Global Sex Products Market Size, Share, Trends & Growth Forecast Report By Product Type (Sex Toys, Condoms, Lubricants, Sexual Wellness Products, and Others), Gender (Male, Female, and Unisex), Distribution Channel (Online Stores, Specialty Stores, Pharmacies, Supermarkets/Hypermarkets, and Others), and End-User (Individuals and Commercial), and Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), Industry Analysis From 2025 To 2033.

Sex Products Market Size

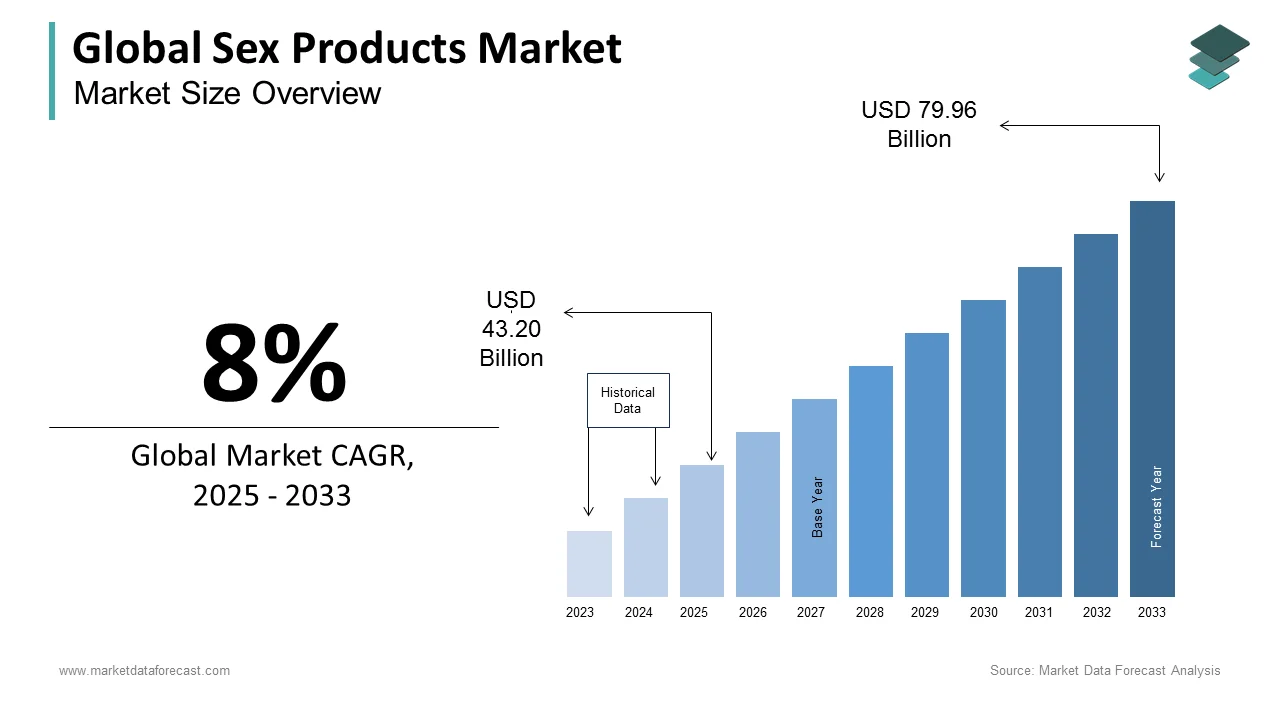

The size of the global sex products market was worth USD 40 billion in 2024. The global market is anticipated to grow at a CAGR of 8% from 2025 to 2033 and be worth USD 79.96 billion by 2033 from USD 43.20 billion in 2025.

Sex products are used to enhance sexual pleasure, health, and overall intimacy and these products include sex toys, condoms, lubricants, intimate wellness supplements, and erotic lingerie. Over the past decade, changing societal attitudes, increasing awareness of sexual health, and the growing acceptance of sexual wellness products have significantly driven market expansion. Advancements in technology, coupled with the rising influence of digital platforms, have also facilitated the accessibility and normalization of these products among diverse consumer groups.

