Global Socks Market Size, Share, Trends & Growth Forecast Report – Segmented By Product (Casual and Athletic), End-User (Men and Women) and Region (North America, Europe, Asia Pacific, Latin America, Middle east and Africa) – Industry Analysis (2025 to 2033)

Global Socks Market Size

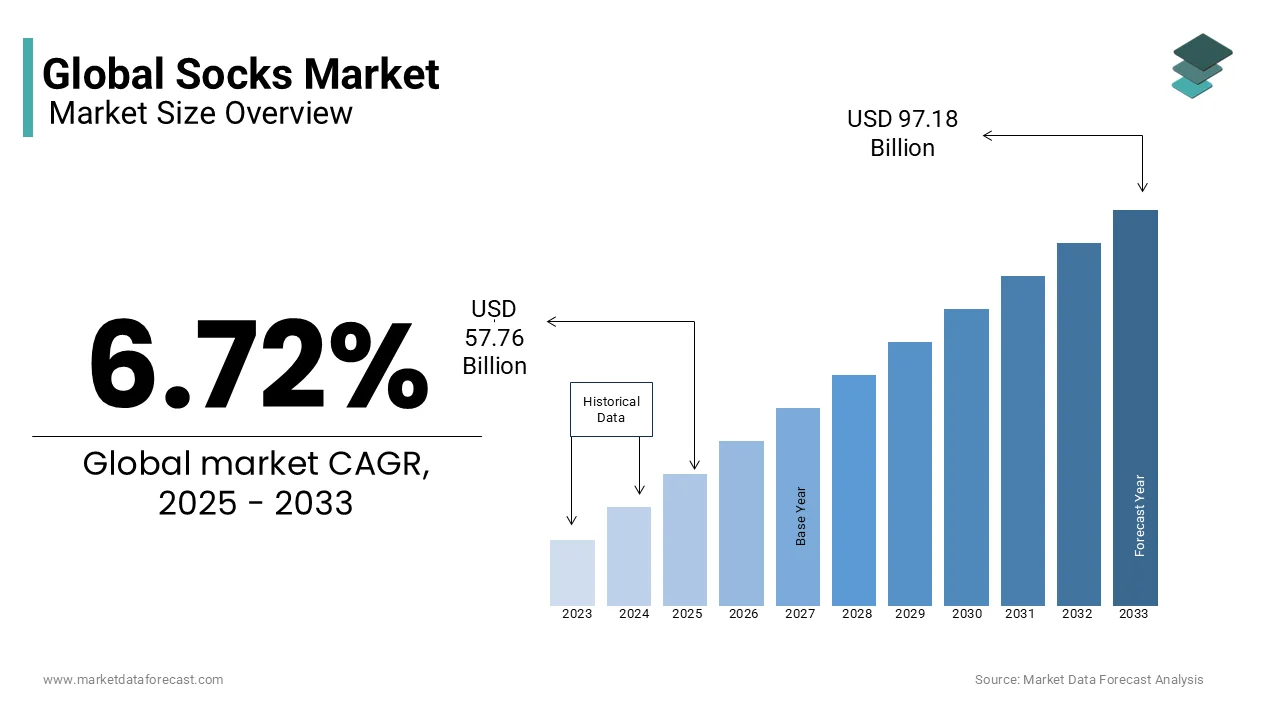

The Global Socks market was valued at USD 54.12 billion in 2024. The global market size is expected to grow at a CAGR of 6.72% from 2025 to 2033 and be worth USD 97.18 billion by 2033 from USD 57.76 billion in 2025.

Socks are not merely utilitarian garments but also fashion accessories that reflect personal style while providing essential comfort, protection, and hygiene. In recent years, advancements in textile technology have expanded the role of socks, with innovations such as moisture-wicking fabrics, compression support, and temperature-regulating materials addressing specific consumer demands. For instance, the American Podiatric Medical Association (APMA) emphasizes that over 75% of adults experience foot-related issues at some point in their lives, underscoring the critical role of well-designed socks in promoting foot health.

Beyond functionality, socks have emerged as a medium for self-expression, particularly among younger demographics. According to a survey conducted by the Fashion Institute of Design & Merchandising (FIDM), millennials and Gen Z consumers prioritize unique and bold designs when purchasing socks, often viewing them as a statement piece in their attire. This trend has spurred demand for limited-edition collections and collaborations between sock brands and high-profile designers or pop culture franchises.

