Global Ski Market Size, Share, Trends & Growth Forecast Report By Product (Skis and Poles, Ski Boots, Ski Protective Gear and Accessories), Distribution Channel (Offline, Online), and Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), Industry Analysis From 2025 To 2033.

Global Ski Market Size

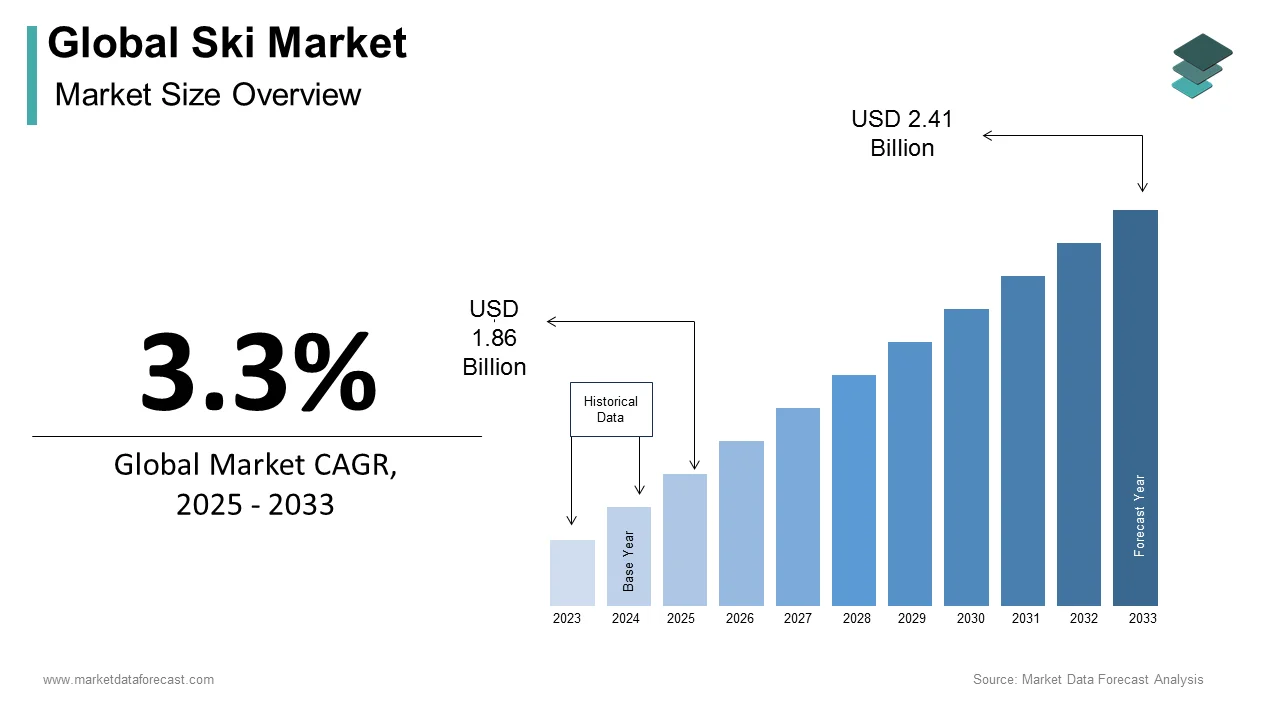

The size of the global ski market was worth USD 1.80 billion in 2024. The global market is anticipated to grow at a CAGR of 3.3% from 2025 to 2033 and be worth USD 2.41 billion by 2033 from USD 1.86 billion in 2025.

The global ski market is deeply intertwined with environmental factors, particularly the challenges posed by climate change. In recent years, there has been a decline in natural snowfall, resulting in an increased reliance on artificial snow production. For instance, in preparation for the 2026 Winter Olympics, Cortina d'Ampezzo in Italy is heavily utilizing artificial snow due to insufficient natural snowfall, as reported by Reuters. This trend raises concerns about the sustainability of such practices, given the significant water and energy resources required for snowmaking. Participation in skiing varies across regions. In the 2020/21 winter season, Germany had the highest number of skiing participants in Europe, with just over 14.6 million individuals engaging in the sport. France followed, with over 8.5 million skiers during the same period. These figures highlight the sport's popularity in certain European countries.

