Global Smart Foods Market Size, Share, Trends & Growth Forecast Report Segmented By Food Type (Functional Food, Encapsulated Food, Genetically Modified Food), End Products, And Region (North America, Europe, APAC, Latin America, Middle East And Africa), Industry Analysis From 2025 To 2033

Smart Foods Market Size

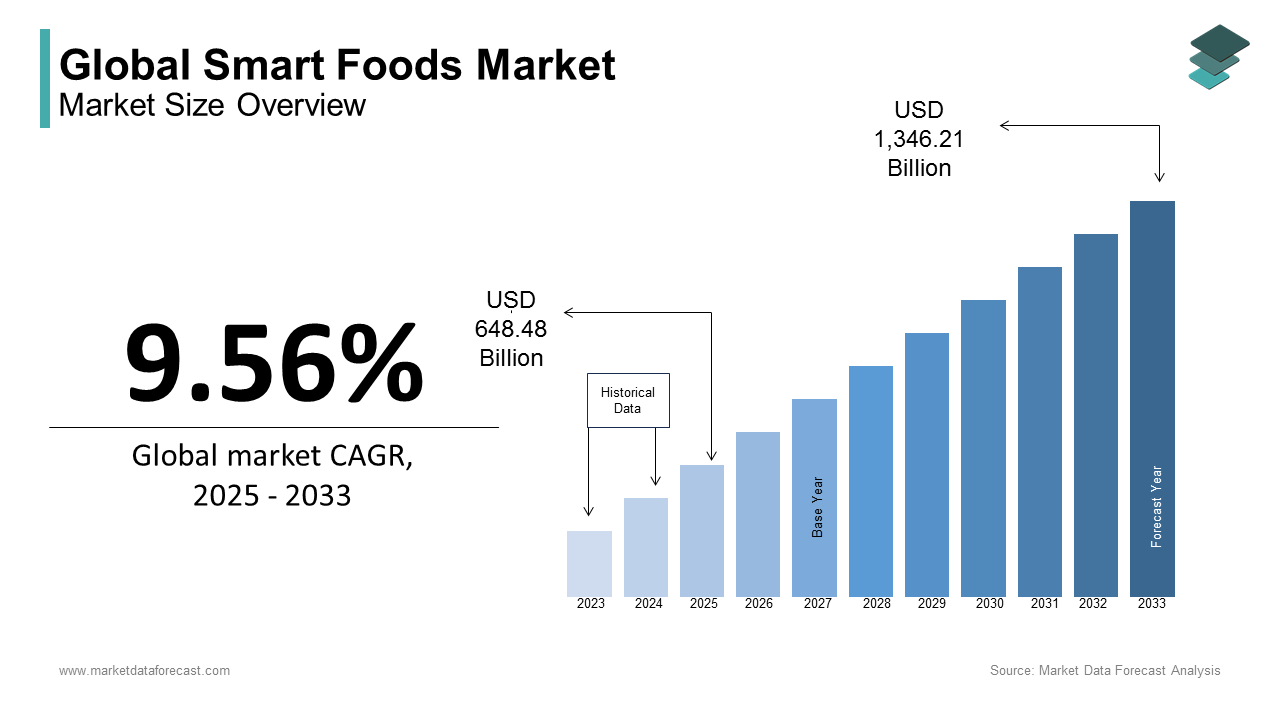

The global smart foods market size was calculated to be USD 591.89 billion in 2024 and is anticipated to be worth USD 1346.21 billion by 2033 from USD 648.48 billion In 2025, growing at a CAGR of 9.56% during the forecast period.

Smart foods are revolutionizing the global food industry by offering products that are nutritionally superior, environmentally sustainable, and beneficial for public health. Smart foods are integral to addressing global health challenges, including malnutrition, obesity, and chronic diseases such as diabetes and cardiovascular disorders. According to the World Health Organization (WHO), over 2 billion people suffer from micronutrient deficiencies worldwide which is highlighting the need for fortified and functional foods that can bridge nutritional gaps. Moreover, consumers are increasingly opting for healthier alternatives such as plant-based proteins and biofortified foods with the global prevalence of obesity tripling since 1975, as reported by the Centers for Disease Control and Prevention (CDC).

Traditional food production is responsible for nearly 26% of global greenhouse gas emissions from an environmental perspective, as per the Food and Agriculture Organization (FAO). Smart foods such as alternative proteins, lab-grown meat, and regenerative agriculture-based crops offer solutions to mitigate climate change and reduce water consumption. Additionally, the FAO estimates that shifting to more sustainable food sources could cut agricultural land use by 75% and consequently making smart foods a critical component in global sustainability efforts.

