Global Smart Building Market Size, Share, Trends & Growth Forecast Report By Type (Automation Software and Services), Systems (Building Energy Management System, Physical Security System, Building Communication Systems, Plumbing and Management Systems, Water Management System, Parking, Elevators, Escalator Management System and others), Application (Manufacturing Facilities, Residential Buildings, Commercial Buildings, University, School And Hospital Buildings, Government And Public Infrastructure, and others) and Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), Industry Analysis From 2025 To 2033.

Global Smart Building Market Size

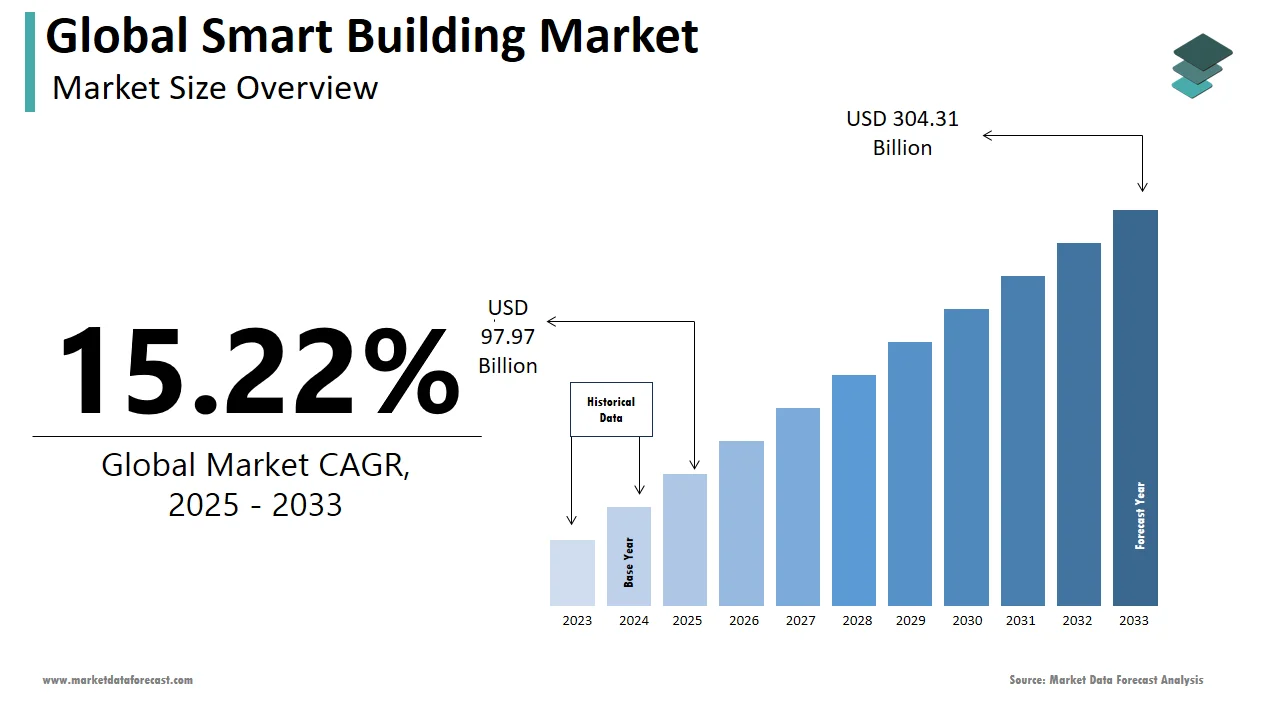

The global smart building market was valued at USD 85.03 billion in 2024. The global market is anticipated to rise at a CAGR of 15.22% from 2025 to 2033, and its size is estimated to grow from USD 97.97 billion in 2025 to USD 304.31 billion by 2033.

Smart buildings are any type of infrastructure that uses automation to control building operations, which can be something like ventilation, lighting, heating, air conditioning, security, and others. To do this, actuators, sensors, and microchips are used in the building to collect data and, therefore, manage services and functions. This kind of infrastructure aids operators, owners, and managers of various facilities to enhance their asset performance and reliability, which results in space optimization, minimizes energy consumption, and reduces the impact of buildings. Smart buildings transmit useful building administrations that make residents beneficial (for example, light, warm comfort, air quality, security, sanitation, and others) at affordable cost and ecological impact throughout the lifecycle of the building. Achieving this vision requires information from the first starting point of the configuration phase to the end of the building's useful life.

The smart building market saw tremendous growth due to the incorporation of AI-based building management systems. These are becoming increasingly normal, providing customers with access to data-driven information. Also, advanced data analytics were integrated for power optimization. Further, the prevalence of IoT devices in building automation and improved control systems has significantly boosted its market share.

