Global Sewing Machines Market Size, Share, Trends & Growth Forecast Report By Type (Electric, Computerized, Manual), Use Case, Application and Region (North America, Europe, Asia Pacific, Latin America and Middle East & Africa), Industry Analysis From 2025 to 2033

Global Sewing Machines Market Size

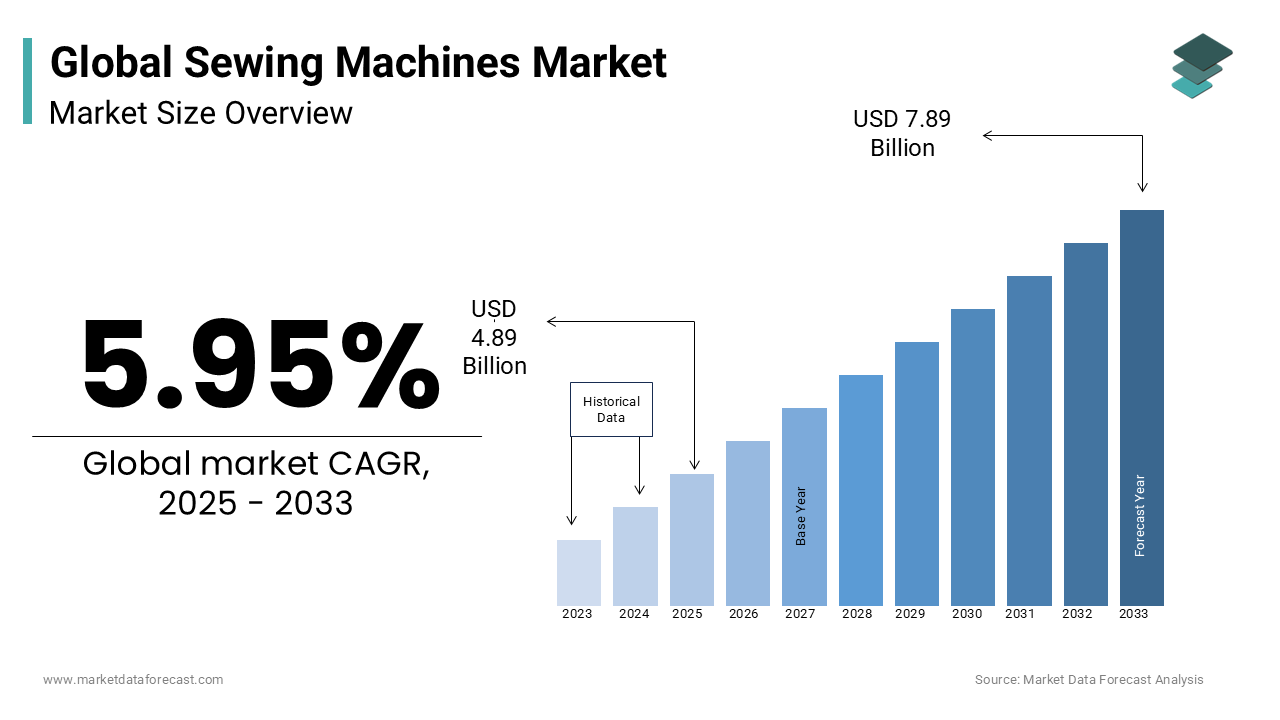

The global sewing machines market was worth USD 4.62 billion in 2024. The sewing machines market is estimated to grow at a CAGR of 5.95% from 2025 to 2033 and be valued at USD 7.89 billion by the end of 2033 from USD 4.89 billion in 2025.

Sewing machines are used by a wide range of people, from individuals who sew at home to big factories that produce clothing and other fabric-based products. There are different types of sewing machines, including basic mechanical ones, electronic versions, and advanced computerized models. Factories use special industrial machines to make large quantities of clothing, car seat covers, and furniture upholstery.

More people are now interested in making their own clothes and accessories. Websites like Etsy had around 96.48 million active buyers in 2023 showing how popular handmade fashion has become. Because of this trend, many people are investing in personal sewing machines.

