Global Smart Hospitals Market Size, Share, Trends & Growth Forecast Report By Component (Software, Hardware and Services), Technology (Remote Medicine Management, Medical Connected Imaging, Medical Assistance, Electronic Health Records & Clinical Workflow and Outpatient Vigilance), Application, Connectivity and Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), Industry Analysis From 2025 To 2033.

Global Smart Hospitals Market Size

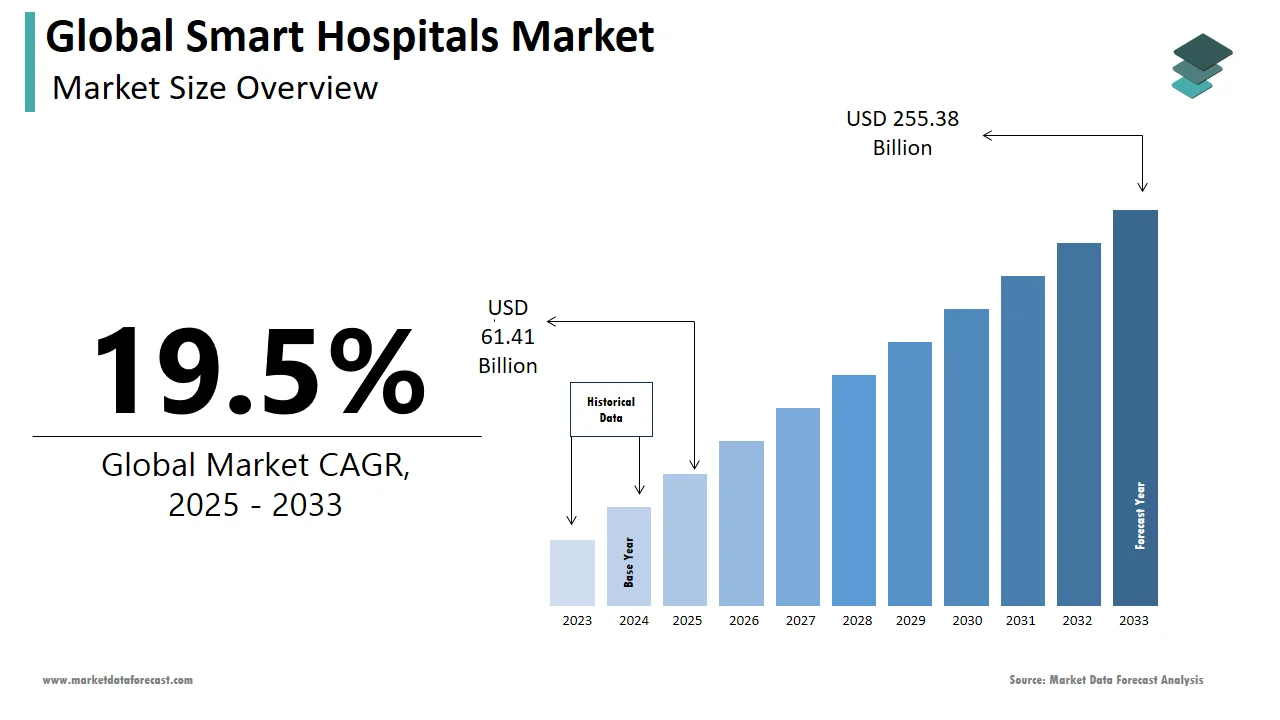

The global smart hospitals market was worth US$ 51.39 billion in 2024 and is anticipated to reach a valuation of US$ 255.38 billion by 2033 from US$ 61.41 billion in 2025, and it is predicted to register a CAGR of 19.5% during the forecast period 2025-2033.

