Global Smart Speakers Market Size, Share, Trends & Growth Forecast Report Segmented By Intelligent Virtual Assistant (Alexa, Google Assistant, Siri and Cortana), Component (Hardware and Software), Distribution Channel (Online and offline), Application (Residential and Commercial), and Region (North America, Europe, Asia Pacific, Latin America, and Middle East & Africa), Industry Analysis From 2024 to 2033

Global Smart Speakers Market Size

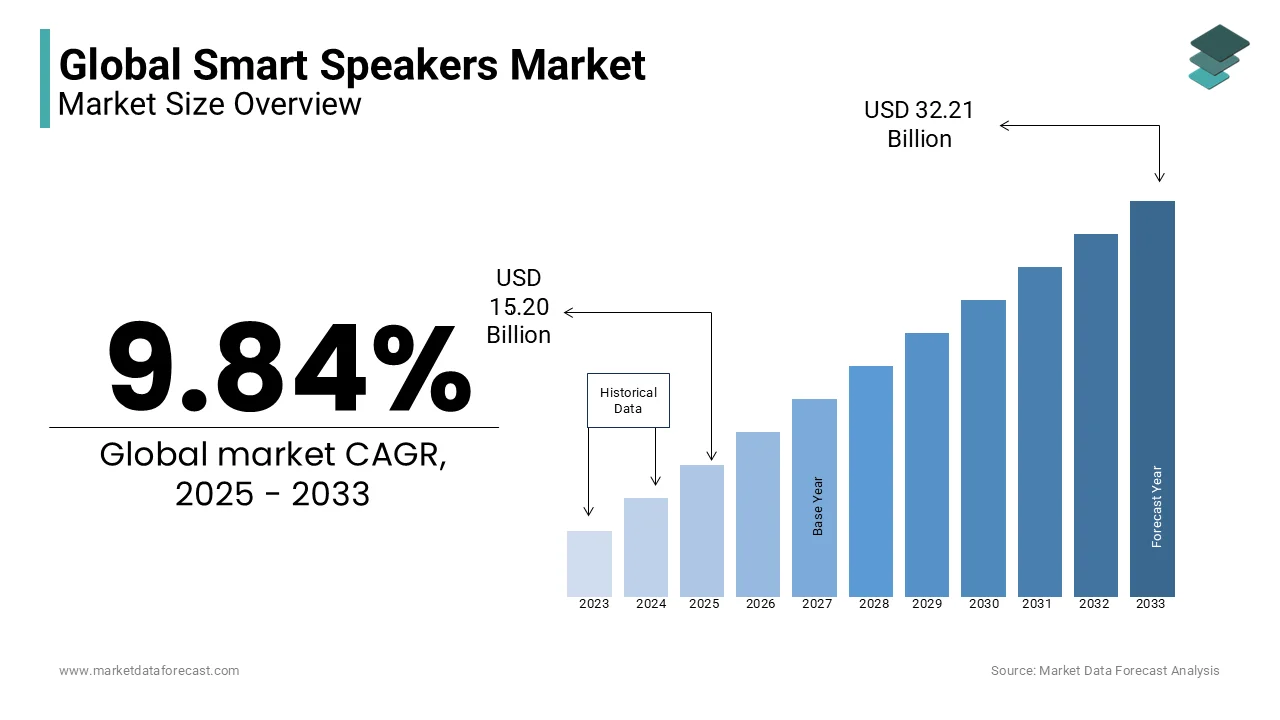

The global smart speakers market was worth USD 13.84 billion in 2024. The global market is projected to grow from USD 15.20 billion in 2025 to USD 32.21 billion by 2033, growing at a CAGR of 9.84% during the forecast period.

Smart speakers are focused on voice-activated devices that combine audio playback capabilities with intelligent virtual assistants like Amazon Alexa, Google Assistant or Apple Siri. These devices allow users to perform a range of tasks such as playing music, controlling smart home devices, setting reminders, answering queries and managing daily schedules and this is all done through voice commands. The market has experienced significant growth with global shipments reaching approximately 150 million units in 2024. Moreover, it is dominated by key players such as Amazon (holding around 25-30% market share with its Echo devices), Google (20 to 25% market share with its Nest speakers) and Apple (10 to 15% with its HomePod line) while other brands like Sonos and Xiaomi compete in specific regions and premium segments.

