Global Smart Factory Market Size, Share, Trends, & Growth Forecast Report Segmented by Technology (Information Technology System, Enterprise Resource Planning (ERP), Manufacturing Execution System, and Industrial Control System), Field Devices, Application, and Region (North America, Europe, Asia Pacific, Latin America, and Middle East & Africa), Industry Analysis From 2024 to 2033

Global Smart Factory Market Size

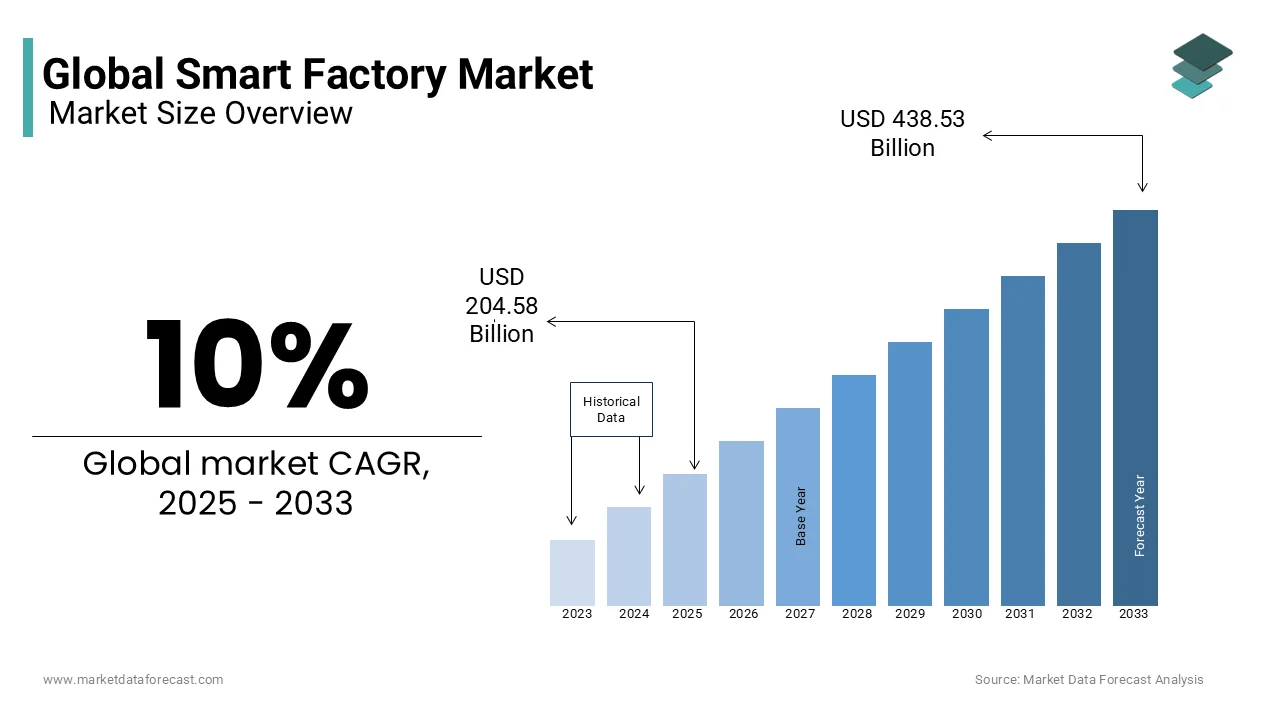

The global smart factory market was worth USD 185.98 billion in 2024. The global market is projected to grow at a CAGR of 10% from 2025 to 2033, and the global market size is estimated to be worth USD 438.53 billion by 2033 from USD 204.58 billion in 2025.

A smart factory represents advanced technologies like artificial intelligence (AI), the Internet of Things (IoT), robotics, and big data analytics are integrated into production processes. These factories use interconnected machines and systems to automate tasks, optimize efficiency, and enable real-time decision-making. The goal of a smart factory is to improve productivity, reduce operational costs, and enhance product quality while ensuring flexibility in meeting customer demands. This concept is a key pillar of Industry 4.0, which focuses on digital transformation across industries.