The increasing awareness of sexual health is reflected in global sexual wellness trends. According to the World Health Organization (WHO), more than one million sexually transmitted infections (STIs) are acquired daily worldwide, emphasizing the importance of safe sex practices and the demand for high-quality contraceptive products. Additionally, studies by the Guttmacher Institute indicate that the proportion of reproductive-age married women who use a modern or traditional contraceptive method rose from 55% to 63% between 1990 and 2010, highlighting the critical role of condoms and sexual health products in both family planning and STI prevention.

Moreover, sexual dysfunction remains a significant global concern, impacting both men and women. Research from the American Urological Association suggests that nearly 52% of men experience some degree of erectile dysfunction (ED) at some point in their lives, contributing to the demand for products such as performance enhancers, lubricants, and vibrators designed to enhance pleasure and intimacy. Similarly, the North American Menopause Society reports that nearly 50% of postmenopausal women experience vaginal dryness, further driving the demand for intimate health products. Additionally, societal acceptance of sexual wellness products has grown significantly due to the increasing visibility of sexual health education and the influence of media. Surveys conducted by the Kinsey Institute suggest that over 65% of adults have used a sex toy at least once, demonstrating a shift toward open discussions and experimentation in personal intimacy. Furthermore, online searches for sexual wellness products have increased by over 80% in the last five years, according to Google Trends, showcasing the growing consumer curiosity and demand for discreet, accessible solutions.

MARKET DRIVERS

Increasing Awareness and Acceptance of Sexual Health

The growing awareness and acceptance of sexual health have significantly driven the sex products market. According to a 2021 report by the Guttmacher Institute, comprehensive sexuality education programs in schools and communities have been linked to improved sexual health outcomes and reduced stigma around sexual wellness products. The U.S. Centers for Disease Control and Prevention (CDC) highlights that over 50% of sexually active adults in the United States use some form of sexual health product, reflecting increased openness toward these solutions. Additionally, a study published by the Journal of Sexual Medicine found that 70% of millennials consider sexual wellness an integral part of their overall health. This growth underscores societal shifts toward prioritizing sexual health and well-being.

Technological Advancements in Product Innovation

Technological advancements have revolutionized the sex products market, enhancing functionality and user experience. Innovations such as app-controlled devices and AI-driven sex tech are reshaping consumer expectations. For instance, products like wearable intimacy devices and virtual reality experiences have gained traction. The U.S. Food and Drug Administration has approved certain medical-grade devices, such as pelvic floor trainers, which blend technology with sexual health benefits. Furthermore, the United Nations Population Fund emphasizes that digital tools and innovations play a critical role in addressing unmet sexual health needs, particularly among younger populations. These advancements highlight the dynamic evolution of the industry, driven by tech-savvy consumers seeking personalized solutions.

MARKET RESTRAINTS

Social Stigma and Cultural Taboos

Social stigma and cultural taboos surrounding sexual health significantly hinder the growth of the sex products market. A 2019 report by the Guttmacher Institute highlights that in regions like South Asia and Sub-Saharan Africa, societal norms often discourage open discussions about sexual health, with over 70% of women reporting discomfort in seeking sexual wellness products due to fear of judgment. The U.S. Department of Health and Human Services emphasizes that cultural and religious beliefs play a major role in suppressing conversations around sexual health, particularly in conservative communities. For example, a study published in Reproductive Health Matters found that nearly 50% of individuals in Middle Eastern countries associate sexual wellness products with shame or immorality. This stigma creates significant barriers to market penetration, as companies struggle to promote their products effectively. Such societal attitudes limit consumer acceptance, especially in regions where sexual health remains a taboo subject.

