Global Sterilization Services Market Size, Share, Trends & Growth Forecast Report By Method (Steam, Ethylene Oxide, Gamma and E-beam), Type (Contract Sterilization Services and Validation Services), End-User (Hospitals and Clinics, Food and Beverage and Pharmaceuticals) and Region (North America, Europe, Asia Pacific, Latin America, and Middle East & Africa), Industry Analysis From 2025 to 2033

Global Sterilization Services Market Size

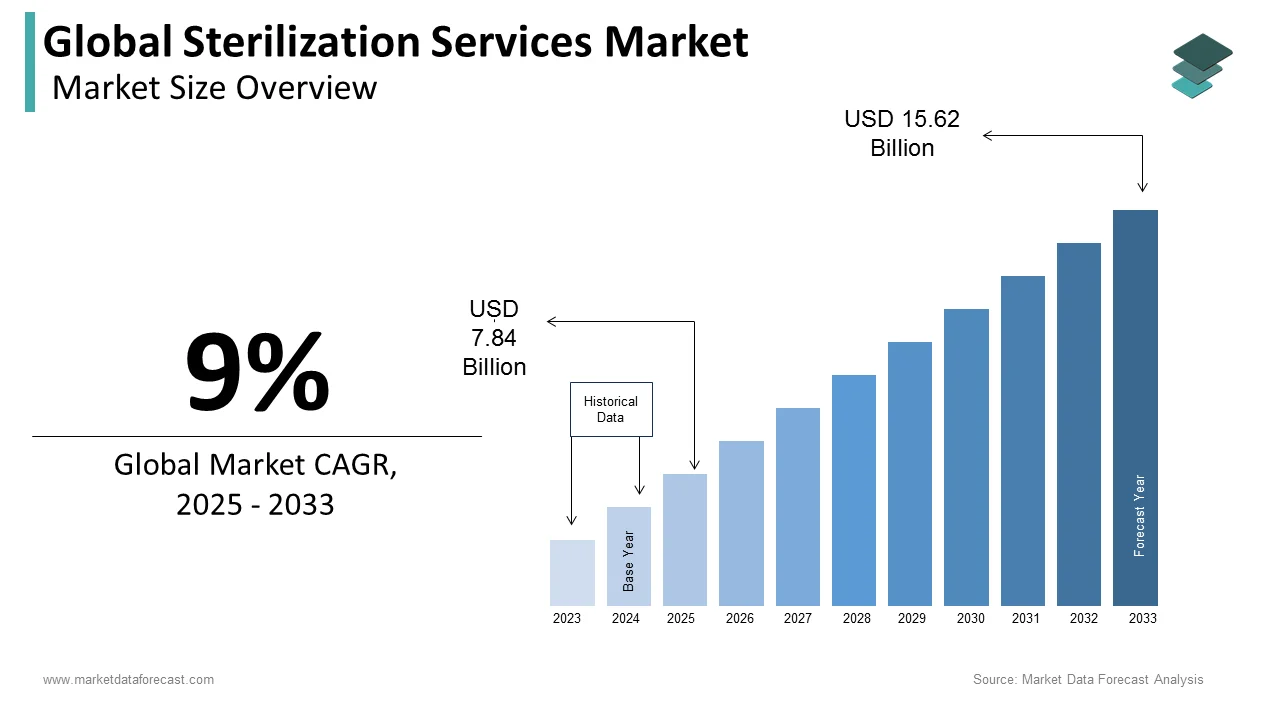

The global sterilization services market size was valued at USD 7.19 billion in 2024. The global market is anticipated to grow at a CAGR of 9% from 2025 to 2033 and be worth USD 15.62 billion by 2033 from USD 7.84 billion in 2025.

Sterilization services involve the use of any physical or chemical method that destroys all life types, like microorganisms, spores, and viruses. The elimination of all types of microbial life is precisely done by an effective chemical agent or by heat, which includes either wet steam at a pressure of 120 °C (250 °F) or more for at least 15 minutes or dry heat at a temperature of 160 to 180 °F °C (320 to 360 °F) for three hours. All microorganisms comprising spore-forming and non-spore-forming bacteria, viruses, fungi, and protozoa contaminate pharmaceuticals or other products and therefore constitute a health risk. Therefore, according to WHO, classical sterilization services using saturated steam under pressure or hot air are the most effective and should be used wherever possible.

CURRENT SCENARIO

The sterilization services market has been experiencing an upward growth trajectory in recent years. The majority of the market share is captured by the North American region which witnessed an extreme number of coronavirus cases and subsequent mortalities. Apart from this, several measures and actions were taken by the Food and Drug Administration (FDA) and its associated agencies. Ethylene oxide (EtO) is the most widely applied process in the United States to clean medical supplies and is now put under limitations due to its harmful effects, instead is encouraging the use of vaporized hydrogen peroxide gas. Healthcare equipment manufacturers and contract sterilizers globally also extensively use EtO for sterilizing. Annually, over 20 billion devices sold are cleaned with EtO.

