Global Surveillance Radar Market Size, Share, Trends, & Growth Forecast Report - Segmented By Type (Short-Range, Medium-Range, and Long-Range), Platform (Airborne, Ground, Naval, and Space), Application (Commercial, Military, Homeland Security, and Others), Component (Antennas, Transmitters, Receivers, Amplifiers, Duplexers, Digital Signal Processor and Others), Dimension (2D, 3D and 4D), Frequency (HF, UHF & VHF, L, S, C, X, Ku, Ka, and Multi-bands) & Region - Industry Forecast From 2024 to 2032

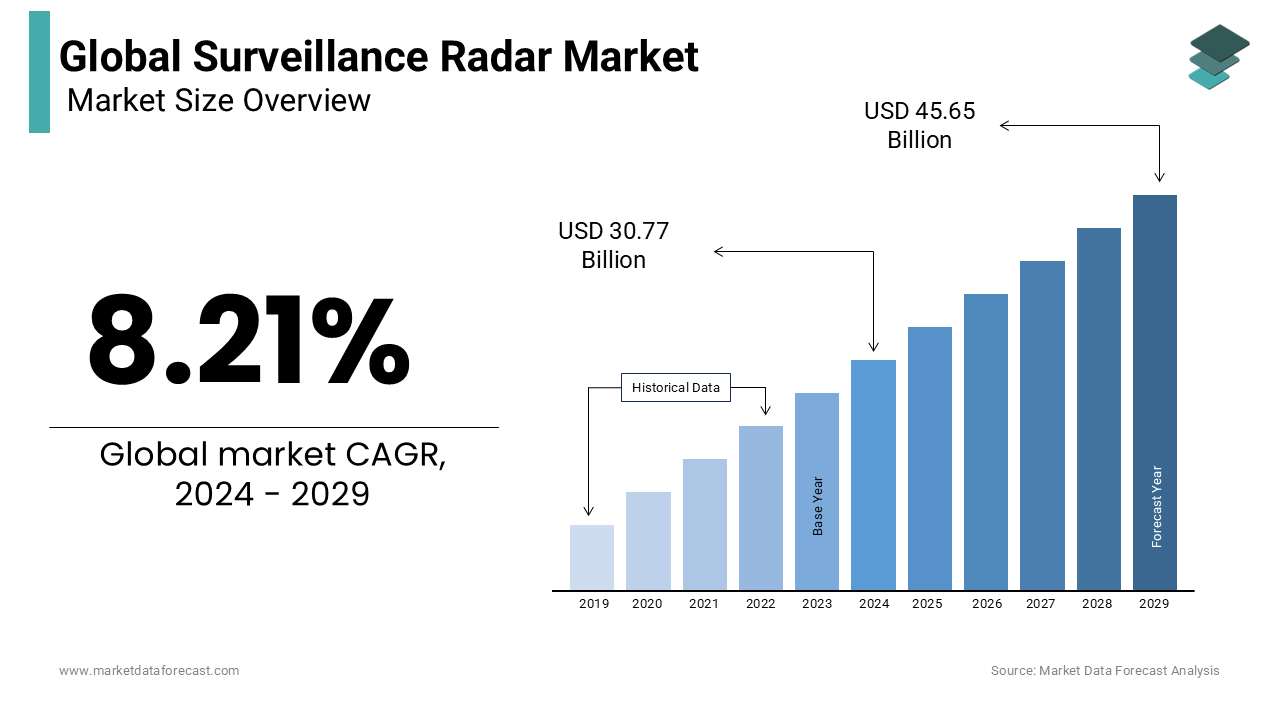

Global Surveillance Radars Market Size (2024 to 2032)

The global surveillance radars market was worth USD 28.44 billion in 2023. The global market is expected to be worth 30.77 Billion USD in 2024. It is expected to grow at a CAGR of 8.21% during the forecast period and reach a value of 57.85 Billion USD by 2032.