MARKET DRIVERS

Integration of Advanced Technologies

Smart speakers leverage AI and natural language processing (NLP) to improve functionality. These advancements enable more accurate voice recognition and personalized experiences. According to the U.S. Department of Energy, over 50 million households are adopting IoT technologies that enables smart speakers to act as hubs for connected devices. Additionally, a Stanford University study found that 95% of voice recognition systems now achieve human-like accuracy which enhances their usability in diverse settings like homes, schools, and healthcare.

Rising Adoption of Smart Home Devices

Smart speakers are central to the growing trend of smart homes. The U.S. Census Bureau reports that 35% of U.S. homes now include at least one smart home feature such as intelligent lighting or thermostats. Furthermore, the Environmental Protection Agency (EPA) highlights that 20% energy savings are achieved by using smart devices and is encouraging eco-conscious consumers to integrate smart speakers for better energy management and control.

MARKET RESTRAINTS

Privacy and Security Concerns

Consumers worry about data collection and potential breaches due to the continuous listening nature of smart speakers. A 2022 survey by the Pew Research Center found that 72% of Americans believe most devices collect data that could be misused. The FTC has flagged several incidents where smart speakers recorded unintended conversations such as in 2019 when a study revealed 1,000 Amazon Alexa recordings were shared with contractors for analysis. Moreover, the FBI warned in 2023 about IoT device vulnerabilities and is emphasizing that 55% of U.S. households lack sufficient cybersecurity measures to protect against breaches.

Compatibility and Interoperability Issues

The lack of standardized protocols in the smart home ecosystem limits seamless device integration. NIST reports that fragmented IoT systems hinder interoperability with 35% of smart device owners citing difficulties connecting devices from different brands. In Europe, a 2021 study by the European Commission found that 42% of consumers hesitated to buy smart home products due to compatibility concerns. Efforts like the Matter protocol launched by the Connectivity Standards Alliance aims to address these issues but adoption remains slow and thereby creating hurdles for cohesive smart home experiences.

MARKET OPPORTUNITIES

Expansion into Emerging Markets

Emerging markets like India, Brazil, and Southeast Asia represent significant growth opportunities for smart speakers. The World Bank reports that internet penetration in low- and middle-income countries has increased to 62% in 2022 up from 48% in 2019 which is driven by affordable mobile data and infrastructure improvements. Moreover, disposable incomes in Asia-Pacific have risen steadily with India’s per capita income projected to grow by 5.9% annually, as per the International Monetary Fund (IMF) in 2023). Additionally, smart speaker adoption aligns with the UN’s push for digital inclusion in underserved regions and is making it a priority for companies to introduce cost-effective and culturally relevant products in these markets.

Development of Multilingual and Context-Aware Assistants

According to Ethnologue in 2023, over 7,100 languages spoken globally which is continuously increasing the demand for multilingual and culturally adaptive smart speakers. UNESCO highlights that 40% of the global population lacks access to education in their native language that indicates a gap technology could address. India where 22 official languages and over 1,600 dialects exist voice assistant usage grew by 270% in regional languages between 2020-2022, as per the Internet and Mobile Association of India (IAMAI). companies can tap into markets where linguistic diversity is essential by integrating localized NLP and voice recognition which enhances accessibility and creating tailored user experiences that drive adoption in non-English-speaking regions.

MARKET CHALLENGES

Privacy and Security Concerns

Consumers are increasingly concerned about the potential for unauthorized data collection and breaches associated with smart speakers which continuously listen for voice commands. The U.S. Census Bureau reports that 85% of Americans are concerned about how companies use their personal data. Additionally, the 2021 Consumer Privacy Protection Act (CPPA) mandates stricter privacy standards for smart devices which puts more pressure on manufacturers to address security concerns. This heightened focus on data privacy, along with incidents like the 2019 Alexa privacy breach, where sensitive audio was shared unintentionally and has made users wary of adopting smart speakers.

