Global Surgical Robots Market Size, Share, Trends & Growth Forecast Report By Component, Surgery Type, End User and Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), Industry Analysis From 2025 To 2033.

Global Surgical Robots Market Size

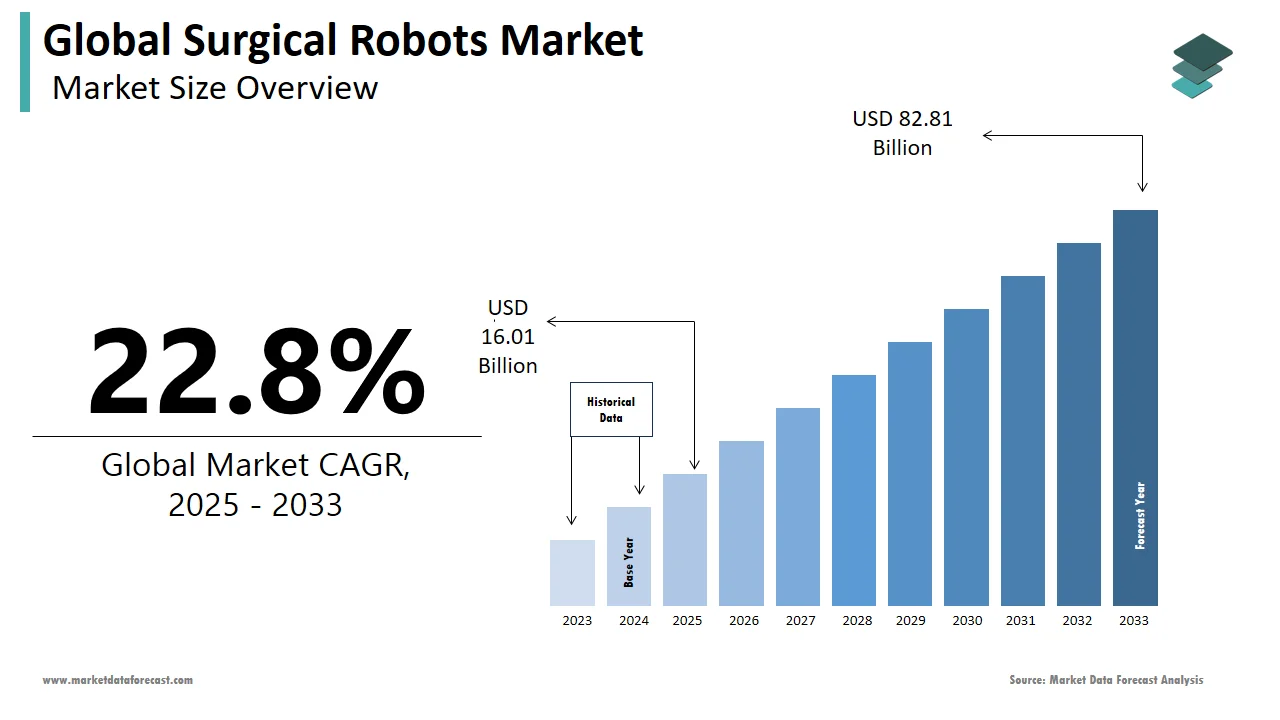

The global surgical robots market was worth US$ 13.04 billion in 2024 and is anticipated to reach a valuation of US$ 82.81 billion by 2033 from US$ 16.01 billion in 2025, and it is predicted to register a CAGR of 22.8% during the forecast period 2025-2033.

Robotic surgery is a minimally invasive surgery that uses computer-controlled robots allowing doctors to operate with less damage to the body. It is also known as robot-assisted surgery. Surgeons who use the robotic system find that it enhances precision, flexibility, and control during the operation and allows them to see the site for many procedures better. Using robotic surgery, surgeons can perform both delicate and complex procedures. In robotic surgery, the robot does not work independently, and the surgeon instructs the robot to do a specific task in the body. The da Vinci Si surgical robot, the world’s most advanced computer-assisted surgical system, was first used in 2008 at NYU Langone and became the first medical center in New York.

MARKET DRIVERS

Advances in robotics are shaping the future of the healthcare industry. Technological advancements in robotics in surgical procedures are one of the major factors propelling the surgical robot market worldwide.

In addition, the growing incidence of chronic diseases is resulting in increasing surgical procedures worldwide, increasing the need for surgical robots to manage treatment procedures and drive market growth effectively. These procedures are surgical interventions, cataract surgery, orthopedic surgery, and cardiac surgery. Each year, over 500,000 open heart procedures are performed. In addition, 38,741 and 12,245 elective orthopedic surgeries were included in 2019 and 2020, respectively. Increased regulatory approval for surgical robots is also expected to favor the market. In addition, advantages associated with robotic surgeries include reduced post-surgery pain, less blood loss, faster recovery, fewer and smaller scars, increased precision for more accurate joint replacements, shorter hospital stay, and less risk of infection, further supporting the market growth.