The global ski market also focuses on sustainability initiatives to mitigate environmental impacts. Alta Ski Area in Utah, for example, established the Alta Environmental Center in 2008 to guide its sustainability efforts. Through this center, Alta has reduced greenhouse gas emissions, implemented land conservation projects, and supported environmental research, as detailed by The Avant Ski. Furthermore, the International Ski and Snowboard Federation (FIS) has partnered with the United Nations' World Meteorological Organization to address the effects of climate change on winter sports. This collaboration aims to improve weather forecasting and snow management for ski federations and event organizers, as reported by AP News on September 25, 2024.

MARKET DRIVERS

Increasing Participation in Winter Sports

The growing interest in winter sports has been a key driver of the Ski Market. Approximately 400 million ski visits were recorded globally during the 2018/19 season, with steady growth observed in subsequent years despite pandemic-related disruptions. The U.S. Bureau of Economic Analysis states that outdoor recreation, including winter sports, contributed substantially to the U.S. economy in 2021, with skiing being a significant contributor. Additionally, Switzerland's Federal Statistical Office highlights that overnight stays at Swiss ski resorts increased notably annually from 2017 to 2019, reflecting rising international tourism. These trends demonstrate how improved accessibility to ski resorts and growing global interest in skiing directly boost equipment demand as enthusiasts invest in high-quality gear to enhance their experience.

Technological Advancements in Ski Manufacturing

Innovations in ski manufacturing have transformed the industry by improving performance and sustainability. The European Environment Agency notes that eco-friendly ski production methods, such as using recycled materials, have gained traction, with a reported considerable increase in consumer preference for sustainable products between 2019 and 2022. Furthermore, advancements in 3D shaping technology have enhanced precision and reduced material waste, according to research published by the Fraunhofer Institute for Manufacturing Technology. These innovations appeal to both professional athletes and recreational skiers, driving market expansion and increasing adoption rates worldwide.

MARKET RESTRAINTS

High Costs of Ski Equipment and Accessories

The high costs associated with ski equipment and accessories act as a significant restraint to market growth. Statista highlights that only a small share of U.S. households participate in skiing annually, with cost being a major barrier. The European Commission’s Directorate-General for Internal Market, Industry, Entrepreneurship and SMEs notes that rising inflation and energy costs have increased production expenses, leading to higher retail prices. For instance, the price of aluminum, a key material in ski manufacturing, rose significantly between 2020 and 2022, according to the International Monetary Fund (IMF). These factors limit accessibility, particularly among younger demographics, constraining market expansion despite growing interest in winter sports.

Environmental Concerns and Climate Change

Climate change poses a major challenge to the Ski Market by threatening the availability of natural snow. The Intergovernmental Panel on Climate Change (IPCC) reports that global warming has led to a 5-10% reduction in snow cover in key skiing regions over the past three decades. A study by the Swiss Federal Institute for Forest, Snow, and Landscape Research predicts that low-altitude ski resorts in the Alps could lose up to 50% of their natural snow cover by 2050 under current climate scenarios. Austria’s Federal Ministry for Climate Action states that ski resorts experienced a 10% decline in winter tourism revenue during years with poor snow conditions. As resorts increasingly rely on artificial snowmaking, operational costs rise significantly, with the International Energy Agency (IEA) reports snowmaking can increase resort energy consumption by up to 50%. These further burden the industry and discourage new investments in ski equipment.

MARKET OPPORTUNITIES

Expansion of Indoor Ski Resorts

The rise of indoor ski resorts presents a significant opportunity for the Ski Market, particularly in regions with limited natural snow. According to the International Report on Snow & Mountain Tourism, there are a sizeable number of indoor ski facilities globally, with rapid growth observed in the Middle East and Asia-Pacific regions. China’s National Bureau of Statistics highlights that the country has invested substantially in indoor ski infrastructure since 2018. These facilities provide year-round access to skiing, reducing seasonality constraints and boosting equipment sales. As indoor resorts expand globally, they create consistent demand for skis, catering to both beginners and experienced skiers.