From a material perspective, the growing emphasis on sustainability is reshaping the socks landscape. The Environmental Protection Agency (EPA) reports that textiles account for approximately 5% of landfill waste globally, prompting manufacturers to explore eco-friendly alternatives like organic cotton, bamboo fibers, and recycled polyester. Additionally, innovations in manufacturing processes, such as waterless dyeing techniques, are gaining traction, reducing the environmental footprint of sock production. These developments highlight the evolving role of socks as not just everyday essentials but also products that align with broader societal trends toward health, individuality, and environmental responsibility.

MARKET DRIVERS

Increasing Focus on Foot Health and Ergonomic Designs

The growing awareness of foot health is a significant driver of the socks market, with consumers increasingly prioritizing ergonomic designs that offer comfort and support. According to the American Podiatric Medical Association (APMA), approximately 80% of adults experience foot-related issues during their lifetime, prompting a surge in demand for specialized socks such as compression and diabetic-friendly variants. Compression socks, for instance, are now widely adopted not only by athletes but also by professionals who spend long hours standing or sitting. This trend underscores the intersection of healthcare and fashion, as brands innovate to combine functionality with style. With foot health becoming a priority, socks designed to alleviate discomfort and prevent medical conditions are expected to dominate consumer preferences.

Rising Popularity of Athleisure and Active Lifestyles

The global shift toward active lifestyles and athleisure wear has significantly bolstered the socks market, particularly in the sports and performance segments. The Centers for Disease Control and Prevention (CDC) reports that over 50% of Americans engage in regular physical activity, driving demand for high-performance athletic socks. These socks, often made from moisture-wicking and breathable materials like merino wool and synthetic blends, enhance comfort during workouts while minimizing the risk of blisters and odors. Brands are capitalizing on this trend by introducing innovative designs that cater to both athletic performance and casual aesthetics. As athleisure continues to redefine modern wardrobes, the demand for versatile and stylish socks is set to rise further.

MARKET RESTRAINTS

Fluctuating Raw Material Costs and Supply Chain Disruptions

The socks market is significantly affected by the volatility in raw material costs, particularly for fibers like cotton and polyester. Polyester, a petroleum-based fiber that constitutes more than 50% of global textile materials is highly sensitive to oil price fluctuations. Data from the World Trade Organization (WTO) indicates that rising energy costs have increased the production expenses of synthetic fibers, further straining manufacturers. These cost uncertainties are compounded by supply chain bottlenecks, as highlighted by the Federal Reserve Economic Data (FRED), which have delayed raw material shipments and disrupted production schedules. Such challenges disproportionately affect smaller manufacturers, who lack the resources to absorb rising costs or navigate logistical hurdles, thereby constraining market growth.

Environmental Concerns and Regulatory Pressures

Environmental concerns pose a significant restraint on the socks market, particularly due to the widespread use of non-biodegradable synthetic fibers and resource-intensive manufacturing processes. The Environmental Protection Agency (EPA) estimates that textiles account for nearly 17 million tons of annual waste in U.S. landfills, with synthetic fibers like polyester taking centuries to decompose. This environmental impact has led to stricter regulations, such as the EU’s Sustainable Products Initiative, which mandates sustainable practices and limits the use of harmful chemicals in textile production. Additionally, the World Bank reports that textile dyeing and treatment contribute to approximately 20% of global industrial water pollution, compelling manufacturers to adopt cleaner technologies. While these measures aim to promote sustainability, they increase operational costs and create compliance challenges, particularly for companies in developing nations where regulatory frameworks are still evolving. This regulatory pressure acts as a barrier to market expansion.

MARKET OPPORTUNITIES

Growing Demand for Sustainable and Eco-Friendly Socks

The rising consumer preference for sustainable products presents a significant opportunity for the socks market. According to the U.S. Environmental Protection Agency (EPA), over 60% of consumers are willing to pay a premium for eco-friendly apparel with socks made from organic cotton, bamboo, or recycled materials. The World Wildlife Fund (WWF) highlights that sustainable fibers like bamboo require 30% less water than conventional cotton by making them an attractive alternative for environmentally conscious buyers. Additionally, innovations such as biodegradable dyes and waterless dyeing technologies are gaining traction with the International Labour Organization (ILO) reporting a 25% increase in demand for sustainably produced textiles since 2020. Brands that adopt green manufacturing practices can tap into this growing niche by enhancing their market share while contributing to global sustainability goals.

