Global Sustainable Marine Fuels Market Research Report – Segmentation By Type (Hydrogen, Ammonia, Methanol, Biofuels, Others), Application (Tankers/Carriers, Barges/Cargo vessels, Tugboats, Defense Vessels, Ferries, Yachts, Cruise Ships, Others), & Region - Industry Forecast From 2024 to 2032

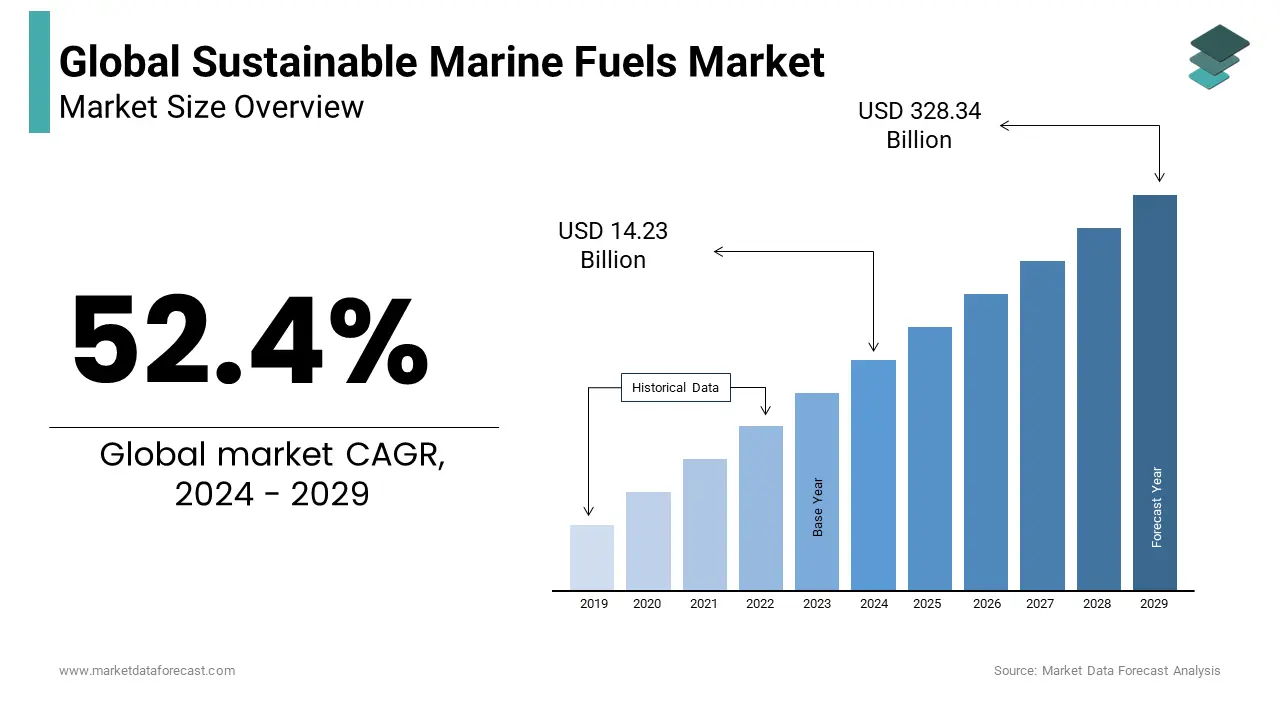

Global Sustainable Marine Fuels Market Size (2024 to 2032)

The global sustainable marine fuels market was valued at USD 9.34 billion in 2023. The global market size is estimated to be worth USD 14.23 billion in 2024. It is anticipated to reach around USD 414.08 billion by 2032 with a CAGR of 52.4% during the forecast period.

Current Scenario of the Sustainable Marine Fuels Market

Sustainable marine fuels, also known as alternative marine fuels or low-carbon fuels, act as reliable solutions for improving air quality and supporting the environmental policies in port communities. These are the apparent alternatives to fossil fuels as they offer energy from renewable and green sources such as solar, wind power, biomass, industrial scrap, and more. The sustainable marine fuels market accounted for the most significant growth from the past years and is projected to have notable growth in the coming years. The growing demand for renewable energy sources and growing knowledge among manufacturers owing to stringent government regulations for environmental protection all contribute to the sustainable marine fuels market growth. The increasing carbon emissions significantly enhance the demand for sustainable marine fuels. The global carbon dioxide emissions from fossil fuels and industry is 37.15 billion metric tons (GtCO2) 2022. The emissions are expected to rise by 1.1 percent in 2023, reaching a record high of 37.55 GtCO2. Various reports state that global carbon emissions have increased by more than 60% since 1990 and are estimated to increase in the coming years.

MARKET DRIVERS

The rising initiatives to limit carbon emissions are a significant factor driving the growth of the global sustainable marine fuels market.

