Global Smokehouse Market Size, Share, Trends & Growth Forecast Report Segmented By Type (Indoor, Outdoor), Product, End Use, And Region (North America, Europe, APAC, Latin America, Middle East And Africa), Industry Analysis From 2025 To 2033

Global Smokehouse Market Size

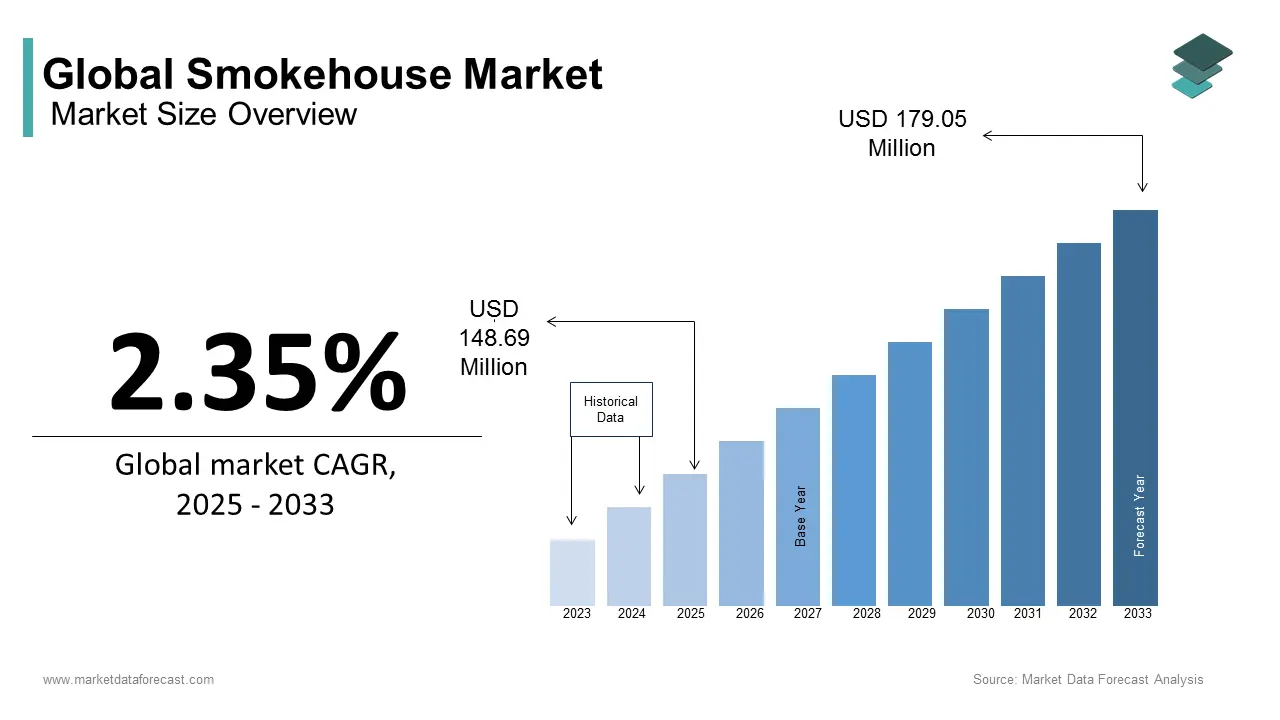

The global smokehouse market size was calculated to be USD 145.28 million in 2024 and is anticipated to be worth USD 179.05 million by 2033 from USD 148.69 million In 2025, growing at a CAGR of 2.35% during the forecast period.

As of 2024, smokehouse market represents a compelling blend of culinary tradition and modern consumer preferences, offering an array of smoked products such as meats, seafood, cheeses, and even plant-based alternatives. Smokehouses utilize both traditional wood-fired methods and advanced automated systems to impart rich, smoky flavors while enhancing the preservation of perishable goods. This process not only elevates taste but also resonates with the growing consumer demand for artisanal, handcrafted foods that emphasize authenticity and heritage.

