Global Sugarcane Wax Market Size, Share, Trends & Growth Forecast Report - Segmentation By Application (Pharmaceuticals, Food, Textiles and Leather, Cosmetics and Others), and Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa) – Industry Analysis (2024 to 2032)

Global Sugarcane Wax Market Size (2024 to 2032)

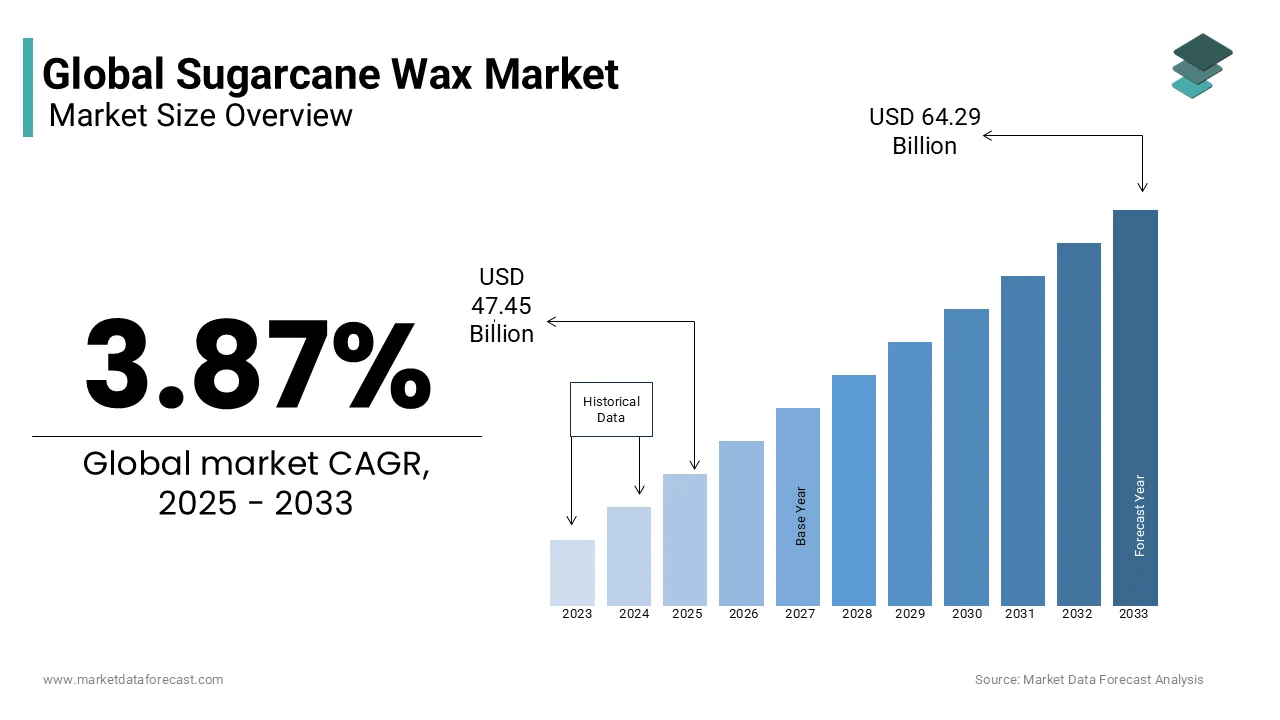

The Global Sugarcane Wax Market is expected to grow at a CAGR of 3.87% during the forecast period 2024 to 2032. The market size is estimated to reach USD 45.70 million in 2024, and USD 61.92 million by the end of 2032.

MARKET OVERVIEW

Sugar cane contains around 60% octacosanol, which helps reduce cholesterol and triglyceride levels. Rising per capita disposable income, changes in lifestyles, and escalating consumer health awareness have resulted in substantial spending on dietary supplements in emerging Asia-Pacific economies such as China, India, and ASEAN countries. Industry expansion in North America and Europe is predicted to be driven by the presence of the established pharmaceutical industry, the expansion of the geriatric population, and an increase in the number of people with cardiovascular disease. The chocolate was also covered with cane wax. The durability of the gloss has improved, the melting has been reduced, and the filler has also been lightened. To keep vegetables and fruits fresh or to give them a fresh appearance, emulsions of sugar cane wax mixed with other natural waxes have been produced.

Vegetables or fruits were dipped in the emulsions or sprayed with wax emulsions. Sugarcane wax is presented in the form of a thin layer on the outside of the cane stalk and is obtained as a by-product during the production of sugarcane goods. It is available in various colors, including hard green, brown, and beige. It is widely employed in pharmaceuticals, fruit and vegetable processing, chocolate goods, cosmetics, and polishing materials. The sugarcane wax is indigestible and harmless to health. Sugarcane wax provides good oil and solvent retention for bright anionic emulsions. Sugarcane waxes are probably the most durable waxes. They contain 100% sugar cane and, therefore, are pure natural goods. The added value of sugarcane plants increases considerably.

