Global Ship Recycling Market Size, Share, Trends, & Growth Forecast Report By Vessel Size (Less than 60000 DWT, 60000 to 125000 DWT, Above 125000 DWT), Method, Vessel Type, and Region (North America, Europe, Asia Pacific, Latin America, Middle east and Africa), Industry Analysis From 2025 to 2033

Global Ship Recycling Market Size

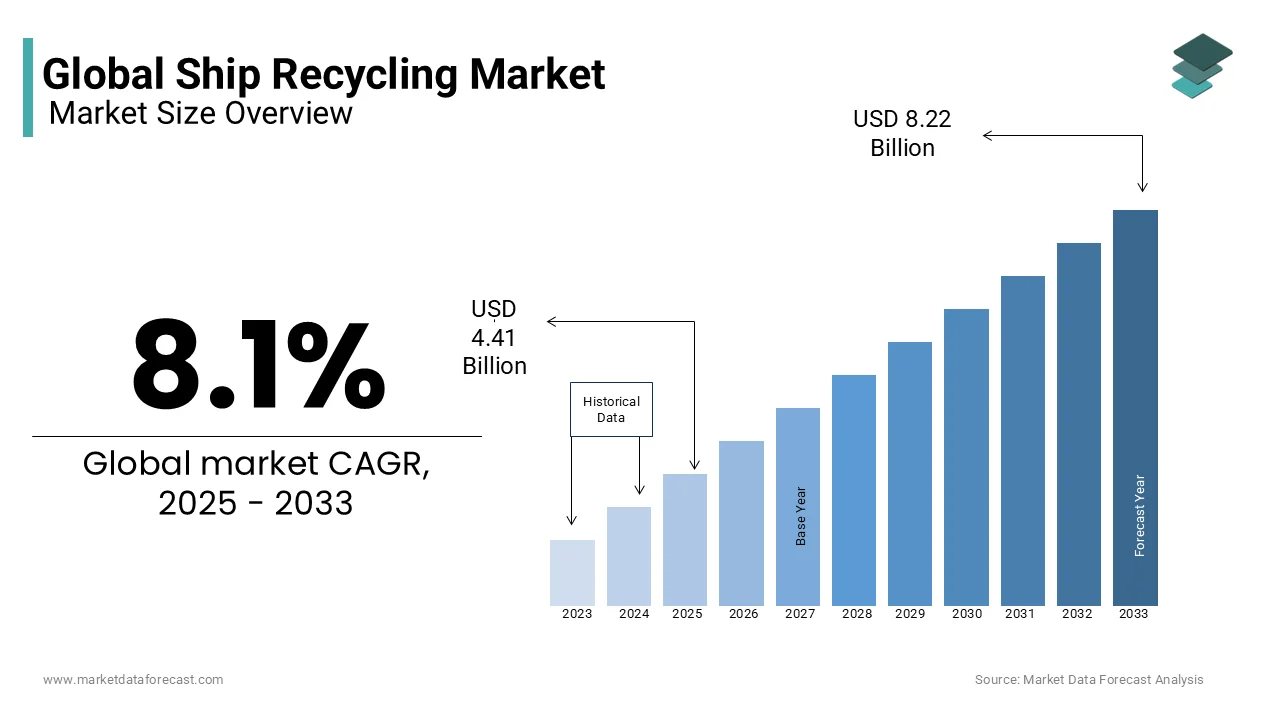

The global ship recycling market size was valued at USD 4.08 billion in 2024 and the global market size is expected to reach USD 8.22 billion by 2033 from USD 4.41 billion in 2025. The market is promising CAGR for the predicted period is 8.1%.

Ship recycling is an integral component of the global maritime industry, which involves the dismantling of obsolete vessels to recover valuable materials such as steel, aluminum, and other recyclable components. This process not only supports the circular economy by reusing resources but also plays a pivotal role in waste management within the shipping sector. In 2023, the ship recycling industry gained renewed attention due to its environmental and economic implications. According to the United Nations Conference on Trade and Development (UNCTAD), approximately 800 ships are recycled annually, with South Asia dominating the market share in India, Bangladesh, and Pakistan, which collectively account for over 70% of global ship recycling activities.