According to the Food and Agriculture Organization (FAO), global meat production exceeded 340 million metric tons in 2021, highlighting the substantial raw material base available for smoked meat products. Additionally, the FAO reports that global fish consumption has more than doubled since 1990, driven by increased awareness of the health benefits of seafood, making smoked fish a popular dietary choice. Furthermore, the rise of plant-based diets has spurred innovation in smoked vegetarian and vegan products. These underscore the versatility of smoking techniques across various food categories, catering to evolving dietary trends. As consumers increasingly prioritize unique flavor profiles and high-quality ingredients, smokehouses continue to play a pivotal role in shaping the culinary landscape, seamlessly blending tradition with innovation to meet contemporary demands.

MARKET DRIVERS

Growing Demand for Protein-Rich Diets

The global emphasis on protein-rich diets is a pivotal driver of the smokehouse market. According to the Food and Agriculture Organization (FAO), global per capita meat consumption averaged 43 kilograms per person in 2021, reflecting a consistent upward trend over the past decade. This growth is particularly evident in developing regions, where rising incomes and urbanization have improved access to animal-based proteins. Smokehouses leverage this demand by offering premium smoked meats that cater to health-conscious consumers seeking both flavor and nutrition. The FAO also highlights that poultry, a key ingredient in many smokehouse products, accounts for approximately 35% of global meat production, making it the most consumed meat globally. The versatility of poultry, combined with its widespread popularity, enhances the appeal of smoked poultry products. As global protein consumption continues to rise, smokehouses are strategically positioned to innovate and meet evolving consumer preferences with high-quality offerings.

Rising Popularity of Artisanal and Gourmet Foods

The increasing consumer appetite for artisanal and gourmet foods is a significant factor driving the smokehouse market. The Specialty Food Association reports that specialty food sales in the U.S. reached USD 175 billion in 2021, underscoring the growing demand for premium, handcrafted products. Smoked foods, celebrated for their rich flavors and traditional preparation techniques, align seamlessly with this trend. Additionally, the USDA Economic Research Service notes that small-scale producers, including boutique smokehouses, have gained substantial market traction due to their focus on quality and authenticity. Consumers are increasingly willing to pay a premium for unique culinary experiences, such as wood-smoked cheeses or heritage-breed meats. This preference is further supported by the National Restaurant Association, which found that 62% of consumers are more likely to try menu items featuring locally sourced or artisanal ingredients. These dynamics highlight the expanding role of smokehouses in meeting the demands of the burgeoning gourmet food sector.

MARKET RESTRAINTS

Stringent Food Safety Regulations

The smokehouse market faces significant challenges due to stringent food safety regulations imposed by government agencies. The U.S. Food and Drug Administration (FDA) enforces strict guidelines on smoked food production, particularly regarding temperature control and smoking processes to prevent microbial contamination. For instance, the FDA mandates that smoked meats must reach an internal temperature of at least 150°F during processing to ensure safety. These regulations often require smokehouses to invest heavily in advanced equipment and compliance measures, which can be financially burdensome for small-scale producers. Additionally, the Centers for Disease Control and Prevention (CDC) reports that foodborne illnesses affect approximately 48 million people annually in the U.S., underscoring the need for rigorous oversight. While these measures are essential for consumer safety, they increase operational costs and create barriers to entry for smaller players, potentially stifling innovation and market growth.

Health Concerns Related to Processed Foods

Growing health concerns surrounding processed foods pose a significant restraint to the smokehouse market. The World Health Organization (WHO) has classified processed meats, including certain smoked products, as Group 1 carcinogens, linking them to an increased risk of colorectal cancer when consumed excessively. This classification has led to heightened consumer scrutiny and reduced demand for traditional smoked meats. Furthermore, the U.S. Department of Agriculture (USDA) reports that per capita consumption of red meat and poultry declined slightly from 223 pounds in 2019 to 217 pounds in 2021, partly due to health-conscious dietary shifts. Consumers are increasingly prioritizing plant-based or minimally processed alternatives, pressuring smokehouses to innovate while maintaining profitability. Although smoked foods remain popular, the negative perception of processed meats threatens long-term market expansion, requiring producers to adapt by offering healthier options or transparent labeling to rebuild consumer trust.