Surveillance radar is a piece of electrical equipment that detects the position and velocity of distant objects such as planes, ships, and automobiles. Radar systems use a receiver to detect electromagnetic radiation and calculate the object's position and distance. They are perfect for collision avoidance and driver assistance because they provide reliable detection of any object within the detection cones. Radar systems, on the other hand, lose efficiency as the distance between the item and the system grows.

MARKET DRIVERS

The ability of next-generation combat aircraft to give high tactical capabilities during warfare has boosted demand from countries such as the United States, China, and India. The market for UAVs equipped with surveillance radars has been fuelled by concerns about border and coastline security.

Furthermore, increased demand for military aircraft fleet modernization programmers has resulted in an increase in new aircraft orders, which is projected to fuel market expansion. Similarly, rising military spending on fighter jets equipped with advanced radar technology in order to bolster defense capabilities is expected to propel the surveillance radar market forward over the forecast period.

The demand for conventional military equipment to be modernized has increased as warfare and battlefield management have changed. Modernization is required to stay up with technical advancements in combat.

MARKET RESTRAINTS

Radar requirements for military applications include excellent operating efficiency, user-friendly advanced technologies, platform compatibility, and a wide frequency band, all of which add to the design's complexity. The demand for lightweight and tiny radar systems is increasing. Techniques and fundamental theories, on the other hand, limit the size and performance of radar systems. The market's growth is expected to be hampered by these design and development limits in surveillance radar systems. Radar-equipped systems are employed in military applications. They operate in hostile circumstances, and any equipment failure on the battlefield might result in devastating damage.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 to 2032 |

|

Base Year |

2023 |

|

Forecast Period |

2024 to 2032 |

|

CAGR |

8.21% |

|

Segments Covered |

By Type, Platform, Application, Component, Dimension, Frequency, & Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regions Covered |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Market Leaders Profiled |

Lockheed Martin (US), L3Harris (US), Raytheon (US), Griffon (US), ISA (Israel), Elbit Systems (Israel), BAE Systems (UK), Saab (Sweden), Leonardo (Italy), Aselsan (Turkey) |

SEGMENTAL ANALYSIS

Global Surveillance Radars Market Analysis By Type

The short-range category held the biggest market share in 2020, owing to its widespread use in commercial and military ground-based applications.

The long-range category is predicted to rise at the quickest CAGR throughout the projection period, owing to rising demand for over-the-horizon (OTH) radars, which are used to identify targets thousands of kilometers away.

Global Surveillance Radars Market Analysis By Platform

The ground segment is predicted to be the largest section in 2020 due to increased deliveries of surveillance radar-based combat vehicles in Asian countries.

The airborne category is predicted to grow at a quicker CAGR throughout the forecast period due to the development of upgraded next-generation combat aircraft.

Global Surveillance Radars Market Analysis By Application

The commercial segment is predicted to grow at the quickest rate over the projection period, owing to increased demand for technologically advanced radar-based air traffic control units to replace conventional air traffic control units.

Global Surveillance Radars Market Analysis By Component

During the forecasted period, digital signal processors are expected to have the biggest market share. By doing signal processing, the digital signal processor works like a computer that performs all command and control operations. Previously, systems relied on analog signal processing. High-end processors, such as Field Programmable Gate Array (FPGA), Graphics Processing Unit (GPU), and general-purpose processors, are used in the latest digital signal processing.

Global Surveillance Radars Market Analysis By Dimension

In the Surveillance Radar market, 3D is expected to be the largest and fastest-growing segment. T3D surveillance radars solve the problems that 2D radars have. Active electronically scanned arrays with digital beamforming capabilities are used in 3D radars. These radars are essential for air defense and other applications that demand precise target coordinates. For surveillance, certain 3D radars use stacked beams. The use of digital beamforming has allowed 3D surveillance radars to progress.

