Global Smart Electricity Meter Market Research Report - Segmentation by Phase (Single, Three), By Communication Technology Type (Power Line Communication, Radio Frequency, Cellular), By End-Users (Industrial, Commercial, Residential)- Industry Analysis, Size, Share, Growth, Trends and Forecast 2024 to 2032.

Global Smart Electricity Meter Market Size (2024 to 2032):

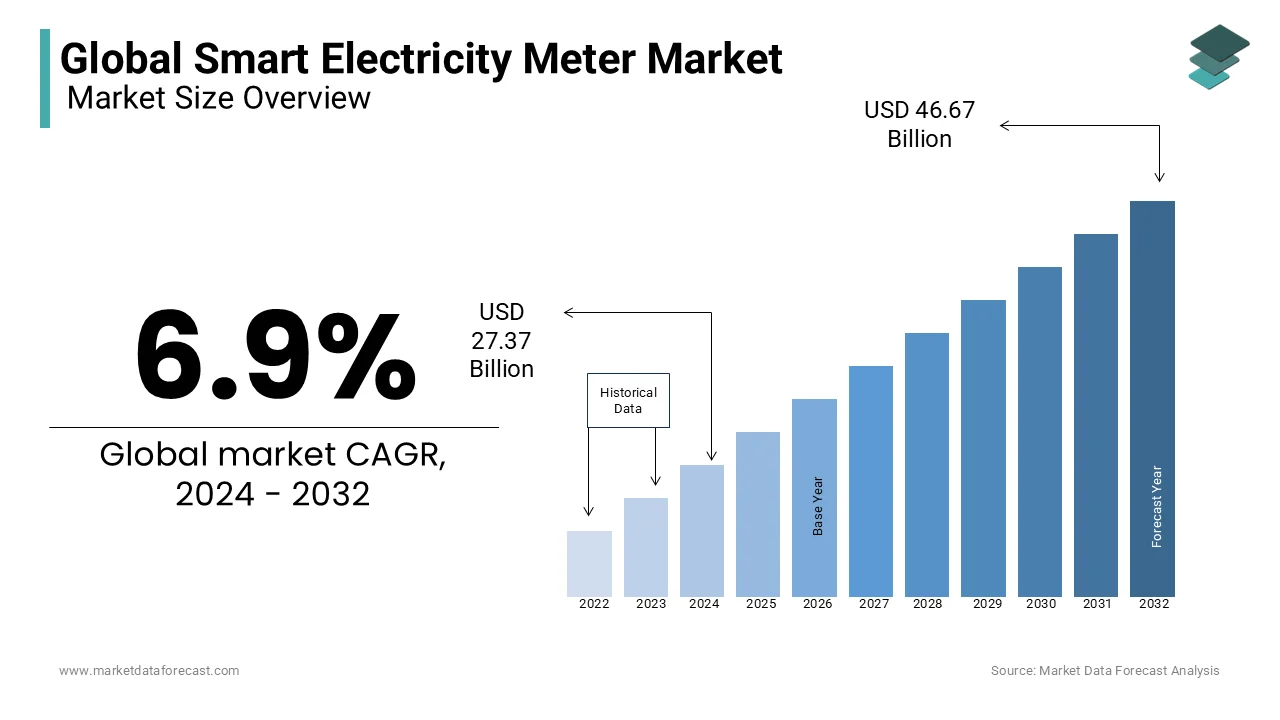

The Global Smart Electricity Meter Market was worth US$ 25.6 billion in 2023 and is anticipated to reach a valuation of US$ 46.67 billion by 2032 from US$ 27.37 billion in 2024, and it is predicted to register a CAGR of 6.9% during the forecast period 2024-2032.

MARKET SCENARIO

Electricity may be a basic need in today's world, where the smart electrical meter is the advancement brought in to take care of data regarding usage and avoiding any unaccounted consumption. Smart electricity meters facilitate the inline communication of electricity suppliers with consumers' electricity meters wipe out the manual intervention in meter readings. Smart Electricity meters provide consumers with accurate real-time data of their energy consumption while rendering greater control over electricity consumption. The smart electricity meters also help the buyer in selecting tariff plans tailored to suit their energy consumption.