One of the most significant impacts of smart factories is their ability to reduce downtime through predictive maintenance. A study found that predictive maintenance can reduce machine downtime by 30% to 50% and extend the lifespan of machinery by 20% to 40%. This not only saves costs but also ensures smoother production flows. Additionally, smart factories have been shown to improve energy efficiency significantly. According to the U.S. Department of Energy, implementing smart manufacturing practices can lead to energy savings of 10% to 20%, contributing to global sustainability goals.

Another interesting statistic comes from the World Economic Forum, which highlights that smart factories can increase overall production output by 15% to 20% while improving product quality by reducing defects. Furthermore, the integration of IoT devices in manufacturing has led to a dramatic increase in data collection.

MARKET DRIVERS

Advancements in Artificial Intelligence and Machine Learning

The integration of AI and machine learning drives smart factory adoption by enabling predictive maintenance and process optimization. According to the U.S. Department of Energy, predictive maintenance reduces downtime by 30-50% and lowers maintenance costs by 25%. These technologies allow real-time monitoring and self-diagnosis of equipment, minimizing disruptions. The National Institute of Standards and Technology (NIST) states that AI-driven systems improve energy efficiency by up to 20% in industrial settings. Additionally, a report by the International Energy Agency (IEA) shows that AI can cut energy consumption in manufacturing by 10-15%. By leveraging these advancements, manufacturers achieve higher precision, reduce waste, and align with sustainability goals. This technological evolution not only enhances productivity but also fosters innovation, making AI and machine learning pivotal forces propelling the smart factory market forward.

Growing Demand for Customization and Flexibility

The rising consumer demand for personalized products is driving smart factory adoption. The U.S. Census Bureau reports that 48% of consumers are willing to pay more for customized goods, pushing manufacturers to adopt flexible systems. Smart factories leverage IoT and robotics to enable mass customization, reducing changeover times by 50%, as per the National Science Foundation. The Environmental Protection Agency (EPA) notes that flexible production systems minimize material waste by 20%, aligning with sustainability goals. Furthermore, the Federal Trade Commission (FTC) noted that modular systems enhance adaptability, allowing manufacturers to respond quickly to market trends. This shift towards tailored manufacturing meets evolving customer expectations while optimizing resource utilization, positioning customization as a critical growth driver in the smart factory landscape.

MARKET RESTRAINTS

High Initial Investment Costs

The implementation of smart factory technologies requires significant upfront investment, acting as a restraint. The U.S. Department of Commerce estimates that deploying industrial IoT systems costs between $50,000 and $200,000 per facility. Small and medium-sized enterprises (SMEs) face challenges securing funding, with the Federal Reserve reporting that only 30% of SMEs have access to sufficient capital for digital upgrades. Integrating legacy systems with new technologies further increases costs. The U.S. Small Business Administration (SBA) states that 60% of SMEs delay digital transformation due to financial constraints. While long-term benefits exist, the initial expenditure remains a barrier, particularly in developing regions. These financial hurdles hinder extensive adoption, slowing the pace of smart factory implementation globally.

Cybersecurity Vulnerabilities

Cybersecurity risks pose a major challenge to smart factory growth. The U.S. Cybersecurity and Infrastructure Security Agency (CISA) reports a 25% increase in cyberattacks on manufacturing systems in 2022, with ransomware being a primary threat. Connected devices create entry points for hackers, potentially disrupting operations. The National Institute of Standards and Technology (NIST) reveals that 60% of manufacturers lack robust cybersecurity protocols, making them vulnerable to breaches. The Federal Bureau of Investigation (FBI) states that the average cost of a cyberattack on industrial systems exceeds $1 million. Such attacks cause financial losses and damage brand reputation. These vulnerabilities deter companies from fully embracing smart factory technologies despite their potential benefits which is showcasing by pointing out the need for stronger security measures.

