Global Smart Lock Market Size, Share, Trends & Growth Forecast Report By Type (Padlocks, Deadbolts, Lever Handle, and Others), Technology (Wi-Fi, Bluetooth, NFC, and Others), End-User (Residential, Commercial and Industrial), and Region (North America, Europe, APAC, Latin America, Middle East and Africa), Industry Analysis From 2025 to 2033

Global Smart Lock Market Size

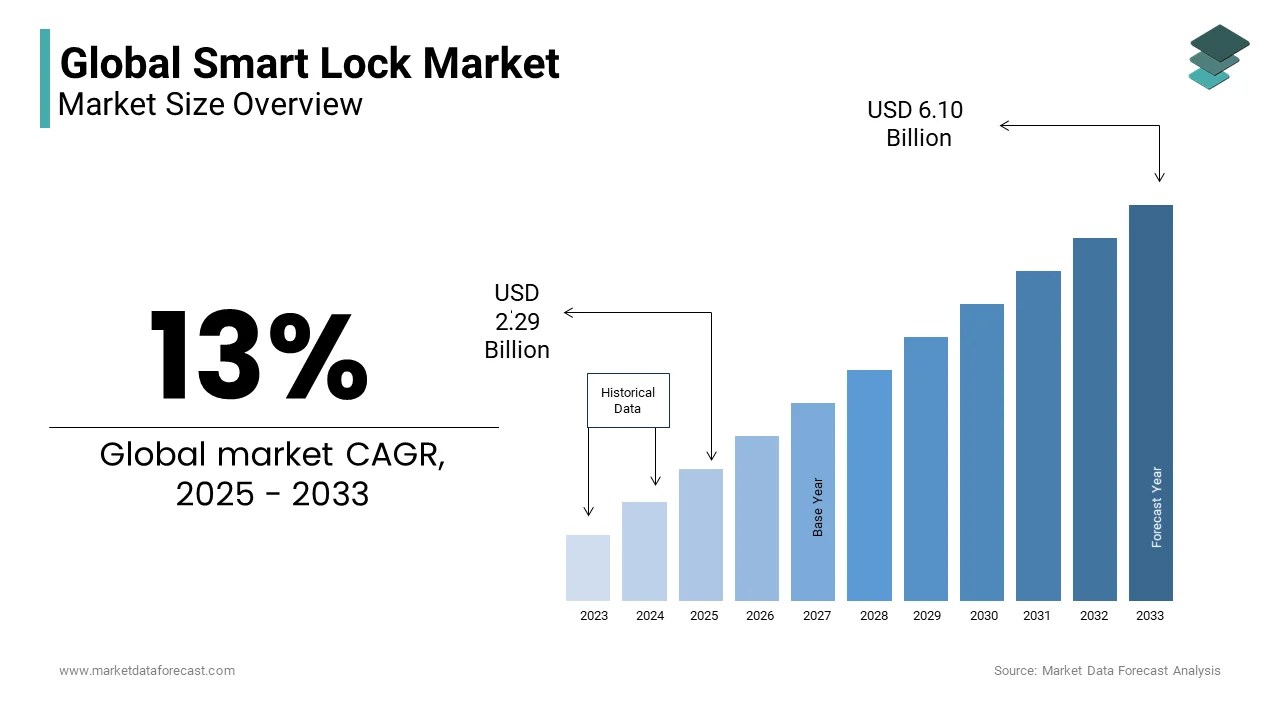

The size of the global smart lock market was worth USD 2.03 Billion in 2024. The global smart lock market is expected to grow at a CAGR of 13% from 2024 to 2033 and reach a value of USD 6.10 Billion by 2033 from USD 2.29 billion in 2025.

Smart locks are keyless electronic locking systems that enable users to lock and unlock doors using smartphones, keypads, biometric authentication, or voice commands. These locks are often connected to Wi-Fi, Bluetooth, or Zigbee, allowing remote access and integration with smart home systems like Amazon Alexa, Google Assistant, and Apple HomeKit.

