Global Stickers Market Size, Share, Trends, & Growth Forecast Report Segmented By Type (Printable Stickers, Decorative Stickers, Label Stickers, Tactical Stickers, Vinyl Stickers), Material, Application and Region (Latin America, North America, Asia Pacific, Europe, Middle East and Africa), Industry Analysis from 2025 to 2033

Global Stickers Market Size

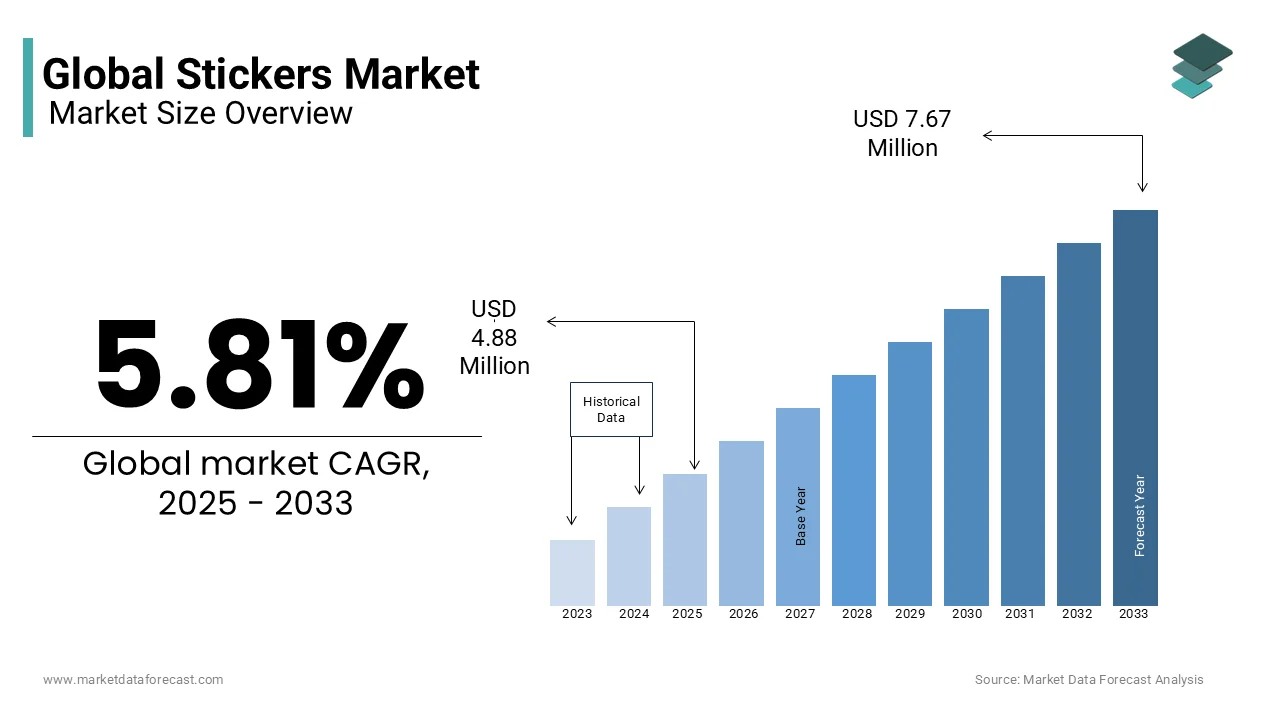

The global stickers market size was valued at USD 4.61 billion in 2024 and is projected to grow from USD 4.88 billion in 2025 to USD 7.67 billion by 2033, the market is expected to grow at a CAGR of 5.81% during the forecast period.

Stickers are adhesive-backed labels made from materials such as paper, vinyl, or plastic, used for decoration, branding, and communication purposes. Their applications range from personal expression and creative arts to industrial labeling and product packaging. The growing popularity of stickers is driven by their versatility, ease of use, and cost-effectiveness. They are widely used in industries such as retail, food and beverages, automotive, electronics, and education.

The rise of digital printing technology has revolutionized sticker production, allowing for high-quality, customizable designs with minimal setup time. According to Smithers, an authority on the printing industry, digital printing now accounts for nearly 20% of all label production, significantly enhancing the efficiency of sticker manufacturing. Additionally, sustainability is becoming a crucial factor, with many brands shifting toward biodegradable and recyclable sticker materials. The Sustainable Packaging Coalition reports that the demand for eco-friendly adhesives and compostable sticker substrates has increased by 30% over the past five years.