MARKET DRIVERS

One major driver is the increasing consumer awareness of health and wellness. There is a heightened demand for functional foods that offer health benefits beyond basic nutrition because individuals have become more conscious of their dietary choices. This trend is evident in the rising consumption of products fortified with vitamins, minerals, and probiotics. According to the Economic Research Service of the U.S. Department of Agriculture, in 2023, U.S. consumers' expenditures on food accounted for 12.9% of household budgets which is reflecting the prioritization of health-oriented food purchases.

Another significant factor is the advancement in food technology and innovation. Developments in areas such as genetically modified organisms (GMOs), encapsulated foods, and functional foods have expanded the range of smart food products available to consumers. These innovations enhance the nutritional profile, shelf life, and convenience of food products, making them more appealing to health-conscious consumers. The USDA reports that approximately 94% of U.S. soybeans, a major crop, are genetically modified for herbicide tolerance, significantly improving agricultural productivity and reducing the environmental impact of farming practices.

MARKET RESTRAINTS

One notable restraint is the lack of market growth in underdeveloped regions. Limited awareness and accessibility to smart food products in these areas hinder market expansion. According to the World Bank, as of 2023, approximately 690 million people worldwide are undernourished, with the majority residing in developing countries. This widespread food insecurity limits the demand for innovative food products, as the focus remains on basic nutrition. The World Bank emphasizes that addressing food insecurity in these regions is crucial for global food market development.

Another restraint is the high cost associated with developing and marketing innovative food products. The U.S. Food and Drug Administration notes that advancements in food technology require substantial investment in research, development, and compliance with regulatory standards. These costs often result in higher prices for smart food products, making them less accessible to price-sensitive consumers. Research from the Journal of Food Science and Technology reveals that the cost of new food product development often ranges between $100,000 to $500,000 for a single product, depending on its complexity. The FDA's New Era of Smarter Food Safety blueprint highlights the need for collaboration between industry stakeholders to manage these costs and ensure consumer safety.

MARKET OPPORTUNITIES

One notable opportunity is the increasing investment in climate-smart agricultural practices. The U.S. Department of Agriculture (USDA) has committed over $3 billion to approximately 140 pilot projects under the Partnerships for Climate-Smart Commodities initiative. These projects aim to promote the production and marketing of climate-smart commodities, benefiting more than 60,000 farms and encompassing over 25 million acres of working land. The USDA anticipates that these efforts will sequester more than 60 million metric tons of carbon dioxide equivalent over the projects' lifespans and is equivalent to removing over 12 million gasoline-powered passenger vehicles from the road for one year.

Another significant opportunity lies in the growing market for upcycled food products. Technological advancements and changing consumer preferences have led to innovative uses of food byproducts, creating new revenue streams and reducing waste. For instance, companies are transforming whey, a byproduct of cheesemaking, into nutritional products, and processing damaged avocados into cooking oil. According to the Environmental Protection Agency (EPA), food waste accounts for approximately 30-40% of the U.S. food supply, highlighting the potential of upcycling initiatives to address both economic and environmental concerns. This approach not only minimizes environmental impact but also offers economic benefits to farmers and local economies. The Financial Times reports that such initiatives are gaining traction, reflecting a broader trend towards sustainability in the food industry.

MARKET CHALLENGES

One major challenge is the complexity of supply chain adaptability. The U.S. Department of Agriculture highlights that consolidated processing capacities have led to supply bottlenecks, reducing effective plant and slaughter capacities. This centralization makes the supply chain vulnerable to disruptions, as seen during the COVID-19 pandemic, where small and midsize farmers struggled to access processing facilities, limiting their ability to bring products to market. A 2020 report by the USDA highlighted that about 1.5 billion pounds of pork were left unprocessed due to plant closures, causing a surge in supply chain disruptions. Building more distributed, local processing capacities is essential to enhance resilience and provide more choices for producers.