Growing Demand for Sustainable and Eco-Friendly Equipment

The increasing consumer preference for sustainable products offers a promising opportunity for the Ski Market. A report by the European Commission’s Directorate-General for Environment highlights that eco-friendly ski equipment, made from recycled or sustainably sourced materials, has seen a notable increase in demand since 2020. The German Federal Ministry for Economic Affairs states that a significant portion of European consumers prioritize environmentally sustainable sports gear, even if it comes at a premium. Additionally, the U.S. Environmental Protection Agency emphasizes that manufacturers adopting green practices can reduce production waste. For instance, companies using bio-based resins and sustainably sourced wood have reported a 15% rise in sales. This shift towards sustainability aligns with global environmental goals and attracts environmentally conscious consumers, driving innovation and market growth in the ski industry.

MARKET CHALLENGES

Seasonal Nature of Skiing

The seasonal nature of skiing poses a significant challenge to the Ski Market, as it limits consistent revenue generation throughout the year. According to the Outdoor Industry Association, ski equipment sales are heavily concentrated during the winter months, with annual sales steeply rising between November and February. This seasonality creates cash flow challenges for manufacturers and retailers, who must manage inventory and production costs during off-peak months. The International Report on Snow & Mountain Tourism states that ski resorts in Europe and North America typically operate at full capacity for only a limited number of days annually, depending on weather conditions. Furthermore, Switzerland’s Federal Statistical Office reports that ski tourism revenues can increase during years with shorter or warmer winters. This dependency on specific weather conditions and limited operational periods restricts market growth and increases financial risks for stakeholders.

Rising Competition from Alternative Winter Activities

The Ski Market faces increasing competition from alternative winter activities, which attract potential customers and fragment the market. The European Commission’s Directorate-General for Education, Youth, Sport, and Culture notes that snowboarding has grown considerably over the past decade and particularly among younger demographics aged 18-34. Additionally, the rise of indoor entertainment options, such as virtual reality experiences, has further diverted interest from skiing. According to Canada’s National Ski Areas Association, ski resort visitation rates have declined since 2015 due to competition from these alternatives. As consumer preferences evolve, the Ski market must innovate and adapt to retain its customer base while addressing the growing appeal of diverse recreational activities.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

Segments Covered |

By Product, Distribution Channel, and Region. |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis; DROC, PESTLE Analysis, Porter's Five Forces Analysis, Competitive Landscape, Analyst Overview of Investment Opportunities |

|

Regions Covered |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Market Leader Profiled |

Fischer Sports GmbH, Black Diamond Equipment, Ltd, Amer Sports Corporation, Skis Rossignol SAS, United States Ski Pole Company, Fatcan Ski Poles, Apex Ski Boots, Icelantic LLC, Demon United, Helly Hansen AS, and Others. |

SEGMENT ANALYSIS

By Product Insights

The ski boots segment dominated the market by holding 35.5% of the global market share in 2024. The domination of the ski boots segment is majorly driven by their critical role in ensuring safety, comfort, and performance, making them essential for skiers of all levels. The U.S. Department of Commerce highlights that ski boots contribute a giant amount annually to the U.S. market. Their importance lies in their direct impact on skier control and compatibility with ski bindings, driving consistent demand. As participation in skiing grows, the need for high-quality, durable boots remains paramount, solidifying their position as the largest and most vital segment in the market.

On the other hand, the ski protective gear and accessories segment is flourishing with a projected CAGR of 6.8% over the forecast period owing to the increasing awareness of safety and advancements in materials such as lightweight, impact-resistant composites. The U.S. Consumer Product Safety Commission notes that the adoption of helmets alone has increased strongly over the past decade, significantly reducing head injuries. Additionally, a study by the European Environment Agency highlights that eco-friendly and customizable accessories, such as goggles and gloves, have seen a noticeable rise in demand since 2019. This segment's rapid expansion reflects evolving consumer priorities, emphasizing safety and sustainability, making it a key driver of innovation and growth in the skiing industry.

