Global SME Insurance Market Size, Share, Trends, & Growth Forecast Report – Segmented By Product Type (Property Insurance, Public Liability Insurance, Workers Compensation Insurance and Goods in Transit Insurance), Distribution Channel (Bancassurance, Digital & Direct Channels, Brokers and Agency) & Region - Industry Forecast From 2024 to 2032

Global SME Insurance Market Size (2024 to 2032)

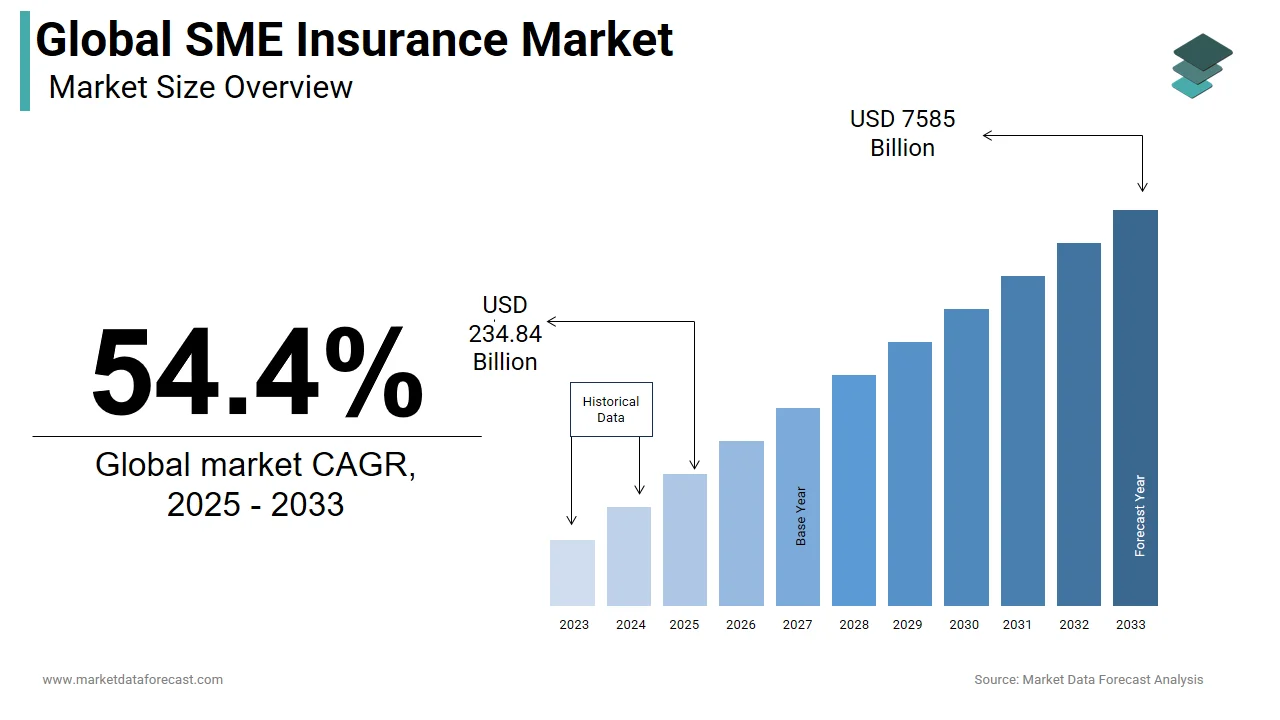

The global SME insurance market size was worth USD 22.8 billion in 2023 and is anticipated to be valued at USD 24.23 billion in 2024 and USD 39.35 billion by 2032, growing at a CAGR of 6.25% from 2024 to 2032.

Current Scenario of the Global SME Insurance Market

Presently, there is a huge opportunity for companies as the majority of SMEs are either not insured or underinsured. As per a study, worldwide, around 80 percent of high-earning small and medium enterprises do not have correct insurance coverage or are underserved and are also without a Standard Industrial Classification code (SIC). Moreover, more than 50 percent of SMEs don’t have a guard for their three threats. There is an urgent need for this as world losses continue for the fourth straight year and have crossed 100 billion dollars in 2023 due to natural disasters.

Also, there was a significant 20 percent increase in the first-quarter premiums in 2023. Hence, this is the first time in 20 years that this sector has witnessed an average price surge of more than 20 percent. In the second half of 2023, the market was able to move forward with the greatest average premium rise of about 18 percent in the commercial sector.

MARKET DRIVERS

The growing government schemes and support, raising awareness of risks related to operating a business, and favourable legal framework are driving forward the SME insurance market’s growth rate.

Many governments around the world have recognized the difficulties faced by them. Like, the Australian Small Business and Family Enterprise Ombudsman (ASBFEO) carried out a study on Small Business Natural Disaster Preparedness and Resilience in 2022 which discovered various issues encountered by SMEs in taking insurance. This acceptance of the problems by government authorities shows the beginning of change and is believed to propel the demand for SME insurance, which is enhancing the market’s growth.