MARKET OPPORTUNITIES

Expansion of Plant-Based and Alternative Protein Products

The growing demand for plant-based and alternative protein products presents a significant opportunity for the smokehouse market. Smokehouses can capitalize on this trend by developing smoked plant-based meats and cheeses, which offer the same rich flavors as traditional smoked products while appealing to vegan and vegetarian consumers. The Good Food Institute reports that U.S. retail sales of plant-based foods grew by 27% in 2020 alone, reaching USD 7 billion, indicating strong market potential. Additionally, the Food and Agriculture Organization (FAO) emphasizes that plant-based proteins have a significantly lower environmental footprint compared to animal-based proteins, aligning with consumer preferences for eco-friendly options. By innovating in this space, smokehouses can tap into a rapidly expanding market segment and diversify their product offerings.

Rising Demand for Locally Sourced and Sustainable Foods

The increasing consumer preference for locally sourced and sustainable foods provides another key opportunity for the smokehouse market. The United States Department of Agriculture (USDA) reports that local food sales in the U.S. reached USD 12 billion in 2021, reflecting a growing emphasis on reducing carbon footprints and supporting local economies. Smokehouses that adopt sustainable practices, such as using locally sourced raw materials or renewable energy for smoking processes, can attract environmentally conscious consumers. Furthermore, the National Restaurant Association highlights that 70% of consumers are more likely to visit restaurants offering locally sourced menu items, underscoring the appeal of such products. By leveraging regional ingredients and emphasizing sustainability, smokehouses can strengthen brand loyalty and differentiate themselves in a competitive market. This shift not only meets consumer expectations but also aligns with global efforts to promote sustainable food systems, as emphasized by the FAO's initiatives to reduce food system emissions.

MARKET CHALLENGES

High Energy Consumption and Environmental Concerns

The smokehouse market faces significant challenges due to the high energy consumption associated with traditional smoking processes, which has raised environmental concerns. The U.S. Energy Information Administration (EIA) reports that the industrial sector accounts for approximately 33% of total energy consumption in the United States, with food processing being a notable contributor. Traditional smokehouses often rely on wood-fired or electric systems, which can be energy-intensive and contribute to carbon emissions. Additionally, the Food and Agriculture Organization (FAO) states that food production and processing account for 26% of global greenhouse gas emissions, urging industries to adopt sustainable practices. Smokehouses must balance the demand for authentic smoked flavors with the need to reduce their environmental footprint. Transitioning to energy-efficient technologies or renewable energy sources, such as solar-powered smokers, could mitigate these challenges but requires substantial investment and innovation.

Competition from Mass-Produced Alternatives

Intense competition from mass-produced alternatives poses another major challenge for the smokehouse market. The U.S. Department of Agriculture (USDA) highlights that large-scale food manufacturers dominate the processed meat industry, leveraging economies of scale to offer lower-priced products. These mass-produced smoked goods often undercut smaller, artisanal smokehouses, making it difficult for them to compete on price. While mass-produced options may lack the artisanal quality of traditional smokehouse products, their affordability and widespread availability appeal to budget-conscious buyers. To remain competitive, smokehouses must emphasize their unique value propositions, such as superior flavor, craftsmanship, and locally sourced ingredients, while exploring niche markets to differentiate themselves from industrial competitors.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

2.35% |

|

Segments Covered |

By Type, Product, End Use, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis; Segment-Level Analysis; DROC, PESTLE Analysis; Porter’s Five Forces Analysis; Competitive Landscape; Analyst Overview of Investment Opportunities |

|

Regions Covered |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Market Leaders Profiled |

R & V Works (Cajun Fryer), Alto-Shaam, Inc., Town Food Service Equipment Co., Inc., Weber-Stephen Products LLC, Pro Smoker, ScottPec, Inc., Smokehouse Products, Walton's Smokehouse, Viking Range Corporation, Lynx Grills, Inc., Wolf Steel, Ltd., Char-Broil LLC |

