Global Single Nucleotide Polymorphism (SNP) Genotyping Market Size, Share, Trends & Growth Forecast Report – Segmented By Technology (Microarrays and Gene Chips, SNP Pyrosequencing, Sequemon MassArray Maldi-TOF, Taqman Allelic Discrimination, Applied Biosciences SNPlex, Next-Generation Sequencing (NGS), Powered Polymerase Chain Reaction (PCR) and Others), End-User and Region (North America, Europe, Asia Pacific, Latin America, Middle East and Africa) - Industry Analysis (2024 to 2029)

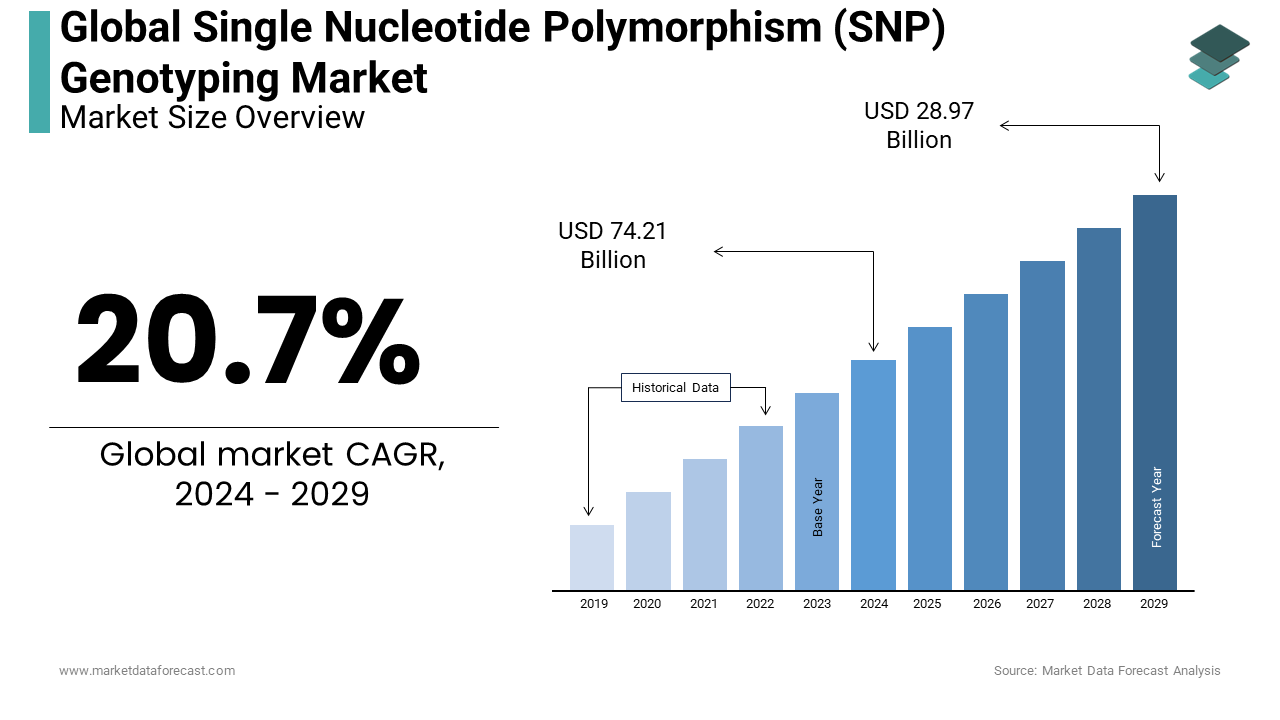

Global Single Nucleotide Polymorphism (SNP) Genotyping Market Size (2024 to 2029)

The global single nucleotide polymorphism (SNP) genotyping market is expected to grow to USD 28.97 billion by 2029 from USD 74.21 billion in 2024, registering a CAGR of 20.7% from 2024 to 2029.

Current Scenario of the Single Nucleotide Polymorphism (SNP) Genotyping Market

The single nucleotide polymorphism (SNP) genotyping market is growing rapidly with North America in the lead followed by Europe and then by Asia Pacific. Currently, the industry is driven by technological advancements in this field like DNA microarrays and next-generation sequencing (NGS). Moreover, the rising application of genotyping in developing new drugs around the world is one of the key factors that is propelling the growth of the SNP genotyping industry. Further, the industry for genotyping is also assisted by elements such as the increasing number of elderly people, the high cost of healthcare services and the escalating quantity of financial aid, grants and investments.

MARKET DRIVERS

Y-o-Y increase in the incidences of deadly diseases and conditions such as respiratory problems, diabetes and cancer propel SNP genotyping market growth.