MARKET OPPORTUNITIES

Integration of 5G Technology

The rollout of 5G networks presents transformative opportunities for smart factories. The Federal Communications Commission (FCC) states that 5G supports up to 1 million connected devices per square kilometer, enabling seamless communication between machines. This capability enhances real-time data processing and automation. The U.S. Department of Energy emphasizes that 5G-powered systems reduce energy consumption by 25% through optimized workflows. The National Science Foundation notes that 5G enables augmented reality (AR) applications for remote maintenance, cutting repair times by 40%. As global 5G infrastructure expands, its integration into smart factories will unlock unprecedented precision and scalability. This technology drives innovation, making 5G a cornerstone for future smart manufacturing ecosystems.

Adoption of Sustainable Manufacturing Practices

Smart factories offer opportunities to advance sustainable manufacturing practices. The Environmental Protection Agency (EPA) reports that smart technologies reduce greenhouse gas emissions by 15% through optimized energy use. Advanced analytics and IoT sensors minimize waste by enabling precise resource monitoring. The U.S. Department of Energy states that smart factories achieve a 20% reduction in water usage by implementing intelligent systems. The National Renewable Energy Laboratory (NREL) stresses that renewable energy integration cuts carbon footprints by 30%. As governments enforce stricter environmental regulations, adopting sustainable practices becomes both a necessity and a competitive advantage. Smart factories lead the way in green manufacturing, aligning with global sustainability goals.

MARKET CHALLENGES

Skills Gap in the Workforce

A significant challenge facing smart factories is the growing skills gap among workers. The U.S. Bureau of Labor Statistics projects a shortage of 2.1 million skilled manufacturing workers by 2030. Transitioning to smart factories demands expertise in AI, robotics, and data analytics, areas where traditional workers often lack training. The National Association of Manufacturers (NAM) reports that 80% of manufacturers face difficulties finding qualified candidates for advanced roles. The Department of Labor estimates an average training expense of $1,500 per worker to upskill employees. This shortage hampers effective operation and maintenance of smart systems. Addressing this skills gap is crucial for realizing the full potential of smart factories and ensuring their long-term success.

Interoperability Issues Among Systems

Interoperability challenges between diverse systems hinder smart factory functionality. The National Institute of Standards and Technology (NIST) identifies that 60% of manufacturers encounter difficulties integrating legacy equipment with modern IoT platforms. These compatibility issues fragment data flows and reduce efficiency. The U.S. Department of Commerce notes that interoperability problems result in annual losses of $15 billion for the manufacturing sector. The International Electrotechnical Commission (IEC) observed the lack of standardized protocols complicates vendor collaboration. Without unified standards, manufacturers struggle to achieve end-to-end connectivity, limiting scalability. Overcoming these interoperability barriers is essential for maximizing the benefits of interconnected systems and driving smart factory adoption.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

10% |

|

Segments Covered |

By Technology, Field Devices and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview of Investment Opportunities |

|

Regions Covered |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Market Leaders Profiled |

Insights Inc., Invensys PLC, Mitsubishi Electric Corporation, Ubisense Group PLC, CMC Associates, Johnson Controls Inc., Microsoft, General Electric Co., Apriso Corporation, Siemens AG, Rockwell Automation, and ABB Ltd. |

