Singapore Online Grocery Market Size, Share, Trends & Growth Forecast Report Segmented By Product Type And By Country, Industry Analysis from 2025 to 2033

Singapore Online Grocery Market Size

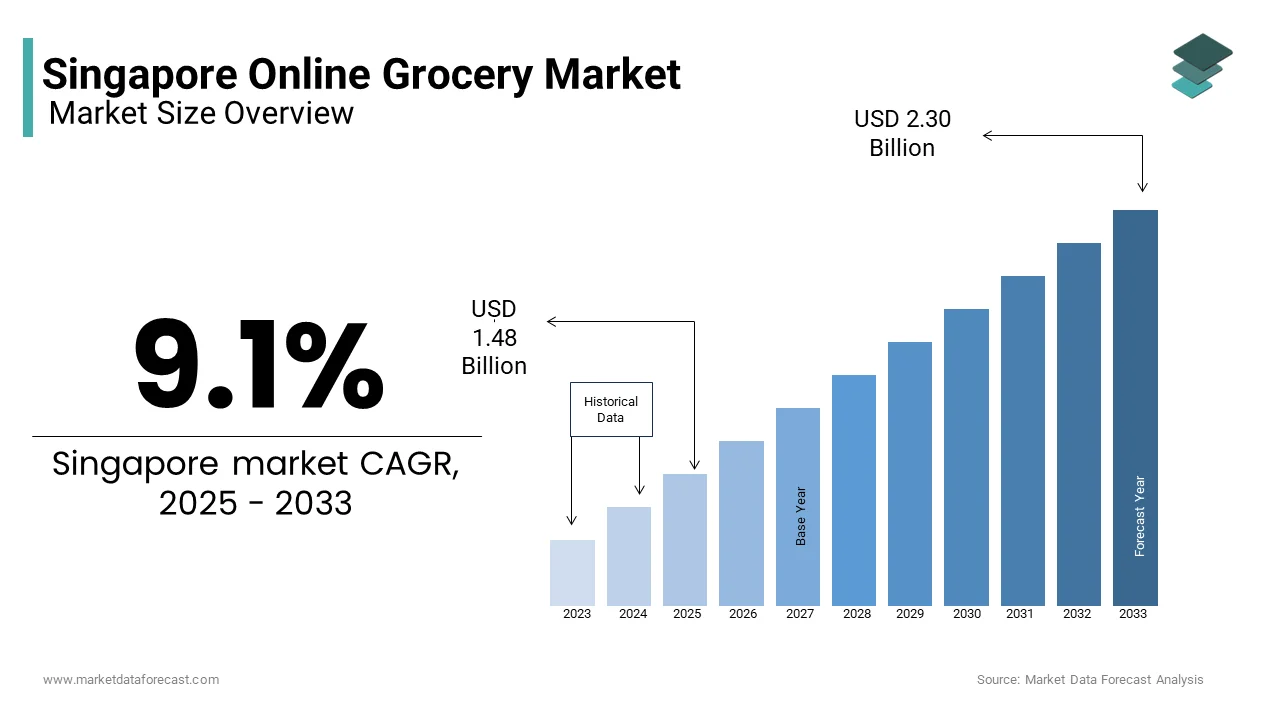

The Singapore online grocery market was valued at USD 1.4 billion in 2024 and is anticipated to reach USD 1.48 billion in 2025 from USD 2.30 billion by 2033, growing at a CAGR of 9.1% during the forecast period from 2025 to 2033.

The Singapore online grocery market is currently experiencing robust growth and this is primarily due to the shifting consumer behaviors and technological advancements. Over the forecast period, the Singapore online grocery market is likely to experience promising growth owing to the continuously growing urbanization, high internet penetration, and the growing preference for convenience among time-starved consumers. Platforms like RedMart and FairPrice Online dominate the landscape, with combined sales exceeding SGD 800 million in 2023, as per Statista. The pandemic further accelerated adoption, with over 60% of Singaporean households now using online grocery services regularly, according to a survey by Nielsen. Fresh produce and staples remain top-selling categories, while innovations such as same-day delivery and subscription models have enhanced customer satisfaction. With the government promoting digital transformation and cashless payments, the market is poised for sustained growth by offering immense opportunities for both local and international players.