Also, the new and improved offerings can assist companies in expanding the industry. The pandemic highlighted the weak spots or challenges in policy, which led customers to new business models like ghost kitchens and digitally enabled operations to get coverage and compelling companies to add this to provisions. The success of e-commerce and other online technologies is also influencing the growth of digital operations in the SME insurance industry.

MARKET RESTRAINTS

Intense competition and price sensitivity are deviating the SME insurance market from the growth trajectory.

Moreover, the existing policy offers limited coverage and is insufficient to fully meet the changing industry requirements. This increases the intensity of competition in furnishing more customised products. Apart from this, potential flaws for legacy carriers are also decreasing the confidence level among SME clients if insurance companies do not pay attention to the evolving small enterprise consumer demands and choices.

MARKET OPPORTUNITIES

Changing customer demands and preferences are providing major transitions in the SME insurance market. The demand for more diversified and comprehensive solutions is expected to further boost the market share.

This is due to increased consumer awareness propelled by policy gaps uncovered during COVID-19 and priorities for more coverage flexibility. Also, the advent of InsurTechs and other substitute carriers will expand the industry’s growth trajectory. In addition, insurance companies can take advantage of improved focus and greater confidence levels among small-business purchasers to strengthen their market presence and position by creating more tailor-made, adaptable coverages and better consulting services. Additionally, the use of automated operations using AI- and ML-powered solutions can further accelerate the claim process, valuation, and reimbursement.

MARKET CHALLENGES

The SME insurance market growth is hindered by multiple factors. This consists of a strong season of natural disasters, rising inflation, and unstable property valuation dynamics. The subsequent destruction has forced commercial property insurance providers to regularly boost policyholder premiums and apply more limiting policy provisions. Moreover, customers who are executing risky activities with insufficient property management practices or are situated in disaster-prone regions should estimate existing price hikes and coverage restrictions. In addition, serious convection storms are responsible for almost 68 percent of total climate-associated losses in Q1 of 2023 and caused an economic impact of 35 billion dollars. For example, hailstorms, thunderstorms, and tornadoes. This is one of the reasons why insurance companies do not cover this in their policy or do not provide insurance in certain regions.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 to 2032 |

|

Base Year |

2023 |

|

Forecast Period |

2024 to 2032 |

|

CAGR |

6.25% |

|

Segments Covered |

By Product Type, Distribution Channel, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regions Covered |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Market Leaders Profiled |

AIA, AIG, AXA, Tokio Marine, Sompo, Allianz, PingAn, Chubb, Great Eastern, China Life and Others. |

SEGMENTAL ANALYSIS

Global SME Insurance Market Analysis By Product Type

The property insurance segment accounts maximum share of the SME insurance market and is expected to remain high all along the forecast period. The growing governmental support is driving the segment forward. Moreover, industry experts have estimated that there will be a 5 percent to 25 percent rise in the insurance premium for commercial property. This includes coverage for tangible assets like inventories, machinery, and buildings, as these are highly important to the functioning of a SME. Also, it becomes substantial because of the financial burden these small companies suffer in case of natural calamities, robbery, and fire. But, this rise in premiums due to a surge in inflation may be a challenge for some of the SMEs in the industry.

Global SME Insurance Market Analysis By Distribution Channel

The digital and direct channels have a strong presence and a significant upward growth trajectory in the SME insurance market. Today, the vast majority of Western and Asian populations have access to the Internet and digital platforms and services, so consumers favour comfort and availability over their laptops, smart devices, or systems. Also, SMEs progressively prefer easy and quick search options as well as the facility to provide immediate buying and quotes.

REGIONAL ANALYSIS

Asia Pacific is the biggest industry and is believed to have an upward trajectory during the forecast period for the SME insurance market. This is due to the substantial contribution of the SME industry to their respective GDPs. This massive and increasing quantity of potential customers is propelling the regional market. For instance, cybersecurity incidents have sharply risen in India, with an astonishing 13 lakh cases in 2022. Such an industry environment in the country is boosting the demand for suitable cyber insurance offerings. Furthermore, there is still a large number of the SME population not aware of cyber insurance. In a survey conducted among Singapore SMEs, there is a drop in cognizance of sufficient cyber risk measures.

North America also accounts for a sizeable share of the SME insurance market and is anticipated to move forward in the coming years. The rising legal requirements are accelerating the shift towards complete cover. At the same time, increasing awareness of cybersecurity mediums and attack vectors is fuelling the SME insurance market size. In addition, the United States alone witnessed a record of billion-dollar climate and weather incidents, costing more than 57 billion dollars. Moreover, the availability of digital insurance platforms due to technological developments is influencing North America’s revenue share. Additionally, the changing demographic profile, involving the growth of gig employees, is providing new opportunities for customised insurance policies.