SEGMENTAL ANALYSIS

By Type Insights

The indoor smokehouses segment stood as the largest category of the market by accounting for 60.3% of the global smokehouse market share in 2024. The ability of indoor smokehouses to provide controlled environments to make sure consistent quality and compliance with stringent food safety regulations is propelling the growth of the indoor segment in the global market. Indoor smokehouses are widely adopted in industrial-scale operations due to their efficiency and integration with automated technologies. The USDA emphasizes that indoor smoking processes significantly reduce contamination risks, making them ideal for producing smoked meats, cheeses, and seafood. Their dominance underscores their importance in meeting the growing demand for premium, ready-to-eat smoked products while maintaining high hygiene standards, particularly in urbanized regions like North America and Europe.

On the other hand, the outdoor segment is predicted to grow at the fastest CAGR of 5.2% over the forecast period due to the rising popularity of artisanal and craft foods, particularly among small-scale producers who emphasize traditional smoking methods. The FAO highlights that outdoor smokehouses appeal to consumers seeking authentic, handcrafted flavors, aligning with the global trend toward locally sourced and sustainable foods. Additionally, the increasing adoption of outdoor barbeque culture in regions like Asia-Pacific and Latin America further boosts demand. Outdoor smokehouses also benefit from lower setup costs compared to industrial indoor systems, making them accessible to smaller players. This segment's rapid expansion highlights its role in preserving culinary traditions while catering to evolving consumer preferences for unique, high-quality smoked products.

By Product Insights

The electric grill segment was the largest segment of the global market by holding 40.3% of the global market share in 2024. The domination of electric grill segment in the global market is attributed to their ease of use, precise temperature control, and compliance with environmental regulations, as they produce minimal emissions compared to traditional methods. Electric grills are particularly popular in urban areas where space is limited and air quality regulations are stringent. The USDA highlights that electric grills are widely adopted in industrial smokehouses due to their efficiency and ability to maintain consistent smoking conditions. This segment's dominance underscores its importance in meeting consumer demand for high-quality smoked products while adhering to modern sustainability standards, making it a preferred choice for both large-scale producers and urban consumers.

On the contrast, the charcoal and wood grill smokehouses segment is a rapidly emerging segment and is predicted to witness a CAGR of 5.8% over the forecast period due to the rising consumer demand for authentic, smoky flavors that only traditional charcoal and wood-fired methods can deliver. The FAO notes that artisanal producers and small-scale smokehouses are increasingly adopting these methods to cater to the growing preference for handcrafted, premium smoked foods. Additionally, regions like Europe and Asia-Pacific are witnessing a resurgence in traditional barbeque culture, further driving demand. Despite challenges such as higher operational costs and environmental concerns related to emissions, the segment's focus on authenticity and unique taste experiences positions it as a key driver of innovation and market diversification in the coming years.

By End-use Insights

The commercial segment led the market by holding 60.3% of the global market share in 2024 due to their widespread adoption in restaurants, hotels, and industrial food processing facilities, where large-scale production and consistent quality are essential. The USDA highlights that commercial smokehouses benefit from advanced technologies, enabling precise temperature control and compliance with stringent food safety standards. Their importance lies in meeting the growing demand for ready-to-eat smoked products, such as meats, seafood, and cheeses, particularly in urbanized regions. The segment's dominance underscores its critical role in supporting the foodservice industry and catering to consumer preferences for premium, high-quality smoked goods.

On the other hand, the residential segment is anticipated to expand at a CAGR of 6.8% from 2025 to 2033. This growth is fueled by the rising popularity of home cooking and barbeque culture, particularly in regions like North America and Europe. The FAO notes that consumers are increasingly investing in at-home smoking equipment to experiment with gourmet flavors and artisanal techniques. Additionally, the growing trend of "do-it-yourself" food preparation and the desire for healthier, preservative-free smoked foods further drive demand. Despite higher upfront costs, residential smokehouses appeal to health-conscious and culinary enthusiasts. This segment's rapid expansion highlights its importance in empowering consumers to create authentic smoked dishes at home while aligning with personalized dietary preferences.

