Global Smart Pills Technologies Market Size, Share, Trends, COVID-19 Impact & Growth Analysis Report – Segmented By Application & Region - Industry Forecasts (2024 to 2032)

Global Smart Pills Technologies Market Size (2024 to 2032)

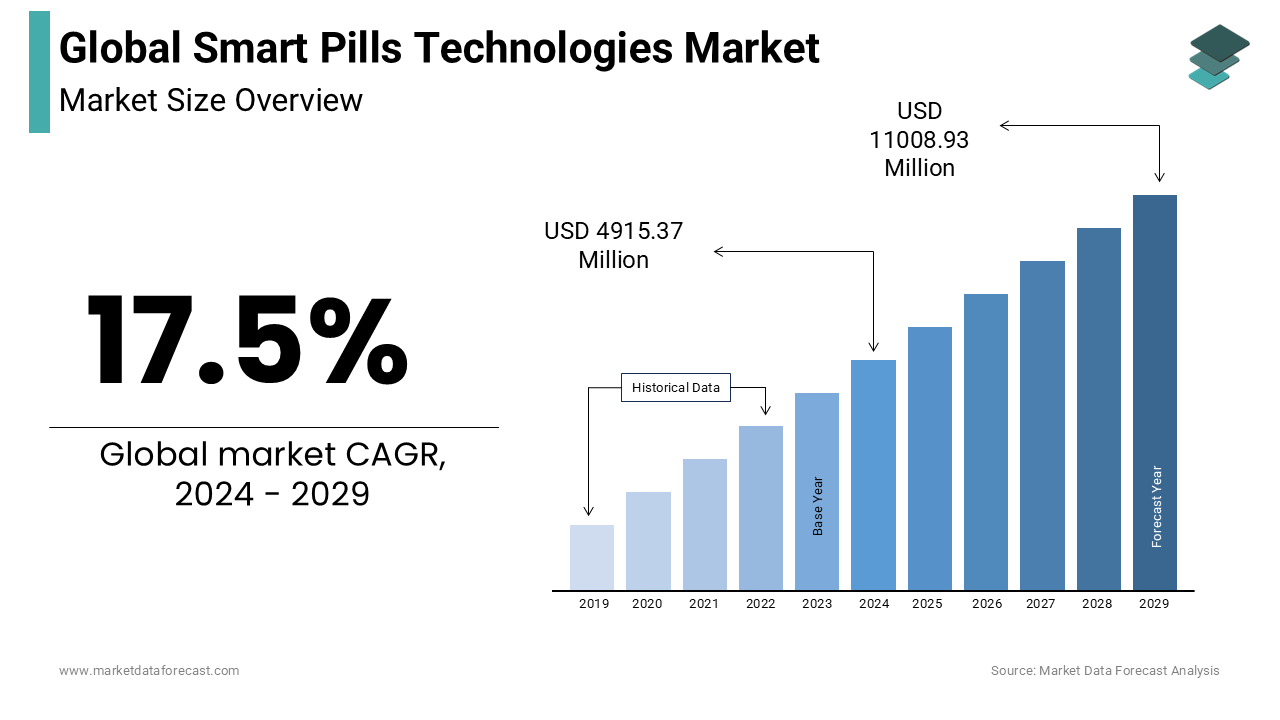

In 2023,the global smart pills technologies market size was valued at USD 4183.29 million and it is expected to reach USD 17,859.07 million by 2032 from USD 4915.37 million in 2024, growing at a CAGR of 17.5 % during the forecast period.

Smart pill technology is used to diagnose gastrointestinal (G.I.) disorders such as constipation and gastroparesis. Smart pill technology gives the practitioner various parameters such as pH, temperature, and gastrointestinal tract pressure. A smart pill is a nascent technology with immense medical diagnostics potential. Smart pill technology uses cameras, biosensors, hydrogen ion concentration, or chemical sensors. These technologies in this smart pill help to take a clear picture of the inner side of the body to detect the correct damaged part for further treatment. Smart pill technology is emerging as the best method to analyze disorders and monitor patients. Adopting technologically advanced systems and growing awareness about gastrointestinal illnesses will likely provide lucrative growth opportunities during the forecast period.

MARKET DRIVERS

The global smart pills technologies market is primarily driven by the rising prevalence of geriatric gastrointestinal diseases, changing lifestyles, including the shift in diet patterns and the aging population, as older people are at a higher risk of acquiring various gastrointestinal diseases such as ulcerative colitis and IBD. Growing incidence of capsule endoscopy applications in treating intestinal health issues like small bowel tumors, Crohn's disease, and celiac disease obscure G.I. bleed.

The growing number of chronic diseases in many patients drives the smart pills technologies market forward.

