Global Sulfur Fertilizers Market Size, Share, Trends, COVID-19 Impact & Growth Forecast Report - Segmented By Type (Sulfates, Elemental Sulfur, Liquid Sulfur Fertilizers), Crop Type (Oilseeds & Pulses, Cereals & Grains, Fruits & Vegetables and Others), Form (Wet and Dry), Mode of Application (Soil, Foliar, And Fertigation), Cultivation Type (Open Field, Controlled Environment and Others) and Region (Latin America, Europe, North America, Asia Pacific, and the Middle East & Africa) - Industry Analysis from 2025 to 2033

Global Sulfur Fertilizers Market Size

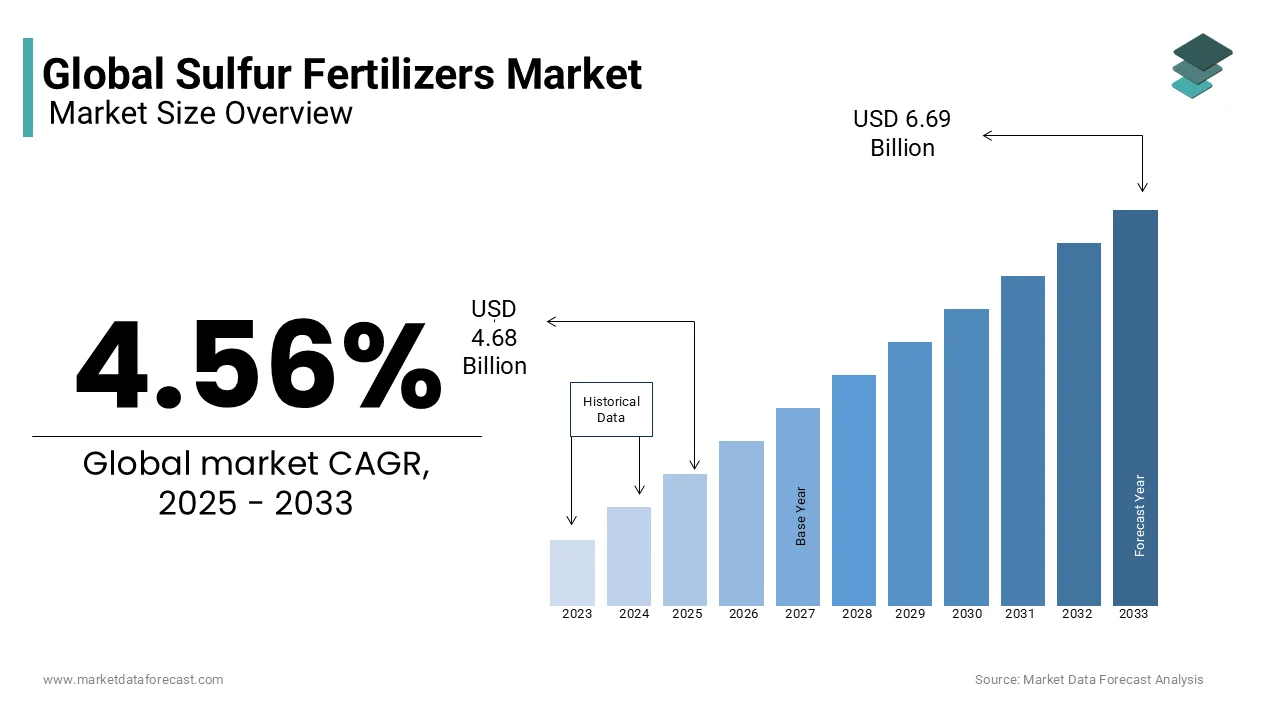

The global sulfur fertilizers market was valued at USD 4.48 billion in 2024 and is anticipated to reach USD 4.68 billion in 2025 from USD 6.69 billion by 2033, growing at a compound annual growth rate (CAGR) of 4.56 % during the forecast period from 2025 to 2033.

MARKET DRIVERS

Micronized elemental sulfur is expected to drive the fertilizer industry, including the sulfur fertilizers market, during the forecast period. One of the most important requirements of the farmers about fertilizers is the immediate availability and solubility in water. As it helps make the fertilizer easily available for the plants to utilize for their growth and other metabolic activities. Micronized elemental sulfur will have less leaching property than normal sulfur fertilizer, which will be a market driver for the adoption of the fertilizer by most farmers. This results in increased sales and revenue to the market by helping the farmers.

The availability of the different types of forms and applications of sulfur fertilizer, like dry and liquid forms, top dressing, and others, will likely contribute to the growth of the sulfur fertilizer market at a higher rate. This feature makes the adoption by the farmers easier by acting as an attention feature to both users and producers. In recent times, the top-dressing application of sulfur has been an ideal form for the use of sulfur fertilizer. As there is an increase in the requirement of the sulfur fertilizer from the external source to the plants and soil due to decreasing amount of the natural sulfur in the natural resources like soil, rain, etc., this could propel the market to expand at a higher rate with proper strategic decisions to increase the sale without compromising on the quality and utility requirements of the farmers.