Expansion of E-Commerce and Customization Trends

The proliferation of e-commerce platforms offers a transformative opportunity for the socks market by enabling brands to reach global audiences and offer personalized products. The U.S. Census Bureau reports that online retail sales grew by 14.3% in 2022 with apparel accounting for a significant portion of this growth. This trend is fueled by social media platforms, where visually appealing and personalized socks often go viral, driving impulse purchases. Companies can cater to individual preferences by fostering customer loyalty and boosting revenue in an increasingly competitive market.

MARKET CHALLENGES

Counterfeit Products and Market Saturation

The socks market faces significant challenges from the proliferation of counterfeit products, which undermine brand reputation and erode profitability. The U.S. Department of Commerce estimates that counterfeit goods account for approximately 2.5% of global trade, with textiles and apparel being one of the most affected categories. Counterfeit socks often mimic premium brands by flooding markets with low-quality alternatives that confuse consumers and dilute trust in established labels. Additionally, the World Trade Organization (WTO) highlights that market saturation is becoming a growing concern, as the low barriers to entry have led to an influx of small-scale manufacturers producing generic designs. This oversupply intensifies price competition by squeezing profit margins for legitimate players. Brands must invest heavily in anti-counterfeiting measures and innovative marketing strategies to differentiate themselves in an increasingly crowded marketplace.

Limited Consumer Awareness of Specialty Socks

Limited consumer awareness about specialty socks, such as those designed for medical or ergonomic purposes is a major challenge for the market players. The Centers for Disease Control and Prevention (CDC) reports that over 34 million Americans are diagnosed with diabetes whereas only 10% of them use diabetic socks which are specifically designed to prevent foot complications. Similarly, the American Academy of Orthopaedic Surgeons (AAOS) notes that compression socks, which aid in circulation and reduce fatigue are underutilized even among individuals with sedentary lifestyles or professions requiring prolonged standing. This lack of awareness limits the adoption of high-value products, restricting revenue growth for manufacturers. Educating consumers through targeted campaigns and partnerships with healthcare providers could address this gap but it requires substantial investment and coordination

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

6.72% |

|

Segments Covered |

Based on Product, End-User, and By Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview of Investment Opportunities |

|

Regions Covered |

North America, Europe, Asia Pacific, Latin America, Middle East and Africa |

|

Market Leaders Profiled |

Nike Inc., Puma S.E., Adidas A.G., Asics Corporation, THORLO, Inc., Balega, Drymax Technologies Inc., and Under Armour, Inc. |

SEGMENTAL ANALYSIS

By Product Insights

The casual socks segment dominated the market by holding 67.7% of the global market share in 2024. The domination of the casual socks segment is primarily due to its universal appeal and everyday necessity, catering to a broad demographic across age groups and lifestyles. The American Apparel & Footwear Association (AAFA) highlights that casual socks are purchased more frequently than any other type with an average consumer buying four to six pairs annually. Their affordability and versatility make them indispensable in daily wardrobes, while innovations like moisture-wicking fabrics and sustainable materials enhance their appeal. Casual socks play a critical role in driving with consistent demand and stabilizing industry growth.

The athletic socks segment is another major segment and is estimated to showcase the fastest CAGR of 8.5% from 2025 to 2033 owing to the rising popularity of athleisure wear and active lifestyles, with over 50% of Americans engaging in regular physical activity, as per the Centers for Disease Control and Prevention (CDC). Technological advancements, such as compression technology and breathable fabrics, have made athletic socks essential for performance and comfort. The World Health Organization (WHO) notes that increasing health awareness has further boosted demand for fitness-related apparel. Athletic socks are also becoming fashion statements by blending functionality with style. This segment’s rapid expansion underscores its importance in meeting modern consumer needs while driving innovation and premiumization in the socks market.

By End-User Insights

The men segment led the market and captured 67.9% of the global market share in 2024. The growing number of fashion-conscious consumers, increasing sock styles for various occasions, evolving fashion preferences of males, rising awareness of sock materials, and online shopping trends are anticipated to continue to drive the growth of the men segment in the global market. The adoption of socks as accessories for casual and commercial attire by men will show growth in the men's segment. The growing promotional efforts by the leading sock brands are expected to encourage expenditure on good quality shoe accessories such as sockets, as they advise maintaining an excellent care appearance.

