact compared to hardware.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 to 2032 |

|

Base Year |

2023 |

|

Forecast Period |

2024 to 2032 |

|

CAGR |

9.3% |

|

Segments Covered |

By Product, Type, Consumption, Distribution Channel and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regions Covered |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Market Leaders Profiled |

ABB (Switzerland), Eaton (Ireland), Schneider Electric (France), Siemens (Germany), Emerson (US), Fortive (France), Mitsubishi Electric Corporation (Japan), Senseor (France), Trafag AG (Switzerland), KONCAR-Electrical Engineering Institute, Inc. (Croatia) |

SEGMENTAL ANALYSIS

Global Switchgear Monitoring Market Analysis By Type

The GIS segment is predicted to dominate the switchgear monitoring market throughout the forecast period. The market for gas-insulated switchgear monitoring is driven by the escalating call for monitoring high-voltage electrical assets to avoid unplanned outages and reduce maintenance costs.

Global Switchgear Monitoring Market Analysis By Voltage

The high-voltage segment had the largest share of the switchgear monitoring market, by voltage in 2023. The expansion of the high-voltage segment is driven by higher call for high-voltage switchgear monitoring systems. Any defect in switching devices is likely to hamper the electricity supply of a city or an entire region.

Global Switchgear Monitoring Market Analysis By Monitoring

The temperature segment had the largest share of the switchgear monitoring market in 2023. Temperature monitoring offers early detection of emerging problems, leading to quick problem identification and better maintenance than results in limited downtime or no equipment failure.

REGIONAL ANALYSIS

Asia-Pacific accounted for most of the worldwide market for switchgear monitoring systems in 2023. China is the largest and most dynamic market in the area. It is the world's leading power transmission and distribution country. The country's focus is to develop transmission lines capable of transferring high loads over long distances and to create a reliable electricity system nationwide. There is rapid development and expansion of renewable energy projects like wind and solar in China. Asia-Pacific has the largest share of the switchgear monitoring market due to escalated investment in the development of smart grid infrastructure, transmission and distribution expenses, escalating dependence on renewable energy production sources and infrastructure activities in the recent past. China had the largest installed generation and distribution capacity in the region due to high call for electricity supply, which led to increasing call for switchgear monitoring systems.

KEY PLAYERS IN THE GLOBAL SWITCHGEAR MONITORING MARKET

The key players operating in the global switchgear monitoring market are ABB (Switzerland), Eaton (Ireland), Schneider Electric (France), Siemens (Germany), Emerson (US), Fortive (France), Mitsubishi Electric Corporation (Japan), Senseor (France), Trafag AG (Switzerland), KONCAR-Electrical Engineering Institute, Inc. (Croatia), and others.

RECENT HAPPENINGS IN THE GLOBAL SWITCHGEAR MONITORING MARKET

- Siemens launches a monitoring system for medium voltage switchboards. The system is designed to monitor the operation of the circuit breaker drive, as well as to verify the reliability of the trip system and the closed circuit.

- Eaton introduces the latest switchgear monitoring and management platform to improve personnel safety and enhance system availability.

DETAILED SEGMENTATION OF THE GLOBAL SWITCHGEAR MONITORING MARKET INCLUDED IN THIS REPORT

This research report on the global switchgear monitoring market has been segmented and sub-segmented based on type, voltage, component, monitoring, end-user, and region.

By Type

- GIS

- AIS

By Voltage

- High

- Medium

By Component

- Hardware

- Software

- Services

By Monitoring

- Temperature

- PD

- Gas

- Others

By End User

- Utilities

- Industries

- Commercial

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East & Africa

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2500

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]