REGIONAL ANALYSIS

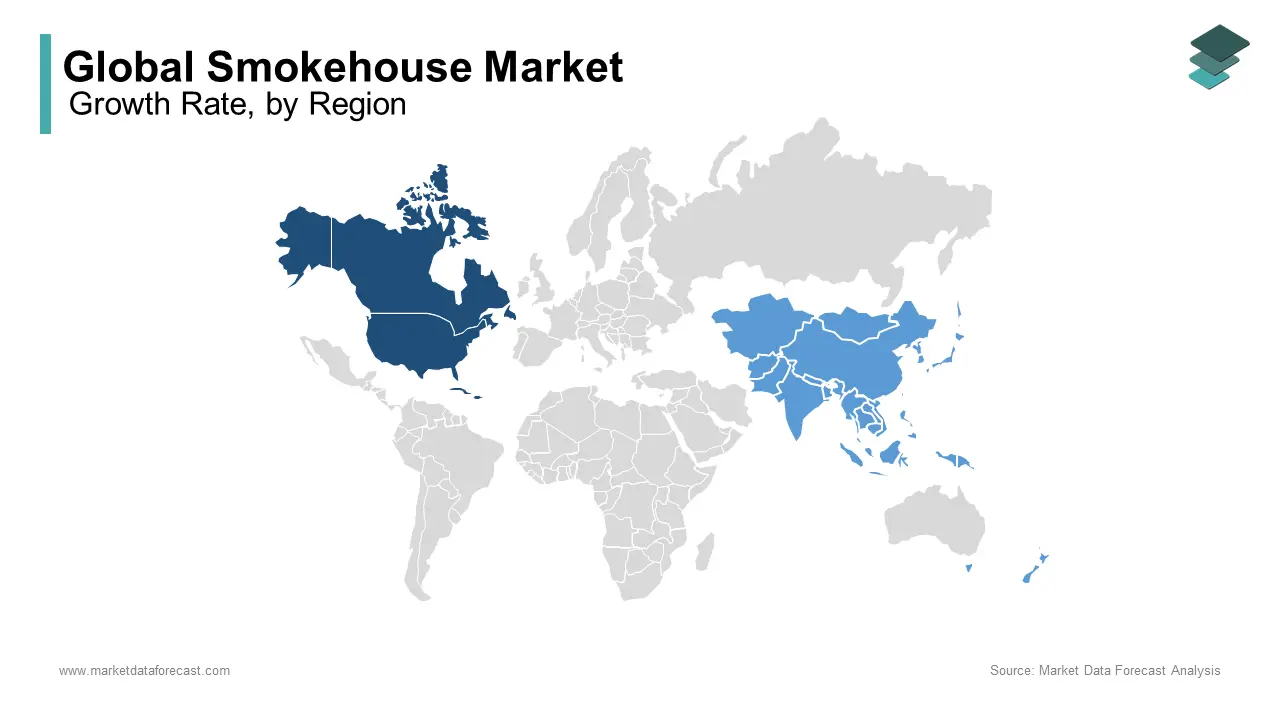

North America dominated the market by accounting for 35.7% of the global market share in 2024 owing to the strong barbecue culture of North America, high consumption of smoked meats, and a well-established network of artisanal and industrial smokehouses. The USDA highlights that per capita meat consumption in the U.S. reached 225 pounds annually in 2021, fueling demand for premium smoked products. Additionally, advancements in smoking technologies, such as automated smokers, and stringent food safety regulations ensure consistent quality and safety. North America's dominance reflects its role as a hub for innovation, catering to consumer preferences for flavorful, protein-rich diets while maintaining high production standards.

The Asia-Pacific region is the most lucrative regional segment for smokehouses and is predicted to witness a CAGR of 6.5% over the forecast period. The growth of the Asia-pacific region in the global market is fueled by rapid urbanization, rising disposable incomes, and the adoption of Western dietary trends, including smoked seafood and meats. The FAO reports that fish consumption in Asia increased by 30% over the past decade, creating a lucrative market for smoked fish products. Furthermore, growing health consciousness and demand for ready-to-eat gourmet foods are driving innovation among regional producers. Governments in the region, such as China and India, are promoting sustainable aquaculture practices, supporting smoked seafood production. This rapid expansion positions Asia-Pacific as a critical growth driver for the global smokehouse industry, with significant potential for future investments and product diversification.

