Global Swine Feed Market Size, Share, Trends, and Growth Forecast Report – Segmented By Type (Stater Feed, Sow Feed and Grower Feed), Additives (Vitamins, Amino Acids, Anti Biotics, Enzymes and Others) Form (Pellets, Mash and Crumbles) and Region (North America, Europe, Asia Pacific, Latin America, and Middle East-Africa) – Industry Analysis (2025 to 2033)

Global Swine Feed Market Size

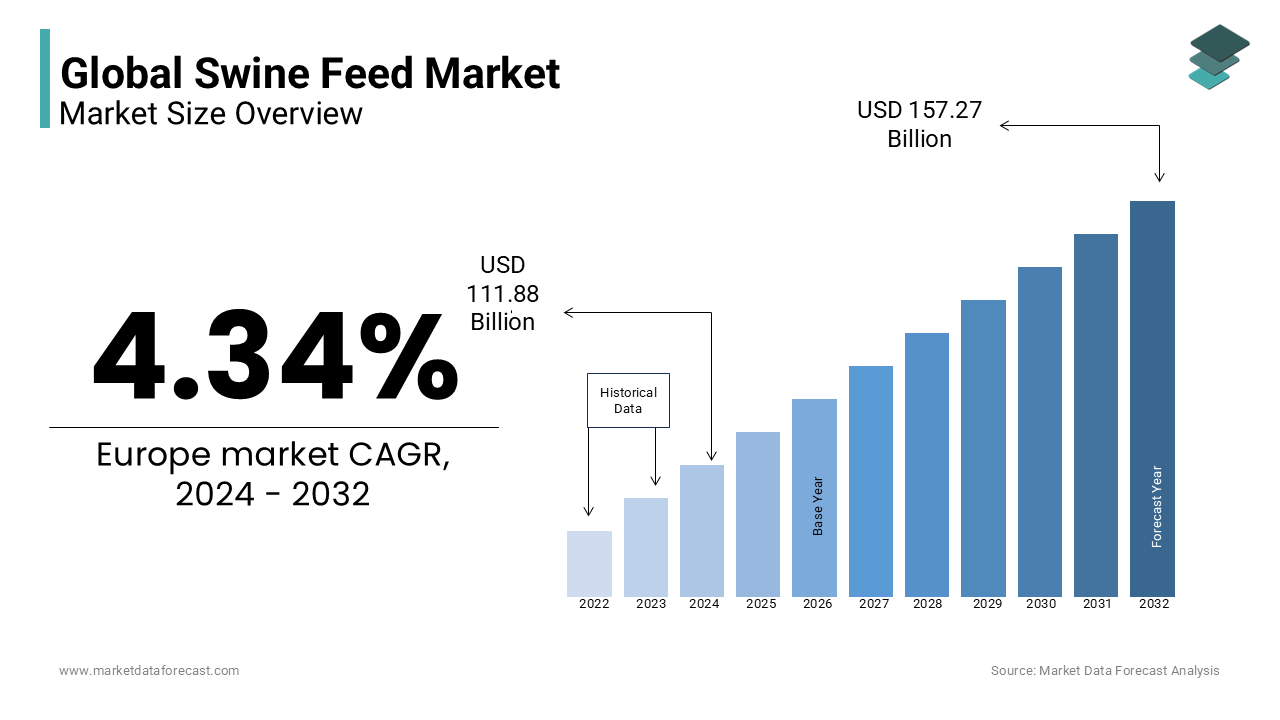

The size of the global swine feed market was expected to be valued at USD 112.02 billion in 2024 and is anticipated to reach USD 116.88 in 2025 from USD 164.19 billion by 2033, growing at a CAGR of 4.34 %from 2025 to 2033.

The Asia-Pacific region is expected to account for the largest share of the global market during the forecast period due to an increase in the consumption of pig meat in several countries in this region. Pellet feed is anticipated to have a high demand in the market, with a potential increase in demand from pig growers.

Market Drivers

One of the major driving factors for the swine feed market is the rising demand for pork of good breed and high quality. Among the consumers, there is a high demand for animal protein, mostly animal meat, which fuels the production of pigs and will further boost the market in the coming days. Across the world, the accessibility and affordability of pork make it more popular among consumer groups in varying economies. The taste and texture of pork products such as bacon, ham and others will promote the sale of pork in the consumer group and boost the demand for feed. In Western countries, there is a well-established pork market, and a trade of live pigs and pork in several nations globally is expected to boost the growth of the market.

The availability of swine feed additives and supplements is positively influencing the swine feed market. In the areas where pork meat and products are more popular, growers are highly concentrated on enhancing the health of pigs. They are purchasing high-quality feed to increase the yield that provides complete and suitable nutrition to the swine. The launch of the new swine health supplements and probiotics will help the growers achieve their targeted goals and promote global market growth. Key market players are introducing feed premixes, high-quality feed ingredients, and additives to ensure the proper health and well-being of the pigs. Many programs and swine feeding systems are used to create awareness about the nutritional requirements of the swine, and knowing about the efficient ways to feed pigs will favor the growth of the swine feed market.

