Global Smart Transformer Market Size, Share, Trends, & Growth Forecast Report – Segmented By Component (Converters, Switches, Transformers, Hardware For Transformer Monitoring), Type (Power, Distribution, Specialty, and Instrument), Application (Smart Grid, Traction Locomotive, Electric Vehicle Charging), & Region - Industry Forecast From 2024 to 2032

Global Smart Transformer Market Size (2024 to 2032)

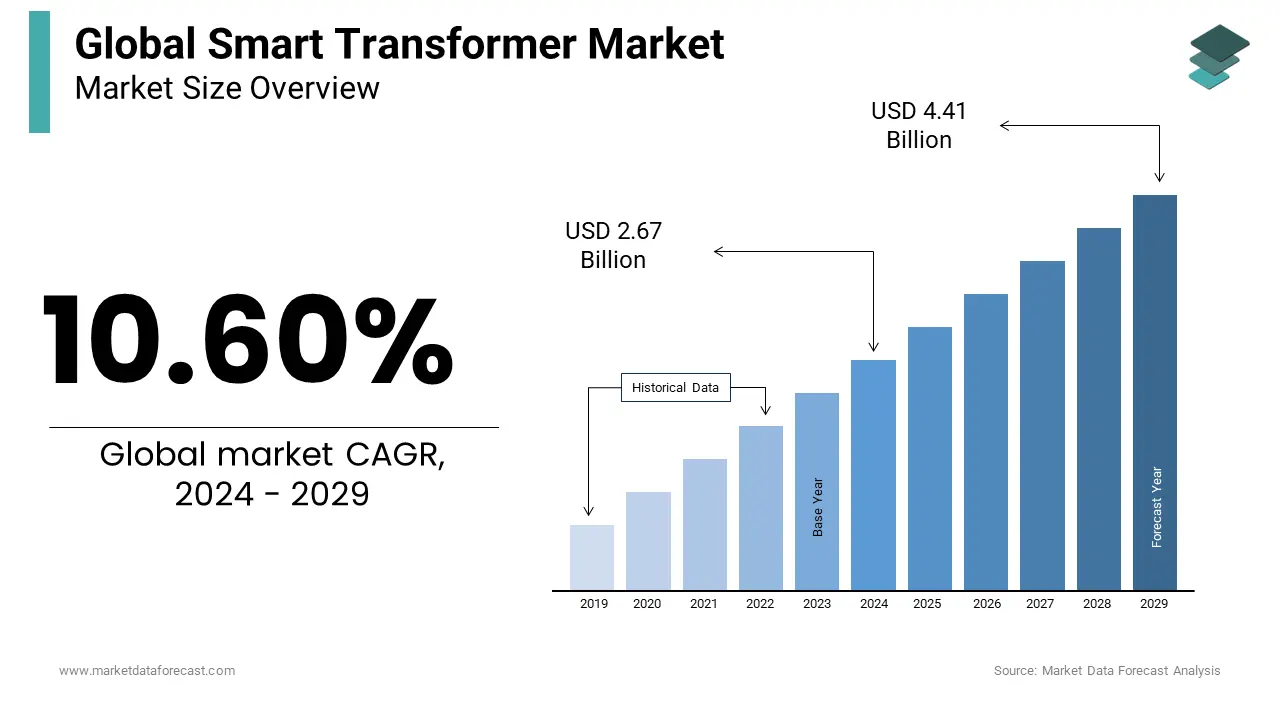

The Global Smart Transformer Market is predicted to grow from USD 2.41 billion in 2023 and is projected to reach a valuation of USD 5.98 billion by 2032 from USD 2.67 billion in 2024 at an annual expansion rate (CAGR) of 10.60% over the foreseen period.

MARKET SCENARIO

However, access to economic capital, cybersecurity, and data privacy are aspects that hinder the expansion of the market. On the other hand, improvements in the electricity sector and the monitoring of microgenerators create opportunities in the industry. Smart transformers integrate the general functionality of a transformer with communication technology, monitoring software, and others. The smart transformer works autonomously to regulate voltage, maintain contact with the smart grid to allow remote access, and facilitate feedback into a power supply system. The remote access provided by smart transformers saves users time and resources. An instinctive intelligent transformer monitoring function improves reliability by keeping a watch on critical components such as the core, winding, tap changer, and others. Smart transformers protect electrical equipment against power variations, reduce energy consumption and greenhouse gas emissions, and improve the efficiency of electrical devices. They are environmentally friendly and allow users to save money by using energy efficiently.

MARKET TRENDS

The smart transformer market is still nascent, but it has enormous expansion potential. Currently, the market is mainly driven by the rise of aging power distribution networks around the world. As part of development initiatives, governments in developing countries are making huge investments to expand the scope of electrification in different towns and cities. Smart transformers are employed in such projects, and therefore their implementation leads to market expansion. The smart transformer works independently to regulate voltage, maintain contact with the smart grid to allow remote access, and provide feedback on a power supply system. The remote access provided by smart transformers saves users time and resources. A built-in intelligent transformer monitoring function improves reliability by monitoring critical components.

MARKET DRIVERS

The worldwide smart transformer market is predicted to experience extraordinary expansion during the outlook period. The tremendous expansion of the electricity sector coupled with escalating population and rising call for energy has boosted the smart transformer market in various areas. The expansion is mainly attributed to the improvement of aging utility infrastructure, escalated investment in the industrial sector, and related government regulations that have improved the smart transformer market in several countries, which is predicted to continue in the future. The call for safer and more efficient power transmission, associated with environmental concerns about electricity production, has led to the development of numerous international and national regulations, such as the eco-design regulations of the European Commission, among others. These regulations are also boosting the global smart transformer market. The market is also positively influenced by the huge increase in the development of utility (transformer) and industrial infrastructure in emerging markets such as China and India, among others.