The economic study stated that high-temperature sterilization methods are the most essential processes accessible, while methods that utilize low temperatures account for a considerably small market share. For instance, sterilization with H2O2. This condition is predicted to further accelerate the expansion of the sterilization services market in the projection period. However, issues related to the security of reused devices, equipment and tools are likely to restrict the growth rate of the market to a certain degree in the years ahead. Besides this, the failure of the final consumer to comply with sterilization rules and principles is also anticipated to constrain the industry’s progress. So, all these factors have encouraged the development of local manufacturing technology for mobile sterilization devices.

MARKET DRIVERS

Rising Prevalence of Healthcare-Associated Infections (HAIs)

In recent times, the threat of HAIs has drastically increased and is still rising in radiology departments around the world. This is because of the key role radiology plays in directing clinical decisions for diagnosis, treatment, and monitoring of several diseases from the majority of medical specialties. Moreover, the infection incidence in hospitals has risen from 3.5 percent to 14.4 percent, and this elevated prevalence rate is in secondary and tertiary care facilities, as per a study in December 2022. The most frequent HAIs are surgical site infections 32.6 percent, bloodstream infections 19.5 percent, urinary infections 18.5 percent, and Respiratory infections 16.3 percent. The infected devices and equipment also contributed 7 percent of HAIs. Surprisingly, 61 percent of overall patients who participated in the study were consuming antibiotics, and among those, 89 percent with HAIs had taken at least one antimicrobial medicine.

The growing patient population worldwide of various diseases and Y-O-Y growth in the number of surgical procedures that are being performed are contributing to the sterilization services market growth. The growing number of surgical procedures resulting from the prevalence of several chronic diseases and medical disorders, patients that need continuous treatment, and the rapidly increasing contamination in the atmosphere are further accelerating the growth of the sterilization services market. Recently in March 2024, the Environmental Protection Agency (EPA) in the United States enforced tighter restrictions on a chemical called ethylene oxide after discovering greater than anticipated cancer risks. It is utilized to sterilize loads of medical equipment and devices, including syringes and catheters. This regulation will significantly curb the emission of ethylene oxide by around 90 percent by aiming for almost 90 commercial sterilization facilities in the country. So, now market players first have to check for the antimicrobial chemicals in the air and ensure the pollution measures are functioning properly.

Also, infected devices may contribute to the cross-transmission of viruses and diseases. Such factors result in the demand for sterilization equipment to stop the spreading of contagious diseases. Besides, the growth of the pharmaceutical industry is another significant factor accelerating the market's growth rate.

MARKET RESTRAINTS

On the other hand, factors such as the presence of stringent government policies before the services are allowed for commercial use, lack of awareness of the need for sterilization, massive equipment costs, and saturation in developed regions hinder the sterilization services market from achieving its true potential.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

Segments Covered |

By Method, Type, End-User, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis; DROC, PESTLE Analysis, Porter's Five Forces Analysis, Competitive Landscape, Analyst Overview of Investment Opportunities |

|

Regions Covered |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Market Leader Profiled |

STERIS Corporation, Getinge Group, Advanced Sterilization Products, 3M Company, Belimed AG, Cantel Medical Corporation, Anderson Products Matachana Group, MMM Group, and Sterigenics International Inc. |

SEGMENTAL ANALYSIS

By Method Insights

The ethylene oxide segment accounted for a significant share of the sterilization services market in 2024. The Ethylene Oxide sterilization segment will still dominate the sterilization services market, primarily due to the vast range of Ethylene Oxide sterilization service suppliers worldwide and the numerous advantages this method offers, like broad material compatibility and simple penetration into the narrow lumen and large sterilizing volume/chamber capacity.

By Type Insights

The contract sterilization services segment was the leader in the market in 2024. This classification's massive share is attributed to medical device firms' growing preference for contract sterilization services and increasing outsourcing by sterile processing departments (SPDs)/central sterile supply departments (CSSDs) in hospitals to specialized third-party vendors to cut back in-house prices involving sterilization.

By End-User Insights

In 2024, the hospital and clinics segment led the market and is expected to register a significant CAGR during the forecast period. Conversely, the medical device companies segment is anticipated to grow aggressively and is considered the most lucrative segment. Factors such as the increasing number of medical device companies in developing countries, the rising need to guarantee sterility, and the growing use of single-use products drive this segment's growth.

Other segments, such as F&B and pharmaceuticals, accounted for a substantial share of the global sterilization services market in 2024, considering the recent COVID-19 pandemic. Therefore, it is expected that these segments will grow significantly soon.