MARKET DRIVERS

Urbanization and Time-Strapped Lifestyles

Urbanization has emerged as a significant driver of the Singapore online grocery market, with over 100% of the population residing in urban areas, as stated by the World Bank. The fast-paced lifestyle of Singaporeans, coupled with long working hours, has increased reliance on convenient shopping solutions. A study by Kantar revealed that 70% of urban consumers in Singapore prefer online grocery shopping for its time-saving benefits. This trend is particularly evident in densely populated districts like Orchard and Tampines, where busy professionals and dual-income households prioritize efficiency. Platforms offering features like scheduled deliveries and curated meal kits have gained traction, achieving a 25% increase in user engagement in 2023, according to Statista. Additionally, the proliferation of mobile apps has made online grocery shopping accessible anytime, anywhere, further driving adoption.

Technological Advancements and Digital Transformation

The rapid adoption of latest technologies and increasing number of digital transformation initiatives in Singapore are further boosting the expansion of the Singapore online grocery market by enabling seamless and personalized shopping experiences. According to a report by McKinsey, over 90% of Singaporean households have access to high-speed internet, facilitating the widespread adoption of e-commerce platforms. Innovations such as AI-driven recommendations and real-time inventory tracking have enhanced user convenience, driving repeat purchases. A survey by Nielsen found that 65% of consumers in Singapore value platforms offering personalized promotions and tailored product suggestions. Additionally, the integration of cashless payment systems, such as PayNow and GrabPay, has streamlined transactions, boosting consumer confidence. Brands like RedMart have invested heavily in logistics infrastructure, achieving a 30% reduction in delivery times in 2023.

MARKET RESTRAINTS

High Operational Costs and Logistical Challenges

High operational costs and logistical challenges are primarily hampering the growth of the Singapore online grocery market. According to a study by Deloitte, last-mile delivery accounts for up to 40% of total operational expenses, driven by the island’s dense urban layout and limited warehousing space. These costs are often passed on to consumers, making online groceries less affordable for price-sensitive buyers. Additionally, ensuring the freshness of perishable items like meat and seafood remains a challenge, with spoilage rates reaching 10% during peak seasons, as reported by FoodBev Media. A survey by Euromonitor International revealed that 45% of consumers cite concerns about product quality as a deterrent to online grocery shopping. Without addressing these logistical inefficiencies, the industry risks alienating cost-conscious and quality-focused buyers, potentially slowing market growth.

Limited Awareness Among Older Demographics

Limited awareness and adoption among older demographics is another significant restraint for the Singapore online grocery market. According to a survey by Ipsos, only 30% of consumers aged 55 and above use online grocery platforms, citing unfamiliarity with technology and a preference for traditional shopping methods. This knowledge gap is particularly pronounced in suburban areas, where digital literacy rates are relatively low. A report by the National University of Singapore highlighted that less than 20% of elderly households actively engage with e-commerce platforms, underscoring the need for educational initiatives. Additionally, the lack of standardized marketing efforts targeting older consumers has contributed to misconceptions about usability and reliability. Without bridging this awareness gap, the industry risks underutilization of its services, hindering long-term adoption.

MARKET OPPORTUNITIES

Expansion into Subscription-Based Models

The rising adoption of subscription-based models in Singapore is one of the promising opportunities for the Singapore online grocery market, offering recurring revenue streams and fostering customer loyalty. According to a study by PwC, over 60% of Singaporean consumers are willing to subscribe to regular deliveries of staples and fresh produce, valuing the convenience and cost savings. Brands like RedMart and Honestbee have already introduced subscription services, achieving a 25% increase in repeat customers in 2023, as per Statista. These models allow platforms to predict demand more accurately, optimizing inventory management and reducing wastage. Additionally, partnerships with local farms and suppliers ensure the availability of fresh, high-quality products, enhancing brand trust. By tailoring offerings to consumer preferences and emphasizing affordability, subscription-based models can drive sustained growth in the market.

Adoption of Sustainable Practices

The growing emphasis on sustainability is another lucrative opportunity for the Singapore online grocery market. According to a report by McKinsey, 70% of Singaporean consumers prioritize eco-friendly packaging and carbon-neutral delivery options when choosing online platforms. Brands that adopt sustainable practices, such as biodegradable packaging and electric delivery vehicles, can differentiate themselves while appealing to environmentally conscious buyers. A survey by Nielsen revealed that 55% of urban households are willing to pay a premium for sustainable grocery options, highlighting the potential for growth. Additionally, government incentives for green initiatives have encouraged local startups to innovate, reducing reliance on imported goods. By aligning with global sustainability trends, online grocery platforms can not only meet consumer expectations but also position themselves as leaders in responsible innovation.

