Global Sexual Wellness Market Size, Share, Trends & Growth Forecast Report By Product (Contraceptives, Condoms, Sex Toys, Lubricants, Sexual Enhancement Supplements and Others), Distribution Channel (Hospital Pharmacy, Retail Pharmacy and Online Pharmacy) and Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), Industry Analysis From 2025 To 2033.

Global Sexual Wellness Market Size

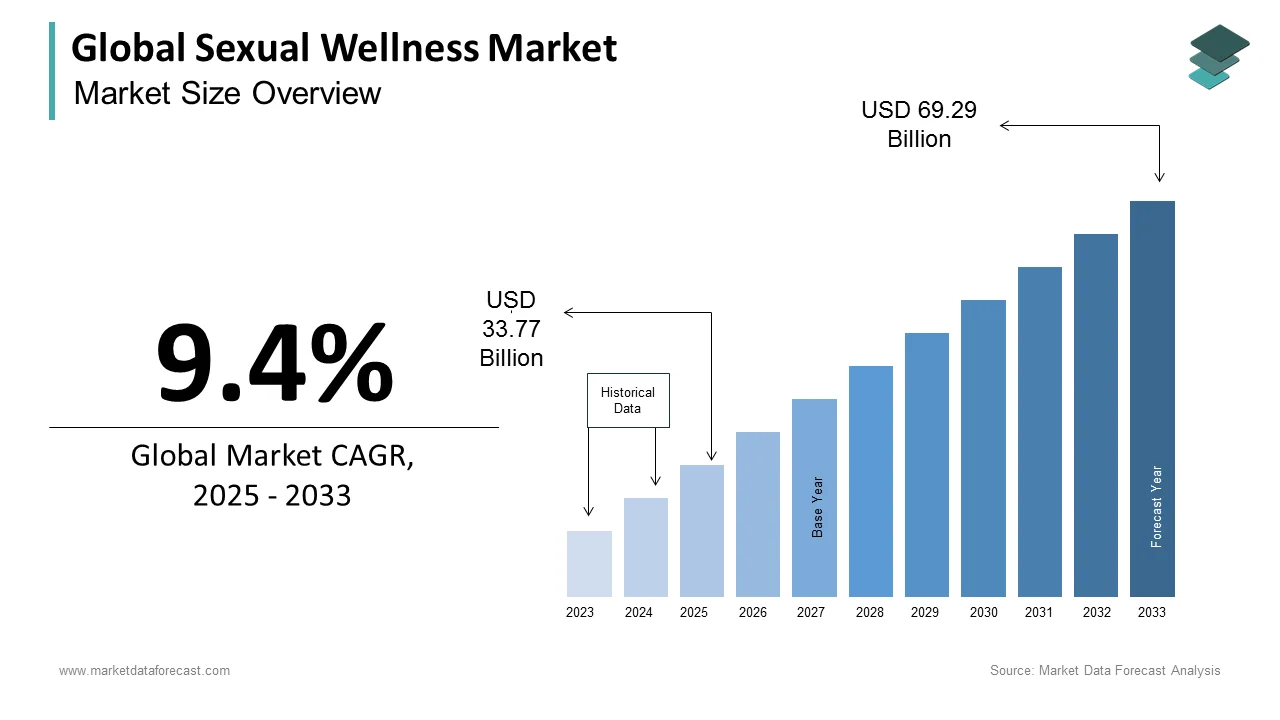

The size of the global sexual wellness market was worth USD 30.87 billion in 2024. The global market is anticipated to grow at a CAGR of 9.4% from 2025 to 2033 and be worth USD 69.29 billion by 2033 from USD 33.77 billion in 2025.

Sexual wellness means attaining physical, mental, and sexual prosperity. The primary purpose of sexual wellness products is to provide safe sex and, at the same time, help to enhance sexual pleasure. The state of physical, mental, and social well-being concerning sexuality is sexual wellness. The products associated with sexual health are to provide safe sex along with developing sexual pleasure. The NYC Health Department endorses masturbation as the safest sexual activity to decrease contact with others and prevent COVID-19 from spreading. Countries such as the U.K., China, the U.S., Japan, and Germany strongly demand sexual wellness products from online retailers.

MARKET DRIVERS

The rising awareness regarding sexual wellness among the population is primarily accelerating the global sexual wellness market growth.

