Global Sink Market Size, Share, Trends, & Growth Forecast Report Segmented By Number of Bowls (Single Bowl, Double Bowl, and Multi Bowl), Material, and Region (Latin America, North America, Asia Pacific, Europe, Middle East and Africa), Industry Analysis from 2025 to 2033

Global Sink Market Size

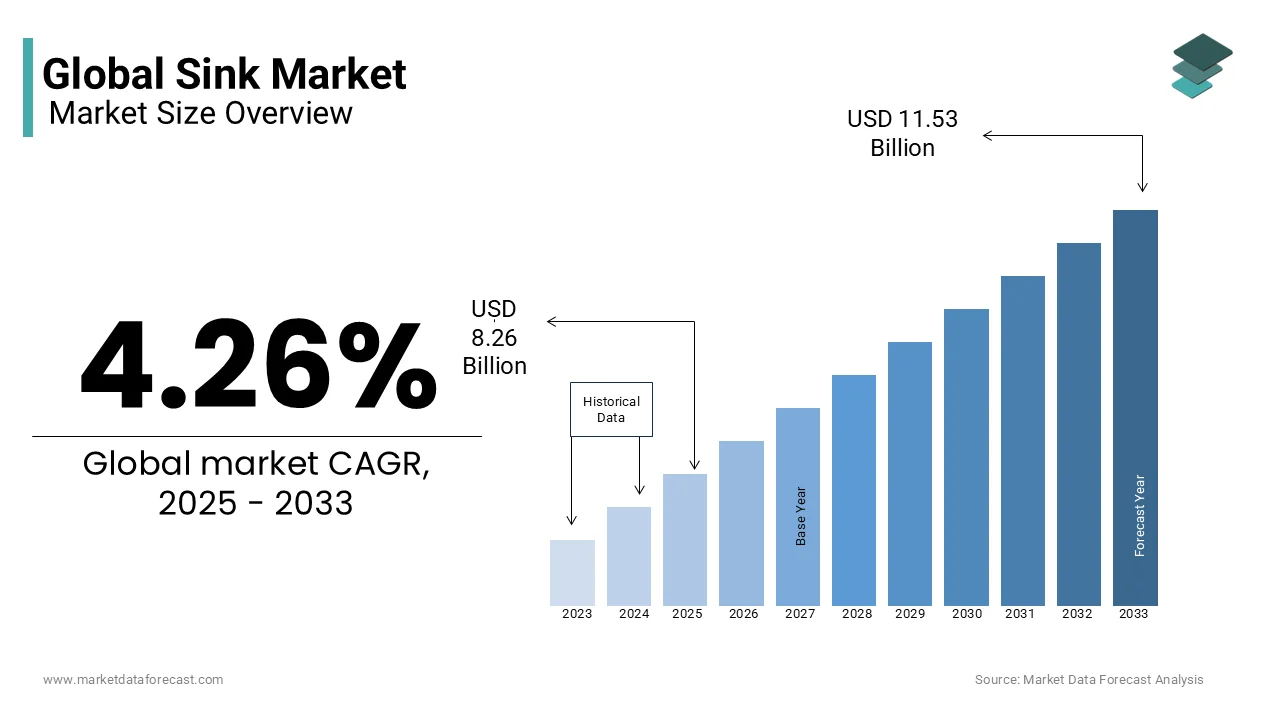

The global sink market size was valued at USD 7.92 billion in 2024 and is expected to reach USD 11.53 billion by 2033 from USD 8.26 billion in 2025. The market is projected to grow at a CAGR of 4.26%.

The sink market is an essential segment within the broader kitchen and bathroom fixtures industry, encompassing a diverse range of sink types, including stainless steel, ceramic, composite, and natural stone sinks. These products are integral to both residential and commercial infrastructures, serving functional, sanitary, and aesthetic purposes. The demand for ergonomically designed, durable, and innovative sink solutions has been rising, fueled by shifting consumer preferences, modern interior designs, and advancements in material technology.