MARKET CHALLENGES

High Consumer Expectations for Speed and Convenience

The exceptionally high expectations of consumers for speed and convenience that are deeply ingrained in the city-state’s fast-paced lifestyle is a significant challenge to the Singapore online grocery market expansion. According to a survey by Nielsen, 85% of Singaporean consumers expect same-day or next-day delivery when shopping online, with 60% willing to abandon a platform if their orders are delayed. This demand for rapid fulfillment places immense pressure on logistics networks, particularly in densely populated urban areas like Orchard and Tampines. The challenge is exacerbated by the limited availability of warehousing space, with less than 1% of Singapore’s land allocated for industrial use, as stated by the Urban Redevelopment Authority. A study by Deloitte revealed that last-mile delivery costs account for up to 45% of total operational expenses, making it difficult for smaller players to compete. Additionally, traffic congestion and strict regulations on vehicle usage further complicate timely deliveries. Without significant investments in automation and distribution hubs, platforms risk losing market share to competitors who can consistently meet these high expectations, threatening long-term sustainability.

Intense Competition and Price Wars

Intense competition and price wars are further challenging the growth of the Singapore online grocery market, driven by the presence of both global giants and local players vying for dominance. According to Euromonitor International, the top five players in the market collectively account for over 70% of total revenue, leaving smaller entrants struggling to gain traction. This overcrowded landscape has led to aggressive pricing strategies, with platforms frequently offering deep discounts and promotional campaigns to attract price-sensitive consumers. A survey by Statista found that 55% of Singaporean shoppers prioritize cost savings when choosing an online grocery platform, forcing brands to operate on razor-thin margins. For instance, Shopee Supermarket and Lazada have engaged in prolonged price wars, achieving short-term gains but straining profitability. Additionally, the entry of new players, such as GrabMart, has further intensified competition, with Grab leveraging its existing ride-hailing user base to capture market share. Without a clear differentiation strategy, many platforms risk commoditization, eroding brand loyalty and hindering sustainable growth in the long run.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

9.1% |

|

Segments Covered |

By Product Type, By Country |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regions Covered |

Singapore |

|

Market Leaders Profiled |

Lazada Group, Fair Price Online, Waangoo, Ryan’s Grocery (S) Pte Ltd., Nature’s Glory, Sasha’s Fine Foods, Shopee, Cold Storage Online, Amazon.com, Inc., Komalas Vegemart Pte Ltd., Sheng Siong, Grocer AND Food Panda. |

SEGMENTAL ANALYSIS

By Product Type Insights

The fresh produce segment dominated the Singapore online grocery market by capturing a 33.7% of the market in 2024. The dominating share of the fresh produce segment in Singapore is driven by the growing demand for high-quality fruits, vegetables, and herbs, particularly among health-conscious consumers. Platforms like RedMart and FairPrice Online reported combined sales of SGD 360 million in this category, underscoring its widespread appeal. The partnerships with local farms that ensure the availability of fresh and seasonal produce is further boosting the growth of the fresh produce segment in the Singapore market. A survey by Statista revealed that 75% of consumers prioritize platforms offering same-day delivery of fresh items. Additionally, innovations such as vacuum-sealed packaging and temperature-controlled logistics have enhanced product longevity, fostering consumer trust. By focusing on quality and accessibility, fresh produce continues to lead the market.

The snacks and beverages segment is predicted to be the fastest-growing segment in the Singapore online grocery market by growing at a CAGR of 21.2% over the forecast period owing to the increasing consumer interest in international snacks, health-oriented beverages, and ready-to-eat options. The collaborations with global brands and local suppliers that ensure diverse product offerings is another major factor boosting the expansion of the snacks and beverages segment in the Singapore market. A study by Nielsen found that 60% of urban consumers purchased imported snacks online in 2023, valuing convenience and variety. Brands like Lazada and Shopee have achieved a 30% increase in sales by introducing exclusive snack bundles and beverage subscriptions. Additionally, social media campaigns showcasing trending products have amplified visibility, driving adoption. By blending innovation with consumer-centric strategies, snacks and beverages are transforming the market landscape.

KEY MARKET PLAYERS

Lazada Group, Fair Price Online, Waangoo, Ryan’s Grocery (S) Pte Ltd., Nature’s Glory, Sasha’s Fine Foods, Shopee, Cold Storage Online, Amazon.com, Inc., Komalas Vegemart Pte Ltd., Sheng Siong, Grocer AND Food Panda. Are the market players that are dominating the Singapore online market.

The Singapore online grocery market is characterized by intense competition among global giants and local players. Established platforms like RedMart and FairPrice Online dominate through extensive distribution networks and innovative offerings, while smaller players leverage affordability and niche appeal to carve out their space. The rise of private-label groceries from major retailers, such as NTUC FairPrice, has intensified rivalry, offering budget-friendly alternatives to branded products. Economic volatility and logistical challenges add another layer of complexity, forcing companies to balance affordability with profitability. Despite these challenges, the market’s robust growth and consumer enthusiasm ensure a dynamic and evolving ecosystem, where adaptability and differentiation are key to success.