Compatibility and Interoperability Issues

The fragmented nature of the smart speaker market creates compatibility issues with many devices only working within proprietary ecosystems. The 2020 Smart Home Consumer Adoption Report by the Consumer Technology Association (CTA) reveals that 41% of consumers have faced difficulties connecting smart devices from different brands. The National Institute of Standards and Technology (NIST) further underscores the issue by noting that the lack of universal standards across devices and platforms leads to integration problems and ultimately hindering consumers' ability to create cohesive smart home experiences.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

9.84% |

|

Segments Covered |

By OS Type, Technology, Application, Power Source, and Region |

|

Various Analyses Covered |

Global, Regional and country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview of Investment Opportunities |

|

Regions Covered |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Market Leaders Profiled |

The major players in the global smart speakers market include Amazon, Google, Apple, Sonos, Samsung, Bose, Alibaba (Tmall Genie), Xiaomi, Facebook (Meta), and Harman Kardon. |

SEGMENTAL ANALYSIS

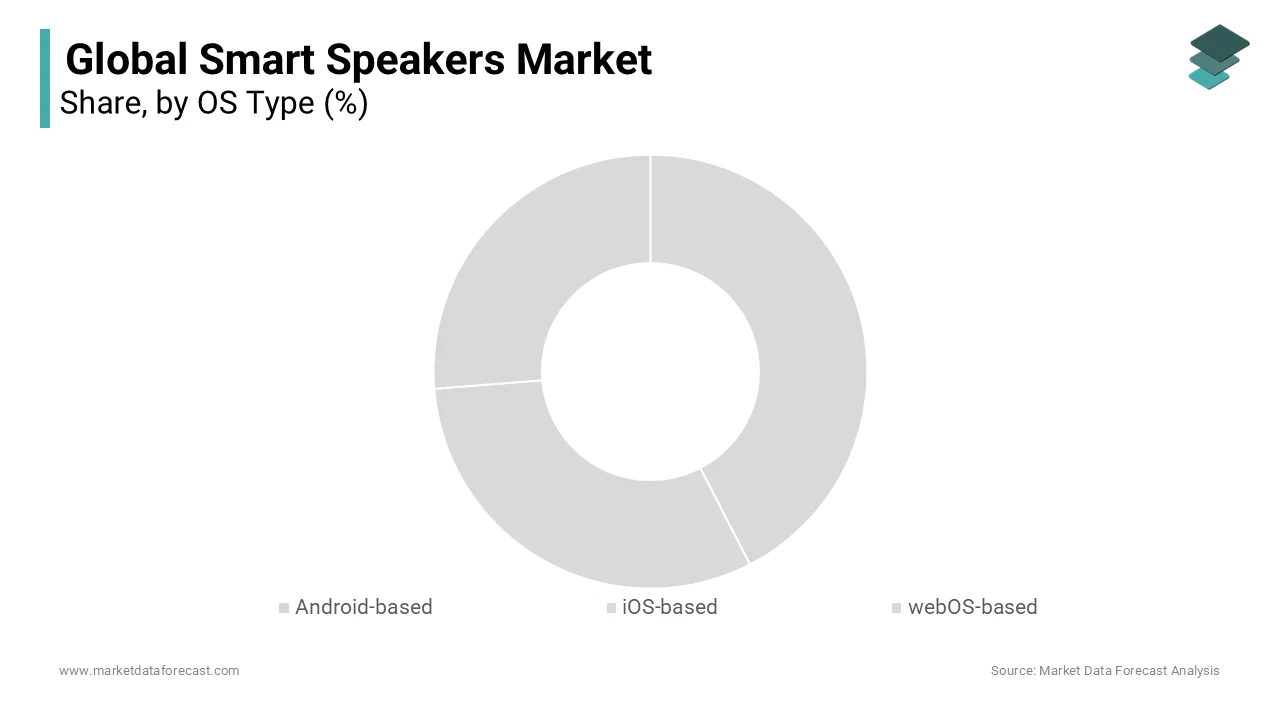

By OS Type Insights

The android-based segment dominated the market and accounted for 31.4% of the global market share in 2024. The growth of the android-based devices is majorly driven by the by the devices utilizing Google Assistant. Amazon's Alexa and Google Assistant as of 2022 each accounted for approximately 31.7% and 31.4% of the market share, respectively. Devices like Google Home seamlessly integrate with Google's suite of services and is enhancing user experience. Google's extensive global presence facilitates widespread adoption across diverse markets. Android-based smart speakers are often priced competitively and is making them accessible to a broader consumer base.