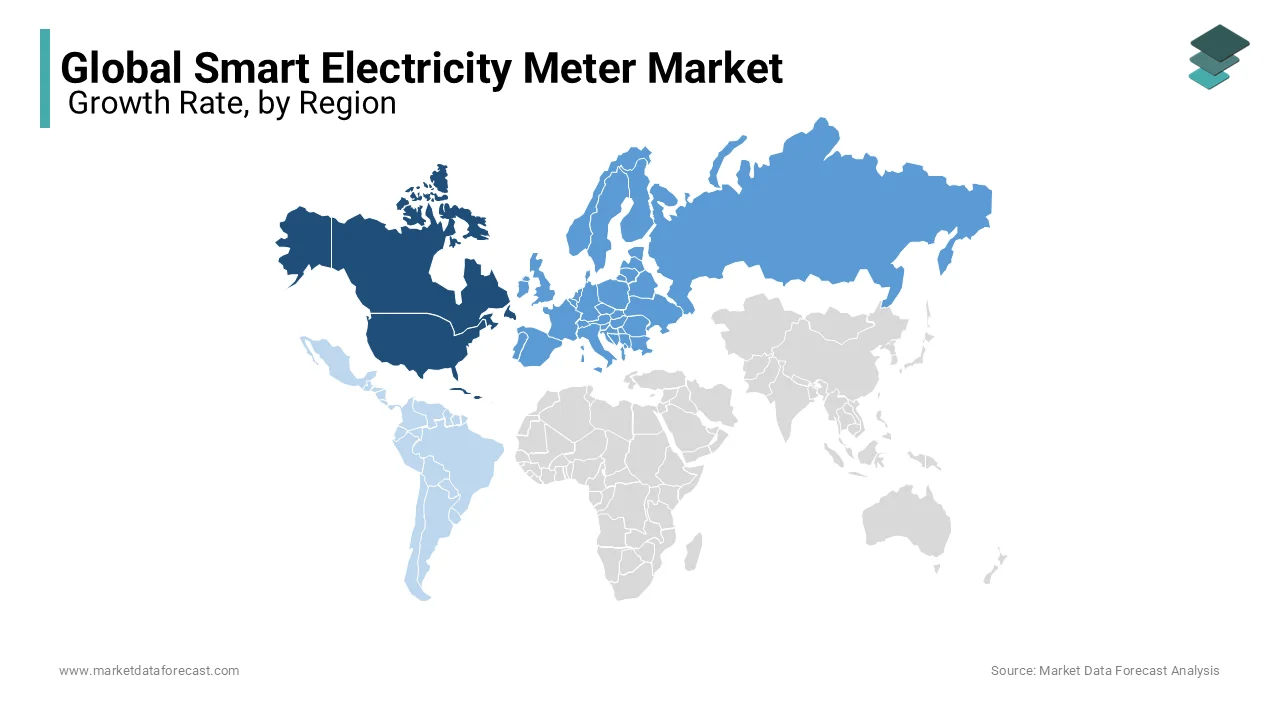

The smart electricity meter market is witnessing significant growth with favorable government mandates and monetary incentives. Also, additional benefits like efficient energy management, controlled energy consumption and greater security against electricity theft will drive the smart meter market. North America is the leading region for these smart electricity meters around the world.

MARKET DRIVERS

Smart electric meters can assist the end-users in watching the electricity consumption data and thus customize their usage according to the electricity tariff rates.

Smart electricity meters are intelligent devices that can measure power consumption alongside remote meter connection and disconnection, reporting, fault detection, and analysis of the used power in units on a daily basis. Smart meters also can assist in voltage & power quality monitoring and collection & storage of real-time data within the central system. Therefore, a customer can access their energy consumption information anytime and take proper measures to chop down energy costs. These allow a discount on the consumption of electricity during peak time as customers can observe, calculate, and analyze their usage to scale back the energy consumption during threshold hours, managing energy costs. These benefits offered by smart electric meters over traditional meters have attracted the eye of governments and several end-users, increasing the adoption of smart electric meters in recent years, thereby pushing the global smart electricity meter market forward.

MARKET RESTRAINTS

One of the main limitations of the deployment of smart electric meters is the gap in terms of installation cost between the cost-bearing party and the potential beneficiary.

