Global Small Satellite Market Size, Share, Trends, & Growth Forecast Report By Component (Telemetry, Tracking, and Command, Power System, Propulsion System, Command & Data Handling, and Others), Application, Weight, End-use, and Region (North America, Europe, Asia Pacific, Latin America, and Middle East & Africa), Industry Analysis From 2024 to 2033

Global Small Satellite Market

The global small satellite market was worth USD 3.87 billion in 2024. The global market size is expected to be worth USD 4.18 billion in 2025. It is expected to grow at a CAGR of 7.94% during the forecast period and reach a value of USD 7.70 billion by 2033.

The small satellite are revolutionizing access to space by offering cost-effective solutions compared to traditional large-scale satellites. According to the International Academy of Astronautics, small satellites now account for over 70% of all spacecraft launched annually, driven by advancements in miniaturization, modular design, and standardized platforms like the CubeSat specification.

The proliferation of low Earth orbit (LEO) constellations for broadband internet, Earth observation, and IoT connectivity dominates the sector. SpaceX’s Starlink, for instance, has deployed over 4,500 satellites as of 2024, while OneWeb aims to complete its 648-satellite network by 2025. Beyond commercial ventures, academic and government institutions increasingly leverage small satellites for scientific research. NASA’s CubeSat Launch Initiative, for example, has enabled over 150 educational and research missions since 2010.

Technological advancements, such as high-throughput propulsion systems and AI-driven data processing, are expanding capabilities. The European Space Agency’s (ESA) OPS-SAT mission, a 3U CubeSat, demonstrated autonomous navigation and software updates in orbit with the sector’s agility. Additionally, launch service providers like Rocket Lab and Virgin Orbit have pioneered dedicated small satellite rideshares by reducing deployment costs by 40% compared to conventional methods, as per a 2023 Aerospace Corporation report.

Environmental and regulatory considerations are also shaping the landscape. The United Nations Office for Outer Space Affairs emphasizes sustainable practices, with 62% of recent small satellite missions incorporating deorbiting mechanisms to mitigate space debris, as noted in a World Economic Forum study. This synergy of affordability, innovation, and responsibility positions small satellites as pivotal to democratizing space access and addressing global challenges.

MARKET DRIVERS

Advancements in Miniaturization and Cost Efficiency

The rapid miniaturization of satellite components has been a cornerstone in driving the small satellite market. Innovations in electronics, sensors, and propulsion systems have enabled satellites to perform complex tasks despite their compact size. According to NASA's Small Spacecraft Technology program, modern CubeSats can now achieve resolutions as fine as 3 meters for Earth observation, a capability previously reserved for larger satellites. According to the U.S. Department of Defense, the cost of building and launching small satellites is approximately $2 million per unit, compared to $50–$400 million for traditional satellites. This affordability has democratized access to space by enabling startups and universities to participate actively. Furthermore, the Federal Aviation Administration reports that over 1,500 small satellites were launched globally in 2023 alone.

Growing Demand for Global Connectivity Solutions

The escalating demand for global internet coverage and IoT connectivity is another major driver propelling the small satellite market. The International Telecommunication Union estimates that 2.7 billion people remain unconnected to the internet, creating a pressing need for scalable solutions. Small satellites operating in low Earth orbit (LEO) are pivotal in addressing this gap, with constellations like SpaceX’s Starlink aiming to provide high-speed broadband to remote areas. The United Nations Office for Outer Space Affairs notes that LEO-based networks reduce latency to under 50 milliseconds, significantly improving user experience. Additionally, the U.S. Federal Communications Commission states that over 40% of new satellite applications in 2023 were for communication purposes, reflecting the sector's focus on connectivity. These trends showcase how small satellites are bridging digital divides while fostering economic and social development worldwide.

MARKET RESTRAINTS

Space Debris and Orbital Congestion Challenges

The increasing number of small satellites being deployed has exacerbated concerns about space debris and orbital congestion. According to the European Space Agency, there are over 36,000 pieces of space debris larger than 10 cm currently orbiting Earth, posing collision risks to operational satellites. Small satellites, particularly those in low Earth orbit (LEO), contribute significantly to this issue due to their shorter operational lifespans and limited deorbiting mechanisms. According to the United Nations Office for Outer Space Affairs, only 30% of small satellites launched in the past decade included propulsion systems for controlled reentry, leaving many defunct units in orbit. Furthermore, NASA’s Orbital Debris Program Office warns that the Kessler Syndrome such as a cascading effect of collisions, which could render certain orbits unusable if mitigation measures are not prioritized.