Moreover, the rising need for genetic analysis in plant and animal feed material accelerates the market growth. In addition, the surging popularity of precision medical care has positioned SNP genotyping at the center of the individualized medicine revolution, pushing forward the progress of the global market. Also, the biotechnology advancements in agriculture are another factor contributing to the market expansion. Likewise, in July 2024, ISAAA Inc., in collaboration with the Philippine Agriculture and Fisheries Biotechnology Program (DA Biotech), released a policy summary document named Advancing Philippine Agriculture: Strategic Framework for the Commercialization of Biotech Innovations and this is aimed at commercializing biotech innovations.

DTC genetic testing kits are gaining traction which enables customers to access genetic data without the requirement for a healthcare practitioner, fuelling market growth. Besides this, the emergence of automatic and miniaturized genotyping platforms that furnish greater output and convenience. Increasing research emphasis on notable and uncommon diseases resulted in the development of specialist genotyping assays for their identification and study. Further use cases in the agriculture industry for crop and livestock enhancement could generate new revenue channels. The recent developments in SNP array technologies for genome-wide DNA polymorphisms present potential opportunities for the single nucleotide polymorphism (SNP) genotyping market. It provides a high-output genotyping platform. A study was performed, advanced and assessed a 135k larger density SNP genotyping array to assist genetic research and rearing uses in kiwifruit. It possesses the benefit of a complete design which can be an effective means in genetic analyses and breeding use cases in high-value crops. Additionally, for the past decade, experts have been developing affordable, easy-to-handle, quick, and sensitive SNP detection methods and biosensors. These are believed to boost the market's growth rate in the coming years.

MARKET RESTRAINTS

The single nucleotide polymorphism (SNP) genotyping market growth is derailed by the absence of standardization and privacy risks in SNP procedures. Moreover, the interpretation and analysis of huge volumes of data produced by high-efficiency SNP genotyping platforms need state-of-the-art bioinformatics resources and proficiency which also decreases the expansion of the industry. Apart from this, connecting to special clinical and phenotype results continues to obstruct the market from moving forward, particularly for complicated traits. Additionally, another issue is the requirement for comprehensive and varied patient genotype-phenotype data collections to develop the diagnosis and treatment of upcoming patients. Substantial expenses related to modern genotyping equipment and the requirement for specialized bioinformatics help might hinder the availability of SNP genotyping, particularly in under-resourced settings. Also, the wide complication of genetic changes demands comprehensive data sets and intricate analyses, which can be interpretational problems. Apart from the need for a huge dataset, the growth of the SNP genotyping market is further expected to be impeded by the diverse and complex laws and regulations administering privacy protection with different practices and definitions throughout different jurisdictions.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 to 2029 |

|

Base Year |

2023 |

|

Forecast Period |

2024 to 2029 |

|

Segments Analysed |

By Technology, End-User & Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, Drivers, Restraints, Opportunities, Challenges; PESTLE Analysis; Porter's Five Forces Analysis, Competitive Landscape, Analyst Overview of Investment Opportunities |

|

Regions Analysed |

North America, Europe, Asia Pacific, Latin America, the Middle East, and Africa |

|

Key Market Players |

Illumina, Affymetrix, Agena Bioscience, Thermo Fisher Scientific, Sequenom, Douglas Scientific, Bio-Rad Laboratories Inc., Promega Corporation and Fluidigm. |

SEGMENTAL ANALYSIS

Global Single Nucleotide Polymorphism (SNP) Genotyping Market Analysis By Technology

The SNP pyrosequencing segment prevailed over others with a significant portion of the single nucleotide polymorphism (SNP) genotyping market share. This can be attributed to its flexibility, accuracy, and parallel processing, and it can also be operated by automatic equipment. Moreover, the rising frequency of chronic diseases resulted in a greater demand for individualized medicine also contributed to the expansion of the segment. In addition, rapid identification techniques decreased the discovery period and surged the application of single nucleotides to provide better outcomes from the process are other key factors influencing the segment’s market share. Additionally, the segment’s market size is expected to further expand due to rising investments and R&D projects by government and private establishments to better understand and prepare for a future pandemic like COVID-19.

The next-generation sequencing segment is quickly gaining traction and is predicted to drive further during the forecast period. Persistent study and research activity is one of the key factors in propelling the segment forward. This revolutionary technology has rapidly pushed genomics developments over several domains. Further, its ability to swiftly sequence millions of DNA fragments all at once, furnishing extensive knowledge into epigenetic modifications, gene expression profiles, genetic changes and genome structure. Apart from this, the emergence of modern and sophisticated NGS platforms, like Oxford Nanopore, Pacific Biosciences, and Illumina, has changed the area of genomics by enabling the parallel sequencing of DNA fragments from millions to billions.

