Global Silage Additives Market Size, Share, Trends, & Growth Forecast Report – Segmented By Type (Inoculants, Acids and Organic Acid Salts, Enzymes, Adsorbents and Chemical Inhibitors), Application Type (Cereal Crops, Legumes Type and Others) and Region (North America, Europe, Asia Pacific, Latin America, and Middle East and Africa) – Industry Analysis From 2025 to 2033

Global Silage Additives Market Size

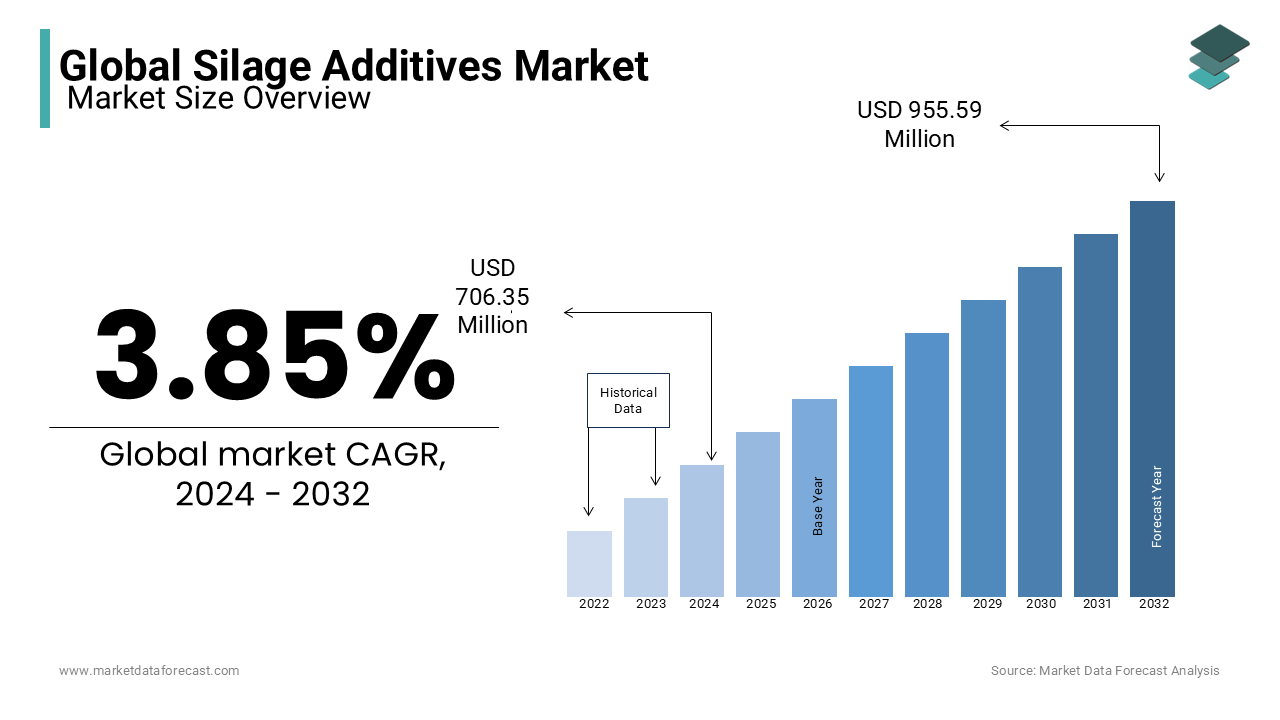

The global silage additives market was valued at USD 706.35 million in 2024 and is anticipated to reach USD 733.54 million in 2025 from USD 992.38 million by 2033, growing at a CAGR of 3.85% during the forecast period from 2025 to 2033.

Silage additives have been used to increase the ensiling procedure with successive enhancements in animal performance. Its advantages have created an opportunity for the Silage Additives Market.

Silage additives are essential in animal nutrition as they are worth increasing silage quality and regulating the conservation process so that by the time of nurturing, it has maintained as many of the nutrients existing in the original fresh forage as possible. That, in turn, enhances animal performance and fitness, consequently refining the yield and value of food from animal origin. Silage additive thus helps make superior forage into good quality silage. The demand for meat has accelerated due to the continuous increase in population, lifestyle variations, and cultural inclinations.

The industrialization of animals and meat production is the driving factor of the market. An increase in demand for animal protein all around the globe has applied pressure on livestock farmers for better quality and quantity. This condition has created an opportunity for silage additive producers.

However, the low efficiency of silage additives compared with other additives is likely to obstruct the growth of the market.