Regulatory Hurdles and Spectrum Allocation Issues

The navigating complex regulatory frameworks and securing radio frequency spectrum allocations present significant restraints for the small satellite market. The International Telecommunication Union states that obtaining global frequency coordination for satellite communications can take up to three years, delaying project timelines and increasing costs. Additionally, the spectrum allocation disputes have risen by 45% since 2020 as more operators vie for limited bandwidth, as per the U.S. Federal Communications Commission. This competition is further complicated by varying national policies, with some countries imposing stringent licensing requirements. According to the United Nations Committee on the Peaceful Uses of Outer Space, inconsistent international regulations create barriers for emerging players, particularly startups and academic institutions. These regulatory bottlenecks hinder innovation and slow the pace of deployment by challenging the scalability of small satellite initiatives worldwide.

MARKET OPPORTUNITIES

Expansion of Earth Observation for Climate Monitoring

The growing emphasis on climate change mitigation and environmental monitoring presents a significant opportunity for the small satellite market. According to the National Oceanic and Atmospheric Administration (NOAA), small satellites can provide critical data on greenhouse gas emissions, deforestation, and ocean health at a fraction of the cost of traditional systems. For instance, the European Space Agency’s Sentinel-2 mission, which utilizes small satellite technology, has mapped over 10 million square kilometers of land to monitor vegetation and water quality since its inception. According to the United Nations Framework Convention on Climate Change, global investments in climate observation technologies will exceed $10 billion annually by 2030 by creating a fertile ground for small satellite applications. These advancements enable governments and organizations to make data-driven decisions by fostering sustainable development while addressing pressing environmental challenges.

Emergence of On-Orbit Servicing and Space Logistics

The development of on-orbit servicing and space logistics represents a transformative opportunity for the small satellite market. The U.S. Defense Advanced Research Projects Agency (DARPA) states that on-orbit refueling and repair missions could extend the lifespan of small satellites, reducing the need for frequent replacements and lowering long-term costs. Furthermore, NASA’s OSAM-1 (On-orbit Servicing, Assembly, and Manufacturing) mission aims to demonstrate the feasibility of robotic servicing, which could save up to $500 million annually in satellite maintenance expenses. According to the International Astronautical Federation, the global space logistics market is projected to grow by 15% annually, driven by innovations in autonomous systems and robotics. These capabilities not only enhance operational efficiency but also pave the way for new business models, such as satellite-as-a-service by unlocking untapped revenue streams in the burgeoning space economy.

MARKET CHALLENGES

Limited Lifespan and Reliability Concerns

The relatively short operational lifespan of small satellites poses a significant challenge to their widespread adoption. According to the U.S. Government Accountability Office, the average mission duration for small satellites is between two to five years, compared to 10–15 years for larger satellites. This limitation is primarily due to the use of commercial off-the-shelf components, which are cost-effective but less durable in harsh space environments. According to the European Space Agency, radiation exposure and thermal stress cause over 20% of small satellites to fail within their first year of operation. Additionally, the lack of robust redundancy systems in smaller platforms further exacerbates reliability issues. These factors increase the frequency of replacements by raising long-term costs and complicating mission planning for operators relying on consistent data streams.

Cybersecurity Vulnerabilities in Satellite Networks

Their susceptibility to cyber threats has emerged as a critical challenge as small satellites become integral to global communication and data networks. According to the U.S. Department of Homeland Security warns that small satellites often lack advanced encryption and cybersecurity measures by making them vulnerable to hacking and signal jamming. A report by the United Nations Institute for Disarmament Research have shown that over 60% of small satellite missions do not incorporate end-to-end encryption, leaving sensitive data at risk of interception. Furthermore, the Federal Bureau of Investigation states that instances of satellite-related cyberattacks have increased by 35% since 2020 with the growing reliance on interconnected LEO constellations.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

7.94% |

|

Segments Covered |

By Component, Application, Weight, End-use, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview of Investment Opportunities |

|

Regions Covered |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Market Leaders Profiled |

Airbus S.A.S. (Netherlands), The Boeing Company (U.S.), Lockheed Martin Corporation (U.S.), Northrop Grumman Corporation (U.S.), Sierra Nevada Corporation (U.S.), ST Engineering (Singapore), Thales Group (France), SpaceX (U.S.), and L3Harries Technologies (U.S.). |

SEGMENT ANALYSIS

By Component Insights

The power system segment dominate the small satellite market by holding a 28.3% of share in 2024 with the power systems in ensuring uninterrupted satellite operations, including communication, data processing, and payload functionality. Solar panels and batteries are the primary components, with advancements like triple-junction solar cells achieving efficiencies of up to 30%. According to the European Space Agency, over 90% of small satellites rely on solar energy, making this segment indispensable.