The iOS-based segment is rising at the fastest pace and is predicted to witness a CAGR of 31.2% during the forecast period. Apple’s ecosystem continues to drive demand for HomePod. Consumers with existing Apple devices (iPhone, iPad, Mac) prefer the seamless integration with Siri and services like Apple Music and Apple TV. In fact, Siri now supports over 40 languages and is boosting its appeal in international markets. This interconnectedness has led to a rise in HomePod sales because many Apple users opt for smart speakers that integrate with their devices.

By Technology Insighst

The Bluetooth/Wi-Fi segment is the most prominent segment and accounted for 75.3% of the global market share in 2024. These technologies are highly compatible with a broad range of devices such as smartphones, tablets, laptops and other smart home devices. This offers seamless connectivity across ecosystems like Amazon Alexa, Google Assistant and others. In fact, Amazon Echo and Google Nest are two of the leading smart speaker brands which have contributed to the market's dominant Bluetooth/Wi-Fi technology. These devices are favored due to their universal compatibility with various connected devices and are driving their adoption across diverse households. Alexa is integrated in over 100 million devices as of 2023 and this compatibility plays a key role in shaping market growth, as reported by Amazon Press Release.

The near field communication (NFC) segment is quickly emerging and is projected to witness a CAGR of 28.4% over the forecast period. NFC technology allows for quick and seamless pairing between devices and is making it easier for users to connect their smartphones, tablets, or other NFC-enabled devices to smart speakers with just a simple tap. Users can enjoy instant connection, voice control, and music streaming. This convenience has driven its rapid adoption and especially among tech-savvy users who prioritize ease of use. As of 2023, Apple HomePod and Sony’s smart speakers have incorporated NFC for faster setup and smoother integration, as per the Apple Press Release.

By Application Insights

The residential segment ruled the smart speakers market by application in 2024 and accounted for 85.8% of the global market share. The widespread adoption of smart speakers in homes and particularly for tasks like voice-controlled music streaming, home automation, and virtual assistance are propelling the domination of the residential segment in the global market. In 2023, over 70% of U.S. households reported owning at least one smart speaker, primarily for residential use, according to Statista.

The commercial segment is rapidly growing and is predicted to witness a CAGR of 27.8% over the forecast period. In office settings, smart speakers help improve productivity by scheduling meetings, controlling office equipment, and assisting with administrative tasks. According to Gartner, the integration of voice assistants into corporate environments is expected to rise by 45% by 2025. The commercial segment is also expanding in hospitality and healthcare where voice-activated devices provide enhanced services for both customers and employees.

By Power Source Insights

The wireless segment led the market and captured 80.2% of the global market share in 2024. Wireless smart speakers offer portability and flexibility in use and allows consumers to place them anywhere in the home or office without being restricted by power cords. Wi-Fi and Bluetooth are the most common technologies and is providing users with seamless connectivity that enhances the device's usability. According to a survey by Statista, over 60% of consumers find wireless features essential for their device usage.

The wired segment is projected to grow at a CAGR of 23.5% over the forecast period. Wired-powered smart speakers offer consistent and uninterrupted power and is making them especially suitable for business and commercial environments where reliability is critical. The lack of battery life concerns makes wired-powered speakers ideal for spaces that need continuous operation. According to the National Institute of Standards and Technology (NIST), technologies requiring constant power delivery like smart speakers experience 20-30% lower failure rates when powered by a wired connection and consequently ensures operational continuity.

