Global Small Arms Market Size, Share, Trends, & Growth Forecast Report Segmented By Type (Handgun, Rifles, and Shotgun), Application (Defense & Homeland Security, Self-Defense, Sports, Hunting, and Law Enforcement), and Region (North America, Europe, Asia Pacific, Latin America, and Middle East & Africa), Industry Analysis From 2024 to 2033

Global Small Arms Market Size

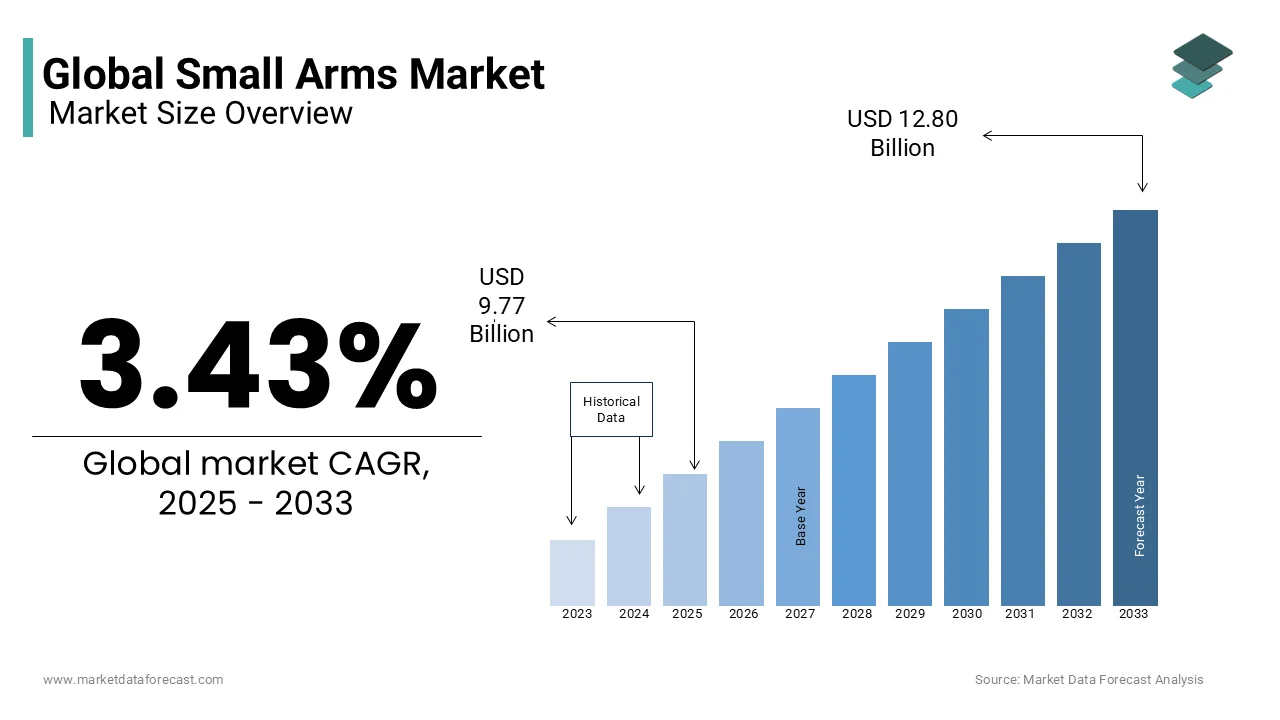

The global small arms market was valued at USD 9.45 billion in 2024. The global market is estimated to reach USD 12.80 billion by 2033 from USD 9.77 billion in 2025, rising at a CAGR of 3.43% from 2025 to 2033.

Small arms are firearms such as pistols, revolvers, rifles, and shotguns. They are used by many groups, including the military, police forces, and civilians. People use them for different reasons, such as defense, security, hunting and sports shooting. In 2017, the total number of firearms worldwide was estimated at 1 billion. Out of these, 857 million were owned by civilians, making up 85% of all firearms. Military forces had about 133 million guns (13%), while law enforcement agencies had 23 million (2%). The United States had the highest number of civilian-owned guns, estimated at 393 million, which is 46% of all civilian guns worldwide. This equals about 120.5 guns for every 100 people in the country.

