Global Shipping Containers Market Size, Share, Trends and Growth Forecast Report By Container Size, Container Type, And By Region (North America, Europe, Asia Pacific, Latin America, and Middle East & Africa) - Industry Analysis From 2025 to 2033

Global Shipping Containers Market Size

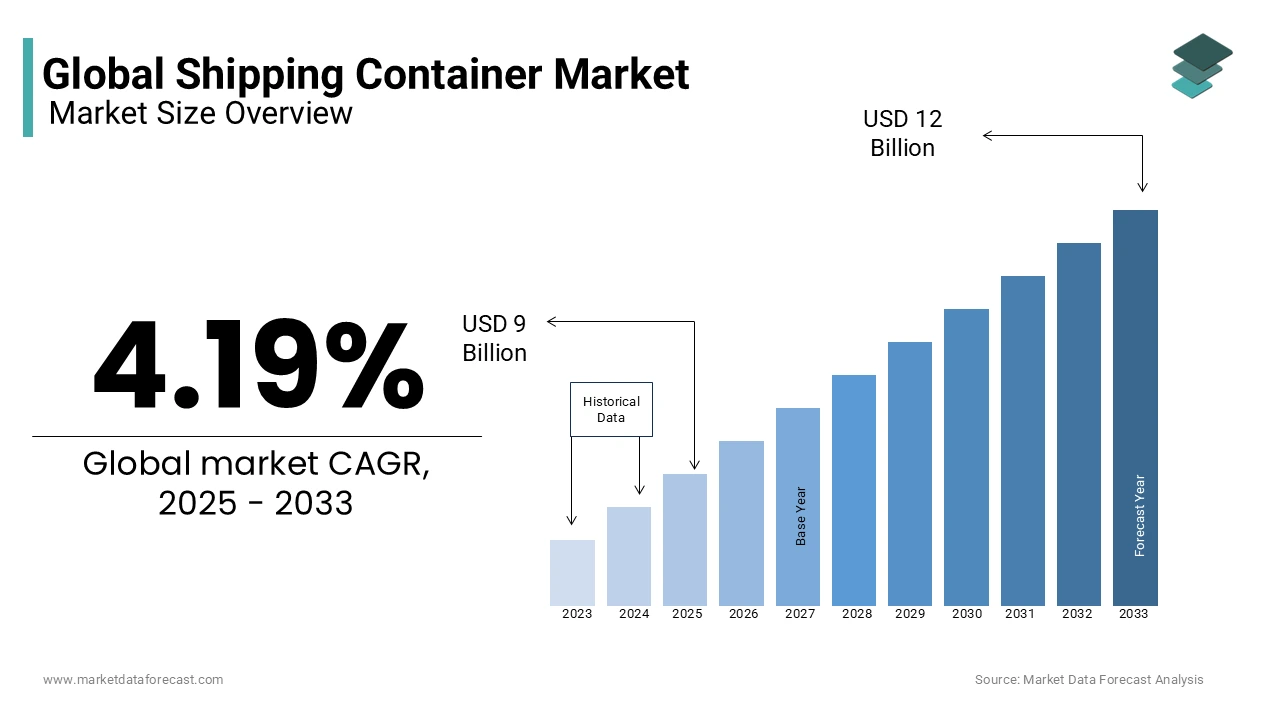

The global shipping containers market size was valued at USD 8.16 billion in 2024 and is anticipated to reach USD 9 billion in 2025 from USD 12 billion by 2033, growing at a CAGR of 4.19% during the forecast period from 2025 to 2033.

Current Scenario Of The Global Shipping Containers Market

The shipping container market is facilitating the efficient movement of goods across oceans and continents. Standardized in design, these robust steel containers have revolutionized logistics by enabling secure and cost-effective transportation.

The global container ship fleet reached a capacity of approximately 29.5 million TEUs (Twenty-Foot Equivalent Units) as of mid-2024 which is marking an 11% increase from the previous year. This expansion is attributed to the delivery of 264 new ships, adding 1.6 million TEUs in the first half of 2024 alone, as reported by the Baltic and International Maritime Council (BIMCO). Such growth underscores the critical role of containerization in meeting the demands of an interconnected global economy.