Another industry trend is sustainability and energy efficiency, which has been at the top of the company’s priority list. In 2024, it is expected that the incorporation of 5G technology will provide a faster and more dependable network ,coupled with the capability to assist an increased number of linked devices. Additionally, the focus will be on the design and planning of smart buildings with the customers’ well-being in mind. Lastly, smart city projects and initiatives will augment the market value.

MARKET DRIVERS

The increasing number of intelligent energy systems is driving the growth of the smart building market.

The continuous demand for improved security, secured access, efficiency, durability, and comfort is leading to new advances in smart building technology. IT players are progressively focusing on expanding the application and coverage of IoT-based systems for building automation. This is paving the way for further development of innovative solutions and products. The aim is to improve the interoperability of intelligent construction technologies. The industry is moving towards establishing standardized security solutions that will augment market growth in the future. Moreover, commercial sensors offer more comfort to extensive projects and may work as a unified communication protocol. On the other hand, custom-built sensors will be more suitable for small projects since they can be integrated with more elements.

MARKET RESTRAINTS

High upfront costs are one of the key factors hindering the growth trajectory of the smart building market.

Implementing intelligent technologies for the building includes sensor installation, setting up control systems, and data analytics applications. Other problems associated with this are the lack of interoperability among different smart building systems, data privacy concerns, weak cybersecurity, and poor cognizance. Also, resistance to change from traditional building management practices is further hampering the market growth. Often, building owners, for the sake of sales, include some of the modern technologies and solutions but fail to execute proper maintenance. This is why home or flat owners are unable to trust these technologies. There is also reluctance from building owners to invest in long-term upgrades due to stringent regulations and compliance requirements, uncertainty about return on investment, and cost-effectiveness, which limit the expansion of the smart building market.

MARKET OPPORTUNITIES

The rising use of facial recognition and biometric security systems, voice-activated control systems, automation, and technologically advanced materials that meet environmental conditions is expected to boost the smart building market value.

The growth in artificial intelligence and machine learning-based solutions will significantly increase the efficiency and effectiveness of biometric security systems, facial recognition, and voice-assisted systems. Companies are using Edge and Cloud more wisely. In addition, governments around the world are developing sustainable products and solutions for building construction and automation. So, in 2023, we saw a rise in the frequency of sustainable methods, and incentives were also announced. However, over 80 percent of small societies and residential apartments lack Building Management Systems (BMS) and are consuming more power and energy, which is leading to carbon emissions.

MARKET CHALLENGES

Issues in data privacy and ethical implications in gathering and utilizing information in smart buildings are some of the key hurdles to market growth.

For instance, in September 2023, the Dark Angles hacking group demanded 51 million dollars from Johnson Controls for deleting and decrypting the data stolen. It was a digital robbery in which attackers swiped 27 terabytes of data and were even able to decode the ESXi servers. Also, the Russia-Ukraine war further increased the pace and attack surface of cyberattacks. A large number of government installations in North America, Europe, and Asia and related agencies were targeted and infiltrated countless times. The threat is so big that if the defense or any heavily protected servers and systems are not, how can the residential and commercial buildings be?

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

15.22% |

|

Segments Covered |

By Component, Solution, Service, Building Type, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regions Covered |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Market Leaders Profiled |

Honeywell (United States), Johnson Controls (Ireland), Cisco (United States), Hitachi (Japan), Siemens (Germany), IBM (United States), Schneider Electric (France), Intel (United States), Huawei (China), ABB (Switzerland), L&T Technology Services (India), 75F (United States), Telit (United Kingdom), Pointgrab (Israel), LogicLadder (India), Spacewell (Belgium), PTC (United States), Avnet (United States), Softdel (United States), Spaceti (Czech Republic), and others. |

SEGMENTAL ANALYSIS

By Component Insights

The solution segment holds the larger share of the smart building market and is anticipated to flourish during the forecast period. The services segment is believed to be able to propel at a higher CAGR in the coming years, but Johnson Controls, Schneider Electric, Envision Digital, Switch Automation, Siemens, and Building IoT will be the most popular smart building platforms in 2023. And, all these companies use IoT and Software-as-a-Service (Saas) concepts to deliver value to their customers.

By Solution Type Insights

The security and emergency management segment is leading this category of the smart building market and is likely to grow at a higher CAGR in the forecast period. This is due to the penetration of digital technologies into routine activities, and busy lifestyles are accelerating the growth rate of smart infrastructure products. This is surging the demand for live security and emergency management. Furthermore, the integration of the Internet of Things with smart evacuation systems and cloud and fog layers is boosting the segment’s application.

