Global Smart Port Market Research Report - Segmentation by Technology (Internet of things, Process automation, Artificial intelligence, and Blockchain), By Throughput capacity (Extensively busy, moderately busy and scarcely busy), By Port type (Seaport and Inland port), By Element (Smart port infrastructure, Smart safety & security, Traffic management system, Port community system and Terminal automation & cargo handling) and Region - Industry Forecast of 2024 to 2032

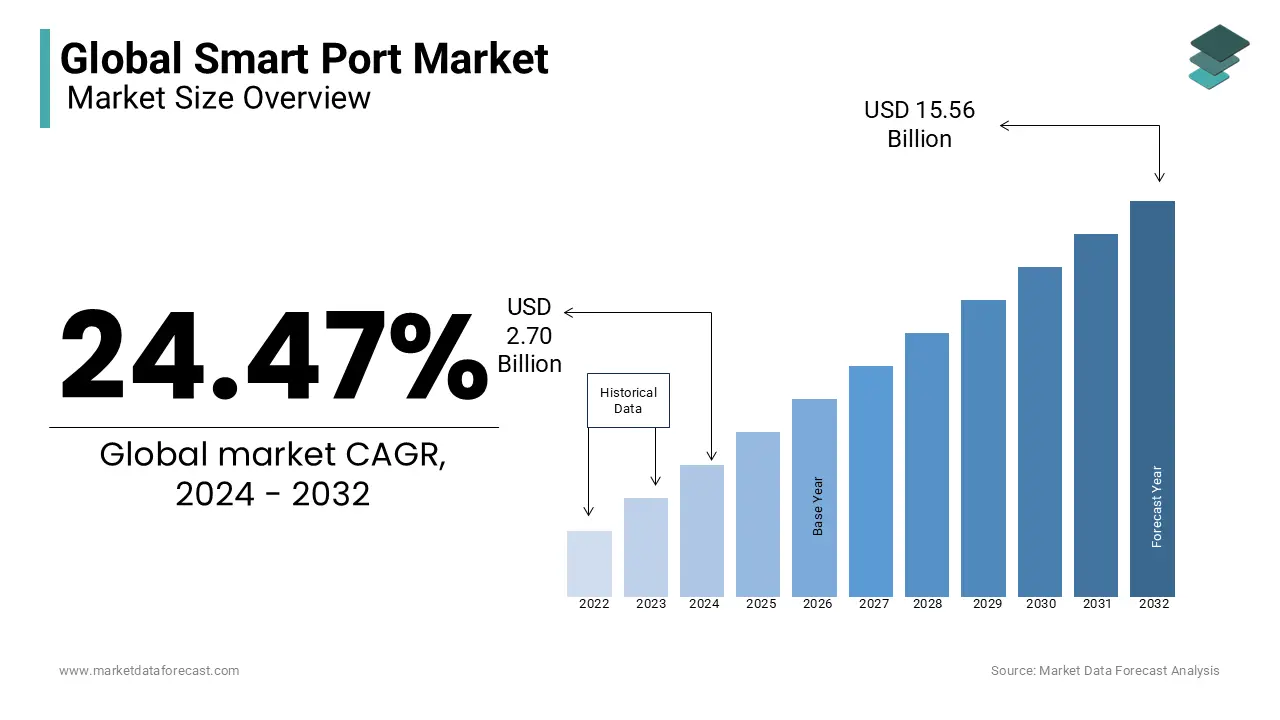

Global Smart Port Market Size (2024-2032):

The size of the global smart port market was worth US$ 2.17 Billion in 2023. The global market is anticipated to grow at a CAGR of 24.47% from 2024 to 2032 and be worth US$ 15.56 billion by 2032 from US$ 2.70 billion in 2024.

MARKET SCENARIO

It comprises digitized infrastructure that provides a variety of advantages, including reduced human-related disturbances, better decision-making, predictable performance, and cheaper operational costs. Because of the flow provided by the automation process, smart ports run more smoothly than traditional ports. Because of the increased national and international trade via maritime transportation, various harbor authorities worldwide rapidly implement smart technologies. Because these technologies help improve the port's overall efficiency, their increasing acceptance has a favourable impact on global smart port market growth.

MARKET DRIVERS AND RESTRAINTS

The increased demand for Industry 4.0 to enhance port efficiency is the primary factor that drives the global smart port market during the forecast period.

