Global Spatial Light Modulator Market Size, Share, Trends, & Growth Forecast Report Segmented By Application (Projectors, Displays, Optical Communication, Biomedical Applications, and Consumer Electronics), Technology, End Use, Component Type, and Region (North America, Europe, Asia Pacific, Latin America, and Middle East & Africa), Industry Analysis From 2024 to 2033

Global Spatial Light Modulator Market Size

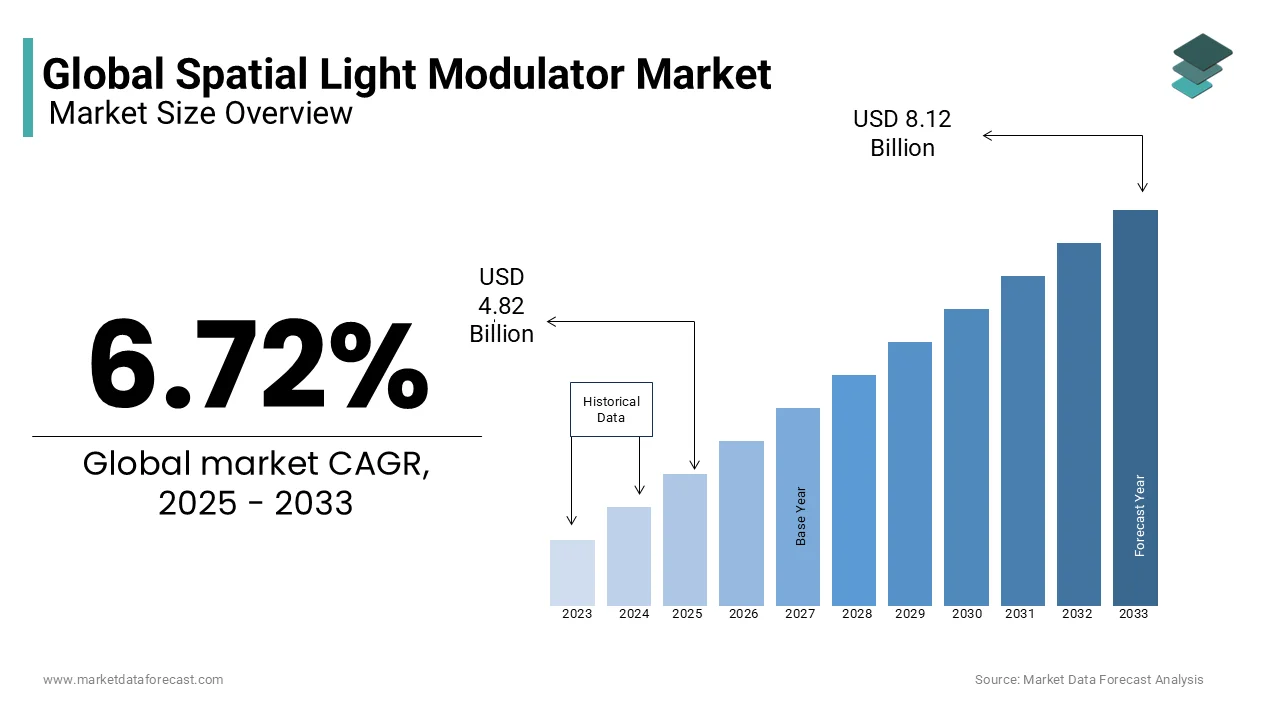

The global spatial light modulator market was worth USD 4.52 billion in 2024. The global market is projected to reach USD 8.12 billion by 2033 from USD 4.82 billion in 2025, rising at a CAGR of 6.72% from 2025 to 2033.

A Spatial Light Modulator (SLM) is a device that controls the intensity, phase, or polarization of light in a spatially varying manner. It plays a crucial role in optical computing, holography, laser beam shaping, and advanced display technologies. SLMs are widely used in augmented reality (AR), virtual reality (VR), medical imaging, defense applications, and optical communication systems. They help create high-resolution projections and dynamic holographic displays and is making them a key component in future optical technologies.

The demand for SLMs is increasing due to technological advancements and their diverse applications. The rising adoption of AR/VR technologies in consumer electronics, healthcare, and industrial training is fueling the need for high-performance SLMs.

Furthermore, over 80% of medical imaging procedures, including optical coherence tomography (OCT) and laser scanning microscopy, rely on precise light modulation, as stated by the National Institute of Biomedical Imaging and Bioengineering. Additionally, in the defense sector, governments worldwide are investing in laser-based systems. According to the U.S. Department of Defense, funding for directed-energy weapons including laser beam control using SLMs surpassed USD 1.5 billion in 2023.