The International Maritime Organization (IMO) report states that the Hong Kong Convention, aimed at ensuring environmentally sound ship recycling practices, has yet to be universally ratified by leaving significant gaps in regulatory enforcement. Meanwhile, data from the NGO Shipbreaking Platform reveals that nearly 90% of large ocean-going vessels are broken down on tidal beaches in developing nations by raising concerns about worker safety and environmental degradation. For instance, toxic substances like asbestos and heavy metals often leach into coastal ecosystems. Despite these challenges, the European Union reports a growing trend toward sustainable ship recycling with its approved facilities handling around 15% of global tonnage in 2022. This shift underscores the increasing demand for greener practices amid stricter international regulations and heightened awareness of corporate social responsibility.

SHIP RECYCLING MARKET TRENDS

Automation and Robotics in Recycling

Automation and robotics are transforming ship recycling by enhancing efficiency, safety, and environmental compliance. Robotic cutting tools, for instance, are increasingly employed for precision tasks like cutting steel plates, reducing the need for human labor and minimizing risks. Industry reports estimate that such technologies can boost productivity by 20-30%, while also lowering the environmental hazards traditionally associated with manual shipbreaking.

New Shipbreaking Yards Development Across Emerging Regions

The global demand for ship recycling is leading to the development of new yards in emerging regions, including the Middle East, Africa, and Latin America. Countries such as Turkey and Brazil have been expanding their shipbreaking infrastructure, adhering to international standards. In Turkey, the ship recycling sector has grown by 15% over the last two years, with new facilities focusing on environmentally safe dismantling. These new facilities are helping diversify the ship recycling market, reducing dependency on traditional hubs like South Asia.

Green Ship Recycling Practices

Driven by stringent environmental regulations and corporate sustainability goals, there is an increasing focus on green ship recycling. The EU Ship Recycling Regulation (EU SRR) mandates that EU-flagged vessels be dismantled at facilities that meet high environmental and safety standards. This shift has led to wider adoption of eco-friendly methods like dry-docking and closed-loop recycling systems, which help minimize emissions and hazardous waste.

MARKET DRIVERS

Aging Global Ship Fleet

The global fleet is aging rapidly, with many vessels reaching the end of their operational life. Ships generally have a lifespan of 25-30 years, after which they become inefficient and expensive to maintain. In 2023, it was estimated that over 2,500 ships were scheduled for decommissioning globally. The International Maritime Organization (IMO) predicts that by 2030, the number of ships needing recycling will increase by 30%. This rise in obsolete vessels presents a significant opportunity for the ship recycling market, as owners seek to dismantle older vessels and recover valuable materials like steel, thus reducing the demand for new raw materials.

Stricter Environmental Regulations

Environmental regulations, such as the Hong Kong International Convention for the Safe and Environmentally Sound Recycling of Ships, adopted in 2009, have driven the demand for sustainable ship recycling. Although not fully ratified globally, many nations have adopted similar regulations, pushing shipowners to recycle vessels in an eco-friendly manner. By 2023, 70% of the world’s shipbreaking activities were concentrated in South Asia, where governments are increasingly enforcing green standards. This focus on compliance has accelerated the demand for certified recycling facilities, further driving market growth.

Automation and Technological Advancements in Shipbreaking

The integration of automation and technology in shipbreaking has made the process safer and more efficient. Innovations like robotic cutting tools, automated disassembly systems, and AI-driven monitoring are being widely adopted. In 2023, the global use of automated shipbreaking processes increased by 15%, particularly in regions like Europe and North America. These advancements have enabled shipyards to process ships more quickly while adhering to strict safety regulations, fueling further growth in the market.