MARKET RESTRAINTS

The restraints to the sulfur fertilizers market can be the increasing pressure on the sulfur manufacturers in the manufacturing regions. Environmental concerns arose against the manufacturer’s practices followed during the over and undersupply of sulfur in these regions. The price volatility of sulfur, which is mainly influenced by the handling and logistic costs, is also a restraint to the market. The dependency on the oil and gas sector and fluctuations in supply and demand also determine the price of the sulfur fertilizer, making it more difficult for users to purchase. The dependency on certain factors will ultimately affect the entire industry and make it more uncertain for the customers to utilize the product, and the effect can be more observed in the case of the commodities that are required more and cannot be substituted with other products.

Impact of COVID-19 on the Sulfur Fertilizers Market

The COVID-19 pandemic has shown an impact on the sulfur fertilizers market, but no high impact has been noticed. To safeguard the health of the people, the government has imposed restrictions on industry operations and travel restrictions. These measures resulted in the disruption of the industrial operational activities, thereby causing a decline in the supply of fertilizer into the market. The sale of produce has also declined as agriculture activities aren’t taking place as before the pandemic due to the non-availability of labor. It caused the imbalance between supply and demand, but the difference is not very significant.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

2.5% |

|

Segments Covered |

By Type, Crop Type, Form, and Region. |

|

Various Analyses Covered |

Global, Regional, and Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview of Investment Opportunities |

|

Regions Covered |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Market Leaders Profiled |

Nutrien, Ltd., The Mosaic Company, Yara International, Mitsui & Co., Ltd., Achema, Royal Dutch Shell plc, Kugler Company, Sulfur Mills Limited, Israel Chemicals Limited, and Others. |

