Global Snacks Market Size, Share, Trends & Growth Forecast Report Segmented By Product (Frozen & Refrigerated, Fruit, Bakery, Savory, Confectionery, Dairy, Others), Packaging, Distribution Channel, And Region (North America, Europe, APAC, Latin America, Middle East And Africa), Industry Analysis From 2025 To 2033

Global Snacks Market Size

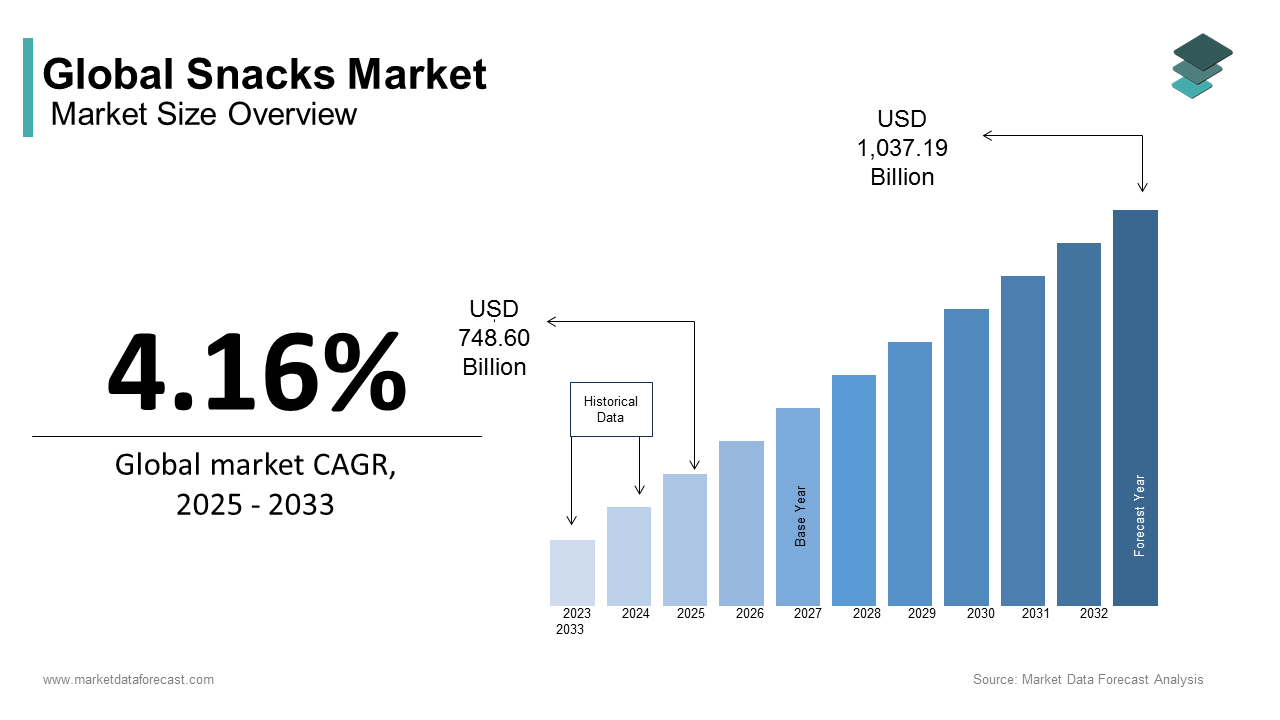

The global snacks market size was calculated to be USD 718.70 billion in 2024 and is anticipated to be worth USD 1,037.19 billion by 2033 from USD 748.60 billion In 2025, growing at a CAGR of 4.16% during the forecast period.