The urbanization rate in Europe plays a significant role in the growth of the sink market. According to Eurostat, over 75% of the European population currently resides in urban areas, with projections indicating further growth by 2030. The rise in urban living has led to an increase in housing developments, renovations, and modular kitchen installations, where high-quality sinks are essential. Additionally, with more than 85% of European households connected to piped water supply systems, the demand for advanced and water-efficient sink solutions has increased.

Sustainability has also emerged as a major factor in the market. According to the European Environment Agency (EEA), household water consumption in Europe averages 144 liters per capita per day, necessitating the adoption of water-efficient sink designs and smart drainage systems. Moreover, the EU Circular Economy Action Plan has encouraged manufacturers to adopt eco-friendly and recyclable materials such as stainless steel and composite granite, significantly impacting production trends.

The growing prevalence of smart home technologies has influenced the market as well. The European Commission reports that nearly 30% of newly built homes incorporate smart kitchen solutions, including touchless faucets, integrated water filtration, and automated sink cleaning mechanisms. As consumers increasingly prioritize hygiene, convenience, and energy efficiency, sink manufacturers are integrating sensor-based water flow systems and antimicrobial surfaces into their products.

MARKET DRIVERS

Urbanization and Housing Development

Rapid urbanization in Europe has significantly increased demand for efficient and high-quality kitchen and bathroom fixtures, including sinks. According to Eurostat, over 75% of the European population currently resides in urban areas, with projections showing further growth by 2030. The European Commission observed that urban dwellers are more likely to live in apartments and smaller homes, necessitating space-efficient sink solutions. Additionally, the EU’s Housing Europe Report indicates that 35% of European households undergo renovations every five years, driving demand for modern sink installations. The push for smart city development and urban renewal projects further amplifies market potential, making urbanization a key driver for innovation and growth in sink designs and materials.

Digitalization and Smart Home Integration

Technological advancements and digitalization are reshaping the sink market, with smart features becoming increasingly popular in European households. Eurostat’s 2024 "Digitalisation in Europe" report states that 30% of European homes now incorporate smart home devices, including IoT-enabled appliances and touchless fixtures. The European Commission also reports that demand for sensor-based water conservation technologies has grown by 22% annually since 2021. Features such as touchless faucets, automatic water flow control, and temperature regulation are gaining traction as consumers seek enhanced hygiene, convenience, and sustainability. The rise of home automation and connected kitchen ecosystems presents a major growth opportunity for sink manufacturers, allowing them to integrate digital features that align with evolving consumer preferences.

MARKET RESTRAINTS

Housing Affordability Challenges

The rising cost of housing in Europe has impacted consumer spending on home improvements, including sink installations. Eurostat’s 2022 data reveals that 10.6% of EU citizens in urban areas spend more than 40% of their income on housing, limiting their ability to invest in premium fixtures. Additionally, the OECD Housing Affordability Report stated that real estate prices in major European cities have increased by 35% in the past decade, making homeownership and renovations less accessible. The financial strain on households reduces discretionary spending, leading to slower adoption of high-end, technologically advanced sinks. This affordability crisis presents a significant restraint on market growth, as budget-conscious consumers prioritize essential home improvements over luxury fixtures.

Water Resource Management Regulations

Europe’s increasing focus on water conservation imposes stringent regulations on sink manufacturers, affecting product designs and compliance costs. The European Environment Agency (EEA) states that household water consumption accounts for 12% of total water use in the EU, prompting stricter efficiency standards. The EU Water Framework Directive enforces guidelines on water-saving technologies, compelling manufacturers to develop sinks that limit water flow without compromising performance. While these regulations promote sustainability, they also increase production costs, as companies must invest in new materials, filtration systems, and water-efficient designs. Non-compliance can result in market entry barriers and financial penalties, making regulatory adherence a significant challenge for businesses in the sink market.