Increased usage of surgical robots in ambulatory surgery centers is another notable factor promoting the growth rate of the surgical robot market.

Ambulatory surgery centers (ASCs) are medical clinics that perform surgical, diagnostic, and preventive procedures that do not require hospital admission. ASCs demand much lower rates than hospitals. Due to these cost benefits, there has been a rapid increase in the number of surgical procedures performed in ASCs. ASCs are adopting more advanced robotics, mainly in the US, to handle complex cases. ASCs that use the da Vinci Surgical System to perform minimally invasive procedures include the Hutchinson Ambulatory Surgery Centre, Health East Ambulatory Surgical Centre, and the Atlanta Minimally Invasive Gynecologic Surgery Center.

MARKET RESTRAINTS

On the other hand, high costs associated with the maintenance of surgical robots are significant restraints to the surgical robots market. In addition, the lack of specially trained professionals, a smaller number of robotic surgery-related hospitals, and risks of nerve damage in some surgeries are a few of the factors expected to share a negative impact on the growth of the surgical robots market during the forecast period.

Impact of COVID-19 on the Global Surgical Robots Market

The growth rate of the global surgical robots market has accelerated due to the COVID-19 initial days. During the pandemic, most of the surgeries were postponed and rescheduled after the pandemic. As days passed, many countries announced lifting the traveling restrictions and encouraged the new normalizing. However, many hospitals and healthcare professionals have relied on robotic assist systems to stop the aggressive spread of coronavirus.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

22.8% |

|

Segments Covered |

By Component, Surgery Type, End-user, and Region. |

|

Various Analyses Covered |

Global, Regional, and country-level analysis; Segment-Level Analysis, DROC; PESTLE Analysis; Porter’s Five Forces Analysis, Competitive Landscape; Analyst Overview of Investment Opportunities |

|

Regions Covered |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Market Leaders Profiled |

Intuitive Surgical, Medtronic, Stryker, Smith & Nephew Zimmer Biomet, ransenterix, Inc., Corindus Vascular Robotics, Renishaw, Auris Health, Inc., Medrobotics Corporation, Think Surgical, CMR Surgical, Verb Surgical, Omnilife Science, Inc., Preceyes BV, China National Scientific Instruments and Materials Corporation (Csimc), Microsure, Titan Medical Inc., Avatera Medical GmbH and Medicaroid Corporation, and Others. |

SEGMENTAL ANALYSIS

By Component Insights

Based on the component, the accessories segment had the highest global surgical robots market share in 2024. This is due to the adoption of advanced instruments and the manufacturing of instruments by various key players with technological advancements. These robotic instruments have high-end cameras for a clear view. In addition, these instruments provide the coagulation, cutting, and dissection of tissues. This segment is increasing due to increased robotic surgeries in developed and developing countries.

By Surgery Type Insights

Owing to the rising use of new knee repair techniques and the increasing number of orthopedic surgeries, the orthopedic segment accounted for a significant share of the global surgical robots market in 2024. This robotic device is mainly used to fix bones in known positions. One of the most done orthopedic procedures is knee replacement surgery. These orthopedic robotic surgeries started to form in 1980.

By End-User Insights

Based on the end-user, the hospital segment is forecasted to register the leading share of the surgical robots market worldwide during the forecast period. Hospitals are equipped with advanced robotic instruments and machines to improve the procedure quality. Hospital is one of the best hospitals for performing robotic surgery. It provides a high level of patient care, high-quality clinical procedures, and a safe environment for patients and healthcare workers.

