Global Snack Products Market Size, Share, Trends & Growth Forecast Report - Segmented By Type (Salted Snacks, Bakery Snacks, Confectionary, Specialty and Frozen Snacks), Distribution Channel, Region (North America, Europe, Asia Pacific, Latin America, And Middle East & Africa) - Industry Analysis (2025 to 2033)

Global Snack Products Market Size

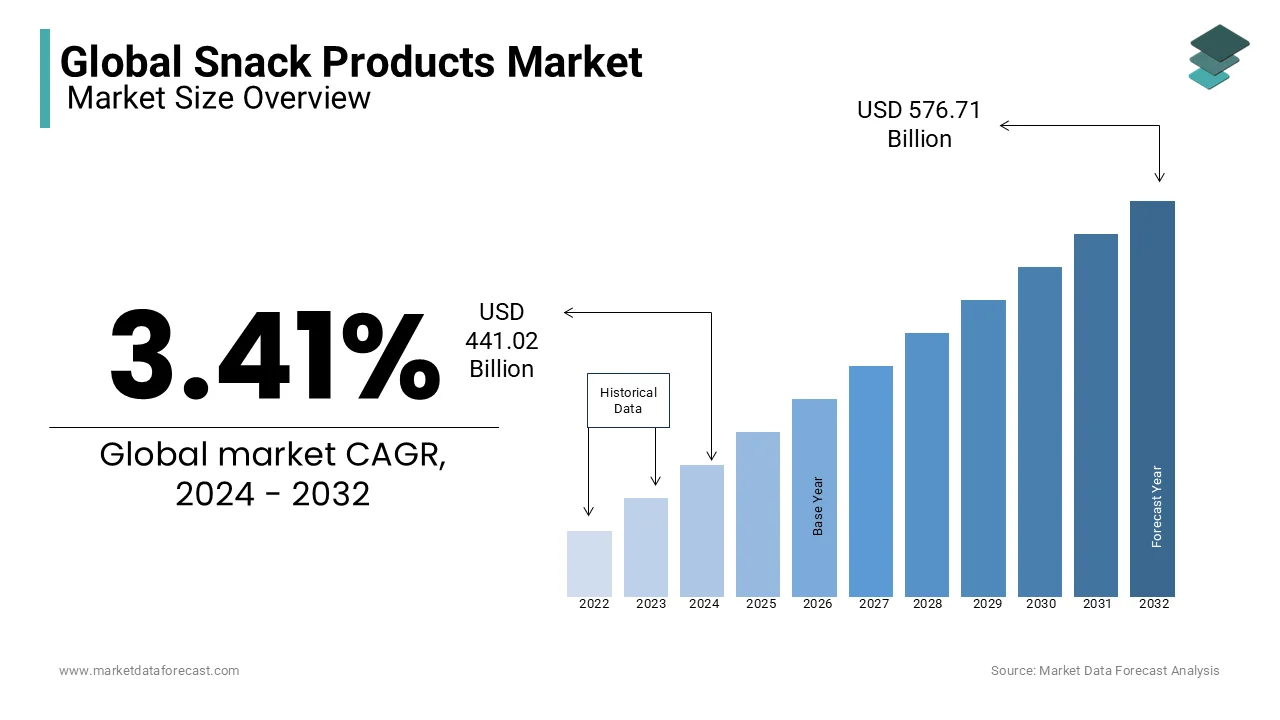

The Global snack products market size was valued at USD 441.02 billion in 2024, and the global market size is expected to be USD 456.06 billion in 2025, and it is estimated to reach USD 596.38 billion by 2033, with a registering CAGR of 3.41% during the forecast period 2025 to 2033.

With the changing consumer eating patterns, snacks have become a substitute for regular meals. Higher disposable incomes, due to increasing urbanization and increasing preference for ready meals, have fueled the growth of the snack industry. Globally, the number of freelancers, dual-income families, and nuclear families is increasing. This demographic change increases the demand for meals prepared several times. The snack is considered the closest alternative to healthy food, which can be eaten at any time.

Current Scenario of Global Snack Products Market

Snacks are products that can be eaten between meals. A snack product can be available in a variety of forms, such as fresh ingredients, processed, and packaged. These are traditionally eaten less than a full meal, whether it may be raw fruit or vegetables or more complicated dishes like sandwiches that are simply packaged. Processed snack food products are in huge demand from consumers as they are less perishable and more durable and portable than prepared foods. In this modern era, every snack product is in huge demand as a number of people are inclined to eat readily available food like snacks and fast food due to lack of time in their busy life schedules. In developed countries like the US, many people are consuming snack products as a main meal due to the rising number of working-class men and women. Snack products are becoming staple food products in the American diet. More than 90% of adults consume one to three snacks per day in the US. The rising awareness of healthy snack options can dominantly improve the quality of the diet, which eventually contributes to healthy living.