SEGMENTAL ANALYSIS

By Technology Insights

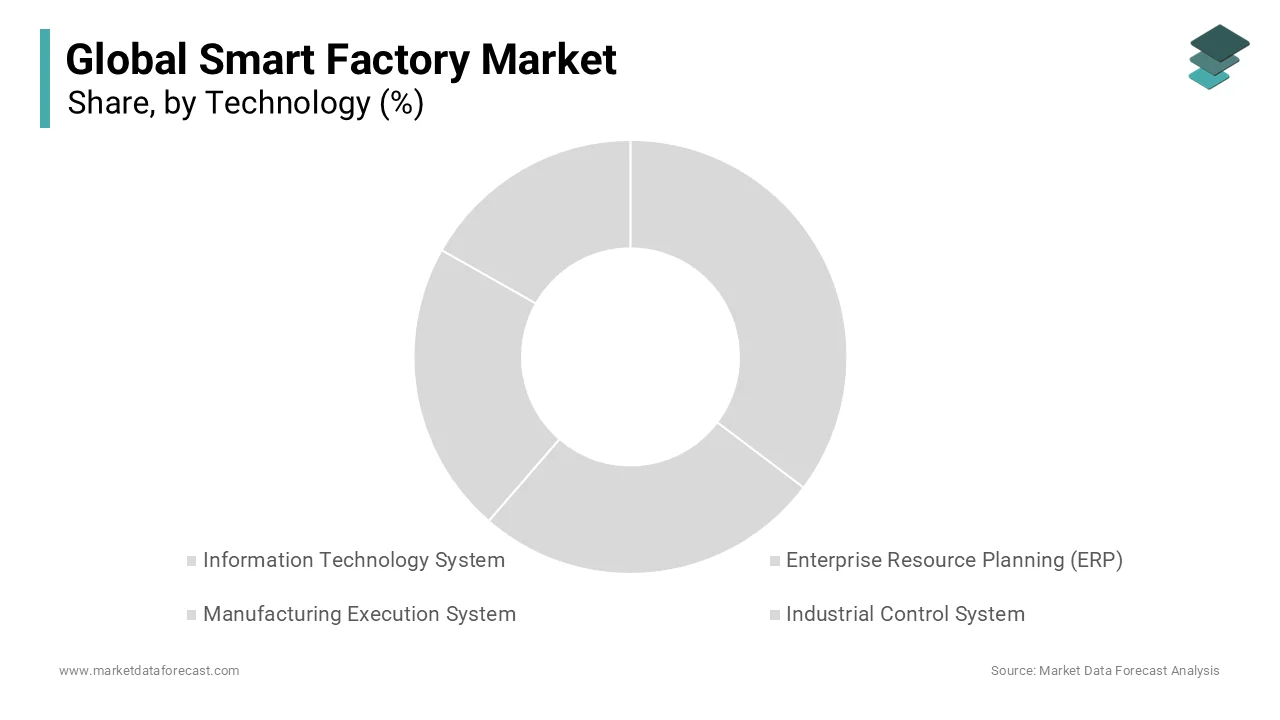

The Manufacturing Execution System (MES) dominates the Smart Factory Market by technology, holding approximately 33% of the market in 2024. Its leadership stems from optimizing production and reducing inefficiencies. The U.S. Department of Commerce reports U.S. manufacturing output was $2.34 trillion in 2022, with MES boosting productivity by 12%. The National Institute of Standards and Technology states MES cuts production errors by 18%, enhancing real-time oversight. Its importance lies in bridging planning and execution, ensuring quality and cost savings, making it vital for smart factories aiming to stay competitive in a data-driven landscape.

The Industrial Control System (ICS) segment grows fastest, with a CAGR of 8.5% from 2025 to 2030. Its surge is driven by automation and real-time control needs. The U.S. Bureau of Labor Statistics reports manufacturing automation rose 10% annually since 2021, with ICS at the core. The U.S. Department of Energy notes ICS reduces energy consumption by 8% in factories, per 2023 data, aiding sustainability. Its importance lies in integrating equipment and data, enhancing precision and scalability. This aligns with Industry 4.0 goals, making ICS critical for future-ready manufacturing, as government trends confirm.

By Field Devices Insights

The Industrial Robotics segment led the Smart Factory Market and had a 35.8% market share in 2024. Its dominance is due to automation’s role in precision and output. The U.S. Census Bureau confirms 39,708 industrial robots were installed in 2022, up 10% from 2021. The U.S. Department of Labor reports robotics cut manufacturing labor costs by 15% in 2023, driving adoption. Its importance lies in enabling high-speed, accurate production, meeting demand in industries like automotive and electronics, and transforming factories into efficient, competitive hubs.