Traditionally perceived as indulgent treats, snacks have become integral to daily diets, addressing both convenience and health-conscious demands. Snacks include a wide array of products such as chips, nuts, bakery items, dairy-based snacks, protein bars, and plant-based alternatives. Factors such as urbanization, technological advancements in food processing, and rising disposable incomes have contributed to the growth of the global snacks market over the last few years. Consumer behavior has notably shifted. According to the International Food Information Council's 2023 Food & Health Survey, 74% of Americans believe that the foods and beverages they consume have a significant or moderate impact on their mental and emotional well-being. This reflects a growing trend towards mindful eating and the selection of snacks that offer functional health benefits. Additionally, the same survey highlighted that "high-protein" was the top eating pattern in 2023, with 18% of respondents adhering to it, indicating a strong consumer preference for protein-enriched snacks.

Technological advancements are further expanding the snacks market worldwide. The rise of functional beverages, for instance, has led to the incorporation of ingredients like probiotics and botanicals aimed at supporting gut health and overall wellness. The International Food Information Council predicts that in 2024, functional beverages will continue to take center stage, redefining the way consumers hydrate. Moreover, the sustainability movement has significantly impacted the sector. The World Economic Forum reports that food-related plastic waste accounts for a substantial portion of global packaging waste, prompting companies to transition toward biodegradable and recyclable materials.

Cultural diversity plays a crucial role in shaping global snack preferences. The rise of third-culture cuisine, which celebrates the fusion of different culinary traditions, is gaining momentum. This trend is leading to increased popularity of snacks that blend flavors and ingredients from various cultures, catering to consumers' adventurous palates. This fusion of tradition and innovation continues to redefine the snacks market, ensuring its relevance in an ever-evolving consumer landscape.

MARKET DRIVERS

Rising Urbanization and Busy Lifestyles

Urbanization is a key driver of the snacks market, with over 57% of the global population living in urban areas as of 2023, according to the United Nations Department of Economic and Social Affairs (UN DESA) . This shift has led to busier lifestyles, increasing demand for convenient, ready-to-eat snack options. The U.S. Bureau of Labor Statistics (BLS) reports that urban consumers spend considerable part of their food budget on snacks, reflecting their reliance on quick meals. Urban centers also serve as hubs for innovation, driving demand for premium and health-focused snacks. As cities expand, so does the accessibility to modern retail formats like supermarkets and online platforms, boosting snack consumption globally.

Growing Health Consciousness and Demand for Functional Snacks

Health consciousness is reshaping the snacks market, with 60% of consumers actively seeking healthier snack alternatives, according to the Centers for Disease Control and Prevention (CDC) . This trend is driven by rising awareness of nutrition and preventive healthcare, particularly among millennials and Gen Z. Consumers are gravitating toward snacks enriched with vitamins, probiotics, and plant-based ingredients. Government initiatives, such as dietary guidelines issued by the U.S. Department of Agriculture (USDA) , promote balanced diets and encourage manufacturers to innovate. With obesity rates rising globally, snacks offering low sugar, high protein, or gluten-free options are gaining traction, making health-focused products a major growth driver.

MARKET RESTRAINTS

Stringent Food Safety Regulations and Compliance Costs

Stringent food safety regulations pose a significant restraint to the snacks market, with compliance costs rising globally. The U.S. Food and Drug Administration (FDA) mandates strict labeling, ingredient sourcing, and hygiene standards, which can increase production expenses, as reported by the International Food Policy Research Institute (IFPRI). Small and medium-sized enterprises (SMEs) are particularly affected, as they often lack the resources to meet these requirements. Additionally, the European Food Safety Authority (EFSA) highlights that non-compliance penalties have surged notably in 2022, discouraging new entrants. These regulations, while ensuring consumer safety, limit innovation and slow market expansion.

Health Concerns and Negative Perception of Processed Snacks

Health concerns and negative perceptions of processed snacks act as a major restraint for the snacks market. The World Health Organization (WHO) reports that over 39% of adults globally are overweight or obese, leading to increased scrutiny of high-calorie, processed snacks. Consumers are increasingly avoiding products with artificial additives, trans fats, and excessive sugar. Furthermore, the U.S. Department of Agriculture (USDA) notes that sales of traditional processed snacks declined by 3% in 2022 due to health awareness campaigns. This shift forces manufacturers to reformulate products, incurring additional costs. Such negative perceptions hinder the growth of conventional snack categories, impacting overall market revenue.