Firearms affect public safety in many ways. In 2016, the number of firearm-related deaths worldwide was between 195,000 and 276,000. Most of these deaths were due to homicides. In the United States, there were 13.5 firearm-related deaths per 100,000 people, ranking the country among the highest in the world for such deaths. To reduce the dangers linked to illegal firearm trade and misuse, governments and international organizations are working together to create and enforce laws that regulate firearm ownership and distribution.

MARKET DRIVERS

Increased Military Spending

The growing need for military strength has led to a significant increase in defense budgets around the world. In 2023, global military spending reached $2.443 trillion, an increase of 6.8% from the previous year, as stated by the Stockholm International Peace Research Institute (SIPRI). This rise is largely due to conflicts and security concerns, particularly the war in Ukraine. Ukraine alone spent $64.8 billion on its military, making it one of the highest spenders globally. Additionally, European countries such as Poland raised their defense budgets, spending $31.6 billion to enhance their military capabilities. With nations investing more in security, the demand for small arms and other military equipment continues to grow.

High Civilian Gun Ownership

A large number of civilians worldwide own firearms, which contributes significantly to the growth of the small arms market. The Small Arms Survey estimates that as of 2017, civilians owned approximately 857 million firearms, making up 85% of the total 1 billion firearms worldwide. The United States leads in civilian firearm ownership, with an estimated 393 million guns, representing 46% of all privately owned firearms in the world. This means there are about 120.5 guns per 100 people in the country. People own firearms for various reasons, such as self-defense, sports shooting, and hunting. The high demand for civilian firearms continues to support the production and sale of small arms globally.

MARKET RESTRAINTS

Strict Gun Laws and Regulations

The small arms market faces restrictions due to strict laws and regulations imposed by governments and international bodies. Many countries have introduced laws to control the production, sale, and ownership of firearms to prevent violence and illegal arms trafficking. The Arms Trade Treaty (ATT), which came into effect on December 24, 2014, sets international standards for arms transfers. By May 31, 2023, a total of 113 countries had signed and ratified the treaty, according to the ATT Secretariat. These strict regulations force gun manufacturers and sellers to comply with complex legal requirements, which increases business costs and slows down expansion in the market.

Increase in Firearm-Related Deaths

Gun-related violence remains a major concern, affecting public safety and leading to calls for stricter gun control laws. According to the World Health Organization (WHO), about 4.4 million people die each year due to injuries and violence, making up 8% of global deaths. Firearms contribute significantly to this statistic, as a large number of homicides and suicides involve guns. Among people aged 5-29 years, injuries such as homicides, suicides, and traffic accidents are among the top five causes of death. The rise in firearm-related deaths has led to increasing efforts to enforce stricter gun control laws, which may reduce the availability of small arms in some markets.

MARKET OPPORTUNITIES

Growing Defense Production in Emerging Markets

Many developing countries are increasing their investment in defense manufacturing, which presents a big opportunity for small arms producers. For example, India has set a goal to increase its annual defense production to $35 billion by the end of the decade, up from $20 billion currently. This was reported by Financial Times. India aims to reduce its reliance on foreign arms and become a key player in the global weapons market. Companies such as Hindustan Aeronautics and Bharat Dynamics have seen more orders due to both local and foreign demand. Government programs like "Make in India" have encouraged domestic firearm production, leading to a 56% rise in the defense sector index over the past year.

More Firearms for Police and Law Enforcement

Police departments around the world are upgrading their weapons to improve public safety, creating demand for new firearms. In the United States, the Department of Justice's Office of Justice Programs (OJP) provides funding to support local police agencies. In 2023, the President's Budget allocated $3.401 billion in discretionary funding for law enforcement, which includes grants for purchasing firearms and protective gear. Additionally, similar investments are being made in other countries as governments prioritize internal security. These funds allow law enforcement agencies to equip officers with the latest small arms and tactical gear, creating a steady market for firearm manufacturers.

MARKET CHALLENGES

Illegal Trafficking of Small Arms

One of the biggest challenges in the small arms market is the illegal trade of firearms. The United Nations Office on Drugs and Crime (UNODC) states that illegal arms trafficking increases crime, fuels conflicts, and threatens security worldwide. Since these weapons are sold and transported secretly, it is difficult to track and stop illegal transactions. Many criminal groups and terrorist organizations obtain weapons through illegal means, making it harder for governments to control the flow of firearms. Stopping illegal small arms trade requires strong international cooperation, tougher laws, and better enforcement by security agencies.