Leading the market, the Mediterranean Shipping Company (MSC) has solidified its position as the world's largest container shipping company. By November 2024, MSC operated a fleet of over 790 vessels, with a total capacity exceeding 5.5 million TEUs, accounting for 20% of the global container capacity, according to Alphaliner. This significant market share reflects MSC's strategic expansion and influence in maritime logistics.

Market Drivers

Expansion of Global Trade

The expansion of global trade is mainly driving the shipping container market ahead. According to the World Trade Organization (WTO), the value of world merchandise exports reached approximately USD 22.3 trillion in 2021 and is marking a substantial increase of 26.5% from the previous year. This surge in trade volume necessitates efficient and standardized methods of transporting goods, thereby boosting the demand for shipping containers. The WTO's data indicates that merchandise trade volume grew by 3.5% in 2022, underscoring the robust activity in international commerce. As global trade continues to flourish, the reliance on containerized shipping as a cost-effective and secure means of transporting goods is expected to intensify which is further propelling the shipping container market.

Growth in Global Manufacturing Output

The rise in global manufacturing output is another pivotal propellent of the shipping container market. The United Nations Industrial Development Organization (UNIDO) reported a 3.6% growth in world manufacturing production in the third quarter of 2022 and is indicating a stable expansion in the sector. This increase in manufacturing activities leads to higher production of goods requiring transportation and thereby escalating the demand for shipping containers. Notably, regions such as Northern America and Asia & Oceania demonstrated strong performance, contributing significantly to the heightened need for containerized shipping solutions. As manufacturing industries expand their output to meet global demand, the shipping container market is poised to experience sustained growth, driven by the necessity to transport manufactured goods efficiently across international borders.

Market Restraints

Stringent Environmental Regulations

The shipping container market faces major challenges due to stringent environmental regulations aimed at reducing greenhouse gas (GHG) emissions from maritime activities. The International Maritime Organization (IMO) has adopted a revised strategy targeting net-zero GHG emissions from international shipping by or around 2050, with indicative checkpoints aiming for a 20% reduction by 2030 and 70% by 2040, relative to 2008 levels. Achieving these ambitious goals necessitates substantial investments in cleaner technologies and alternative fuels, which can be financially burdensome for shipping companies. Compliance requires the adoption of energy-efficient ship designs, alternative fuels, and advanced emission control systems, leading to increased operational costs and significant capital expenditures, thereby restraining the growth and profitability of the shipping container market.

Fluctuations in Steel Prices

The production of shipping containers is heavily reliant on steel, making the market vulnerable to fluctuations in steel prices. According to the World Steel Association, global crude steel production reached 1,950.5 million tonnes in 2021, reflecting the material's critical role in various industries, including container manufacturing. Volatility in steel prices, influenced by factors such as raw material costs, supply-demand dynamics, and geopolitical tensions, directly impacts the manufacturing costs of shipping containers. For instance, a surge in steel prices can lead to increased production expenses, which may be passed on to end-users or result in reduced profit margins for manufacturers. This price instability poses a significant restraint, affecting the affordability and supply stability within the shipping container market.

Market Opportunities

Adoption of Green Technologies

The shipping container market is poised to benefit from the global shift towards sustainable and environmentally friendly technologies. The International Maritime Organization (IMO) has set ambitious targets to reduce greenhouse gas emissions from international shipping by at least 50% by 2050 compared to 2008 levels. This regulatory push encourages the development and adoption of green technologies, such as energy-efficient container designs and alternative fuels. For instance, the United Kingdom's Department for International Trade emphasizes the need to connect world-class UK technology to global gaps in sustainability within the maritime sector. Embracing these innovations not only ensures compliance with international regulations but also enhances competitiveness in a market increasingly driven by environmental considerations.

Government Initiatives and Investments

Government initiatives and investments play a crucial role in shaping the shipping container market. For example, the UK's National Shipbuilding Strategy outlines a comprehensive plan to revitalize the maritime industry, focusing on modernizing infrastructure and fostering innovation. This strategy aims to enhance the country's shipbuilding capabilities and competitiveness on a global scale. Similarly, the UK's Department for International Trade has launched a five-year action plan for Maritime Trade and Investment, targeting key areas such as green maritime technologies and digital advancements. These concerted efforts by governments not only stimulate domestic industries but also create a favorable environment for the growth and evolution of the shipping container market.

