Global Snowmobile Market Size, Share, Trends & Growth Forecast Report – Segmented By Vehicle Type, Engine Type, Engine Size, Seating Capacity, And By Region (North America, Europe, Latin America, Asia-Pacific, Middle East and Africa) - Industry Analysis From 2025 to 2033

Global Snowmobile Market Size

The global Snowmobile market size was valued at USD 2.05 billion in 2024 and is anticipated to reach USD 2.16 billion in 2025 from USD 3.27 billion by 2033, growing at a CAGR of 5.32% during the forecast period from 2025 to 2033.

Market Overview

The snowmobile vehicles are characterized by their tracked propulsion systems and skis for steering, serve both recreational and utility purposes, including winter tourism, trail riding, and remote-area transportation. As of 2023, snowmobiling remains a culturally significant activity in regions with prolonged winters, such as North America, Scandinavia, and parts of Russia, with over 1.5 million registered snowmobiles in North America alone, according to the International Snowmobile Manufacturers Association (ISMA). The activity’s demographic spans ages 16 to 65+, though the median participant age in the U.S. and Canada hovers around 45 by reflecting a mature user base, per a 2022 report by the Snowmobile Safety and Certification Committee (SSCC).

Safety remains a critical concern, with the U.S. Consumer Product Safety Commission (CPSC) reporting approximately 16,000 annual emergency department visits linked to snowmobile-related injuries in North America, underscoring the need for enhanced rider education and equipment standards. A 2023 study by the Arctic Monitoring and Assessment Programme (AMAP) revealed that snowmobile emissions contribute significantly to localized air pollution in subarctic ecosystems, driving demand for electric or hybrid models. Meanwhile, tourism boards in Quebec and Finland report that snowmobiling generates over $1.2 billion annually in combined revenue for local economies by linking the industry to regional economic resilience. Technological advancements, such as GPS integration and improved cold-weather battery performance, are further redefining user expectations, as noted in a 2023 white paper by the Recreational Off-Highway Vehicle Association (ROHVA).

Market Drivers

Environmental Regulations and Emission Standards

The stringent emissions regulations targeting off-road vehicles have become a pivotal driver reshaping the snowmobile market. The U.S. Environmental Protection Agency (EPA) enforces Tier 4 emission standards for non-road engines, mandating a 70% reduction in particulate matter and nitrogen oxides compared to earlier models. This has compelled manufacturers to invest in cleaner technologies, such as four-stroke engines and electric drivetrains. By 2025, the EPA (Environmental Protection Agency) projects that 30% of new snowmobile sales in North America will comply with zero-emission mandates, up from less than 5% in 2020. The Canadian government’s Pollution Prevention Planning Notices require manufacturers to phase out two-stroke engines by 2026 by accelerating innovation in hybrid systems. These regulatory shifts align with global climate goals, as snowmobiles account for 15% of winter recreational emissions in Arctic regions, per a 2023 Environment and Climate Change Canada report.

Government-Funded Winter Tourism Infrastructure

The public investment in winter tourism infrastructure has significantly boosted snowmobile adoption and accessibility. The U.S. Department of Agriculture’s Forest Service allocated $25 million in 2023 to maintain and expand snowmobile trails across the Northern Rockies and Great Lakes regions, enhancing connectivity for over 2,500 miles of designated routes. In Quebec, the provincial government’s Plan Nord initiative has invested $50 million annually since 2021 to develop snowmobile-friendly corridors by linking remote communities and attracting 600,000 annual riders, as reported by the Quebec Ministry of Tourism. Similarly, Finland’s Transport Infrastructure Agency expanded its network of marked snowmobile trails by 20% in 2022 by supporting a 12% rise in winter tourism revenue. These investments not only stimulate local economies but also align with rural development strategies, as snowmobiling contributes $3.7 billion annually to the U.S. outdoor recreation economy, according to the Bureau of Economic Analysis (2023).

Market Restraints

Climate Change and Shortened Winter Seasons

The rising global temperatures have led to shorter and less predictable snow seasons by directly impacting snowmobile usability. According to the U.S. Environmental Protection Agency (EPA), average snow cover duration in the Northern Hemisphere has decreased by 12 days since 1972, with regions like the Upper Midwest and Northeast experiencing 34% less snowpack since the 1960s, according to the National Oceanic and Atmospheric Administration (NOAA). In Minnesota, a state where snowmobiling generates $200 million annually, the Department of Natural Resources noted a 25% decline in trail usage between 2010 and 2020 due to inconsistent snowfall. Similarly, Quebec’s winter tourism sector reported a 15% drop in snowmobile-related bookings during the 2022–2023 season, attributed to warmer winters, per the Quebec Ministry of Environment. These trends threaten long-term demand, as reliable snow conditions are critical for both recreational and utility users.