Smart hospitals are an advanced version of traditional hospitals. They are equipped with technological developments such as AI, IoT, cloud computing, and big data, aiming to deliver a better patient outcome and assist in hospital management. Smart hospitals use real-time data and advanced technologies to offer personalized and effective healthcare to the needy. The awareness regarding the importance of smart hospitals is growing across various countries. The conversion of traditional hospitals into smart hospitals is in full swing in some countries and has been happening rapidly. The trend of smart hospitals can also be seen in developing countries. Improved patient outcomes, increased efficiency, reduced costs, and enhanced patient experience are some of the significant advantages of smart hospitals.

MARKET DRIVERS

Technological advancements are one of the major factors driving the growth of the smart hospitals market. The world is seeing a technological revolution in all sectors, and the huge potential of these technologies fuelled hospital management to make the most of these advancements to cater to its need in creating patient-centric hospitals. It not only aided in creating a patient-centric platform but also helped in managing the communication flow and network within various departments in a hospital. These technologies helped in the analysis of revenue generated and aided the stakeholders in take important decisions. Integrating technological developments such as AI, ML, and cloud computing into hospitals has helped them deliver better patient care. Smart hospitals can access real-time data and aid in decision-making and accurate diagnosis, which helps provide appropriate treatment to the patients. The advantage of cloud computing is that it helps hospitals limit data hacks and cyber-attacks, provides improved patient data security and provides access to collaboration and coordination between healthcare providers.

The growing digitization in the healthcare industry further contributes to the smart hospitals market growth. Healthcare digitization has shaped the future of hospitals and their management. It has successfully integrated digital technologies, systems, and data to improve patient care and streamline processes to increase the efficiency of the process. It overturned the manual paperwork system to an electronic system that maintains, stores, and keeps the record safe for better analysis. Digitization has revolutionized by replacing the manual recording of data with digital format making patient history, diagnosis, treatment, and medication plan accessible. Digitization led to the facilitation of telemedicine and telehealth, allowing patients to consult doctors and healthcare professionals remotely. It improved access to patients who stay in rural areas or are unable to visit clinics and hospitals due to busy schedules. It has also aided in medical imaging by capturing, storing, and sharing data for faster diagnosis and easy collaboration among doctors and healthcare professionals. Another important aspect of digitization has enabled the exchange of data seamlessly within different healthcare providers and hospitals. This has led to better coordination and improved patient care. It has also enabled the analysis of large volumes of data for population health management by using data analytics tools to analyze patterns, trends, and risk factors for better management of public health.

The growing burden of chronic diseases is propelling the smart hospitals market growth. People need quality healthcare at an affordable cost. People suffering from chronic diseases such as cancer, diabetes, and CVD must take regular treatments and visit hospitals frequently. To such patients, the cost of healthcare will be high. According to the World Health Organization (WHO) data, chronic diseases account for 74% of overall deaths worldwide. It predicted approximately 41 million people die due to chronic diseases each year. 77% of the deaths from chronic diseases are witnessed in low-and-middle-income countries. An estimated 1 billion people worldwide suffer from at least one chronic condition. Due to changing lifestyles, busy schedules, and unhealthy habits, chronic illnesses are on the rise. Digitization has led to the invention of digital tools like wearable devices that enable patients to actively participate in healthcare and self-care management by accessing health records and tracking vital signs for chronic conditions and directly communicating with healthcare professionals and doctors.

Furthermore, the growing healthcare spending and increasing demand for qualitative and cost-effective healthcare are further fuelling the smart hospitals market growth. The growing geriatric population is another factor supporting the market growth. In addition, people diagnosed with various diseases often visit hospitals to manage diseases, resulting in hefty hospital costs. As a result, people's desire to have personalized, effective, and efficient healthcare is increasing. This has led to demand for smart hospitals. The growing healthcare costs are further boosting the growth rate of the smart hospitals market. Furthermore, an increasing number of initiatives from the governments in favor of smart hospitals and a growing focus on patient-centered care are promoting the smart hospitals market.

MARKET RESTRAINTS

Data security and privacy concerns hamper the smart hospitals market growth. Smart hospitals store and generate a vast amount osensitive data dealing with patientsve, and weak cyber security protocols and unauthorized access to data could lead to breaches and loss of data. This could eventually lead to a loss of trust and value degradation of the hospital and overall healthcare system. Therefore, to prevent this, investment in high-tech security systems is needed, and it requires a good amount of investment.