Stringent Regulatory Policies

Stringent regulatory policies present a major challenge for the sex products market, impacting innovation and accessibility. The U.S. Food and Drug Administration (FDA) imposes rigorous standards on the manufacturing and labeling of intimate wellness products, which can delay product launches and increase compliance costs. According to a 2021 report by the World Health Organization, several countries, including India and parts of Africa, enforce outright bans or heavy restrictions on adult products, citing cultural or moral grounds. Additionally, a survey conducted by the European Union’s Horizon 2020 program revealed that 40% of sex tech companies face challenges navigating diverse regulatory frameworks when expanding into international markets. These inconsistencies disrupt global supply chains and limit access to essential products. The United Nations Population Fund notes that such restrictions disproportionately affect marginalized groups, further reducing access to sexual health solutions and stifling industry growth.

MARKET OPPORTUNITIES

Growing Demand for Personalized and Inclusive Products

The demand for personalized and inclusive sex products is a key growth opportunity in the market. According to a study published in Sexual Health , 60% of consumers prefer products that cater to diverse needs, including gender-neutral options and solutions tailored to LGBTQ+ communities. The U.S. Department of Health and Human Services notes that increasing awareness of sexual health has encouraged companies to develop inclusive products, fostering greater accessibility. For example, a survey by the Kinsey Institute found that 55% of LGBTQ+ individuals are more likely to purchase brands offering inclusive designs. By focusing on underserved demographics, companies can enhance customer loyalty and expand their reach in a competitive market.

Expansion into Emerging Markets

Emerging markets present significant opportunities for the sex products industry due to rising urbanization and increased internet penetration. According to the United Nations Population Fund, over 60% of young adults in Southeast Asia and Latin America now have access to online platforms, enabling them to explore sexual wellness products discreetly. The International Trade Administration reports that e-commerce sales of sexual wellness products in these regions grew by 20% annually between 2019 and 2022. Additionally, a 2022 World Health Organization study highlights that sexual health education programs in emerging economies have led to a 35% increase in demand for intimate care products over the past five years. By leveraging localized marketing strategies and affordable pricing, companies can overcome cultural barriers and tap into these high-growth markets, ensuring long-term profitability and brand expansion.

MARKET CHALLENGES

Limited Access to Sexual Health Education

Limited access to comprehensive sexual health education remains a significant challenge for the sex products market, particularly in developing regions. According to UNESCO’s 2021 Global Education Monitoring Report, only 37% of young people in Sub-Saharan Africa and South Asia receive adequate sexual health education, leading to widespread misinformation about sexual wellness products. The U.S. Centers for Disease Control and Prevention (CDC) emphasizes that inadequate education often perpetuates stigma, discouraging individuals from exploring or adopting such products. A study published in Reproductive Health in 2020 found that 50% of adolescents in low-income countries associate sexual health products with shame or embarrassment due to societal taboos and lack of awareness. This knowledge gap stifles market growth, as companies face difficulties in building trust and normalizing product usage. Addressing this challenge requires partnerships between governments, NGOs, and private sectors to promote inclusive and accurate sexual health education, empowering consumers to make informed decisions.

Counterfeit and Unregulated Products

The proliferation of counterfeit and unregulated sex products poses a major challenge to the industry, threatening consumer safety and brand reputation. According to a 2020 report by the World Health Organization (WHO), approximately 40% of intimate care products sold in informal markets across Africa and Southeast Asia are counterfeit or substandard, lacking proper quality assurance or safety standards. The U.S. Food and Drug Administration (FDA) has issued public warnings about the dangers of using unregulated devices, which can lead to infections, injuries, or other health risks. Additionally, a 2021 report by the Organisation for Economic Co-operation and Development (OECD) estimates that counterfeit goods cost legitimate industries, including sexual wellness, over $500 billion annually in lost revenue globally. These unsafe alternatives not only endanger consumers but also erode trust in reputable brands. Strengthening regulatory frameworks and raising awareness about the risks of counterfeit products are essential steps to safeguarding consumer health and ensuring market integrity.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