By Distribution Channel

The offline segment led the market by distribution channel by accounting for 70.4% of global market share in 2024. The rising preference from consumers for physically inspecting ski equipment, ensuring proper fit and quality, especially for products like ski boots and protective gear is majorly driving the expansion of the offline segment in the global market. The U.S. Census Bureau highlights that specialty sports retailers and ski resort shops generate billions annually in the United States alone. Offline channels also benefit from immediate product availability and personalized customer service, enhancing trust and satisfaction. As skiing remains a tactile and experience-driven sport, offline distribution remains crucial, solidifying its position as the largest and most trusted segment in the market.

On the other hand, the online segment is predicted to grow at the fastest CAGR of 8.5% throughout the forecast period owing to the increasing internet penetration, convenience, and competitive pricing, which appeal to tech-savvy consumers. A report by the European E-Commerce Association highlights those online sales of ski equipment grew decently between 2019 and 2022 owing to the improved e-commerce platforms and virtual try-on technologies. Additionally, the U.S. Department of Commerce notes that online retail total ski equipment sales in 2021 grew as compared to that in 2017. The rise of sustainable shipping options and direct-to-consumer brands further boosts this segment's appeal. Its rapid expansion reflects shifting consumer behavior, emphasizing accessibility and innovation, making it a key driver of future market growth.

