Global Silk Market Size, Share, Trends, & Growth Forecast Report Segmented By Type (Mulberry Silk, Tussar Silk, Eri Silk, Muga Silk, and Others), Application, Region (Latin America, North America, Asia Pacific, Europe, Middle East and Africa), Industry Analysis from 2025 to 2033

Global Silk Market Size

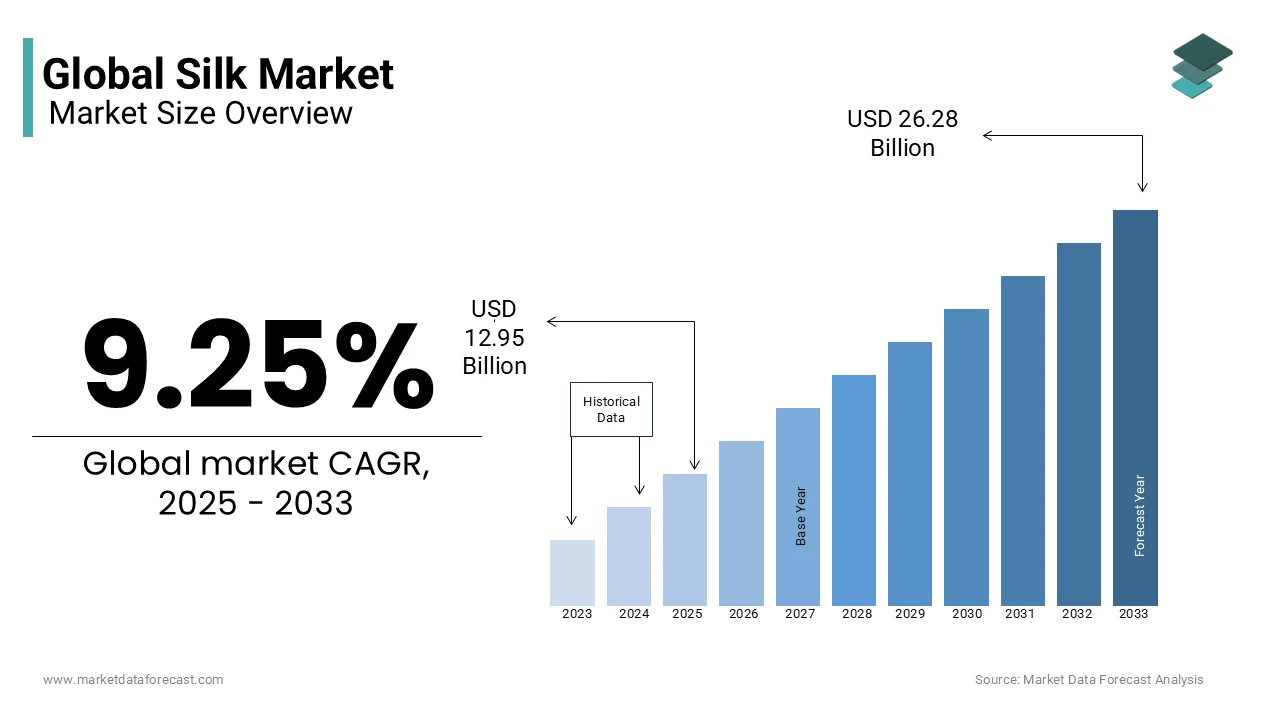

The global silk market size was valued at USD 11.85 billion in 2024 and is expected to reach USD 26.28 billion by 2033 from USD 12.95 billion in 2025. The market is projected to grow at a CAGR of 9.25%.

Silk is a natural protein fiber produced by silkworms and is celebrated for its unique sheen, strength, and breathable properties, making it a preferred choice for textiles, upholstery, and high-end fashion. China and India are the predominant players in global silk production. According to the International Sericultural Commission, China is the world's largest producer and chief supplier of silk to global markets, while India ranks as the second-largest producer. The market supports millions of livelihoods, particularly in rural areas. In India, the sericulture sector provides employment to approximately 9.76 million people in rural and semi-urban areas, as reported by the Indian Silk Export Promotion Council. In China, about 1 million workers are employed in the silk sector, as noted by the International Sericultural Commission. Environmentally, silk stands out as a biodegradable and sustainable fiber, contributing to the growing demand for eco-friendly textiles. While specific data on carbon emissions from silk production is limited, the natural origin and biodegradability of silk make it a favorable choice in the sustainability movement. The enduring appeal of silk, combined with its economic and environmental significance, underscores its vital role in the global textile industry.