Segments Covered |

By Product Type, Gender, Distribution Channel, End-user, and Region. |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis; DROC, PESTLE Analysis, Porter's Five Forces Analysis, Competitive Landscape, Analyst Overview of Investment Opportunities |

|

Regions Covered |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Market Leader Profiled |

Durex, Trojan, Lelo, We-Vibe, Fun Factory, Doc Johnson, Lifestyles, Jimmyjane, Pipedream Products, California Exotic Novelties, Tenga, Adam & Eve, Lovehoney, Satisfyer, OhMiBod, Bijoux Indiscrets, Blush Novelties, BMS Factory, Womanizer, Nexus., and Others. |

SEGMENT ANALYSIS

By Product Type Insights

The condoms segment held a 40.1% share of the global sex products market in 2024 and stood as the top performer in the global market. The domination of condoms segment in the global market is majorly attributed to their role as an essential tool for safe sex and family planning. The United Nations Population Fund (UNFPA) reports that approximately 20 billion condoms are distributed globally each year, supported by government health programs and NGOs promoting sexual health. Condoms remain critical in preventing sexually transmitted infections (STIs) and unintended pregnancies, making them indispensable. Their affordability, accessibility, and ease of use further solidify their dominance. As a cornerstone of sexual wellness, condoms play a vital role in public health initiatives, ensuring sustained demand and market stability.

On the other hand, the sexual wellness products segment is developing at a rapid pace, with an estimated CAGR of 8.5% over the forecast period due to the rising awareness about sexual health and the destigmatization of intimate care solutions. A 2020 study published in the Journal of Sexual Medicine found that over 55% of adults now prioritize sexual wellness as part of overall health. Innovations such as pelvic floor trainers, arousal gels, and hormone-balancing supplements are gaining traction, particularly among women and aging populations. Governments and organizations like the World Health Organization (WHO) are promoting sexual wellness education, reducing cultural taboos. This segment’s rapid expansion underscores its importance in addressing unmet needs and fostering holistic well-being, positioning it as a key driver of future market growth.

By Gender Insights

The female segment led the market by capturing a 45.9% share of the global sex products market in 2024. The rising awareness of sexual wellness among women and the growing availability of female-centric products such as lubricants, arousal gels, and pelvic health devices are propelling the growth of the female segment in the global market. A 2020 survey by the U.S. Department of Health and Human Services found that over 55% of women aged 18-44 prioritize sexual health as part of their overall well-being. Products addressing issues like hormonal balance and intimate care are gaining traction. The segment's importance lies in empowering women to take charge of their sexual health, supported by campaigns from organizations like the World Health Organization (WHO). This focus ensures sustained demand and innovation in female-oriented solutions.

However, the unisex segment is rapidly expanding and is predicted to grow at a CAGR of 8.7% over the forecast period owing to the rising demand for inclusive and gender-neutral products, such as app-controlled devices and intimacy enhancers, catering to diverse demographics. A 2021 report by the Guttmacher Institute highlights that over 50% of LGBTQ+ individuals express interest in inclusive products, reflecting broader societal trends toward diversity. Governments and NGOs, including the United Nations Population Fund, are promoting inclusivity in sexual health education, reducing stigma around shared solutions. Innovations in technology, such as AI-driven intimacy aids, are further driving adoption. This segment’s rapid expansion underscores its importance in addressing underserved populations and fostering equality in sexual wellness, making it a key driver of future market growth.

By Distribution Channel Insights

The online stores dominated the sex products market by capturing 38.6% of the global market share in 2024 due to the discreetness, convenience, and wide product availability offered by e-commerce platforms. The International Trade Administration highlights that online sales of sexual wellness products grew by 20% annually between 2020 and 2022, fueled by increased internet penetration and digital literacy. The COVID-19 pandemic further accelerated this trend, with a 2021 report by the U.S. Department of Commerce noting that over 50% of consumers shifted to online purchases for intimate care products. Online stores are critical in reaching underserved regions and reducing stigma, making them indispensable for market growth.

