Global Swimming Pool Market Size, Share, Trends & Growth Forecast Report - Segmentation By Type (Fiberglass Pool, Concrete Pool, and Vinyl Liner Pools), Application, and Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa) – Industry Analysis (2025 to 2033)

Global Swimming Pool Market Size

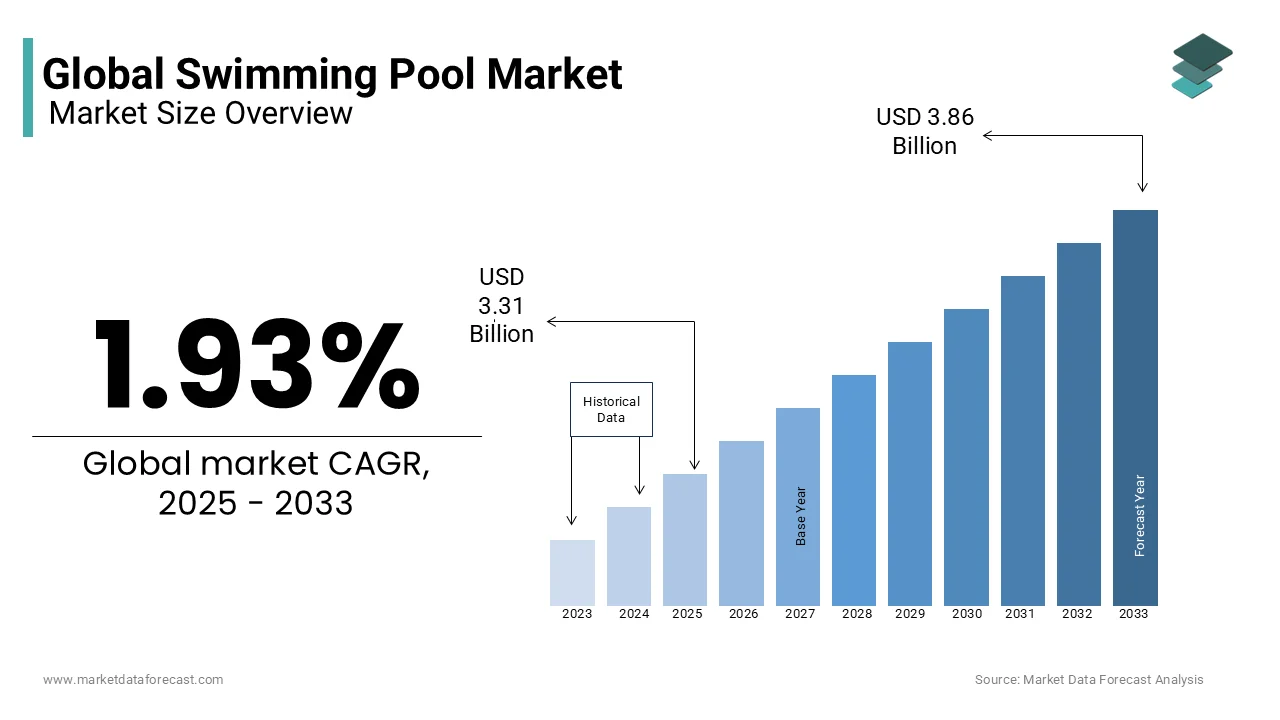

The Global swimming pool market was valued at USD 3.25 billion in 2024. The global market size is expected to grow at a CAGR of 1.93% from 2025 to 2033 and be worth USD 3.86 billion by 2033 from USD 3.31 billion in 2025.

The global swimming pool market is experiencing steady growth. Factors such as increasing disposable incomes, rising demand for residential pools, particularly in urban areas with expanding housing developments and a growing emphasis on leisure and wellness are primarily driving the expansion of the swimming pool market worldwide. One of the latest trends in the worldwide market is the growing trend of integrating smart technologies into pool systems, such as automated cleaning and energy-efficient filtration. As per Eurostat, over 60% of new pool installations now include smart features, enhancing convenience and sustainability. Additionally, the post-pandemic focus on home improvement has further propelled demand, ensuring sustained growth in both residential and commercial segments.