The women segment is anticipated to grow at a promising CAGR over the forecast period. This leadership stems from the diverse range of socks tailored to women by including fashion-forward designs, sheer variants, and performance wear for sports and fitness. The National Retail Federation (NRF) highlights that women are more likely to purchase multiple pairs of socks for both functional and aesthetic purposes by driving higher consumption rates. Additionally, the growing popularity of athleisure among women has further boosted demand for stylish yet functional socks. This segment's importance lies in its ability to influence trends and drive innovation by making it a key revenue generator for manufacturers.

REGIONAL ANALYSIS

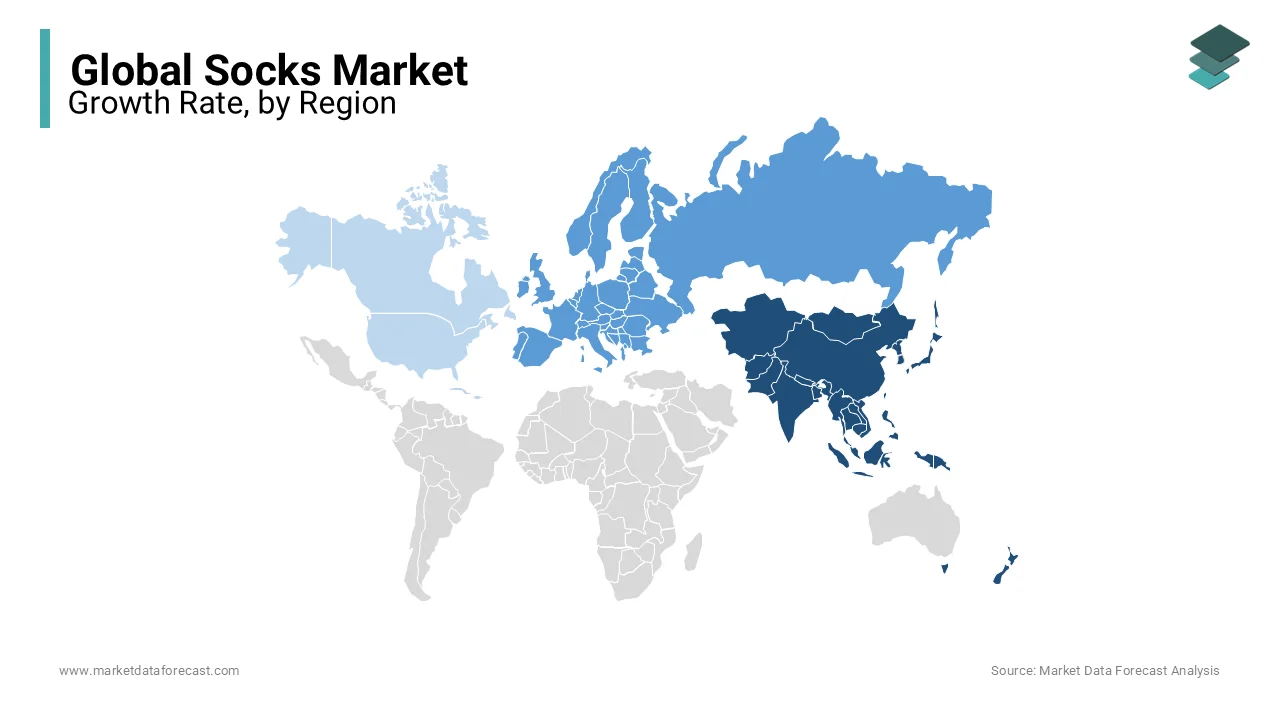

Asia-Pacific held 45.4% of global market share in 2024. The domination of the Asia-Pacific in the global market is driven by its extensive textile manufacturing capabilities, with countries like China and India producing 24% and 22% of the world’s cotton socks respectively, according to the International Cotton Advisory Committee (ICAC). Additionally, the Asian Development Bank (ADB) notes that urbanization rates in Asia have increased by 15% over the past decade by boosting consumer spending on apparel. This growth is further supported by advancements in knitting and dyeing technologies by enabling mass production at competitive prices. The region’s importance lies in its ability to cater to both domestic and international markets by ensuring its central role in shaping global trends and meeting diverse consumer needs.