Europe held a prominent share of the global smokehouse market in 2024. The growth of the European market is driven by its long-standing tradition of smoked meats and cheeses, particularly in countries like Germany, Poland, and the Nordic nations. According to the European Market Observatory for Fisheries and Aquaculture Products (EUMOFA), Europe is a leading producer of smoked fish, with smoked salmon being one of the most popular products. The region benefits from strict food safety regulations enforced by the European Food Safety Authority (EFSA), ensuring high-quality standards. Additionally, the growing demand for organic and sustainably produced smoked goods aligns with consumer preferences for eco-friendly options. While growth may be slower compared to Asia-Pacific, Europe’s mature market remains stable, supported by cultural traditions and high-quality craftsmanship. The region is also seeing innovation in plant-based smoked products, catering to rising veganism and flexitarian diets.

In Latin America, the smokehouse market is gaining traction due to the region's rich culinary traditions, including barbeque and smoked meats. According to the Food and Agriculture Organization (FAO), per capita meat consumption in Latin America averaged 79 kilograms annually in 2020, creating a solid foundation for smoked products. Countries like Brazil and Argentina are leading markets, driven by their love for grilled and smoked meats, such as chorizo and beef jerky. However, challenges such as limited access to advanced smoking technologies and economic disparities in some areas hinder rapid growth. Despite this, the market is expected to grow steadily, supported by urbanization and increasing health consciousness, which encourage the adoption of ready-to-eat smoked foods. Rising middle-class incomes are also driving demand for premium smoked products.

The Middle East and Africa represent emerging markets for the smokehouse market, with growth fueled by urbanization, rising incomes, and exposure to global dietary trends. The African Development Bank highlights that Africa’s urban population is projected to reach 56% by 2050, driving demand for processed and preserved foods, including smoked goods. In the Middle East, smoked seafood, such as smoked salmon and mackerel, is gaining popularity among affluent consumers seeking gourmet options. However, challenges such as limited cold chain infrastructure and lower awareness of smoked products in rural areas persist. Despite these hurdles, the region offers untapped potential, particularly in premium and imported smoked products, making it an attractive area for future investments. The growing tourism industry in the Middle East further boosts demand for high-end smoked delicacies.

KEY MARKET PLAYERS AND COMPETITIVE LANDSCAPE

Major Players of the global smokehouse market include R & V Works (Cajun Fryer), Alto-Shaam, Inc., Town Food Service Equipment Co., Inc., Weber-Stephen Products LLC, Pro Smoker, ScottPec, Inc., Smokehouse Products, Walton's Smokehouse, Viking Range Corporation, Lynx Grills, Inc., Wolf Steel, Ltd., Char-Broil LLC

The global smokehouse market is highly competitive, with key players focusing on product innovation, strategic partnerships, and market expansion to gain a competitive edge. The industry is driven by the increasing demand for smoked food products, particularly in the foodservice and home-cooking sectors.

Major companies such as Weber-Stephen Products LLC, Master built Manufacturing, and Char-Broil LLC dominate the market through diverse product offerings, technological advancements, and strong brand recognition. These companies consistently introduce smart smoking solutions, including Wi-Fi and Bluetooth-enabled smokers, to enhance user convenience and control.

The competition is further intensified by the growth of artisanal and specialty smokehouses. Small and mid-sized businesses are carving out a niche by offering customized and premium smoked products, focusing on sustainable and organic smoking methods to appeal to health-conscious consumers.

Mergers and acquisitions also play a crucial role in shaping the competitive landscape. Companies seek strategic acquisitions to expand their geographical reach and strengthen their supply chain networks. Additionally, regulatory compliance, such as environmental standards and food safety regulations, impacts competition, pushing companies to adopt eco-friendly practices.