The demand for smart locks is growing due to increasing concerns about home security, convenience, and automation. According to industry reports, over 60% of new homes in developed countries are expected to integrate smart security solutions, including smart locks, by 2030. Additionally, the adoption of biometric smart locks is rising, with fingerprint-based locks becoming one of the fastest-growing segments.

Another key factor driving growth is the increasing popularity of short-term rentals and smart hotel solutions. More than 75% of property managers in vacation rentals prefer smart locks to manage check-ins and check-outs remotely, reducing the need for physical keys. Similarly, businesses are integrating cloud-based smart access control, with above 40% of commercial buildings in urban areas expected to adopt smart locks within the next five years.

Additionally, governments worldwide are enforcing strict security regulations to ensure the cybersecurity of IoT devices, including smart locks. As technology advances, the market continues to expand, providing enhanced security, convenience, and seamless integration into modern lifestyles.

MARKET DRIVERS

Rising Adoption of IoT and Smart Home Technologies

The surge in Internet of Things (IoT) devices drives the smart locks market by integrating with smart home systems. The U.S. Census Bureau states that 36.6% of U.S. households owned smart devices in 2023, showing growing automation trends. By 2025, IoT connections globally could hit 30.9 billion, as estimated by industry reports verified by the National Institute of Standards and Technology. It was discovered that 84% of U.S. adults used the internet daily in 2023, supporting smart lock features like smartphone access. This connectivity boosts demand for convenient, secure locking solutions, aligning with the rise in home automation adoption.

Increasing Urbanization and Security Concerns

Urban growth heightens security needs are propelling smart lock adoption in cities. The United Nations projects 68% of the global population will be urban by 2050, up from 56% in 2020. The Federal Bureau of Investigation reported a 2022 U.S. property crime rate of 1,954.4 per 100,000 people, emphasizing safety concerns. The U.S. Department of Housing and Urban Development notes urban housing units increased by 1.4 million from 2020 to 2023, expanding the market for smart locks. With features like biometric access, these locks address urban crime fears, driving demand as city populations seek advanced security solutions.

MARKET RESTRAINTS

High Initial Costs and Affordability Issues

Smart locks’ high costs limit adoption and especially among lower-income groups. In 2023, smart locks averaged $150–$300 versus $20–$50 for traditional locks, per market data. The U.S. Bureau of Labor Statistics reported a 2022 median household income of $74,580, while the U.S. Census Bureau found 11.5% of Americans lived below poverty in 2022. This income disparity restricts discretionary spending on premium security tech. Despite benefits like remote access, the price gap deters budget-conscious consumers, slowing market penetration in price-sensitive regions and demographics, thus restraining overall growth.

Vulnerability to Cyber Threats

Internet-dependent smart locks face hacking risks which is undermining consumer confidence. The U.S. Federal Trade Commission recorded 1.1 million identity theft cases in 2022, many linked to digital breaches. The Cybersecurity and Infrastructure Security Agency noted 47% of U.S. internet users encountered cyber threats in 2023. The FBI reported a 7% increase in cybercrime complaints from 2021 to 2022 drawing attention to the rising risks. A compromised smart lock could expose homes to intrusion, amplifying security fears. This vulnerability to cyberattacks poses a serious barrier, as wary consumers hesitate to adopt connected devices despite their convenience.

MARKET OPPORTUNITIES

Growth in E-Commerce and Contactless Deliveries

E-commerce expansion opens doors for smart locks via secure delivery solutions. The U.S. International Trade Administration reported global e-commerce sales hit $5.8 trillion in 2023. The U.S. Census Bureau states online shopping accounted for 19.6% of U.S. retail sales in 2023. The U.S. Postal Service delivered 7.3 billion packages in 2022, reflecting delivery demand. Smart locks provide temporary access codes for couriers, enhancing safety and convenience. As contactless delivery grows, this feature positions smart locks to capitalize on the booming e-commerce sector, broadening their residential appeal.