MARKET DRIVERS

Rising Demand for Residential Pools

The increasing demand for residential swimming pools is one of the most significant drivers propelling the growth of the global swimming pool market. According to Nielsen, over 70% of homeowners in affluent regions like North America and Europe view pools as a symbol of luxury and relaxation, creating a lucrative market for pool manufacturers. For instance, in Australia, sales of fiberglass residential pools surged by 25% in 2022, as per the Australian Pool and Spa Association. This trend is further amplified by the growing emphasis on staycations and home-based entertainment. According to the World Health Organization, over 50% of consumers prioritize outdoor spaces for physical activity and mental well-being, encouraging investments in backyard amenities. Additionally, advancements in compact and customizable pool designs have addressed space constraints, broadening their appeal.

Integration of Smart Technologies

The integration of smart technologies into swimming pool systems that enhances user experience and operational efficiency are further boosting the expansion of the global swimming pool market. According to a study by Deloitte, the adoption of smart pool technologies grew by 30% in 2022, with markets like the US and Germany leading the charge, as per the International Pool and Spa Trade Association. The emphasis on energy efficiency and water conservation has further amplified this trend. As per Eurostat, smart filtration systems reduce energy consumption by 20% while improving water quality, aligning with consumer values. Additionally, the availability of remote monitoring apps has enhanced convenience, allowing users to manage pool functions via smartphones.

MARKET RESTRAINTS

High Installation and Maintenance Costs

One of the primary restraints hindering the swimming pool market is the high cost associated with installation and ongoing maintenance. According to the National Swimming Pool Foundation, the average cost of installing a concrete pool range from USD 50,000 to USD 100,000, depending on size and features. This financial burden is particularly challenging for middle-income households, as per the Consumer Financial Protection Bureau. For instance, in Brazil, over 40% of potential buyers cited budget constraints as the main barrier to pool ownership, according to the Brazilian Construction Association. While affluent consumers can absorb these costs, smaller households often struggle to justify the investment, limiting market accessibility. Furthermore, recurring expenses for chemicals, repairs, and energy usage add to the financial strain, posing a significant challenge for broader adoption.

Stringent Environmental Regulations

The stringent environmental regulations governing water usage and chemical treatments that impact pool construction and operation is further hindering the growth of the global swimming pool market. According to the Environmental Protection Agency (EPA), over 30% of local governments in drought-prone regions impose restrictions on pool filling and refilling, discouraging installations. For example, in California, water scarcity policies led to a 15% decline in new pool projects in 2022, as per the California Water Resources Control Board. This issue is exacerbated by growing concerns about chemical runoff contaminating ecosystems. As per the World Wildlife Fund, only 20% of consumers trust traditional chlorine-based treatments, driving demand for eco-friendly alternatives. These challenges not only increase operational risks but also limit opportunities for innovation, posing a significant hurdle for market expansion.

MARKET OPPORTUNITIES

Expansion of Eco-Friendly Pool Solutions

The growing emphasis on sustainability is a notable opportunity for the swimming pool market. According to a study by Bain & Company, over 60% of European and North American consumers prioritize eco-friendly products, creating a niche for brands offering sustainable pool solutions. For instance, in Germany, companies like Speck Pumps introduced solar-powered filtration systems, boosting sales by 25%, as per the German Renewable Energy Federation. The rising awareness of environmental responsibility is adding to boost to the growth rate of the swimming pool market. As per the European Environment Agency, eco-friendly pools reduce water and energy consumption by up to 30%, aligning with consumer values. Additionally, certifications like LEED (Leadership in Energy and Environmental Design) have enhanced brand credibility, attracting premium buyers.

Growth of Modular and Portable Pools

The development of modular and portable pools that cater to space-constrained urban areas and temporary installations is another major opportunity for the regional market. According to Statista, the modular pool segment grew by 40% in 2022, with markets like Japan and South Korea leading the charge, as per the Asian Pool Association. The emphasis on flexibility and affordability has further amplified this trend. As per McKinsey & Company, over 50% of urban consumers prioritize cost-effective and space-saving solutions, creating a niche for innovative designs. Additionally, advancements in lightweight materials have improved portability, addressing previous concerns about durability.