Technology has made sewing machines more advanced and easier to use. Modern machines have features like touchscreens, automatic stitching patterns, and even artificial intelligence to help users sew with more accuracy. More consumers now prefer fixing their clothes instead of throwing them away, making sewing machines even more useful.

Asia-Pacific is the biggest region for making and selling textiles, with countries like China, India, and Bangladesh leading the market. The World Trade Organization states that China alone exported USD 303 billion worth of textiles in 2022.

MARKET DRIVERS

Rising Demand for Customized Apparel

More people are now choosing clothes that are made just for them, and this is boosting the sewing machines market. Online stores offering personalized fashion are driving this trend. These stores need advanced sewing machines to make unique designs quickly and efficiently. The World Trade Organization also found that the global textile and garment industry was worth $1.5 trillion in 2022. This shows how big the opportunity is for sewing machine makers. Industrial sewing machines with programmable features are becoming very popular to meet this demand.

Expansion of Small-Scale Garment Businesses

The growth of small garment businesses is another big reason why the sewing machines market is growing. The International Labour Organization says that small and medium businesses make up over 90% of all businesses worldwide and provide many jobs in developing countries. These small businesses need affordable sewing machines to make clothes for local and international markets. For example, India’s textile industry employs over 45 million people, and there is a rising demand for home-use sewing machines, according to the Confederation of Indian Textile Industry. Also, more people are doing DIY fashion projects at home, which has increased sales of sewing machines. This demand from both small businesses and hobbyists is helping the sewing machines market grow steadily.

MARKET RESTRAINTS

Environmental Concerns Related to Production

Another challenge is the environmental impact of making sewing machines. A report by the Ellen MacArthur Foundation says the fashion industry is responsible for 10% of global carbon emissions. Sewing machines are made using metals, plastics, and electronics, which harm the environment. Governments are now forcing companies to follow stricter environmental rules. For example, the European Union requires energy-efficient machines, which increases costs for manufacturers. The United Nations Environment Programme also says that less than 20% of electronic waste is recycled, making the problem worse. These issues slow down the growth of the sewing machines market and force companies to spend more money on sustainable solutions.

High Initial Investment Costs

One big problem for the sewing machines market is the high cost of advanced industrial machines. This high price stops small businesses and startups from buying modern equipment, which limits their ability to produce more clothes. The World Bank also points out that small businesses in poorer regions struggle to get loans because interest rates can be over 20%. These financial challenges make it hard for many businesses to buy new sewing machines. As a result, the market grows more slowly in these areas, even though there is a lot of demand for textiles and garments around the world.

MARKET OPPORTUNITIES

Growing E-Commerce Integration

One exciting opportunity for the sewing machines market is its connection with online shopping. This growth has created a need for small, easy-to-use sewing machines for people who sell handmade items online. Platforms like Etsy and Amazon let artisans sell their products, which has increased the demand for affordable sewing machines. McKinsey & Company found that 75% of shoppers are willing to pay more for eco-friendly products, so companies are making green sewing machines.

Technological Advancements in Smart Sewing Machines

Smart sewing machines are another big opportunity for the market. These machines can do things like stitch automatically, work through mobile apps, and detect errors in real time. Deloitte found that 53% of people are interested in smart home devices, which means there is a lot of potential for smart sewing machines. Advances in artificial intelligence and machine learning also allow these machines to adjust settings based on the fabric being used.

MARKET CHALLENGES

Intense Competition Among Key Players

The sewing machines market faces a big challenge because of the tough competition among companies. This competition leads to price wars and lower profits, especially in the mid-range and budget segments. The Boston Consulting Group notes that older brands are struggling to compete with newer companies that offer cheaper but reliable machines. For example, Chinese manufacturers have gained nearly 30% of the global market by selling affordable machines. This competitive environment forces companies to spend a lot on research and development while dealing with shrinking profits, making it hard for smaller businesses to survive.