Market Challenges

Labor Disputes and Workforce Challenges

The shipping container market is significantly impacted by labor disputes and workforce challenges, which can disrupt port operations and supply chains. In October 2024, over 45,000 dockworkers affiliated with the International Longshoremen's Association (ILA) initiated a three-day strike across 36 U.S. East and Gulf Coast ports, demanding a 77% wage increase over six years and a complete ban on automation. This labor action, the first of its kind since 1977, led to substantial delays in cargo handling and draws attention to vulnerabilities in maritime logistics. The strike concluded with a new six-year contract, effective from October 1, 2024, to September 30, 2030, which includes a 62% wage increase, raising the hourly base rate for workers from $39 to $63. This agreement, while averting prolonged disruptions, underscores the critical need for effective labor relations and contingency planning within the shipping industry.

Port Congestion and Supply Chain Disruptions

Port congestion presents a formidable challenge to the shipping container market, leading to delays and increased operational costs. The International Monetary Fund (IMF) reported that, as of March 2022, global supply chains experienced significant disruptions, with port congestion causing long delays in delivering goods to consumers and firms. Factors contributing to congestion include labor shortages, shifts in demand, and infrastructure limitations. For instance, the unexpected surge in U.S. container imports after the third quarter of 2020 overwhelmed port capacities, exacerbating delays. Such congestion not only hampers the efficiency of maritime transport but also has ripple effects across global trade, emphasizing the necessity for infrastructure investment and improved supply chain management to mitigate these challenges.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

4.19% |

|

Segments Covered |

By Container Type, Containers Size and Region. |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview of Investment Opportunities |

|

Regions Covered |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Market Leaders Profiled |

Almar Container Group, CARU Containers BV, China International Marine Containers Co. Ltd, China Shipping Container Lines, Evergreen Marine Corporation, Ritveyraaj Cargo Shipping Containers, Sea Box Inc, Singamas Container Holdings Limited, Triton International Limited, W&K Container Inc. |

SEGMENT ANALYSIS

Shipping Containers Market Analysis By Container Size

The Large containers (40 feet) segment dominated the shipping containers market and held 50.7% market share in 2024 due to their ability to transport vast cargo volumes, optimizing economies of scale. The U.S. Census Bureau reports that 80% of U.S. imports by volume in 2022 utilized 40-foot containers, spotlighting their critical role in global trade. With a capacity of 67.7 cubic meters (U.S. Department of Transportation), they efficiently handle consumer goods and industrial equipment, reducing shipping costs by 30% per unit compared to smaller alternatives, making them indispensable for international logistics.

The High cube containers (40 feet) segment is predicted to witness the highest CAGR of 4.8% through 2033. Its growth is linked to the demand for lightweight, voluminous cargo like furniture and construction materials. The U.S. International Trade Commission notes a 15% annual increase in high cube usage for exports from 2020-2023, reflecting their versatility. Offering 76.4 cubic meters of capacity (U.S. Department of Transportation), they provide 13% more space than standard 40-foot containers, catering to e-commerce and modular housing trends, thus enhancing logistics efficiency and supporting sustainable urban development.

Shipping Containers Market Analysis By Container Type

The Dry storage containers segment led the shipping containers market and captured a 36.1% market share in 2024. The position of this segment is because of the versatility in transporting non-perishable goods like electronics and apparel. The U.S. Census Bureau data from 2023 shows dry cargo comprised 70% of the 11 billion tons of global seaborne trade volume, emphasizing their dominance. As per the U.S. Department of Transportation in 2023, with an 80% capacity utilization rate, they reduce logistics costs by 20% compared to specialized containers, per the Bureau of Transportation Statistics. This cost-efficiency and adaptability make them essential for global supply chains.

The Refrigerated containers (reefers) segment is estimated to register the fastest CAGR of 5.6% projected through 2033. Progress is propelled by surging demand for perishables like food and pharmaceuticals. The U.S. Department of Agriculture reported 1.3 billion tons of perishable goods shipped globally in 2023, a 12% rise from 2021. The U.S. International Trade Commission notes a 15% yearly increase in reefer exports from 2021-2023, fueled by e-commerce and health sectors. According to the U.S. Department of Transportation, with a 95% temperature reliability rate, reefers ensure cold chain integrity, vital for global food security and medical logistics.