Financial Struggles for Small Arms Companies

Even though military spending is increasing, many small and medium-sized arms manufacturers face financial difficulties. A 2024 report by the European Commission estimates that defense companies in the European Union (EU) have a debt financing gap of €1 billion to €2 billion. This makes it hard for smaller businesses to grow and invest in new technology. Many companies struggle to access funding because banks hesitate to lend due to strict Environmental, Social, and Governance (ESG) rules. As a result, small firearms manufacturers face challenges in competing with large defense contractors, limiting their ability to expand their operations or secure government contracts.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

3.43% |

|

Segments Covered |

By Type, Application, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview of Investment Opportunities |

|

Regions Covered |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Market Leaders Profiled |

Kalashnikov Group (Russia), Smith & Wesson Brands Inc. (U.S.), Sturm, Ruger & Co., Inc. (U.S.), Heckler & Koch GmbH (Germany), American Outdoor Brands Corporation (U.S.), Glock Ges.m.b.H. (Austria), Remington Arms Compant LLC (U.S.), Colts Manufacturing LLC (U.S.), FN Herstal (Belgium), and Israel Weapons Industries (Israel). |

SEGMENTAL ANALYSIS

By Type Insights

The handguns segment dominated the small arms market by holding 47.6% of the global market share in 2024. The dominance of handguns segment in the global market is attributed to their compact design, ease of use, and widespread adoption for personal defense. The U.S. Bureau of Alcohol, Tobacco, Firearms and Explosives (ATF) reports that handguns accounted for 54% of all firearms manufactured domestically in 2021, totalling over 6.5 million units. Their importance is further highlighted by FBI crime data, which shows that handguns were used in 73% of firearm-related homicides in 2021, underscoring their dual role in civilian safety and criminal activity.

The rifles segment is estimated to showcase the highest CAGR of 7.8% over the forecast period owing to the increased demand for recreational shooting, hunting, and tactical training programs. According to the National Shooting Sports Foundation (NSSF), rifle sales in the U.S. surged by 40% between 2019 and 2021, fuelled by heightened interest in outdoor activities during the pandemic. Additionally, military modernization efforts globally contribute significantly; the U.S. Department of Defense allocated $2.1 billion in 2022 for small arms procurement, including advanced rifles. Rifles' versatility in both civilian and military applications ensure their prominence, making them critical for national security and economic markets alike.

By Application Insights

The defense & homeland security segment led the small arms market by accounting for 38.4% of the global market share in 2024. The growth of the defense & homeland segment is driven by rising geopolitical tensions and increased defense budgets globally. The U.S. Department of Defense allocated $773 billion in 2023, with significant spending on small arms for modernization. According to the Stockholm International Peace Research Institute (SIPRI), global military expenditure reached $2.1 trillion in 2022, underscoring the importance of small arms in national security. Small arms are critical for infantry operations, border security, and counter-terrorism efforts, ensuring their central role in defense strategies worldwide.

The self-defence segment is the fastest growing segment in the global market currently and is estimated to showcase a CAGR of 8.7% over the forecast period owing to the rising concerns over personal safety and increasing crime rates. The FBI’s Uniform Crime Reporting Program notes that violent crimes rose by 4.5% in 2022, prompting higher firearm ownership for protection. Additionally, the National Shooting Sports Foundation (NSSF) reports that first-time gun buyers accounted for 40% of all firearm sales in 2021, with self-defence being the primary motivation. The segment's importance lies in empowering civilians to ensure personal safety, particularly in regions with inadequate law enforcement coverage, making it a pivotal driver of market expansion.