By Building Type Insights

The commercial segment holds significant market potential for smart buildings. The companies are prioritizing energy and security & emergency management. Also, the increasing investment in intelligent technologies and innovations to improve the operational efficiency of commercial buildings is fueling the segment growth. In addition, the rising emphasis by stakeholders like owners and developers of commercial real estate (CRE) on constructing economically viable structures that generate long-term returns is favoring the segment’s expansion. State authorities around the world are evaluating and financially supporting the CRE to enhance fuel-efficiency processes considerably.

REGIONAL ANALYSIS

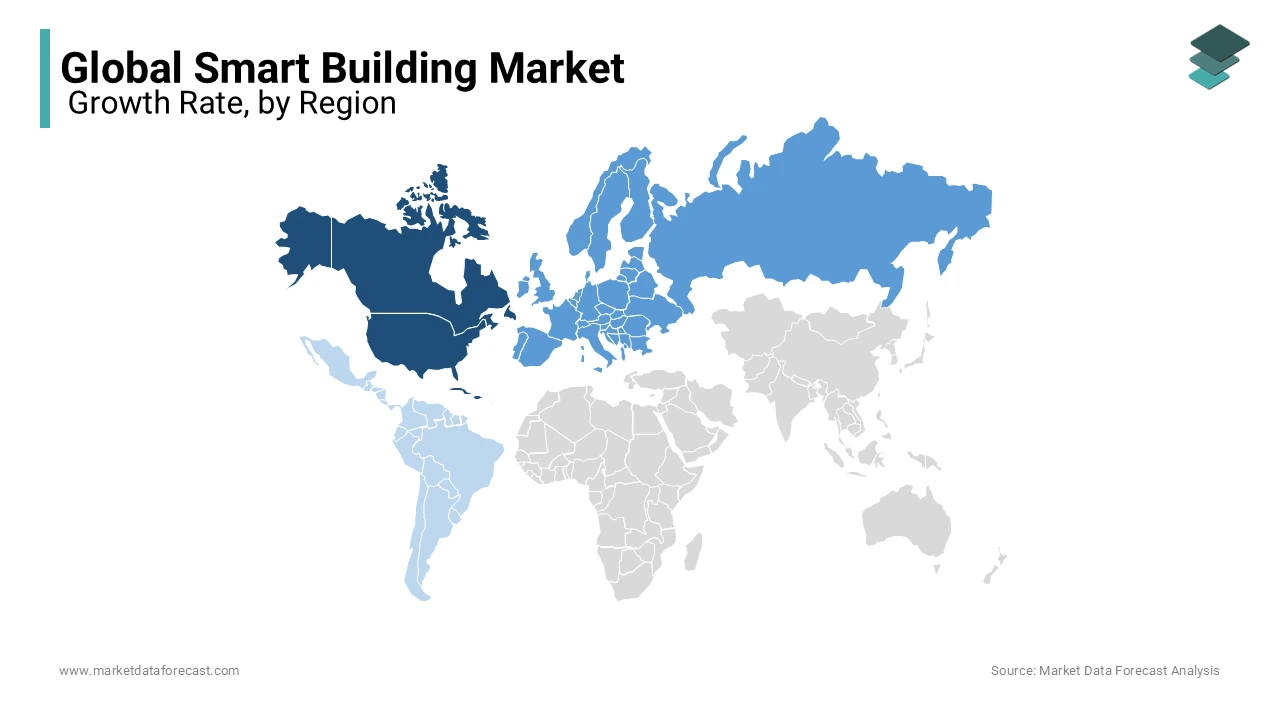

North America dominated the smart building market in 2024. Almost all the key players in the region have transitioned into smart building solutions to enhance the productivity of business operations. The United States is leading the regional market because of the rising financial support and investments in eco-friendly construction and infrastructure technology. Likewise, The Westin Houston Medical Center in Texas, Fulton East in Chicago, and Corning Optical Communications in Hickory (North Carolina) are some of the prime examples of smart buildings.

Europe's smart building market is the second-largest market for smart buildings and is poised to drive forward during the forecast period. The technology and energy professionals in the region have invented or created a layer between appliances, power, fuel applications, and intelligent devices to optimize and streamline the digital transformation of buildings, as per the CORDIS. This is done to fast-track the digitalization of buildings. Apart from this, the European Union has also financed the domOS project, the objective of which is to flawlessly incorporate digital gadgets with powerful applications. It is a pilot project with locations distributed over the five European nations and has ten partners. The domOS ecosystem is developed as an application that can operate independently like smartphone apps.

Asia Pacific is estimated to register significant progress during the projection period for the smart building market. One of the factors fueling the regional market growth is the booming construction sector. For instance, the construction of Waseda University Waseda Campus E Building in Tokyo City (Japan), Major Dhyan Chand Sports University in Utter Pradesh (India), Kwun Tong Primary School Development in Hong Kong, Mandla Medical Collage in India and St George’s Anglican Grammer School in Australia are some major construction projects whose work started in the fourth quarter of 2023. Moreover, the increasing smart city initiatives across the APAC region are another reason pushing forward the market expansion. Singapore, Seol Hong Kong, Osaka, Nagoya, Beijing, Kuala Lumpur, and Bangkok are the smart cities in their respective countries. Hence, with the Internet of Things, AI, ML, and other modern technologies, these factors will propel Asia Pacific’s smart building market.