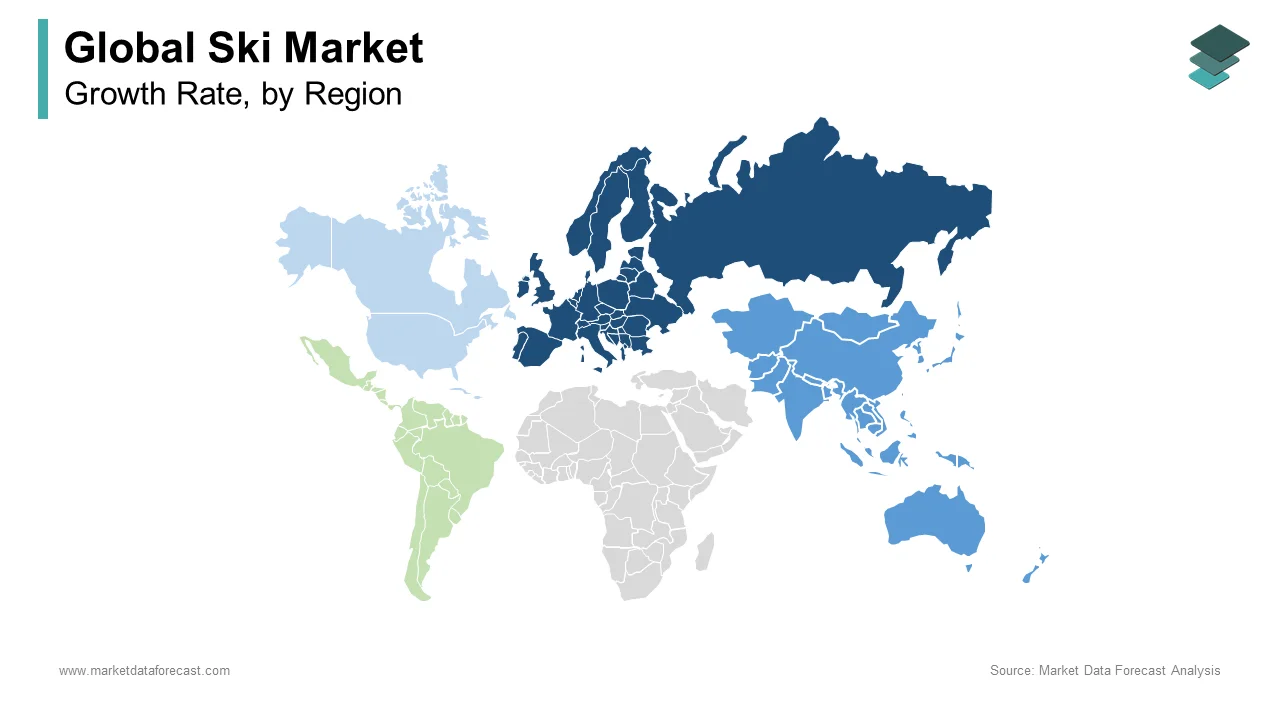

REGIONAL ANALYSIS

Europe dominated the ski market globally in 2024 by accounting for 40.3% of the global market share owing to the well-established ski tourism infrastructure, with the Alps attracting approximately 120 million annual visitors, according to Austria’s Federal Ministry for Agriculture, Forestry, Regions, and Water Management. Countries like Austria, France, and Switzerland contribute significantly to equipment sales, generating substantially, per data from the European Commission. Europe's dominance stems from its deep-rooted skiing culture, advanced resorts, and high participation rates. As the region continues to invest in sustainable tourism and snowmaking technologies, it remains a cornerstone of the global Ski Market.

The Asia-Pacific region is swiftly accelerating and is estimated to progress at a CAGR of 7.2% over the projection period. This growth is fueled by increasing disposable incomes, urbanization, and government initiatives. China’s National Bureau of Statistics reports that indoor ski facilities have grown majorly since 2018, attracting new enthusiasts. Additionally, Japan’s Ministry of Land, Infrastructure, Transport, and Tourism highlights that ski tourism revenue has increased by 15% since 2019 due to improved infrastructure. The region's rapid expansion reflects evolving consumer preferences and infrastructure development, positioning it as a key driver of future market growth.

North America holds a major share of the Ski Market. The region benefits from a strong skiing culture, particularly in the United States and Canada, where iconic resorts like Aspen and Whistler attract millions annually. According to Statistics Canada, winter sports tourism contributes over $8 billion annually to the Canadian economy. In the U.S., the National Ski Areas Association reports that ski resort visits increased from 61 million in 2021–2022 to 64.7 million in 2022–2023 The market is driven by high disposable incomes and a preference for premium equipment. While growth may be slower compared to emerging markets, ongoing investments in sustainable snowmaking technologies and eco-friendly resorts ensure steady performance in the coming years.

Latin America represents a smaller but growing segment of the Ski Market, with Chile and Argentina leading due to their Andes mountain ranges. Chile’s National Ski Federation highlights a notable annual increase in domestic ski participation since 2019. However, limited natural snow and infrastructure constraints hinder rapid growth. Indoor ski facilities, such as Brazil’s Snowland, are gaining traction, catering to urban populations. While the region faces challenges, rising urbanization and increasing awareness of winter sports are expected to drive moderate growth in the coming years.

The Middle East and Africa are emerging markets in the skis industry, driven by innovative indoor ski facilities. The UAE leads with Ski Dubai which contributes significantly to the local economy, according to the UAE Ministry of Economy. Saudi Arabia is investing in winter sports as part of its Vision 2030 initiative, aiming to diversify tourism. In Africa, South Africa’s indoor ski facilities, like the Ski Dubai-inspired Snow Factor in Johannesburg, are introducing winter sports to new demographics. While the region accounts for a small share of the global market, government investments in tourism and recreational infrastructure are expected to spur steady growth, particularly among affluent urban populations seeking unique experiences.

KEY MARKET PLAYERS

Some of the notable companies dominating the global ski market profiled in this report are Fischer Sports GmbH, Black Diamond Equipment, Ltd, Amer Sports Corporation, Skis Rossignol SAS, United States Ski Pole Company, Fatcan Ski Poles, Apex Ski Boots, Icelantic LLC, Demon United, Helly Hansen AS, and Others.

TOP 3 PLAYERS IN THE MARKET

Amer Sports Corporation

Amer Sports, a Finnish company, owns renowned ski brands such as Atomic and Salomon. These brands are recognized for their high-quality skis, boots, and bindings, catering to both recreational skiers and professionals. Amer Sports' commitment to research and development has led to innovative products that enhance performance and safety, solidifying its strong presence in the market.