MARKET RESTRAINTS

Strict Regulatory Frameworks

The complexity and costs associated with regulatory frameworks are significant barriers to market growth. Although the Hong Kong Convention sets the global standard for ship recycling, it has yet to be ratified by enough nations to come into force. Regions like the European Union have implemented their own regulations, such as the EU Ship Recycling Regulation, which requires EU-flagged ships to be dismantled at approved facilities. Since 2019, compliance-related expenses have increased by an estimated 20%, discouraging smaller shipyards from entering the market and limiting the number of compliant facilities.

Worker Safety Issues

Worker safety remains a critical challenge in the ship recycling industry, particularly in South Asia, where over 70% of shipbreaking takes place. Inadequate safety measures have resulted in high injury and fatality rates. For instance, in 2022, more than 100 workers were killed in Bangladeshi shipbreaking yards, with thousands more suffering from injuries. These safety issues are exacerbated by poor working conditions, lack of personal protective equipment, and insufficient training. As safety standards become more stringent, operational costs rise, discouraging some operators from participating in the market and limiting industry capacity.

MARKET OPPORTUNITIES

Growing Demand for Recycled Steel

The ship recycling market presents a significant opportunity to meet the increasing global demand for recycled steel. According to the U.S. Geological Survey, recycled steel constituted approximately 70% of raw steel production in the United States in 2020. Ships, primarily constructed from high-grade steel, become valuable sources of recyclable material at the end of their operational life. Efficient recycling processes can recover up to 95% of a vessel's weight in reusable steel, thereby reducing the need for virgin steel production and contributing to resource conservation. This not only supports environmental sustainability but also offers economic advantages by lowering production costs and energy consumption associated with steel manufacturing.

Implementation of Stricter Environmental Regulations

The enforcement of stringent environmental regulations globally has created a substantial opportunity for the ship recycling market to adopt safer and more sustainable practices. The Hong Kong International Convention for the Safe and Environmentally Sound Recycling of Ships, adopted in 2009 aims to ensure that ships when being recycled after reaching the end of their operational lives and do not pose any unnecessary risks to human health, safety, and the environment. As of April 2023, 20 countries have acceded to the convention by representing 30.16% of the world's merchant shipping by gross tonnage. This regulatory framework compels ship owners to recycle vessels in certified facilities that comply with environmental and safety standards, thereby promoting the growth of eco-friendly recycling operations and enhancing the industry's overall sustainability.

MARKET CHALLENGES

Environmental and Occupational Hazards

The ship recycling industry faces significant challenges related to environmental pollution and worker safety. According to the Organisation for Economic Co-operation and Development (OECD), improper handling of hazardous materials during ship dismantling can lead to severe environmental contamination and health risks for workers. The OECD emphasizes the need for stringent safety protocols and environmental regulations to mitigate these risks. Implementing comprehensive safety measures and environmental management systems is essential to address these challenges effectively.

Economic Viability and Competition

The economic viability of ship recycling operations is challenged by fluctuating market conditions and competition from emerging recycling facilities. According to a report by Lloyd's List, new ship recycling facilities are being established in various countries, increasing competition in the market. The report highlights that these new facilities must overcome challenges such as developing adequate infrastructure and complying with environmental regulations to compete effectively.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

8.1% |

|

Segments Covered |

By Vessel Size, Method, Vessel Type, and Region |

|

Various Analyses Covered |

Global, Regional, & Country Level Analysis; Segment-Level Analysis; DROC, PESTLE Analysis; Porter’s Five Forces Analysis; Competitive Landscape; Analyst Overview of Investment Opportunities |

|

Regions Covered |

North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

|

Market Leaders Profiled |

Spot Shipping A.S., Alang Info Services, Salasar Balaji Shipbreakers Pvt. Ltd., Dortel Ship Recycling, R L Kalthia Ship Breaking Pvt. Ltd., Izmir Ship Recycling Co., Osm Thome, Ksrm Steel Plant Ltd., Marine Recycling Corp., Leyal Gemi Geri Donusum Grubu. |