The desire to reduce operational costs, collect real-time data, and make data-driven choices at port facilities drives the adoption of smart technologies among harbor authorities. Artificial intelligence (AI), the Internet of Things (IoT), blockchain, and process automation are among the technologies utilized to transform a typical port into a smart port. These technologies can be utilized individually or in combination to change traditional infrastructure into digital infrastructure. Reduced human-related disturbances, limited operating expenses, smarter decision-making, and more predictable performance are advantages of the smart port over traditional ports.

Aside from these advantages, smart technologies are being adopted by all sorts of ports as a result of increased technological innovation and the accompanying simplicity of technology integration. The use of maritime transportation for national and international trade has expanded dramatically in recent years. The increased desire for sea transportation is due to advantages such as cheaper transportation costs. The pressure on shipyards and decks has increased as global commerce operations have increased. The harbor authorities have been obliged to accept smart technologies and solutions for automating numerous harbor operations due to a growth in the number of activities, which propels the global smart port market forward.

On the other hand, with the rise of digitalization, there is an increasing concern about data security. In a digital context, there are numerous hurdles to guaranteeing end-to-end security.

Every year, millions of cyber-attacks and data breaches occur, raising concerns about digital security. Furthermore, because the concept of connecting physical devices to the internet is still relatively new, security hasn't always been a high priority during the product development process. This is considered a serious concern, particularly in ports, where the materials handled are frequently valuable cargo. This further hampers the global smart port market in the next six years.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 to 2032 |

|

Base Year |

2023 |

|

Forecast Period |

2024 to 2032 |

|

CAGR |

24.47% |

|

Segments Covered |

By Technology, Throughput capacity, Port Type, Element, and Region. |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview of Investment Opportunities |

|

Regions Covered |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Market Leaders Profiled |

Royal Haskoningdhv, ABB, Trelleborg Ab, Accenture, Port Of Rotterdam, Ramboll Group A/S, Abu Dhabi Ports, IBM, Navis, Awake.Ai, and Others. |

SEGMENTAL ANALYSIS

Global Smart Port Market Analysis By Technology

During the projection period, the Internet of Things is predicted to be the fastest-growing market for smart ports. IoT has been extensively used by ports that are undergoing digitalization. Smart port infrastructure, intelligent traffic flows, and intelligent commerce flows are the three primary characteristics that make up the IoT platform. It has aided ports in traffic control, pollution control, and road safety. The Internet of Things (IoT) has revolutionized the way seaports operate. The Internet of Things connects the physical aspects of any process to the Internet, allowing for real-time data sharing and remote access.

Global Smart Port Market Analysis By Throughput Capacity

From 2024 - 2032, the extensively busy category is expected to lead the global smart port market in the next six years. The ports have been divided into categories based on the number of Twenty-Foot Equivalent Unit (TEU) containers handled. Ports with a capacity of more than 18 million TEU per year, moderately busy ports with a capacity of 5 to 8 million TEU per year, and barely busy ports with a capacity of less than 5 million TEU per year are all extremely busy.

Global Smart Port Market Analysis By Port Type

The fastest-growing segment is expected to be the seaport in the global smart port market based on the port type. A seaport is a safe region on the water where ships dock to load and unload cargo. Many seaports dot the coastline and are active participants in ongoing freight operations. Seaports are outfitted with smart digital technologies such as smart sensors and IoT, making cargo handling simple for port operators and ensuring operational efficiency.

An inland port is where merchandise or passengers are loaded and unloaded. Because of multimodal rail or road transportation, inland ports ensure real-estate growth.

Global Smart Port Market Analysis By Element

Based on elements, smart port infrastructure tends to dominate the global smart port market in the upcoming years. Because it is the most demanding aspect of transforming any port into a smart port, the smart port infrastructure segment of the smart ports market has the biggest market share among all the other segments. Furthermore, with the expansion of global trade, vessels, and cargo volumes have grown, posing a challenge for seaport operations management. As a result, ports are increasingly adopting smart solutions that will help them optimize operations, increase productivity, and lower logistical costs without requiring significant new infrastructure or equipment investment. On the other hand, as a result, increased trade via ports around the world has necessitated investments in port infrastructure upgrading.