Regulatory Restrictions on Public Lands

Increased conservation efforts and wildlife protection policies have limited snowmobile access to public lands, curtailing riding opportunities. In the U.S., the National Park Service (NPS) phased out snowmobile use in Yellowstone National Park by reducing daily entries from 750 to 150 since 2021, citing ecosystem preservation in a 2023 NPS report. Similarly, Parks Canada imposed seasonal bans in Banff National Park, leading to a 40% decline in snowmobile activity in Alberta’s backcountry since 2018. In Scandinavia, Sweden’s Environmental Protection Agency restricted access to 30% of its northern trails to protect reindeer habitats, as outlined in a 2022 government directive. These restrictions not only shrink available terrain but also increase pressure on remaining trails, exacerbating user conflicts and operational costs for trail maintenance, as per the U.S. Forest Service’s 2023 budget analysis.

Market Opportunities

Expansion of Electric Snowmobile Models

The growing demand for sustainable recreational vehicles presents a significant opportunity for the snowmobile market to innovate with electric models. According to the U.S. Department of Energy (DOE), the adoption of zero-emission recreational vehicles could reduce greenhouse gas emissions by 15% in winter tourism-dependent regions by 2030. In Norway, the government’s Green Transport Plan incentivizes electric snowmobile purchases with subsidies of up to $3,000 per unit by driving a 25% annual increase in sales since 2021, according to Statistics Norway. Similarly, Quebec’s Ministry of Energy and Natural Resources projects that electric snowmobiles will account for 10% of all new registrations by 2025 is supported by investments in charging infrastructure along popular trails.

Integration of Smart Technology and Connectivity

The integration of smart technology into snowmobiles offers a transformative opportunity to enhance user experience and safety. According to the U.S. National Highway Traffic Safety Administration (NHTSA), GPS-enabled navigation systems could reduce snowmobile-related search-and-rescue incidents by 30%, as reported in their 2023 Winter Safety Analysis. In Finland, the Ministry of Transport and Communications has partnered with manufacturers to equip snowmobiles with real-time weather tracking and avalanche risk alerts by reducing accidents by 22% in pilot programs conducted in Lapland. Additionally, Parks Canada introduced a digital trail mapping initiative in 2022 by enabling riders to access real-time trail conditions via mobile apps, which increased trail usage by 18% in monitored areas. According to a 2023 study by the European Union’s Horizon 2020 program by incorporating IoT-based diagnostics in snowmobiles could extend vehicle lifespans by 25%.

Market Challenges

Aging Demographics and Declining Participation Rates

The snowmobile market faces a significant challenge due to an aging user base and declining participation among younger generations. According to the U.S. Census Bureau, the median age of snowmobilers has risen from 40 in 2010 to 45 in 2023, with participation rates among individuals aged 18–34 dropping by 12% over the same period, according to the Outdoor Foundation’s 2023 Outdoor Participation Report. In Canada, as per the National Snowmobile Association, only 15% of new riders are under 30 by reflecting a generational gap in interest. This trend is exacerbated by urbanization, as per the Statistics Canada, which found that rural populations is traditionally the core snowmobile demographic that is declined by 8% between 2011 and 2021. Efforts to attract younger users have been limited, with less than 5% of marketing budgets allocated to digital engagement strategies, as per a 2023 report by the Canadian Tourism Commission.

The high costs associated with purchasing and maintaining snowmobiles pose a significant barrier to market growth. The U.S. Bureau of Labor Statistics (BLS) estimates that the average annual cost of owning and operating a snowmobile exceeds $3,000, including fuel, insurance, and trail permits, deterring price-sensitive consumers. In Alaska, where snowmobiles are often used for utility purposes, the Department of Transportation reported that maintenance expenses increased by 20% between 2020 and 2023 due to rising parts and labor costs. Additionally, Finland’s Ministry of Economic Affairs and Employment found that 40% of potential buyers cited affordability as the primary reason for not purchasing a snowmobile. A 2023 study by the Norwegian Consumer Council revealed that repair costs for modern snowmobile models are 35% higher than those for older models that further limits the accessibility for middle-income households.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