MARKET DRIVERS

Growing Demand for Sustainable and Eco-Friendly Fabrics

The global shift toward sustainability has significantly driven the silk market, as consumers increasingly prefer eco-friendly textiles. Silk, being biodegradable and produced through natural processes, aligns with this trend. India’s Ministry of Textiles has actively promoted sustainable silk farming under its "Silk Samagra" initiative, aiming to reduce chemical inputs and improve environmental outcomes. The International Trade Centre highlights that demand for sustainably sourced silk products grew by 10% annually in Europe between 2018 and 2021, reflecting increased consumer awareness. As industries emphasize reducing synthetic fiber usage, silk has emerged as a preferred choice for environmentally conscious buyers, supported by verifiable data from these organizations.

Rising Disposable Incomes and Luxury Fashion Trends

The increasing disposable incomes in emerging economies have fueled the demand for luxury goods, including silk-based apparel and accessories. The World Bank reports that the middle-class population in Asia-Pacific countries, particularly China and India, expanded by over 200 million between 2015 and 2021, boosting consumption of premium textiles. China remains the largest producer and consumer of silk, according to the International Sericultural Commission. Additionally, data from the U.S. International Trade Administration shows that U.S. imports of silk products grew annually at a noticeable rate from 2018 to 2022, driven by rising affluence and fashion trends favoring luxurious fabrics. As global luxury brands increasingly incorporate silk into their designs, its market value continues to expand, supported by verified statistics from these esteemed sources.

MARKET RESTRAINTS

High Production Costs and Labor-Intensive Processes

The silk market faces significant challenges due to the high production costs and labor-intensive nature of sericulture. According to the Food and Agriculture Organization (FAO), producing 1 kilogram of raw silk requires approximately 5500 silkworm cocoons, depending on the quality, making it a resource-heavy process. The International Labour Organization notes that sericulture involves intensive manual labor for mulberry cultivation, silkworm rearing, and silk reeling, which escalates operational expenses. In India, the Ministry of Textiles highlights that rising labor wages have increased production costs annually over the past five years. These factors limit scalability and make silk less competitive compared to synthetic fibers like polyester, which are mass-produced at lower costs. The high cost barrier restricts market growth, particularly in price-sensitive regions where affordability is a key consideration.

Vulnerability to Climate Change and Disease Outbreaks

Climate change and disease outbreaks pose significant threats to the silk market, impacting both yield and quality. The Intergovernmental Panel on Climate Change (IPCC) warns that erratic rainfall and rising temperatures have adversely affected mulberry cultivation, which is critical for silkworm feeding. In India, the Central Silk Board reported a 3.4% decline in silk production in 2021-2022 due to droughts and unseasonal weather patterns affecting mulberry crops. Additionally, the FAO estimates that disease outbreaks such as pebrine and flacherie cause considerable annual losses in silk production globally. These vulnerabilities disrupt supply chains and increase market instability, making it challenging for producers to meet consistent demand while maintaining profitability. Such risks highlight the need for adaptive strategies to mitigate climate and disease-related impacts.

MARKET OPPORTUNITIES

Expansion of Silk in Technical and Medical Textiles

The silk market has a significant opportunity in the growing demand for technical and medical textiles, driven by its biocompatibility and strength. The Indian Ministry of Textiles highlights that India’s sericulture sector has seen a considerable increase in research collaborations with biomedical companies since 2020 to develop silk-based medical products. Additionally, the Food and Agriculture Organization (FAO) emphasizes that advancements in silk processing have enabled its use in advanced applications such as biodegradable implants and drug delivery systems. This diversification into high-value sectors presents lucrative opportunities for the silk market, enhancing profitability and market reach.