Chronic diseases are a significant cause of death in the world. According to the National Health Council, nearly 135 million people suffer from at least one chronic disease, such as heart disease, stroke, or diabetes. Increasing advancement in the smart pill is expected to have market growth in the future. It used miniaturization of electronic components with wide usage and applications in the coming years. These smart pills are used widely in developed and developing countries, driving the market forward. Increasing funding activities and manufacturing spending drive the market forward. Startups are increasing the production and manufacturing of these smart pills such that hospitals and clinic are increasing their growth. Increasing awareness also drives the market forward. Most governments approve licenses for this drug to increase the usage of this drug in finding various health problems. Rise in adoptions of capsule endoscopy by hepatologists for assessing and detecting the severity of esophageal varices. In addition, the growing popularity of smart pills among patients is less Invasive due to an inactive lifestyle. Growth opportunities for the smart pill technology market are likely to increase owing to increasing investments in R & D of smart pill technology and collaborations between research organizations and companies.

MARKET RESTRAINTS

High costs for installing and maintaining the devices in the laboratories, less availability of technology, and lack of patient confidence are restraining the market's growth rate.Also, the possibility of health risks associated with a smart pill inserted into the body might affect market growth. Moreover, privacy issues and ethical concern factors when the data is sent back to the doctor and patient through smart pills may alter the data when it is sent from the patient's body to the patient, and smartphones are primarily affecting the market growth over the forecast period.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 to 2032 |

|

Base Year |

2023 |

|

Forecast Period |

2024 to 2032 |

|

Segments Analysed |

By Application and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, Drivers, Restraints, Opportunities, Challenges; PESTLE Analysis; Porter's Five Forces Analysis, Competitive Landscape, Analyst Overview of Investment Opportunities |

|

Regions Analysed |

North America, Europe, Asia Pacific, Latin America, Middle East, and Africa |

|

Companies Analysed |

CapsoVision, Inc., Given Imaging, Inc., Medimetrics S.A. de C.V., Olympus Corporation, Bio-Images Research Limited, Novartis, Given Imaging Ltd, Philips Healthcare, Smartpill, Inc., Medtronic, Inc., Pentax Medical Company, Siemens Healthcare, Stryker Corporation, GE Healthcare, Boston Scientific Corporation, IntroMedic Inc., Chongqing Jinshan Science & Technology Group Co. Ltd., Proteus Digital Health Inc |

SEGMENTAL ANALYSIS

Global Smart Pills Technologies Market Analysis By Application

Based on the application, the capsule endoscopy segment is expected to be one of the largest markets due to the advantages attached, such as disease diagnosis in the small intestine. This capsule endoscopy is used with a wireless camera with the smart pill, which has to be swallowed to take a picture of the internal parts which has the problem. This camera takes thousands of our digestive tracts. This endoscopy is used to examine the esophagus, diagnose cancer, diagnose celiac disease, and determine the reason for gastrointestinal bleeding. This technology is used mainly in Canada and the U.S. for government approval for patients suffering from a small intestine problems.The drug delivery market is also expected to experience growth due to the benefit of improving medication efficiencies, improving patient compliance & convenience, and fast-paced technology.

REGIONAL ANALYSIS

Geographically, North America is the biggest market in terms of market share globally, followed by Europe. The market in North America is highly driven due to favorable reimbursement scenarios, FDA approvals for smart pills, and rising investments by the government and other agencies. The smart pills technologies market has grown in various regions across the globe. North America dominated the smart pills technologies market over the forecast period. North America held the largest market share, with a favorable reimbursement scenario. Various factors are boosting the market growth in this Region. The FDA and other approvals for smart pill technology-based products, initiatives, and investments by the government and various private organizations are causing the growth. North America is expected to have a significant share of the smart pills technologies market by 2025. According to the U.S. Centres for Disease Control and Prevention, nearly 60 and 70 million Americans are diagnosed with gastrointestinal diseases yearly. As a result, millions of colonoscopy procedures are performed to diagnose colorectal cancers. Due to this procedure, many people suffer from uncomfortable burns that lead to infection for patients. For this, U.S. people are focusing on smart pills, which reduce this complicated procedure. This smart pill process allows wireless communication and real-time information transmission to doctors.

The Asia Pacific held the largest market share in the smart pills technologies market after North America during the forecast period. Increasing disposable income of the patient population, the participation of significant market players, and increasing awareness among the people about gastrointestinal diseases and their diagnostic and treatment methods influence the market growth in this Region. The smart pills technologies market in the Asia-Pacific region is projected to grow at the highest CAGR, significantly due to increasing reimbursements, training in endoscope handling, and substantial corporate investments in R&D. China and India have been using these smart pills for ten years back. In China, most of these pills are used for sleep disorders. Nearly 35 percent of people in China suffer from this sleep disorder due to changes in their daily activities and food intake. These sleep disorders lead to some critical disorders such as depression, insomnia, etc. For these people, this smart pill technology is used to know the reason for all these or any medication they are taking daily is the reason for this disorder. By considering all these factors, the market drives in this Region.