The propulsion system segment is likely to experience a fastets CAGR of 17.5% during the forecast period. This rapid expansion is driven by the need for precise orbital adjustments, collision avoidance, and deorbiting capabilities to address space debris concerns. According to the Federal Aviation Administration, over 40% of new small satellites now incorporate propulsion systems when compared to just 15% a decade ago. Innovations such as electric and green propulsion technologies have reduced costs by 30% by enabling broader adoption. Additionally, the United Nations Office for Outer Space Affairs emphasizes that regulatory mandates for sustainable practices are accelerating demand for advanced propulsion systems by making this segment pivotal for the future of space exploration and satellite sustainability.

By Application Insights

The communication segment dominated the small satellite market with 45.4% of the total share in 2024 owing to the rising demand for global internet coverage and IoT connectivity, with constellations like SpaceX’s Starlink aiming to provide broadband access to underserved regions. According to the International Telecommunication Union, over 2.7 billion people lack internet access, driving investments in LEO-based communication networks. Small satellites offer low-latency, high-speed connectivity by making them indispensable for bridging digital divides. Their affordability and scalability further solidify their dominance by enabling rapid deployment of thousands of units to meet growing data demands.

The Earth observation segment is augmented to register a CAGR of 18.5% during the forecast period. This rapid expansion is fueled by the increasing need for real-time environmental monitoring and disaster management solutions. According to the National Oceanic and Atmospheric Administration, small satellites now provide 60% of critical climate data by enabling governments to track greenhouse gas emissions and deforestation. According to the United Nations Framework Convention on Climate Change, global spending on climate observation technologies will exceed $10 billion annually by 2030. Small satellites excel in delivering cost-effective, high-resolution imagery by fostering innovation in agriculture, urban planning, and resource management.

By Weight Insights

The microsatellites segment was accounted in holding 45.6% of the small satellite market share in 2024 with their versatility, offering a balance between size, cost, and capability for applications like Earth observation, communication, and scientific research. According to the U.S. National Aeronautics and Space Administration, microsatellites account for over 60% of all remote sensing missions due to their ability to host advanced payloads while remaining cost-effective. This segment’s importance lies in its role in bridging the gap between larger satellites and smaller platforms by enabling high-resolution imaging and IoT services at reduced costs.

The nanosatellites segment is esteemed to witness a CAGR of 25.3% during the forecast period due to their rapid expansion is driven by advancements in miniaturization, modular design, and declining launch costs by making them ideal for academic research and commercial constellations. According to the United Nations Office for Outer Space Affairs, nanosatellites accounted for over 70% of all educational space missions in 2023 by fostering innovation in climate monitoring and telecommunications.

By End-use Insights

The commercial segment was the largest and held the small satellite market share of 65.4% in 2024 with the rising demand for satellite-based internet services, Earth observation, and IoT connectivity. Companies like SpaceX and OneWeb are deploying thousands of small satellites to provide global broadband coverage, with SpaceX’s Starlink alone serving over 1.5 million users as of 2024. The affordability and scalability of small satellites make them ideal for commercial ventures. According to the Federal Communications Commission, commercial applications generated $30 billion in revenue in 2023.

The military segment is likely to experience a CAGR of 18.3% during the forecast period. This rapid expansion is fueled by the increasing need for secure communication, real-time surveillance, and space situational awareness. According to the Defense Advanced Research Projects Agency, small satellites enable cost-effective deployment of resilient networks, critical for countering adversarial threats. As per the United Nations Institute for Disarmament Research, defense-related satellite launches have surged by 40% since 2020. The ability of small satellites to enhance national security through rapid deployment and redundancy makes them indispensables.