High costs associated with establishing and maintaining healthcare IT and infrastructure required for smart hospitals are one of the major factors hampering the market growth. In addition, Issues associated with standardization and interoperability inhibit the market's growth rate. Furthermore, there are other significant obstacles to market growth besides reluctance to adopt advanced technologies from healthcare providers. Furthermore, factors such as data privacy and security concerns, lack of skilled workforce who can handle the operations of smart hospitals in some countries, and lack of funding and favorable reimbursement scenarios are expected to impede the market growth.

Impact of COVID-19 on the Smart Hospitals Market

COVID-19 has impacted the smart hospitals market in a variety of ways. During the COVID-19 pandemic, the adoption of remote patient monitoring, telemedicine, and digital health technologies has grown significantly. Due to the coronavirus, people and governments of various countries have realized the importance of efficient, effective, and secure healthcare delivery models. Due to COVID-19, the digital transformation in healthcare has increased, favoring the smart hospitals market. Many hospitals and healthcare providers have searched for effective patient care while maintaining social distancing. Due to the impact of COVID-19, many governments worldwide have supported the smart hospitals market by increasing their funding. This has been done considering the possibility of repeating pandemic events such as COVID-19 in the coming years. Overall, the COVID-19 pandemic has provided opportunities and challenges to the smart hospital market. However, considering the decreasing impact of the COVID-19 pandemic and increasing awareness among healthcare providers and governments regarding the advantages associated with smart hospitals, the global smart hospitals market is estimated to showcase a promising CAGR in the coming years.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

19.5% |

|

Segments Covered |

By Component, Application, Technology, Connectivity, and Region. |

|

Various Analyses Covered |

Global, Regional, and country-level analysis; Segment-Level Analysis, DROC; PESTLE Analysis; Porter’s Five Forces Analysis, Competitive Landscape; Analyst Overview of Investment Opportunities |

|

Regions Covered |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Market Leaders Profiled |

Medtronic, Philips, GE Healthcare, Siemens AG, Qualcomm Life, Allengers, Athenahealth, AdhereTech, Cerner Corporation, McKesson, St. Jude Medical, Samsung, Renesas Electronics Corporation, and Honeywell Life Care Solutions, and Others. |

SEGMENTAL ANALYSIS

By Component Insights

Based on components, the software segment occupied the most significant share of the global market in 2024, and the domination of the segment is estimated to continue during the forecast period. Software plays an integral role in the establishment of an innovative hospital. The segment's growth is primarily driven by factors such as the rising adoption of technological advancements.

On the other hand, the services segment is expected to register the fastest CAGR during the forecast period. The segment's growth can be attributed to the poor awareness levels among healthcare providers and people regarding smart hospital solutions.

By Application Insights

Based on the application, the EHR and clinical workflow segment is expected to account for the major share of the global smart hospitals market during the forecast period. EHR is one of the essential components of a smart hospital. The benefits associated with the EHR, such as improved patient outcomes, increased efficiency, better coordination between healthcare providers, enhanced patient safety, and improved public healthcare, are among the significant factors propelling segmental growth.

The outpatient vigilance segment is estimated to witness a promising CAGR during the forecast period.

By Technology Insights

Based on technology, the artificial intelligence segment is anticipated to hold the most significant global smart hospitals market share during the forecast period. The penetration of AI is increasing in the healthcare industry. AI can help upgrade the capabilities of a smart hospital and has been used to improve its performance of a smart hospital. Furthermore, the interest in integrating AI into hospital workflows has risen among healthcare professionals due to the recent COVID-19 pandemic.

By Connectivity Insights

Based on the connectivity, the wireless segment had the most significant share of the smart hospitals market in 2024. The growing adoption of wireless technological advancements in smart hospitals is driving segmental growth.