Europe holds around one-third portion of the SME insurance market share. The majority of companies in the region consist of small and medium enterprises, as per the European Economic and Social Committee. They are currently struggling due to limited resources and capabilities, which makes them vulnerable to industry and economic disruptions. Besides this, the Netherlands, the United Kingdom, France, and Germany are experiencing a considerable surge in the industry. Also, the regional market is not uniform, as laws, industry dynamics, and economic prosperity vary largely among countries. Likewise, due to the booming SME industry and higher risk cognizance, the Eastern Europe area poses a huge growth potential.

Latin America is dealing with a tough economic outlook, which is decreasing its chances of achieving a high growth rate and maintaining a moderate pace during the projection period for the SME insurance market. The region falls behind other developing markets concerning insurance offerings owing to elements like weak infrastructure, a big pool of informal manpower, low investment levels in public- and private sectors, political instability, and insecurity in a few nations. Further, Mexico is growing at a faster rate than others like Colombia and Brazil, which sit at the lowest spot. On the other, industry experts have predicted that Argentina could register a contraction in Gross Premium Written.

The Middle East and Africa SME insurance market is an upcoming industry with substantial growth potential for domestic and international companies. The region has a sizeable number of registered SME companies, and its population is comparatively younger than that of developed economies. Moreover, Saudi Arabia and the UAE are likely to lead the MEA market’s value.

KEY PLAYERS IN THE GLOBAL SME INSURANCE MARKET

Companies playing a major role in the global SME insurance market include AIA, AIG, AXA, Tokio Marine, Sompo, Allianz, PingAn, Chubb, Great Eastern, China Life and Others.

RECENT HAPPENINGS IN THE GLOBAL SME INSURANCE MARKET

- In May 2024, IAG introduced its expert cyber underwriting agency called “Cylo, backed by CGU.” This will assist in reinforcing cyber insurance coverage for cyberattacks. It is an innovative “secure and insure” solution that includes cyber security under the cyber insurance policy.

- In September 2023, Onsecurity launched its latest cyber insurance policy for SMEs in India. This is formulated with strong safety against online threats and is a complete package for guarding against a wide variety of online risks, including ransomware attacks, data breaches, theft, or any associated legal expenditure.

-

Digital Fineprint, a UK-based Insuretech firm, has transitioned from static data acquired through proposal forms to dynamic data found in thousands of open data sources online. The organization gathers data from various online sources and creates algorithms to pre-underwrite and assess the risk connected with SME applicants' actions. The system streamlines the underwriting process and generates an investigative dashboard with all accessible data. It also enables insurers to assess and analyze their whole portfolio, revealing their outlying SME clients that require specialized goods and services.

- Chubb LTD, a Zurich-based insurance firm, offers a service that goes beyond standard insurance coverage. In the case of a cyber crisis, SMEs will have access to an incident response team that will help them with anything from contacting authorities to addressing public relations or customer service issues. Chubb also connects SMEs to an ecosystem, making them more accessible. Chubb Studio is an "insurance in a box" solution that links to SMEs' systems to quickly provide modular coverages and embedded solutions.

DETAILED SEGMENTATION OF THE GLOBAL SME INSURANCE MARKET INCLUDED IN THIS REPORT

This research report on the global SME insurance market has been segmented and sub-segmented based on product type, distribution channel and region.

By Product Type

- Property Insurance

- Public Liability Insurance

- Workers Compensation Insurance

- Goods in Transit Insurance

By Distribution Channel

- Bancassurance

- Digital & Direct Channels

- Brokers

- Agency

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

Frequently Asked Questions

How does the cost of SME insurance vary across different countries?

The cost of SME insurance varies significantly depending on factors such as the country's regulatory environment, risk exposure, the specific industry, and the size of the business. For example, insurance premiums may be higher in countries with higher risk profiles for natural disasters or where litigation costs are high. Conversely, countries with strong risk management practices and lower risk exposures may see lower premiums.

How can SMEs determine the right level of coverage for their business?

SMEs can determine the right level of coverage by conducting a thorough risk assessment of their operations. This includes identifying potential risks, evaluating the financial impact of these risks, and considering the legal requirements in their country. Consulting with an insurance broker or advisor can help businesses understand their options and choose appropriate coverage levels.

What role do government regulations play in the SME insurance market?

Government regulations play a critical role in shaping the SME insurance market by setting standards for policy coverage, pricing, and claims handling. Regulations ensure that insurers operate fairly and transparently, providing adequate protection for businesses. In some countries, governments may also offer subsidies or incentives to encourage SMEs to purchase insurance.

Can SMEs purchase insurance policies online, and what are the benefits?

Yes, many SMEs can purchase insurance policies online. The benefits of buying insurance online include convenience, as businesses can compare policies and prices from different providers quickly. Online platforms often offer tools for customizing coverage and provide instant quotes, making the process more efficient. Additionally, digital insurance solutions may offer cost savings due to reduced administrative expenses.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2500

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]