Global Students and Workers Non-Residential Accommodation Market Size, Share, Trends & Growth Forecast Report By Type (Dormitories, Off Campus Establishments, Migrant Workers' Camps), By Price Point (Economy, Mid-Range, Luxury), By Channel (Direct Sales, Distributor), By Mode of Booking (Online Bookings, Direct Bookings, Other Mode of Booking), and Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), Industry Analysis From 2025 To 2033.

Global Students and Workers Non-Residential Accommodation Market Size

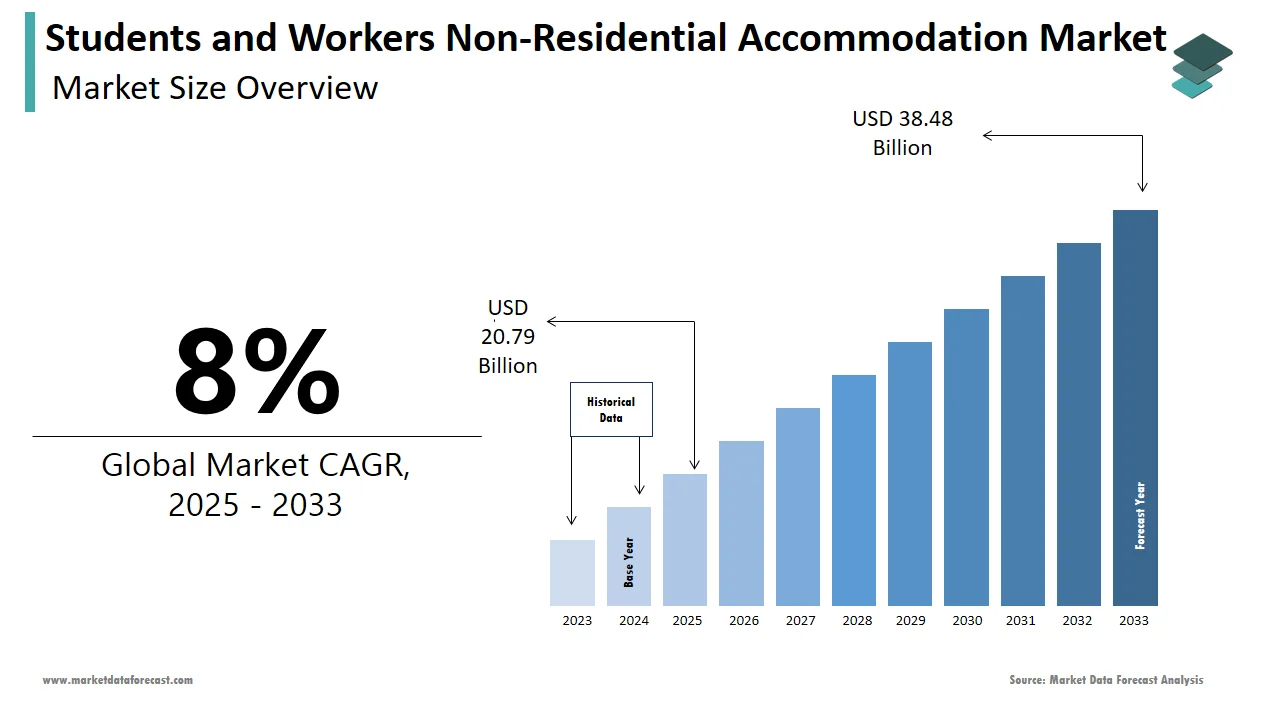

The Global Students and Workers Non-Residential Accommodation Market was worth US$ 19.25 billion in 2024 and is anticipated to reach a valuation of US$ 38.48 billion by 2033 from US$ 20.79 billion in 2025 and is predicted to register a CAGR of 8% during 2025-2033.

The Students and Workers' Non-Residential Accommodation market includes boarding and lodging; it may include other related services like complementary services (housekeeping, meals, and laundry) provided by related entities (organizations, sole traders, and partnerships). These establishments may be short or long-term for occupancy sold through direct sales or meditators through online booking, direct booking, and others.

With the increased demand for traveling, rising employment, and educational opportunities worldwide, the student's and workers' Non-Residential Accommodation Market is expected to increase its market potential. In addition, the increase in internet and mass media access is perking the market growth positively.