The Industrial Network segment is anticipated to witness the fastest CAGR of 10.8% over the forecast period. Its rise is propelled by IoT and connectivity demands. The U.S. National Science Foundation reports IoT devices in manufacturing hit 16.8 billion in 2023, up 20% from 2022, relying on networks. The U.S. Department of Commerce states network-enabled data use increased factory efficiency by 25% in 2023. Its importance lies in real-time data sharing, boosting agility and decision-making. This supports smart factory evolution, aligning with national tech advancement goals, per government insights.

By Application Insights

The Discrete Industry segment emerged as the best performer in the Smart Factory Market with a 55.3% market share in 2024. It is fueled by automotive and transportation demands. The U.S. Department of Transportation reports 11.7 million vehicles were produced in 2023 with smart tech cutting assembly time by 15%. The Bureau of Economic Analysis notes discrete manufacturing added $1.38 trillion to U.S. GDP in 2022 and is showcasing its economic weight. Its importance lies in delivering precise, scalable production, meeting consumer needs for quality and customization efficiently.

The Process Industry segment is estimated to register the fastest CAGR of 9.8% from 2025 to 2033. Its expansion is driven by automation in pharmaceuticals and food sectors. The U.S. Food and Drug Administration reports pharmaceutical production rose 13% in 2023, aided by smart systems. The U.S. Department of Agriculture states food processing efficiency improved 10% in 2023 via automation. Its importance lies in ensuring safety and compliance while scaling output to meet rising global demand. This segment’s growth reflects critical needs for quality control and regulatory adherence, per government data.