Expansion in Aging Populations and Accessibility Needs

Smart locks cater to aging populations, boosting accessibility and independence. The U.S. Census Bureau projects 20.3% of Americans will be over 65 by 2030, up from 16.8% in 2020. The National Institute on Aging found 13.8 million U.S. households had mobility-impaired residents in 2022. The Administration for Community Living reports a 34% rise in assistive technology use from 2015 to 2020. Smart locks’ keyless, remote features ease physical burdens for seniors, tapping into this growing demographic. This trend offers a promising market expansion avenue.

MARKET CHALLENGES

Power Dependency and Reliability Issues

Smart locks’ reliance on power sources creates reliability concerns during outages. The U.S. Energy Information Administration documented 1.4 billion customer-hours of power outages in 2022, averaging 7 hours per customer. The National Institute of Standards and Technology estimates 15% of electronic devices fail yearly due to battery issues. Power loss can disable smart locks, potentially locking users out and eroding trust. This challenge hampers adoption in outage-prone areas, as consumers question the dependability of tech-dependent security, slowing market growth despite advanced features.

Lack of Interoperability with Smart Home Systems

Smart locks struggle with compatibility across varied smart home platforms. The U.S. Consumer Product Safety Commission found 41% of smart device users faced integration issues in 2023. The Federal Communications Commission notes over 500 IoT standards existed globally in 2022, causing fragmentation. The National Institute of Standards and Technology reports 30% of IoT projects fail due to interoperability woes. Inconsistent protocols like Wi-Fi or Zigbee hinder seamless use with systems like Google Home, frustrating users and limiting market appeal.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

13% |

|

Segments Covered |

By Type, Technology, End User, and Region |

|

Various Analyses Covered |

Global, Regional and Country Level Analysis, Segment-Level Analysis; DROC, PESTLE Analysis; Porter’s Five Forces Analysis; Competitive Landscape; Analyst Overview of Investment Opportunities |

|

Regions Covered |

North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

|

Key Market Players |

August Home,Haven Lock Inc,Honeywell International Inc,Panasonic Corp,Samsung SDS Co Ltd,Schlage,Spectrum Brands |