The growing number of government initiatives in collaboration with private institutions to control carbon emissions and decarbonize the environment due to shipping activities is augmenting the adoption of sustainable marine fuels, leading to market growth. Various initiatives like eco-port policies and green shipping are encouraging shipowners to adopt eco-friendly fuels through the shipping process, positively impacting global market revenue expansion. For instance, the International Maritime Organization has released the need to reduce carbon emissions and implemented a mandatory emission reduction of about 50% for every vessel up to 2050. Significant countries like the United Kingdom, the United States, and Japan had made a goal of net-zero carbon emissions from shipping activities in the same period. The growing awareness regarding the environmental impact is enhancing the market players' adoption of renewable energy sources and boosting the market growth rate. The increasing market for sustainable marine fuels is due to corporate commitments as most of the companies in the maritime industry are seeking carbon emission reductions and adopting cleaner energy sources, propelling growth opportunities in the sustainable marine fuels market in the coming years. The rising trend of shaping the maritime industry, growing regulatory mandates, and rising awareness among investors regarding environmental concerns and corporate sustainability are augmenting the market growth.

The growing investments by the various market players in the research and developmental activities propel the market growth rate.

Most market players are collaborating with various organizations to focus on decarbonization, which is accelerating investments in R&D activities to develop methods for reducing carbon emissions. For Instance, the US Energy Department collaborated with the Bioenergy Technologies Office (BETO) for R&D activities to achieve the target of low and net zero carbon sustainable fuels for marine transportation.

MARKET RESTRAINTS

The high cost of sustainable marine fuels, which are low-carbon or carbon-free fuels, is a major factor restraining the global market growth.

Compared to fossil fuels, these alternative fuels are considered expensive, limiting adoption among the manufacturers as some vessels require upgrades. Complex manufacturing procedures for producing sustainable marine fuels increase overall expenses, which will be challenging for manufacturers with budget restrictions. The constant fluctuations in market prices compared to fossil fuels are another challenging factor in expanding market growth. Sustainable marine fuels such as synthetic, hydrogenated, and biofuels often have high production costs, challenging the maritime industry. Various drawbacks like fuel aging and oxidation can lead to high acid numbers and high viscosity, and the formation of gums and sediments will limit their adoption, restricting the market revenue growth.

Another major challenge for the market expansion is the presence of underdeveloped infrastructure. The infrastructure required to generate enough power for everyday use needs to be well-developed in most regions, which is causing manufacturers to adopt regular fossil fuels. It costs more for a complete shift towards alternative fuels as the initial installation and maintenance are expensive. Various sustainable marine fuels possess certain disadvantages, such as difficult storage conditions for hydrogen, toxicity and environmental impact by ammonia during leakage, high costs, and limited production of biofuels. All these factors are expected to impede the market growth opportunities in the coming years.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 to 2032 |

|

Base Year |

2023 |

|

Forecast Period |

2024 to 2032 |

|

CAGR |

52.4% |

|

Segments Covered |

By Type, Application, and Region. |

|

Various Analyses Covered |

Global, Regional, & Country Level Analysis; Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview of Investment Opportunities |

|

Regions Covered |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Market Leaders Profiled |

Neste Corporation, FincoEnergies, Liquid Wind AB, A.P. Moller-Maersk A/S, TotalEnergies SE, Exxon Mobil Corporation, Shell plc, Chevron Corporation, BP plc, Gevo Inc., and Others. |

SEGMENTAL ANALYSIS

Global Sustainable Marine Fuels Market Analysis By Type

The hydrogen segment held the most significant share of the sustainable marine fuels market revenue in 2023. The primary factor fueling hydrogen adoption is that it does not produce any residue or trails in any toxic emission, which is essential for reducing carbon emissions by the maritime industry. This encourages shipowners and manufacturers to adopt hydrogen as a popular choice as it meets the low carbon emission target by following stringent regulations, escalating the segment growth rate. Hydrogen stability is another primary factor as it does not react explosively compared to other fuels derived from the conventional crude oil method, which boosts segment growth. The versatility and availability make hydrogen highly dense and a potential carrier, which helps drive the engines of large marine ships and contributes to segment growth.

The methanol segment is gaining traction and is expected to grow substantially during the forecast period. Various factors like affordability and reliability are making methyl alcohol an excellent substitute for conventional fuels such as marine and ship fuels, augmenting the segment revenue growth. Methanol as a marine fuel is gaining more attention among shipowners as it can be used as maritime fuel due to its affordability and ease of handling, driving the segment growth opportunities in the coming years.

Biofuels are expected to grow steadily during the forecast period due to rising demand for fuels derived from renewable organic sources such as animal fats, vegetable oils, and algae as alternatives to traditional marine fuels.