The Middle East and Africa is predicted to progress at a CAGR of 8.7% from 2025 to 2033 due to factors such as the rising awareness of foot health, particularly in urban areas where sedentary lifestyles and chronic conditions like diabetes are becoming more prevalent. According to the International Diabetes Federation (IDF), the Middle East and North Africa region has one of the highest prevalence rates of diabetes globally, with over 73 million adults living with diabetes in 2021 with a figure expected to rise significantly by 2030. This trend is driving demand for specialized socks, such as diabetic and compression variants, which promote better circulation and reduce discomfort. Additionally, the African Development Bank (AfDB) highlights that retail modernization, including the expansion of shopping malls and e-commerce platforms, has improved access to affordable and trendy socks across the region. Investments in local manufacturing hubs, such as Ethiopia’s Hawassa Industrial Park, are also enhancing regional production capacity. This region’s rapid growth underscores its potential to become a key player in the global socks market.

North America and Europe are expected to grow steadily owing to the consumer preferences for premium and sustainable products in these regions. The U.S. Department of Commerce notes that eco-friendly socks made from recycled materials account for over 20% of sales in North America, reflecting the region’s focus on sustainability. In Europe, regulatory frameworks like the EU Circular Economy Action Plan are encouraging brands to adopt greener practices. Latin America shows moderate growth potential, supported by rising disposable incomes and urbanization, with Brazil and Mexico leading consumption trends. According to the Economic Commission for Latin America and the Caribbean (ECLAC), urban populations in these countries have grown by 10% in the past decade. Meanwhile, the Middle East benefits from luxury fashion trends, while Africa’s expanding youth demographic ensures sustained demand. Collectively, these regions will play a vital role in diversifying product offerings and adopting innovative solutions to meet evolving consumer expectations.

KEY MARKET PARTICIPANTS AND COMPETITIVE LANDSCAPE

The major key players in the global socks market are Nike Inc., Puma S.E., Adidas A.G., Asics Corp, SKechers USA, Inc., Hanesbrands Inc., Under Armour, Inc., VF Corp., Jockey International Inc., Drymax Technologies Inc.

The global socks market is highly competitive, characterized by a mix of established brands, emerging players, and regional manufacturers vying for market share. Key players such as Nike Inc., Adidas A.G., and Hanesbrands Inc. dominate the industry through their strong brand equity, innovative product offerings, and extensive distribution networks. These companies leverage advanced technologies, such as moisture-wicking fabrics and ergonomic designs, to cater to performance-driven consumers while also expanding into casual and lifestyle segments. The growing emphasis on sustainability has further intensified competition, with brands like Adidas adopting eco-friendly materials and Hanesbrands implementing water-saving initiatives to appeal to environmentally conscious buyers.

Regional players and smaller manufacturers also contribute to the competitive landscape, particularly in Asia-Pacific, where low production costs enable them to offer affordable products. However, these players often face challenges in competing with global giants on innovation and brand recognition. The rise of e-commerce has leveled the playing field to some extent, allowing niche brands like Drymax Technologies Inc. to reach targeted audiences through digital platforms.

Differentiation remains a key focus, with companies investing in collaborations, influencer marketing, and localized strategies to capture diverse consumer bases. For instance, Puma and Skechers frequently partner with celebrities to launch exclusive collections, driving brand visibility. Meanwhile, emerging markets in Africa and the Middle East present untapped opportunities, intensifying efforts to expand geographically.

TOP 3 PLAYERS IN THE MARKET

Nike Inc.

Nike Inc. is a dominant player in the global socks market, leveraging its strong brand identity and focus on athletic performance to capture a significant share of the sports and lifestyle segments. The company’s innovative sock designs, such as those featuring Dri-FIT technology, cater to athletes and fitness enthusiasts by offering moisture-wicking, breathable, and ergonomic solutions. Nike’s contribution extends beyond product innovation; it has set benchmarks in sustainability by incorporating recycled materials into its sock production. Its collaboration with high-profile athletes and influencers amplifies brand visibility, ensuring its leadership in premium and performance-driven segments.

Adidas A.G.

Adidas A.G. is another key player, renowned for blending functionality with style to appeal to both athletes and casual consumers. The company’s Primeknit technology and eco-friendly initiatives, such as using Parley Ocean Plastic, have positioned it as a leader in sustainable sock manufacturing. Adidas has capitalized on the growing athleisure trend, with its socks being a staple in urban fashion. By aligning with global environmental goals and investing in cutting-edge textile technologies, Adidas contributes significantly to shaping consumer preferences and driving demand for eco-conscious products.