REGIONAL ANALYSIS

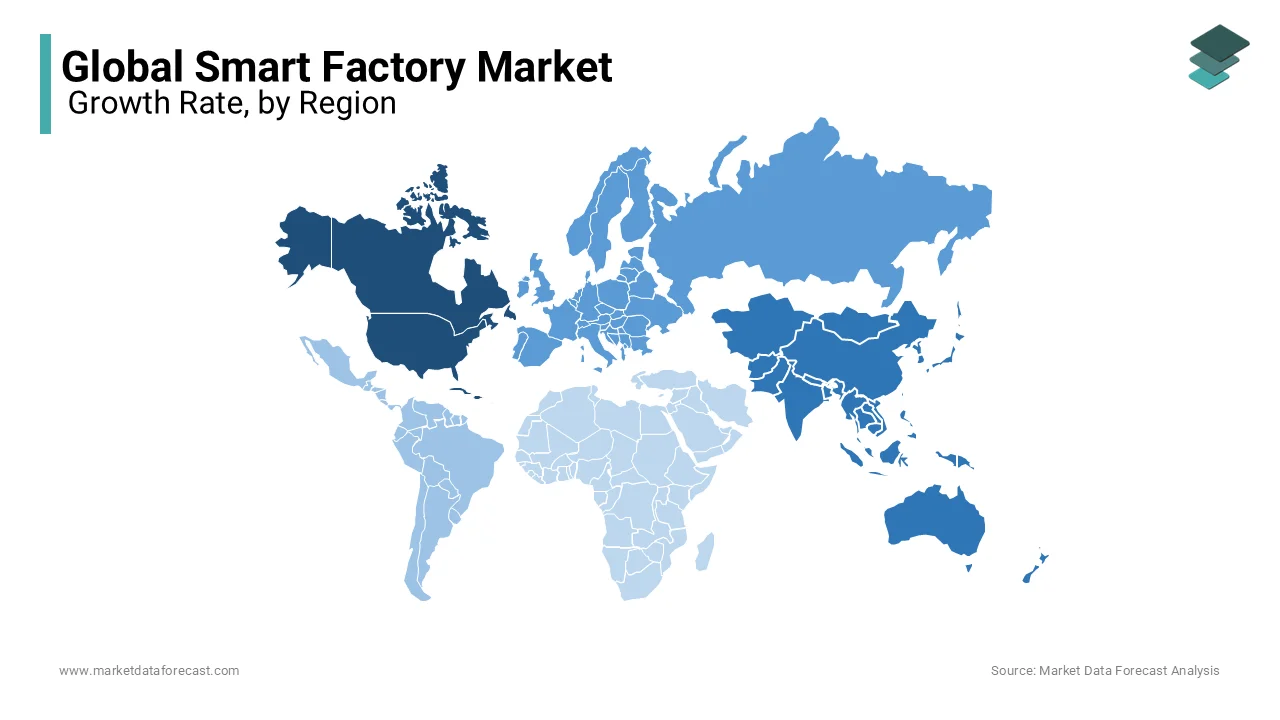

North America held a significant position in the Smart Factory Market and a 26.3% market share in 2024 which is driven by advanced technological adoption and a robust manufacturing base. According to the U.S. Bureau of Economic Analysis, private goods-producing industries, which include manufacturing, increased by 1.5% in the third quarter of 2023, contributing substantially to the U.S. GDP. The U.S. Department of Commerce emphasizes the need for investment in technological innovation and R&D to ensure that future technologies are designed, discovered, and manufactured domestically and is exhibiting the region's commitment to maintaining its competitive edge in smart manufacturing. North America's importance in the smart factory landscape is underscored by its strong innovation ecosystem and substantial R&D investments, positioning it as a global leader in smart factory solutions.

The Asia-Pacific region is experiencing rapid growth in the Smart Factory Market and is expected to advance at a CAGR of 13.2% during the forecast period which is propelled by swift industrialization and proactive government initiatives. China's economy expanded by 5% in 2024, with industrial output rising by 5.8%, as reported by the National Bureau of Statistics and spotlighted by the Associated Press. This growth is supported by strong exports and recent stimulus measures aimed at enhancing manufacturing capabilities. In India, overall exports in November 2023 were estimated at USD 62.58 billion, showing a positive growth of 1.23% over November 2022, according to the Ministry of Commerce and Industry. This surge is driven by increased manufacturing investments and the adoption of IoT technologies. The region's vast production scale and cost efficiencies strengthen its status as a global manufacturing powerhouse.

Europe stands as a significant player in the smart factory market, with projections indicating substantial growth in the coming years. This growth is driven by the increasing need for manufacturers to enhance productivity, reduce operational costs, and maintain competitiveness in the global market. Germany leads the region, commanding approximately 26% of the European smart factory market share as of 2024. The adoption of advanced manufacturing technologies, such as Industrial Internet of Things (IIoT) and automation, is further bolstered by initiatives like Germany's "Industrie 4.0," aiming to revolutionize manufacturing processes across the continent.

Latin America's smart factory market is poised for significant expansion. This growth is attributed to rapid industrialization and the increasing adoption of automation technologies across various sectors. Countries like Brazil and Mexico are at the forefront, with Brazil witnessing substantial investments from global players. Notably, Chinese electric vehicle manufacturers, such as BYD, have established production facilities in Brazil, transforming the region into a strategic hub for automotive manufacturing. These developments underscore Latin America's potential as an emerging market for smart manufacturing solutions.

The Middle East and Africa (MEA) region is gradually embracing smart factory technologies with growth prospects linked to ongoing industrialization efforts and investments in automation. While specific market size data is limited, the region's adoption of smart manufacturing is influenced by initiatives aimed at economic diversification and technological advancement. Countries like the United Arab Emirates and Saudi Arabia are investing in modernizing their industrial sectors, which is expected to drive the uptake of smart factory solutions. The overall growth trajectory in the MEA region is anticipated to be steady, contingent upon infrastructure development and supportive policy frameworks.

Top 3 Players in the Market

Siemens AG (Germany)

Siemens AG is a global leader in industrial automation, digitalization, and smart factory solutions, leveraging advanced IoT, AI, and industrial software to optimize manufacturing. In October 2024, Siemens acquired Altair Engineering for $10.6 billion, significantly expanding its industrial software and AI capabilities. This acquisition is expected to add approximately €600 million to Siemens’ digital business revenue, which totaled €7.3 billion in 2023. Siemens continues to drive smart factory innovation through MindSphere, its cloud-based IoT platform that enables predictive maintenance, real-time monitoring, and data-driven optimization, helping manufacturers improve efficiency and reduce downtime.