Another significant challenge is the difficulty in gathering accurate data within food manufacturing. The National Institute of Standards and Technology notes that, historically, food manufacturers have struggled with data collection, hindering their understanding of ingredients, products, and operations. In a 2021 report, NIST found that more than 40% of food manufacturers had inadequate or inconsistent data collection systems, making it difficult to ensure product consistency and quality. Although advancements in sensor technology have improved data gathering, many small and medium-sized manufacturers still find these technologies inaccessible or unaffordable. This lack of data impedes the optimization of processes and the assurance of product quality, posing a barrier to the advancement of smart food initiatives.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

9.56% |

|

Segments Covered |

By Food Type, End Products, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis; Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview of Investment Opportunities |

|

Regions Covered |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Market Leaders Profiled |

Cargill Inc. Arla Foods, Kerry Group, Nestlé, Archer Daniels Midland Company (ADM), Aveka, GSK, Firmenich, BASF, Kellogg |

SEGMENTAL ANALYSIS

By Food Type Insights

The functional foods segment was the largest segment in the smart foods market by accounting for a 39.4% of the global market share in 2024. These foods are enriched with additional nutrients or ingredients that provide health benefits beyond basic nutrition, such as fortified cereals, probiotic yogurts, and omega-3 enriched products. The rising prevalence of chronic diseases, including obesity, diabetes, and cardiovascular conditions, has led consumers to seek out functional foods as preventive measures. According to the World Health Organization, noncommunicable diseases are responsible for 41 million deaths annually, accounting for 74% of all global fatalities. This growing health consciousness among consumers significantly contributes to the prominence of functional foods in the market.

The genetically modified (GM) foods segment is experiencing the fastest growth in the smart foods market and is estimated to record a CAGR of 14.4% from 2025 to 2033. GM foods are developed through genetic engineering to enhance desired traits such as increased resistance to pests, improved nutritional content, and longer shelf life. The rapid adoption of GM crops in agriculture has been a key driver of this growth. For instance, the U.S. Department of Agriculture reports that in 2020, 94% of soybean and 92% of corn planted in the United States were genetically engineered varieties. The ability of GM foods to address food security challenges and meet the demands of a growing global population underscores their expanding role in the smart foods market.

By End Products Insights

The dairy products segment dominated the smart foods market by capturing 31.6% of the global market share in 2024. The growth of the dairy products segment is majorly driven by high consumer demand for functional dairy items like probiotic yogurts and fortified milk. The U.S. Department of Agriculture reports that in 2021, the U.S. food and beverage manufacturing sector employed 1.7 million people, with dairy product manufacturing being a significant contributor. This substantial employment underscores the importance of dairy products in the food industry.

The dietary supplements segment is swiftly gaining traction in the smart foods market and is expected to register a CAGR of 8.8% from 2025 to 2033. This surge is attributed to increasing health consciousness and a proactive approach to preventive healthcare among consumers. The U.S. Food and Drug Administration emphasizes the importance of dietary supplements in supporting health, noting that a significant portion of the population uses these products to enhance nutrient intake. A 2020 FDA survey revealed that 60% of individuals aged 45-64 and 50% of individuals aged 65 and older use dietary supplements, signalling an increased focus on maintaining health as individuals age. The rising prevalence of lifestyle-related diseases has further propelled the demand for dietary supplements, highlighting their expanding role in the smart foods market.