MARKET CHALLENGES

Intense Competition and Price Wars

The intense competition among established brands and private labels that complicates efforts to build brand loyalty is one of the notable challenges to the global swimming pool market. According to Kantar Worldpanel, private label pools account for over 25% of total sales in Europe, with major retailers like Home Depot offering affordable alternatives to branded products. For instance, in France, private labels captured 30% of the fiberglass pool market share in 2022, as per the French Retail Federation. This competition is further intensified by price wars, making it difficult for brands to differentiate themselves. As per Nielsen, over 60% of consumers switch between brands based on discounts and promotions, underscoring the challenge of retaining customer loyalty. Additionally, the lack of innovation in traditional categories limits opportunities for premiumization, posing a significant obstacle for market participants striving to stand out.

Fluctuating Raw Material Prices

The volatility of raw material prices that impacts production costs and pricing strategies is also challenging the expansion of the swimming pool market. According to the International Construction Materials Council, the price of concrete and fiberglass fluctuated by up to 15% over the past year due to supply chain disruptions. For example, in Italy, shortages of raw materials caused logistical challenges, leading to a 10% increase in pool production costs, as per the Italian Construction Association. These fluctuations create uncertainty for manufacturers, forcing them to either absorb additional costs or pass them on to consumers. As per the European Central Bank, inflationary pressures have further exacerbated this issue, reducing consumer spending power and affecting demand. These challenges not only strain profitability but also hinder long-term planning and investment in the swimming pool market.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

1.93% |

|

Segments Covered |

By Type, Application, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regions Covered |

North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

|

Market Leader Profiled |

Cody Pools, Presidential Pools and Spas, Compass Ceramic Pools UK, Concord Pools and Spas, Riverbend Sandler, Albixon, All Seasons Pools, Blue Haven, Jetform Swimming Pools and Morehead Pools |

By Type Insights

The fiberglass pools segment dominated the swimming pool market by holding 46.1% of the global market share in 2024. The dominating position of fiberglass pools segment in the global market is attributed to their durability and low maintenance requirements, appealing to homeowners seeking long-term solutions. For instance, in Australia, fiberglass pools accounted for over 60% of all residential installations, as per the Australian Pool and Spa Association. The rising preference for cost-effective and time-efficient installations are further boosting the growth of the fiberglass pools segment in the global market. According to Eurostat, fiberglass pools reduce installation time by 30% compared to concrete pools, driving demand across demographics. Additionally, advancements in surface finishes have addressed previous concerns about aesthetics, ensuring sustained popularity.

The vinyl liner pools segment is another promising segment in the global market and is anticipated to register the fastest CAGR of 7.8% over the forecast period owing to their affordability and versatility, appealing to budget-conscious consumers. For example, in Canada, vinyl liner pools gained immense popularity, with sales surging by 40% in 2022, as per the Canadian Pool Builders Association. The growing emphasis on customization and aesthetic appeal is further propelling the expansion of the vinyl liner pools segment in the global market. According to Statista, over 50% of millennials and Gen Z consumers prioritize unique and stylish designs, creating a niche for innovative solutions. Additionally, advancements in UV-resistant liners have improved durability, addressing previous concerns about wear and tear.

by Application Insights

The residential swimming pools segment had 66.7% of the global market share in 2024. The growth of the residential segment in the global market can be credited to the widespread adoption of pools in private homes, particularly among affluent households with disposable incomes. For instance, in the US, over 80% of pool installations are in residential properties, as per the National Swimming Pool Foundation. The rising trend of home improvement and backyard enhancements are further aiding the expansion of the residential segment in the worldwide market. According to Statista, residential pool sales increased by 20% in 2022, reflecting heightened consumer interest in creating personalized leisure spaces. Additionally, the availability of financing options has made pool ownership more accessible, ensuring sustained demand.

The commercial segment is growing rapidly and is estimated to exhibit a CAGR of 8.3% over the forecast period owing to the increasing demand for recreational and fitness facilities in hotels, gyms, and resorts. For example, in the UAE, luxury hotels reported a 35% increase in demand for infinity pools, as per the Middle East Hospitality Association. The growing emphasis on experiential tourism and wellness is one of the major factors boosting the growth of the commercial swimming pools segment in the global market. According to McKinsey & Company, over 60% of travelers prioritize hotels with premium amenities, creating a niche for specialized venues. Additionally, the integration of smart technologies has enhanced operational efficiency, addressing previous concerns about maintenance costs. These innovations underscore the transformative potential of commercial swimming pools to reshape the market landscape.