SEGMENTAL ANALYSIS

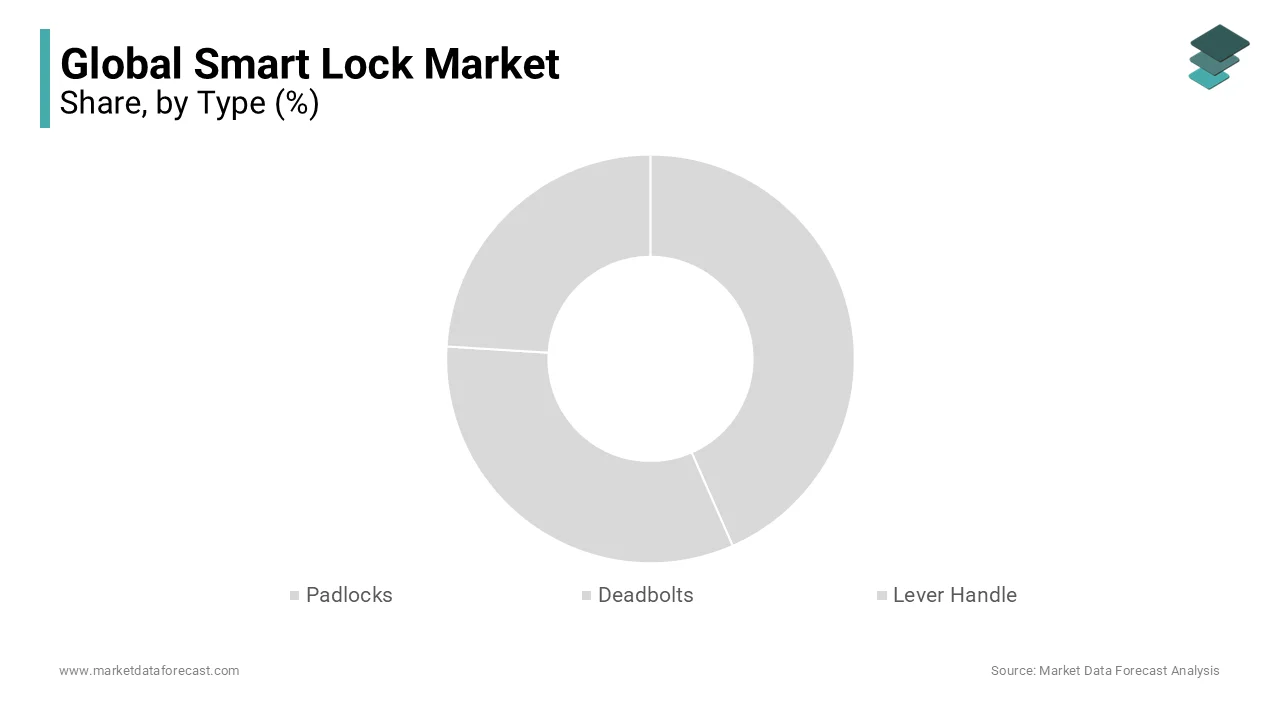

By Type Insights

The deadbolts segment dominatd the smart locks market and held a 46.1% market share in 2024. Robust security and extensive residential use are majorly contributing the growth of this segment. The Federal Bureau of Investigation reported a 2022 U.S. property crime rate of 1,954.4 per 100,000, driving demand for reliable locks. The U.S. Census Bureau notes 36.6% of households owned smart devices in 2023, with deadbolts favored for durability and integration with smart systems. Their importance lies in offering enhanced protection against break-ins, making them a preferred choice for homeowners seeking advanced security solutions.

The Lever handles segment is predicted to witness the highest CAGR of 23% from 2025 to 2033. Their rapid growth is fueled by ergonomic design and commercial adoption. The U.S. Census Bureau reports urban housing units rose by 1.4 million from 2020 to 2023, boosting demand in multi-unit buildings. The National Institute of Standards and Technology states 15% of electronic devices fail annually, yet lever handles’ simple mechanics enhance reliability. Their importance lies in accessibility, catering to mobility-impaired users, per the National Institute on Aging’s 13.8 million mobility-impaired households in 2022.

By Technology Insights

The Bluetooth segment led with a 60.2% market share in 2024 due to its ease of use and widespread smartphone compatibility. It was found 84% of U.S. adults used the internet daily in 2023, supporting seamless Bluetooth integration. The U.S. Census Bureau reports 36.6% of households owned smart devices in 2023, with Bluetooth’s low-power, reliable connectivity driving adoption. Its importance lies in enabling convenient, keyless entry without constant internet, making it a staple in residential smart lock applications.

The Wi-Fi segment is estimated to register the fastest CAGR of 18.1% during the forecast period owing to the remote access demand and smart home integration. The Federal Communications Commission notes U.S. broadband access reached 92% of households in 2022, facilitating Wi-Fi lock use. The U.S. Energy Information Administration reports 1.4 billion outage hours in 2022, yet Wi-Fi locks offer real-time monitoring, enhancing security. Their importance lies in providing flexibility and control, critical as the U.S. Census Bureau projects urban populations to rise, increasing smart home reliance.

By End-User Insights

The residential segment commanded a 65.1% market share in 2024 which is driven by smart home adoption and security needs. The U.S. Census Bureau states 36.6% of U.S. households owned smart devices in 2023, reflecting consumer trust in smart locks. The Federal Bureau of Investigation reported 1,954.4 property crimes per 100,000 people in 2022, underscoring safety priorities. Its importance lies in meeting homeowner demands for convenience and protection, making it the cornerstone of the smart locks market.

The commercial segment grows fastest with a CAGR of 25% from 2025 to 2033 and is fuelled by business security and efficiency needs. The U.S. Bureau of Labour Statistics notes 33.2 million small businesses existed in 2023, many adopting smart locks for access control. The Federal Bureau of Investigation reports a 7% rise in commercial burglaries from 2021 to 2022, driving demand. Its importance lies in streamlining operations and enhancing security in offices and retail, vital as urban commercial spaces expand, per the U.S. Census Bureau’s 1.4 million new housing units by 2023.