MARKET DRIVERS

Increasing health problems, as well as changes in lifestyles and diets, have spurred demand for various snack options around the world. The increasing substitution of meals for snacks, as well as more and more people requesting vegan products without allergens, is a crucial trend that is stimulating the market. International brands took advantage of this opportunity by packaging their products in a more practical way to increase shelf life and make them easier to consume while traveling. Innovative concepts, flexible products to meet consumer needs, and busy lifestyles will benefit market growth. Private label healthy snack products are gaining importance in the United States compared to brand name products due to the massive price gap between private labels and brand name products; the former is more affordable than the latter. With busy lifestyles, late retirements and less free time, consumers are looking for less messy, convenient but nutritious food. For many consumers, snacks have become an essential part of their lives. More and more consumers are turning to gourmet snacks that remind them of the past.

Consumers around the world are extremely careful with their snack routines and are turning to healthy alternatives like fruits, vegetables, and granola bars due to the additional metabolic benefits they offer. The growing demand for weight control foods due to the widespread prevalence of obesity in developed countries such as the United States and the United Kingdom is supposed to drive demand for healthy snack options during the outlook period. The evolution of traditional consumption patterns has expanded the possibilities for flavour innovation in many regions. Factors such as increased divestment income and population growth are expected to promote market growth in developing countries. Furthermore, changes in consumer awareness are assumed to increase the demand for organic snacks in the coming years. Today, ready-to-eat foods make up the largest segment of the conventional and unconventional food industry. This segment is multiplying due to the high acceptance of these foods by consumers around the world. Innovative products in functional ingredients, ready meals and organic foods and advancements in packaging technology should provide an opportunity for future growth in the sector.

MARKET RESTRAINTS

Stringent rules and regulations by the government in approving processed habits in favor of public safety are major factors restricting the growth rate of the market. Food and Drugs Administration raids the companies introducing snack products and imposes stringent action on those who are not following the food safety regulations. They allow the results publicly to create awareness among the public, eventually degrading the product portfolio of the respective company. The shifting trend towards the adoption of home-based food products rather than depending on processed or packaged products is due to a growing concentration on maintaining health and wellness with the rising concern over chronic diseases. Recent studies reveal that excess eating of snack products raises the risk of heart-related issues. Some snacks are very low in nutrients and don’t have any effect on improving health. Eating low nutritionally valued food products complicates the risk of various diseases. The snack products market growth rate is hindered by these factors during the forecast period.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

3.41% |

|

Segments Covered |

By Type, Distribution Channel And Region |

|

Various Analyses Covered |

Global, Regional and Country Level Analysis; Segment-Level Analysis; DROC; PESTLE Analysis; Porter’s Five Forces Analysis; Competitive Landscape; Analyst Overview of Investment Opportunities |

|

Regions Covered |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Market Leaders Profiled |

Kellogg’s Company, Nestle Inc, ConAgra Foods Inc, Calbee, Inc, Frito Lay’s, Cadbury Schweppes PLC, Ferrero Group, Hershey Foods, Meridian Foods, PepsiCo. |

SEGMENTAL ANALYSIS

By Type Insights

The bakery snacks segment is leading with the dominant share of the market. The demand for freshly baked, ready-to-eat snack products like biscuits and others has been surging enormously for many years. The bakery snacks have a unique texture and extended shelf life compared with the other products. Bakery snacks are in huge demand from athletes as they are rich in carbohydrates that provide instant energy. Launch of new products in favor of health-conscious people is a slight way to gain traction over the market share. Increasing social gatherings and celebrating with snack products is the latest trend in the corporate world, which is escalating the growth rate of the market. The confectionery segment is gaining huge traction over the growth rate of the market. It is likely to hit the highest CAGR by the end of 2032. Confectionery products are witnessing huge popularity due to the increasing prominence of healthier food options. Companies' strategies to label the ingredients in an appropriate to reach the target customer who chooses definite snack products are one of the common factors for the confectionery segment to grow eventually during the forecast period.

By Distribution Channel Insights

The specialist retailers segment is leading the significant share of the market, whereas the internet sales segment is cleanly growing at a faster rate. Penetration of e-commerce platforms in the food and beverage industry is showing positive results in the sales of snack products. A growing number of people using smartphones and applications that deliver food products to the doorstep online are attracting many consumers, which is ascribed to bolstering the growth rate of the internet sales segment. Rapidly adopting new technologies to distribute snack products without any delay to the respective channels is inclined to show growth opportunities for market value. The convenience stores segment is likely to gain the highest growth opportunities throughout the forecast period.