SEGMENTAL ANALYSIS

By Method Insights

The beaching segment ruled the market by occupying a share of 70.8% of the global market in 2024. The beaching method involves grounding ships on tidal beaches, primarily in South Asia, where labor costs are low and steel demand is high. Its prevalence stems from cost efficiency and minimal infrastructure requirements. However, environmental concerns persist due to improper waste management. Despite regulatory scrutiny, its economic viability ensures dominance. According to the International Labour Organization (ILO), labor costs in these regions are nearly 80% cheaper than in Europe or North America by making beaching an economically attractive option.

The dry-dock recycling segment is estimated to have a prominent CAGR of 8.5% during the forecast period due to the stringent environmental regulations, such as the EU Ship Recycling Regulation, which mandates safer practices. Dry-dock facilities prevent toxic spills and ensure compliance with the Hong Kong Convention. The International Labour Organization highlights that dry-dock methods reduce worker fatalities by 40% compared to beaching. The segment's share is projected to rise significantly with Europe investing heavily in sustainable infrastructure.

By Vessel Size Insights

The less than 60,000 DWT segment dominated the ship recycling market by capturing 55.4% of the global recycling market share in 2024. This segment primarily includes smaller vessels such as ferries, offshore supply vessels, and smaller bulk carriers. Its prevalence is attributed to the shorter operational lifespan of these vessels, typically ranging from 15 to 20 years when compared to larger ships. Additionally, the lower dismantling complexity and cost make this segment attractive to recyclers, particularly in regions like South Asia. The steel recovered from these vessels contributes significantly to local economies, with UNCTAD estimating that each ton of recycled steel generates approximately $400-$500 in revenue. However, environmental concerns persist due to the use of rudimentary dismantling methods in some regions.

The above 125,000 DWT segment is the fastest-growing segment and is expected to register a CAGR of 7.3% over the forecast period owing to the increasing decommissioning of large vessels such as Very Large Crude Carriers (VLCCs), Ultra Large Container Ships (ULCS), and Capesize bulk carriers. These vessels are typically retired after 25-30 years of service and their recycling yields substantial quantities of high-grade steel and valuable components. According to the IMO , the average VLCC contains over 40,000 tons of steel, which is a lucrative target for recyclers. The segment's rapid growth is further fueled by stricter environmental regulations, which mandate the retirement of older, less efficient vessels. Investments in advanced recycling technologies, particularly in Europe and China, have also enhanced the capacity to handle these massive ships sustainably.

By Vessel Type Insights

The bulk carriers segment held the largest share of 45.1% in the global ship recycling market in 2024. The widespread use of bulk carriers in global trade, transporting commodities like coal, grain, and iron ore is propelling the expansion of the bulk carriers segment in the global market. Bulk carriers are frequently decommissioned due to aging fleets and regulatory compliance costs with an average lifespan of 25-30 years,. The segment's importance lies in its contribution to steel recovery, with each vessel yielding up to 90% recyclable material. This aligns with circular economy goals by making bulk carriers pivotal in resource efficiency.

The offshore vessels segment is predicted to showcase the highest CAGR of 8.2% by vessel type during the forecast period owing to the global energy transition, which has rendered many offshore support vessels obsolete as investments shift away from fossil fuels. The IEA notes that over 200 offshore vessels were decommissioned between 2018 and 2022 due to reduced oil exploration activities. Additionally, stringent environmental regulations, such as those under the IMO’s sulfur cap, have accelerated retirements. The segment's importance lies in its high-value materials by including specialized alloys, and its role in reducing maritime carbon footprints.