MARKET OPPORTUNITIES

Sustainable and Water-Efficient Products

With increasing environmental concerns, sustainability is emerging as a major opportunity for sink manufacturers. The European Environment Agency (EEA) reports that EU households consume an average of 144 liters of water per person per day, demonstrating the need for water-efficient solutions. The European Commission’s Circular Economy Plan encourages the use of eco-friendly materials such as recycled stainless steel and composite granite, creating incentives for sustainable product development. Additionally, the EU Green Deal’s climate goals promote tax reductions and grants for companies manufacturing water-efficient fixtures. This focus on sustainability allows sink manufacturers to innovate and cater to environmentally conscious consumers, enhancing market growth while aligning with global water conservation initiatives.

Smart Technology Integration

The integration of smart technology in household fixtures presents a lucrative opportunity for sink manufacturers. The European Commission’s 2024 Digital Transformation Report states that over 60% of new homes in Europe are built with smart home capabilities, driving demand for IoT-enabled sinks. Features such as automatic temperature control, touchless operation, and app-based monitoring are becoming increasingly attractive to consumers. Eurostat reports that European smart home penetration is expected to reach 50% by 2030, creating a vast market for tech-integrated fixtures. Manufacturers investing in AI-driven water management systems and self-cleaning sink surfaces can capitalize on this trend, offering innovative solutions that enhance hygiene, convenience, and sustainability in modern homes.

MARKET CHALLENGES

Economic Disparities Across Regions

Economic inequalities across European countries create uneven market penetration for high-end sink products. Eurostat’s 2023 Economic Report indicates that while Western Europe enjoys an average disposable income of €24,000 per year, Eastern European nations report figures as low as €9,000 per year. This gap affects purchasing power, as consumers in lower-income regions opt for basic, low-cost sink models rather than premium smart or designer sinks. Additionally, the World Bank’s European Economic Outlook reported that inflation and economic instability have reduced household spending by 8% in certain countries, limiting demand for luxury home fixtures. These economic disparities challenge manufacturers to balance affordability and innovation, tailoring products for diverse market segments.

Regulatory Compliance and Standards

Strict EU regulations on water efficiency, materials, and environmental impact create compliance challenges for sink manufacturers. The EU Water Efficiency Directive mandates that all newly manufactured sinks and faucets meet specific water conservation requirements, pushing companies to redesign products frequently. The European Chemicals Agency (ECHA) also enforces restrictions on certain materials used in sink coatings and plumbing systems, requiring businesses to transition to alternative, often more expensive, materials. Compliance with these evolving regulations increases research and development costs, delays product launches, and limits design flexibility. Non-compliance can result in market bans, penalties, or reputational damage, making regulatory adherence a significant hurdle in the sink market.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

4.26% |

|

Segments Covered |

By Number of Bowls, Material, and Region |

|

Various Analyses Covered |

Global, Regional, & Country Level Analysis; Segment-Level Analysis; DROC; PESTLE Analysis; Porter’s Five Forces Analysis; Competitive Landscape; Analyst Overview of Investment Opportunities |

|

Regions Covered |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Market Leaders Profiled |

Franke Group, Kohler Co., Blanco America, Inc., Elkay Manufacturing Company, Moen Incorporated, Teka Group, Reginox, Duravit AG, Ruvati USA, and Alveus d.o.o., and others |