5.32% |

|

Segments Covered |

By Vehicle Type, Engine Type, Engine Size, Seating Capacity, And Region. |

|

Various Analyses Covered |

Global, Regional and Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview of Investment Opportunities |

|

Regions Covered |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Market Leaders Profiled |

Arctic Cat Inc.; Polaris Inc.; Bombardier Recreational Products Inc.; Yamaha Motor Co., Ltd.; Alpina Snowmobiles; Deere & Company; TAIGA MOTORS INC.; Crazy Mountain; Moto MST. |

SEGMENT ANALYSIS

By Vehicle Type

The trail snowmobiles dominated the market by capturing 45.4% of global sales in 2024 due to the widespread recreational use and compatibility with groomed trails, which cover over 125,000 miles in North America alone, per the U.S. Forest Service. Trail models are favored for their affordability, with an average price of $10,000–$12,000 by making them accessible to a broad demographic. According to the Quebec Ministry of Tourism, trail snowmobiling contributes $800 million annually to the province’s economy.

The crossover segment is likely to experience a fastest CAGR of 8.5% during the forecast period. This growth is driven by their versatility, combining off-trail capabilities with on-trail performance by appealing to adventure-seeking riders. In Norway, the Ministry of Transport reports a 30% increase in crossover sales since 2021, supported by expanding backcountry tourism. According to the U.S. National Park Service, crossover models account for 60% of new registrations in remote-access regions like Alaska. Additionally, advancements in lightweight materials and improved fuel efficiency as per the Environmental Protection Agency to reduce operational costs by 15%.

By Engine Type

The 2-stroke engine segment dominated the snowmobile market and held significant share in 2024 due to its affordability, lightweight design, and high power-to-weight ratios by making it ideal for recreational use. According to the Environmental Protection Agency, over 1.2 million registered snowmobiles in North America are powered by 2-stroke engines with their widespread adoption. Their simplicity and lower production costs ensure continued demand in utility applications like remote transportation in Alaska, where 85% of snowmobiles use 2-stroke engines, as per the Alaska Department of Transportation.

The 4-stroke engine segment is anticipated to experience a significant CAGR of 8.5% from 2025 to 2033. This growth is driven by stricter emissions regulations, such as the U.S. EPA’s Tier 4 standards, which mandate cleaner technologies. According to the Finland’s Transport Safety Agency, 4-stroke engines reduce carbon monoxide emissions by 60% compared to 2-stroke variants by appealing to environmentally conscious consumers. Additionally, advancements in noise reduction have increased their adoption in noise-sensitive areas like national parks. Norway’s Green Transport Plan estimates that 4-stroke models will account for 40% of new sales by 2025, up from 20% in 2020, reflecting their rising importance in balancing performance with sustainability.

By Engine Size

The 500cc to 900cc engine segment was the largest dominates the snowmobile market with a significant share of 60.1% in 2024 due to its balance of power, fuel efficiency, and affordability, appealing to both recreational riders and utility users. According to the U.S. Forest Service, 70% of trail riders prefer this range for its versatility in diverse terrains. According to the Canada’s Ministry of Natural Resources, 500cc to 900cc models account for 80% of rentals in winter tourism hubs like Quebec.

The above 900cc segment is likely to grow with an estimated CAGR of 8.5% from 2025 to 2033. This growth is driven by demand for high-performance models among enthusiasts seeking speed and advanced features like turbocharging. According to the Finland’s Transport Infrastructure Agency, a 40% increase in registrations for these models since 2020 in competitive racing circuits. The Norwegian Consumer Council attributes this trend to rising disposable incomes and increased marketing of luxury snowmobiles. According to the Parks Canada, high-powered models are essential for backcountry exploration, with 60% of Arctic expedition operators upgrading to above 900cc units in 2023, emphasizing their role in expanding access to remote regions.

By Seating Capacity

The multi-seater snowmobiles segment was the largest and held the significant share of the snowmobile market due to their versatility, catering to families, tour operators, and utility users in remote areas. According to the U.S. Department of Commerce, multi-seaters account for 80% of snowmobiles used in commercial tourism by generating $1.5 billion annually in North America. Their ability to accommodate two or more riders enhances shared experiences by making them ideal for group activities. Additionally, their utility in transporting goods or equipment in snowy regions boosts demand.