REGIONAL ANALYSIS

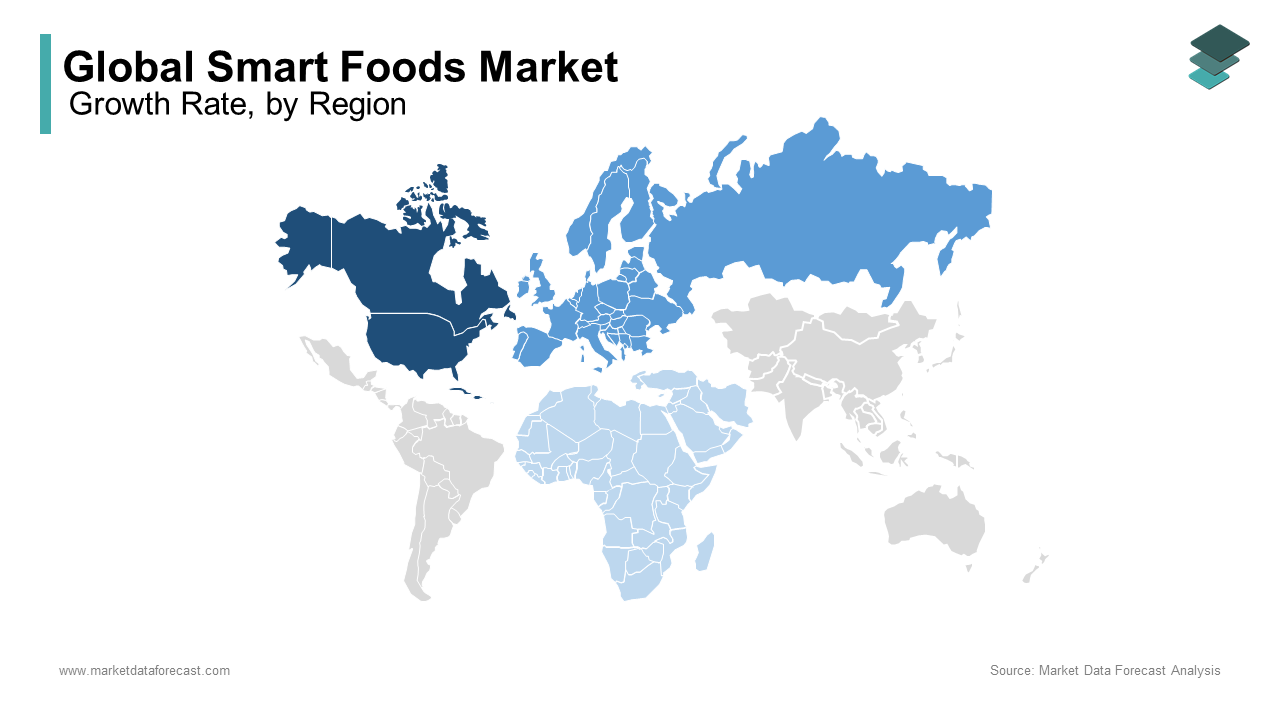

The North American region led the smart foods market by accounting for a significant 35.3% share of the global market in 2024. The CAGR for the regional market is anticipated to be 11.6% throughout the estimation period. This leadership is attributed to the region's advanced technological infrastructure, high consumer awareness regarding health and wellness, and substantial investments in food innovation. The U.S. Department of Agriculture reports that in 2023, U.S. consumers' expenditures on food accounted for 12.9% of household budgets, reflecting a strong market for innovative food products. Additionally, government initiatives promoting healthy eating and sustainable agriculture further bolster the market's growth in this region.

The Asia-Pacific region is registering the fastest growth and is expected to exhibit a CAGR of 12.4% during the projection period of 2025-2033. This rapid expansion is driven by increasing urbanization, rising disposable incomes, and a growing awareness of health and wellness among consumers. Governments in countries like China and India are investing in modernizing their agricultural sectors and promoting food innovation to ensure food security and meet the demands of their large populations. For instance, The Food and Agriculture Organization (FAO) reports that Asia accounts for over 80% of global aquaculture production, which has increased by over 8% annually in recent years. It is contributing significantly to the global supply of smart food products.

In Europe, the smart foods market is experiencing steady growth. The growing consumer demand for sustainable and health-oriented food options are driving the smart foods market in Europe. The European Union's Farm to Fork Strategy, which is a part of the European Green Deal, aims to create a fair, healthy, and environmentally-friendly food system. As part of this strategy, the EU has set a target to make 25% of all agricultural land organic by 2030, as reported by the European Commission.

In Latin America, the smart foods market is poised for growth due to improving economic conditions and increasing urbanization. The region's focus on enhancing agricultural productivity and sustainability is contributing to the gradual adoption of smart food products. Urbanization in the region also plays a pivotal role. By 2030, the United Nations expects that nearly 90% of the Latin American population will live in urban areas, creating a greater demand for innovative food solutions that are convenient, healthy, and sustainable. The Food and Agriculture Organization highlights that initiatives to enhance agricultural productivity and sustainability are underway in these areas, which may further support market growth.

The smart foods market in Middle East and Africa are also projected to experience growth in the coming years. Factors such as urbanization and increasing awareness of health and nutrition are contributing to the gradual adoption of smart food products in these regions. According to the African Development Bank, agricultural growth in the region is expected to reach 6% annually, with much of the focus on enhancing food systems through technology and innovation.

KEY MARKET PLAYERS AND COMPETITIVE LANDSCAPE

Major Players of the global smart foods market include Cargill Inc. Arla Foods, Kerry Group, Nestlé, Archer Daniels Midland Company (ADM), Aveka, GSK, Firmenich, BASF, Kellogg

The global smart foods market is characterized by intense competition among key players striving to capture market share through innovation and strategic initiatives. Companies such as Cargill Inc., Arla Foods, and Nestlé S.A. are at the forefront, leveraging advanced technologies and extensive research and development to introduce innovative products that cater to evolving consumer preferences. These industry leaders hold key technologies and focus on high-end markets, contributing significantly to the advancement of the smart foods sector.

The competitive landscape is further shaped by strategic partnerships, mergers, and acquisitions, enabling companies to expand their product portfolios and global reach. For instance, the acquisition of Whole Foods by Amazon in 2017 marked a significant shift in the market, integrating advanced logistics and technology into the natural and organic foods segment.