SEGMENTAL ANALYSIS

By Number of Bowls Insights

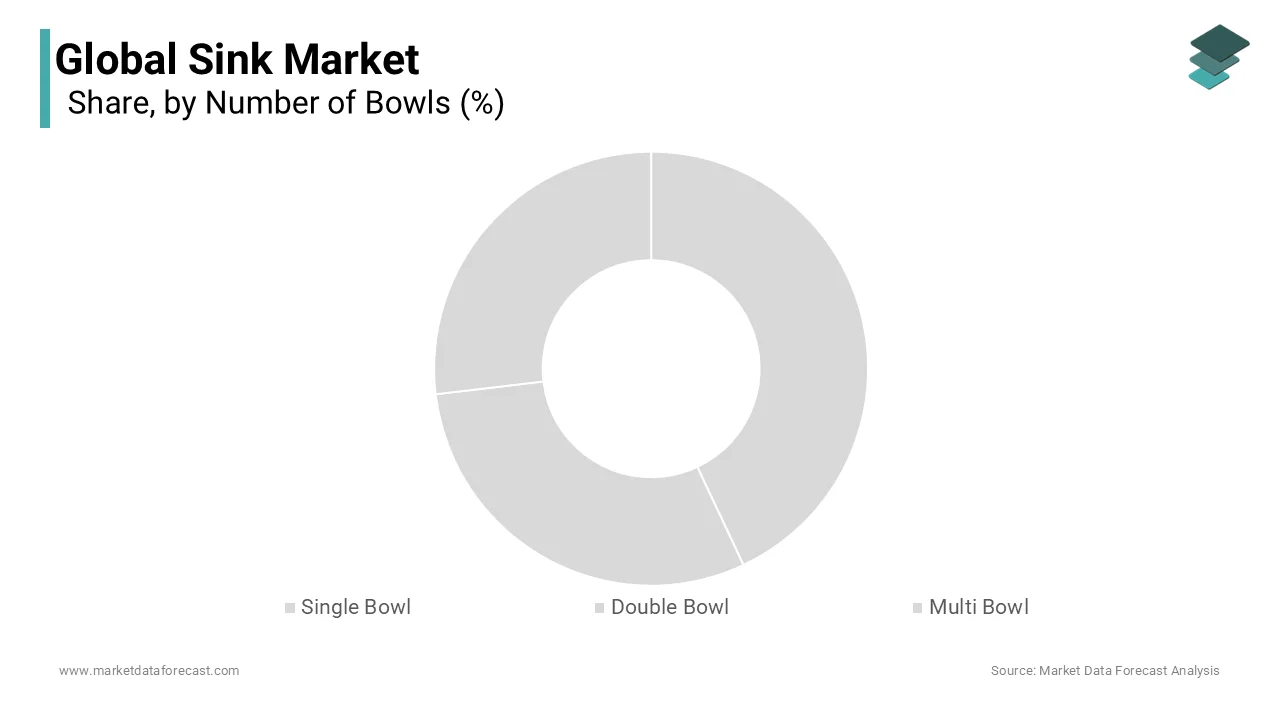

The single bowl sinks segment dominated the market and accounted for 48.24% of global sales in 2024. Their popularity is largely due to their suitability for compact kitchens, especially in urban settings where space is at a premium. The European Union reports that over 75% of its population resides in urban areas, leading to smaller living spaces. Additionally, Eurostat data indicates that 47.5% of EU residents live in flats, which often feature limited kitchen areas. Single bowl sinks offer a practical solution in these environments, providing essential functionality without occupying excessive space. Their straightforward design also appeals to minimalistic trends prevalent in modern urban housing.

The Multi bowl sinks segment is anticipated to witness the fastest CAGR of 6.34% from 2025 to 2033. This surge is driven by increasing consumer demand for versatile kitchen solutions that enhance efficiency. Multi bowl sinks allow for simultaneous tasks, such as washing and rinsing, streamlining kitchen workflows. The European Commission revealed a trend towards multifunctional home appliances, with 30% of European households adopting smart kitchen technologies. This shift towards multifunctionality in kitchen design complements the rising preference for multi bowl sinks, as they align with the modern consumer's desire for convenience and efficiency in household chores.

By Material Insights

The Metallic sinks segment and particularly those made from stainless steel held the largest market share at 52.98% in 2024. Their dominance is attributed to their durability, corrosion resistance, and ease of maintenance. Stainless steel's ability to withstand high temperatures and heavy usage makes it a preferred choice in both residential and commercial kitchens. The European Committee for Standardization (CEN) notes that stainless steel is extensively used in kitchen environments due to its hygienic properties and longevity. Moreover, its sleek appearance complements modern kitchen aesthetics, further solidifying its position as the leading material in the sink market.