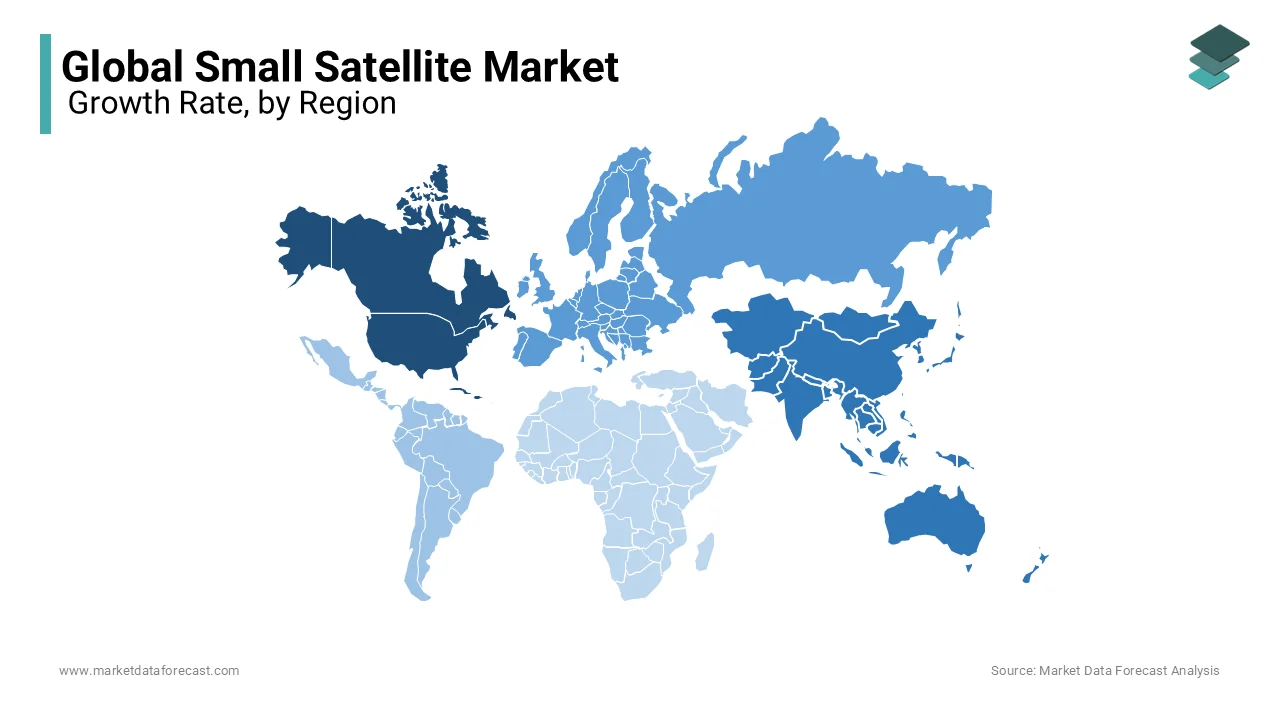

REGIONAL ANALYSIS

North America dominated the small satellite market with 45.4% of the global share in 2024 owing to the presence of key players like SpaceX, Rocket Lab, and NASA, alongside robust investments in commercial space ventures. According to the U.S. Department of Commerce, the region accounted for over 60% of global small satellite launches in 2023, supported by advanced infrastructure and favorable regulatory frameworks. North America’s dominance is further bolstered by initiatives such as NASA’s CubeSat Launch Initiative, which has enabled over 150 missions since 2010. The region's focus on innovation and scalability ensures its pivotal role in shaping the future of space exploration and connectivity.

Asia-Pacific is likely to experience a CAGR of 22.7% throughout the forecast period. This growth is fueled by increasing investments in space programs by countries like China, India, and Japan, alongside rising demand for Earth observation and disaster management solutions. According to the Indian Space Research Organisation, the region launched over 300 small satellites between 2020 and 2023 for agricultural monitoring and urban planning. As per the United Nations Economic and Social Commission for Asia and the Pacific, government-led initiatives, such as China’s BeiDou Navigation System, are driving regional advancements.

Europe is expected to maintain steady growth with the ESA’s focus on sustainable space technologies and LEO constellations, with projected contributions of $8 billion by 2030, as per the European Commission. Latin America shows potential in leveraging small satellites for environmental monitoring, with Brazil aiming to launch 20 satellites by 2026, as stated by the Brazilian Space Agency. The Middle East and Africa are anticipated to grow significantly, with Saudi Arabia and South Africa investing in satellite-based internet and resource mapping. The African Union’s Space Policy estimates a 15% annual increase in satellite adoption by enhancing regional connectivity and development.