Additionally, companies are focusing on sustainability and health trends, developing products that align with consumer demand for nutritious and environmentally friendly options. This includes the development of functional foods, plant-based alternatives, and products with enhanced nutritional profiles. The emphasis on research and development, coupled with strategic market expansions, underscores the dynamic and competitive nature of the smart foods market.

Overall, the competition in the smart foods market is driven by innovation, strategic collaborations, and a keen focus on meeting consumer demands for health-conscious and sustainable food options.

TOP STRATEGIES USED BY THE KEY MARKET PARTICIPANTS

Product Innovation and Diversification: Companies are investing in research and development to create new products that cater to evolving consumer preferences. For instance, Simply Good Foods acquired Quest Nutrition in 2019, expanding its portfolio with high-protein snacks and shakes, and further diversified by purchasing Only What You Need (OWYN) in 2023, a plant-based protein shake brand. These acquisitions align with the growing demand for health-conscious and plant-based options.

Strategic Partnerships and Acquisitions: To enhance market reach and capabilities, companies are engaging in partnerships and acquisitions. For example, in 2022, Cargill formed a joint venture with Delacon to create a leading plant-based phytogenic feed additives business, focusing on healthier animal nutrition and sustainable solutions. This move strengthens Cargill's position in the smart food sector by expanding its product offerings and market presence.

Supply Chain Optimization and Sustainability Initiatives: Firms are optimizing their supply chains and implementing sustainable practices to meet consumer expectations and regulatory requirements. Nestlé S.A., for instance, has committed to achieving net-zero greenhouse gas emissions by 2050, working closely with farmers and suppliers to promote regenerative agriculture and reduce environmental impact. This commitment enhances Nestlé's brand reputation and aligns with the increasing consumer demand for sustainable products.

TOP 3 PLAYERS IN THE MARKET

Cargill Inc. has been at the forefront of integrating sustainable practices into its operations. The company has invested in regenerative agriculture, aiming to improve soil health and reduce environmental impact. Cargill's efforts in promoting sustainable farming practices contribute to the development of smart food solutions that meet consumer demands for health and sustainability.

Nestlé S.A. has significantly influenced the smart foods market through its focus on health and wellness. The company has expanded its portfolio to include plant-based and functional foods, catering to the growing consumer demand for healthier options. Nestlé's commitment to innovation and nutrition science has solidified its position as a leader in the smart foods sector.

Ingredion Incorporated has contributed to the smart foods market by developing innovative ingredient solutions. The company focuses on plant-based proteins and clean-label ingredients, aligning with consumer preferences for natural and sustainable products. Ingredion's advancements in food technology support the creation of smart food products that offer enhanced nutritional benefits.

RECENT HAPPENINGS IN THE MARKET

- In March 2024, NewSpring Franchise announced a strategic investment in Shake Smart, a healthy fast-casual concept. This partnership aims to accelerate Shake Smart's expansion and capitalize on the increasing consumer demand for nutritious, on-the-go meal options.

- In July 2024, Foodsmart partnered with TPG's Rise Fund to enhance the accessibility of its telenutrition and food benefits management platform. This collaboration seeks to improve health outcomes by providing personalized nutrition guidance and affordable meal planning to a broader population.

MARKET SEGMENTATION

This research report on the global smart foods market has been segmented and sub-segmented based on food type, end products, and region.

By Food Type

- Functional Food

- Encapsulated Food

- Genetically Modified Food

By End Products

- Bakery & Confectionery Products

- Dairy Products

- Meat Products

- Beverages

- Dietary Supplements

By Region

- North America

- Europe

- The Asia Pacific

- Latin America

- The Middle East and Africa

Frequently Asked Questions

1. What are the key factors driving the growth of the smart foods market?

Factors such as increasing consumer awareness of health and wellness, advancements in food technology, demand for functional foods, and changing dietary preferences are driving the market.

2. Who are the primary consumers of smart foods?

Health-conscious consumers, fitness enthusiasts, people with dietary restrictions (e.g., lactose-intolerant, gluten-free), and aging populations looking for preventive health solutions.

3. How is technology influencing the smart foods market?

Technologies such as artificial intelligence (AI) in personalized nutrition, biotechnology for enhanced ingredients, and sustainable food processing methods are shaping the industry.

4. Which smart food segments are gaining popularity?

Plant-based alternatives, functional beverages, fortified snacks, protein-rich foods, and gut-health-focused products like probiotics and fermented foods are trending.

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2500

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]