ABB Ltd. (Switzerland)

ABB Ltd. remains a dominant force in robotics, industrial automation, and electrification, providing AI-powered automation solutions for smart factories. The company’s ABB Ability™ digital platform integrates real-time monitoring, AI-driven analytics, and predictive maintenance tools to enhance operational efficiency. In December 2024, ABB partnered with Microsoft to integrate AI-powered automation solutions into manufacturing, helping industries improve energy efficiency and sustainability. ABB’s investments in collaborative robots (cobots) and smart control systems have positioned it as a key player in the evolution of fully automated, data-driven factories.

Rockwell Automation Inc. (United States)

Rockwell Automation is at the forefront of smart manufacturing, industrial IoT, and real-time analytics, enabling manufacturers to optimize their operations with data-driven insights and automation control systems. Its FactoryTalk software suite is widely used for process optimization and digital twin technology, allowing factories to simulate and enhance production lines before implementation. In November 2024, Rockwell Automation partnered with NVIDIA to develop AI-powered automation and machine vision solutions, further improving efficiency in manufacturing processes. The company is also pioneering 5G-enabled smart factory solutions, facilitating real-time remote monitoring and control, making it a key innovator in next-generation industrial automation.

TOP STRATEGIES USED BY THE KEY MARKET PARTICIPANTS

Siemens AG – Expansion Through Acquisitions and Digitalization

Siemens employs a merger and acquisition (M&A) strategy to enhance its industrial software and automation portfolio. A prime example is its $10.6 billion acquisition of Altair Engineering in October 2024, aimed at strengthening its AI-driven industrial software and simulation tools. Additionally, Siemens focuses heavily on IoT-driven digitalization through its MindSphere platform, which enables real-time predictive maintenance, remote monitoring, and cloud-based automation for smart factories. The company also integrates AI and machine learning into its manufacturing solutions to enhance efficiency and reduce downtime, ensuring a strong foothold in the digital transformation of industrial automation.

ABB Ltd. – AI and Robotics Innovation with Strategic Partnerships

ABB focuses on AI-powered robotics and automation solutions to remain a leader in the smart factory market. Its ABB Ability™ digital platform integrates data analytics, AI, and machine learning for predictive maintenance and real-time performance tracking. A major strategic move by ABB in December 2024 was its partnership with Microsoft to integrate AI-driven automation solutions, enhancing factory energy efficiency and sustainable manufacturing. ABB also continues to expand its cobots (collaborative robots) and machine vision technologies, which are vital in increasing production flexibility. By leveraging AI-powered industrial control systems, ABB ensures smarter and more autonomous factory operations.

Rockwell Automation Inc. – AI, 5G, and Industrial IoT Leadership

Rockwell Automation is positioning itself as a leader in AI-powered smart manufacturing and industrial IoT (IIoT). The company invests in AI, 5G, and edge computing to enhance factory automation capabilities. Its FactoryTalk® software suite provides digital twin technology that helps manufacturers optimize production processes before full-scale implementation. In November 2024, Rockwell partnered with NVIDIA to integrate AI-powered machine vision and automation control, strengthening its foothold in intelligent manufacturing. Additionally, Rockwell is actively developing 5G-enabled automation solutions, allowing factories to implement real-time, remote-controlled manufacturing operations which is a game-changer in industrial automation.

COMPETITIVE LANDSCAPE

The smart factory market is highly competitive, driven by rapid advancements in automation, artificial intelligence (AI), industrial IoT (IIoT), and digital twin technologies. The market is dominated by global players such as Siemens AG, ABB Ltd., and Rockwell Automation Inc., each leveraging distinct strategies to strengthen their market position.