The prevailing price for the installation and operation of smart meters is exceptionally high. Smart meter deployment is extremely capital-intensive for both utility providers and consumers. The costs related to installation for these smart electric meters are too high in comparison to the standard electro-mechanical and electronic meters. As a result, most of the utility providers are reluctant to shift their focus toward the installation of this latest technology. In most countries, the states don't provide subsidies, and hence, funding may be a severe restraint for smart power meter deployment. Because of this reason, countries are still using traditional analog meters and thus act as a restraint for the global smart electricity meter market.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 to 2032 |

|

Base Year |

2023 |

|

Forecast Period |

2024 to 2032 |

|

CAGR |

6.9% |

|

Segments Covered |

By Phase, Communication Technology Type, End-Users, and Region. |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview of Investment Opportunities |

|

Regions Covered |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Market Leaders Profiled |

Itron Inc, Landis+Gyr Ltd, GE Energy Company, Elster Group, Sensus USA Inc, Silver Spring, Jiangsu Linyang, Echelon, Holley Metering |

SEGMENTAL ANALYSIS

Global Smart Electricity Meter Market Analysis By Phase

Three-phase meters are mostly utilized in industrial applications and large commercial applications. The affordable price of the three-phase meters compared to its counterpart and the increasing number of industries and commercial facilities around the world drive the installations of the three-phase smart electric meters.

Global Smart Electricity Meter Market Analysis By End-Users

Increasing investments for the development of commercial facilities like banking institutions, educational institutions in developed and developing economies have fueled the expansion within the commercial segment. The installation of those devices in the residential sector help in decreasing the levels of CO2 emissions globally as consumer awareness towards energy savings would increase. The rise in residential construction activities and government policies like the EU 20-20-20 policy, which aims to convert 80% of the installed meter base to smart meters, have ensured the expansion within the demand for smart electric meters.

REGIONAL ANALYSIS

The North American smart electricity meter market is reaching maturity, leading to a receding business as the sizes of the project are now decreasing from millions to a little of 10,000s. However, the replacement of first-generation meters and therefore the shift to advanced metering infrastructure with higher capabilities and improved technology are expected to revive the smart electricity meters market in this region in the future.

Europe's smart electricity meters market also witnessed excellent growth within the installation of these meters in several nations. The main factor driving the market within the region is consumer awareness for the increased adoption of renewable sources of energy, along with government subsidies.

The Asia Pacific smart electricity market in recent years has witnessed maximum growth in population, which has seen immense growth in sectors like residential, commercial and industrial. The increased rural electrification has seen new grids being used to satisfy the electricity demand. China has the utmost deployment of smart power meters in the Asia Pacific region and globally.

Brazil, Mexico are major countries in Latin America smart electricity market that are expected to have major smart meter rollouts in the coming years.

KEY PLAYERS IN THE GLOBAL SMART ELECTRICITY METER MARKET

Companies playing a prominent role in the global smart electricity meter market include Itron Inc., Landis+Gyr Ltd, GE Energy Company, Elster Group, Sensus USA Inc., Silver Spring, Jiangsu Linyang, Echelon, Holley Metering, and Others.

RECENT HAPPENINGS IN THE GLOBAL SMART ELECTRICITY METER MARKET

-

Itron and US utility CPS Energy have expanded their collaboration to enhance energy-water literacy. The online tool will provide interactive educational resources and materials to advance sustainability awareness and education for K-12 Students and communities, with the aim to assist boost energy and conservation.

DETAILED SEGMENTATION OF THE GLOBAL SMART ELECTRICITY METER MARKET INCLUDED IN THIS REPORT

This research report on the global smart electricity meter market has been segmented and sub-segmented based on phase, communication technology type, end-users, and region.

By Phase

- Single

- Three

By Communication Technology Type

- Power Line Communication (PLC)

- Radio Frequency (RF)

- Cellular

By End-Users

- Industrial

- Commercial

- Residential

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East & Africa

Frequently Asked Questions

What was the global smart electric meter market size in 2023, and what is the projected size by 2029?

The global smart electric meter market size reached US$ 25.6 Billion in 2023 and is projected to increase to US$ 46.67 Billion by 2032, showcasing a growth rate (CAGR) of 6.9% during 2024-2032.

What are smart electricity meters, and what are the primary drivers of the market?

Smart electricity meters facilitate real-time communication between electricity suppliers and consumers, providing accurate usage data and enabling consumers to customize their usage. Government mandates, monetary incentives, efficient energy management, controlled consumption, and security against theft are key drivers of the market.

Which regions are driving the smart electricity meter market, and who are the key players?

North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa are key regions. Major players include Itron Inc., Landis+Gyr Ltd, GE Energy Company, Elster Group, Sensus USA Inc., Silver Spring, Jiangsu Linyang, Echelon, and Holley Metering.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2500

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]