The Middle East & Africa smart building market is believed to achieve noticeable economic development in the forecast period. The is a surge in requirement for energy-saving and environmentally friendly intelligent building products and solutions. However, challenges like political stability, time-to-time security issues, and resource allocation can restrict the industry's progress. Moreover, the regional governments have started to focus on the reduction of carbon emissions because of the carbon tax by the EU, and they import a large value of cars and vehicle parts, packaged medicines, broadcasting equipment, and refined petroleum products. So, to decrease this burden, the demand for smart building technologies and ecosystems will grow in the future.

Latin America smart building is expected to attain a steady CAGR in the coming years due to the rising pace of urbanization, infrastructure development and acceptance and recognition of intelligent building and energy technologies throughout the region. Besides this, the 5G network is rapidly growing and is projected to reach around 463 million connections in total by the end of 2023, which is about 57 percent. Therefore, all these factors will elevate the adoption of smart building technologies in the area.

KET MARKET PLAYERS

Honeywell (United States), Johnson Controls (Ireland), Cisco (United States), Hitachi (Japan), Siemens (Germany), IBM (United States), Schneider Electric (France), Intel (United States), Huawei (China), ABB (Switzerland), L&T Technology Services (India), 75F (United States), Telit (United Kingdom), Pointgrab (Israel), LogicLadder (India), Spacewell (Belgium), PTC (United States), Avnet (United States), Softdel (United States) and Spaceti (Czech Republic) are some of the notable players in the global smart buildings market.

RECENT MARKET HAPPENINGS

- In April 2024, ROSHN collaborated with Cisco to develop and find new applications of Internet of Things technology for its sustainable smart buildings. This includes incorporating sensors and software with physical systems and equipment like air conditioning, alarms, security, and lighting. They will transform them into a single IT-controlled network infrastructure. This partnership mechanism will also look to use the US-based company’s technology in the Giga project’s innovation hub, which is scheduled to open in 2025.

- In April 2024, Schneider Electric released the PA-00991 EcoStruxure Building Operation 2024 version 6.0.2 software, which is available immediately. It is the successor to version 6.0.1, which was launched in February 2024. It is suitable and suggested for all the projects covered under EcoStruxure Building Operation 2024.

- Schneider Electric provides various types of building automation and control systems to deliver optimum energy and operational efficiency to its residents. The company also offers an open innovation platform for buildings, which is considered an IoT collaboration solution to implement smart buildings for the future.

- Cisco Systems Inc. actively participates in the smart building market through various types of building automation and networking solutions. The company offers a digital construction solution to lay the foundations for new-generation smart buildings. Construction solutions that include building automation, optimized lighting and the company's IoT technology help make the building smarter.

MARKET SEGMENTATION

This research report on the global smart building market has been segmented and sub-segmented based on component, solution, service, building type, and region.

By Component

-

Solution

-

Services

By Solution Type

-

Building Infrastructure Management

-

Security and Emergency Management

-

Energy Management

-

Network Management

-

Workforce Management

By Service Type

-

Consulting

-

System Integration and Deployment

-

Support and Maintenance

By Building Type

-

Residential

-

Commercial

-

Industrial

By Region

-

North America

-

Europe

-

Asia-Pacific

-

Middle East & Africa

-

Latin America

Frequently Asked Questions

What is the current size of the global smart building market?

The global smart building market is expected to be worth USD 97.97 billionn in 2025.

Which regions contribute the most to the global smart building market share?

North America, Europe, and Asia-Pacific are among the leading contributors to the global smart building market share, with increasing adoption of smart technologies in commercial and residential structures.

What factors are driving the growth of the global smart building market?

The growth of the global smart building market is driven by factors such as the increasing demand for energy-efficient solutions, advancements in IoT (Internet of Things) technologies, and a focus on sustainable and intelligent building management.

Who are the key players in the global smart building market?

Honeywell (United States), Johnson Controls (Ireland), Cisco (United States), Hitachi (Japan), Siemens (Germany), IBM (United States), Schneider Electric (France), Intel (United States), Huawei (China), ABB (Switzerland), L&T Technology Services (India), 75F (United States), Telit (United Kingdom), Pointgrab (Israel), LogicLadder (India), Spacewell (Belgium), PTC (United States), Avnet (United States), Softdel (United States) and Spaceti (Czech Republic) are some of the notable companies in the smart building market.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2500

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]