The e-commerce boom has also contributed to the rising use of stickers for branding and packaging. A survey by Packaging World revealed that 65% of consumers believe customized packaging, including branded stickers, enhances the perceived value of a product. Furthermore, social media platforms have played a key role in sticker culture, with Instagram and TikTok witnessing a surge in DIY sticker businesses and personalization trends. These factors collectively indicate that stickers are not just decorative elements but essential tools for communication, marketing, and sustainability.

MARKET DRIVERS

The demand for personalized products is a key driver in the stickers market, with customization gaining significant traction. The global trend toward individualized consumer goods has seen a notable increase in demand for bespoke sticker applications. For instance, over 60% of consumers in the U.S. report preferring customized products for personal use, as per a 2023 report by the National Retail Federation (NRF). This rise in personalization is also reflected in the branding sector, where 72% of businesses cite custom stickers as a cost-effective way to enhance brand identity and engagement, according to a 2024 study by Printing Impressions. The growing desire for uniqueness in products continues to fuel the stickers market, particularly in personal and promotional contexts.

Technological advancements in printing have significantly impacted the stickers market by improving production efficiency and quality. For example, digital printing technologies have led to a 25% reduction in production time compared to traditional methods, as reported by the Printing Industries of America (PIA) in 2023. Additionally, the use of eco-solvent inks has increased by 30% over the past few years, driven by demand for more environmentally friendly products, according to a study by the Ink Manufacturers Association. These innovations have not only reduced costs but also enabled manufacturers to produce intricate designs and offer greater customization, meeting the growing demand for personalized and high-quality stickers. The ability to produce detailed, durable, and eco-friendly stickers quickly is fueling the market's expansion.

MARKET RESTRAINTS

The sticker market faces challenges due to environmental concerns associated with traditional sticker materials. Conventional stickers often utilize non-biodegradable substances like vinyl and adhesives, contributing to environmental pollution. This has led to increased scrutiny from consumers and regulatory bodies advocating for sustainable alternatives. The U.S. Environmental Protection Agency (EPA) reports that in 2018, approximately 27 million tons of plastic were landfilled, highlighting the environmental impact of non-recyclable materials. Such environmental considerations are prompting manufacturers to explore eco-friendly materials, but the transition poses challenges in terms of cost and material performance.

Fluctuations in raw material prices continue to challenge the sticker market, with materials such as paper, plastics, and adhesives being particularly susceptible to price volatility. For example, the U.S. Bureau of Labor Statistics (BLS) reported that the Producer Price Index (PPI) for plastics materials and resins manufacturing surged by 15% in 2023 due to supply chain disruptions and the rise in crude oil prices. Similarly, the price of paper has increased by an average of 7% over the last year, driven by both raw material shortages and higher transportation costs. These rising production costs have led to a 5-10% increase in sticker prices in some segments, potentially affecting demand, particularly in cost-sensitive markets. The uncertainty in raw material prices highlights the vulnerability of sticker manufacturers to external economic factors.

MARKET OPPORTUNITIES

The growing demand for personalized products is a key driver for the stickers market. According to a 2023 survey by the Custom Sticker Association, nearly 60% of consumers stated they preferred personalized products, with stickers being among the most popular items for customization. In particular, personalized stickers for personal use (such as laptop decals and custom labels) have seen a significant uptick, with some manufacturers reporting a 25% increase in sales of custom-designed stickers in the past year. Additionally, businesses are increasingly using stickers for branding, with 48% of small businesses, as per the Small Business Administration, utilizing custom stickers for promotional purposes. These trends reflect the growing consumer preference for unique, customizable products and the expanding role of stickers as an affordable, versatile tool for self-expression and brand identity.

Technological advancements in printing have drastically improved sticker production. For example, digital printing, which now accounts for 45% of total printing in the sticker industry, offers greater precision and color accuracy compared to traditional methods. This shift to digital printing has decreased production costs by up to 15%, according to the Printing Industries of America. Additionally, eco-solvent inks, which are used by 32% of manufacturers as per a report by Ink World, offer environmentally friendly alternatives without compromising quality. These advancements have reduced production times by up to 25%, allowing manufacturers to meet growing consumer demand faster. As a result, sticker producers can offer more customization options, bolstering the market's overall growth and satisfying diverse consumer needs.