MARKET OPPORTUNITIES

Expansion of E-commerce and Digital Platforms

The rapid expansion of e-commerce presents a significant opportunity for the snacks market. This growth is fueled by increasing internet penetration and smartphone usage, particularly in emerging markets. Over 55% of global consumers now shop online for groceries, including snacks, driven by convenience and personalized recommendations. Subscription-based snack boxes and direct-to-consumer models are gaining traction. Additionally, digital marketing campaigns targeting health-conscious and younger demographics are boosting brand visibility. As e-commerce infrastructure improves globally, this channel offers immense potential for snack manufacturers to reach untapped markets.

Rising Demand for Ethnic and Regional Snacks

The growing demand for ethnic and regional snacks provides a lucrative opportunity for the snacks market. Consumers are increasingly exploring diverse flavors, driven by globalization and cultural exchange. The International Trade Administration (ITA) highlights that a notable portion of millennials prefer trying international snacks, reflecting their adventurous eating habits. Regions like Asia-Pacific and Latin America are key contributors, offering unique snacks like rice crackers, plantain chips, and seaweed-based products. Governments are also promoting local snacks as part of cultural heritage initiatives, further boosting exports. By leveraging authentic recipes and locally sourced ingredients, snack manufacturers can cater to this trend and expand their product portfolios significantly.

MARKET CHALLENGES

Fluctuating Raw Material Costs and Supply Chain Disruptions

Fluctuating raw material costs and supply chain disruptions pose a significant challenge to the snacks market. The U.S. Department of Agriculture (USDA) reports that prices of key ingredients like wheat, corn, and palm oil surged in 2022, driven by geopolitical tensions and climate-related disruptions. These fluctuations increase production costs, with small-scale manufacturers particularly vulnerable. The global food supply chains faced delays during the post-pandemic recovery phase, impacting snack production timelines. Additionally, transportation bottlenecks have raised logistics costs by 10% annually, as per the International Transport Forum (ITF) . Such instability forces companies to either absorb higher costs or pass them on to consumers, risking affordability and demand. Addressing these challenges requires investment in resilient supply chains and alternative sourcing strategies

Intense Market Competition and Brand Differentiation

Intense competition in the snacks market makes brand differentiation a critical challenge. The snacks market faces intense competition, with private-label brands gaining significant traction, particularly in mature categories like chips and cookies. This trend has led to price wars and shrinking profit margins for traditional brands. The European Commission reports that private-label snacks now account for 22% of total sales in Europe, driven by cost-conscious consumers. Additionally, the Food and Agriculture Organization (FAO) emphasizes that differentiation is a growing challenge, as many snack categories lack unique offerings, forcing companies to compete on pricing rather than innovation. To remain competitive, brands must invest in unique flavors, sustainable packaging, and targeted marketing, which can strain resources for smaller players.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

4.16% |

|

Segments Covered |

By Product, Packaging, Distribution Channel, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis; Segment-Level Analysis; DROC, PESTLE Analysis; Porter’s Five Forces Analysis; Competitive Landscape; Analyst Overview of Investment Opportunities |

|

Regions Covered |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Market Leaders Profiled |

General Mills, Inc., PepsiCo, The Kraft Heinz Company, Nestlé, The Kellogg Company, Unilever, Conagra Brands, Inc., Grupo Bimbo, Danone, and Mars, Inc. |

SEGMENTAL ANALYSIS

By Product Insights

The savory snacks segment was the largest segment in the global snacks market and held 28.7% of the global market share in 2024. The widespread appeal of savory snacks across demographics and convenience as on-the-go food options are driving the expansion of the segment in the global market. Potato chips, popcorn, and extruded snacks were key contributors to global sales in 2022, per the U.S. Department of Agriculture (USDA). The segment’s importance lies in its adaptability to regional tastes and growing innovation in healthier alternatives like baked or low-sodium options. With majority of consumers aged 18–45 preferring savory snacks, as reported by the International Food Information Council (IFIC), this segment remains central to the snacks industry.