Hanesbrands Inc.

Hanesbrands Inc. is a leading player in the everyday and casual socks segment, catering to a broad demographic through its diverse portfolio of brands, including Hanes, Champion, and Bali . The company’s dominance stems from its ability to offer affordable, high-quality socks for men, women, and children, making it a household name in North America and beyond. Hanesbrands’ commitment to sustainability is evident in its initiatives to reduce water usage and carbon emissions across its supply chain. By focusing on mass-market accessibility and consistent quality, Hanesbrands ensures steady revenue streams while maintaining relevance in an increasingly competitive market.

STRATEGIES USED BY THE MARKET PLAYERS

Product Innovation and Technological Advancements

Leading players like Nike Inc., Adidas A.G., and Under Armour, Inc. focus on developing cutting-edge technologies to enhance sock performance. Nike’s Dri-FIT technology and Adidas’ Primeknit fabric are examples of innovations designed to improve comfort, breathability, and moisture management. These advancements cater to athletes and fitness enthusiasts, reinforcing brand loyalty among performance-driven consumers. By continuously introducing new features, these companies maintain their leadership in the athletic socks segment and set industry standards for functionality.

Sustainability and Eco-Friendly Initiatives

Sustainability has become a key focus for major players aiming to align with consumer preferences for environmentally responsible products. Adidas A.G. collaborates with Parley Ocean Plastic to create socks from recycled ocean waste, while Hanesbrands Inc. implements initiatives to reduce water usage and carbon emissions across its supply chain. These efforts not only enhance brand reputation but also appeal to eco-conscious consumers who prioritize sustainable purchasing decisions.

Brand Collaborations and Influencer Marketing

Collaborations with celebrities, athletes, and influencers are critical strategies to boost brand visibility. Puma S.E. frequently partners with high-profile figures to launch limited-edition collections, creating excitement and driving consumer interest. Similarly, Skechers USA, Inc. leverages social media platforms like Instagram and TikTok to engage younger audiences through influencer endorsements. These collaborations help brands stay relevant in a competitive market by tapping into pop culture trends.

Expansion of Product Portfolios

Diversifying product offerings allows companies to address niche markets and cater to specific consumer needs. VF Corp. and Jockey International Inc. have introduced specialized socks, such as compression socks for medical use and thermal socks for extreme weather conditions. By targeting underserved segments, these brands increase their market reach and strengthen their position as comprehensive solution providers.

Global Expansion and Localization

Expanding into emerging markets is a priority for key players like Nike Inc. and Adidas A.G. . These companies tailor their products and marketing strategies to suit local preferences, particularly in regions like Asia-Pacific and Latin America. For example, Nike’s localized campaigns in India and China emphasize affordability and style, resonating with regional consumers. This approach helps brands establish a stronger foothold in high-growth markets.

Strengthening E-Commerce Presence

With the growing popularity of online shopping, companies like Hanesbrands Inc. and Under Armour, Inc. are investing in e-commerce platforms to improve accessibility and customer convenience. By offering personalized recommendations and exclusive online deals, these brands enhance the shopping experience and foster customer loyalty. A robust digital presence ensures they remain competitive in an increasingly digital retail landscape.

RECENT MARKET DEVELOPMENTS

- In February 2025, Arvin Goods launched its newest socks collection which is manufactured from Recover recycled cotton fibre (RRCF). It includes 79 percent reprocessed materials which consist of 36 percent RRCF and 43 percent fabric. This sustainable apparel brand claimed it will conserve water equal to 18 gallons against traditional cotton socks

- In November 2024, Balenzia opened its eighteenth store in Mumbai’s Chhatrapati Shivaji Maharaj International Airport (CSMIA). It already had five stores in the city and this marks the sixth one to expand its customer footprint.

MARKET SEGMENTATION

This research report on the global socks market has been segmented and sub-segmented based on the product, end-user, and region.

By Product

- Casual

- Athletic

By End-User

- Men

- Women

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- The Middle East and Africa

Frequently Asked Questions

What is the size of Socks Market ?

The Global Socks market was valued at USD 54.12 billion in 2024. The global market size is expected to grow at a CAGR of 6.72% from 2025 to 2033 and be worth USD 97.18 billion by 2033 from USD 57.76 billion in 2025.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2500

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]