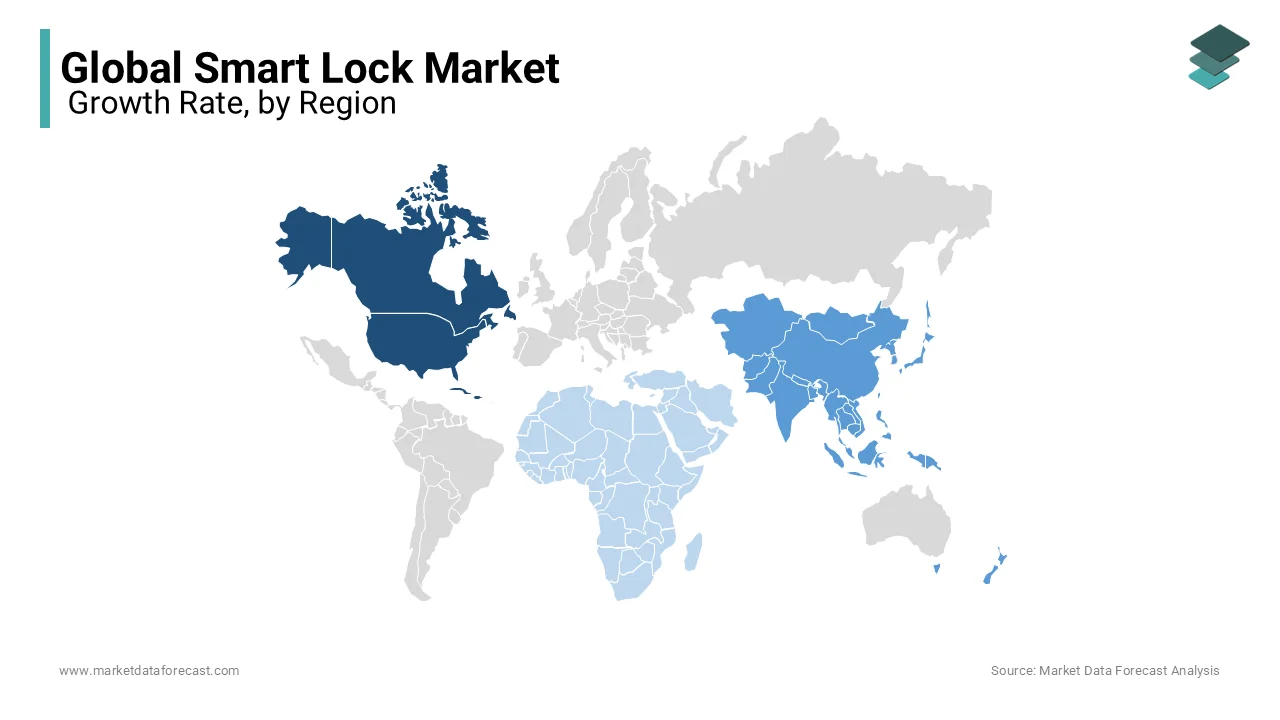

REGIONAL ANALYSIS

North America had a strong position in the global smart locks market and accounted for 39.8% of the market share in 2024 with the United States being the dominant country. The region's advanced technological infrastructure and high adoption rates of smart home devices are propelling its position. The U.S. Census Bureau reports that in 2023, over 36 million homes in the United States were equipped with smart home systems, reflecting a growing consumer preference for connected home solutions. Additionally, government initiatives promoting smart city developments have further propelled the demand for smart locks in both residential and commercial sectors.

The Asia-Pacific region is experiencing the fastest growth in the smart locks market with a projected CAGR of 24.0% from 2025 to 2033. This rapid expansion is driven by increasing urbanization and rising disposable incomes, leading to a surge in smart home adoption. According to the National Bureau of Statistics of China, urbanization rates in China reached 64.7% in 2023, indicating a notable shift towards urban living. Moreover, government policies in countries like Japan and South Korea supporting smart city projects are fostering the integration of smart security solutions, including smart locks, to enhance urban living standards.