During the forecast period, Europe held the largest market share in the smart pill market, after North America and the Asia Pacific. The increasing geriatric population, changing lifestyle-related syndromes and disorders, and government investments boost the market growth. An increasing number of patients suffering from diseases such as heart failure, stroke, asthma, and cancer and an increasing number of older adults more aware of health results in an improvement in drug discovery, further promoting the market. Nearly twenty percent of people in Germany are collapsing due to forgetting to take their medication at the right time. For this, the government has introduced smart pill technology to remind the drug usage and indicate the overdosage of the drug. In 2022, BIOCORP, a French company, has an agreement with Merck KGaA, Darmstadt, to design and develop a specific version of the Mallya device. It is used as a pen injector that collects the dose and time of each injection and transfers information in real-time to companion software. It is done through enabled Bluetooth and is mainly used in European countries.

Smart pills have also been used in Latin America. Due to increasing self-medication among the many Brazilian people, this technology drives in this Region.

Middle East Africa holds a significant share of the smart pills technologies market and is expected to grow better over the forecast period. Increasing population and awareness among the people about gastrointestinal diseases and their diagnostics and treatments boost the market growth in this Region. Saudi Arabia has increased the production of smart pills with various technologies. Saudi Arabia's healthcare system uses smartphone technology to the smart pills to reduce the number of drug-overdose poisoning cases. Researchers at the King Abdullah University of Science and Technology in Saudi Arabia (KAUST) have developed a smart pill bottle that sends wireless alerts to patients' phones when it detects tampering, unsafe storage conditions, or overdose. This government also provides this sensor technology at lower costs, driving the Region's market growth. Many medical errors occur in the elder's medication due to taking many daily pills. Egypt uses the pill box method, which remains the medication or vitamin supplements for the patient at the correct time with the prescribed dosage by doctors. Researchers are focused on manufacturing these smart pills technologies with advanced technology for easy use to boost the market.

KEY PLAYERS IN THE GLOBAL SMART PILLS TECHNOLOGIES MARKET

Some of the notable companies operating in the global small pill technologies market profiled in this report are CapsoVision, Inc., Given Imaging, Inc., Medimetrics S.A. de C.V., Olympus Corporation, Bio-Images Research Limited, Novartis, Philips Healthcare, Smart pill, Inc., Medtronic, Inc., Pentax Medical Company, Siemens Healthcare, Stryker Corporation, G.E. Healthcare, Boston Scientific Corporation, IntroMedic Inc. and Proteus Digital Health Inc.

RECENT MARKET DEVELOPMENTS

- On September 23, 2020, Capsovision announced that the U.S. Food and Drug Administration (FDA) allows using CapsoCam Plus, a small bowel capsule endoscope. This capsule will help healthcare providers promote a fully remote capsule endoscopy procedure without direct contact.

- In November 2019, the Boston Scientific Company announced supporting data for two devices related to the peripheral drug-eluting product portfolio.

- In 2019, A Silicon Valley company launched the first digital pill to detect cancer in a person. It is a chemotherapy pill taken by cancer patients packed with a sensor that can alert a physician, pharmacist, or caregiver after swallowing it.

- In 2021, Smart pill startup etectRx partnered with Pear Therapeutics to develop EtectRx, which provides wireless sensors embedded in medications. The companies combine to build a product together, combining medication with digital therapeutics. It also received Food and Drug Administration approval.

DETAILED SEGMENTATION INCLUDED IN THIS REPORT

This research report on the global smart pills technologies market has been segmented and sub-segmented into the following categories.

By Application

- Capsule Endoscopy

- small Bowel Video Capsule Endoscopy

- Colon Capsule Endoscopy

- OMOM Capsule Endoscopy Platform

- MiroCam

- Upgraded Mirocam

- Advanced Capsule Endoscope

- Drug Delivery

- Patient monitoring

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

Frequently Asked Questions

How much is the smart pills technologies market going to be worth by 2032?

As per our research report, the smart pills technologies market size is projected to be USD 17,859.07 million by 2032.

Which region is growing the fastest in smart pills technologies market?

Geographically, the North American smart pills technologies market accounted for the largest share of the global market in 2023.

At What CAGR, the smart pills technologies market is expected to grow from 2024 to 2032?

The global smart pills technologies market is estimated to grow at a CAGR of 17.5% during the forecast period from 2024 to 2032.

Does this report include the impact of COVID-19 on the smart pills technologies market?

Yes, we have studied and included the COVID-19 impact on the smart pills technologies market in this report

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2500

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]