Global Slickline Services Market Research Report - Segmentation By Slickline Tools (Pulling Tools, Gauge Cutter, Downhole Bailer, Bridge Plug and Others), By Application (Offshore and Onshore), and Region - Industry Forecast 2024 to 2032.

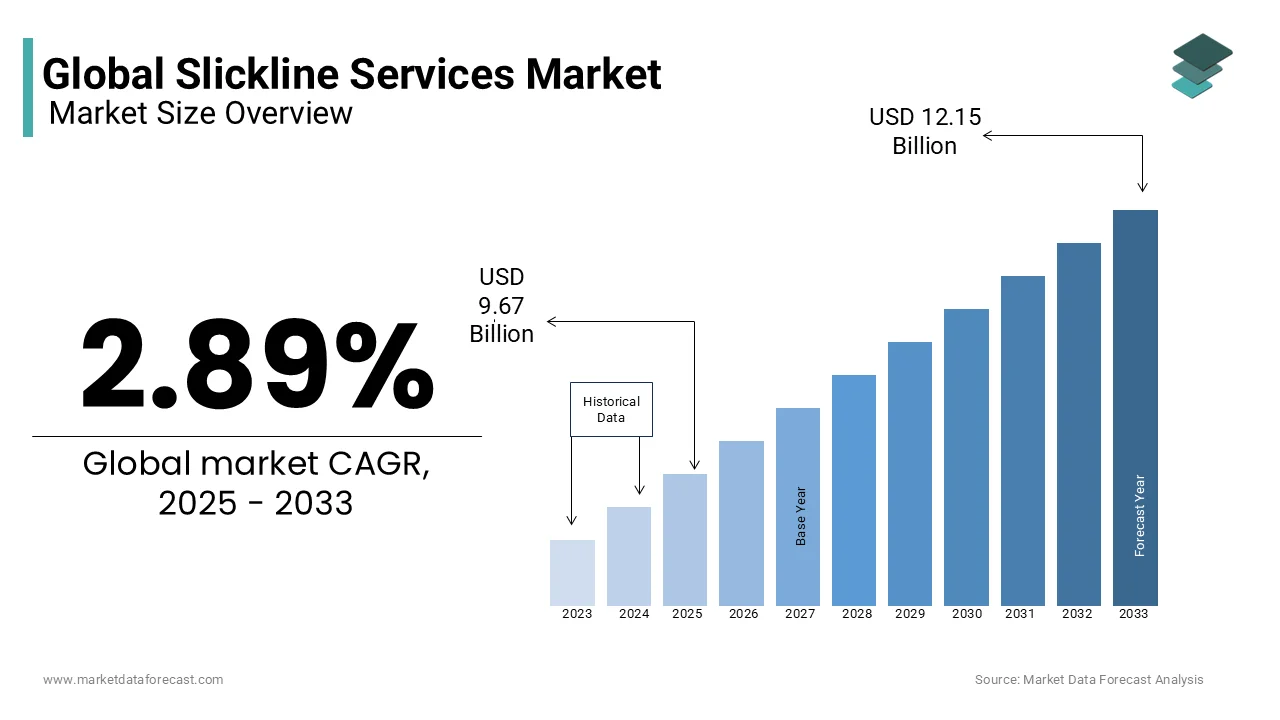

Global Slickline Services Market Size (2024-2032):

The size of the global slickline services market was worth US$ 9.14 Billion in 2023. The global market is anticipated to grow at a CAGR of 2.89% from 2024 to 2032 and be worth USD 11.81 billion by 2032 from USD 9.40 billion in 2024.

MARKET SCENARIO

Slickline refers to a single-stranded wire or cable that is thrown down a well to deliver or retrieve material from the downhole. Hardware components include plugs, valves, gauges, and other tools that can be adjusted with slickline tools. Slickline services are part of downhole tool recovery. These services include operations such as maintenance, downhole debris removal, flow completion, and placement of hydraulic packers using sealing plugs. Additionally, slickline services can measure depth and well drilling. Worldwide oil prices have shown signs of recovery and are improving apace and onshore projects are easier to start than offshore projects. Therefore, based on the optimism associated with the recovery in crude prices, onshore projects are predicted to register significant expansion over the foreseen period, in turn boosting the global slickline services market.

MARKET DRIVERS

The main factors driving the expansion of the worldwide slickline services industry are the escalating exploration for oil and gas and the escalating efforts to produce oil and gas in mature oil fields.

The expansion in oil and gas production can be attributed to improving worldwide economic conditions. Also, according to the same report, the use of natural gas for electricity generation escalated from 5,952.8 terawatt-hours (TWh) in 2017 to 6,182.8 TWh in 2018. Production is predicted to increase throughout the foreseen period. Along with the increase in natural gas production, the growing call for oil and gas has led to an increase in worldwide oil and gas exploration and production (E&P). The main trend observed in the worldwide SWL services industry is escalating investment to drive the production of SWL service products. Due to the large-scale application of these products in the oil and gas industry, most of the industry players are focused on expanding their production capacity. These investments in slickline services are primarily aimed at improving existing wells, exploring new wells, and expanding geographically into new industries. In oil and gas, slickline services incorporate cabling technology, employed by well operators, to limit the amount of equipment and devices employed in wells. These services are employed in exploration activities for intervention in wells, evaluation of reservoirs, and recovery of pipelines. Therefore, the recovery in oil and gas prices is predicted to drive expansion in the SLS industry in the future.