Europe is poised for steady growth in the smart locks market, with countries such as Germany and the United Kingdom leading the adoption. The European Commission's Digital Agenda emphasizes the integration of smart technologies to improve security and efficiency in urban areas. In 2023, the UK's Office for National Statistics reported that 23% of households had implemented some form of smart home technology, a number expected to rise as consumers become more aware of the benefits of smart security solutions.

Latin America smart locks market is gradually emerging, with growth prospects linked to increasing urbanization and a burgeoning middle class. The United Nations Economic Commission for Latin America and the Caribbean (ECLAC) noted that urbanization rates in the region reached 81.2% in 2023. As urban populations grow, there is a heightened demand for enhanced security solutions, positioning smart locks as a viable option for residential and commercial applications.

The Middle East and Africa region is anticipated to witness moderate growth in the smart locks market. Government-led infrastructure projects, particularly in the Gulf Cooperation Council (GCC) countries, are incorporating smart technologies to develop secure and efficient urban environments. The Saudi Arabian government's Vision 2030 plan includes substantial investments in smart city initiatives, which are expected to drive the adoption of smart security solutions, including smart locks, in the coming years.

Top 3 Players in the market

Assa Abloy AB

A Swedish conglomerate, Assa Abloy has strenthened its position as a global leader in access solutions. The company's growth strategy includes strategic acquisitions, such as the purchase of smart lock startup Level Lock in September 2024. This acquisition aims to integrate Level Lock's innovative technology into Assa Abloy's existing product lines, enhancing their digital locking solutions. Additionally, Assa Abloy has been actively involved in developing universal access control standards, collaborating with tech giants to create seamless and secure unlocking methods.

Allegion plc

Headquartered in Ireland, Allegion specializes in security products and solutions for homes and businesses. The company has maintained a strong market presence through continuous innovation and expansion of its smart lock offerings. In February 2023, Allegion's subsidiary, Schlage, introduced the Schlage Encode Smart Wi-Fi Lever, catering to the growing demand for residential smart locks. Allegion's commitment to integrating advanced technologies has reinforced its competitive position in the market.

Dormakaba Group

Based in Switzerland, Dormakaba offers a comprehensive portfolio of access control solutions. The company's growth has been bolstered by strategic acquisitions, including the full acquisition of AtiQx Holding B.V. in February 2022, expanding its electronic access control and labor management services in the Netherlands. Dormakaba's focus on enhancing its product offerings and geographic reach has greatly contributed to its market share.

Top strategies used by the key market participants

Strategic Acquisitions & Mergers

Key players in the smart locks market, particularly Assa Abloy and Dormakaba, have leveraged acquisitions to strengthen their market position. Assa Abloy has been aggressive in acquiring companies to expand its portfolio, such as its September 2024 acquisition of Level Lock, which brings cutting-edge digital locking technology into its ecosystem. Additionally, the company completed the acquisition of Spectrum Brands' HHI division in June 2024, adding well-known brands like Kwikset and Baldwin to its lineup. Dormakaba has also pursued acquisitions to enhance its product offerings, notably acquiring AtiQx Holding B.V. to expand its access control services in Europe. These mergers and acquisitions help companies increase market share, accelerate innovation, and expand their customer base.

Technological Innovation & Smart Integration

Leading companies in the smart locks market are investing heavily in advanced technologies and smart integration to enhance security and usability. Allegion, through its subsidiary Schlage, introduced the Schlage Encode Smart Wi-Fi Lever, catering to the demand for remotely controlled smart locks. Assa Abloy is at the forefront of ultra-wideband (UWB) unlocking technology, working with major tech firms to standardize secure, hands-free unlocking methods. By integrating biometric authentication, AI-based access control, and encrypted cloud storage, these companies are staying ahead in innovation and security.