SEGMENTAL ANALYSIS

Global Sulfur Fertilizers Market By Crop Type

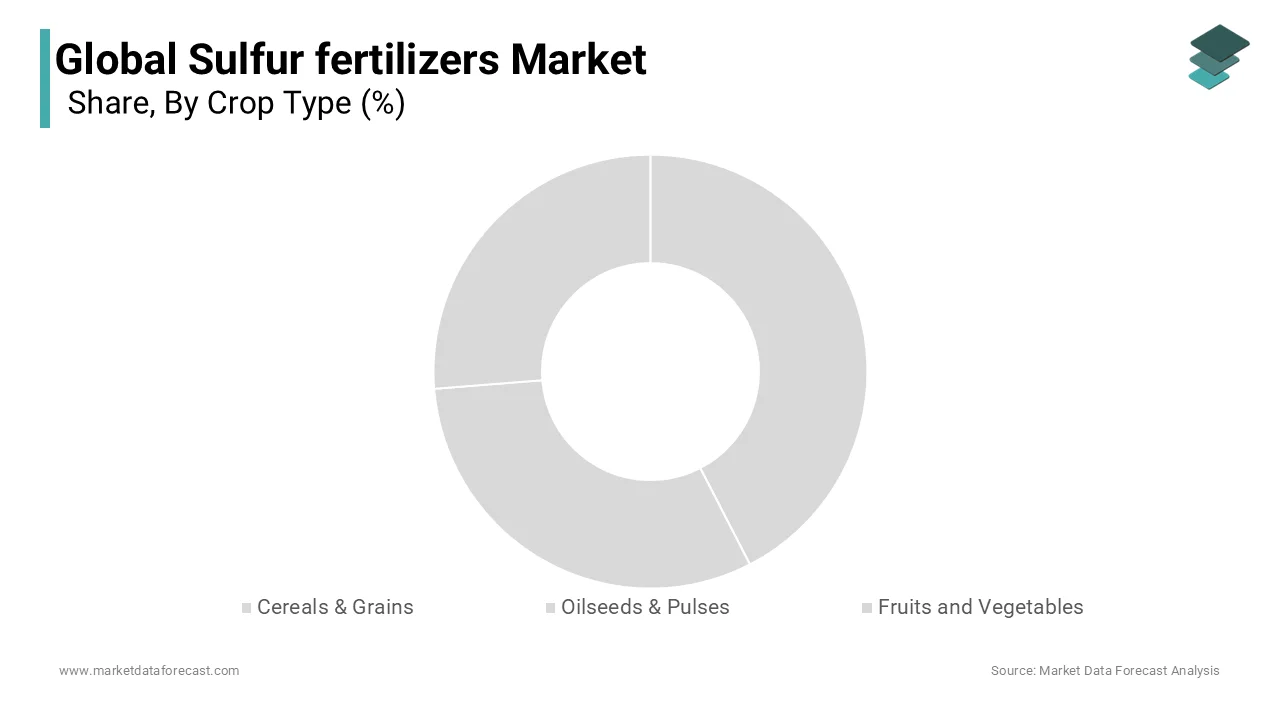

The oilseeds and pulses segment is expected to have a high market share in the sulfur fertilizers market. Semi-arid tropical areas where the majority of the global oilseed production occurs but have a low yield. Oilseed crops are tolerant and have low transpiration. The crops grown in the semi-arid region generally suffer from sulfur deficiency due to its insufficient supply. Sulfur is more required for crops like soybeans, canola, groundnuts, and others. Sulfur is an important nutrient for the synthesis of oil and protein in the plant. Thus, the requirement of the sulfur fertilizer is more important for the oilseed crops to harvest maximum yield. Hence, it propels the market segment to grow at a high growth rate.

Global Sulfur Fertilizers Market By Type

In terms of market value, the sulfates segment is anticipated to hold the dominating position in the sulfur fertilizers market. The consumption of traditional and new mixed fertilizers such as ammonium sulfate, single superphosphate, ammonium phosphate sulfate, and sulfates of micronutrients has increased to a maximum extent in the past few years across various regions. Sulfates are readily available forms of sulfur for the plants to absorb and utilize in the various production processes. Sulfate fertilizers are one such fertilizer where the sulfur is supplied to plants in the form of sulfate.

Global Sulfur Fertilizers Market By Form

The solid or dry form of sulfur fertilizer is expected to be a fast-growing segment in the sulfur fertilizer market during the forecast period. As the moisture and water content is very low in the dry form of the fertilizer, it is more convenient to store and has an extended shelf life. Across the various regions in the world where agriculture is more predominant, the use of sulfur is in the form of dry sulfate, such as ammonium sulfate and ammonium phosphate sulfate. The demand across the various regions for such advantageous factors has driven the segment growth in the market in the past and coming years.

Global Sulfur Fertilizers Market By Mode of Application

The soil segment holds a high market share in the sulfur fertilizers market during the forecast period. It is the most used form of application by most customers because of its convenience in the application and easy availability of the product for utilization. This mode of application is of low cost, thereby decreasing the cost of fertilizers and the overall cost of cultivation. The broadcast also plays a vital role in the application of the method as it provides the uniform application of the fertilizer to the crop.

Global Sulfur Fertilizers Market By Cultivation Type

With the changing environment, cultivators prefer to change the conventional way of cultivation to well-protected cultivation. During the forecast timeline, the controlled environment has the highest share in the sulfur fertilizers market. CEA, or Controlled environment agriculture, utilizes advanced technology to cultivate the crop in controlled systems. The increasing adoption of this method is due to the goal of approaching food security and efficient use of the available resources. Enclosed structures used for crop growing, such as Greenhouses and playhouses, are highly temperature controlled, and effective utilization of space to produce a high yield with good quality is the main motive for using such structures for cultivation. So, the effective utilization of fertilizers that promote the growth and development of the crops grown in a controlled environment are most preferred, resulting in the rise in the demand for fertilizers and propelling the sulfur fertilizers market sales.