Competition in the market is primarily fueled by technological innovation, with companies racing to develop AI-driven automation, robotics, and real-time analytics solutions. Siemens leads with its industrial software and IoT integration, particularly through its MindSphere platform and major acquisitions like Altair Engineering ($10.6 billion, 2024). ABB, on the other hand, focuses on AI-powered robotics and automation, forming key partnerships such as its collaboration with Microsoft to enhance factory energy efficiency. Rockwell Automation is heavily investing in 5G, industrial IoT, and AI-driven analytics, positioning itself as a leader in connected smart factories.

The competition is also geographically diverse, with strong players emerging from Europe, North America, and Asia-Pacific. Chinese companies such as Huawei and Fanuc are increasing their presence, challenging Western dominance. As global demand for automated and sustainable manufacturing grows, competition is expected to intensify, with new entrants and strategic alliances shaping the future of smart factory innovation.

KEY MARKET PLAYERS

The major players in the global smart factory market include Insights Inc., Invensys PLC, Mitsubishi Electric Corporation, Ubisense Group PLC, CMC Associates, Johnson Controls Inc., Microsoft, General Electric Co., Apriso Corporation, Siemens AG, Rockwell Automation, and ABB Ltd.

RECENT HAPPENINGS IN THE MARKET

- In December 2024, private equity firm EQT and Singapore's sovereign wealth fund GIC acquired a majority stake in UK-based smart meter provider Calisen, valuing the company at approximately £4 billion. Calisen manages 12 million smart meters and offers services in electric vehicle charging units, solar and battery technology, and heat pumps.

- In November 2024, Siemens announced the acquisition of U.S. industrial software company Altair for $10.6 billion. This strategic move aims to bolster Siemens' presence in the industrial software market, emphasizing the growing importance of software in smart factory operations.

- In February 2025, JLL Partners established a $1.1 billion continuation fund to extend its ownership of Solvias, a contract pharmaceuticals researcher and manufacturer. This initiative attracted investments from TPG and Pantheon which is drawing attention to the trend of private equity firms retaining control over valuable assets in the smart factory sector.

MARKET SEGMENTATION

This research report on the global smart factory market is segmented and sub-segmented into the following categories.

By Technology

- Information Technology System

- Enterprise Resource Planning (ERP)

- Manufacturing Execution System

- Industrial Control System

By Field Devices

- Industrial Robotics

- Articulated Robot

- Cylindrical Robot

- Scara Robot

- Cartesian Robot

- Control Devices

- Sensors

- Relays & Switches

- Motors & Drive

- Industrial Network

- RFID System

- Chipless RFID

- Chip-Based RFID

- Wireless Network

- Chipsets

- Microprocessor System

- Sensors

- Wired Network

- Ethernet Media Converters

- Unmanaged Switches

- Managed Switches

- RFID System

By Application

- Process Industry

- Pharmaceuticals

- Food & Beverages

- Chemical

- Oil & Gas

- Discrete Industry

- Automotive & Transportation

- Packaging

- Mining, Minerals & Metals

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

Frequently Asked Questions

What is driving the growth of the global Smart Factory market?

The growth of the global Smart Factory market is driven by several factors, including the increasing adoption of Industry 4.0, the need for improved manufacturing efficiency, rising labor costs, and advancements in technologies such as IoT, AI, and robotics.

How does a Smart Factory improve manufacturing efficiency?

A Smart Factory improves manufacturing efficiency through real-time monitoring and control of production processes, predictive maintenance to reduce downtime, optimized supply chain management, and the use of AI and machine learning to enhance decision-making and process optimization.

What are the key challenges faced in implementing Smart Factory solutions?

Key challenges in implementing Smart Factory solutions include high initial investment costs, the need for skilled workforce, data security concerns, integration of legacy systems with new technologies, and the complexity of managing large amounts of data.

What industries are the primary adopters of Smart Factory technologies?

Primary adopters of Smart Factory technologies include the automotive, aerospace, electronics, pharmaceuticals, and consumer goods industries. These sectors benefit significantly from the enhanced efficiency, quality, and flexibility offered by Smart Factory solutions.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2500

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]