The frozen and refrigerated snacks segment is projected to grow at a CAGR of 7.2% from 2025 to 2033. Factors such as urbanization, busy lifestyles, and rising demand for ready-to-eat meals are fuelling the growth of the frozen and refrigerated snacks segment in the global market. Millennials and Gen Z drive demand for innovative products like frozen dumplings, spring rolls, and protein-packed bites. Government initiatives promoting food safety and extended shelf-life solutions further support this trend. The segment’s expansion reflects convenience-driven consumption patterns and technological advancements in freezing techniques.

By Packaging Insights

The bags and pouches segment led the market by capturing 42.4% of the global market share in 2024. The domination of the bags and pouches segment is primarily driven by their lightweight, cost-effective, and versatile nature, making them ideal for a wide range of snack products like chips, nuts, and popcorn. Their importance lies in sustainability trends, with recyclable and biodegradable pouches gaining traction. More than half of consumers prefer eco-friendly packaging, further solidifying this segment’s dominance.

On the other hand, the jars segment is growing rapidly and is predicted to progress at a CAGR of 6.2% in the future. This rapid growth is fueled by increasing demand for premium and artisanal snacks, such as gourmet spreads, dips, and pickled snacks, which are often packaged in jars. Millennials and health-conscious consumers drive demand for transparent, resealable, and reusable packaging. The Food and Agriculture Organization (FAO) highlights those global sales of jarred food products reached $40 billion in 2022. Government initiatives promoting sustainable packaging solutions, such as reusable glass jars, further support this trend. Jars’ durability and ability to preserve freshness make them increasingly important in the snacks industry.

By Distribution Channel Insights

The supermarkets and hypermarkets segment led the snacks market by contributing 45.2% of the market share in 2024. This leadership is driven by their widespread presence, offering a one-stop shopping experience with diverse snack options. Their importance lies in their ability to cater to all consumer segments, from budget-conscious shoppers to premium buyers. Additionally, supermarkets often partner with brands for exclusive promotions, boosting sales. With over 90% of consumers preferring in-store purchases for immediate consumption, as per the Food Marketing Institute (FMI), this segment remains central to the snacks industry.

However, the online segment is projected to grow at a promising CAGR of 11.8% over the forecast period. The growing internet penetration, smartphone usage, and convenience-driven shopping habits are fuelling the growth of the online segment in the global market. Millennials and Gen Z are key drivers, with significant percentage of online shoppers purchasing snacks monthly, as stated by the International Trade Administration (ITA). Government initiatives promoting e-commerce infrastructure further support this trend. Online platforms enable personalized recommendations, subscription services, and doorstep delivery, making them increasingly vital for modern consumers.