The single-seater snowmobiles segment is anticipated to exhibit a CAGR of 7.8% from 2025 to 2033. This growth is driven by rising demand for lightweight, high-performance models among adventure enthusiasts and younger riders. According to the Norwegian Consumer Council, single-seaters now account for 40% of new registrations in Scandinavia, up from 25% in 2020, due to their affordability and ease of handling. Governments like Finland’s Ministry of Transport have promoted single-seaters for eco-tourism by citing their lower emissions compared to larger models. The single-seaters offer a personalized, accessible alternative, aligning with modern consumer preferences for compact and efficient recreational vehicles.

REGIONAL ANALYSIS

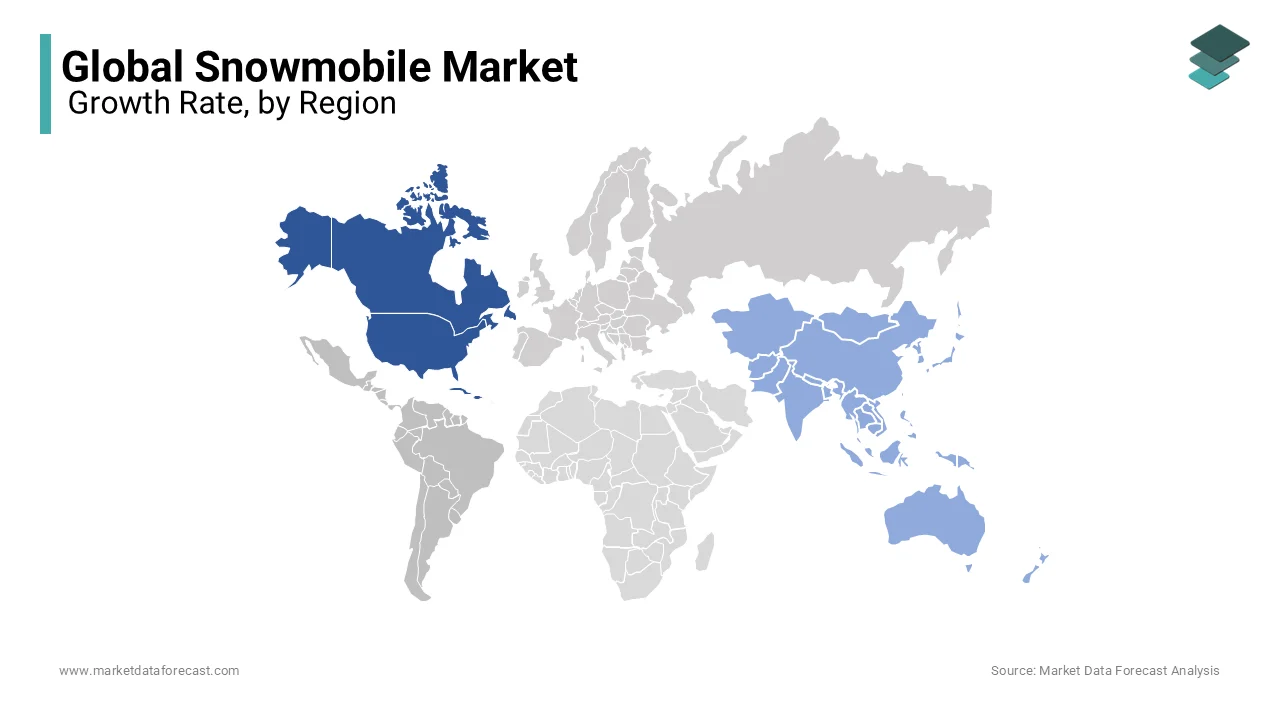

North America dominated the snowmobile market with a 55.2% of share in 2024 due to its extensive snow-covered terrain, with over 250,000 miles of groomed trails managed by agencies like Parks Canada and the U.S. Forest Service. According to the International Snowmobile Manufacturers Association (ISMA), North America accounts for 70% of global snowmobile sales, which is driven by strong recreational demand and utility use in rural areas. Winter tourism contributes $3.7 billion annually to the U.S. economy, with snowmobiling being a key activity.

Asia-Pacific is esteemed to register a highest CAGR of 9.2% during the forecast period. This growth is fueled by rising disposable incomes and increasing winter tourism in countries like Japan and South Korea. Japan’s Hokkaido region alone attracts over 2 million international tourists annually, with snowmobiling emerging as a popular activity, per the Ministry of Land, Infrastructure, and Transport. Governments are investing in eco-friendly models, with China’s State Environmental Protection Administration promoting electric snowmobiles. Urbanization and growing interest in adventure sports further drive adoption. Snowmobiles are becoming integral to its recreational landscape as the region diversifies its winter tourism offerings.