REGIONAL ANALYSIS

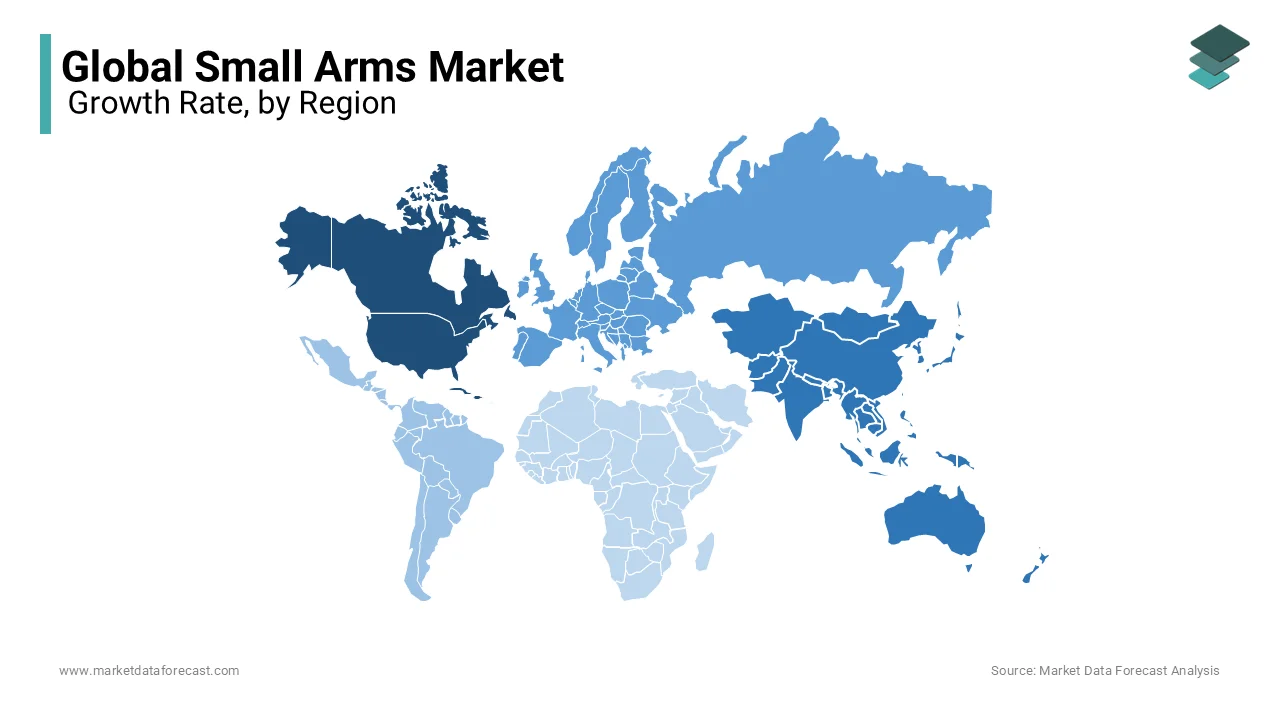

North America played the most dominating role in the global small arms market by 43.3% of the total market share in 2024. The United States plays a major role in this dominance because of its high number of civilian gun owners. The Small Arms Survey states that U.S. civilians own about 393 million firearms, which means there are around 120.5 guns for every 100 people. This strong culture of gun ownership continues to drive demand for small arms. Additionally, the U.S. government spends heavily on defense, with ongoing military modernization programs. These factors together make North America the leader in the global small arms market.

The Asia-Pacific region is the fastest-growing market for small arms with an expected CAGR of 5.5% over the forecast period owing to the rising defense budgets and military upgrades in India and China. For example, India's defense sector has expanded significantly, with the Nifty India Defence index increasing by 56% in just one year, according to the Financial Times. This growth is part of India's goal to produce more weapons locally and reduce its dependence on foreign arms. As more countries in the region focus on strengthening their defense forces, the demand for small arms for both military and civilian use continues to rise.

Even though military spending is rising worldwide, small and medium-sized defense companies in Europe face financial challenges. A 2024 European Commission report found that defense companies in the EU have a funding shortage of €1 billion to €2 billion. This lack of financial support makes it harder for smaller businesses to invest in production and research. Because of these financial struggles, many small arms manufacturers in Europe find it difficult to expand their businesses or compete with larger companies. If governments and financial institutions do not address these issues, the ability of European companies to meet the rising demand for small arms may be limited in the future.

Latin America is one of the most violent regions in the world due to widespread firearm-related crimes. The United Nations Office on Drugs and Crime (UNODC) reports that more than 60% of homicides in Latin America and the Caribbean involve firearms. This high level of gun-related violence affects government policies and influences the demand for small arms. Some governments are tightening gun laws to reduce crime, while others are increasing investments in law enforcement to improve security. These changing policies can affect the small arms market, as restrictions may reduce sales in some areas, while increased security spending may create more demand for weapons in others.