Global Health Organizations and other organizations' efforts for bettering women's health in many underprivileged countries have positively contributed to the market growth of sexual wellness products, especially sex toys. The rising prevalence of sexually transmitted diseases and HIV and the need to prevent these diseases propel the market growth during the forecast period. Furthermore, the ease of online shopping due to the increasing usage of the internet through smartphones and other smart devices has increased sales of sexual wellness products. In addition, the rise in acceptance of the LGBT community and the rights and legalization of gay marriages propel the sexual wellness market. Growing awareness among people is likely to boost market growth.

The growing number of customers using various sex toys for developing sexual experiences is promoting global market growth.

The rising awareness regarding sexual health products is also accelerating the growth rate of the global sexual wellness market. With the increasing incidences of AIDS/HIV and other sexually transmitted diseases, introducing the latest sex toys worldwide and growing familiarity with sex toys in developing countries such as China, India, and Brazil are expected to boost the global sexual wellness market. In addition, rising awareness in people through digital advertisements and sexual wellness products such as contraceptives and other vibrators are gaining more popularity in the recent past.

With the increased presence of deep-rooted market players, the key players focus on new product offerings with rising developed and secured devices for various physical activities propelling market growth. In addition, the increasing concern regarding personal hygiene and the easy availability of low-cost products at stores that provide significant discounts are favorable signals for the market to grow further.

Moreover, female contraceptives have gained popularity among women as they offer many advantages, such as avoiding sexually transmitted diseases and unwanted pregnancies. For instance, in 2018, ONE, a condom manufacturing company, introduced UltraFeel condoms and combined a 2ml lubricant pouch in the same package. The key market participants are playing a promising role in this non-commercial sector of condom distribution. Increasing the significance of customers regarding their online and digital purchases is expected to enhance market growth.

MARKET RESTRAINTS

The key factor affecting the growth of the sexual wellness market is the reservations and societal hindrances associated with sexual wellness products.

The lack of awareness among people regarding the benefits of these products is the leading cause of reservations and social hindrances. Sexual products and business are seen as taboo in many cultures, and therefore personal reservations and prejudice against these products can cause losses for the market. In addition, harmful chemicals in these sexual wellness products can be dangerous to the body and are a significantly restricting factor. The accessibility of substitutes for condoms is also a negatively impacting factor. Latex condoms can result in infections leading to hesitance toward their use.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

Segments Covered |

By Product, Distribution Channel, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis; DROC, PESTLE Analysis, Porter's Five Forces Analysis, Competitive Landscape, Analyst Overview of Investment Opportunities |

|

Regions Covered |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Market Leader Profiled |

Church & Dwight Co., Inc., Reckitt Benckiser Group plc, Doc Johnson Enterprises, Karex Berhad, TENGA Co., Ltd., Hot Octopuss, Caya, California Exotic Novelties LLC, Bijoux Indiscrets, and Adam & Eve Stores |

SEGMENTAL ANALYSIS

By Product Insights

The sex toys segment dominated the global sexual wellness market in 2024 and is expected to grow fastest among all other sub-segments during the forecast period. The social stigma regarding sex toys is fading away, with more people being educated and increasing awareness due to various initiatives. As a result, it has increased the sale of sex toys. Furthermore, initiatives such as sex-positive movements help break the stereotypes of age, gender, and social construct and positively impact the sex toys sub-segment. In addition, the increase in the use of e-commerce sites is also responsible for driving market growth.

The lubricant segment is expected to grow at the fastest rate among all others. Aging often leads to many changes in the body, like vaginal dryness and erectile dysfunction, and can decrease the intimacy between partners. Chronic pains and an unhealthy lifestyle can also lead to the same problems. The use of lubricants can solve this problem. These lubricants are available at low prices and are compatible with condoms and other sexual wellness products, such as vibrators. The most common lubricants used are water lubricants.

The increased acceptance of sexual minorities like the LGBTQ community or gay community has promoted vibrators and other sexual wellness products.

Sexual enhancement supplies are expected to grow at a promising rate during the forecast period. The prevalence of an unhealthy lifestyle can lead to many diseases, stress, and depression, thus decreasing the sexual power of a person. Therefore, it has led to an increase in the usage of enhancement supplies.

By Distribution Channel Insights

The retail pharmacy had the largest market in 2024 and is expected to grow at a vibrant rate. The increase in awareness among people regarding sexual wellness products has improved the revenue share of this sub-segment. Therefore, a better distribution channel is the main factor in improving the growth rate.