Current Scenario Of The Global Silage Additives Market

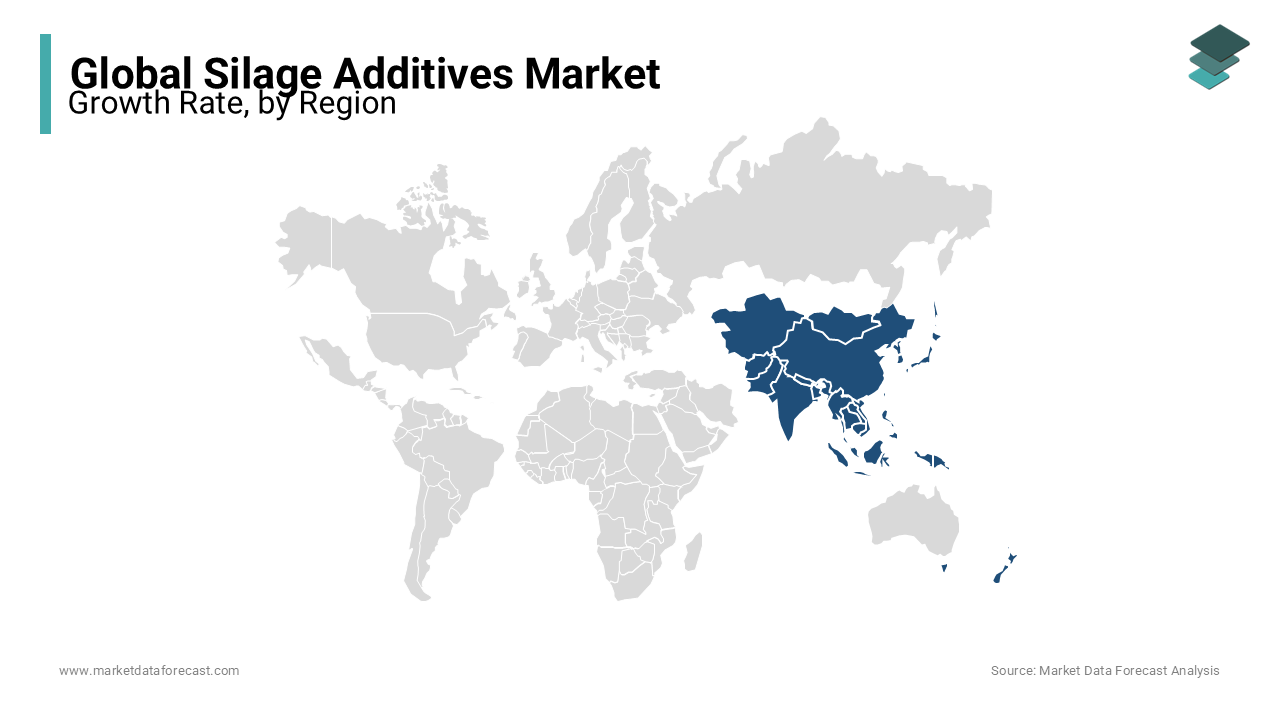

Presently, the silage additives market is experiencing moderate to steady growth. Considering the existing internal and external factors, it is expected to see a gradual increase in demand propelled by aspects such as rising meat and dairy consumption. Moreover, North America currently spearheads the market, accounting for a significant share, while regions like Asia Pacific are anticipated to grow at higher rates, contributing to overall market expansion, as per today’s business dynamics.

MARKET DRIVERS

The increasing demand for high-quality animal feed drives the growth of the silage additives market. The livestock sector must change or evolve in conjunction with other aspects of agri-food systems worldwide to be more productive, as stated by the Food and Agriculture Organization of the United Nations (FAO). It stresses on the fact that the consumption of animal protein, especially pork and poultry, is surging mainly because of the enhanced purchasing power, urbanisation, and population growth. On the other hand, it warned that this demand requires to be well proportioned with ecological concerns, socio-economic issues and a range of safety problems impacting both humans and animals. Ensuring the security, quality, accessibility, and availability of livestock feed is also an important aspect. Achieving this needs a commitment to restoring and managing grasslands and pastures for the production of fodder and feed ingredients, coupled with effective processing and application of compound feed. Therefore, as industrial-scale livestock production grows, so does the demand for high-quality feed and silage additives.

- Around the world, over 130 countries are involved in the commercial production and sale of animal feed, with approximately 8,000 facilities generating more than 600 million tons of this each year. Additionally, about 300 million tons are produced directly on farms.

Rising awareness of silage feed efficiency and sustainability also influences the market growth rate. Maximizing livestock food effectiveness relies heavily on superior-quality silage. When animals receive good quality and uniform silage throughout the year, it can significantly improve their health and productivity.

Another factor fueling the market expansion is modern silage technology supports and promotes ecological sustainability by enhancing feed efficiency. This results in the reduction of methane discharge per unit of milk yield, lower land necessity for animal food production, better utilization of nutrients, and a notable decrease in water consumption in silage crop cultivation.