KEY MARKET PLAYERS

The major players in the global small satellite market include Airbus S.A.S. (Netherlands), The Boeing Company (U.S.), Lockheed Martin Corporation (U.S.), Northrop Grumman Corporation (U.S.), Sierra Nevada Corporation (U.S.), ST Engineering (Singapore), Thales Group (France), SpaceX (U.S.), and L3Harries Technologies (U.S.).

TOP 3 PLAYERS IN THE MARKET

Airbus S.A.S. (Netherlands)

Airbus is a leading player in the global small satellite market, renowned for its expertise in designing and manufacturing advanced satellite systems. The company has contributed significantly to Earth observation and telecommunications through platforms like the OneWeb constellation, which aims to provide global internet coverage. Airbus’s Small Geostationary Satellite (SGEO) product line offers cost-effective solutions for both civil and commercial applications. According to the European Space Agency, Airbus has been involved in over 30% of Europe’s satellite missions, underscoring its dominance. Its focus on sustainability is evident in projects like the Eurostar Neo platform, which reduces launch costs by 30%. Airbus’s technological importance and ability to deliver end-to-end solutions position it as a key innovator in the market.

SpaceX (U.S.)

SpaceX has revolutionized the small satellite market with its Starlink constellation, which aims to deploy over 42,000 satellites to provide high-speed internet globally. As per the U.S. Federal Communications Commission, SpaceX accounted for nearly 50% of all small satellites launched in 2023, making it the largest contributor to the market. The company’s reusable Falcon 9 rockets have drastically reduced launch costs, enabling affordable access to space. SpaceX’s rideshare program further democratizes satellite deployment by allowing multiple small satellite operators to share payload space. With over 1.5 million active Starlink users as of 2024, SpaceX’s impact on global connectivity and its role in advancing LEO-based technologies are unparalleled.

The Boeing Company (U.S.)

Boeing is a major player in the small satellite market, leveraging its expertise in aerospace engineering to develop innovative solutions for defense, communications, and exploration. The company’s 702X small satellite platform is designed for flexibility and scalability, catering to both commercial and military needs. According to the U.S. Department of Defense, Boeing plays a critical role in national security, providing resilient satellite networks for secure communications. Additionally, Boeing’s partnership with NASA on projects like the Artemis program due to its commitment to advancing space exploration. By integrating cutting-edge technologies such as AI-driven data processing and modular designs, Boeing ensures its continued dominance in the evolving small satellite ecosystem.

TOP STRATEGIES USED BY THE KEY MARKET PARTICIPANTS

Strategic Partnerships and Collaborations

Key players in the small satellite market, such as Airbus and Thales Group, have prioritized strategic partnerships to enhance their technological capabilities and expand their market reach. For instance, Airbus collaborates with OneWeb to develop and deploy a constellation of over 648 satellites for global internet coverage, leveraging its expertise in satellite manufacturing and integration. Similarly, Thales Group partners with government agencies and private entities to deliver advanced Earth observation and defense solutions. According to the European Space Agency, such collaborations have enabled these companies to secure long-term contracts worth billions of dollars, while fostering innovation through shared resources and expertise.

Vertical Integration and End-to-End Solutions

Companies like SpaceX and Lockheed Martin have adopted vertical integration strategies to strengthen their market position. SpaceX’s development of reusable rockets, such as the Falcon 9, alongside its Starlink constellation, allows the company to control both launch services and satellite operations, reducing dependency on third parties. According to the U.S. Federal Aviation Administration, this approach has lowered launch costs by up to 40%, giving SpaceX a competitive edge. Lockheed Martin, on the other hand, offers end-to-end solutions, from satellite design to data analytics, ensuring seamless service delivery for defense and commercial clients. This strategy enhances customer retention and maximizes profitability.

Focus on Sustainability and Technological Innovation

Sustainability and innovation are central to the strategies of leading players like Northrop Grumman and ST Engineering. Northrop Grumman invests heavily in developing on-orbit servicing technologies, such as the Mission Extension Vehicle (MEV), which extends the lifespan of satellites and reduces space debris. The U.S. Defense Advanced Research Projects Agency emphasizes that such innovations align with global efforts to promote sustainable space practices. ST Engineering focuses on miniaturization and energy-efficient designs, enabling cost-effective solutions for emerging markets.