REGIONAL ANALYSIS

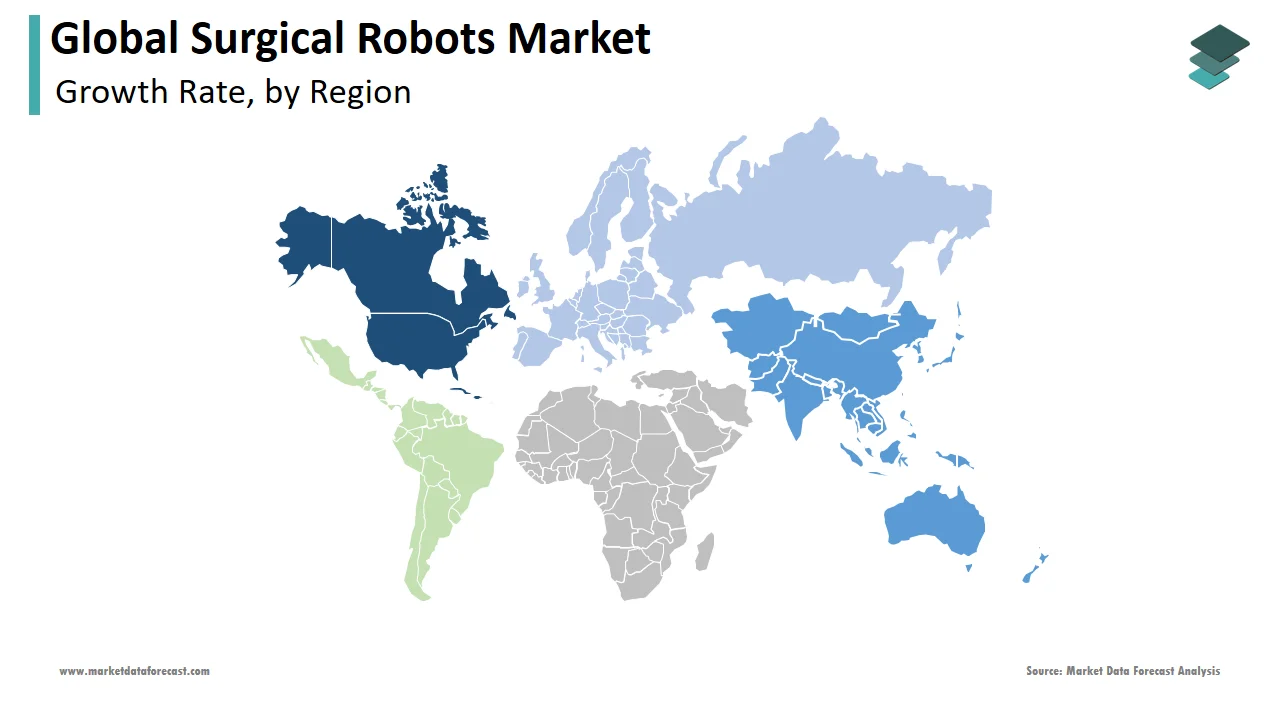

Due to the increased adoption of surgical robots and growing chronic diseases, North America held a significant share of the global surgical robots market in 2024. The domination of the North American region in the worldwide market is anticipated to continue throughout the forecast period. The U.S. accounted for most of the North American regional market share in 2024. In the US, robotic-assisted surgery (RAS) is becoming increasingly popular in urology. In addition, the use of robots in surgeries such as prostatectomy, hysterectomy, nephrectomy, and cardiac surgery drives the market in Canada. According to the device manufacturers' report, nearly 644,000 robotic-assisted surgical procedures were performed in the United States in the year 2017.

The Asia Pacific is expected to have the fastest CAGR during the forecast period. Growing public awareness of the healthcare benefits, increasing healthcare facilities and government initiatives to build up an advanced healthcare infrastructure, and developing automated instruments are the facts that drive the market forward. According to the International Federation of Robots, China is the largest market, accounting for 44% of robot installations and ranking ninth globally in density, up from 25th place just five years ago. In India, robotic surgeries are increasing year by year. There are 66 centers and 71 robotic installations in 2019, with more than 500 trained robotic surgeons in India. More than 12,800 surgeries have been performed with robotic assistance in the last ten years.

KEY MARKET PLAYERS

Companies playing a prominent role in the global surgical robots market include Intuitive Surgical, Medtronic, Stryker, Smith & Nephew Zimmer Biomet, ransenterix, Inc., Corindus Vascular Robotics, Renishaw, Auris Health, Inc., Medrobotics Corporation, Think Surgical, CMR Surgical, Verb Surgical, Omnilife Science, Inc., Preceyes BV, China National Scientific Instruments and Materials Corporation (Csimc), Microsure, Titan Medical Inc., Avatera Medical GmbH and Medicaroid Corporation, and Others.

RECENT MARKET HAPPENINGS

- In 2021, TransEnterix Inc. received CE mark approval for the Intelligent Surgical Unit (ISU) that provides machine vision on the Senhance Surgical System.

- In 2022 Auris Health, Inc. announced its 510(k) clearance for MONARCH Platform from the U.S. Food and Drug Administration (FDA) for endourological procedures. It is designed to give urologists the ability to reach and view kidney-related areas properly.

MARKET SEGMENTATION

This research report on the global surgical robots market has been segmented and sub-segmented based on component, surgery type, end-user, and region.

By Component

- Systems

- Accessories

- Services

By Surgery Type

- Gynecological Surgery

- Urological Surgery

- Neurosurgery

- Orthopedic Surgery

- General Surgery

- Other Applications

By End-User

- Hospitals

- Ambulatory Surgery Centres

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East & Africa

Frequently Asked Questions

How big is the global surgical robots market?

The global surgical robots market size is anticipated to be worth USD 82.81 billion by 2033.

What are some of the prominent players in the surgical robots market?

Companies playing a significant role in the global surgical robots market are Intuitive Surgical, Medtronic, Stryker, Smith & Nephew are Zimmer Biomet.

Does this report include the impact of COVID-19 on the surgical robots market?

Yes, we have studied and included the COVID-19 impact on the global surgical robots market in this report.

Which segment by surgery type held the significant share in the surgical robots market?

Based on the surgery type, the orthopedic surgery type accounted for the major share of the surgical robots market in 2024.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2500

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]