Global Sustainable Marine Fuels Market Analysis By Application

The ferries segment dominated the global market with considerable growth and is expected to dominate during the forecast period. Ferries include ships with containers, passenger ships, and small leisure boats that use sustainable marine fuels to maintain the boat's performance intact while reducing carbon emissions from recreational boating experiences, which is augmenting the segment revenue growth. The increased adoption of green ammonia due to complete renewable carbon-free production in the ferries as an alternative to fuel oil will accelerate the market growth opportunities. The growing utilization of sustainable fuel alternatives such as methanol or biofuels allows ferry operators to limit carbon emissions by maintaining air quality. The predictable ferry routes and operations provide opportunities for integrating sustainable fuel solutions.

The barges and cargo vessels segment is projected to have a prominent share owing to the bulk transportation of goods and commodities across oceans and waterways. These vessels mainly operate on longer routes, which consume high amounts of fuel, resulting in the emission of greenhouse gases and pollutants. This, in turn, influences them to adopt sustainable marine fuels such as biofuels, propelling the segment's growth. The scalability and compatibility of sustainable fuels are gaining traction among vessel operators because reducing the environmental impact propels segment growth.

REGIONAL ANALYSIS

The Asia Pacific region will dominate the global sustainable marine fuels market in 2023 with a prominent share and is anticipated to maintain the domination during the forecast period. The presence of emerging countries like India, Japan, China, and South Korea in the region is escalating maritime transportation activities contributing to market growth. The growing government and private institutes' collaboration to raise awareness among manufacturers regarding carbon emissions and the need to control them is creating opportunities for market expansion in the region. The rising adoption of stringent regulations by international maritime organizations in the Asia Pacific region is making the market rise for sustainable marine fuels across the region.

The European region held the second-largest global market share and is estimated to experience notable growth during the forecast period. The stringent regulations implemented by the European government to reduce carbon emissions by 30% by the end of 2050 act as a driving factor for the sustainable marine fuels market's growth in the region. The utilization of green ammonia as a shipping fuel, which offers a high-energy, carbon-free alternative to fossil fuels, is boosting the market's growth opportunities.

The North American sustainable marine fuel market is estimated to grow substantially in the coming years. The growing favorable government policies encourage the utilization of alternative fuels in marine transportation, which contributes to the regional market growth. The United States contributes to the most carbon emissions worldwide, enhancing the market players' adoption of alternative fuels and expanding the regional market growth rate.

The Latin American region is projected to grow moderately during the forecast period. The growing mandates by the international government and industry collaborations are driving the market growth opportunities in the region to adopt low-carbon fuels.

The Middle East and African markets are expected to proliferate at a steady growth rate during the forecast period. The increased adoption of biofuels and the gaining traction of hydrogen and ammonia are providing growth opportunities to the market across the region.

KEY PLAYERS IN THE GLOBAL SUSTAINABLE MARINE FUELS MARKET

Companies playing a prominent role in the global sustainable marine fuels market include Neste Corporation, FincoEnergies, Liquid Wind AB, A.P. Moller-Maersk A/S, TotalEnergies SE, Exxon Mobil Corporation, Shell plc, Chevron Corporation, BP plc, Gevo Inc., and Others.

RECENT HAPPENINGS IN THE GLOBAL SUSTAINABLE MARINE FUELS MARKET

- In February 2024, Hafina Bunkers announced its collaboration with the member units and Goodfuels supplier Finco Energies. This collaboration has revolutionized vessel fueling by introducing advanced sustainable marine fuel solutions.

- In March 2024, Prime Minister of India Narendra Modi officially launched India's first hydrogen fuel cell ferry in-house. The vessel was delivered by Cochin Shipyard Limited (CSL) for duty to Varanasi in Uttar Pradesh.

- In May 2024, Genevos announced the approval of its recent development of a 250kW Hydrogen Power Module naval fuel cell from Bureau Veritas. With the introduction of the HPM-250, a next-generation maritime fuel cell, the Genevos had achieved significant achievement.

DETAILED SEGMENTATION OF THE GLOBAL SUSTAINABLE MARINE FUELS MARKET INCLUDED IN THIS REPORT

This research report on the global sustainable marine fuels market has been segmented and sub-segmented based on type, application, and region.

By Type

- Hydrogen

- Ammonia

- Methanol

- Biofuels

- Others

By Application

- Tankers/Carriers

- Barges/Cargo Vessels

- Tugboats

- Defense Vessels

- Ferries

- Yachats

- Cruise Ships

- Others

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East & Africa

Frequently Asked Questions

1. What is the global sustainable marine fuels market growth rate during the projection period?

The global sustainable marine fuels market is expected to grow at a CAGR of 52.4% between 2024 and 2032.

2. What can be the total global sustainable marine fuels market value?

The global sustainable marine fuels market is expected to reach a revised size of USD 414.08 billion by 2032.

3. What are the top 5 key players in the global sustainable marine fuels market?

Liquid Wind AB, A.P. Moller-Maersk A/S, TotalEnergies SE, Exxon Mobil Corporation, and Shell plc are key players in the global sustainable marine fuels market.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2500

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]