REGIONAL ANALYSIS

The North American market dominated the global sterilization services market in 2024, followed by Europe due to a rise in surgical procedures, a growing need for sterilization and equipment in healthcare infrastructure, and the outsourcing of products. Furthermore, Y-O-Y's growth in the incidence of hospital-acquired infections and growing outsourcing of sterilization services by most medical device companies further accelerate the growth rate of this regional market. In this region, the United States sterilization services market was in the top position in 2019. Growing incidences of chronic diseases and increased adoption of standard sterilization services among hospitals and research centers are majorly supporting the U.S. market. The Canadian sterilization services market is forecasted to have a promising growth rate between 2024 to 2029. Steripro Canada is a certified company that provides sterilization services and reprocesses medical devices.

The European market was the 2nd most significant region in the global market in 2024 and is predicted to register a substantial CAGR during the forecast period. As per the WHO, the expenses per annum due to healthcare-associated infections are around 7.7 billion USD in Europe. In addition, the growing need for disinfectant medical devices and rising diseases in hospitals and clinics positively impact the demand for sterilization services in this region. The U.K. sterilization services market accounted for most of the European market in 2019. Scapa Healthcare offers a wide range of sterilization services, including in-house gamma irradiation, microbiology, storage, and product stability.

The Asia-Pacific market is expected to grow at the highest CAGR rate during the forecast period. Increasing surgical procedures, growing medical tourism, and healthcare infrastructure development are majorly promoting this regional market. Comprehensive technologies are used across this region's various medical centers, food processing, agriculture, and cosmetics. The significant impact of the COVID-19 pandemic, the growing demand for sterilization in food-borne diseases, and the further increasing demand for pharmaceutical and biotechnology industries amplify the market demand. Countries such as China and India are expected to register the highest growth. The government initiatives bolster sterilization device production.

The Latin American market is the second quickest-growing region, followed by APAC in the global market. The increasing aging population and the growing number of hospitals and clinics drive this regional market. Sterigenics International LLC announced that it had acquired Sao Paulo-based Companhia Brasileira de Esterilização (CBE), the largest specialist in sterilization and microbial load reduction in Latin America.

The market in the Middle East & Africa held a smaller portion of the global market in 2024. The increase in the availability of sterilized services, growth in the number of service providers providing customized sterilization services and launch of new sterilization amenities over the region. Africa is said to have slow growth in the market.

KEY MARKET PARTICIPANTS

Notable companies leading the global sterilization services market profiled in this report are STERIS Corporation, Getinge Group, Advanced Sterilization Products, 3M Company, Belimed AG, Cantel Medical Corporation, Anderson Products Matachana Group, MMM Group, and Sterigenics International Inc.

The global sterilization services market is consolidated, and some key market participants account for most of the share. New Product Launches and Acquisitions are some of the key strategies adopted by the major market participants to maximize their market share.

RECENT HAPPENINGS IN THIS MARKET

- In March 2024, Steris introduced the Verfit sterilization covers and bags for EU GMP Annex 1 compliance. It comes with a new characteristic called a viewing window to check visually and ensure the dryness of a sterilized component.

- In January 2023, vaporized hydrogen peroxide was marked and registered by the FDA as an established sterilization method for medical devices. This is connected to the agency’s efforts to provide a substitute for ethylene oxide sterilization in the form of revised directions for sterile medical device manufacturers.

- In July 2024, the Center for Devices and Radiological Health (CDRH) added extra steps further to advance the development of novel medical device sterilization. This was done by revising their Recognized Consensus Standards database to incorporate the entire acknowledgment of one sterilization standard known as ISO 22441:2022 and two Technical Information Reports, i.e., AAMI TIR104:2022 and AAMI TIR17:2019/(R)2020.

MARKET SEGMENTATION

This research report on the global sterilization services market has been segmented and sub-segmented based on method, type, end-user, and region.

By Method

- Steam

- Ethylene Oxide

- Gamma

- E-beam

By Type

- Contract Sterilization Service

- Validation Services

By End-User

- Hospitals and Clinics

- Food and Beverage

- Pharmaceuticals

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

Frequently Asked Questions

How much was the global sterilization services market worth in 2024?

The global sterilization services market size was valued at USD 7.19 billion in 2024.

Does this report include COVID-19 on the sterilization services market?

This report has an inclusive analysis on how the COVID-19 has impacted the sterilization services market.

Which region had the largest share of the sterilization services market in 2024?

Geographically, the North American region accounted for the most significant share of the global market in 2024.

Who are some of the notable players in the sterilization services market?

STERIS Corporation, Getinge Group, Advanced Sterilization Products, 3M Company, Belimed AG, Cantel Medical Corporation, Anderson Products Matachana Group, MMM Group, and Sterigenics International Inc. are a few of the promising companies in the sterilization services market.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2500

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]