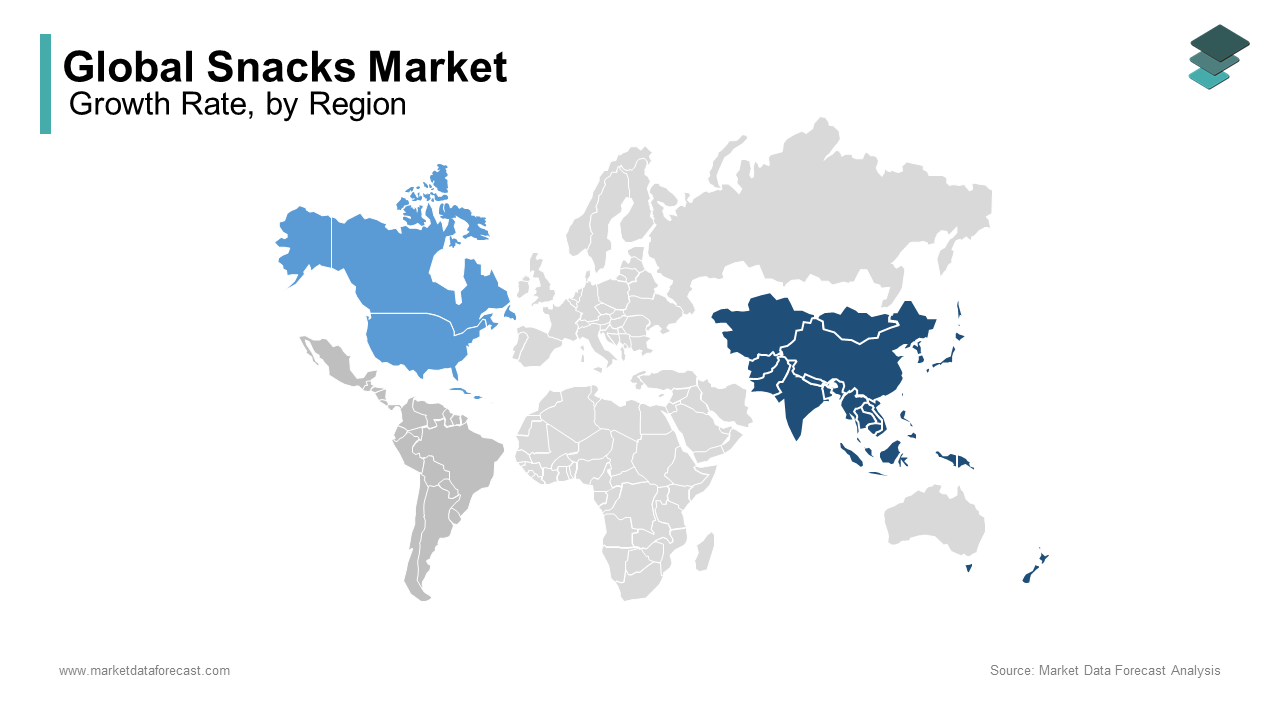

REGIONAL ANALYSIS

The Asia-Pacific dominated the snacks market worldwide by holding 35.1% of the global market share in 2024. The growth of the Asia-Pacific region in the global market is primarily attributed to the large population base, rising disposable incomes, and urbanization trends. China and India are key contributors, with snack consumption growing notably every year. The region's importance lies in its diverse consumer preferences, driving innovation in flavors and formats. For instance, research by the Agriculture and Horticulture Development Board (AHDB) in the UK found that Gen Z consumers are more likely to be concerned about the protein content of their food compared to older generations.

The healthy snacks segment in North America is projected to grow at a CAGR of 8.5% during the forecast period. The growing health awareness, with a substantial portion of U.S. consumers prioritizing nutritious snacks, as stated by the Centers for Disease Control and Prevention (CDC) is contributing to the snacks market expansion in North America. Millennials and Gen Z drive demand for plant-based, gluten-free, and low-sugar snacks. Government initiatives, such as the USDA’s Dietary Guidelines for Americans, promote healthier diets and further boost this trend. The Organic Trade Association (OTA) highlights those sales of organic snacks reached a significant mark in 2022, underscoring their significance. This segment’s expansion reflects shifting lifestyle priorities and regulatory support.

The European snacks market is expected to grow steadily. This growth is driven by strict food safety regulations and high demand for premium and organic snacks. The UK, Germany, and France are the largest contributors, as reported by the Research Institute of Organic Agriculture (FiBL). Consumers in Europe are increasingly prioritizing sustainable and health-conscious options, with 77% of Europeans willing to pay more for eco-friendly products, per the European Commission’s Eurobarometer survey. Urbanization and rising disposable incomes further support market expansion.

Latin America’s snacks market is poised for robust growth, with Brazil leading the annual growth. Economic recovery and increasing urbanization are key drivers. Similarly, a study published in the journal Nutrients found that urbanization is associated with increased consumption of processed and convenience foods, including snacks. Mexico and Argentina also contribute significantly, driven by a youthful population and rising middle-class demand for convenience foods. The region’s focus on traditional flavors and locally sourced ingredients boosts innovation.

The Middle East and Africa snacks market is expanding and is fueled by rapid urbanization and changing consumer lifestyles. Saudi Arabia’s Vision 2030 program is enhancing retail infrastructure, boosting snack accessibility. In Africa, the youthful demographic—where 60% of the population is under 25, according to the United Nations Population Fund (UNFPA) drives demand for affordable and convenient snacks.