REGIONAL ANALYSIS

Asia-Pacific

The Asia-Pacific region led the global shipping container market by holding 41.6% of the market share in 2024. This dominance is primarily driven by China's substantial manufacturing sector, which significantly contributes to global trade volumes. Additionally, major ports in the region, such as Shanghai and Singapore, consistently rank among the world's busiest, facilitating high container throughput. The region's robust export activities and well-established port infrastructure solidify its leading position in the market.

North America

North America accounted for 20.1% of the global shipping container market share in 2024. The United States plays a pivotal role, with key ports such as Los Angeles and Long Beach handling significant container volumes. In 2023, the Port of Los Angeles managed substantial TEU (Twenty-Foot Equivalent Unit) traffic, reflecting the region's strong import and export activities. The demand is driven by substantial imports of consumer goods and industrial products, supported by a strong economy and advanced logistics infrastructure.

Europe

Europe holds a notable position in the global shipping container market. The region's extensive network of ports, including Rotterdam and Hamburg, facilitates high volumes of containerized trade. In 2023, the Port of Rotterdam handled significant TEU traffic, underscoring Europe's strategic location and diversified industrial base, which contribute to its substantial share in the market.

Latin America

Latin America represents a smaller portion of the global shipping container market. However, the region is experiencing growth due to increasing trade activities, particularly in agricultural exports. Brazil's Port of Santos, for instance, handled a notable volume of TEUs in recent years, as reported by the National Agency for Waterway Transportation (ANTAQ). Investments in port infrastructure and regional trade agreements are expected to enhance the market's performance in the coming years.

Middle East and Africa

The Middle East and Africa collectively hold smaller portion of the global shipping container market share. The region's market is expanding due to rising trade volumes, particularly in oil, minerals, and industrial goods. Key ports in the Middle East, such as Dubai and Jeddah, act as transit hubs connecting Asia, Europe, and Africa. Infrastructure developments and strategic initiatives to boost trade are anticipated to improve the market's performance in these regions.

Top 3 Players in the market

China International Marine Containers (CIMC)

Established in 1980, CIMC has evolved into the world's largest manufacturer of shipping containers, holding more than 30% of the global market share. The company's extensive product line includes dry freight containers, refrigerated containers, and specialized containers, catering to diverse transportation needs. CIMC's dominance is attributed to its large-scale production capabilities, continuous innovation, and strategic positioning within China's robust manufacturing sector. By leveraging economies of scale and advanced manufacturing technologies, CIMC has maintained competitive pricing and high-quality standards, reinforcing its leadership position.

Dong Fang International Container (Hong Kong) Co. Ltd

As a key player in the shipping container market, Dong Fang International Container specializes in the production of various container types, including standard dry containers and specialized units. The company's commitment to quality and innovation has enabled it to secure a substantial share of the global market. Strategically located in Hong Kong, Dong Fang benefits from access to major shipping routes and international trade hubs, facilitating efficient distribution and service to a global clientele. The company's growth is driven by its focus on meeting diverse customer requirements and adapting to evolving industry standards.

Maersk Container Industry AS

A subsidiary of the Danish conglomerate A.P. Møller-Mærsk A/S, Maersk Container Industry (MCI) specializes in the production of refrigerated containers, commonly known as reefers. MCI is renowned for integrating advanced technologies into its products, enhancing the efficiency and reliability of temperature-sensitive cargo transportation. The company's focus on innovation and quality has solidified its position as a leader in the refrigerated container segment. MCI's contributions are pivotal in supporting the global cold chain logistics, ensuring the safe and efficient transport of perishable goods across continents.

Top strategies used by the key market participants

Expansion of Production Capacity

One of the primary strategies used by major shipping container companies is expanding their production capacity to meet growing global demand. China International Marine Containers (CIMC) has significantly increased its manufacturing footprint by establishing production plants in China and overseas. Dong Fang International Container has upgraded its factories to enhance efficiency, ensuring a steady supply of high-quality containers. Maersk Container Industry (MCI) focuses on expanding refrigerated container production to support the rising demand for cold chain logistics. By increasing production capacity, these companies ensure they can meet global trade needs while maintaining a competitive edge.

Technological Innovation and Product Diversification

To remain market leaders, these companies invest heavily in research and development to create innovative products. CIMC leads the market in developing smart containers with IoT tracking, allowing real-time cargo monitoring. Dong Fang enhances container durability and energy efficiency using advanced materials and coatings. MCI specializes in refrigerated containers with cutting-edge insulation and CO₂ refrigeration technology to ensure optimal cargo preservation. By continuously diversifying their product offerings, these companies cater to the evolving needs of global logistics and supply chain industries.

