Global Spatial Omics Market Size, Share, Trends & Growth Forecast Report By Technology (Spatial Transcriptomics, Spatial Genomics, Spatial Proteomics), By Product (Instruments, Consumables, Software), By Workflow (Sample Preparation, Instrumental Analysis, Data Analysis), By Sample (FFPE, Fresh Frozen), By End-Use (Academic & Translational Research Institutes, Pharmaceutical & Biotechnology Companies), and Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), Industry Analysis From 2025 to 2033.

Global Spatial Omics Market Size

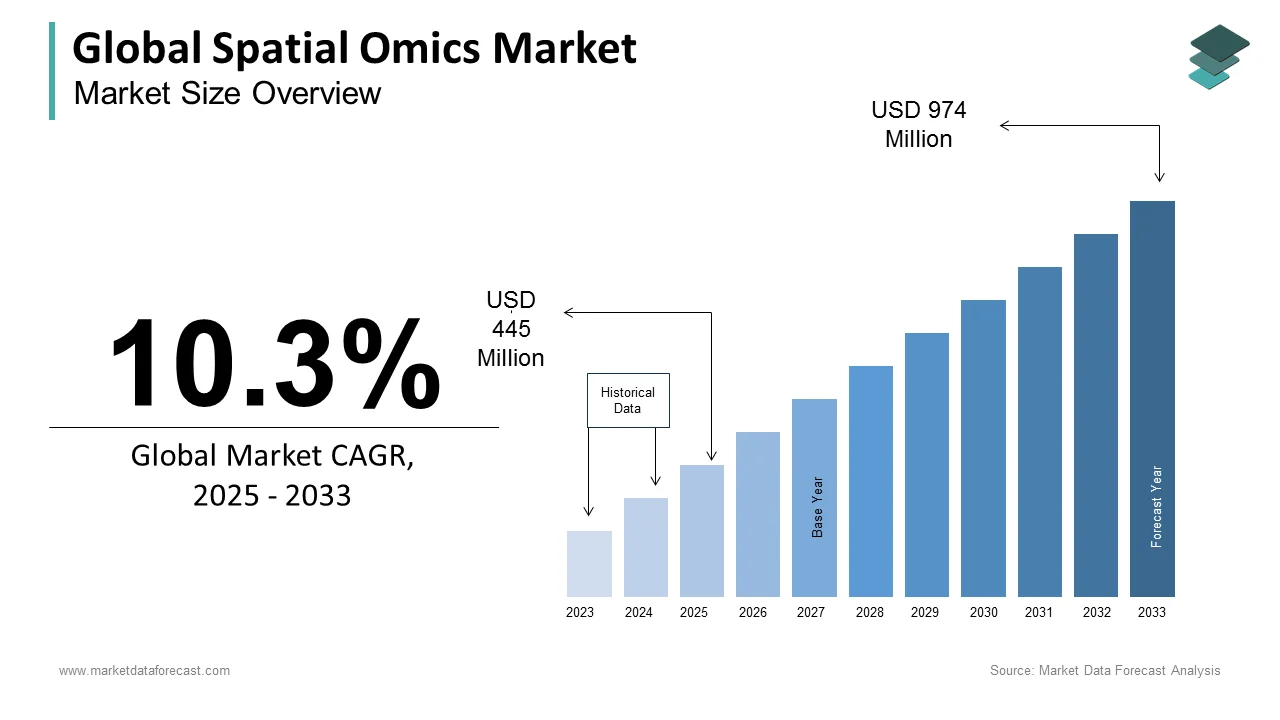

The size of the global spatial omics market was worth USD 403 million in 2024. The global market is anticipated to grow at a CAGR of 10.3% from 2025 to 2033 and be worth USD 974 million by 2033 from USD 445 million in 2025.

Spatial omics is the field of biotechnology that combines spatial biology with multi-omics techniques, enabling researchers to understand complex biological systems at a deeper level. It integrates various "omics" data types such as genomics, transcriptomics, proteomics and metabolomics with spatial information and is allowing scientists to analyze the molecular composition of tissues within their natural architectural context. Recent advancements highlight its importance in precision medicine and cancer research. For example, over 60% of cancer research centers worldwide now use spatial omics technologies to study tumor microenvironments. Moreover, spatial transcriptomics can generate up to 10 million spatially resolved transcript reads per tissue sample and provides unparalleled insights into gene expression at a single-cell resolution. This breakthrough capability has led to the discovery of new biomarkers and therapeutic targets and particularly in oncology and immunology.