However, the specialty stores segment is another major segment and is expected to expand at a CAGR of 8.7% during the forecast period. The growing preference from consumers for personalized shopping experiences and expert guidance on sexual wellness products are fuelling the growth of the specialty stores segment in the global market. A 2021 survey by the Kinsey Institute found that 50% of consumers trust specialty stores for high-quality, curated products tailored to their needs. These stores often host workshops and educational sessions, reducing stigma and promoting awareness. Additionally, urbanization and increasing disposable incomes are driving demand for premium and niche products. Specialty stores play a vital role in fostering inclusivity and addressing unmet needs, positioning them as a key driver of innovation and customer engagement in the market.

By End-User Insights

The individuals segment had the leading share of 65.3% of the global sex products market in 2024, owing to the increasing awareness of sexual wellness and the growing acceptance of personal pleasure products. A 2020 survey by the U.S. Department of Health and Human Services found that over 60% of adults aged 18-44 prioritize sexual health as part of their overall well-being, driving demand for individual-use products. Discreet online purchasing options and innovative designs tailored to personal needs further boost adoption. The segment's importance lies in its role in empowering individuals to take charge of their sexual health, supported by campaigns from organizations like the World Health Organization (WHO), ensuring sustained growth.

However, the commercial segment is predicted to grow at the highest CAGR of 9.3% during the forecast period due to the rising demand for adult entertainment products, spa services, and luxury hotels offering intimate wellness experiences. A 2021 report by the International Trade Administration highlights that businesses are investing in premium sexual wellness products to enhance customer experiences. Urbanization and increasing disposable incomes are driving this trend, particularly in emerging markets like Asia-Pacific and Latin America. The United Nations Population Fund emphasizes the role of commercial establishments in reducing stigma around sexual health discussions. This segment’s rapid expansion underscores its importance in fostering innovation and creating new revenue streams, positioning it as a key driver of future market growth.

REGIONAL ANALYSIS

North America dominated the market and commanded 35.4% of the global sex products market share in 2024. The region's leadership is driven by high consumer awareness, advanced e-commerce infrastructure, and progressive attitudes toward sexual wellness. The U.S. Centers for Disease Control and Prevention (CDC) notes that over 60% of adults in the U.S. have access to sexual health resources, fostering openness to such products. This region's importance lies in its innovation-driven market, with tech-integrated solutions like app-controlled devices gaining popularity. North America’s dominance is further supported by stringent regulatory frameworks, such as those enforced by the U.S. Food and Drug Administration (FDA), ensuring product safety and building consumer trust.

The Asia-Pacific region is the fastest-growing region with a projected CAGR of 8.7%. This growth is fueled by rapid urbanization, rising disposable incomes, and increasing awareness about sexual health. A 2021 study by the United Nations Population Fund highlights that over 55% of young adults in urban areas are more open to adopting sexual wellness solutions. Additionally, the expansion of e-commerce platforms has significantly boosted accessibility, with online sales of sexual wellness products growing by 20% annually in countries like India and China, according to the International Trade Administration. Governments in the region are also launching sexual health initiatives, reducing stigma. This rapid growth underscores the region's potential to become a pivotal player in the global market.

Europe is a mature market for sex products. The region benefits from progressive societal attitudes, robust healthcare systems, and widespread access to sexual health education. A 2021 survey by the European Society of Contraception and Reproductive Health found that over 65% of adults in Western Europe are comfortable discussing sexual wellness, driving demand for innovative products. Countries like Germany and the UK lead in adopting tech-driven solutions such as app-controlled intimacy devices. However, stricter regulations in Eastern Europe, particularly regarding adult products, pose challenges. The region's growing emphasis on sustainability, highlighted by the European Environment Agency, is shaping consumer preferences toward eco-friendly products, reinforcing its role as a trendsetter in the global market.