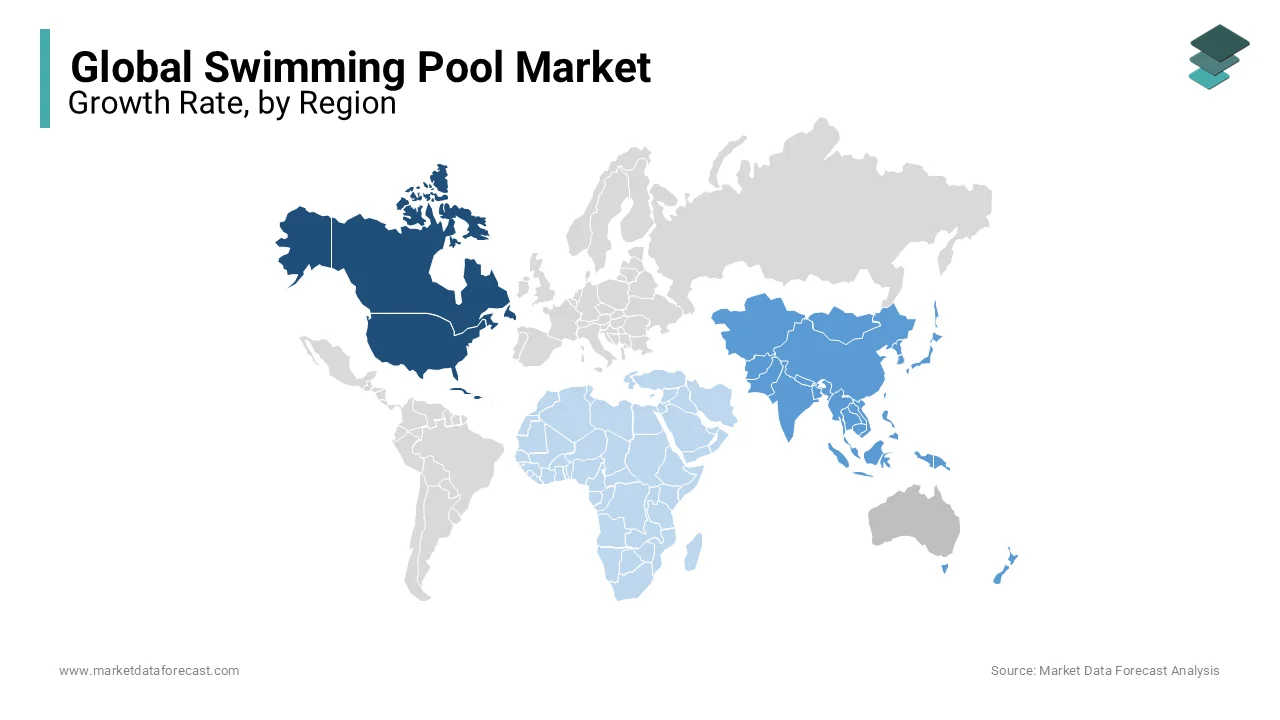

REGIONAL ANALYSIS

North America holds a commanding position in the global swimming pool market by holding the largest share of the global market. The dominance of North America in the global market is driven by high disposable incomes, a strong culture of backyard leisure, and favorable climatic conditions in states like California, Florida, and Texas. According to the National Swimming Pool Foundation, there are over 10 million residential pools in the United States alone, with annual spending on pool maintenance and upgrades exceeding $9 billion. The demand for energy-efficient and smart pool technologies, such as automated cleaning systems and solar-powered heaters, is further propelling growth. Canada also contributes significantly, particularly in regions with shorter summers, where indoor pools and spas are popular. A key factor driving this market is the increasing trend of home customization, with pools seen as a status symbol. Urbanization and the rise of gated communities with communal pools have also played a role. With steady investments in sustainable pool solutions, North America continues to shape global trends and maintain its leadership in the industry.