The Granite sinks segment is projected to experience a significant CAGR of 5.07% between 2025 and 2033. This growth is fueled by consumers' increasing preference for aesthetic appeal combined with functionality. Granite sinks offer a unique, high-end appearance and are known for their scratch and stain resistance. The European Consumer Organisation (BEUC) reports a rising trend in the adoption of natural and composite stone materials in home interiors, reflecting a consumer shift towards premium and durable home fixtures. Additionally, granite sinks' noise-reducing properties enhance their appeal in open-plan living spaces, aligning with contemporary home design trends.

REGIONAL ANALYSIS

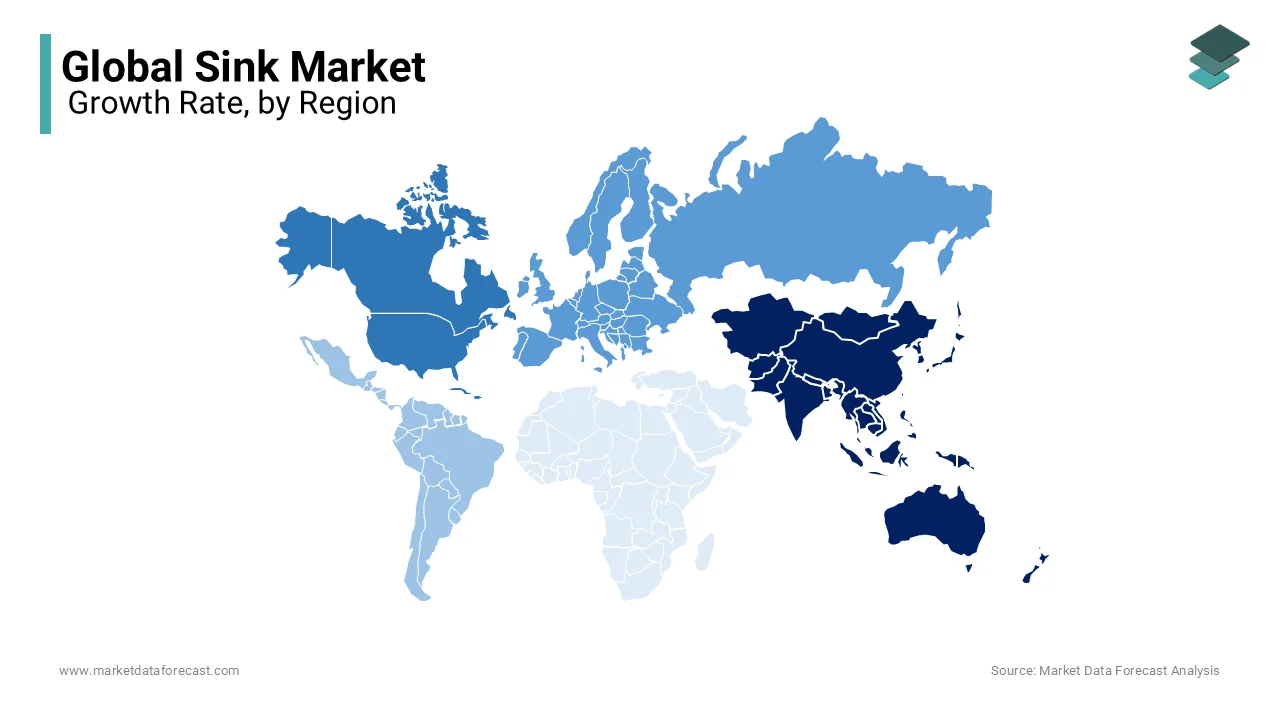

The Asia-Pacific region led the global kitchen sinks market by commanding a share of 35.8% in 2024. This dominance is primarily attributed to rapid urbanization and population growth in countries like China and India. The United Nations reports that urban areas in Asia are expanding swiftly, with projections indicating that by 2050, urban dwellers will constitute about 64% of the region's total population. This urban expansion has spurred extensive residential construction activities, increasing the demand for kitchen and bathroom fixtures, including sinks. Additionally, rising disposable incomes have empowered consumers to invest in modern home amenities, further bolstering the sink market in this region.