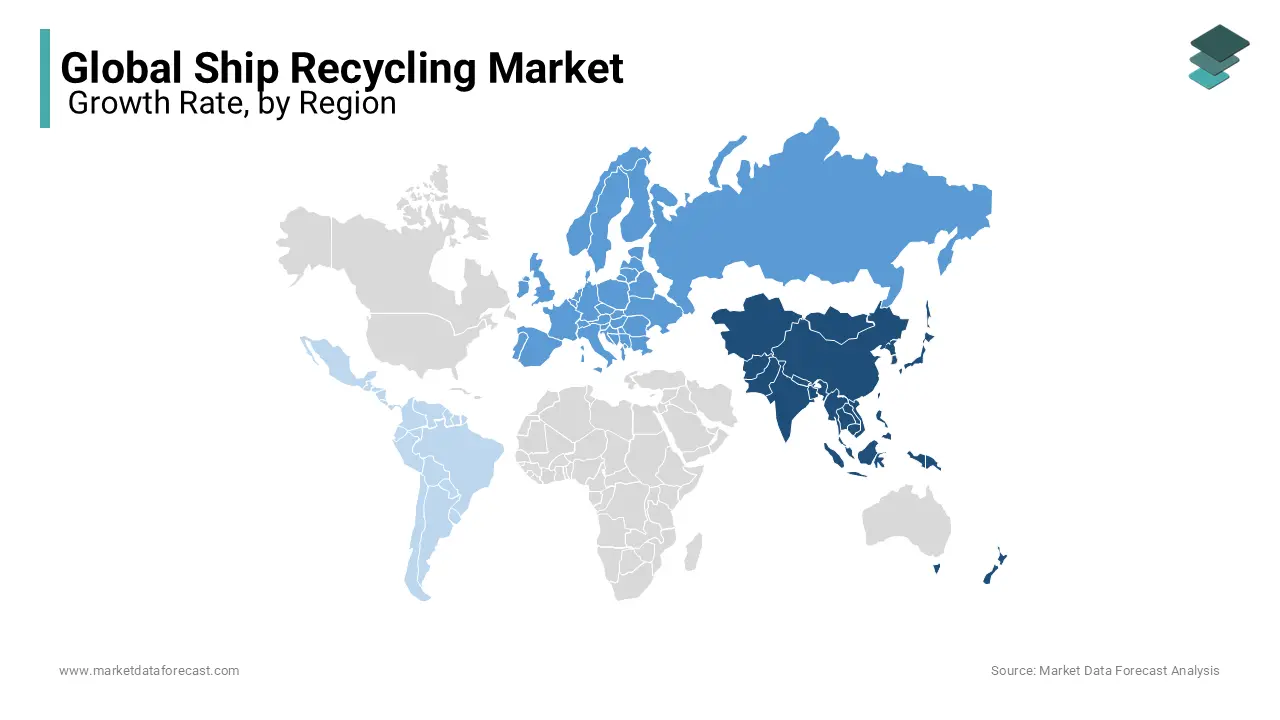

REGIONAL ANALYSIS

Asia-Pacific dominated the ship recycling market by accounting for 70.7% of the global recycling market share in 2024. Countries like India, Bangladesh, and Pakistan lead due to cost-effective labor and high demand for recycled steel. These nations dismantle over 600 ships annually, contributing significantly to local economies and global resource recovery. However, environmental concerns persist due to beaching methods, which often result in toxic waste leakage. Asia-Pacific remains pivotal in meeting global steel demands, with recycled steel from ships accounting for nearly 10% of the region’s annual steel production, as highlighted by the IMO.

Europe is likely to have a steady CAGR of 6.8% during the forecast period. This growth is driven by the EU Ship Recycling Regulation, which mandates environmentally sound practices and prohibits beaching. Europe’s approved facilities handled approximately 12% of global tonnage in 2022, up from 7% in 2018. The EMSA emphasizes that investments in green technologies and improved safety measures have bolstered capacity. Europe’s leadership in sustainable practices sets a global benchmark, reducing toxic waste and promoting circular economy principles by making it a model for other regions.