REGIONAL ANALYSIS

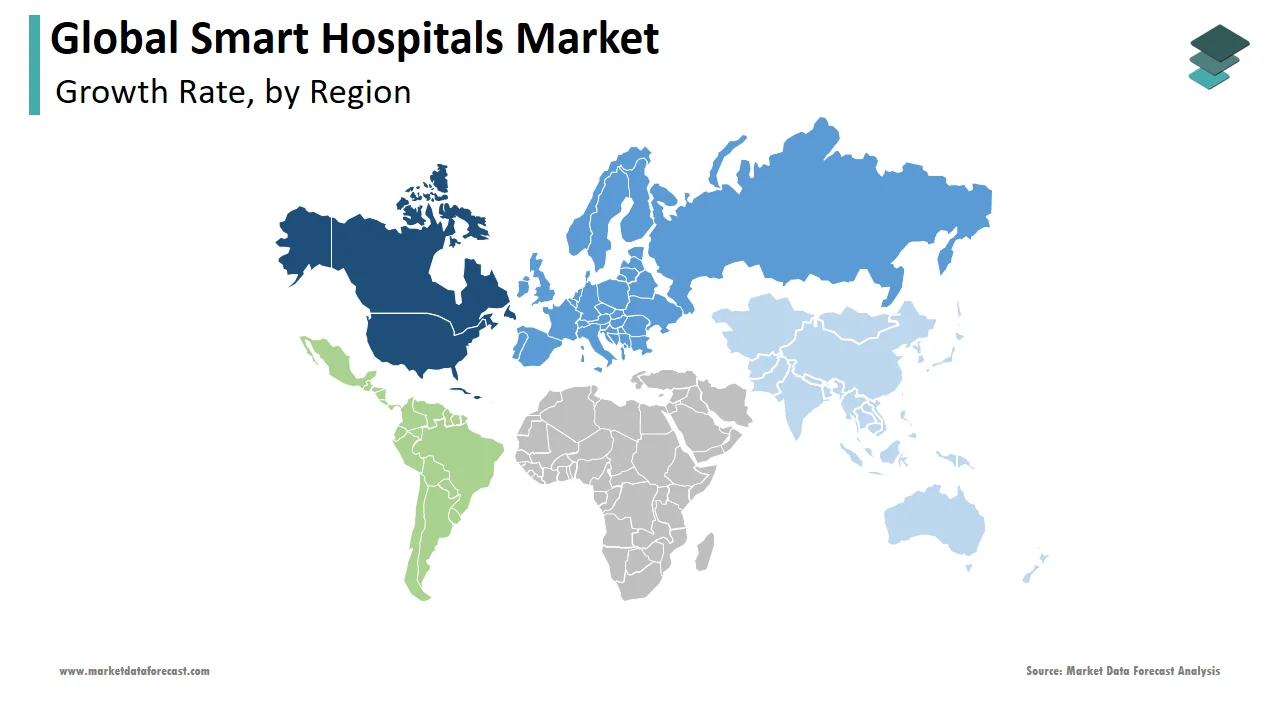

The North American smart hospitals market occupied the largest share of the global market in 2024. The region's dominance is expected to continue during the forecast period. The growth of the North American market is primarily driven by factors such as increasing funding by the North American governments for the infrastructure of smart hospitals and increasing healthcare expenditure. In addition, North America ranks top in adopting technological developments, which favors regional market growth. The presence of sophisticated healthcare infrastructure in North American countries is another major factor boosting the smart hospitals market in North America. In 2024, the U.S. led the smart hospitals market in North America, followed by Canada.

During the forecast period, the European smart hospitals market is predicted to occupy a substantial share of the worldwide market. Key factors propelling European market growth are favorable initiatives for smart hospitals, the increasing patient population suffering from chronic diseases, and the rising demand for cost-effective healthcare delivery. Companies such as Philips Healthcare, Siemens Healthineers, GE Healthcare, and Cerner are some notable European companies. During the forecast period, European countries such as the UK, Germany, Spain, France, and Italy are estimated to hold the largest share of the European market.