Global Surveillance Radars Market Analysis By Frequency

During the forecast period, the Ku-band segment is expected to increase at the fastest rate. It has a fast-scan mode that allows it to cover a full 360° in 20 seconds. In comparison to lesser bands, Ka-bands offers a wider beam coverage and better throughput. Rain fading occurs as a result of the rain's absorption of electromagnetic radiation.

REGIONAL ANALYSIS

In 2020, the North American market was valued at USD 3.62 billion. Due to the existence of important military players, it is expected to dominate the market during the projection period.

Due to increased defense spending on military land and naval-based systems, Asia-Pacific is likely to be the fastest-growing region. Furthermore, increased passenger traffic from emerging economies such as China and India is expected to drive market expansion, as surveillance radars play a significant role in air traffic control.

The Middle East and Africa are expected to grow significantly over the projection period, owing to an increase in new aircraft purchases by carriers in the United Arab Emirates and Saudi Arabia. Furthermore, Israel and Saudi Arabia have a large lead in radar-based sophisticated systems. This will aid the region's market expansion. Increased military spending on modernizing ground-based radar equipment by governments such as Brazil and Argentina has supported the market's expansion in South America.

KEY PLAYERS IN THE GLOBAL SURVEILLANCE RADAR MARKET

Lockheed Martin (US), L3Harris (US), Raytheon (US), Griffon (US), ISA (Israel), Elbit Systems (Israel), BAE Systems (UK), Saab (Sweden), Leonardo (Italy), Aselsan (Turkey)

RECENT HAPPENINGS IN THE MARKET

- Elbit Systems has been awarded a $350 million contract to supply ground defense systems to a foreign customer. Elbit Systems has not revealed the product in question, nor has it identified the customer, who appears to be a country in Asia. The deal will be completed over a three-year timeframe.

- Raytheon Technologies has been granted a five-year, $102.6 million contract to update, replace, and repair the ALR-67(V) 3 radar warning systems that are installed on the US Navy's F/A-18 tactical aircraft. The firm-fixed-price contract for the radar warning platform also covers inventory, obsolescence, and configuration management support services. The AN/ALR-67(V) 3 is a digital radar warning receiver that offers situational awareness to fighter pilots. Even when adjacent transmitters are interfering, the system can find emitters in high-pulse-density situations and intercept faint distant signals.

DETAILED SEGMENTATION OF THE GLOBAL SURVEILLANCE RADARS MARKET INCLUDED IN THIS REPORT

This research report on the global surveillance radars market has been segmented and sub-segmented into the following categories.

By Type

-

Short-Range

- Medium-Range

- Long-Range

By Platform

- Airborne

- Ground

- Naval

- Space.

By Application

-

Commercial

- Military

- Homeland Security

- Others

By Component

-

Antennas

- Transmitters

- Receivers

- Amplifiers

- Duplexers

- Digital Signal Processor

- Others.

By Dimension

-

2D

- 3D

- 4D

By Frequency

- HF

- UHF & VHF

- L, S, C, X, Ku, Ka

- Multi-bands

By Region

-

North America

- Europe

- Asia Pacific

- Latin America

- The Middle East and Africa

Frequently Asked Questions

What factors are driving the growth of the surveillance radar market?

The growth is primarily driven by increasing defense budgets, rising geopolitical tensions, advancements in radar technology, and the growing need for border and coastal surveillance.

What are the key applications of surveillance radars?

Surveillance radars are used for various applications, including air traffic control, border and coastal surveillance, critical infrastructure protection, and military applications such as missile defense and battlefield monitoring.

How is technology impacting the surveillance radar market?

Technological advancements, such as the development of AESA (Active Electronically Scanned Array) radars, miniaturization of components, and integration with AI and machine learning, are enhancing the capabilities and efficiency of surveillance radars.

What future trends are expected in the surveillance radar market?

Future trends include the integration of multi-function capabilities, increased use of unmanned systems with radar capabilities, enhanced cyber-security measures, and a greater focus on developing compact and portable radar systems for diverse applications.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2500

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]