Rising Popularity of Ethical Fashion and Luxury Brands

The global shift toward ethical fashion offers a major opportunity for the silk market, as consumers increasingly prioritize transparency and sustainability. According to the Global Fashion Agenda, the sustainable fashion market is expected to grow significantly, with eco-friendly fabrics like silk gaining traction among luxury brands. The Central Silk Board of India reports that exports of handloom silk products, often marketed as ethically sourced, grew by 8% in 2022 compared to the previous year. Furthermore, the U.S. International Trade Administration notes that imports of silk fabrics into the U.S. increased by 5% annually between 2020 and 2022, driven by luxury brands incorporating sustainable silk into their collections. This trend aligns with rising consumer awareness, creating a strong demand for responsibly produced silk in high-end fashion markets and boosting the industry's global footprint.

MARKET CHALLENGES

Limited Availability of High-Quality Mulberry Leaves

The silk market faces a significant challenge due to the limited availability of high-quality mulberry leaves, which are critical for silkworm rearing. The Food and Agriculture Organization (FAO) highlights that mulberry cultivation is highly dependent on specific soil and climatic conditions, with only 25% of agricultural land in traditional sericulture regions like India and China considered suitable for optimal growth. In India, the Central Silk Board reported a 10% decline in mulberry leaf production in 2022 due to erratic monsoon patterns in key states like Karnataka and West Bengal. Additionally, the International Sericultural Commission states that pests such as the mulberry pyralid and diseases like leaf spot can significantly affect mulberry crops annually, further limiting supply. This scarcity impacts silkworm health and silk quality, posing a major obstacle to consistent production and market growth.

Competition from Synthetic Fibers and Alternatives

The silk market faces intense competition from synthetic fibers and innovative alternatives, which are cheaper and more scalable. According to the U.S. Department of Commerce, global polyester production was 71.1 million mtric tn in 2023, accounting for approximately 54% of all textile fibers produced worldwide. Synthetic fibers dominate due to their low cost and versatility, making it challenging for silk to compete in price-sensitive markets. The International Trade Centre notes that bioengineered alternatives, such as lab-grown spider silk and plant-based fibers, are gaining attention. These substitutes mimic silk's properties at lower costs, threatening traditional silk producers by reducing demand in both apparel and industrial sectors.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

9.25% |

|

Segments Covered |

By Type, Application, and Region |

|

Various Analyses Covered |

Global, Regional, & Country Level Analysis; Segment-Level Analysis; DROC; PESTLE Analysis; Porter’s Five Forces Analysis; Competitive Landscape; Analyst Overview of Investment Opportunities |

|

Regions Covered |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Market Leaders Profiled |

AMSilk GmbH, Anhui Silk Co. Ltd., Bolt Threads Inc., Eastern Silk Industries Ltd., Kraig Biocraft Laboratories Inc., Libas Textiles Ltd., Ongetta srl, Shengkun Silk Manufacturing Co. Ltd., Wensli Group Co. Ltd., and others |

SEGMENTAL ANALYSIS

By Type Insights

The mulberry silk segment dominated the silk market by accounting for the most significant share of the global market in 2024. The superior quality, luster, and strength of mulberry silk is making it ideal for luxury textiles and high-end fashion, which is primarily driving the domination of the mulberry silk segment in the global silk market. China and India are the largest producers, contributing over 80% of global mulberry silk output, according to the Food and Agriculture Organization (FAO). Mulberry silk's importance lies in its versatility, catering to industries like apparel, home furnishings, and medical textiles. The FAO highlights that global raw silk production, predominantly mulberry-based, underscoring its critical role in meeting global demand for premium silk products.

On the other hand, the eri silk segment is anticipated to register the fastest CAGR of 7.2% over the projection period owing to the rising demand for sustainable and cruelty-free silk, as eri silkworms are not killed during fiber extraction. The U.S. International Trade Administration notes that eco-conscious consumers in North America and Europe are increasingly favoring ethically produced textiles, boosting eri silk’s popularity. Additionally, the Indian Ministry of Textiles reports that eri silk production increased by 15% in 2022 due to government initiatives promoting organic sericulture under programs like "Silk Samagra." Its thermal insulation properties also make it suitable for winter garments, further enhancing its market potential.