Mergers, Acquisitions, and Strategic Partnerships

Acquisitions and partnerships are crucial for consolidating market share and expanding global reach. CIMC has acquired smaller container manufacturers to solidify its dominance, reducing competition and increasing production capacity. Dong Fang collaborates with global shipping companies to secure long-term supply contracts, ensuring a stable revenue stream. MCI partners with major logistics providers to enhance its refrigerated container distribution network. These mergers and alliances allow leading companies to strengthen their market position and build a more resilient supply chain.

Competitive Landscape

The global shipping containers market is highly competitive, dominated by a few major players, including China International Marine Containers (CIMC), Dong Fang International Container, and Maersk Container Industry (MCI). These companies hold the largest market share, leveraging their extensive production capabilities, global distribution networks, and technological advancements to maintain dominance. The competition is driven by factors such as pricing, production efficiency, technological innovation, and sustainability efforts.

CIMC remains the market leader, producing a significant portion of the world's containers. Its ability to scale production efficiently gives it a cost advantage over smaller competitors. Dong Fang International Container follows closely, focusing on high-quality container manufacturing and strategic collaborations with shipping companies. MCI, a leader in refrigerated containers, differentiates itself by investing in advanced insulation and refrigeration technologies to cater to the growing cold chain logistics market.

In addition to these major players, smaller regional manufacturers compete by offering customized solutions and niche products. However, barriers to entry remain high due to the capital-intensive nature of container production and strict international regulations. With increasing global trade, digitalization, and sustainability demands, competition is expected to intensify, pushing companies to innovate and expand their market reach.

KEY MARKET PLAYERS

Almar Container Group, CARU Containers BV, China International Marine Containers Co. Ltd, China Shipping Container Lines, Evergreen Marine Corporation, Ritveyraaj Cargo Shipping Containers, Sea Box Inc, Singamas Container Holdings Limited, Triton International Limited, W&K Container Inc. These are the market players that are dominating the global shipping container market.

RECENT HAPPENINGS IN THIS MARKET

- In February 2025, private equity giant Blackstone agreed to acquire Safe Harbor Marinas, a Dallas-based operator of 138 marinas, for $5.65 billion from Sun Communities. This move underscores Blackstone's strategy to consolidate the fragmented marina industry and capitalize on the sustained demand for boat storage facilities.

- In September 2024, CMA CGM, the world's third-largest shipping group, announced a $1.1 billion investment to acquire a 48% stake in Brazilian port terminal operator Santos Brasil, with intentions for a full takeover. This strategic move aims to enhance CMA CGM's presence in the South American market.

- In February 2025, Ocean Network Express (ONE), HMM, and Yang Ming Marine Transportation announced the formation of the Premier Alliance, aiming to enhance operational efficiency across major East-West trade lanes. This strategic partnership seeks to optimize shipping networks and improve global supply chain resilience.

- In January 2025, Maersk and Hapag-Lloyd launched the Gemini Cooperation, a strategic partnership focused on providing more resilient and flexible shipping solutions. This collaboration aims to enhance global trade operations and streamline logistics efficiencies.

MARKET SEGMENTATION

This research report on the global shipping container market is segmented and sub-segmented into the following categories.

By Container Size

- Small Containers (20 feet)

- Large Containers (40 feet)

- High Cube Containers (40 feet)

By Container Type

- Dry Storage Containers

- Flat Rack Containers

- Refrigerated Containers

- Special Purpose Containers

- Others

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East and Africa

Frequently Asked Questions

What is the current market size of the global shipping container market?

The current market size of the global shipping container market was valued at USD 9 billion in 2025

What are the market drivers that are driving the global shipping container market?

The expansion of global trade is mainly driving the shipping container market ahead and the rise in global manufacturing output is another pivotal propellent of the shipping container market.

who are the market players that are dominating the global shipping container market?

Almar Container Group, CARU Containers BV, China International Marine Containers Co. Ltd, China Shipping Container Lines, Evergreen Marine Corporation, Ritveyraaj Cargo Shipping Containers, Sea Box Inc, Singamas Container Holdings Limited, Triton International Limited, W&K Container Inc. These are the market players that are dominating the global shipping container market.

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2500

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]