MARKET CHALLENGES

The sticker market faces increasing pressure due to the environmental impact of traditional production materials. Conventional materials like vinyl, which accounts for around 60% of sticker production, contribute to long-term waste, as highlighted by the U.S. Environmental Protection Agency (EPA). Vinyl, being non-biodegradable, can take hundreds of years to decompose in landfills, exacerbating environmental pollution. In response to these concerns, the demand for eco-friendly alternatives, such as biodegradable materials, has surged by 18% over the past two years, according to the Green Chemistry Institute. However, transitioning to these sustainable materials presents challenges, as the production cost of biodegradable stickers can increase by 20% compared to traditional ones, creating financial pressure on manufacturers to invest in new technologies and R&D for viable alternatives. This cost increase, combined with the complexity of integrating new materials into existing production processes, has significant implications for the market’s competitiveness.

Fluctuations in raw material prices present a significant challenge for the sticker market. Sticker production relies heavily on materials like paper, plastics, and adhesives, all of which are susceptible to price volatility. For instance, the U.S. Bureau of Labor Statistics (BLS) reports that the Producer Price Index for plastics material and resins manufacturing rose by 8% between 2022 and 2023, largely due to supply chain disruptions and increased crude oil prices. Paper costs have also seen an upward trend, with prices increasing by approximately 5% annually, as reported by the American Forest & Paper Association (AF&PA). These fluctuations impact manufacturing costs and can result in price hikes for consumers. For example, when plastic prices increase, the cost of producing vinyl-based stickers can go up by up to 10%, potentially reducing demand for non-essential products. This volatility may affect profit margins and lead to increased sticker prices, which could limit consumer demand and impact market growth.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

5.81% |

|

Segments Covered |

By Type, Material, Application, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regions Covered |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Market Leaders Profiled |

Avery Dennison, 3M, UPM Raflatac, CCL Industries, Arconvert and Bifem, Multi-Color Corporation, Ritrama, Constantia Labels, Neenah Cold Foil, Chesapeake Label Group, and others. |

SEGMENT ANALYSIS

By Type Insights

The label stickers segment ruled the market by holding 72.2% of the global market share in 2024 due to their widespread use in food and beverage, healthcare, and logistics. The U.S. FDA mandates comprehensive labeling for over 200,000 food products, ensuring nutritional and safety standards are met. In healthcare, the U.S. pharmaceutical industry produces over 4 billion prescriptions annually, further increasing demand for labeling. The logistics sector also drives demand, with over 13 million shipments daily in the U.S. requiring clear identification and tracking labels. These regulatory and operational needs across various sectors solidify the position of label stickers as the largest segment in the stickers market.

The vinyl stickers segment is experiencing rapid growth and is anticipated to post a CAGR of 5.5% over the forecast period. The demand for customizable stickers, which serve purposes like personal expression and advertising, has surged as consumers increasingly turn to durable and versatile options. Digital printing advancements have made vinyl stickers more affordable, with the global digital printing market growing at a CAGR of 6.5%, improving accessibility. E-commerce platforms also play a significant role, as over 70% of small businesses in the U.S. now sell products online, many of them offering vinyl stickers. The shift toward personalization and digital shopping further accelerates the growth of the vinyl stickers segment.

By Material Insights

The paper stickers segment constituted the biggest share of the global market by accounting for 41.5% of the global market share in 2024. This prominence is due to their widespread use in labeling, packaging, and promotional activities across various industries. The U.S. Environmental Protection Agency (EPA) highlights that paper products are among the most recycled materials, with a recycling rate of 68% in 2018, underscoring the environmental benefits and popularity of paper-based stickers. Their cost-effectiveness and ease of customization further contribute to their leading position in the market.

The eco-friendly stickers segment is undergoing the quickest growth and is likely to witness a CAGR of 7.5% from 2025 to 2033. The U.S. Environmental Protection Agency (EPA) reports a 20% increase in the production of sustainable materials over the last five years, aligning with a shift towards biodegradable and recyclable products. This shift is further supported by the global push for reduced plastic waste, with over 180 countries committing to the UN’s environmental goals. Companies are responding by using renewable resources and eco-friendly adhesives in sticker production. Additionally, the demand for sustainable packaging has spiked, with 70% of consumers willing to pay a premium for eco-conscious products, further fueling the growth of eco-friendly stickers.