REGIONAL ANALYSIS

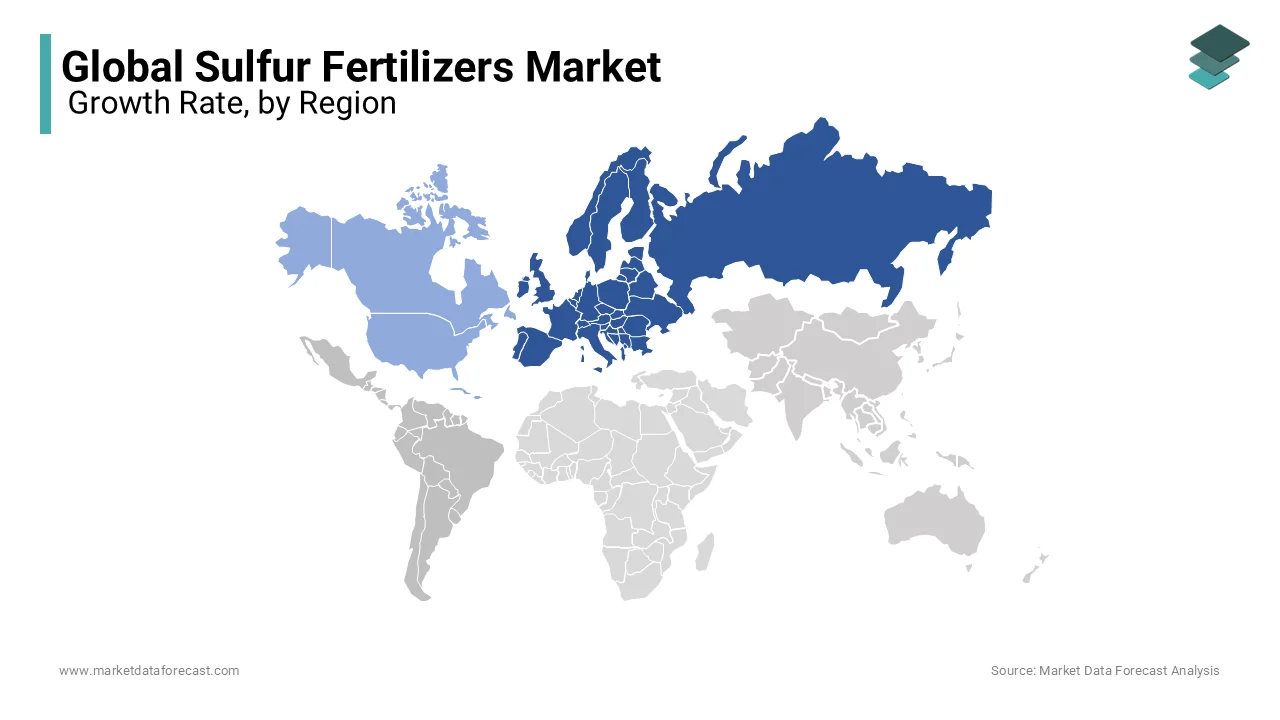

The Asia-Pacific region is the most predominant in the sulfur fertilizers market during the forecast period. As these regions have countries where agriculture is more predominant and most of the population depends on the cultivation of agricultural commodities, such factors drive the market at a significantly high rate. The countries in this region grow a variety of crops and have export-value crops that require high fertilizers. The increasing demand for fertilizers, including sulfur fertilizer, in the Asia-Pacific region drives the market growth. The sulfur fertilizer is used to treat sulfur deficiency, where the untreated plants result in a lower yield.

The North American region dominates the sulfur fertilizer market share. The increase in awareness about the importance of sulfur in agriculture and the larger area of cultivation of agricultural commodities contribute to the growth of the market in this region. The farmers present in the region have large areas of agricultural land where the input requirement is more, resulting in an increase in the number of purchases, thereby increasing sale volume and contributing to the high revenue to the market.

KEY MARKET PLAYERS

Yara International Limited; Coromandel International Ltd; Haifa Group; The Mosaic Company; Nufarm; Zuari Agro Chemicals Ltd; Devco Australia Holdings Pvt Ltd; Koch Industries; EuroChem Group; Israel Chemicals Limited; ICL International; Royal Dutch Shell plc; Kulger Company; Northern Nutrients company.

RECENT HAPPENINGS IN THIS MARKET

- In 2021, Yara International Limited acquired its first organic fertilizer. Yara Suomi Oy had acquired the Ecolan Oy, a Finnish producer of recycled fertilizers. This acquisition strengthens its role in organic farming and contributes to the circular economy.

- In 2021, Northern Nutrients company revealed a plan to build a new sulfur production plant to transform micronized elemental sulfur into urea granules by utilizing Royal Dutch Shell’s Thiogro technology. It helps to bring novel fertilizer offerings to farmers in Saskatchewan and Canada.

- In 2020, to focus on enhanced fertilizer efficiency and to reduce the environmental impact, the Mosaic company signed a five-year agreement with the Financial Technology Research Centre (FTRC).

MARKET SEGMENTATION

This research report on the global sulfur fertilizers market is segmented and sub-segmented into the following categories.

By Crop Type

- Cereals & Grains

- Oilseeds & Pulses

- Fruits and Vegetables

By Type

-

Sulfates

- Elemental Sulfur

- Liquid Sulfur Fertilizers

By Form

- Solid (Dry)

- Liquid

By Mode of Application

- Soil

- Foliar

- Fertigation

By Cultivation Type

- Open Field

- Controlled-environment

- Others

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

Frequently Asked Questions

What is the current market size of the Sulfur Fertilizers Market?

The global sulfur fertilizers market is worth USD 4.28 billion in 2023.

Which sulfur fertilizer formulations are predominantly used in European agriculture?

In Europe, elemental sulfur and sulfate-based fertilizers are widely used to address sulfur deficiencies in soils.

What factors are driving the growth of the Sulfur Fertilizers Market in the Asia-Pacific region?

The growth in the Asia-Pacific Sulfur Fertilizers Market is primarily driven by increased awareness of sulfur's role in crop nutrition and its necessity for high-yield agriculture.

Which sulfur fertilizer products are gaining popularity in the African market?

In Africa, ammonium sulfate and elemental sulfur-based fertilizers are gaining popularity due to their effectiveness in correcting sulfur deficiencies in various crops.

which is the dominating region in sulfur fertilizer market?

North America is the dominating region in the sulfur fertilizer market.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2500

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]