The APAC smart hospitals market is predicted to showcase the highest CAGR during the forecast period. The growing awareness regarding the significance of smart hospitals among healthcare professionals of APAC counties is primarily driving market growth. In addition, APAC has been considerable developments in the healthcare infrastructure in the last few years and is expected to experience more developments in the coming years, which is expected to boost the APAC market growth in the coming years.

The Latin American smart hospitals market is estimated to hold a considerable share of the global market during the forecast period.

The MEA smart hospitals market is projected to showcase a moderate CAGR in the coming years.

KEY MARKET PARTICIPANTS

Medtronic, Philips, GE Healthcare, Siemens AG, Qualcomm Life, Allengers, Athenahealth, AdhereTech, Cerner Corporation, McKesson, St. Jude Medical, Samsung, Renesas Electronics Corporation, and Honeywell Life Care Solutions are some of the notable players in the global smart hospitals market. In addition, some of the solution providers are SAP, Microsoft, Allscripts, CitiusTech Inc., Infor, PhysIQ, Diabetizer, AdhereTech, Epic, STANLEY Healthcare, and Oracle.

The market participants are adopting strategies such as partnerships, collaborations, R&D investments, expanding to the untapped markets, and offering integrated solutions to maximize their share in the global market.

RECENT MARKET HAPPENINGS

- In Feb 2023, China due to the aging population and obstacles with limited resources, hospitals in China launched an AI program by scanning the QR code, it launched a mini program that enables the patient to enter the symptoms, treatment plan, and drugs they are taking. Allowing the doctor to understand the patient better.

- In January 2023, recent technological advancement led to the development of Smart beds, highly equipped with sensors that monitor the body’s vitals, signs of Pneumonia, and bed ulcers. This bed uses a wireless seamless network that tracks the health of the patient and provide accurate data to medical and healthcare professional, reducing re-admission of patients.

- In January 2020, KT Corporation, a South Korean telecommunications company, teamed with Samsung Medical Centre to develop a smart hospital with 5G technology. The primary objective of this collaboration is to develop a smart hospital that can provide improved patient care and has increased efficiency with 5G technology capabilities.

- In April 2019, Koninklijke Philips N.V. and Vietnam Hong Duc General Hospital made a mutual deal. As part of the partnership, Philips would provide Hong Duc General Hospital with the latest medical information technology, patient monitoring, and medical imaging solutions. Also, Philips would offer training programs to strengthen its clinical capacity to deliver better clinical outcomes.

- In November 2018, GE Healthcare launched the Edison platform with applications designed to help hospitals and healthcare systems better use AI. Edison applications offer clinicians a comprehensive digital platform, integrating datasets from numerous providers, healthcare networks, and life sciences. It should help clinicians make faster, more informed decisions to improve patient outcomes.

MARKET SEGMENTATION

This research report on the global smart hospitals market is segmented and sub-segmented into the following categories.

By Component

- Software

- Hardware

- Services

By Application

- Remote Medicine Management

- Medical Connected Imaging

- Medical Assistance

- Electronic Health Records & Clinical Workflow

- Outpatient Vigilance

By Technology

- Cloud Computing

- Artificial Intelligence

- Wearable Technologies

- Radio Frequencies Identification

By Connectivity

- Wired

- Wireless

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East and Africa

Frequently Asked Questions

How much was the global smart hospitals market worth in 2023?

The global smart hospitals market size was worth USD 51.39 billion in 2024.

What is the growth rate of smart hospitals market?

Between 2025 and 2033, the global market for smart hospitals is expected to grow at a CAGR of 19.5%.

Which segment by component dominated the smart hospitals market?

The software segment had the largest share of the smart hospitals market in 2024.

Which region accounted for the major share of the smart hospitals market in 2024?

Geographically, North America dominated the smart hospitals market in 2024.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2500

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]