MARKET DRIVERS

The main factors driving the expansion of the global sugarcane wax industry include the escalating call for sugarcane wax as a preservative in fruit and vegetable processing and escalated R&D investment in the pharmaceutical industry.

In addition, the growing call for specialty and premium chocolate goods, as well as the escalated consumption of confectionery gums and chocolate goods in the developing economies of Asia and the Pacific, is also predicted to drive the call for sugarcane wax during the forecast period. Socio-economic factors such as rapid urbanization, population expansion, changes in taste and preferences, and rising per capita disposable income stimulate industry expansion in developing economies in the region. Sugarcane wax is suitable not only for technical applications but also for applications in the food industry. Thus, sugar cane wax can be employed as a cleaning product (shoe, floor and car care), in the leather and plastics industry, as well as for applications in the additive and chemical industry and cosmetic goods. In addition, it is applicable in the painting and printing ink industry and for candle production.

MARKET OPPORTUNITIES

Industry players invest in R&D activities for the development of economical and sustainable production processes for sugarcane wax and the improvement of the economy of recovery and refining of the wax, which could create an opportunity for industry players during the forecast period. Additionally, the escalating popularity of organic and natural cosmetics due to the growing awareness of the benefits of natural goods is likely to create lucrative opportunities for industry players during the foreseen period. The growing call for sugarcane wax as an alternative to candelilla wax, carnauba wax and chitosan for edible coating of fruits and vegetables is predicted to increase its call during the envisioned period.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 to 2032 |

|

Base Year |

2023 |

|

Forecast Period |

2024 to 2032 |

|

CAGR |

3.87% |

|

Segments Covered |

By Application and Region. |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview of Investment Opportunities |

|

Regions Covered |

North America, Europe, Asia Pacific, Latin America, Middle East & Africa. |

|

Market Leaders Profiled |

Deurex AG (Germany), Cerax (South Africa), Origen Chemicals (South Africa), Huzhou Shengtao Biotech LLC (China), Godavari Biorefineries (India), and Others |

SEGMENTAL ANALYSIS

Global Sugarcane Wax Market By Application

The cosmetics segment is predicted to be the fastest-growing application segment, mainly due to escalated R&D activities by manufacturers. The expansion of the segment is attributed to the growing awareness of the health benefits of sugar cane wax extracts and ongoing research in the medical field. Also, policosanol and octacosanol derived from sugarcane wax extract are widely employed as supplements due to their lipid-lowering property in animals and humans. However, cosmetics are the fastest-growing sugarcane wax application segment. The industry expansion is attributed to the growing call for natural and biological goods in the cosmetic industry. The segment was predicted to dominate the sugarcane wax industry.

REGIONAL ANALYSIS

The Asia-Pacific sugarcane wax industry is predicted to record the highest CAGR of 5.18% during the calculated period.

The Sugarcane Wax Report includes the segmentation of Regions with their respective Countries. Of these, the European industry held the largest share of more than 35%, with a value of 15.2 million dollars. The regional industry is predicted to register a CAGR of 2.8% during the forecast period. Germany and the United Kingdom accounted for more than half of the sugarcane wax industry in Europe. Industry expansion in Europe is predicted to be driven by the presence of the established pharmaceutical industry, the expansion of the geriatric population, and the escalating number of people with cardiovascular disease. The expansion in the region is attributed to escalated disposable income, lifestyle changes, escalated use of dietary supplements, and the growing popularity of organic and natural cosmetics and personal care goods.

KEY MARKET PLAYERS

The major key players in the global Sugarcane Wax Market are Deurex AG (Germany), Cerax (South Africa), Origen Chemicals (South Africa), Huzhou Shengtao Biotech LLC (China), Godavari Biorefineries (India), and others.

RECENT HAPPENINGS IN THE MARKET

-

Louisiana sugarcane growers have faced a hard time with rough weather and flooding this year which could be the reason for damage to the nation's sugar crop. Farmers struggled with rain that fell day after day during a colder spring, followed by a hot, dry end of summer that turned their fields brown. An early frost forced some to replant their crops in the spring, then shortened the growing season when cold temperatures returned.

DETAILED SEGMENTATION OF THE GLOBAL SUGARCANE WAX MARKET INCLUDED IN THIS REPORT

This research report on the global sugarcane wax market has been segmented and sub-segmented based on application and region.

By Application

- Pharmaceuticals

- Food

- Textiles and Leather

- Cosmetics

- Others

By Region

- North America

- Latin America

- Europe

- Asia Pacific

- Middle East & Africa

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2500

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]