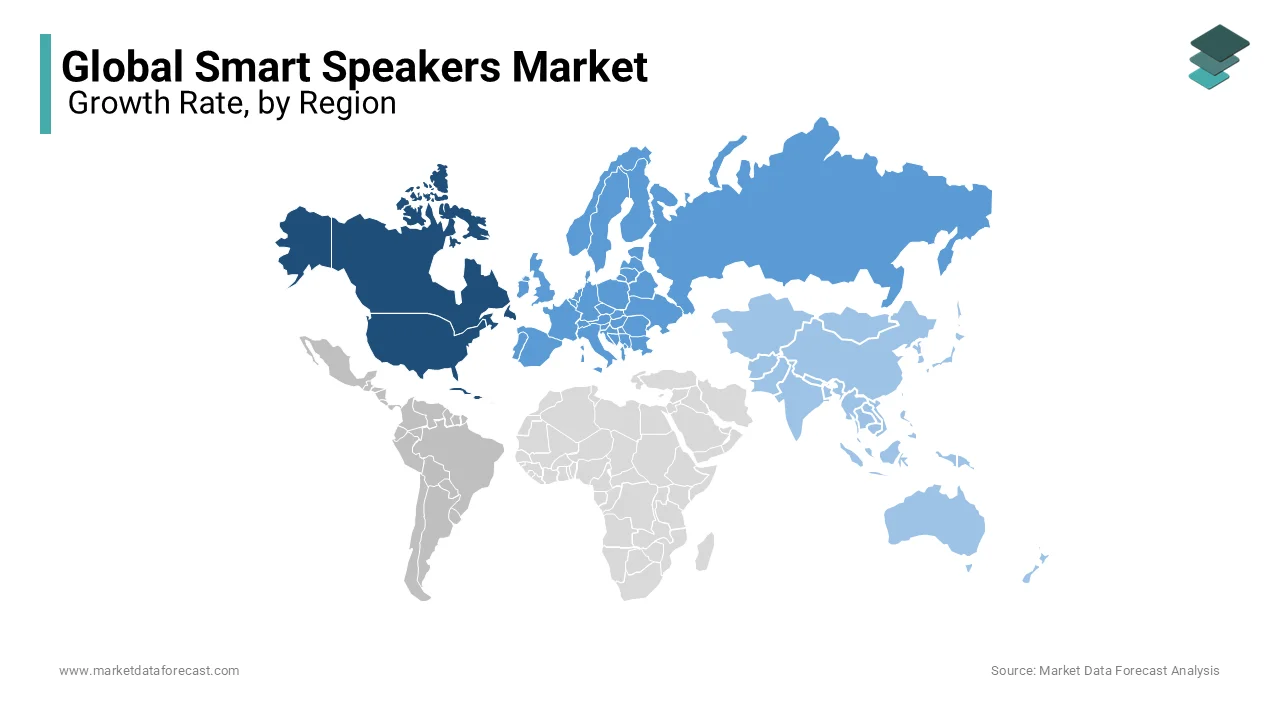

REGIONAL ANALYSIS

North America held the largest share of 40.2% in global smart speaker market in 2024. The domination of North America in the global market is majorly attributed to the high consumer adoption, advanced technologies, and integration with other smart home devices. Particularly the United States is a leader in the global smart speaker market. The U.S. is home to the largest market share with Amazon Alexa and Google Home dominating. The U.S. Census Bureau reports that 70% of U.S. households have at least one smart home device and is highlighting the region's dominance.

Europe is experiencing steady growth in the global smart speaker market and is forecasted to progress at a CAGR of 15.5% over the forecast period. The European smart speaker market is led by countries like the UK and Germany. In 2022, Europe represented for approximately 25% of global sales. The UK holds a significant share with Germany following closely. According to Eurostat, 52% of European households had some form of smart home technology in 2023 which creates a favorable environment for smart speaker growth.

Asia-Pacific is the fastest-growing region for the smart speaker globally and is projected to register a CAGR of 25.88% over the forecast period. The region is particularly driven by China and India. Moreover, India is emerging as a key player with adoption rates expected to rise as disposable income and urbanization increase. The region benefits from increasing middle-class income and technological advancements and makes it the largest market for growth opportunities in smart home tech. According to the National Bureau of Statistics of China, the number of internet users in the country reached 1.05 billion in 2023 which significantly contributes to the growth of connected home devices.

Latin America market is anticipated to rise at a healthy CAGR over the forecast period and is led by Brazil and Mexico. The region is in the early stages of smart speaker adoption. In 2022, Brazil accounted for 55% of smart speaker sales in the region. It is propelled by increasing internet penetration and demand for affordable smart home devices. The International Telecommunication Union (ITU) reports that 70% of Latin American households now have internet access which is boosting the potential for smart speaker sales.