Global Single Nucleotide Polymorphism (SNP) Genotyping Market Analysis By End-User

The pharmacogenomics segment is believed to leading category of the single nucleotide polymorphism (SNP) genotyping market during the forecast period. This can be linked to the greater reliance on SNP genotyping for drug development, companion predictive biomarkers in clinical testing, and the discovery of companion diagnostics. This dependence shows the importance of this type of genotyping in the advent of precision therapies and the enforcement of pharmacogenomics, customized treatments to genetic cases for better healthcare results. Moreover, the segment’s market size also grew due to the rising inclination towards personalized medicines. It is expected to expand in the coming years considering the changes in patients post-pandemic.

The diagnostic and forensics segment is the second largest under this category. This is because of technological developments like alternative light & ballistics, laser ablation coupled plasma mass spectrometry and DNS sequencing, automated fingerprint identification and magnetic fingerprinting.

REGIONAL ANALYSIS

North America dominated the single nucleotide polymorphism (SNP) genotyping market in 2023.

The regional market is likely to witness further advancement in this field in the coming years and continue to be the regional leader in the global market during the forecast period. The domination of the North American market can be mainly credited to its strong pharmaceutical and biotechnological industry, large studies and development projects and the presence of prominent genotyping technology companies. In addition, as per a 2022 study published by the National Association of Chronic Disease Directors, around 60 percent of mature Americans suffer from at least one deadly and persistent disease. The major reasons behind deaths in the United States are cardiovascular problems, cancer and diabetes. Additionally, the CDC reported that out of the country’s annual medical expenditure of 3.8 trillion USD, approximately 90% is spent on mental health disorders and chronic diseases.

Europe holds a notable portion of the global SNP genotyping market.

The rising adoption of modern technologies in the healthcare industry is fuelling the growth of the European market. There is a progressive trend of prominent private companies rapidly incorporating SNP genotyping technologies. This shows an increased acceptance of its significance in different applications involving diagnostics, pharmaceuticals, and customized medicines. For instance, in March 2024, MGI Tech, a life science company, press released the acquisition of transformative DNBSEQ-T20×2 (T20) ultra-high throughput sequencer from the Eurofins Genomics Europe Genotyping A/S (Eurofins Genomics) coupled with genomics data center ZTRON Appliance and a wide variety of MGI's advanced laboratory automation items and systems.

The Asia-Pacific is expected to grow at the fastest CAGR in the global market.

Asia is experiencing a progressive adoption of genome sequencing technologies in various applications and is expected to advance during the forecast period for the single nucleotide polymorphism (SNP) genotyping market. This can be attributed to the higher government grants, financial aid and favourable policies encouraging the industry players. For instance, in June 2024, experts in Japan developed a quick DNA diagnostic procedure to solve the problem of illegal international trade of citrus breeds. Further, in June 2024, MGI Tech Co. Ltd. reported the introduction of Low-pass whole genome sequencing (Low-pass WGS) for large-scale operations in the agricultural industry, an extremely efficient full workflow solution.

KEY PLAYERS IN THE GLOBAL SNP GENOTYPING MARKET

Companies playing a dominating role in the global single nucleotide polymorphism (SNP) genotyping market include Illumina, Affymetrix, Agena Bioscience, Thermo Fisher Scientific, Sequenom, Douglas Scientific, Bio-Rad Laboratories Inc., Promega Corporation and Fluidigm.

RECENT HAPPENINGS IN THE GLOBAL MARKET

- In May 2024, a case-control study was published which discovered that the TT genotype of SNP rs11568820 was considerably less common in hospitalized coronavirus patients and proposed its preventive role against acute illness and hospitalization.

- In February 2024, Benchmark Holdings, an aquaculture biotechnology company, announced the expansion of its genetics department by introducing products with competitive genotyping services and tools. This greatly enhances access to modern genomic tools throughout the world market and involves genotyping of tissue sample-to-data from 14.50 euros or 12.41 pounds per sample.

- In January 2024, Thermo Fisher Scientific introduced the new Axiom PangenomiX Array. It is the biggest and most genealogically varied array to date. Moreover, it provides optimum genetic cover for pharmacogenomic study and populace scale disease research.

DETAILED SEGMENTATION OF THE GLOBAL SINGLE NUCLEOTIDE POLYMORPHISM (SNP) GENOTYPING MARKET INCLUDED IN THIS REPORT

This research report on the global single nucleotide polymorphism (SNP) genotyping market has been segmented and sub-segmented based on the following categories.

By Technology

- Microarrays and Gene Chips

- SNP Pyrosequencing

- Sequemon MassArray Maldi-TOF

- Taqman Allelic Discrimination

- Applied Biosciences SNPlex

- Next-Generation Sequencing (NGS)

- Powered Polymerase Chain Reaction (PCR)

- Others

By End-User

- Pharmacogenomics

- Diagnostic and Forensics

- Agricultural Biotechnology

- Breeding

- Animal Livestock

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East and Africa

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2500

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]