Market Restraints

The high volatility of the raw material prices restricts the growth of the swine feed market during the forecast period. The high price volatility of the additives, along with the raw materials used in the preparation of the feed, can hamper the growth of the market. The small and medium pig farm growers are mostly impacted by the significant increase in the price of corn because of the high purchasing cost due to their economic position. The increasing number of people moving towards a vegan and vegetarian food diet can hamper the sale of pig meat, thereby influencing the swine feed market negatively. The outbreak of swine diseases like African Swine Fever (ASF), Porcine Epidemic Diarrhea (PED), and some other deadly diseases are predicted to limit the market growth further. For instance, China has the highest pig population in the world, and the spread of African swine fever resulted in the authorities' rejection of a significant number of pigs in China. In 2019, around 1.02 million pigs, according to the China Ministry of Agriculture & Rural Affairs, were culled to stop the spread of ASF in China country.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

4.34% |

|

Segments Covered |

By Type, Additives, Form, And Region |

|

Various Analyses Covered |

Global, Regional and Country Level Analysis; Segment-Level Analysis; DROC; PESTLE Analysis; Porter’s Five Forces Analysis; Competitive Landscape; Analyst Overview of Investment Opportunities |

|

Regions Covered |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Market Leaders Profiled |

Cargill Incorporated, Novus International Inc., BASF SE, Alltech Inc., Land O’Lakes, Hansen Holdings A/S, Kent Nutrition Group, Nutreco NV, Archer Daniels Midland (ADM), Lallemand Inc., De has animal Nutrition. |

SEGMENTAL ANALYSIS

Global Swine Feed Market By Type

The grower feed is expected to have a high demand in the swine feed market during the forecast period. This is due to an increase in the consumption rate of piglets, and the grower feed is designed to stimulate their growth, which is one of the reasons for the growth of the segment.

Global Swine Feed Market By Additives

Amino acids are projected to have a large market share in the Swine feed market owing to their usage in pig feed preparation as an additive. Amino acids are required for the proper metabolism in the swine. Swine can synthesize certain amino acids on their own. However, they are incapable of synthesizing some amino acids on their own, such as Valine, Lysine, Threonine, and others. Such amino acids are required to be supplied through feed as amino acids play an important role in the production of digestive enzymes, which are required for the overall development and well-being of the swine.

The demand for several other swine additives, such as acidifiers, enzymes, vitamins, and others, is expected to increase in the coming years due to their rising demand for superior-quality pig meat.

Global Swine Feed Market By Form

The pellets segment is anticipated to hold the largest share of the swine feed market during the forecast period. Pellet feed products are in high demand from pig growers due to their potential to improve the feed conversion ratio of swine. The adoption of swine feed in the pellets is increasing due to palatability and their efficiency in enhancing swine performance.

There is an increase in the demand for mash feed from the small pig growers for whom the high cost of feed is a restrain. Mash feed is a convenient option for the sow and lactating pigs as they can be customized, and extra nutrients can be added. It can be kept in moist conditions to increase the feed intake for the sow pigs.

REGIONAL ANALYSIS

Asia-Pacific region consists of regions such as India, China, Malaysia, South Korea, and Others where pig meat consumption is increasing at a significant rate and acts as a major driving factor for the growth of the swine feed market in this region. China alone has a considerable share in pork production and exports to many other nations in the world market. Low farm cost, low cost of labor, high pork production, and distribution network of pork are associated with high profitability in certain economies and accelerating the growth of the market. In certain nations, there is an increase in population size coupled with increasing urbanization, along with high consumer spending, which is projected to drive market growth in the coming years. However, the outbreak of the African Swine Fever in certain countries in the Asia-Pacific region has negatively impacted the market growth.

North America is projected to witness considerable growth in the swine feed market in the coming years. The rise in the demand for high-quality swine meat and other products across different nations in the region drives market growth. The U.S. region has major market players such as Archer Daniels Midland (ADM), Cargill Incorporated, and others who are expected to influence the market growth in the region. Another important factor for the growth of the market in the region is the greater profitability through the exports of pork.

In South America, Brazil is expected to hold a high market share in the regional swine feed market owing to the rapid increase in the number of pigs in the region. The country is also emerging as a significant export of the porker.

KEY MARKET PLAYERS

Some of the major prominent companies in the global swine feed market include Cargill Incorporated, Novus International Inc., BASF SE, Alltech Inc., Land O’Lakes, Hansen Holdings A/S, Kent Nutrition Group, Nutreco NV, Archer Daniels Midland (ADM), Lallemand Inc., De has animal NutrNutrition.

RECENT HAPPENINGS IN THIS MARKET

- In 2021, De Heus Animal Nutrition will be a Netherlands-based producer of compound feed, concentrates, and other feed specialties. It has acquired Golpasz, a Poland-based feed company. This acquisition combines the expertise of both companies and provides customized solutions to the consumers.

MARKET SEGMENTATION

This research report on the global swine feed market has been segmented and sub-segmented based on type, additives, form, and region.

By Type

- Starter Feed

- Sow Feed

- Grower Feed

By Additives

- Vitamins

- Amino Acids

- Antibiotics

- Enzymes

- Others

By Form

- Pellets

- Mash

- Crumbles

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

Frequently Asked Questions

what is the current market size of the global swine pig feed market?

The global swine pig feed market is valued at USD 116.88 billion in 2025.

What factors are driving the growth of the swine feed market?

The growth of the swine feed market is primarily driven by increasing pork consumption worldwide, rising demand for high-quality and specialized feed formulations to optimize swine health and performance, technological advancements in feed production, and a growing focus on animal nutrition and welfare.

How do global trends in meat consumption and trade affect the demand for swine pig feed?

Global trends in meat consumption and trade, including shifts in dietary preferences, population growth, income levels, trade agreements, and food security concerns, can significantly impact the demand for swine feed by influencing pork production levels and feed ingredient prices.

What technological advancements are influencing the swine feed industry, such as precision feeding or alternative protein sources?

Technological advancements such as precision feeding systems, real-time monitoring tools, genetic improvements, and the development of alternative protein sources (such as insect meal, single-cell proteins, and algae) are driving innovation and efficiency in the swine feed industry.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2500

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]