Europe is mature yet steadily growing landscape for swimming pools in the global market. Countries like France, Germany, and Italy lead the charge, with France alone accounting for nearly 30% of Europe’s total pool installations, according to Eurostat data. The region benefits from a robust tourism sector, where luxury resorts and wellness centers often feature state-of-the-art swimming facilities. Additionally, the growing popularity of eco-friendly pools, which use saltwater or natural filtration systems, aligns with Europe’s strong environmental regulations and consumer preferences. Germany has seen a 10% annual increase in demand for such sustainable solutions, as per industry reports. Southern European nations, including Spain and Greece, leverage their warm climates to promote outdoor pools for both residential and commercial use. Meanwhile, Eastern Europe is emerging as a new growth hotspot, with countries like Poland and Romania witnessing increased pool adoption due to rising urban middle-class populations. Despite economic fluctuations, Europe’s focus on innovation and sustainability ensures its continued relevance in the global market.

The Asia-Pacific region is the fastest-growing segment in the global swimming pool market. This growth is fueled by rapid urbanization, rising disposable incomes, and a burgeoning luxury real estate sector. China and Australia are the largest contributors, with China accounting for over 60% of the region’s pool installations, as per the International Trade Administration. In Australia, swimming pools are a staple in suburban homes, with over 1.2 million pools installed nationwide, supported by the country’s warm climate. Meanwhile, India and Southeast Asian nations like Thailand and Vietnam are seeing increased adoption, driven by the rise of wellness tourism and high-end residential projects. For instance, Thailand’s hospitality sector invests heavily in pool amenities to attract international tourists. Technological advancements, such as energy-efficient pumps and IoT-enabled pool management systems, are gaining traction among affluent consumers. Government initiatives promoting recreational infrastructure in urban areas further bolster this trend. As the region’s middle class expands, the Asia-Pacific market is poised to play an increasingly pivotal role in shaping global dynamics.

Latin America is a region with potential remains largely untapped. Brazil dominates the regional landscape, representing over 50% of installations, thanks to its tropical climate and cultural affinity for outdoor activities. According to the Brazilian Association of Pool Manufacturers, the country added nearly 50,000 new pools annually between 2020 and 2022. Mexico follows closely, with demand driven by the growing popularity of gated communities and vacation homes equipped with private pools. However, challenges such as economic instability and limited access to financing hinder widespread adoption in smaller markets like Argentina and Colombia. Despite these barriers, Latin America’s tourism industry, particularly in the Caribbean and coastal regions, provides a steady stream of opportunities for commercial pool installations. Resorts and hotels are investing in luxurious pool facilities to cater to international travelers. Moreover, rising awareness about water conservation has spurred interest in eco-friendly designs, though adoption remains nascent. With strategic investments and improved economic conditions, Latin America could emerge as a significant player on the global stage.

The Middle East and Africa collectively hold around a considerable share of the global swimming pool market, with the Middle East driving most of the activity. The UAE and Saudi Arabia lead the charge, fueled by the region’s arid climate and booming luxury real estate sector. According to the Dubai Real Estate Institute, over 70% of high-end residential projects in Dubai feature swimming pools, reflecting their status as essential amenities. Similarly, Saudi Arabia’s Vision 2030 initiative has spurred investments in entertainment and hospitality infrastructure, including world-class resorts with expansive pool facilities. In contrast, Africa’s contribution remains modest, concentrated primarily in South Africa and Egypt, where affluent urban populations and tourism hubs drive demand. South Africa, for instance, has seen a 5% annual increase in pool installations, supported by a thriving middle class. However, factors like water scarcity and high installation costs pose significant challenges across the region. Despite these hurdles, the adoption of innovative solutions, such as water-recycling systems, offers promise for sustainable growth. While still niche, the Middle East and Africa’s focus on luxury and tourism positions them as emerging contributors to the global market.

KEY MARKET PLAYERS AND COMPETITIVE LANDSCAPE

Cody Pools, Presidential Pools and Spas, Compass Ceramic Pools UK, Concord Pools and Spas, Riverbend Sandler, Albixon, All Seasons Pools, Blue Haven, Jetform Swimming Pools, and Morehead Pools are some of the notable players in the global swimming pool market.