COMPETITIVE LANDSCAPE

The small satellite market is characterized by intense competition, driven by the convergence of technological innovation, increasing demand for space-based services, and the entry of new players. Established aerospace giants like Airbus, Boeing, and Lockheed Martin compete alongside disruptive innovators such as SpaceX and emerging regional players like ST Engineering and Thales Group. This competitive landscape is further intensified by the growing involvement of startups and academic institutions, facilitated by the affordability and accessibility of small satellite technologies. According to the U.S. Federal Aviation Administration, over 500 organizations globally are now engaged in small satellite development or deployment, reflecting the market's fragmentation and dynamism.

The competition is most pronounced in low Earth orbit (LEO) applications, where companies vie for dominance in communication constellations, Earth observation, and IoT connectivity. SpaceX’s Starlink project, with plans to deploy over 42,000 satellites, exemplifies this rivalry, challenging traditional satellite operators and other LEO constellation initiatives like OneWeb. Meanwhile, Airbus and Thales Group focus on high-reliability systems for government and defense clients, leveraging their expertise in large-scale projects. Regional players, particularly from Asia-Pacific and Europe, are also gaining traction, supported by government investments and local demand for satellite-based solutions.

The market’s competitive intensity is further fueled by cost pressures, as companies strive to offer affordable solutions without compromising performance. Innovations in propulsion, miniaturization, and AI-driven data analytics are key differentiators. The European Space Agency notes that partnerships and mergers are increasingly common strategies to consolidate capabilities and capture larger market shares. Overall, the small satellite market remains a battleground of innovation, scalability, and strategic positioning, shaping the future of global connectivity and space exploration.

RECENT MARKET DEVELOPMENTS

- In August 2023, Airbus partnered with Voyager Space to form a joint venture for the development of the Starlab space station. This initiative aims to serve the European Space Agency and its member states for microgravity research in low Earth orbit.

- In December 2021, Boeing collaborated with Blue Origin, Sierra Space, and Redwire to develop the Orbital Reef space station. This partnership, under NASA's Commercial LEO Destinations program, seeks to create a mixed-use business park in space.

- In October 2021, Lockheed Martin partnered with Nanoracks and Voyager Space to propose the Starlab space station. This initiative is designed to maintain a U.S. presence in low Earth orbit after the International Space Station is retired.

- In October 2023, Northrop Grumman joined the Starlab project, shifting its focus from its own station project. The company is now developing an autonomous docking system for its Cygnus spacecraft to resupply the station.

- In December 2021, Sierra Nevada Corporation's subsidiary, Sierra Space, partnered with Blue Origin, Boeing, and Redwire to develop the Orbital Reef space station. This collaboration is part of NASA's Commercial LEO Destinations program.

- In March 2025, Thales CEO Patrice Caine cautioned European governments about over-reliance on private satellite constellations like Starlink. He emphasized the need for reliable and stable government-controlled satellite systems.

- In October 2023, SpaceX was selected by Hisdesat to launch the Spainsat NG I and II satellites using Falcon 9 rockets. This contract aims to support Spain's government and military secure communications needs.

- In January 2024, L3Harris Technologies was awarded a contract by the Space Development Agency to build 18 satellites for the Tranche 2 Tracking Layer. These satellites will enhance missile-tracking capabilities for national defense.

MARKET SEGMENTATION

This research report on the global small satellite market is segmented and sub-segmented into the following categories.

By Component

- Telemetry, Tracking, and Command

- Power System

- Propulsion System

- Command & Data Handling

- Others

By Application

- Communication

- Navigation

- Earth Observation

- Others

By Weight

- Minisatellite

- Microsatellite

- Nanosatellite

- Picosatellite

By End-use

- Civil

- Military

- Commercial

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

Frequently Asked Questions

What factors are driving the growth of the small satellite market?

Key drivers include increasing demand for Earth observation and remote sensing, advancements in miniaturization technology, rising government investments in space programs, and growing private sector participation.

What are the primary applications of small satellites?

Small satellites are used for various applications, including Earth observation, communication, scientific research, technology demonstration, and defense and security. Earth observation and communication are the largest segments, driven by the need for high-resolution imaging and global connectivity.

What technological advancements are influencing the small satellite market?

Advancements include miniaturization of satellite components, improved launch vehicle capabilities, development of reusable rockets, and innovations in satellite communication technologies such as phased array antennas and optical communication systems.

How is the small satellite market impacting global connectivity?

Small satellites play a crucial role in enhancing global connectivity by providing broadband internet services to remote and underserved areas. Projects like SpaceX's Starlink and OneWeb's satellite constellations aim to create global satellite networks, significantly improving internet access worldwide.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2500

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]