North America is anticipated to experience robust growth in the sink market with a projected CAGR of 6.2% between 2025 and 2033. This growth is driven by a strong culture of home renovation and remodeling. The Joint Center for Housing Studies of Harvard University reported that in 2022, American homeowners spent over $400 billion on home improvement projects. This trend reflects a consumer preference for upgrading kitchen and bathroom spaces, leading to increased demand for high-quality sinks. Moreover, the U.S. Census Bureau indicates a steady rise in new housing starts, further contributing to the market's expansion as new homes require modern fixtures.

Europe is expected to maintain a steady growth trajectory in the sink market. Germany stands out as a significant contributor, driven by its robust economy and a strong demand for premium home improvement products. The Federal Statistical Office of Germany (Destatis) reported that in 2022, the country saw a 2.5% increase in residential construction permits compared to the previous year. This uptick in construction activities, coupled with a consumer preference for high-quality and aesthetically pleasing kitchen and bathroom fixtures, is expected to sustain the demand for sinks in the European market.

In Latin America, the sink market is poised for moderate growth in the coming years. The Economic Commission for Latin America and the Caribbean (ECLAC) found that urbanization rates have reached approximately 81% as of 2022, leading to increased housing developments. However, economic disparities and fluctuations in disposable income levels may temper the pace of market expansion. Nonetheless, government initiatives aimed at improving housing conditions and infrastructure could provide a stimulus for the sink market, particularly in urban centers where demand for modern kitchen and bathroom fixtures is on the rise.

The Middle East and Africa region is expected to witness gradual growth in the sink market. The United Nations projects that urbanization in Africa will reach 60% by 2050, indicating a significant shift towards urban living. Similarly, the Middle East showcases high urbanization rates, with the World Bank reporting over 70% urban residency as of 2022. These trends suggest a growing demand for residential construction and, consequently, kitchen and bathroom fixtures. However, economic challenges and political instability in certain areas may pose constraints. Despite these hurdles, investments in infrastructure and housing developments, particularly in urban centers, are anticipated to drive the demand for sinks in this region over the coming years.

KEY MARKET PARTICIPANTS AND COMPETITIVE LANDSCAPE

Franke Group, Kohler Co., Blanco America, Inc., Elkay Manufacturing Company, Moen Incorporated, Teka Group, Reginox, Duravit AG, Ruvati USA, and Alveus d.o.o. are playing dominating role in the global sink market.

The global sink market is highly competitive, driven by evolving consumer preferences, technological advancements, and sustainability trends. Major players such as Franke Holding AG, Kohler Co., and Blanco GmbH dominate the market, competing on product innovation, quality, and brand reputation. These companies continuously invest in R&D to introduce advanced materials, smart kitchen integrations, and ergonomic designs, setting them apart from smaller manufacturers.

Apart from premium brands, the market also features mid-range and budget-friendly manufacturers that cater to mass-market consumers. Companies like Elkay Manufacturing, Ruvati, and Kraus offer cost-effective alternatives, intensifying price-based competition. Additionally, the rise of e-commerce platforms and direct-to-consumer sales has increased competition, as smaller brands gain visibility alongside established market leaders.

Geographically, North America and Europe are dominated by premium brands, while Asia-Pacific and Latin America present opportunities for emerging manufacturers due to increasing urbanization and home renovations. Sustainability has also become a key competitive factor, with companies integrating eco-friendly materials and water-saving technologies to meet regulatory and consumer demands.

TOP 3 PLAYERS IN THE MARKET

Franke Holding AG

Franke Holding AG is a global leader in kitchen solutions, specializing in high-quality kitchen sinks, faucets, and related accessories. The company has a strong market presence, particularly in Europe, North America, and Asia. Franke's growth has been fueled by its commitment to innovation, offering advanced sink designs with features such as integrated drainage systems and durable materials like stainless steel and granite composite. Their ability to blend functionality with modern aesthetics has made them a preferred choice for both residential and commercial applications. By continuously expanding their product lines and incorporating smart kitchen technologies, Franke has significantly contributed to the evolution of the global sink market.

Kohler Co.