By Application Insights

The commercial use segment held 54.7% of the global market share in 2024. The growth of the commercial use segment in the global market is majorly driven by the widespread utilization across retail, logistics, and manufacturing industries for branding, labeling, and promotional activities. The U.S. Food and Drug Administration (FDA) mandates comprehensive labeling on food products, with over 17 billion food labels required annually, highlighting the critical role of stickers in conveying nutritional information and ensuring consumer safety. Additionally, in retail, 63% of consumer purchasing decisions are influenced by product labels and packaging, further bolstering the demand for commercial stickers. Regulatory compliance, alongside the need for effective marketing tools, strengthens the commercial segment’s dominant market position.

The personal use segment is registering the fastest growth in the stickers market and is anticipated to register a CAGR of 7.5% over the forecast period. This rapid expansion is attributed to the increasing consumer demand for personalized and decorative items, as individuals seek unique ways to express their identities and preferences. A 2023 survey by Statista found that 68% of consumers prefer custom-made products, highlighting the appeal of unique stickers. The rise of e-commerce platforms like Etsy has made customized stickers more accessible, with the global online market for personalized items reaching $35 billion in 2023. Additionally, the popularity of DIY crafts and home décor projects has grown, with 56% of U.S. adults engaging in DIY activities annually. These factors contribute to the rapid expansion of the personal use segment in the stickers market.

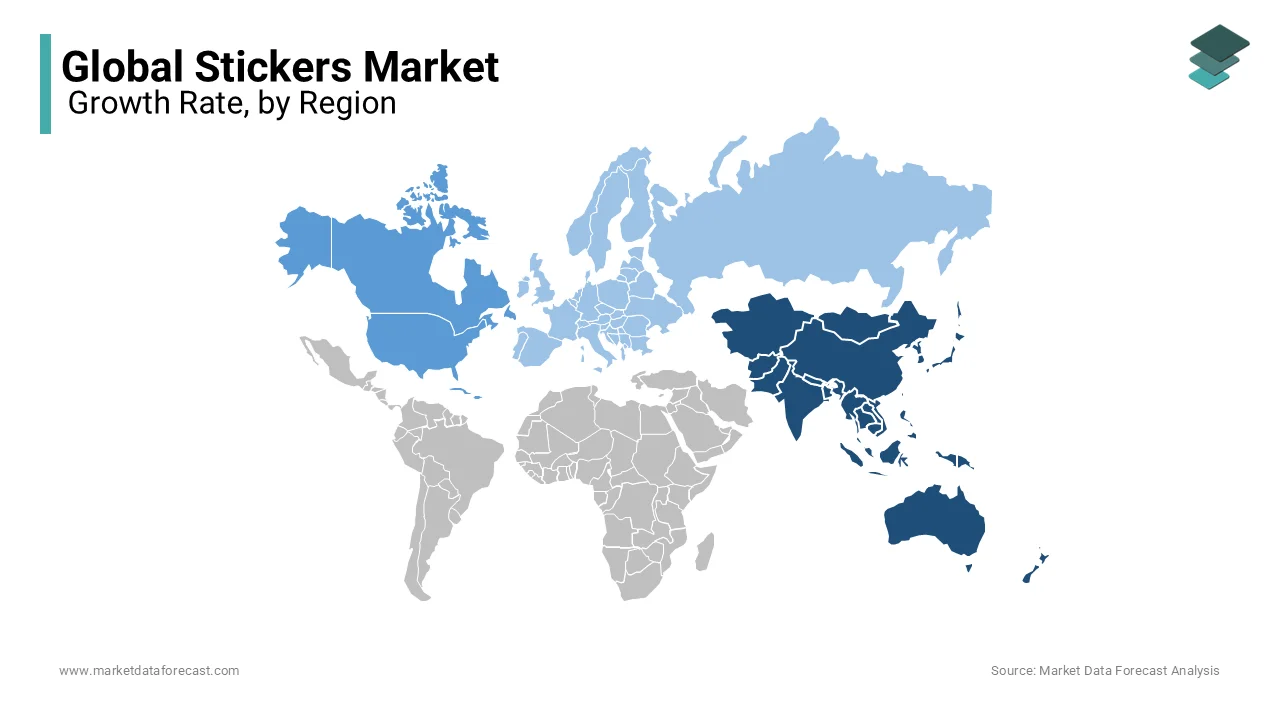

REGIONAL ANALYSIS

The Asia-Pacific region holds a significant position in the global stickers market and accounted for 30.8% of the global market share in 2024. The growth in urbanization is one of the major factors propelling the stickers market growth in this region. With Asia experiencing an urban population increase of 1.1 billion people from 2000 to 2020, leading to greater demand for personalized products. Additionally, the rise in disposable income, with India’s middle-class expected to grow by 10 million people annually, contributes to higher spending on customizable items like vinyl stickers. The region also boasts a high level of digital connectivity, with over 2.5 billion internet users, driving the popularity of e-commerce and personalized products like stickers.