MARKET DRIVERS

Advancements in Precision Medicine

Precision medicine is a major driver of the spatial omics market because it enables more personalized treatments by understanding diseases at the molecular level. In particular, spatial omics technologies allow for deeper insights into tumor microenvironments which is essential for cancer treatment. According to the National Cancer Institute (NCI), spatially resolved data from technologies like spatial transcriptomics can identify novel biomarkers and therapeutic targets in cancer which is improving treatment accuracy. The adoption of spatial omics in oncology has already improved clinical outcomes in early-stage cancer detection with over 25% of leading oncology centers using spatial technologies in their research.

Rising Demand for Multidisciplinary Research

The growing complexity of biological systems requires integrated as well as multidimensional data to gain comprehensive insights into molecular processes. Spatial omics enables this integration by merging multiple types of omics data (genomics, proteomics, transcriptomics) with spatial context. The U.S. National Institutes of Health (NIH) reports a significant increase in research grants for spatial omics applications and is supporting projects in immunology, neuroscience, and developmental biology. Over 40% of NIH-funded biomedical research now utilizes spatial technologies to study tissue structure and molecular interactions that facilitates discoveries that would be impossible with traditional single-omics approaches.

MARKET RESTRAINTS

High Cost of Technology and Implementation

The high costs associated with spatial omics technologies are a major restraint for market growth. Instruments used for spatial transcriptomics, mass cytometry, and multiplexed imaging often require significant upfront investments. According to the National Institutes of Health (NIH), the cost of implementing spatial omics technologies can be upwards of $1 million for equipment and necessary infrastructure, which limits access, especially for smaller research institutions. Moreover, the U.S. National Science Foundation (NSF) reports that the expenses involved in training personnel and maintaining these advanced systems can be prohibitive for many organizations and thereby slowing broader adoption.

Complexity and Lack of Standardization

The complexity of spatial omics workflows when combined with the lack of standardization represents a significant barrier to widespread adoption. As noted by the National Center for Biotechnology Information (NCBI), different spatial omics technologies (e.g., spatial transcriptomics, multiplexed imaging) often lack uniform protocols which can lead to inconsistencies in results. This hampers reproducibility and complicates data integration. In addition, regulatory challenges related to these advanced techniques are reported by the U.S. Food and Drug Administration (FDA) that cites the need for more standardized guidelines for spatial omics methods to ensure accuracy and reliability in clinical applications.

MARKET OPPORTUNITIES

Expanding Application in Immuno-oncology

The increasing application of spatial omics in immuno-oncology presents a significant opportunity for market growth. Spatial omics technologies allow for a deeper understanding of tumour microenvironments and enables the identification of immune cell interactions and their roles in cancer progression. According to the National Cancer Institute (NCI), over 60% of clinical cancer trials now incorporate spatial omics methods to evaluate immunotherapy effectiveness. This integration aids in developing more precise immunotherapies, boosting the demand for spatial omics tools. Furthermore, the U.S. Food and Drug Administration (FDA) has highlighted the potential of these technologies in identifying new cancer biomarkers for targeted therapies.

Integration with Artificial Intelligence (AI) and Machine Learning (ML)

The integration of spatial omics with artificial intelligence (AI) and machine learning (ML) offers transformative potential for data analysis and interpretation. AI and ML algorithms can enhance spatial omics workflows by automating data processing and improving the identification of complex patterns in multi-omics datasets. According to the U.S. Department of Energy (DOE), AI-driven approaches are becoming increasingly vital in analyzing large-scale spatial datasets with AI applications growing by 25% annually in the biomedical field. This synergy between spatial omics and AI/ML technologies is poised to enhance research productivity and accelerate drug discovery.

MARKET CHALLENGES

Data Overload and Interpretation Challenges

The massive volume of data generated by spatial omics technologies presents significant challenges in data management and interpretation. These techniques produce multi-dimensional datasets that integrate genomics, transcriptomics, and proteomics with spatial information and is resulting in large-scale along with complex data that is difficult to analyze. According to the National Institutes of Health (NIH), managing and interpreting such large datasets is a major bottleneck in spatial omics research with a reported 70% of researchers citing data analysis as the most time-consuming and resource-intensive aspect. This challenge necessitates advanced computational tools and expertise which are often not widely available.