The market in the Middle East and Africa region is predicted to have steady growth over the forecast period. It is seeing gradual but steady growth in smart speaker adoption, with the UAE and South Africa at the forefront. In 2022, the UAE represented 30% of the region’s market share. Urbanization whose increasing disposable income and consumer interest in tech-driven convenience are expected to propel market growth. According to the African Development Bank, 60% of the population in the UAE now has access to internet-connected devices and further driving the smart speaker market.

KEY MARKET PLAYERS

The major players in the global smart speakers market include Amazon, Google, Apple, Sonos, Samsung, Bose, Alibaba (Tmall Genie), Xiaomi, Facebook (Meta), and Harman Kardon.

COMPETITIVE LANDSCAPE

The competition in the smart speaker market is fierce, with several key players dominating the landscape. The market is primarily led by global tech giants like Amazon, Google, and Apple, who offer advanced voice-activated assistants including Alexa, Google Assistant, and Siri, respectively. These companies have established a strong presence in both developed and emerging markets, thanks to their robust product ecosystems and continuous technological advancements.

Amazon is the leader with its Echo devices leading global sales, benefiting from its established retail and smart home ecosystems. Google follows closely with its Google Nest range, emphasizing seamless integration with its search engine and Android operating system. Apple’s HomePod focuses on premium sound quality and deep integration with Apple’s ecosystem, although it has a smaller market share compared to Amazon and Google.

In addition to these leaders, newer entrants like Sonos and Bose are carving out niches with premium audio systems that combine high-quality sound with smart assistant features.

The market is also witnessing regional competition, especially in the Asia-Pacific region, where companies like Xiaomi and Alibaba are offering cost-effective alternatives tailored to local needs.

To stay competitive, companies are constantly innovating, introducing new features like improved sound quality, AI capabilities, multilingual support, and smart home integrations. As the smart home market expands, the competition will intensify, with price sensitivity, product integration, and user experience becoming key differentiators.

RECENT HAPPENINGS IN THE MARKET

- In April 2024, the UK government enacted new regulations to enhance the security and longevity of smart speakers. The law mandates manufacturers to provide clearer information on product lifespan and support duration, aiming to protect consumers from premature obsolescence. Failure to comply with these regulations can result in fines, ensuring manufacturers prioritize long-term support for their devices.

- In August 2024, Sonos launched the Era 100, a smart speaker praised for its excellent stereo sound and bass. While it lacks Google Assistant support, it offers compatibility with Amazon Alexa and Apple Siri, providing users with versatile voice assistant options. The Era 100 is part of Sonos' strategy to expand its presence in the smart speaker market by offering high-quality audio experiences.

MARKET SEGMENTATION

This research report on the global smart speakers market is segmented and sub-segmented into the following categories.

By OS Type

- Android-based

- iOS-based

- webOS-based

By Technology

- Bluetooth/Wi-Fi

- Near Field Communication (NFC)

- Others (Zigbee, Z-wave, etc.)

By Application

- Residential

- Commercial

By Power Source

- Wireless

- Wired

By Region

- North America

- Asia Pacific

- Latin America

- Europe

- Middle East & Africa

Frequently Asked Questions

What factors are driving the growth of the smart speaker market?

Key factors driving market growth include increasing consumer demand for smart home devices, advancements in artificial intelligence and voice recognition technologies, and the rising popularity of IoT (Internet of Things) ecosystems.

What are the most popular features consumers look for in smart speakers?

Consumers often look for high-quality audio, reliable voice recognition, compatibility with other smart home devices, and access to a wide range of applications and services such as streaming music, setting reminders, and controlling smart home appliances.

How are smart speakers enhancing user experiences through AI and voice assistants?

Smart speakers enhance user experiences by leveraging AI and voice assistants like Amazon Alexa, Google Assistant, and Apple Siri to provide personalized responses, anticipate user needs, and integrate seamlessly with other smart devices and services.

What future trends are expected in the smart speaker market?

Future trends include the integration of more advanced AI capabilities, improved interoperability between different brands and devices, expanded language support, and the development of specialized smart speakers tailored for specific use cases like healthcare and education.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2500

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]