MARKET RESTRAINTS

Fodder or forage loss is one of the key restraints impeding the expansion of the silage additives market. Research shows that poor management practices can lead to losses of up to 30 per cent in silage. It can significantly impact profitability and sustainability by increasing the demand for additional forage.

- As per a study, typically, even well-prepared silage experiences dry matter losses of around 8 per cent to 10 per cent, or sometimes more. If attention to detail wanes, those losses can jump to over 30 per cent. In instances where silage suffers from major aerobic deterioration, total losses can be greater than 50 per cent. Since a lot of these wastes are in the form of carbon dioxide, they often remain unnoticed.

MARKET OPPORTUNITIES

Microbial inoculants is one of the key innovations presenting potential opportunities for the expansion of the silage additives market. A major breakthrough in silage technology is the development of specialized microbial cultures, particularly lactic acid bacteria (LAB). These inoculants enhance fermentation quality, improve aerobic stability, and raise the nutritional value of forage or fodder. For instance, using LAB alongside other additives like cellulase and glucose has been shown to considerably surge both dry matter and crude protein contents in mixed silage. Therefore, augmenting the overall quality of the feed.

MARKET CHALLENGES

Climate variability is among the major challenges hindering the progress of the silage additives market. Frequent weather changes lead to unpredictable climate patterns that can impact both the availability and quality of forage. Factors like extreme heat, droughts, or too much rain can interfere with the fermentation process, ultimately reducing silage quality. It’s essential for companies to design adaptable products that perform well across different environmental scenarios.

Maintaining the silage quality is another complicated problem, affecting the efficacy, safety, and value of feed. It’s crucial to recognise that proper storage is equally important as the ensiling process.

- According to the Minnesota Crop News, losses of up to 20 per cent can take place in silage and hay without anyone realizing it. Hay storage issues are generally related to moisture content, whereas silage losses are more commonly due to oxygen exposure during storage and feeding.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

3.85% |

|

Segments Covered |

By Type, Application and Region |

|

Various Analyses Covered |

Global, Regional, and Country Level Analysis; Segment-Level Analysis; DROC; PESTLE Analysis; Porter’s Five Forces Analysis; Competitive Landscape; Analyst Overview of Investment Opportunities |

|

Regions Covered |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Market Leaders Profiled |

BASF SE (Germany), ADDCON (Germany), Novozymes A/S (Denmark), DSM N.V. (The Netherlands), Cargill Inc. (U.S.), Evonik Industries AG (Germany), Selko Feed Additives (The Netherlands), Volac International Limited (U.K.), Schaumann BioEnergy GmbH (Germany), CHR. Hansen Holdings A/S (Denmark) |