Kohler Co. is one of the most recognized names in kitchen and bathroom fixtures, with a longstanding reputation for quality and design excellence. The company has a robust global presence, with a strong foothold in the premium sink segment. Kohler’s contribution to the sink market comes through its extensive range of sinks made from enameled cast iron, stainless steel, and innovative composite materials. Their focus on sustainability and water efficiency, along with the introduction of smart sink solutions, has positioned them as a forward-thinking player in the market. Through continuous investment in research and development, Kohler has been at the forefront of launching cutting-edge sink designs that cater to modern consumer needs.

Blanco GmbH + Co KG

Blanco GmbH + Co KG is a German company known for its premium kitchen sinks and related accessories. The company has established a strong presence in Europe and North America, with a growing market in Asia. Blanco’s signature innovation, Silgranit sinks—crafted from a durable granite composite material—has set a benchmark in the market for resilience and aesthetic appeal. The company’s focus on ergonomics and seamless integration with modern kitchen designs has made it a top choice for homeowners and professionals alike. By consistently improving its product range and expanding its distribution network, Blanco has played a significant role in shaping global sink market trends.

STRATEGIES USED BY THE MARKET PLAYERS

Product Innovation and Technological Advancement

Leading sink manufacturers invest heavily in research and development (R&D) to create innovative and technologically advanced products. Franke Holding AG focuses on incorporating integrated drainage systems, antibacterial surfaces, and smart kitchen technologies into its sinks to enhance hygiene and convenience. Kohler Co. is at the forefront of sustainable materials and touchless sink systems, catering to consumers looking for modern and eco-friendly solutions. Blanco GmbH has gained market recognition for its Silgranit sinks, a durable and stylish granite composite material that offers resistance to scratches and stains, setting a new standard in the market.

Market Expansion and Global Presence

To strengthen their market position, major sink companies continuously expand their global reach. Franke Holding AG has expanded significantly in Asia-Pacific and North America, forming strategic alliances and localizing production to cater to regional preferences. Kohler Co. has aggressively entered emerging markets such as India, China, and the Middle East, capitalizing on the rising demand for modern home improvement solutions. Blanco GmbH has focused on premium markets in Europe and North America, ensuring strong brand visibility in the luxury kitchen segment.

Sustainability and Eco-Friendly Initiatives

With growing environmental concerns, sustainability has become a key strategy for sink manufacturers. Kohler Co. has pledged to achieve carbon neutrality and water efficiency across its product range, launching water-saving sink systems that align with global environmental standards. Franke Holding AG prioritizes recyclable stainless steel sinks and eco-friendly packaging, reducing its carbon footprint. Blanco GmbH has developed sinks made from sustainable and durable composite materials, ensuring longer product life cycles while minimizing environmental waste.

RECENT HAPPENINGS IN THE MARKET

- In February 2025, Delta Faucet announced the upcoming launch of the Clarifi™ Under Sink Water Filtration Systems, designed to reduce contaminants like chlorine and microplastics, with availability expected in winter 2025. Also, in February 2025, Delta Faucet unveiled the PivotPro™ 3-in-1 Combination Shower, featuring a 7-inch raincan shower head with 360-degree pivot capability, set for release in fall 2025.

MARKET SEGMENTATION

This research report on the global sink market has been segmented and sub-segmented based on number of bowls, material, and region.

By Number of Bowls

- Single Bowl

- Double Bowl

- Multi Bowl

By Material

- Metallic

- Granite

- Others

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

Frequently Asked Questions

1. What is the expected market size of the global sink market in the coming years?

The market is projected to reach USD 8.26 billion in 2025 and is expected to grow to USD 11.53 billion by 2033.

2. Which regions are expected to dominate the sink market?

Major growth is expected in North America, Europe, and Asia-Pacific, with China, India, and the U.S. being key contributors to market expansion.

3. How does the growth of the construction industry impact the sink market?

The rise in residential and commercial construction activities, particularly in emerging economies, is boosting demand for high-quality and aesthetically appealing sinks.

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2500

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]