The swimming pool market is characterized by intense competition, with established brands and emerging startups vying for market share. According to McKinsey & Company, the market is fragmented, with no single entity holding more than 25% of the share, fostering a highly dynamic environment. Key players like Hayward and Pentair dominate the premium segment, while private labels compete aggressively on affordability and accessibility.

Emerging startups, supported by venture capital funding, are disrupting traditional business models. For instance, brands like SwimCloud are pioneering smart pool management systems, challenging incumbents in the technology segment. As per the European Commission, this competitive landscape drives innovation and ensures affordability for end-users. However, regulatory compliance and raw material volatility remain critical challenges for all participants, shaping the market’s evolution.

TOP PLAYERS IN THE SWIMMING POOL MARKET

Hayward Industries, headquartered in the US, holds a substantial presence globally, offering iconic brands like AquaRite and Super Pump. Pentair, based in the UK, specializes in energy-efficient and smart pool systems, with a growing footprint in markets like Europe and Asia. Meanwhile, Fluidra, a Spanish firm, is renowned for its innovative pool automation solutions, widely adopted by commercial properties. These players collectively drive innovation and set benchmarks for the swimming pool market.

TOP STRATEGIES USED BY KEY PLAYERS

Key players in the swimming pool market employ diverse strategies to strengthen their positions. One prominent strategy is sustainability initiatives. For instance, in March 2023, Hayward Industries announced a commitment to achieving carbon neutrality across its supply chain by 2030, aiming to appeal to eco-conscious consumers.

Another strategy is product diversification. In June 2023, Pentair launched a line of solar-powered pool heaters targeting environmentally conscious buyers. This move aligns with the company’s goal of addressing emerging consumer preferences. Additionally, as per the European Investment Bank, Fluidra has invested heavily in AI-driven pool management tools to enhance user experience. These strategies reflect a commitment to innovation and market leadership.

RECENT HAPPENINGS IN THE MARKET

- In April 2024, Hayward Industries acquired a Swedish startup specializing in AI-driven pool automation systems. This acquisition aimed to expand its portfolio of smart pool solutions and cater to tech-savvy buyers.

- In May 2024, Pentair partnered with a German renewable energy provider to launch a line of solar-powered pool heaters. This initiative aimed to strengthen its position in the eco-friendly segment.

- In July 2024, Fluidra introduced a subscription-based service for pool maintenance, targeting residential customers. This move aimed to enhance customer retention and explore new revenue streams.

- In September 2024, Zodiac secured USD 100 million in funding from global investors to scale its sustainable pool initiatives. This investment aimed to enhance transparency and accountability.

- In November 2024, Hayward launched a campaign promoting its zero-waste packaging initiative. This effort aimed to enhance brand credibility and appeal to eco-conscious consumers.

MARKET SEGMENTATION

This research report on the global swimming pool market has been segmented and sub-segmented into the following categories.

By Type

- Fiberglass Pool

- Concrete Pool

- Vinyl Liner Pools

By Application

- Residential

- Commercial Swimming Pools

- Public Swimming Pools

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- The Middle East and Africa

Frequently Asked Questions

What is the Swimming Pool Market's estimated size and growth rate?

The Global swimming pool market was valued at USD 3.25 billion in 2024. The global market size is expected to grow at a CAGR of 1.93% from 2025 to 2033 and be worth USD 3.86 billion by 2033 from USD 3.31 billion in 2025.

What are the restraining factors that are restricting the growth of the global market?

High installation and maintenance costs are the restricting factors of the global swimming pools market.

Who all are the top vendors in the global swimming pool market?

The major vendors are Cody Pools, Presidential Pools and Spas, Compass Ceramic Pools UK, Concord Pools and Spas, Riverbend Sandler, Albixon, All Seasons Pools.

What market categories does the Swimming Pool Market?

The product type, the application, and the geographical region are to be seen in the global swimming pool market

Which are the dominant countries in the global swimming pool market?

The North America and Asia pacific are the top countries that are dominating the global swimming pools market.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2500

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]