Limited Reproducibility Across Platforms

Reproducibility is a critical challenge in the spatial omics market because there is no standardized approach across different platforms and technologies. The National Center for Biotechnology Information (NCBI) reports that inconsistencies in experimental protocols and data acquisition methods often lead to difficulties in replicating results, especially across different research environments. A recent survey by the U.S. Department of Energy (DOE) found that nearly 40% of spatial omics studies encounter issues related to reproducibility, which can delay the validation of research findings and hinder clinical translation of these technologies.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2024 to 2033 |

|

Segments Covered |

By Technology, Product, Work Flow, Sample, End-Use, and region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, Drivers, Restraints, Opportunities, Challenges; PESTLE Analysis; Porter's Five Forces Analysis; Competitive Landscape; Analyst Overview of Investment Opportunities |

|

Regions Covered |

North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

SEGMENTAL ANALYSIS

By Application Insights

The diagnostics segment held the major share of 48.5% of the global market share in 2024. This segment is anticipated to remain dominant in the global market during the forecast period owing to the rising need for molecular diagnostics in oncology, neurology, and infectious diseases. The increasing focus on precision medicine, especially in cancer and thereby further bolsters this segment's growth. As reported by the U.S. Food and Drug Administration (FDA), targeted therapies based on molecular diagnostics have revolutionized oncology treatment and is resulting in a 30-50% increase in survival rates in some cancer types.

The single-cell analysis segment is projected to grow at a CAGR of 16.1% from 2025 to 2033. This growth is driven by the increasing need for precision medicine and the ability to analyze individual cells in their native context. The increasing incidence of chronic diseases and the need for personalized medicine are key drivers of this segment’s growth. For example, the American Cancer Society reports that in 2024, an estimated 1.9 million new cancer cases will be diagnosed in the U.S. alone that is pushing the demand for single-cell technologies that can provide early, accurate diagnosis and tailored treatments.

By Solution Type Insights

The consumables segment captured 52.8% of the global market share in 2024. The domination of the consumables segment is primarily propelled by the essential nature of consumables such as reagents, kits, and other consumable materials that are required for the operation of spatial omics instruments. For instance, the International Society for Research in Human Proteomics reported that the growth of personalized medicine and the genomics business (which reached USD 67.4 billion in 2022) are contributing significantly to the consumption of reagents and kits.

The software segment is on the rise and is predicted to witness the fastest CAGR of 12.3% during the forecast period. The increasing volume of genomic research studies has led to a heightened need for robust software solutions for data management and interpretation. Advanced computational tools are essential for visualizing, interpreting, and managing the complex data generated by spatial omics studies. Collaborations among companies to enhance their software offerings are anticipated to drive the segment's growth. For example, in April 2021, Vizgen received a grant of USD 37 million to enhance the commercialization of its MERSCOPE platform which includes advanced software for spatial omics data analysis.

By Sample Insights

The formalin-fixed paraffin-embedded (FFPE) segment dominated the market by accounting for 60.3% of the global market share in 2024. The domination of the FEPE segment is majorly attributed to FFPE's widespread use in clinical tissue banks and is making it readily available for both research and diagnostic purposes. For example, approximately 70% of clinical tissue samples in pathology labs are stored as FFPE specimens, as per the National Institutes of Health, NIH.

The fresh frozen segment is anticipated to grow at the fastest CAGR of 11.2% over the forecast period. These tissues are ideal for proteomic and transcriptomic analyses because they preserve proteins and nucleic acids more effectively than FFPE. This preservation allows for high-quality analyses which are essential in understanding complex diseases such as cancer, neurological disorders, and genetic conditions. The American Association for Cancer Research (AACR) reports that fresh frozen tissues are critical for understanding the molecular underpinnings of cancer. AACR also indicates that over 1.8 million new cancer cases are expected to be diagnosed in the United States in 2023 and is making the ability to analyze tissue samples accurately crucial for early detection and treatment planning.

By End Users Insights

The academic and research institutions segment captured a significant share of 44.2% in the global market in 2024. These institutions are at the forefront of scientific discovery, driving innovation in spatial omics technologies. Academic institutions are responsible for a significant portion of scientific publications in the field of spatial omics. For instance, a study published in Nature Communications in 2021 highlighted that over 60% of spatial transcriptomics research papers were authored by academic researchers and thereby underscoring their pivotal role in advancing the field.