MARKET RESTRAINTS

Access to affordable capital, cybersecurity, and data privacy are factors that hamper market expansion.

MARKET OPPORTUNITIES

The global smart transformer market is predicted to see a lot of developments during the foreseen period due to the incessant technological advances in the power sector related to the escalating call for power. The market is also likely to have a lot of expansion activity from well-established worldwide companies. Mergers and acquisitions activity is predicted to be observed over the foreseen period with various contracts and agreements between major contractors and governments around the world. The growing popularity of the electric vehicle market and the growing call for allied infrastructure will create lucrative expansion opportunities for this market during the foreseen period.

MARKET CHALLENGES

High initial investments can hamper market expansion during the foreseen period. Factors such as the high initial cost of installing electrical transformers and the lack of data for successful planning can limit business expansion.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 to 2032 |

|

Base Year |

2023 |

|

Forecast Period |

2024 to 2032 |

|

CAGR |

10.60% |

|

Segments Covered |

By Component, Type, Application, and Region. |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis; Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview of Investment Opportunities |

|

Regions Covered |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Market Leaders Profiled |

ABB Ltd. (Switzerland), Siemens AG (Germany), Schneider Electric SE (France), Eaton Corporation plc (Ireland), General Electric Company (U.S.), and Mitsubishi Electric Corporation (Japan). Bharat Heavy Electricals Limited (India), Crompton Greaves Ltd. (India), Howard Industries. (U.S.), SPX Transformer Solutions, Inc. (U.S.), Alstom (France), Ormazabal (Spain), and Others. |

SEGMENTAL ANALYSIS

Global Smart Transformer Market Analysis By Type

Based on the type, distribution transformers are predicted to be the fastest growing from 2024-2029. Distribution transformers are more efficient than power transformers because they are subject to load fluctuations and the risk of failure is greater.

Global Smart Transformer Market Analysis By Application

Regarding applications, the smart grid segment is predicted to be the largest market by 2029. One of the main uses of a smart transformer in smart grids is integrating energy from products distributed in the main network.

REGIONAL ANALYSIS

The Asia-Pacific region is moving towards clean energy on a large scale to efficiently meet its growing energy needs. India, China, and Singapore are among the potential expansion markets in the electricity and utility sectors. In addition, Asia-Pacific offered the highest potential returns for foreign direct investment and attracted 45% of all capital investment worldwide in 2019. Investment is predicted to increase in the modernization of infrastructure and urbanization of populations, especially in developing economies like China and India, which is likely to boost the smart transformer market in Asia-Pacific. The Chinese market was by far the largest in the world in terms of infrastructure development in 2023. Escalated investment in smart grid and smart city technologies, including automation of distribution networks, smart meters, and response systems to call in countries such as Japan, South Korea, and Australia, would create opportunities for the smart transformer market.

KEY PLAYERS IN THE GLOBAL SMART TRANSFORMER MARKET

Companies playing a prominent role in the global smart transformer market include ABB Ltd. (Switzerland), Siemens AG (Germany), Schneider Electric SE (France), Eaton Corporation plc (Ireland), General Electric Company (U.S.), and Mitsubishi Electric Corporation (Japan). Bharat Heavy Electricals Limited (India), Crompton Greaves Ltd. (India), Howard Industries. (U.S.), SPX Transformer Solutions, Inc. (U.S.), Alstom (France), Ormazabal (Spain), and Others.

RECENT HAPPENINGS IN THE GLOBAL SMART TRANSFORMER MARKET

- The Nepal Electricity Authority has made a decision to introduce a smart system to monitor its substations and transformers across the nation online. The Authority's energy skills department is installing the system in substations and large transformers throughout the country.(PowerTransformernews).

DETAILED SEGMENTATION OF THE GLOBAL SMART TRANSFORMER MARKET INCLUDED IN THIS REPORT

This global smart transformer market research report has been segmented and sub-segmented based on component, type, application, and region.

By Component

- Converters

- Switches

- Transformers

- Hardware for Transformer Monitoring

By Type

- Power

- Distribution

- Specialty

- Instrument

By Application

- Smart Grid

- Traction Locomotive

- Electric Vehicle Charging

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East & Africa

Frequently Asked Questions

What are the primary factors driving the growth of the Smart Transformer market?

The market is primarily driven by the growing demand for reliable power systems, increasing integration of renewable energy sources, rising urbanization, and the need for efficient energy management technologies in industrial and residential sectors.

What are the key applications of Smart Transformers in the energy sector?

Smart Transformers are used in applications such as load management, renewable energy integration, voltage regulation, and improving grid reliability and efficiency. They play a critical role in ensuring seamless power distribution in smart grids.

What technological advancements are shaping the Smart Transformer market?

Advancements such as IoT-enabled devices, real-time data monitoring, artificial intelligence for predictive maintenance, and energy-efficient designs are revolutionizing the Smart Transformer market.

What role do Smart Transformers play in reducing energy losses?

Smart Transformers minimize energy losses through real-time monitoring and control of power flow, optimizing load distribution, and reducing power wastage during transmission and distribution processes.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from

$ 2500

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: sales@marketdataforecast.com