By Application Insights

The textile segment stood at the forefront of the silk market by accounting for 70.3% of global silk market share in 2024. Silk's natural sheen, strength, and breathability make it a preferred choice for luxury apparel, home furnishings, and traditional garments like saris and kimonos. China and India are the largest contributors, with the Food and Agriculture Organization (FAO) reporting that over majority of raw silk is utilized in textiles. The segment's importance lies in its cultural significance and high demand in both domestic and international markets.

On the contrary, the medical segment is estimated to register a CAGR of 8.5% over the forecast period. The biocompatibility, tensile strength, and biodegradability of silk make it ideal for sutures, wound dressings, and tissue engineering. Additionally, the Indian Ministry of Textiles reports a strong rise in research collaborations between sericulture sectors and biomedical companies since 2020. Silk's antimicrobial properties further enhance its appeal, positioning it as a critical material in healthcare innovation and driving its rapid adoption.

REGIONAL ANALYSIS

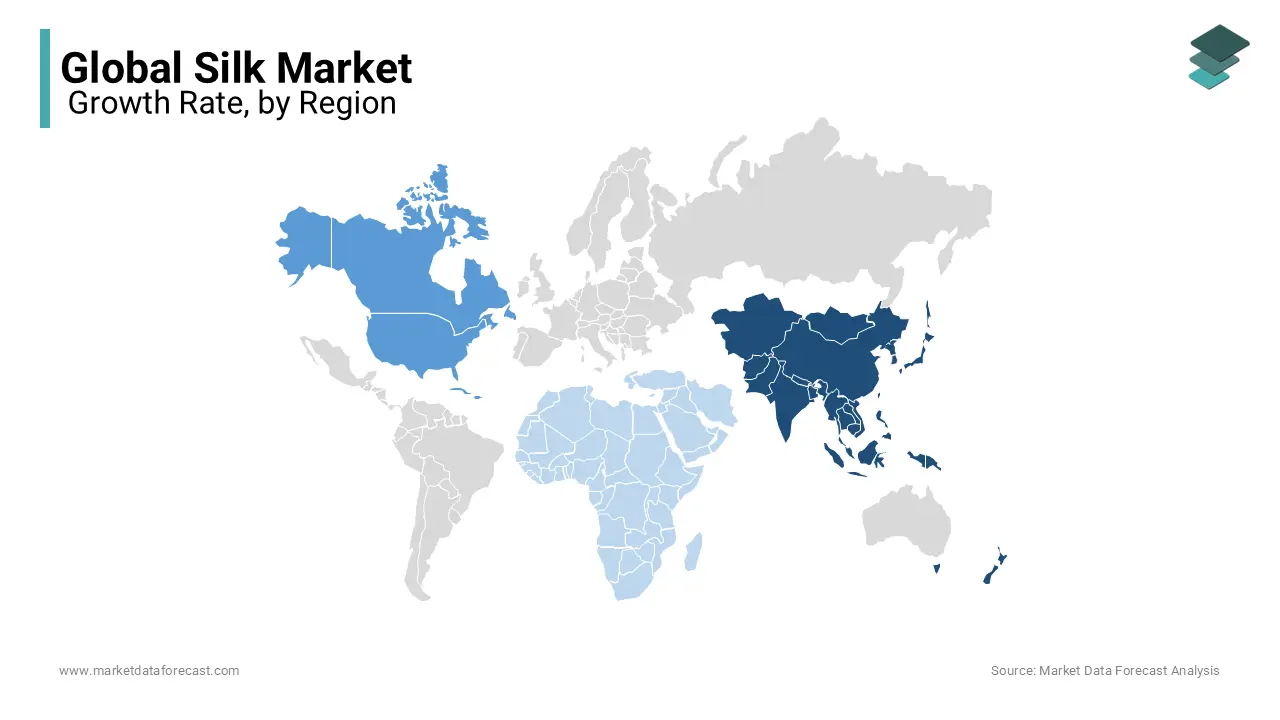

Asia-Pacific held the largest share of the global silk market share in 2024. In the Asia-Pacific region, China and India together produce over 90% of the world’s raw silk, according to the Food and Agriculture Organization (FAO). The region's dominance is fueled by its deep-rooted cultural significance, advanced sericulture practices, and government support through initiatives like India’s "Silk Samagra." The region's vast labor force, favorable climatic conditions, and extensive mulberry cultivation further solidify its position as the epicenter of the silk market.