MARKET RESTRAINTS

The complexity of the processes involved in slickline services can limit the expansion of the worldwide industry. The volatility of oil prices in the recent period, due to the gap between supply and call, geopolitics, and several other factors have restricted the expansion of the call for slickline services.

MARKET OPPORTUNITIES

The rising call and use of mobile devices may drive the worldwide industry for slickline services. Also, the growing importance of wireless services and the growing trend of consumers are predicted to promote the expansion of the worldwide industry. The use of slickline services in the oil and gas industry is notable due to escalated production activity in the industry. In addition, the escalating need for cables for oil and gas hydraulic fracturing companies may influence the expansion of the worldwide steel line services industry in the near future. These services improve oil and gas production and operational efficiency in terms of time and cost, further boosting the worldwide industry. Technological progress is the main factor responsible for exploration and production processes in oil and gas companies. In addition, continued expansion in E&P completion activities to meet the growing call for slickline services are contributing factors to the worldwide industry expansion. Another factor that positively impacts the industry is the expansion path in the Asia-Pacific region due to the expansion of drilling and completion activities to meet the population's growing energy call. Escalating discoveries of oil and gas, coupled with the liberalization of the industry on a worldwide scale, have led to the creation of new opportunities for players to invest.

MARKET CHALLENGES

The main limitations identified in the SLS industry are fluctuating oil prices and the high capital requirement for oil well exploration. In recent years, oil prices have fallen dramatically, eroding the profitability of oil companies. Therefore, the delay in expansion plans will continue to hamper the expansion of the SWL services industry in the coming years.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 to 2032 |

|

Base Year |

2023 |

|

Forecast Period |

2024 to 2032 |

|

CAGR |

2.89% |

|

Segments Covered |

Slickline Tools, Application, and Region. |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview of Investment Opportunities |

|

Regions Covered |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Market Leaders Profiled |

Schlumberger Limited (US), China Oilfield Services Limited (China), Halliburton Company (US), Weatherford International Plc. (US), Baker Hughes Company (US), AOS Orwell Ltd. (Nigeria), Archer Ltd. (UK), Expro Holdings UK 2 Ltd. (UK), National Oilwell Varco (US), Superior Energy Services Inc. (US), Reliance Oilfield Services (US), and Others. |

SEGMENTAL ANALYSIS

Global Slickline Services Market Analysis By Slickline Tools

The Pulling Tools segment is predicted to have the largest industry share and grow at the highest rate over the foreseen period as these tools are employed to reclaim seated components such as plug pins. Almost all drag tools come with a safety feature so they can free a stuck tool and allow the toolchain to surface for component changes. All these factors are responsible for the segment of traction tools with the largest industry share.

REGIONAL ANALYSIS

North America is predicted to have the largest industry share during the period due to the increase in per capita energy consumption and oil and gas exploration and production in the region. According to data from Baker Hughes International Rig Count, 2019, the number of rigs in North America escalated to 1,223 in 2018, up from 1,082 in 2019. Escalated oil and gas exploration and production are driving calls for slickline as these services are employed. in the recovery and delivery of downhole tools and useful in oil and gas production.

In addition, according to the Annual Energy Outlook 2023, the United States is predicted to become a net energy exporter in 2023 due to escalated oil and gas production in the country. Furthermore, according to the report, crude oil production is predicted to reach 14.0 million barrels per day (b / d) by 2026. Therefore, the increase in oil and gas exploration and production is predicted to drive the call for North American steel line services over the foreseen period. Therefore, escalated oil and gas drilling and completion activity in the region is predicted to increase industry calls for slurry services during the foreseen period in the North American region.

KEY PLAYERS IN THE GLOBAL SLICKLINE SERVICES MARKET

Companies playing a prominent role in the global slickline services market include Schlumberger Limited (US), China Oilfield Services Limited (China), Halliburton Company (US), Weatherford International Plc. (US), Baker Hughes Company (US), AOS Orwell Ltd. (Nigeria), Archer Ltd. (UK), Expro Holdings UK 2 Ltd. (UK), National Oilwell Varco (US), Superior Energy Services Inc. (US), Reliance Oilfield Services (US), and Others.

RECENT HAPPENINGS IN THE GLOBAL SLICKLINE SERVICES MARKET

- Schlumberger has announced the launch of LIVE slickline digital services. At the base is a steel line cable designed to provide two-way digital communication. Together with a wide range of specially designed downhole modules, LIVE technology can measure and transmit tool and well information to the surface in real time.

DETAILED SEGMENTATION OF THE GLOBAL SLICKLINE SERVICES MARKET INCLUDED IN THIS REPORT

This research report on the global slickline services market has been segmented and sub-segmented based on slickline tools, application and region.

By Slickline Tools

- Pulling Tools

- Gauge Cutter

- Downhole Bailer

- Bridge Plug

- Others

By Application

- Offshore

- Onshore

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East & Africa

Frequently Asked Questions

1. What is the Slickline Services Market growth rate during the projection period?

The Global Slickline Services Market is expected to grow with a CAGR of 2.89% between 2024-2032.

2. What can be the total Slickline Services Market value?

The Global Slickline Services Market size is expected to reach a revised size of US$ 11.81 billion by 2032.

3. Name any three Slickline Services Market key players?

Baker Hughes Company (US), AOS Orwell Ltd. (Nigeria), and Archer Ltd. (UK) are the three Slickline Services Market key players.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2500

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]