MARKET DRIVERS

Rising Adoption in Biomedical Imaging

The use of spatial light modulators (SLMs) in biomedical imaging drives market growth by enabling precise light control for advanced diagnostics. SLMs enhance holographic imaging for non-invasive procedures. The National Institutes of Health reports U.S. biomedical research funding at $45 billion in 2024 which supports such innovations. The World Health Organization states over 1.6 million diagnostic imaging procedures occur daily worldwide, increasing demand for high-resolution tools like SLMs. This technology improves cellular visualization, pushing manufacturers to innovate for healthcare needs. As medical imaging advances, SLM adoption grows and is fueled by a global focus on cutting-edge optical solutions to enhance diagnostic accuracy and patient outcomes.

Growth in Laser-Based Manufacturing

Laser-based manufacturing, like additive manufacturing, boosts the SLM market by requiring precise beam shaping. SLMs optimize laser efficiency improving production. The U.S. Bureau of Labor Statistics notes 12.8 million manufacturing jobs in 2024, with laser tech on the rise. The International Energy Agency reports industrial energy use at 37% of global consumption in 2023, driving demand for efficient tools. U.S. manufacturing output grew 14% since 2020, per the Federal Reserve, reflecting laser adoption. SLMs support intricate designs in industries like aerospace, expanding market reach. This trend shows SLMs’ role in enhancing manufacturing precision and efficiency.

MARKET RESTRAINTS

High Production Costs

High production costs of SLMs due to complex processes like lithography, limit market growth. Specialized materials raise expenses, with units often exceeding $50,000. The U.S. Bureau of Labor Statistics reports a 3.2% annual rise in manufacturing costs from 2021–2024, impacting affordability. The International Monetary Fund notes a 10% increase in global high-tech production costs in 2023 due to supply chain disruptions. Small firms struggle to adopt SLMs, hindering scalability. This cost barrier restricts market expansion and especially in price-sensitive regions are slowing penetration despite growing demand for advanced optical technologies across various industries.

Limited Technical Expertise

A shortage of skilled professionals in photonics and optics restricts SLM market growth. Expertise is critical for design and operation. The National Science Foundation reports 29% of U.S. STEM graduates in 2024 focused on engineering, with optics underrepresented. UNESCO estimates a 2.2 million global STEM worker shortage in 2024, delaying tech deployment. U.S. vocational enrollment dropped 9% since 2019, per the Department of Education, reducing trained workers. Industries face integration challenges without expertise is limiting SLM use. This skills gap slows market progress despite demand for advanced light modulation solutions.

MARKET OPPORTUNITIES

Expansion in Telecommunications

Telecommunications offers SLM growth potential through optical signal modulation for 5G networks. SLMs enhance long-distance data transmission. The Federal Communications Commission reports 210 million U.S. 5G connections in 2024 which is boosting infrastructure needs. The International Telecommunication Union states global internet users hit 5.4 billion in 2023, increasing bandwidth demand. Fiber optic networks grew 7% annually, per the U.S. Department of Commerce, creating SLM opportunities. This expansion supports faster, reliable communication systems, opening revenue streams for manufacturers. As telecom evolves, SLMs can meet rising needs for efficient data transfer across global networks.

Advancements in Quantum Computing

Quantum computing drives SLM demand by using them to manipulate light for quantum states. The National Institute of Standards and Technology reports $1.6 billion in global quantum funding in 2024. The U.S. Department of Energy notes 320 quantum projects active in 2024 which is relying on photonics like SLMs. NASA estimates quantum systems offer 100-fold speed increases over classical computers and is heightening SLM relevance. This emerging field promises rapid processing growth, positioning SLM manufacturers to innovate. As quantum tech advances, SLMs can tap into this high-potential market, expanding their application scope.

MARKET CHALLENGES

Rapid Technological Obsolescence

Fast technological advancements challenge the SLM market is risking obsolescence as new solutions emerge. Continuous innovation is vital yet costly. The National Science Foundation reports U.S. R&D spending at $730 billion in 2024, reflecting rapid tech shifts. The World Intellectual Property Organization notes 3.4 million patents filed globally in 2024, many in optics. U.S. OLED shipments rose 18% since 2022, per the International Trade Commission, pressuring SLM relevance. Manufacturers must adapt quickly or lose share, straining resources. This pace demands agility to stay competitive in a dynamic optical technology landscape.