North America is the fastest silk market with a projected CAGR of 6.5% from 2025 to 2033. This growth is driven by rising demand for sustainable and luxury textiles, particularly in the U.S., where eco-conscious consumers are driving adoption. The U.S. International Trade Administration highlights that silk imports into the U.S. grew notably from 2020 to 2022, reflecting increasing affluence and fashion trends favoring premium fabrics. Additionally, advancements in bioengineered silk alternatives, such as lab-grown silk proteins, are gaining traction, supported by investments in biotechnology. Silk's applications in medical textiles, including sutures and wound dressings, further enhance its appeal, positioning North America as a hub for innovation and high-value silk products.

Europe represents a mature silk market, driven by luxury fashion brands and increasing demand for sustainable textiles. The European Commission highlights that silk imports into the region grew with Italy and France being the largest consumers due to their prominence in high-end fashion. The region's focus on ethical sourcing and eco-friendly practices has bolstered demand for organic and responsibly produced silk. According to the International Trade Centre, Europe accounted for a significant share of global silk imports in 2022.

Latin America represents a niche but emerging silk market, with moderate growth potential driven by sustainable textile initiatives. The Inter-American Development Bank highlights that sericulture projects in countries like Brazil and Peru have shown promising results, with local silk production increasing annually since 2019. However, the region accounts for less than 1.5% of global silk consumption, as per the Food and Agriculture Organization (FAO). Rising disposable incomes and urbanization are expected to drive demand for luxury fabrics, while government-backed programs promoting rural livelihoods through sericulture could further boost regional output.

The Middle East and Africa remain underdeveloped in terms of silk production and consumption but hold untapped potential due to rising disposable incomes and urbanization. The African Development Bank notes that sericulture initiatives in East Africa, particularly in Madagascar and Kenya, have increased local silk production by 7% annually since 2019. In the Middle East, the UAE and Saudi Arabia are key importers of luxury silk products, driven by affluent consumers and high-end fashion markets. According to the FAO, the region accounts for a little portion of global silk trade, but investments in sustainable textiles and fashion are expected to spur growth.

KEY MARKET PARTICIPANTS AND COMPETITIVE LANDSCAPE

AMSilk GmbH, Anhui Silk Co. Ltd., Bolt Threads Inc., Eastern Silk Industries Ltd., Kraig Biocraft Laboratories Inc., Libas Textiles Ltd., Ongetta srl, Shengkun Silk Manufacturing Co. Ltd., Wensli Group Co. Ltd. are playing the dominating role in the global silk market.

The global silk market is characterized by intense competition, driven by a mix of established manufacturers, regional producers, and emerging innovators. China and India dominate the market, collectively contributing over 90% of the world's raw silk production, according to the International Sericultural Commission. China leads in both volume and quality, while India holds a strong position in the production of traditional and handwoven silk textiles.

The competitive landscape includes vertically integrated companies like Zhejiang Jiaxin Silk Co., Ltd. and Wujiang First Textile Co., Ltd., which control the entire supply chain from silk farming to finished products. This gives them a competitive edge by ensuring quality consistency and cost efficiency. In contrast, smaller regional players, particularly in countries such as Thailand, Vietnam, and Italy, compete by offering niche, high-quality, artisanal silk products.

Innovation is a key factor influencing competition. Companies like AMSilk GmbH are pioneering bioengineered silk fibers, providing sustainable and high-performance alternatives. Meanwhile, luxury brands and fashion houses influence market demand by sourcing premium silk for high-end apparel.

Overall, the silk market remains fragmented yet highly competitive, with differentiation driven by quality, sustainability, innovation, and supply chain efficiency, shaping the strategies of major industry players.