MARKET DRIVERS

The increase in international students’ mobility is surging the demand for the market

Students’ mobility toward other countries for education or occupation positively impacts the growth rate of the Students and Workers Non-Residential Accommodation market. By 2025, one in every three outbound higher education students across global will be from India and China. It is expected to reach 3.85 million outbound mobile higher education students globally, up from 3.04 million in 2011, as per news dated in Times of India. The increase in students' interest in education abroad drives the market potential and scope. China is the biggest source market for international mobile higher education students, with around 6.5 lakh students studying abroad, which grew by 89% between 2007 and 2011. In addition, Canada introduced the ‘Student Partners Program,” a direct visa scheme in 2011 to increase its share of overseas students.

A new way is expected to be flagstone by globalization in terms of more joint ventures, global expansion in setting up facilities in high-growth regions, and allowing restaurant operators to offer their cuisine to customers worldwide. This would change the market trend in a new way in terms of offering customized service to Students and workers staying in Non-Residential accommodations.

MARKET RESTRAINTS

Several potential restraints could impact the market of Students' and workers' Non-Residential Accommodation.

The economic conditions of students/workers greatly impact the market as it can lead to a reduction in the number looking for non-residential accommodation. An increase in competition among service providers due to the large scope of the market is leading to pricing pressure and reduced profit margin for the service providers that hamper market share.

Government regulations and maintenance costs of accommodation in different locations impact the expansion of the market globally. Technology advancement can impact by providing various flexible options like work from home and online education that lead to reducing the need for non-residential accommodation, directly hindering the growth rate of the Students and Workers in the Non-residential Accommodation market.

Unforeseen conditions like the COVID-19 pandemic or the Russia-Ukraine war show a negative impact by affecting markets across the globe.

MARKET OPPORTUNITIES

Innovative Housing and Internet Usage Drive Market Growth

Developers and designers are beginning to concentrate on the creation of innovative housing options. Micro-housing unit is one such innovation that provides housing options near the university at an affordable cost. The feature of Micro housing is a miniature space built for sleeping, studying, and preparing meals. It helps meet the needs of the students and workers to access housing at reasonable prices. Such innovations and developments in accommodation and services offered would help in increasing the market share of the Students and Workers Non-Residential Accommodation Market globally.

According to a report published by Kepios Pte. Ltd., a Singapore-based online reference-based library, in 2023, social media users increased by 227 million, reaching 4.70 billion by July 2022. Every day world spends more than 10 billion hours on social media platforms; such an increase in the use of social media and access to the internet is acting as an exponential factor for the growth of tourism and Non-Residential Accommodation. This could provide an opportunity for Students and Workers Non-Residential Markets to focus on strengthening the mode of booking segment so that noticeable growth in the market can be observed.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 – 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 - 2033 |

|

CAGR |

8% |

|

Segments Covered |

By Type, Price Point, Channel, Mode of Booking, and Region. |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview of Investment Opportunities |

|

Regions Covered |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Market Leaders Profiled |

Centurion Corporation, American Campus Communities, Education Realty Trust Inc., Unite Group Inc., Campus Crest Communities Inc., Marriott International, MGM Resorts International, Hilton Worldwide Holdings, Accor Hotels, TUI Group, and Others. |

SEGMENTAL ANALYSIS

By Type Insights

The dormitories segment is expected to have a high market share in this segment. Dormitories provide accommodation at a lower cost as finance is the major influencing factor for the students and workers mobilized to different places for work or education in choosing the type of non-residential accommodation.

By Price Point Insights

The economy segment is ruling the Students and Workers' Non-residential Accommodation market. Economy pricing meets most of the students' and workers' financial capabilities.

By Channel Insights

Direct sales drive the students' and Workers' Non-Residential Accommodation market growth as students and workers get direct contact with owners, and the possibility of getting misled is less in this segment.

By Mode of Booking Insights

The usage of the internet has reached Luke and the corners of the world, which has led to access to various online services. COVID-19 has made people choose non-contact and fast service providers, which led to an exponential increase in the online booking segment in the Students and Workers Non-Residential Accommodation Market.