Complex Integration Processes

Integrating SLMs into systems is challenging due to compatibility and alignment issues, slowing adoption. Precision is key but hard to achieve. The U.S. Department of Commerce reports 38% of tech integration projects faced delays in 2024 due to complexity. The International Labour Organization notes 24% of global manufacturing firms lack skilled integrators in 2023. Misalignment causes 28% signal loss, per the National Institute of Standards and Technology, requiring expertise. This hurdle increases costs and limits SLM use across industries, posing a significant barrier to market growth.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

6.72% |

|

Segments Covered |

By Application, Technology, End Use, Component Type, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview of Investment Opportunities |

|

Regions Covered |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Market Leaders Profiled |

Vertilas, Soraa, Jenoptik, Holoeye Photonics, Thorlabs, Texas Instruments, Northrop Grumman, Hamamatsu Photonics, Sony Corporation, Ferroperm Optics, Lattice Semiconductor, Microvision, SEIKO Epson, NKT Photonics, and AONIC. |

SEGMENTAL ANALYSIS

By Application Insights

The Displays segment led the Spatial Light Modulator (SLM) market with a 35.8% market share in 2024. Its dominance is driven by demand for high-resolution screens in TVs, smartphones, and AR/VR devices. The U.S. Bureau of Economic Analysis reports the consumer electronics industry added $305 billion to GDP in 2023 which is reflecting its scale. The U.S. Census Bureau notes electronics retail sales reached $85 billion in 2024, emphasizing Displays’ role in SLM growth. This segment’s importance lies in enhancing visual quality across entertainment and professional applications, solidifying its market position.

The Biomedical Applications segment is the fastest-growing segment with a CAGR of 15.5% from 2024-2033. Its rapid rise is fueled by SLM use in optical imaging and diagnostics, critical for healthcare breakthroughs. The National Institutes of Health invested $43 billion in biomedical research in 2024 and is advancing SLM adoption in microscopy, per their annual report. The U.S. Food and Drug Administration approved 50 optical-based medical devices in 2024, spotlighting the segment’s momentum. This growth improves diagnostic precision and treatment efficacy are making it vital for medical innovation and aligning with rising healthcare technology demands.

By Technology Insights

The Liquid Crystal on Silicon (LCOS) segment held a 40.7% market share in 2024 in the SLM market in 2023. It is due to the high resolution and efficiency in displays and projectors. The U.S. Department of Commerce states the semiconductor sector, including LCOS, contributed $250 billion to GDP in 2023. The National Science Foundation allocated $1.3 billion for LCOS-related R&D in 2024, per their funding records, underlining its innovation significance. LCOS drives advanced holography and optical systems and is cementing its dominance in SLM technology applications.

The Microelectromechanical Systems (MEMS) segment is the fastest-growing segment, with a CAGR of 16.3% through 2033. Its growth is propelled by compact design and utility in optical communication and 3D printing. The U.S. Department of Energy reports MEMS enhances 32% of advanced manufacturing systems in 2024. The National Institute of Standards and Technology recorded a 27% rise in MEMS patents in 2024, signaling robust innovation. This segment’s importance lies in enabling high-speed, miniaturized optical devices and is meeting demands for precision and efficiency in industrial and consumer technologies.

By End Use Insights

The Entertainment segment commanded a 38.5% market share in the SLM market in 2024 because of the demand for immersive gaming, VR, and cinema experiences. The U.S. Bureau of Economic Analysis notes the entertainment sector contributed $1.2 trillion to GDP in 2023. The U.S. Census Bureau reports entertainment electronics spending hit $47 billion in 2024, showcasing SLMs’ role in high-quality displays and projectors. This segment’s leadership enhances leisure and media is leveraging SLM technology for superior visual engagement across global markets.

The Healthcare segment is the rapid growing category with a CAGR of 14.5% from 2025-2033 spurred by SLM use in imaging and diagnostics. The U.S. Department of Health and Human Services invested $40 billion in healthcare tech in 2024, per their budget data, boosting SLM integration. The Centers for Disease Control and Prevention states optical imaging improved diagnostic accuracy by 22% in 2024. This growth enhances patient care and medical research is positioning Healthcare as a critical driver of SLM expansion amid global health advancements.

By Component Type Insights

The Hardware segment dominated the SLM market with a 60.8% market share in 2024 due to its role as the core component in modulators and optics. The U.S. International Trade Commission reports hardware exports reached $170 billion in 2023. The U.S. Bureau of Labor Statistics notes hardware manufacturing employed 1.25 million workers in 2024, reflecting its economic impact. Hardware’s importance lies in providing the physical foundation for SLM functionality which is supporting applications from displays to optical communication systems.