The Online Pharmacy segment is expected to grow the fastest during the forecast period. The increased internet usage and the growing demand for these products will help boost this sub-segment. In addition, the availability of many substitutes and better discounts has positively impacted the growth rate.

REGIONAL ANALYSIS

Geographically, North America had the largest market share in 2024, and this region's growth trend is expected to continue throughout the forecast period. The increased awareness regarding sexually transmitted diseases has improved the region's growth rate. In addition, the improvement of online stores will further drive market growth. The U.S. sexual wellness market accounted for a significant share of this region and was valued at USD 10.51 billion in 2023. The Canadian market is also projected to register a healthy CAGR from 2025 to 2033 in this region, which makes this region show greater dominance in the global market for sexual wellness.

The European region had the second-largest share of the global sexual wellness market in 2024 and is expected to have a prominent growth rate during the forecast period. Increased awareness due to more initiatives and better education is responsible for the expected positive growth rate. During the forest period, European countries such as the UK, Germany, Spain, France, and Italy are predicted to showcase healthy growth.

The Asia Pacific region is expected to grow at the fastest rate of all the regions in the coming future. The high population in India and China has boosted the sexual wellness products market. Sex toys increasing popularity is the main constituent having a high growth rate. In addition, an increase in patient population and advancement in healthcare facilities are also fueling the market's growth in the Asia Pacific.

KEY MARKET PLAYERS

Some of the most promising companies playing a leading role in the global sexual wellness market profiled in this report are Church & Dwight Co., Inc., Reckitt Benckiser Group plc, Doc Johnson Enterprises, Karex Berhad, TENGA Co., Ltd., Hot Octopuss, Caya, California Exotic Novelties LLC, Bijoux Indiscrets, and Adam & Eve Stores., and Others.

RECENT MARKET HAPPENINGS

- In November 2022, the sexual health section of CVS is getting a makeover. Bright bottles of lubricants with playful names like Tush Cush or So-Low Lotion are now available alongside condom boxes, pregnancy tests, and vaginal hygiene items in packaging that haven't been updated since the early 1990s. Only a small portion of the lubricants produced by Cake, a two-year-old sex health firm that started as a niche, direct-to-consumer brand and is now found in one of the biggest drug shops in the nation, include Tush Cush and So-Low Lotion.

- In November 2022, through alternative treatments, Love Pharma assists customers in achieving mental and sexual wellness. To address this expanding demand and raise the standard of living, Love Pharma Inc. is releasing cutting-edge goods on the market. The Vancouver-based company aims to improve sexual and mental wellness through its science-backed nutraceuticals and therapeutics, with a focus on existing and emerging disruptive technologies.

- In November 2022, the CDSCO approved the sale of Jupiter Health, Inc.'s Photocil product, which is sold in India under the name PhotoFirst, which treats hair loss, dermatitis, burns, and sexual wellness. India's National Regulatory Authority (NRA) is the Central Drugs Standard Control Organization (CDSCO), which is a part of the Ministry of Health & Family Welfare's Directorate General of Health Services.

- In September 2022, after securing $7 million in additional Series A funding, the sexual wellness startup Dame Products is aiming audiences at a new price point. The Dip vibrator, which the New York-based company will introduce on October 12 as "an unintimidating, inclusive entry point to pleasure for people who are in the early stages of their sexual wellness journey," will be available. Priced at $49, Dip is about $50 less expensive than comparable Dame goods.

MARKET SEGMENTATION

This research report on the global sexual wellness market has been segmented and sub-segmented based on product, distribution channel, and region.

By Product

- Contraceptives

- Condoms

- Sex Toys

- Lubricants

- Sexual Enhancement Supplements

- Others

By Distribution Channel

- Hospital Pharmacy

- Retail Pharmacy

- Online Pharmacy

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East and Africa

Frequently Asked Questions

What is the growth rate of the global sexual wellness market?

The market for sexual wellness across the globe is growing at a healthy rate and is predicted to value USD 69.29 billion by 2033.

Which region led the sexual wellness market in 2024?

Geographically, the North American region had shown dominance in the global sexual wellness market in 2024.

Which are the top players in the global sexual wellness market?

Church & Dwight Co., Inc., Reckitt Benckiser Group plc, Doc Johnson Enterprises, Karex Berhad, TENGA Co., Ltd., Hot Octopuss, Caya, California Exotic Novelties LLC, Bijoux Indiscrets, and Adam & Eve Stores are some of the key market players in the sexual wellness market.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2500

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]