KEY MARKET PLAYERS AND COMPETITIVE LANDSCAPE

Major Players of the global Snacks Market include General Mills, Inc., PepsiCo, The Kraft Heinz Company, Nestlé, The Kellogg Company, Unilever, Conagra Brands, Inc., Grupo Bimbo, Danone, and Mars, Inc.

The global snacks market is highly competitive, driven by a mix of multinational corporations, regional brands, and private-label producers. Industry leaders such as PepsiCo, Mars, and Mondelēz International dominate the landscape with extensive product portfolios, aggressive marketing, and widespread distribution networks. Their ability to continuously innovate, acquire emerging brands, and expand into high-growth markets enables them to maintain a competitive edge.

Despite the dominance of large corporations, mid-sized and emerging brands are increasingly disrupting the market by specializing in niche segments such as organic, plant-based, high-protein, and functional snacks. Companies like Kind Snacks, RXBAR, and Hippeas have gained traction by appealing to health-conscious consumers and leveraging direct-to-consumer (DTC) channels. Private-label brands from retailers such as Walmart’s Great Value and Costco’s Kirkland Signature also pose a strong challenge by offering affordable alternatives to branded snacks.

Competition is further intensified by shifting consumer preferences toward sustainability, clean-label ingredients, and diverse flavor experiences. Digitalization and e-commerce growth have also transformed competitive dynamics, allowing smaller brands to directly reach consumers through online platforms. In response, major players are increasing investment in AI-driven personalization, sustainable packaging, and local flavor innovations to stay ahead in this evolving and fragmented market.

TOP STRATEGIES USED BY THE KEY MARKET PARTICIPANTS

Product Innovation and Health-Focused Offerings

Consumer demand for healthier and functional snacks has pushed major players to innovate their product offerings. PepsiCo, through its “Better for You” initiative, has developed low-fat and low-sodium versions of its classic snacks while launching new plant-based options like Off The Eaten Path and Simply Lay’s. Similarly, Mondelēz International has integrated AI-driven recipe development to accelerate the creation of new, health-conscious snacks tailored to consumer preferences. Mars, recognizing the demand for functional foods, has introduced high-protein and reduced-sugar versions of its iconic brands such as Snickers Protein and Twix Hi-Protein to cater to fitness-focused consumers.

Sustainability and ESG Initiatives

Sustainability has become a key differentiator in the snacks industry, with consumers and stakeholders pushing for ethical sourcing and eco-friendly packaging. PepsiCo’s “PepsiCo Positive” sustainability program aims to make 100% of its packaging recyclable, compostable, or biodegradable by 2025. Mondelēz International is committed to net-zero carbon emissions by 2050, with 100% of its cocoa sourced through its Cocoa Life initiative. Mars has made significant strides toward reducing its environmental footprint by pledging to use only sustainable palm oil and eliminate single-use plastics from its packaging, aligning with global sustainability goals.

Digital Transformation & Direct-to-Consumer (DTC) Expansion

E-commerce and digitalization have reshaped the snacks market, allowing brands to engage directly with consumers. PepsiCo launched "Snacks.com" and "PantryShop.com", enabling customers to customize their snack selections and purchase products directly from the company. Mondelēz International has leveraged AI and big data analytics to optimize supply chains and predict future snacking trends. Mars, recognizing the surge in online grocery shopping, has formed partnerships with leading e-commerce platforms like Amazon and Alibaba, ensuring a stronger presence in the rapidly growing digital retail sector.

Personalization and Premiumization

The growing demand for customized and premium snacks has led companies to introduce small-batch, high-quality variants of their popular products. PepsiCo has capitalized on bold flavors with products like Doritos Flamin’ Hot and Cheetos Mac & Cheese, designed to appeal to Gen Z and millennial consumers. Mars has invested in luxury chocolates, launching premium products such as Dove Signature to attract high-end buyers. Mondelēz International has focused on elevating its classic brands, releasing artisanal versions of Oreo and Cadbury chocolates to tap into the premium snacks market.