North America is growing at a promising CAGR of 7.2% and is driven by substantial demand across sectors such as food and beverage, personal care, and pharmaceuticals. The U.S. Bureau of Labor Statistics highlights that in 2023, the food and beverage industry alone spent over $3 billion on packaging, emphasizing the importance of labeling in product presentation. Additionally, the region’s retail sector saw a 14% growth in e-commerce sales in 2023, boosting demand for packaging stickers and promotional materials. The U.S. also has one of the highest per capita expenditures on personal care products globally, contributing to the increasing use of stickers in product branding and consumer engagement.

Europe is experiencing steady growth. The stickers market in Europe is propelled by the strong manufacturing base of Europe and the widespread adoption of labeling regulations. The European Union's Food Information to Consumers Regulation, which requires nutritional labeling on food products, affects over 450 million EU citizens. In 2022, 78% of European consumers considered product sustainability when making purchasing decisions, aligning with the region's push toward eco-friendly materials. The European Commission's Circular Economy Action Plan encourages sustainable packaging solutions, prompting industries to adopt biodegradable materials for packaging and stickers. Additionally, Europe’s manufacturing sector, contributing approximately €1.4 trillion to the economy in 2023, continues to demand effective labeling for diverse industries.

In Latin America, the stickers market is poised for expansion, driven by increasing urbanization and the growth of the retail sector. The region’s retail sector has grown significantly, with e-commerce sales in Brazil alone reaching $52 billion in 2023, boosting demand for branded packaging and labeling. Additionally, Latin America's food packaging industry is expanding, with an estimated 40% of food products requiring labeling to comply with national regulations. However, economic fluctuations, with inflation rates exceeding 10% in some countries, and varying regulatory frameworks across nations present challenges to uniform market growth.

The Middle East and Africa region is expected to see moderate growth in the stickers market, supported by increasing urbanization, with over 60% of the population in the Middle East residing in urban areas, according to the World Bank. The food and beverage sector is expanding, with processed food consumption in Africa growing at an annual rate of 5%, driving demand for labeling and packaging solutions. Additionally, pharmaceutical sales in the Middle East reached approximately $40 billion in 2023, necessitating compliance with labeling regulations. However, economic disparities, with GDP per capita ranging from $600 in some African nations to over $40,000 in Gulf countries, may influence the pace of market growth.

KEY MARKET PLAYERS AND COMPETITIVE LANDSCAPE

Avery Dennison, 3M, UPM Raflatac, CCL Industries, Arconvert and Bifem, Multi-Color Corporation, Ritrama, Constantia Labels, Neenah Cold Foil, Chesapeake Label Group are playing a dominating role in the global stickers market.

The global stickers market is characterized by intense competition among key players striving to capture market share through diverse strategies. Major companies such as Avery Dennison, 3M, and Oracal lead the market, offering a wide array of sticker products tailored to various industries and consumer preferences.

Product diversification is a common approach, with companies expanding their portfolios to include printable, decorative, label, tactical, and vinyl stickers. This variety caters to personal, commercial, and educational applications, enhancing their appeal to a broad customer base.

Technological advancements play a crucial role in maintaining competitiveness. Investments in digital and UV printing technologies enable the production of high-quality, durable, and vibrant stickers, meeting the growing consumer demand for personalized and aesthetically appealing products.

Sustainability has emerged as a significant factor, with companies developing eco-friendly stickers made from sustainable materials to align with consumer preferences and regulatory requirements. This focus on environmental responsibility not only enhances brand image but also meets the increasing demand for green products.

Strategic partnerships and acquisitions are also prevalent, allowing companies to expand their market reach, access new technologies, and diversify their product offerings. These collaborations facilitate entry into new markets and strengthen distribution networks, contributing to increased market share.