REGIONAL ANALYSIS

The global market for Snack Products has been categorized into four regions: North America, Europe, Asia-Pacific, and the rest of the world. The North American Snack Products was further segmented in the United States, Canada, and Mexico. The European Snack Products market has been ranked in the United Kingdom, Germany, France, Italy, Spain and the rest of Europe. The Asia-Pacific Snack Products market has been divided into China, India, Japan, Australia, and New Zealand, and the rest of the Asia-Pacific. The Snack Products market in the rest of the world has been segmented into South America, the Middle East and Africa.

The Asia Pacific is the world leader in sales of snack products, followed by North America. Snack products are widely consumed in developed regions due to massive commercialization and urbanization. The market is anticipated to grow with a high CAGR in developing countries around the world. Europe represents the largest market for snack products, followed by North America. The preference for healthy and nutritious snacks should help maintain steady growth in developed markets. Asia-Pacific is foreseen to experience the fastest growth during the projection period, due to growing demand from developing countries in India and China. The spread of western eating habits in developing countries and increasing urbanization have contributed to better market penetration for global players in developing countries in Asia-Pacific and South America. Among countries, the United States remains the largest market, accounting for a third of the total revenue. Japan and the United Kingdom together represent a quarter of the global Snack products market share.

KEY PLAYERS IN GLOBAL SNACK PRODUCTS MARKET

Key Players in Global Snack Products Market are Kellogg’s Company, Nestle Inc, ConAgra Foods Inc, Calbee, Inc, Frito Lay’s, Cadbury Schweppes PLC, Ferrero Group, Hershey Foods, Meridian Foods, PepsiCo.

RECENT HAPPENINGS IN THE MARKET

- VMG Partners, a private equity firm operating in creating iconic consumer brands in the Food & Beverage, Personal Care & Beauty, Pet Food & Wellness categories, announced the launch of a new branded snack platform, Velocity Snack Brands (VSB). This platform is likely to acquire, promote and extend various snack brands, starting with the acquisition of pop chips in areas like North America and various international markets in European nations.

- KIND Healthy Snacks (KIND) announced the acquisition of Creative Snacks Co., a North Carolina-based, healthier snack maker for the family. Creative Snacks' award-winning snack offerings contain premium ingredients and include bunches of almonds and coconuts, mixed nuts, granola, and pretzels. This acquisition promotes the production of healthier and tastier snacks in different categories by both organizations.

- In 2017, The Hershey Company acquired parent company SkinnyPop Amplify Snack Brands, along with its entire product portfolio. Hershey's purchase of Amplify was preceded by years of small acquisitions; acquired the meat vendor Krave Pure Foods in 2015 and the "healthy" chocolate crust maker a year later.

- KIND Snacks, supported by Daniel Lubetzky, completed its first acquisition in October 2019 from mountain mix and granola maker, which is a cluster of North Carolina. Creative Snacks was started in 2009 by Hilary and Marius Anderson.

- In February 2019, Unilever acquired Graze, a renowned snack brand in Britain. This acquisition is aimed to extend the present portfolio of Unilever in terms of healthy snacks.

MARKET SEGMENTATION

This research report on the global snack products market has been segmented and sub-segmented based on type, distribution channel, & region.

By Type

- Salted Snacks

- Bakery Snacks

- Confectionary

- Specialty Snacks

- Frozen Snacks

By Distribution Channel

- Specialist Retailers

- Internet Sales

- Supermarkets/Hypermarkets

- Convenience Stores

- Others

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East and Africa

Frequently Asked Questions

1.What are snack products?

Snack products refer to convenient, ready-to-eat food items that are typically consumed between meals or as a quick energy boost. These include a wide range of products such as chips, pretzels, nuts, popcorn, crackers, granola bars, and fruit snacks.

2.What are the key drivers of the snack products market?

The snack products market is driven by factors such as changing consumer lifestyles, increasing demand for on-the-go snacks, rising preference for healthier snack options, and the availability of innovative flavors and varieties. Additionally, the growing trend of snacking as a form of indulgence and relaxation contributes to market growth.

3.What are the different types of snack products available?

Snack products encompass a diverse range of options to suit varying preferences and dietary needs. These include savory snacks like potato chips and cheese crackers, sweet snacks like chocolate bars and cookies, healthy snacks like trail mix and yogurt cups, and specialty snacks like gluten-free or organic options.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2500

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]