The Middle East and Africa remain regions of high demand for small arms due to ongoing conflicts and security concerns. However, political instability and weak economies in some areas may slow down market growth. Many countries in these regions face challenges in enforcing gun laws and preventing illegal arms trade. Governments are trying to strengthen border security and fight weapons smuggling, which could impact how firearms are distributed. While demand for small arms is likely to remain high, the ability of countries to afford new purchases and enforce regulations will influence the market’s future in this region.

KEY MARKET PLAYERS & COMPETITIVE LANDSCAPE

The major players in the global small arms market include Kalashnikov Group (Russia), Smith & Wesson Brands Inc. (U.S.), Sturm, Ruger & Co., Inc. (U.S.), Heckler & Koch GmbH (Germany), American Outdoor Brands Corporation (U.S.), Glock Ges.m.b.H. (Austria), Remington Arms Compant LLC (U.S.), Colts Manufacturing LLC (U.S.), FN Herstal (Belgium), and Israel Weapons Industries (Israel).

The small arms market is highly competitive, driven by evolving defense needs, civilian firearm demand, and technological advancements. The market includes established manufacturers such as Smith & Wesson, Sturm, Ruger & Co., and Kalashnikov Concern, alongside emerging players and niche specialists. Competition is fueled by factors such as product innovation, pricing strategies, and regulatory compliance, as firearm laws vary across regions.

Military and law enforcement contracts are key battlegrounds for major players, as governments worldwide seek reliable, cost-effective, and technologically advanced weapons. Companies like FN Herstal, Heckler & Koch, and Beretta compete aggressively in this space, offering customized solutions for armed forces and police agencies. The civilian market, including self-defense, hunting, and sports shooting, also drives competition, with firms differentiating through design, performance, and brand loyalty.

Technological innovation plays a critical role in competition, with companies integrating smart sighting systems, lightweight materials, and modular firearm designs to gain an edge. Additionally, the rise of 3D-printed firearms and ghost guns presents new challenges for traditional manufacturers.

The market is further influenced by geopolitical tensions, arms control regulations, and international trade restrictions, shaping competition dynamics. Companies that effectively balance innovation, compliance, and global expansion maintain a competitive advantage in this evolving landscape.

Top 3 Players in the Market

Smith & Wesson Brands, Inc.

Founded in 1852 by Horace Smith and Daniel B. Wesson, Smith & Wesson is one of the most storied firearms manufacturers in the United States. Headquartered in Springfield, Massachusetts, the company specializes in designing and manufacturing a wide array of firearms, including pistols, revolvers, rifles, and shotguns. Their products cater to various markets such as law enforcement, military, and civilian sectors. Notable for their commitment to quality and innovation, Smith & Wesson has introduced iconic firearms like the .38 Military & Police revolver, which has been in continuous production since 1899. The company's brands include Smith & Wesson®, M&P®, Performance Center®, and Gemtech®.

Sturm, Ruger & Co., Inc.

Established in 1949 by William B. Ruger and Alexander McCormick Sturm, Sturm, Ruger & Co., commonly known as Ruger, is a prominent American firearms manufacturer. The company operates manufacturing facilities in Newport, New Hampshire; Mayodan, North Carolina; and Prescott, Arizona. Ruger offers a diverse range of firearms, including single-shot, autoloading, bolt-action, and modern sporting rifles; rimfire and centerfire autoloading pistols; single-action and double-action revolvers; and firearms accessories and replacement parts. The company also manufactures lever-action rifles under the Marlin brand. Ruger's emphasis on robust design, reliability, and affordability has made it a preferred choice among firearms enthusiasts and professionals.

Kalashnikov Concern

Based in Izhevsk, Russia, Kalashnikov Concern is the largest firearm manufacturer in the country, producing about 95% of Russia's small arms. The company traces its roots back to 1807 with the establishment of the Izhevsk Arms Factory. Renowned for designing and manufacturing the AK series of assault rifles, particularly the AK-47, Kalashnikov Concern's firearms are celebrated for their reliability and ease of use, making them prevalent in military and civilian markets worldwide. Beyond assault rifles, the company's extensive portfolio includes sniper rifles, machine guns, and other precision weapons. In recent years, Kalashnikov Concern has expanded its product line to include unmanned aerial vehicles and advanced combat equipment, reflecting its commitment to innovation in defense technology.