Groupe Rossignol

Based in France, Groupe Rossignol encompasses brands like Rossignol and Dynastar. The company offers a wide range of ski equipment, including skis, boots, and bindings, designed for various skiing disciplines. Rossignol's long-standing reputation and focus on quality have made it a preferred choice among skiers worldwide.

Fischer Sports GmbH

An Austrian company, Fischer Sports is known for its alpine and Nordic skiing equipment. The brand is particularly esteemed in the cross-country skiing community, offering a diverse range of skis, boots, and bindings. Fischer's dedication to technological advancement and quality has earned it a loyal customer base.

TOP STRATEGIES USED BY THE KEY MARKET PARTICIPANTS

Product Innovation and Technological Advancements

Companies like Fischer Sports GmbH focus on continuous product innovation to meet evolving consumer preferences. For instance, in January 2022, Fischer launched the redesigned Ranger series skis, crafted with sustainable materials to minimize environmental impact.

Strategic Partnerships and Collaborations

Leading companies often engage in strategic partnerships to enhance their market presence. Collaborations between ski resorts, equipment manufacturers, and travel agencies can lead to improved customer experiences and expanded marketing efforts.

Expansion into Emerging Markets

Recognizing growth opportunities, companies are expanding into emerging markets, particularly in the Asia-Pacific region. With over 230 million people participating in snow holidays across China, Japan, South Korea, and India, substantial investments in infrastructure and the adoption of winter sports culture are evident.

COMPETITIVE LANDSCAPE

The ski equipment market is fiercely contested, with top brands striving for dominance. Major players, including Rossignol, Salomon, Atomic, Fischer, and Völkl, focus on delivering premium products designed for diverse skill levels. Their portfolios include skis, boots, bindings, and protective gear, ensuring broad consumer appeal.

Cutting-edge advancements drive competition, with companies integrating lightweight carbon fiber composites and precision engineering to enhance durability and performance. Research and development investments fuel continuous product refinement, attracting both casual enthusiasts and professionals.

Customization trends are reshaping the industry, with skiers demanding tailored solutions. Adjustable bindings, personalized boot fittings, and specialized equipment for various skiing styles are gaining traction. Companies excelling in personalization gain a significant market advantage.

Seasonal fluctuations present challenges, requiring efficient inventory and production management. Firms must align output with peak winter months to maximize profitability. Additionally, growing interest in alternative winter activities intensifies market pressures, compelling brands to innovate consistently.

Partnerships with ski resorts, sponsorship of events, and digital marketing campaigns are crucial strategies for visibility and consumer engagement. Expanding into emerging regions with rising participation rates, such as Asia-Pacific, further strengthens global positioning. The dynamic landscape ensures continuous evolution as brands compete for market share.

RECENT MARKET DEVELOPMENTS

- In October 2024, Johnnie Walker partnered with luxury skiwear brand Perfect Moment to launch the Johnnie Walker Blue Label Ice Chalet and a crossbody bag. These products were made available both online and in select stores globally.

- In March 2024, K2 announced its 2024/25 ski and boot collection, introducing innovations in freeski and freeride equipment. The collection became available online and at select retailers in autumn 2024.

MARKET SEGMENTATION

This research report on the global ski market has been segmented and sub-segmented based on the product, distribution channel, and region.

By Product

- Skis and Poles

- Ski Boots

- Ski Protective Gear and Accessories

By Distribution Channel

- Offline

- Online

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East and Africa

Frequently Asked Questions

1. What is the projected growth of the global ski market?

The global ski market is expected to grow from USD 1.86 billion in 2025 to USD 2.41 billion by 2033, at a CAGR of 3.3%.

2. What are the key factors driving ski market growth?

Increasing participation in winter sports and advancements in ski manufacturing technology.

3. What challenges does the industry face?

High equipment costs, environmental concerns, and climate change impact.

4. How is climate change affecting the ski industry?

Declining snowfall is increasing reliance on artificial snow production.

5. What opportunities exist in the ski market?

Growth of indoor ski resorts and demand for sustainable ski equipment.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2500

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]