The software segment is estimated to register the fastest CAGR of 17.3% during the 2033, driven by demand for SLM control and optimization tools. The U.S. Bureau of Economic Analysis reports software spending rose to $620 billion in 2024. The National Science Foundation notes software R&D funding grew by 20% in 2024, per their annual overview, fostering SLM innovation. This segment’s rapid growth enhances system performance and adaptability, proving essential for scaling SLM applications in telecommunications, biomedical imaging and beyond.

REGIONAL ANALYSIS

North America led the global Spatial Light Modulator (SLM) market and accounted for 35.8% of the total revenue share in 2024. This prominence is attributed to the region's robust technological infrastructure and the strong presence of key photonics industry players. Significant investments in research and development, particularly in augmented reality (AR), virtual reality (VR), and advanced microscopy and have propelled the demand for SLMs. The widespread adoption of these modulators across sectors such as aerospace, automotive, and healthcare further fuels market growth in North America.

The Asia-Pacific region is witnessing the swiftest in the SLM market with a projected CAGR of 7.57% from 2025 to 2033. This rapid expansion is driven by increasing investments in research and development, along with the presence of major consumer electronics manufacturers. Countries like China, Japan, and South Korea are at the forefront, propelled by the demand for high-resolution displays, advanced optical processing, and laser beam steering systems. The region's focus on technological innovation and industrial growth positions it as a significant contributor to the global SLM market.

Europe SLM market is poised for steady growth and is supported by a strong industrial foundation in countries such as the United Kingdom and Germany. Collaborative efforts between research institutions and market players are fostering technological advancements in laser material processing and holographic applications. The region's emphasis on innovation and quality manufacturing is expected to enhance its market position in the coming years.

Latin America and the Middle East & Africa regions are anticipated to witness gradual growth in the SLM market. Factors such as increasing awareness of advanced display technologies and investments in sectors like education, healthcare, and defense contribute to the rising adoption of SLMs. As these regions continue to develop their technological infrastructures, the demand for SLM applications is expected to grow, offering new opportunities for market expansion.

TOP 3 PLAYERS IN THE MARKET

Hamamatsu Photonics K.K.

Hamamatsu Photonics is a leading global provider of spatial light modulators, known for its commitment to innovation and precision in optoelectronic technologies. The company has strengthened its market position through continuous research and development, leading to advanced SLM solutions tailored for applications such as holographic displays, optical computing, biomedical imaging, and photonics research. Hamamatsu’s SLMs are widely recognized for their superior resolution, high-speed modulation, and reliability, making them a preferred choice in industries that require precise light control. With a strong global presence and extensive product portfolio, the company has significantly contributed to the expansion of the SLM market, particularly in scientific research, industrial automation, and medical imaging technologies.

Texas Instruments Incorporated

Texas Instruments (TI) is a dominant force in the spatial light modulator market, primarily due to its Digital Micromirror Device (DMD) technology, which has revolutionized light projection and adaptive optics. TI’s SLMs play a crucial role in applications such as digital projection, 3D printing, and laser beam steering. The company’s focus on high-speed, high-precision light control has enabled advancements in fields like biomedical imaging, augmented reality (AR), and lithography. Through continuous innovation, strategic partnerships, and a robust research and development ecosystem, TI has maintained a strong competitive edge in the market. Its ability to scale production and integrate its technology into various industries has solidified its leadership in the global SLM industry.

Holoeye Photonics AG

Holoeye Photonics AG is a key player specializing in spatial light modulators and diffractive optical elements, catering to research, industrial, and defense applications. The company has built a reputation for providing high-resolution, customizable SLM solutions that support advanced applications like beam shaping, laser material processing, and dynamic holography. Holoeye’s SLMs enable precise phase and amplitude modulation of light, making them essential for applications in optical encryption, microscopy, and high-resolution display technology. The company continues to drive market growth by focusing on cutting-edge research and development, ensuring its products remain at the forefront of photonic innovation. Through collaborations with universities and industrial partners, Holoeye has helped expand the practical applications of SLMs across various high-tech industries.

TOP STRATEGIES USED BY THE KEY MARKET PARTICIPANTS

Research and Development (R&D) Investments

Key players in the Spatial Light Modulator (SLM) market, such as Hamamatsu Photonics, Texas Instruments, and Holoeye Photonics, consistently invest in R&D to advance their technologies and maintain a competitive edge. These companies focus on improving resolution, response time, and light modulation efficiency to meet the growing demands of applications in augmented reality (AR), virtual reality (VR), biomedical imaging, and industrial automation. For instance, Texas Instruments has continuously enhanced its Digital Micromirror Device (DMD) technology, enabling faster and more precise light modulation, while Hamamatsu has worked on developing liquid crystal and MEMS-based SLMs for high-precision optical applications. By prioritizing innovation, these companies can introduce cutting-edge products that align with emerging market needs.