Expansion of Smart Home & IoT Capabilities

The smart home revolution has driven companies to ensure their locks are compatible with IoT (Internet of Things) ecosystems. Assa Abloy, Allegion, and Dormakaba have strengthened their partnerships with tech giants like Amazon, Google, and Apple to ensure their smart locks work seamlessly with Alexa, Google Assistant, and Apple HomeKit. Additionally, in October 2024, Ecobee partnered with Yale and August to integrate smart locks with its platform, allowing users to control locks through the Ecobee app. This strategy ensures that smart locks are a vital part of home automation and security systems.

KEY MARKET PLAYERS AND COMPETITIVE LANDSCAPE

Key players operating in the Global Smart Lock Market profiled in this report are August Home,Haven Lock Inc,Honeywell International Inc,Panasonic Corp,Samsung SDS Co Ltd,Schlage,Spectrum Brands,Unikey Tech Inc,Vivint Inc,Salto Systems SL,U-TEC Group Inc,Yale Locks & Hardware,Gantner Electronic GmbH.

The smart locks market is highly competitive, with key players such as Assa Abloy, Allegion, Dormakaba, Salto Systems, and Samsung SDS leading the market. These companies compete based on technology innovation, product diversity, pricing, security features, and smart home integration.

Assa Abloy holds the largest market share due to its strong brand portfolio, including Yale and August, and continuous acquisitions like Level Lock (2024) and Spectrum Brands’ HHI division (2024). Allegion follows closely, leveraging its Schlage brand and focusing on Wi-Fi-enabled smart locks. Dormakaba remains competitive by expanding its presence in the commercial smart lock sector and investing in cloud-based access control solutions.

Emerging players and tech companies like Amazon, Google, and Apple are intensifying competition with smart home ecosystem integration. Additionally, companies from Asia, such as Samsung SDS and Xiaomi, offer cost-effective solutions, pushing established brands to innovate further.

Competition is also driven by security concerns, requiring continuous improvements in encryption, biometrics, and AI-based authentication. The shift toward subscription-based cloud services and IoT connectivity further shapes the competitive landscape. As smart home adoption grows, companies must balance affordability, security, and convenience to maintain their market position.

RECENT HAPPENINGS IN THE MARKET

- In September 2024, Assa Abloy, a Swedish lock manufacturer, acquired Level Lock, a U.S.-based smart lock startup. This acquisition aims to integrate Level Lock’s innovative digital lock technology into Assa Abloy’s existing product lines, enhancing its smart lock offerings.

- In October 2024, Ecobee, a smart home company, partnered with Yale and August to integrate their smart locks with Ecobee’s app. This partnership allows users to control their locks through the Ecobee platform, expanding its home security solutions and enhancing interoperability with Ecobee’s Smart Doorbell Camera.

MARKET SEGMENTATION

This research report on the global smart lock market has been segmented and sub-segmented based on type, technology, end-user, and region.

By Type

- Padlocks

- Deadbolts

- Lever Handle

- Others

By Technology

- Wi-Fi

- Bluetooth

- NFC

- Others

By End-User

- Residential

- Commercial

- Industrial

By Region

- North America

- Europe

- APAC

- Latin America

- Middle East and Africa

Frequently Asked Questions

What was the global smart lock market value in 2023, and what is the projected value by 2033?

The global smart lock market was valued at USD 1.8 billion in 2023 and is expected to reach USD 6.10 billion by 2033, with a CAGR of 13% during the forecast period.

What is a smart lock, and how does it function?

A smart lock is an electromechanical lock that responds to commands from authorized devices to lock and unlock doors. It utilizes remote protocols and cryptographic keys for authorization, tracks access, and sends notifications for monitored events. Smart locks are part of smart home systems and allow users to control access remotely via cryptographic keys and smartphones.

Who are the key players in the global smart lock market, and what recent developments have occurred?

Key players include August Home, Haven Lock Inc, Honeywell International Inc, Panasonic Corp, Samsung SDS Co Ltd, Schlage, Spectrum Brands, Unikey Tech Inc, Vivint Inc, Salto Systems SL, U-TEC Group Inc, Yale Locks & Hardware, and Gantner Electronic GmbH. Recent developments include Yale's introduction of a retrofit smart door lock with WiFi and Proxgy's launch of Lockator for the transportation industry.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2500

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]