TOP STRATEGIES USED BY THE KEY PARTICIPANTS

Product Innovation and Technological Advancements

Leading small arms manufacturers continuously invest in research and development (R&D) to enhance firearm performance, safety, and usability. Smith & Wesson focuses on developing next-generation pistols and rifles with improved ergonomics, modularity, and advanced sighting systems to appeal to both military and civilian markets. Ruger has adopted innovative manufacturing techniques to produce high-quality firearms at competitive prices, making their products more accessible to law enforcement and sports shooters. Kalashnikov Concern has expanded beyond traditional small arms by integrating modern technologies, such as smart sights, advanced materials, and even unmanned aerial systems (UAS), to stay ahead of global defense industry trends.

Strategic Acquisitions and Expansions

Acquiring smaller firms and expanding into new markets are key strategies employed by major players. Ruger strengthened its market position by acquiring Marlin Firearms, allowing it to diversify its product range with high-quality lever-action rifles. Kalashnikov Concern, historically focused on military contracts, has expanded its footprint in the civilian and sporting arms market, targeting new customer segments. Smith & Wesson, through acquisitions and brand extensions, has broadened its product portfolio beyond handguns to include modern sporting rifles and accessories.

Strengthening Military and Law Enforcement Contracts

Winning defense and police contracts remains a crucial strategy for small arms manufacturers. Smith & Wesson has successfully secured law enforcement contracts in the U.S., supplying agencies with duty pistols and tactical rifles. Kalashnikov Concern maintains strong relationships with the Russian military and international defense clients, ensuring steady demand for its assault rifles, sniper rifles, and machine guns. Ruger, while primarily focused on the civilian market, has expanded its offerings to meet the needs of U.S. police forces and military units by introducing reliable, high-capacity firearms tailored for tactical operations.

RECENT HAPPENINGS IN THE MARKET

- In January 2025, a European consortium led by FN Herstal launched the Small Arms Ammunition Technologies (SAAT) project. This four-year initiative aims to standardize small arms ammunition across Europe, enhancing interoperability and strengthening strategic autonomy in defense.

- In November 2024, Czechoslovak Group (CSG), a Czech defense conglomerate, acquired US-based ammunition manufacturer Kinetic for approximately $2.23 billion. This acquisition positions CSG as the largest Western producer of small-caliber ammunition and expands its presence in the US market.

- In October 2024, the UK Ministry of Defence announced significant reforms to its defense procurement system. The reforms include the creation of a National Armaments Director role, aimed at improving efficiency, reducing waste, and boosting the UK defense industry.

- In October 2024, a report highlighted financial struggles faced by European small arms companies despite increased global military spending. Challenges such as limited access to public funding, bureaucratic obstacles, and ESG-related banking restrictions have hindered innovation and production expansion.

- In November 2023, the British Army provided new details on its small arms replacement initiatives. Project Hunter led to the adoption of the Knight’s Armament KS-1 rifle (L403A1), and insights from this project will influence Project Grayburn, which focuses on identifying the next-generation Individual Weapon to replace the SA80 rifle family.

MARKET SEGMENTATION

This research report on the global small arms market is segmented and sub-segmented into the following categories.

By Type

- Handgun

- Rifles

- Shotgun

By Application

- Defense & Homeland Security

- Self-Defense

- Sports

- Hunting

- Law Enforcement

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

Frequently Asked Questions

Which factors are driving the growth of the small arms market?

Key drivers include increasing defense budgets, rising security concerns due to terrorism and geopolitical tensions, technological advancements in firearms, and an expanding civilian market for self-defense and sporting purposes.

How does civilian demand impact the small arms market?

An expanding civilian firearms market, driven by self-defense and sporting purposes, is significantly boosting the small arms industry.

What technological advancements are influencing the small arms market?

Advancements such as smart firearms, improved ammunition, and lightweight materials are driving market growth and innovation.

How do geopolitical tensions affect the small arms market?

Rising security concerns due to terrorism and geopolitical tensions have led to increased demand for small arms among military and law enforcement organizations.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2500

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]