North America and Latin America are expected to witness steady growth in the ship recycling market which is driven by a stronger focus on regulatory compliance and sustainable practices. In North America, efforts are being made to expand recycling capacity to manage aging fleets in both commercial vessels and government-owned ships. The region is also investing in environmentally sound methods to align with global standards. Latin America, particularly countries like Brazil and Mexico, is gradually emerging as a potential player due to its strategic geographic location and growing industrial infrastructure. However, challenges such as limited facilities and technological gaps remain barriers to rapid expansion.

In the Middle East and Africa, the ship recycling market holds significant untapped potential. Rising maritime trade volumes and the increasing number of obsolete vessels are expected to drive growth in these regions. Governments and private players are beginning to recognize the economic and environmental benefits of formalized recycling operations. While progress has been slow, initiatives to improve safety standards and adopt eco-friendly practices are gaining momentum. These regions are likely to play an increasingly important role in the global ship recycling landscape as they work toward aligning with international sustainability goals and addressing infrastructure limitations.

KEY PLAYERS IN THE MARKET

The ship recycling market is highly competitive, with South Asia—particularly India, Bangladesh, and Pakistan—dominating the industry due to low labor costs and large-scale facilities. These countries handle the bulk of global shipbreaking activities, making them key players in the market. However, regions like Turkey and China are emerging as strong competitors, especially in the area of green recycling, driven by stringent environmental regulations such as the EU SRR. Compliance with international environmental standards and the increasing adoption of eco-friendly practices are becoming critical competitive factors, as are technological advancements like automation and robotics, which are revolutionizing ship dismantling processes globally.

List of key participants in the global Ship Recycling market include

- GMS (Global Marketing Systems)

- Leela Group

- Simsekler Group

- Ersin Shipping

- S.R.I Group

- Priya Blue Industries

- Avon Shipping

- Baijnath Melaram

- Changjiang Ship Recycling Yard

- Danish Ship Finance

COMPETITIVE LANDSCAPE

The ship recycling market is characterized by intense competition, driven by a combination of regional dominance, regulatory compliance, and the growing emphasis on sustainability. The industry is fragmented, with key players operating across different geographies, each leveraging their unique strengths to capture market share. In South Asia, companies like Leela Group and Priya Blue Industries dominate due to cost-effective labor and high steel recovery rates, particularly in India and Bangladesh, which together account for over 70% of global ship recycling activities. However, these regions face scrutiny for environmental concerns, prompting investments in greener practices to align with international standards.

In contrast, European players such as Simsekler Group and Ersin Shipping focus on environmentally sound methods, benefiting from stringent EU regulations that mandate sustainable dismantling. This has positioned Europe as a leader in eco-friendly recycling despite higher operational costs. Meanwhile, GMS (Global Marketing Systems) stands out as a global intermediary, connecting shipowners with compliant yards worldwide, thereby bridging gaps between cost efficiency and sustainability.

The competitive landscape is further shaped by technological advancements, with companies investing in automation and waste management systems to enhance safety and efficiency. Strategic collaborations with governments and NGOs also play a critical role, enabling players to influence policy-making and secure funding for green initiatives.

TOP 3 PLAYERS IN THE SHIP RECYCLING MARKET

GMS (Global Marketing Systems)

GMS is the largest cash buyer of ships for recycling globally, playing a pivotal role in shaping the ship recycling industry. The company acts as an intermediary between shipowners and recycling yards, ensuring that vessels are sold to facilities adhering to environmental and safety standards. GMS has been instrumental in promoting sustainable practices by collaborating with regulatory bodies like the International Maritime Organization (IMO) and advocating for compliance with the Hong Kong Convention. Its global network spans South Asia, Turkey, and Europe, enabling it to handle a significant share of the world’s end-of-life vessels. By offering transparent transactions and supporting eco-friendly dismantling methods, GMS contributes to reducing the environmental footprint of ship recycling while maintaining economic viability.