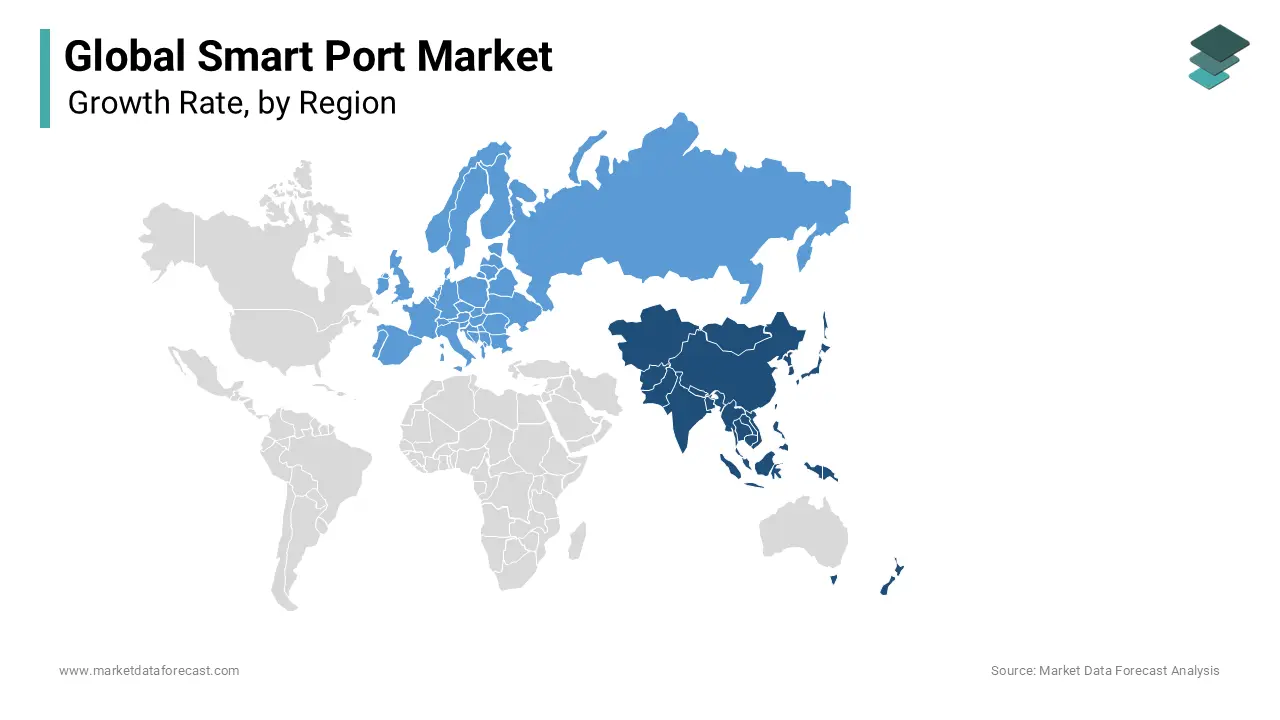

REGIONAL ANALYSIS

The Asia Pacific holds the largest global smart port market share, accounting for more than 37% of worldwide sales. Important ports with significant throughput capacity characterize the region, accounting for the largest proportion of global trade. In addition, countries such as China, Japan, South Korea, and Singapore are acknowledged as essential trading hubs with large commerce volumes. The causes above, combined with the availability of technologies at a reduced cost, particularly from nations such as Taiwan and China, have ensured that the region has experienced considerable growth.

During the forecast period, Europe is expected to have the greatest CAGR in the global smart port market. This is because Europe's ports are smaller than those in the United States, yet they handle a lot of freight. Furthermore, European ports can no longer compete only based on port size, as smaller ports can manage the same amount of traffic as larger ports. As a result, even modestly and sparsely populated ports are rapidly adopting smart operations.

KEY PLAYERS IN THE GLOBAL SMART PORT MARKET

Companies playing a prominent role in the global smart port market include Royal Haskoningdhv, ABB, Trelleborg Ab, Accenture, Port Of Rotterdam, Ramboll Group A/S, Abu Dhabi Ports, IBM, Navis, Awake.Ai, and Others.

DETAILED SEGMENTATION OF THE GLOBAL SMART PORT MARKET INCLUDED IN THIS REPORT

This research report on the global smart port market has been segmented and sub-segmented based on technology, throughput capacity, port type, element, and region.

By Technology

- Internet of things

- Process automation

- Artificial intelligence

- Blockchain

By Throughput Capacity

- Extensively busy

- Moderately busy

- Scarcely busy

By Port Type

- Seaport

- Inland port

By Element

- Smart port infrastructure

- Smart safety & security

- Traffic management system

- Port community system

- Terminal automation & cargo handling

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East & Africa

Frequently Asked Questions

1. What is the Smart Port Market growth rate during the projection period?

The Global Smart Port Market is expected to grow with a CAGR of 24.47% between 2024-2032.

2. What can be the total Smart Port Market value?

The Global Smart Port Market size is expected to reach a revised size of US$ 15.56 billion by 2032.

3. Name any three Smart Port Market key players?

ABB, Trelleborg Ab, and Accenture are the three Smart Port Market key players.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2500

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]