Strategic Partnerships and Collaborations

Forming alliances with research institutions, technology firms, and industrial partners is a crucial strategy for key players in the SLM market. Companies such as Holoeye Photonics collaborate with universities and research centers to develop new applications for SLMs in fields like optical encryption, holography, and quantum computing. Similarly, Hamamatsu Photonics partners with medical and industrial firms to integrate its SLM solutions into advanced imaging systems. These collaborations allow companies to leverage each other’s expertise, accelerate product development, and expand their technological capabilities, ultimately strengthening their market position.

Product Diversification and Customization

To cater to a wide range of industries, leading SLM manufacturers focus on diversifying their product offerings and providing customized solutions. Texas Instruments, for example, offers a broad spectrum of DMD-based SLMs with varying resolutions and sizes to accommodate different projection and adaptive optics applications. Holoeye Photonics specializes in highly customizable SLMs for niche applications such as laser beam shaping and optical metrology. By tailoring their products to meet specific customer requirements, these companies enhance their market reach and secure long-term business relationships.

COMPETITIVE LANDSCAPE

The Spatial Light Modulator (SLM) market is highly competitive, driven by continuous technological advancements and the growing demand for high-resolution light modulation solutions in industries such as augmented reality (AR), virtual reality (VR), biomedical imaging, and industrial automation. The competition is primarily dominated by key players like Hamamatsu Photonics, Texas Instruments, and Holoeye Photonics, which leverage their strong research and development (R&D) capabilities to introduce cutting-edge solutions and maintain market leadership.

Companies in this sector compete based on product innovation, resolution, response time, and light modulation efficiency. Texas Instruments holds a strong position due to its Digital Micromirror Device (DMD) technology, widely used in projection and adaptive optics. Hamamatsu Photonics dominates in high-precision optical applications, including scientific research and medical imaging. Holoeye Photonics, known for its customizable SLMs, has a strong foothold in niche applications such as laser beam shaping and optical metrology.

Smaller and emerging companies compete by offering customized and cost-effective solutions to gain a foothold in specialized applications. Additionally, strategic partnerships, mergers, and acquisitions play a significant role in shaping market dynamics. With increasing applications in quantum computing, LiDAR, and holographic displays, the SLM market is expected to witness intense competition and rapid innovation in the coming years.

KEY MARKET PLAYERS

The major players in the global spatial light modulator market include Vertilas, Soraa, Jenoptik, Holoeye Photonics, Thorlabs, Texas Instruments, Northrop Grumman, Hamamatsu Photonics, Sony Corporation, Ferroperm Optics, Lattice Semiconductor, Microvision, SEIKO Epson, NKT Photonics, and AONIC.

RECENT MARKET DEVELOPMENTS

- In January 2025, Fraunhofer IPMS unveiled advanced 512x320 micromirror arrays with a novel "Piston-Tip-Tilt" actuator concept at the SPIE Photonics West conference in San Francisco. This innovation aims to enhance phase front control, benefiting applications in material processing, 3D holographic displays, and biomedical imaging.

- In December 2024, CEA-Leti developed the first device integrating light sensing and modulation within a single unit. This compact system, combining a liquid crystal cell with a CMOS image sensor, is designed to improve digital optical phase conjugation, with potential applications in microscopy and medical imaging.

MARKET SEGMENTATION

This research report on the global spatial light modulator market is segmented and sub-segmented into the following categories.

By Application

- Projectors

- Displays

- Optical Communication

- Biomedical Applications

- Consumer Electronics

By Technology

- Liquid Crystal Spatial Light Modulators

- Digital Micromirror Devices

- Liquid Crystal on Silicon

- Microelectromechanical Systems

By End Use

- Education

- Entertainment

- Healthcare

- Telecommunications

By Component Type

- Hardware

- Software

- Services

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

Frequently Asked Questions

What factors are driving the growth of the SLM market?

The growth is driven by the increasing adoption of automotive technologies, the rise in digital signage installations, and the use of SLMs in biomedical imaging.

What are the primary applications of Spatial Light Modulators?

SLMs are primarily used in beam shaping, display applications, optical applications, laser beam steering, and holographic data storage.

How is the adoption of SLMs in the automotive industry influencing the market?

The adoption of SLMs in automotive applications, such as LiDAR in advanced driver-assistance systems (ADAS), is contributing to market growth by enabling accurate 3D mapping for object detection.

How is the integration of SLMs in biomedical imaging impacting the market?

The use of SLMs in biomedical imaging techniques, such as optical coherence tomography and multiphoton microscopy, enhances image quality, thereby driving market growth.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2500

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]