Leela Group

Based in India, the Leela Group is one of the leading players in the ship recycling sector, operating from Alang, the world’s largest shipbreaking yard. The group has gained recognition for its efforts to modernize traditional dismantling practices by adopting safer and more environmentally sound methods. Leela Group has invested in infrastructure upgrades, including impermeable flooring and waste management systems, to minimize pollution and comply with international standards. Its contribution to the global market lies in its ability to process large volumes of vessels efficiently while addressing environmental concerns. By aligning with initiatives like the EU Ship Recycling Regulation, the group has positioned itself as a key player in bridging the gap between cost-effective operations and sustainability.

Simsekler Group

The Simsekler Group, headquartered in Turkey, is a prominent name in the global ship recycling market, known for its advanced recycling facilities and adherence to strict environmental regulations. Turkey has emerged as a leader in green ship recycling, and Simsekler Group exemplifies this trend by employing cutting-edge technologies to ensure safe dismantling and efficient resource recovery. The group specializes in processing complex vessels, including oil tankers and offshore units, while prioritizing worker safety and minimizing ecological impact. Its contributions extend beyond operational excellence, as it actively participates in raising industry standards and fostering collaboration with international organizations. By championing sustainable practices, Simsekler Group has become a benchmark for environmentally responsible ship recycling on a global scale.

TOP STRATEGIES USED BY THE KEY MARKET PARTICIPANTS

Adoption of Sustainable Practices

A significant focus for key players has been the transition toward environmentally sound ship recycling methods. Companies like GMS (Global Marketing Systems) and Simsekler Group have invested in facilities that comply with international standards such as the Hong Kong Convention and the EU Ship Recycling Regulation. By promoting green dismantling techniques—such as impermeable flooring, advanced waste management systems, and reduced toxic emissions—these players position themselves as leaders in eco-friendly operations. This not only enhances their reputation but also attracts environmentally conscious clients.

Technological Advancements

Investing in cutting-edge technologies is another critical strategy. For instance, Changjiang Ship Recycling Yard in China has adopted advanced robotic systems and automated processes to improve efficiency and safety during dismantling. Similarly, Leela Group in India has upgraded its infrastructure to handle hazardous materials more effectively. These technological upgrades enable players to recycle larger and more complex vessels while minimizing risks to workers and the environment, thereby strengthening their competitive edge.

Regulatory Compliance and Certifications

Compliance with global regulations is a cornerstone strategy for market leaders. Priya Blue Industries and Ersin Shipping have obtained certifications from international bodies to demonstrate adherence to safety and environmental standards. By aligning with frameworks like the IMO’s guidelines and EU regulations, these companies ensure they remain eligible to serve high-value markets, including Europe and North America. Regulatory compliance also helps them avoid penalties and build trust among stakeholders.

Expansion of Global Networks

Expanding geographic reach and operational capacity is another key strategy. GMS , for example, leverages its extensive global network to connect shipowners with compliant recycling yards across South Asia, Turkey, and Europe. This broad presence allows the company to manage large volumes of end-of-life vessels while offering tailored solutions to clients worldwide. Similarly, Danish Ship Finance focuses on financing sustainable projects in Europe, positioning itself as a critical enabler of green ship recycling.

Focus on Worker Safety and Training

Improving worker safety is a priority for many players. Simsekler Group and Leela Group have implemented rigorous training programs to educate workers on safe dismantling practices and emergency response protocols. Enhanced safety measures reduce accidents, improve operational efficiency, and foster goodwill among regulators and communities.

Partnerships and Collaborations

Strategic alliances with governments, NGOs, and industry bodies are vital for driving innovation and advocacy. For instance, GMS collaborates with organizations like the NGO Shipbreaking Platform to promote transparency and sustainability. Such partnerships help key players influence policy-making, access funding for green initiatives, and stay ahead of regulatory trends.

Diversification of Services

Many players have diversified their offerings beyond traditional shipbreaking. Avon Shipping and Baijnath Melaram provide value-added services such as steel scrap trading, waste management, and resource recovery. By diversifying, these companies increase revenue streams and reduce dependency on fluctuating demand for ship recycling.