Latin America is poised for moderate growth in the sex products market, driven by increasing urbanization and internet penetration. According to the International Trade Administration, online sales of sexual wellness products grew by 12% annually between 2020 and 2022, with Brazil leading regional adoption. A 2020 study by the Pan American Health Organization (PAHO) notes that over 45% of urban youth in the region are becoming more open to exploring sexual wellness solutions. However, cultural taboos and limited access to comprehensive sexual education in rural areas remain barriers. As e-commerce expands and awareness increases, the region is expected to see steady growth, particularly among younger demographics who prioritize modern, discreet solutions.

The Middle East and Africa face significant challenges due to cultural taboos and regulatory restrictions, but gradual progress is being made. A 2020 World Health Organization report highlights a 35% increase in demand for sexual wellness products over the past five years, primarily in urban areas of South Africa, Nigeria, and the UAE. Governments and NGOs are launching initiatives to reduce stigma and promote sexual health awareness, particularly among women. For instance, the African Union’s Sexual and Reproductive Health Framework emphasizes improving access to sexual health resources. Despite conservative norms and limited availability of quality products, rising disposable incomes and expanding digital platforms are expected to drive slow but steady adoption, particularly in North Africa and GCC countries, where urbanization is accelerating.

KEY MARKET PLAYERS

Some of the notable companies dominating the global sex products market profiled in this report are Durex, Trojan, Lelo, We-Vibe, Fun Factory, Doc Johnson, Lifestyles, Jimmyjane, Pipedream Products, California Exotic Novelties, Tenga, Adam & Eve, Lovehoney, Satisfyer, OhMiBod, Bijoux Indiscrets, Blush Novelties, BMS Factory, Womanizer, Nexus., and Others.

TOP 3 PLAYERS IN THE MARKET

Reckitt Benckiser Group plc

Reckitt Benckiser, headquartered in Slough, England, is a global leader in consumer health and hygiene products. The company owns Durex, one of the most recognized brands in the sexual wellness sector. Durex offers a wide range of products, including condoms, lubricants, and sex toys. Reckitt Benckiser's focus on innovation and quality has solidified its position as a market leader.

Karex Berhad

Karex, based in Malaysia, is one of the world's largest condom manufacturers, producing over five billion condoms annually. The company supplies condoms to various brands, including Durex, and also markets its own brands such as Carex and ONE Condoms. Karex's extensive production capacity and global distribution network have made it a significant contributor to the sexual wellness market.

LELO

LELO is a Swedish company renowned for its luxury sex toys and intimate lifestyle products. The brand is known for its high-quality materials, innovative designs, and premium pricing. LELO's products cater to a discerning clientele seeking upscale sexual wellness products, contributing to the diversification and growth of the market

TOP STRATEGIES USED BY THE KEY MARKET PARTICIPANTS

Product Innovation and Diversification

Innovation is a critical strategy for leading brands in the sex products market. Companies like Durex focus on developing cutting-edge condom technologies, such as ultra-thin, ribbed, and warming variants, to enhance user experience. Similarly, Karex Berhad, the world’s largest condom manufacturer, continuously expands its portfolio beyond condoms, introducing lubricants and personal wellness products to cater to evolving consumer preferences. LELO, known for its premium sex toys, leads in smart product innovation, integrating app-controlled vibrators, high-quality materials, and ergonomic designs that appeal to the luxury segment. These innovations not only differentiate brands but also attract a loyal customer base seeking enhanced intimacy experiences.

Strong Branding and Premium Positioning

Brand perception plays a crucial role in consumer trust and loyalty. Durex, as a mainstream brand, builds credibility through global awareness campaigns that emphasize safety, pleasure, and sexual wellness. Meanwhile, LELO positions itself as a high-end luxury brand, leveraging sleek product designs, high-quality silicone materials, and premium pricing to appeal to affluent customers. This premium branding approach allows LELO to stand out in a crowded market, where consumers are willing to invest in superior intimate experiences. On the other hand, Karex Berhad strengthens its branding by supplying well-known companies and ensuring its presence in public health initiatives worldwide.