REGIONAL ANALYSIS

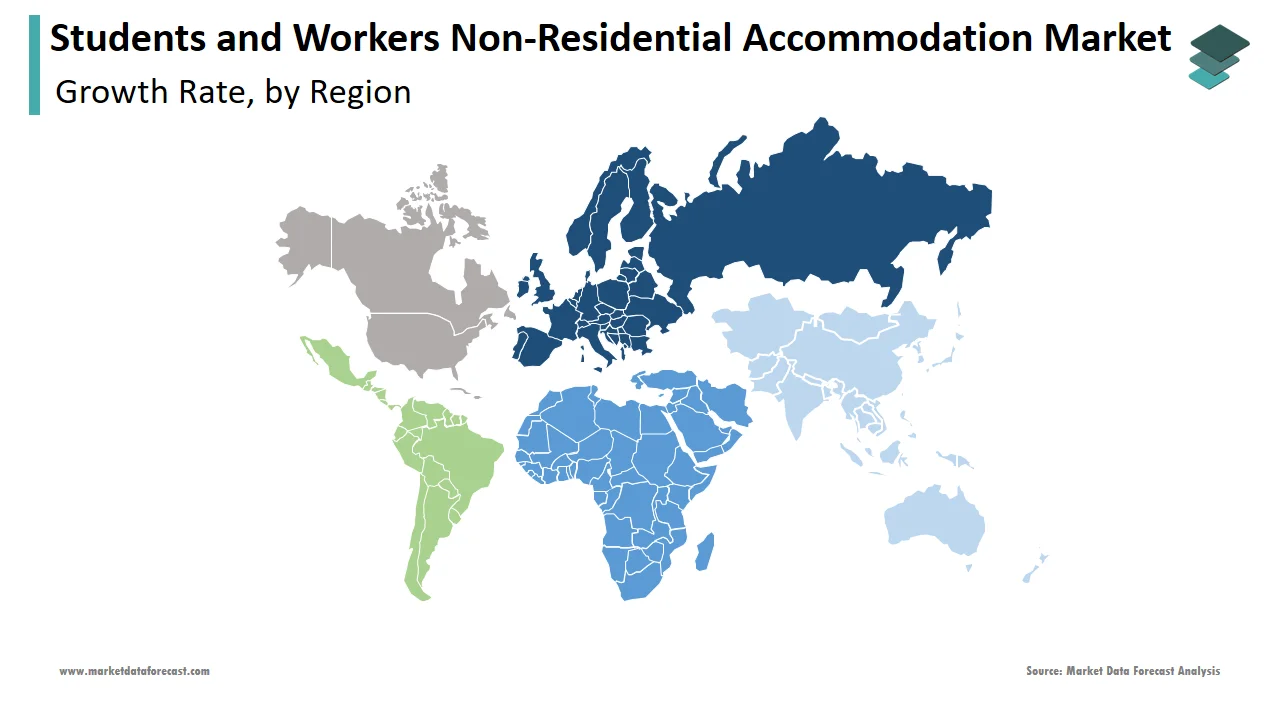

The European region had the largest market for Students and Workers in the Non-residential accommodation service market in 2024, followed by North America. Educational and work migrations are most observed in these regions due to the availability of diversified opportunities.

The Middle East and African region has less market share because of the economic and political conditions prevailing in these areas.

KEY MARKET PLAYERS

Centurion Corporation, American Campus Communities, Education Realty Trust Inc, Unite Group Inc, Campus Crest Communities Inc., Marriott International, MGM Resorts International, Hilton Worldwide Holdings, Accor Hotels, TUI Group, and others.

MARKET SEGMENTATION

This global students and workers non-residential accommodation market research report is segmented and sub-segmented into the following categories.

By Type

- Dormitories

- Off-Campus Establishments

- Migrant Workers' Camps

By Price Point

- Economy

- Mid-Range

- Luxury

By Channel

- Direct Sales

- Distributor

By Mode of Booking

- Online Bookings

- Direct Bookings

- Other Modes of Booking

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East and Africa

Frequently Asked Questions

1. What will be the Students and Workers Non-Residential Accommodation Market value during the forecast period?

Innovation in housing options is a major opportunity for the market.

2. What is the expected CAGR for the market?

Centurion Corporation, American Campus Communities, Education Realty Trust Inc, Unite Group Inc, Campus Crest Communities Inc, and Marriott International are the top key players in the market.

3. Mention the top key players in the market.

Europe has the largest share of the market

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2500

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]