Brand Building and Advocacy

Establishing a strong brand identity focused on sustainability and responsibility is crucial. S.R.I Group and Simsekler Group actively engage in advocacy campaigns to raise awareness about the importance of greenship recycling. By positioning themselves as thought leaders, these players attract partnerships, investments, and long-term contracts.

RECENT HAPPENINGS IN THE GLOBAL MARKET

- In January 2024, GMS (Global Marketing Systems) partnered with a leading dry-dock facility in the UAE to comply with new government regulations banning beaching. This strategic move enhanced GMS’s position by ensuring alignment with global environmental standards and expanding its footprint in the Middle East.

- In December 2023, Leela Group committed to a $50 million investment in green ship recycling technology at its Alang yard. This initiative focuses on improving eco-friendly dismantling operations and reinforcing the company’s leadership in sustainable ship recycling in India.

- In November 2023, Simsekler Group secured a long-term contract with a European shipping firm to recycle EU-flagged vessels. Compliant with the EU Ship Recycling Regulation (EU SRR), this contract bolstered Simsekler’s dominance in the eco-friendly ship recycling market in Turkey.

- In January 2024, Ersin Shipping launched its first dry-dock facility in the UAE, aligning with the country’s new regulations. This expansion has increased the company's capacity in environmentally compliant ship recycling and strengthened its regional competitiveness.

- In October 2023, S.R.I Group expanded its recycling capacity by acquiring a new yard in Chittagong, Bangladesh. This acquisition allows S.R.I Group to process a higher volume of vessels and improves its cost competitiveness globally.

- In December 2023, Priya Blue Industries formed a partnership with a global shipping company to recycle decommissioned container ships at its Alang facility. This collaboration has enhanced its market share in the container ship recycling segment, further solidifying its commitment to sustainable practices.

- In January 2024, Avon Shipping secured a major contract to recycle oil tankers from the Middle East, marking its entry into the UAE’s regulated dry-dock market. This contract strengthens Avon Shipping’s presence in the ship recycling sector across the region.

- In November 2023, Baijnath Melaram upgraded its recycling infrastructure in India to meet the latest international environmental standards, including the Hong Kong Convention. This upgrade has enhanced its competitive edge by providing sustainable ship dismantling solutions.

- In December 2023, Changjiang Ship Recycling Yard announced its investment in automation technologies for its shipbreaking operations in China. The investment aims to improve efficiency and reduce environmental impact, positioning Changjiang as a leader in advanced ship recycling.

- In January 2024, Danish Ship Finance increased funding for green ship recycling projects across Europe and Asia. This move supports the development of sustainable recycling facilities and strengthens Danish Ship Finance’s influence as a key financier in the global ship recycling industry.

MARKET SEGMENTATION

This research report on the global ship recycling market has been segmented and sub-segmented based on vessel size, method, vessel type, and region.

By Vessel Size

- Less than 60000 DWT

- 60000 to 125000 DWT

- Above 125000 DWT

By Method

- Beaching

- Dry-Dock

- Berthing

- Alongside and Slipway

- Others

By Vessel Type

- Oil Tankers

- Bulk Carriers

- Offshore Vessels

- Liquefied Gas Carriers

- Ferries

- Passenger Ships

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa

Frequently Asked Questions

1. What are the main factors driving the ship recycling market?

Key drivers include the increasing demand for steel, the growing number of aging ships, stringent environmental regulations, and the economic benefits of recycling.

2. What are the challenges faced by the ship recycling market?

Challenges include dealing with hazardous waste, fluctuating steel prices, compliance with environmental regulations, and competition from alternative materials.

3. What is the future outlook for the ship recycling market?

The market is expected to grow due to the increasing number of ships reaching the end of their lifespan and the rising demand for recycled materials, especially in developing regions.

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2500

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]