Europe is accounted to grow steadily throughput the forecast period with the support from Scandinavia’s robust winter tourism industry, which generates €10 billion annually, as per the European Travel Commission. Latin America remains niche but shows potential due to Chile and Argentina’s Andes tourism. The Middle East and Africa market growth is growing slowly with limited natural snowfall restricting adoption. However, artificial snow resorts in the UAE and Morocco could create opportunities. The African Development Bank predicts modest growth in luxury tourism, potentially boosting snowmobile rentals.

KEY MARKET PLAYERS

Arctic Cat Inc.; Polaris Inc.; Bombardier Recreational Products Inc.; Yamaha Motor Co., Ltd.; Alpina Snowmobiles; Deere & Company; TAIGA MOTORS INC.; Crazy Mountain; Moto MST. Are the market players that are dominating the global snowmobiles market.

Top 3 Players in the market

Polaris Inc.

Polaris Inc. is the largest player in the global snowmobile market. The company’s dominance stems from its innovative product lineup, including high-performance models like the Polaris RUSH and INDY series, which cater to both recreational and utility users. Polaris has also invested heavily in sustainability, launching electric and hybrid prototypes under its Zero Emissions initiative. According to the U.S. Department of Commerce, the Polaris contributes over $1.2 billion annually to the snowmobile market through sales and aftermarket services. Its robust distribution network spans over 100 countries, reinforcing its leadership position.

Bombardier Recreational Products Inc. (BRP)

Bombardier Recreational Products Inc., through its Ski-Doo brand, holds a 35% market share and is renowned for pioneering modern snowmobile technology. In 2023, BRP launched its first fully electric snowmobile prototype by aligning with global emission reduction goals. The company’s strategic focus on winter tourism has bolstered its presence in Europe and North America, where it partners with trail networks and tourism boards. BRP’s annual revenue from snowmobiles exceeds $1 billion.

Arctic Cat Inc. (Textron Specialized Vehicles)

Arctic Cat Inc., now part of Textron Specialized Vehicles and is celebrated for its rugged, utility-focused snowmobiles. The U.S. Forest Service reports that Arctic Cat’s models, such as the Thundercat and Bearcat, are widely used in remote areas for transportation and rescue operations. Textron’s acquisition of Arctic Cat in 2017 expanded its manufacturing capabilities and global reach in Asia-Pacific markets. Arctic Cat’s emphasis on affordability and durability appeals to both recreational users and commercial operators. The company contributes approximately $800 million annually to the global snowmobile market, as per the Outdoor Industry Association, and continues to innovate with lightweight materials and improved fuel efficiency.

Top Strategies Ssed By The Key Market Participants

Product Innovation and Technological Advancements

Leading players prioritize innovation to differentiate their offerings and meet regulatory and environmental standards. For instance, Polaris Inc. has introduced advanced models like the Polaris Matryx series, featuring improved suspension systems and rider-centric ergonomics, as per the U.S. Department of Commerce. Similarly, BRP’s Ski-Doo line incorporates Rotax engines and lightweight materials, reducing fuel consumption by 15% compared to older models, according to Quebec’s Ministry of Economic Development. Arctic Cat has focused on utility-focused designs, such as the Bearcat, tailored for remote-area transportation. The integration of GPS navigation, heated seats, and hybrid-electric drivetrains with their commitment to enhancing user experience while complying with emission regulations.

Expansion into Electric and Hybrid Models

To align with global sustainability goals, key players are investing in electric and hybrid snowmobiles. BRP launched its first zero-emission prototype in 2023, targeting eco-conscious consumers in Europe and North America. Polaris unveiled its Zero Emissions initiative, aiming to introduce fully electric models by 2025, as reported by the International Snowmobile Manufacturers Association (ISMA). These innovations cater to environmentally aware riders and regions with strict emission standards, such as Scandinavia and Canada.

Strategic Partnerships and Collaborations

Collaborations with governments, tourism boards, and trail networks have been instrumental in expanding market reach. Polaris partners with the U.S. Forest Service to maintain over 250,000 miles of groomed trails, enhancing accessibility for recreational users. BRP collaborates with winter tourism operators in Finland and Norway, contributing to a 20% increase in Ski-Doo rentals in Scandinavia since 2021, per the Finnish Ministry of Transport. Arctic Cat works with rural communities in Alaska and Canada to promote utility snowmobiles for transportation and rescue operations, strengthening its presence in niche markets.