The biopharmaceutical & biotechnological companies segment is the progressing rapidly in the spatial omics market and is anticipated to showcase a CAGR of 14.5% between 2025 and 2033. These companies are increasingly adopting spatial omics technologies to enhance drug discovery and development processes. A survey conducted by the Biotechnology Innovation Organization (BIO) in 2021 revealed that 45% of biopharmaceutical companies were actively incorporating spatial omics technologies into their research workflows which is reflecting a growing trend towards adopting cutting-edge tools for drug discovery.

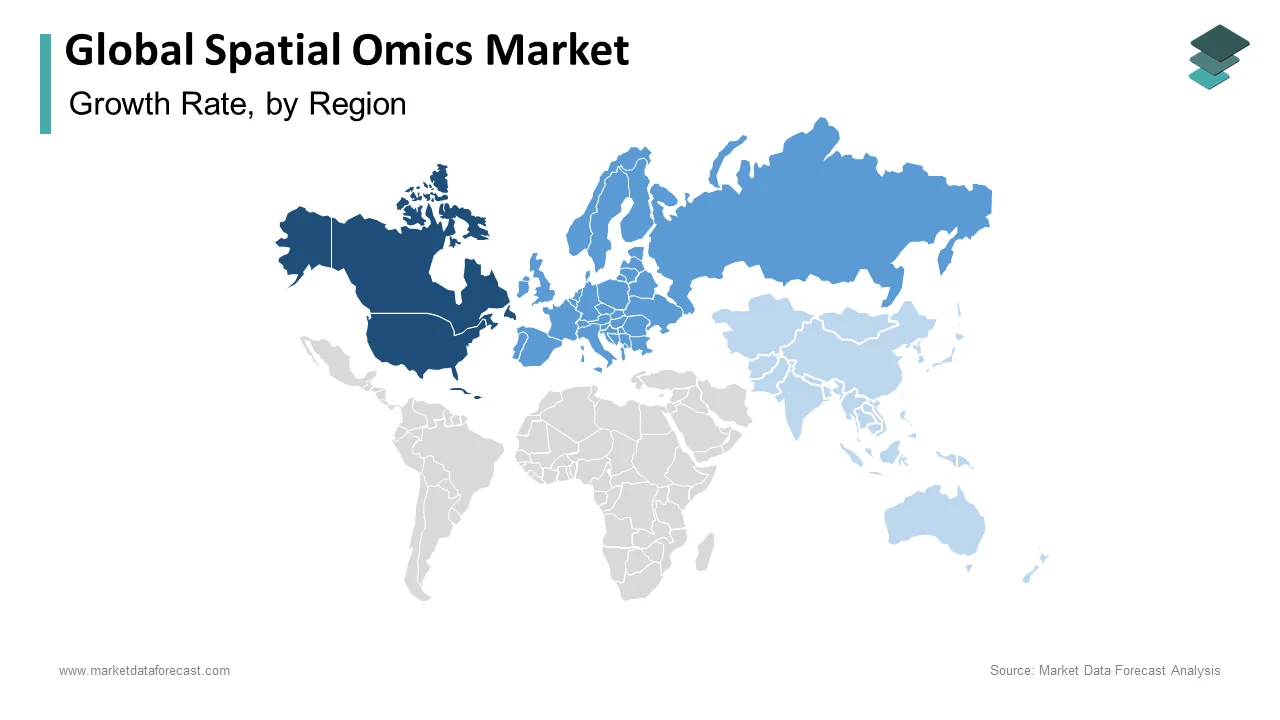

REGIONAL ANALYSIS

North America holds a dominant position in the global spatial omics market and accounted for 39.4% of the global market share in 2024. The United States leads this progress and is driven by substantial investments in biotechnology and a robust research infrastructure. The National Institutes of Health (NIH) reports that the U.S. invests over USD 30 billion annually in biomedical research, a significant portion of which is directed toward cutting-edge technologies like spatial omics. Canada and Mexico also contribute significantly. The increasing demand for precision medicine and clinical research advancements also propels market growth across the region.

Europe commands a considerable share of the global spatial omics market. Germany, the United Kingdom, and France are the leading countries, with Germany, the UK and France all projected to grow at an impressive rate during this period. According to the European Commission, the region is focusing heavily on precision medicine and genomics, with the EU's Horizon Europe program allocating €15 billion to health and bio-sciences in 2024 which is fueling the development and adoption of spatial omics technologies.