TOP STRATEGIES USED BY THE KEY MARKET PARTICIPANTS

Product Innovation and Diversification

Companies are focusing on launching new features and expanding their product ranges to meet diverse consumer needs. For instance, R & V Works, known for its Cajun Fryer brand, specializes in outdoor cooking products, including fryers, smokers, and grills, which are highly regarded for quality and performance. Their product line includes the Cajun Express Smoker, designed to deliver consistent smoking results with minimal effort.

Technological Advancements

Incorporating advanced technologies into smokehouse equipment enhances user experience and product efficiency. Features such as improved temperature control, energy efficiency, and automation are becoming standard, attracting both residential and commercial users seeking convenience and precision in smoking processes.

Strategic Partnerships and Acquisitions

Key players are engaging in mergers, acquisitions, and partnerships to expand their market reach and capabilities. These strategic initiatives allow companies to leverage shared resources, access new markets, and enhance their product offerings, thereby strengthening their competitive positions in the global market.

TOP 3 PLAYERS IN THE MARKET

Masterbuilt Manufacturing, LLC

Masterbuilt is renowned for its innovative and user-friendly smoking equipment, particularly electric smokers. The company offers a diverse range of products designed for both novice and experienced users, emphasizing ease of use and consistent results. Masterbuilt's commitment to quality and innovation has solidified its position as a leader in the smokehouse market.

Char-Broil, LLC

Char-Broil is a well-established brand in the outdoor cooking industry, known for its wide array of grills and smokers. The company offers various smokehouse products, including electric, charcoal, and gas smokers, catering to a broad spectrum of consumer preferences. Char-Broil's extensive distribution network and focus on product innovation have made it a significant contributor to the global smokehouse market.

Southern Pride BBQ Pits & Smokers

Southern Pride specializes in commercial-grade smokers and barbecue pits, serving restaurants, catering services, and other foodservice establishments. The company is recognized for its high-quality, durable equipment that delivers consistent smoking performance. Southern Pride's products are integral to many commercial kitchens, underscoring its vital role in the smokehouse industry.

RECENT MARKET DEVELOPMENTS

- In October 31, 2024, North Country Smokehouse announced the launch of its first fresh product: Organic Ground Pork. This product is available in 1 lb. packs at all The Fresh Market locations. The company emphasizes its commitment to ethical farming practices, sourcing pork from its own vertically integrated farms. The ground pork is crafted with a balanced lean-to-fat ratio, making it suitable for various dishes.

- In May 15, 2024, PANOS Brands, LLC announced the acquisition of The Santa Barbara Smokehouse (SBS), a leader in producing high-quality smoked salmon. SBS is renowned for its artisanal smoking process, utilizing full logs in an open fire kiln. Their products are available in both foodservice channels and traditional retail outlets. This acquisition aligns with PANOS Brands' strategy to expand its portfolio with premium, better-for-you specialty foods.

MARKET SEGMENTATION

This research report on the global smokehouse market has been segmented and sub-segmented based on type, product, end-use, and region.

By Type

- Indoor

- Outdoor

By Product

- Electric Grill

- Charcoal & Wood Grill

- Gas Grill

By End-use

- Residential

- Commercial

By Region

- North America

- Europe

- The Asia Pacific

- Latin America

- The Middle East and Africa

Frequently Asked Questions

1. Which factors influence the growth of the smokehouse market?

Key factors include increasing consumer demand for flavored and preserved food, advancements in smoking technology, rising health consciousness, and regional culinary preferences.

2. What are the key trends in the global smokehouse market?

Trends include the rise of plant-based smoked products, increasing use of natural wood smoking techniques, growth of online sales, and demand for organic and preservative-free smoked foods.

3. Who are the primary consumers of smokehouse products?

Consumers include food enthusiasts, gourmet chefs, BBQ lovers, health-conscious individuals, and restaurant owners looking for high-quality smoked ingredients.

4. How is the smokehouse market expected to grow in the coming years?

The market is projected to grow steadily due to increasing consumer preference for artisanal and gourmet smoked foods, along with rising demand for natural food preservation techniques.

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2500

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]