STRATEGIES USED BY THE MARKET PLAYERS

Product Diversification and Innovation: Companies like Avery Dennison and 3M focus on expanding their product portfolios to cater to diverse customer needs. This includes developing various types of stickers, such as printable, decorative, label, tactical, and vinyl stickers, to serve different applications across personal, commercial, and educational sectors. By offering a wide range of products, these companies can address specific market segments effectively.

Technological Advancements: Investing in advanced printing technologies, such as digital and UV printing, enables companies to produce high-quality, durable, and vibrant stickers efficiently. This approach not only enhances product appeal but also allows for customization, meeting the growing consumer demand for personalized products. Companies that adopt these technologies can achieve faster production times and maintain a competitive edge in the market.

Sustainability Initiatives: With increasing environmental awareness, leading players are developing eco-friendly stickers made from sustainable materials. This strategy aligns with consumer preferences and regulatory requirements, helping companies to enhance their brand image and appeal to environmentally conscious customers. By focusing on sustainability, companies can differentiate themselves in the market and address the growing demand for green products.

Strategic Partnerships and Acquisitions: To expand their market reach and capabilities, companies engage in partnerships and acquisitions. These strategic moves allow them to access new markets, technologies, and customer bases, thereby strengthening their market position. Collaborations with other firms can lead to innovative product offerings and enhanced distribution networks, contributing to increased market share.

TOP 3 PLAYERS IN THE MARKET

Avery Dennison Corporation

Avery Dennison is a prominent entity in the stickers market, renowned for its extensive range of adhesive materials and labeling solutions. The company has made significant contributions to the industry through continuous innovation and a broad product portfolio. Avery Dennison's commitment to sustainability and technological advancements has solidified its position as a leader in the global stickers market.

UPM Raflatac

UPM Raflatac is a significant player in the stickers market, known for its sustainable labeling solutions. The company focuses on developing eco-friendly products, contributing to the industry's shift towards more sustainable practices. UPM Raflatac's emphasis on environmental responsibility and innovation has strengthened its position in the global market.

CCL Industries

CCL Industries is a major contributor to the stickers market, offering a wide array of labeling and packaging solutions. The company's global presence and diverse product offerings have enabled it to meet the needs of various industries, reinforcing its standing in the market. CCL Industries' strategic expansions and focus on innovation have been pivotal in its growth within the stickers industry.

RECENT HAPPENINGS IN THE MARKET

- In June 2024, Fedrigoni strengthened its position in the RFID sector by acquiring a majority stake in BoingTech, enhancing its offerings in both self-adhesives and specialty papers businesses.

- In July 2024, AWT Labels & Packaging expanded its portfolio by acquiring American Label Technologies, a company specializing in RFID and NFC printing technologies. This move enhances AWT's capabilities in smart labeling solutions.

- In May 2024, Wise, a leader in business forms and document solutions, acquired the assets of Phoenix Data. This acquisition is expected to enhance Wise's product offerings and expand its customer base.

MARKET SEGMENTATION

This research report on the global stickers market has been segmented and sub-segmented based on type, material, application, and region.

By Type

- Printable Stickers

- Decorative Stickers

- Label Stickers

- Tactical Stickers

- Vinyl Stickers

By Material

- Paper Stickers

- Vinyl Stickers

- Foil Stickers

- Eco-friendly Stickers

By Application

- Personal Use

- Commercial Use

- Educational Use

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

Frequently Asked Questions

1. What factors are driving the growth of the global stickers market?

The stickers market is growing due to increasing demand in branding and marketing, rising popularity of personalized and decorative stickers, advancements in printing technology, and the expanding e-commerce sector.

2. Which industries contribute the most to the demand for stickers?

Major industries driving sticker demand include retail, food & beverages, automotive, consumer electronics, and e-commerce, where stickers are used for labeling, branding, and promotional purposes.

3. How is digital printing technology influencing the stickers market?

Digital printing has revolutionized the stickers market by enabling high-quality, cost-effective, and customizable sticker production, leading to faster turnaround times and increased adoption by businesses and consumers.

4. What are the latest trends shaping the stickers market?

Emerging trends include eco-friendly biodegradable stickers, smart labels with QR codes and NFC technology, holographic and 3D stickers, and the rise of DIY and personalized sticker businesses.

5. What are the challenges faced by sticker manufacturers?

Challenges include fluctuating raw material costs, increasing competition from digital alternatives, concerns about environmental sustainability, and the need for continuous innovation to meet changing consumer preferences.

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2500

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]