The spatial omics market in the Asia-Pacific is expected to grow at a robust CAGR of 17.8% from 2025 to 2033. China, Japan, and India are the leading countries, with India projected to experience the highest growth rate at, followed by China and Japan at 15. during this period. According to the Asia-Pacific Economic Cooperation (APEC), investment in biotechnology in the region has grown by over 20% annually in the last decade. In particular, China is a global leader in sequencing technologies and large-scale clinical trials, providing a strong foundation for the spatial omics market's expansion.

Latin America is estimated to progress at a CAGR of 14.4% over the forecast period. Brazil and Argentina are the leading countries with Brazil projected to grow at an attractive pace and Argentina with same over coming period. According to the Pan American Health Organization (PAHO), Latin America is experiencing a shift toward personalized medicine, supported by increasing funding from both public and private sectors. This is fueling the demand for advanced spatial omics tools, especially in oncology and infectious disease research.

The market in Middle East and Africa predicted to showcase a steady CAGR during the forecast period. South Africa and Egypt are the leading countries. According to the World Health Organization (WHO), health investments in Africa have been steadily increasing, particularly in genomic research. This when coupled with rising demand for personalized healthcare in the region is accelerating the adoption of spatial omics technologies and especially for applications in cancer, infectious diseases, and genomics.

KEY MARKET PLAYERS

NanoString Technologies, Inc., Bio-Techne, 10x Genomics, Dovetail Genomics, Ultivue Inc.,, Bruker Inc., Vizgen Corporation, Akoya Biosciences, Inc., Seven Bridge Genomics, Millennium Science Pty Ltd., and Others.

COMPETITIVE ANALYSIS

The Spatial Omics market is a rapidly growing field, characterized by intense competition among established players, emerging startups, and academic institutions. Key companies such as NanoString Technologies, 10x Genomics, Akoya Biosciences, and Vizgen are driving innovation in spatial transcriptomics, proteomics, and multi-omics solutions, aiming to address the growing demand for high-resolution molecular data with spatial context.

Competition in the market is fueled by the continuous development of cutting-edge technologies that enhance resolution, throughput, and data analysis capabilities. Companies are focusing on offering platforms with improved spatial resolution, multiplexing capabilities, and user-friendly bioinformatics tools to cater to diverse applications in drug discovery, oncology, neuroscience, and developmental biology.

Strategic collaborations with research organizations, pharmaceutical companies, and academic institutions play a vital role in gaining market share and advancing technology adoption. Startups in the sector are intensifying competition by offering innovative, cost-effective solutions that target niche applications.

Regional competition is evident, with North America dominating the market due to significant R&D investments, while Europe and Asia-Pacific are witnessing rapid growth due to expanding research infrastructure.

Intellectual property, such as patents on advanced imaging technologies and proprietary analysis software, is a key determinant of competitive advantage, alongside customer support and comprehensive service offerings.

RECENT HAPPENINGS IN THE MARKET

- In November 2023, Stellaromics, co-founded by Stanford University researcher Karl Deisseroth, secured $25 million in Series A funding. The investment was led by Plaisance Capital Management and a private family office based in Silicon Valley. The funds are allocated for developing the Plexa platform, an automated instrument designed to commercialize the STARmap spatial omics method.

- In July 2024, the Indian government announced the establishment of a ₹1,000 crore venture capital fund to expand the country's space economy by five times over the next decade. This initiative aims to stimulate private sector-driven research, innovation, and commercial development in space technology, benefiting over 180 government-recognized space tech startups in India.

MARKET SEGMENTATION

This research report on the global spatial omics market has been segmented and sub-segmented based on application, solution type, sample, end-users, and region.

By Application

- Diagnostics

- Translation Research

- Drug Discovery and Development

- Single Cell Analysis

- Cell Biology

- Other

By Solution Type

- Instruments

- Consumables

- Software

By Sample

- FFPE

- Fresh Frozen

By End Users

- Academic and Research Institutions

- Biopharmaceutical & Biotechnological Companies

- Contract Research Organization

- Other

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- The Middle East and Africa

Frequently Asked Questions

What factors are driving the growth of the Spatial Omics Market?

The growth is primarily driven by increased research in fields like oncology and neuroscience, advancements in technology, and the rising demand for personalized medicine.

What are the emerging trends in Spatial Omics applications that may shape the market's future?

Emerging trends include the integration of multi-omics data, 3D tissue imaging, and the development of user-friendly analytical tools for non-experts.

What are the future prospects and challenges for the Spatial Omics Market?

Future prospects include increased adoption in clinical settings and further advancements in technology. Challenges involve addressing data standardization issues and ensuring widespread acceptance in clinical practice.

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2500

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]