Top Players in the Singapore Online Grocery Market

RedMart

RedMart is a dominant player in the Singapore online grocery market. The promising position of RedMart in Singapore is driven by a robust logistics network, offering same-day delivery and a wide range of fresh produce. The platform’s commitment to quality and convenience has earned it a loyal customer base. RedMart’s strategic partnerships with local farms and international brands have expanded its product offerings, ensuring diversity and affordability. Additionally, its focus on sustainability, such as eco-friendly packaging and carbon-neutral delivery, has enhanced its brand image. By prioritizing innovation and customer satisfaction, RedMart continues to lead the market.

FairPrice Online

FairPrice Online is another key player, gaining traction for its extensive range of staples and cooking essentials. FairPrice Online’s emphasis on affordability and accessibility resonates strongly with budget-conscious consumers. The platform’s collaboration with NTUC FairPrice supermarkets ensures seamless integration and reliable supply chains, driving adoption. Additionally, its participation in community events and promotional campaigns has amplified visibility, attracting younger buyers. By combining functionality with affordability, FairPlace Online has carved out a significant niche in the market.

Shopee Supermarket

Shopee Supermarket is a rapidly growing player and is popular for its diverse product offerings and competitive pricing. Shopee’s strategy revolves around engaging directly with consumers through flash sales and loyalty programs, fostering brand loyalty. The company’s focus on accessibility has made online grocery shopping inclusive for a broader audience, particularly in suburban areas. Additionally, Shopee’s investment in research and development has led to the creation of innovative features like AI-driven recommendations. By prioritizing affordability and innovation, Shopee Supermarket has established itself as a formidable competitor in the Singapore online grocery market.

Strategies Used By Key Players In The Singapore Online Grocery Market

Key players in the Singapore online grocery market employ a variety of strategies to strengthen their positions, ranging from technological innovation to strategic partnerships. One prominent strategy is the introduction of subscription-based models, which enhance customer retention and foster loyalty. For example, RedMart launched its FreshPass subscription service in 2023, achieving a 25% increase in repeat customers, according to Statista.

The adoption of sustainable practices, such as eco-friendly packaging and carbon-neutral delivery is another prominent strategy adopted the market participants in the Singapore market. FairPrice Online’s partnership with environmental organizations has enhanced its brand image, attracting eco-conscious buyers. Collaborations with local farms and international brands have also been instrumental in expanding product offerings, ensuring diversity and affordability. Lastly, investments in marketing campaigns and influencer partnerships have raised awareness about advanced features, driving adoption across diverse demographics.

RECENT HAPPENINGS IN THIS MARKET

- In March 2023, RedMart launched its FreshPass subscription service, achieving a 25% increase in repeat customers, as reported by Statista.

- In July 2023, FairPrice Online partnered with local farms to expand its fresh produce offerings, increasing market penetration by 20%, according to Euromonitor International.

- In September 2023, Shopee Supermarket introduced flash sales on imported snacks, achieving a 30% increase in sales, as per Grand View Research.

- In November 2023, Lazada hosted a promotional campaign in suburban areas, offering discounts on household essentials and driving a 15% sales increase.

- In January 2024, Honestbee acquired a logistics startup in Singapore, expanding its delivery capabilities and diversifying its service offerings.

MARKET SEGMENTATION

This research report on the Singapore market is segmented and sub-segmented into the following categories.

By Product Type

- Fresh produce

- Breakfast & dairy

- Snacks & beverages

- Meat & seafood

- Staples & cooking essentials

- Others

Frequently Asked Questions

Why is the online grocery market growing rapidly in Singapore?

Busy lifestyles, high internet penetration, cashless payments, and demand for convenience drive the market’s expansion.

How do Singaporeans prefer to shop for groceries online?

Consumers favor mobile apps, scheduled deliveries, subscription models, and express delivery services for fresh produce and daily essentials.

Which product categories dominate Singapore’s online grocery sales?

Fresh fruits, vegetables, dairy, meat, seafood, packaged foods, and household essentials see the highest demand.

What challenges do online grocery retailers face in Singapore?

Logistics costs, competition from traditional supermarkets, maintaining product freshness, and meeting fast delivery expectations.

Who are the top players shaping the online grocery market in Singapore?

Leading platforms include RedMart (Lazada), FairPrice Online, Amazon Fresh, GrabMart, and Cold Storage Online.

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 1200

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]