SEGMENT ANALYSIS

Global Silage Additives Market Analysis By Type

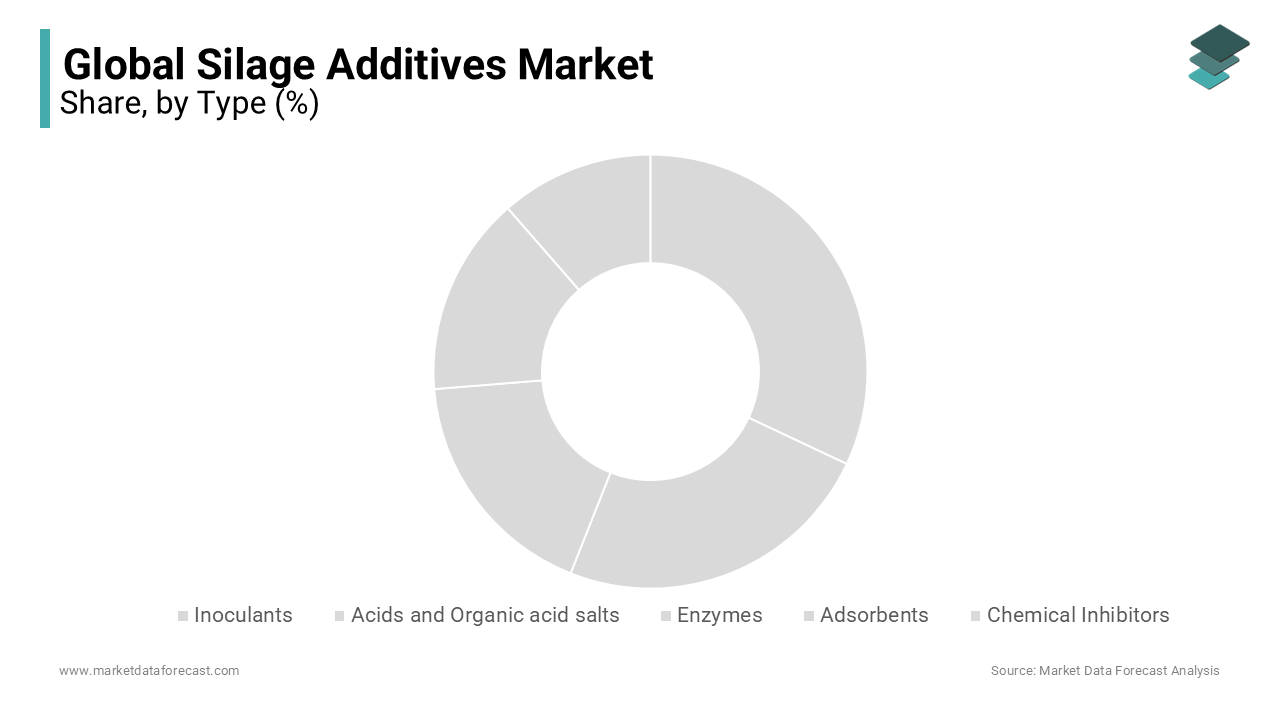

The inoculant segment gained the top spot in the silage additives market. It is expected to maintain its position during the forecast period. These are recognised for their effectiveness in boosting feed quality and livestock productivity and have become the most popular choice among silage supplements owing to the benefits they bring with them. Moreover, these are mainly composed of lactic acid bacteria (LAB) and are extensively used to enhance fermentation processes, which also contributes to the increase in the segment’s market share.

Global Silage Additives Market Analysis By Application

Cereal crops are the most dominant segment of the silage additives market. Under this, the corn sub-segment is leading with a substantial share and considering its consumption pattern, it is believed to be on the same course throughout the estimation period. High energy content, fermentation quality, adaptability, and research support are the reasons behind its supremacy over the years. In addition, technological advancements also fueling the segment's market size.

- A study published in the Farmonut stated that innovative inoculants applied in shredlage processing have the potential to elevate acetate levels in corn silage fermentation by maximum of 15 per cent.

REGIONAL ANALYSIS

Asia-Pacific is the fastest-growing market in silage additives during the forecast period. The Guidelines from the Government in this region to decrease imports of meat & escalate home production and funding to livestock farmers is projected to give an increase to the livestock industry.

North America commands the silage additives market and is likely to continue its growth trajectory over the forecast period. The United States drives the regional market and is the world’s top-most country in silage production. According to research, the U.S. produced about 130 million tons of corn for silage in 2023. For the upcoming 2023-2024 season, it’s anticipated that the nation will remain the largest corn cultivator in the world, with an estimated production of about 389.7 million tons. Besides this, Canada is a global leader in the production of forage seed.

Europe holds a notable place in the silage additives market. The region’s progress in this market is projected to be stable during the forecast period. Moreover, the growth and maturation of the AD industry has led to improved operational standards across plants. In fact, there are far fewer sites that require emergency interventions to manage their biological processes compared to five years ago.

KEY MARKET PLAYERS

BASF SE (Germany), ADDCON (Germany), Novozymes A/S (Denmark), DSM N.V. (The Netherlands), Cargill Inc. (U.S.), Evonik Industries AG (Germany), Selko Feed Additives (The Netherlands), Volac International Limited (U.K.), Schaumann BioEnergy GmbH (Germany), CHR. Hansen Holdings A/S (Denmark). Are some of the major key players involved in the global silage additives market.

MARKET SEGMENTATION

This research report on the global pet food nutraceuticals market has been segmented and sub-segmented based on type, application, and region.

By Type

- Inoculants

- Acids and Organic acid salts

- Enzymes

- Adsorbents

- Chemical Inhibitors

By Application

- Cereal crops

- Corn

- Barle

- Oats

- Wheat

- Sorghum

- Legumes

- Peas

- Fava beans

- Alfalfa

- Clover

- Others

- Ornamental Grass

- Canola

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

Frequently Asked Questions

What is the current size of the Silage Additives Market globally?

The global silage additives market is worth USD 733.54 million in 2025.

Which region dominates the Global Silage Additives Market in terms of market share?

Europe currently holds the largest market share in the Global Silage Additives Market.

What factors contribute to the growth of the Silage Additives Market in North America?

The growth of the Silage Additives Market in North America is driven by the extensive livestock industry, the adoption of advanced farming practices, and the need for high-quality forage preservation.

what is the expected growth value and CAGR of global Silage Additives Market?

The global silage additives market is expected to reach a valuation of USD 992.38 million by 2033 and is estimated to be growing at a CAGR of 3.85% during the forecast period.

who are the key market players involved in the global Silage Additives Market?

BASF SE (Germany), ADDCON (Germany), Novozymes A/S (Denmark), DSM N.V. (The Netherlands), Cargill Inc. (U.S.), Evonik Industries AG (Germany), Selko Feed Additives (The Netherlands), Volac International Limited (U.K.), Schaumann BioEnergy GmbH (Germany), CHR. Hansen Holdings A/S (Denmark).

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2500

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]