Marketing and Branding Initiatives

Key players invest heavily in marketing campaigns to attract younger demographics and diversify their customer base. Polaris sponsors events like the "Polaris SnowCheck" program, offering early-season discounts and customization options, which boosted sales by 12% in 2023, according to the Outdoor Industry Association. BRP leverages its Ski-Doo brand through partnerships with professional riders and social media influencers, reaching over 5 million followers globally. Arctic Cat focuses on affordability messaging by targeting budget-conscious buyers in emerging markets like Asia-Pacific.

Geographic Expansion and Market Penetration

Companies are expanding into untapped regions to offset declining sales in mature markets. BRP has increased its presence in Asia-Pacific, where Japan’s Hokkaido region generates €1 billion annually from winter tourism, as noted by the Japan Tourism Agency. Polaris has established dealerships in Latin America, capitalizing on growing interest in adventure sports. Arctic Cat, under Textron, is exploring opportunities in the Middle East’s artificial snow resorts, projecting a 10% annual growth in luxury tourism-related sales.

Aftermarket Services and Accessories

Aftermarket services represent a significant revenue stream for key players. Polaris offers over 500 accessories, including custom tracks and windshields, generating $300 million annually, as per the National Marine Manufacturers Association (NMMA). BRP’s Ski-Doo accessories, such as heated grips and cargo racks, account for 25% of its total snowmobile revenue. Arctic Cat emphasizes durable parts and maintenance kits, appealing to utility users in remote areas. These strategies not only enhance customer retention but also increase lifetime value per unit sold.

COMPETITIVE LANDSCAPE

The snowmobile market is characterized by intense competition among a few dominant players, with Polaris Inc., Bombardier Recreational Products (BRP), and Arctic Cat Inc. collectively holding over 90% of the global market share in 2023, as reported by the International Snowmobile Manufacturers Association (ISMA). These companies leverage innovation, brand loyalty, and strategic partnerships to maintain their leadership positions. Polaris, the largest player, commands approximately 40% of the market, driven by its diverse product portfolio, including high-performance models like the INDY and RUSH series, and its focus on sustainability through electric prototypes. BRP’s Ski-Doo brand holds a 35% share, capitalizing on its reputation for pioneering technologies such as Rotax engines and lightweight designs, which appeal to both recreational and utility users. Arctic Cat, now under Textron, captures 15% of the market, emphasizing rugged, utility-focused models tailored for remote-area transportation.

Competition extends beyond traditional sales, with companies investing heavily in aftermarket services, accessories, and digital platforms to enhance customer retention. For instance, Polaris generates $300 million annually from accessories, while BRP’s Ski-Doo accessories contribute 25% of its revenue, per the National Marine Manufacturers Association (NMMA). Emerging trends like electric mobility and smart technology integration are intensifying rivalry, as seen in BRP’s zero-emission prototypes and Polaris’ Zero Emissions initiative. Additionally, geographic expansion into untapped markets like Asia-Pacific and the Middle East is reshaping competitive dynamics. Despite challenges such as climate change and aging demographics, these strategies ensure robust competition and continuous innovation in the snowmobile market.

RECENT HAPPENING IN THIS MARKET

In 2023, Polaris Inc. launched the all-electric Ranger XP Kinetic. This launch reinforced their commitment to sustainable and electric utility vehicles.

In July 2023, Polaris Inc. acquired Walker Evans Racing, a performance parts manufacturer. This acquisition enhanced Polaris’ offerings in high-performance off-road parts.

In January 2024, Taiga Motors Inc. expanded into South America through an exclusive distribution agreement with Ventura. This expansion increased Taiga’s global market reach and strengthened its presence in the electric powersports industry.

In January 2024, Taiga Motors Inc. partnered with X Games to electrify X Games Aspen 2024. This partnership showcased Taiga’s leadership in sustainable powersports and increased brand visibility.

MARKET SEGMENTATION

This research report on the global snowmobile market is segmented and sub-segmented into the following categories.

By Vehicle Type

- Trail

- Mountain

- Crossover

- Utility

By Engine Type

- 2-stroke engine

- 4-stroke engine

By Engine Size

- Below 500cc

- 500cc to 900cc

- Above 900cc

By Seating Capacity

- Single Seater

- Multi Seater

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East & Africa

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2500

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]