TOP 3 PLAYERS IN THE MARKET

PepsiCo, Inc.

PepsiCo stands as a global leader in the snacks industry, boasting a diverse portfolio that includes iconic brands such as Lay's, Doritos, and Cheetos. The company's snack division, Frito-Lay, has been instrumental in driving innovation and meeting consumer demands for both traditional and health-conscious snack options. PepsiCo's commitment to sustainability and health is evident through initiatives aimed at reducing sodium and trans fats in their products, as well as introducing baked and organic snack lines. This strategic diversification has solidified PepsiCo's position in the market, catering to a broad spectrum of consumer tastes and preferences.

Mars, Incorporated

Mars has significantly expanded its footprint in the snacks sector, particularly with its recent acquisition of Kellanova, the maker of Pringles and Cheez-It, for nearly $36 billion. This strategic move enhances Mars' presence in the savory snacks segment, complementing its existing confectionery brands like Snickers and M&M's. The acquisition is expected to bolster Mars' annual sales, positioning it as a formidable competitor in the global snacks market. Mars' focus on diversifying its product offerings and investing in popular snack brands underscores its commitment to meeting evolving consumer preferences.

Mondelēz International, Inc.

Mondelēz International is renowned for its extensive range of snack products, including well-loved brands such as Oreo, Ritz, and Chips Ahoy. The company has been at the forefront of leveraging technology to drive innovation, utilizing artificial intelligence to expedite the development of new snack recipes and bring them to market more efficiently. This approach has enabled Mondelēz to respond swiftly to changing consumer tastes and maintain a competitive edge. Additionally, Mondelēz has focused on expanding its global reach and enhancing its product portfolio to include healthier snack options, aligning with the growing consumer demand for nutritious and convenient snack foods.

RECENT MARKET DEVELOPMENTS

- In December 2024, One Rock Capital Partners completed the acquisition of Europe Snacks, a leading manufacturer of private label savory snacks in Europe. Headquartered in Paris, Europe Snacks produces crisps, stacked chips, and crackers for major retailers and branded food companies.

- In September 2024, Authum Investment & Infrastructure and investor Mahi Madhusudan Kela acquired a 46.85% stake in India's Prataap Snacks from Peak XV Partners. They subsequently announced an open offer for an additional 26% stake, aiming for a majority holding in the company known for its Yellow Diamond brand.

- In November 2024, private equity firm Blackstone agreed to acquire a majority stake in Jersey Mike's Subs, valuing the sandwich chain at approximately $8 billion. This move underscores Blackstone's interest in expanding its portfolio within the food and beverage sector.

MARKET SEGMENTATION

This research report on the global snacks market has been segmented and sub-segmented based on product, packaging, distribution channel, and region.

By Product

- Frozen & Refrigerated

- Fruit

- Bakery

- Savory

- Confectionery

- Dairy

- Others

By Packaging

- Bag & Pouches

- Boxes

- Cans

- Jars

- Others

By Distribution Channel

- Supermarket/Hypermarket

- Convenience Stores

- Online

- Others

By Region

- North America

- Europe

- The Asia Pacific

- Latin America

- The Middle East and Africa

Frequently Asked Questions

1. How are consumer preferences influencing the snacks market?

Consumers are shifting toward healthier snacks with organic, protein-rich, and plant-based ingredients, impacting product innovation.

2. What are the major drivers of the snacks market?

Rising demand for convenient and ready-to-eat food, urbanization, increasing disposable income, and innovations in packaging and flavors drive market growth.

3. Who are the key consumers of snack products?

The primary consumers include busy professionals, children, millennials, and health-conscious individuals looking for on-the-go food options.

4. Which are the key segments in the global snacks market?

The global snacks market is segmented by product type (frozen & refrigerated, bakery, savory, confectionery, dairy, etc.), distribution channel, packaging type, and region.

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2500

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]