Expanding Distribution Networks

Global reach is essential for sustaining market leadership. Durex ensures widespread accessibility by distributing its products through retail stores, pharmacies, and online marketplaces such as Amazon and direct-to-consumer websites. Karex Berhad supplies its products to major global brands and governmental organizations, ensuring that its condoms are available in both developed and developing markets. Meanwhile, LELO capitalizes on high-end boutiques, online luxury marketplaces, and its direct-to-consumer e-commerce channels, making its products easily accessible to customers worldwide. By optimizing their distribution strategies, these companies ensure maximum reach and consistent sales growth.

Strategic Partnerships and Acquisitions

Collaboration with key industry players, NGOs, and influencers has helped these brands solidify their presence. Durex frequently partners with health organizations to promote safe sex and sexual education through awareness campaigns. Karex Berhad works closely with NGOs and governments to supply condoms for public health programs, strengthening its reputation as a socially responsible manufacturer. LELO, on the other hand, focuses on acquiring niche sexual wellness brands to expand its market presence and product offerings. These partnerships and acquisitions help companies tap into new markets, boost credibility, and drive long-term growth.

COMPETITIVE LANDSCAPE

The global sex products market is highly competitive, driven by increasing consumer awareness, changing social attitudes, and advancements in product innovation. The market is dominated by key players such as Reckitt Benckiser (Durex), Karex Berhad, and LELO, each leveraging different strategies to maintain their leadership. These companies compete on factors such as product quality, branding, distribution, and technological advancements to differentiate themselves.

The competitive landscape is shaped by the presence of both established brands and emerging startups introducing niche, tech-driven, and eco-friendly products. While mainstream brands like Durex focus on mass-market appeal through condom and lubricant innovations, LELO captures the premium segment with luxury sex toys and intimate wellness products. Meanwhile, Karex Berhad, the world’s largest condom manufacturer, maintains its dominance through extensive global supply partnerships.

E-commerce and digital marketing have intensified competition, allowing smaller brands to directly reach consumers through online platforms and subscription-based models. Additionally, sustainability and ethical production are becoming key differentiators, with brands investing in eco-friendly materials and body-safe innovations.

With rising demand, increased regulatory acceptance, and evolving consumer preferences, the sex products market remains dynamic and fiercely competitive, pushing companies to continuously innovate and expand their market reach.

RECENT MARKET DEVELOPMENTS

- In July 2024, Indian pharmaceutical giant Mankind Pharma announced its acquisition of Bharat Serums and Vaccines Ltd for approximately $1.63 billion. This strategic move grants Mankind access to Bharat Serums' portfolio, which includes products targeting women's health and fertility treatments.

- In July 2024, Flo Health, a leading fertility tracking app, secured $200 million in funding from private equity firm General Atlantic, achieving a valuation exceeding $1 billion. This investment underscores the growing interest in women's health technology within the private equity sector.

MARKET SEGMENTATION

This research report on the global sex products market has been segmented and sub-segmented based on the product type, gender, distribution channel, end-user, and region.

By Product Type

- Sex Toys

- Condoms

- Lubricants

- Sexual Wellness Products

- Others

By Gender

- Male

- Female

- Unisex

By Distribution Channel

- Online Stores

- Specialty Stores

- Pharmacies

- Supermarkets/Hypermarkets

- Others

By End-User

- Individuals

- Commercial

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East and Africa

Frequently Asked Questions

1. What is the expected growth of the global sex products market?

The sex products market is projected to grow from USD 43.2 billion in 2025 to USD 79.96 billion by 2033, at a CAGR of 8%.

2. What factors are driving the demand for sex products?

Increased awareness of sexual health, growing societal acceptance, and advancements in product technology are key drivers.

3. What are the sex products market challenges?

Cultural taboos, social stigma, and stringent regulations in some regions are major obstacles.

4. What opportunities exist in the sex products market?

Personalized and inclusive products, along with expansion into emerging markets, offer growth potential.

5. How are technological innovations influencing the industry?

App-controlled devices, AI-driven products, and wearable intimacy devices are revolutionizing user experience.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2500

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]