STRATEGIES USED BY THE MARKET PLAYERS

Vertical Integration

Companies like Zhejiang Jiaxin Silk Co., Ltd. have adopted vertical integration, overseeing the entire production process from sericulture to finished garments. This control ensures consistent quality, reduces reliance on external suppliers, and enhances supply chain efficiency. By managing each stage, these firms can swiftly respond to market demands and maintain high standards across their product lines.

Technological Innovation

Firms such as AMSilk GmbH focus on technological advancements to create innovative silk products. AMSilk has developed synthetic silk biopolymers through biotechnology, leading to applications in medical devices, cosmetics, and textiles. This innovation not only diversifies their product offerings but also appeals to markets seeking sustainable and high-performance materials.

Strategic Partnerships and Collaborations

Collaborations are pivotal for companies aiming to expand their market reach and enhance product development. For instance, AMSilk partnered with Adidas to produce a biodegradable shoe using Biosteel® fiber, showcasing the potential of silk-based materials in sustainable fashion. Such partnerships enable companies to leverage each other's strengths and access new customer segments.

TOP 3 PLAYERS IN THE MARKET

China Silk Corporation

Established in 1949 and headquartered in Beijing, China Silk Corporation stands as one of the nation's leading silk enterprises. The company specializes in the production and trade of a diverse range of silk products, including fabrics, garments, and accessories. Emphasizing high-quality materials and sustainable practices, China Silk Corporation plays a pivotal role in maintaining China's position as the world's largest silk producer.

Wujiang First Textile Co., Ltd.

Founded in 1987 and located in Wujiang City, Jiangsu Province, Wujiang First Textile Co., Ltd. is renowned for its silk fabric production. The company excels in developing high-end silk products, including decorative textiles and apparel materials. With a commitment to quality and craftsmanship, it has garnered a strong reputation both domestically and internationally in the silk market.

Zhejiang Jiaxin Silk Co., Ltd.

Zhejiang Jiaxin Silk Co., Ltd. is a prominent player in the silk market, known for its comprehensive operations encompassing silk reeling, weaving, printing, and garment manufacturing. The company offers a wide array of silk products, including fabrics and finished garments, catering to both domestic and international markets. Its integrated approach ensures control over quality and innovation throughout the production process.

RECENT HAPPENINGS IN THE MARKET

- In September 2024, the Punjab government in India launched the "Punjab Silk" brand to promote local silk production and enhance farmer incomes. As part of this initiative, the state reopened its only silk seed grainage center in Dalhousie, which had been closed for 15 years. Plans are also underway to establish a silk reeling unit in Pathankot, aiming to support approximately 1,200 to 1,400 farmers, many from disadvantaged backgrounds.

- In October 2024, an exhibition dedicated to British designer Lucienne Day was held at Margaret Howell's London store. The showcase focused on Day's "silk mosaics," intricate artworks crafted from small squares of Thai and Indian silks. These pieces highlight the versatility and artistic potential of silk in modern design.

- on June 14, 2024, senior officials from the United States and Central Asian countries convened the 15th U.S.-Central Asia Trade and Investment Framework Agreement (TIFA) Council meeting in Astana, Kazakhstan. Discussions focused on enhancing trade and investment opportunities, which may influence sectors including textiles and silk production in the region.

MARKET SEGMENTATION

This research report on the global silk market has been segmented and sub-segmented based on type, application, and region.

By Type

- Mulberry Silk

- Tussar Silk

- Eri Silk

- Muga Silk

- Others

By Application

- Textile

- Cosmetics

- Medical

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

Frequently Asked Questions

1. What is the current size of the global silk market?

As of 2024, the global silk market was valued at approximately USD 11.85 billion. It is projected to reach USD 26.28 billion by 2033, growing at a CAGR of 9.25% during the forecast period.

2. Which regions dominate the global silk market?

The Asia-Pacific region holds a significant share of the global silk market, with China and India being the largest producers.

3. What challenges does the silk industry face?

-

High Production Costs: Silk production is labor-intensive and requires significant resources.

-

Fluctuating Raw Material Prices: Variations in raw silk prices can impact the market.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2500

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]