Supply Chain Disruptions

Supply chain problems are another big challenge for the sewing machines market. The World Economic Forum says that over 75% of companies faced delays or shortages of materials during the COVID-19 pandemic. Modern sewing machines need semiconductor chips, but getting these chips has been difficult, with waiting times reaching up to six months. Geopolitical tensions, like those between the U.S. and China, have made the situation worse, according to the International Monetary Fund. These disruptions increase production costs and delay new product launches, hurting companies’ earnings. To fix these issues, manufacturers are trying to find new suppliers and make products locally, but these solutions often cost more money.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

Segments Covered |

By Type, Use Case, Application and Region. |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis; DROC, PESTLE Analysis, Porter's Five Forces Analysis, Competitive Landscape, Analyst Overview of Investment Opportunities |

|

Regions Covered |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Market Leader Profiled |

Aisin Corporation, AMF Reece - Cars s.r.o., Bernina, Brother, Dürkopp Adler, Elna International Corporation, Jack Sewing Machines, Janome Corporation, Seiko Sewing Machine Co., Ltd., and Pegasus Co., Ltd. |

SEGMENTAL ANALYSIS

By Type Insights

The Electric sewing machines segment held the largest market share by accounting for 55.8% of the global market in 2024. This dominance is due to their affordability, ease of use, and versatility, making them ideal for both beginners and small-scale businesses. The World Trade Organization (WTO) shows that the global textile industry, which heavily relies on electric machines, was valued at $1.5 trillion in 2022. These machines are widely used in developing countries where cost-effective solutions are preferred. Their ability to handle various fabrics efficiently adds to their popularity. As a result, electric sewing machines remain crucial for meeting the growing demand for affordable garment production worldwide.

The Computerized sewing machines segment is the fastest-growing segment, with a CAGR of 8.5% from 2025 to 2033. This rapid growth is driven by advancements in technology such as IoT-enabled features and automated stitching patterns which appeal to modern consumers. A report by Deloitte states that 53% of people are interested in smart home devices, including computerized sewing machines. These machines offer precision and efficiency, making them ideal for custom clothing and industrial applications. Additionally, Statista reports that the global e-commerce fashion market is projected to grow by 12% annually, fueling demand for advanced machines.

By Use Case Insights

The apparel segment dominated the sewing machines market by accounting for 65.3% of the total share in 2024. This growth is attributed to the massive size of the global fashion industry, which the World Trade Organization (WTO) values at $1.5 trillion. Apparel production requires versatile sewing machines capable of handling different fabrics and designs, making this segment critical for market growth. The International Labour Organization (ILO) notes that the garment sector employs millions globally, further boosting demand for sewing machines. Affordable and efficient machines are essential for meeting the rising consumer demand for clothing.

The bags segment is the rapidly expanding use case, with a CAGR of 9.2% from 2025 to 2035. This growth is fueled by the increasing popularity of handmade and customized bags, especially among hobbyists and small businesses. The Ellen MacArthur Foundation reports that sustainable fashion trends have led to a surge in demand for eco-friendly bag-making solutions, which sewing machines can support. Platforms like Etsy and Amazon have created opportunities for artisans to sell unique bags online, driving machine sales. Additionally, the United Nations Industrial Development Organization (UNIDO) states that the global accessories market is expanding rapidly, with a focus on locally made products.

By Application Insights

The Industrial sewing machines segment accounted for the largest market share by capturing 45.8% in 2024. This dominance is due to their widespread use in large-scale garment manufacturing, where efficiency and precision are critical. The World Trade Organization (WTO) states that the global textile industry reached $1.5 trillion in 2022, highlighting the importance of industrial machines in meeting production demands. These machines are designed for heavy-duty tasks, such as stitching thick fabrics used in uniforms, upholstery, and automotive interiors. Developing countries, where labor-intensive industries thrive, rely heavily on industrial sewing machines. Their ability to enhance productivity makes them indispensable for manufacturers aiming to scale operations and meet global supply chain requirements.

The Residential sewing machines segment is the fastest-growing application segment, with a CAGR of 7.8% from 2025 to 2033. This growth is driven by the rising popularity of DIY projects and home-based entrepreneurship. The National Retail Federation (NRF) reports that consumer spending on hobbies, including sewing, increased by 8% in 2022, fueling demand for compact and user-friendly machines. Platforms like Etsy have enabled individuals to sell handmade products, encouraging more people to invest in residential sewing machines. Additionally, the U.S. Department of Commerce states that online retail sales grew by 14.3% in 2022, creating opportunities for home-based artisans.

REGIONAL ANALYSIS

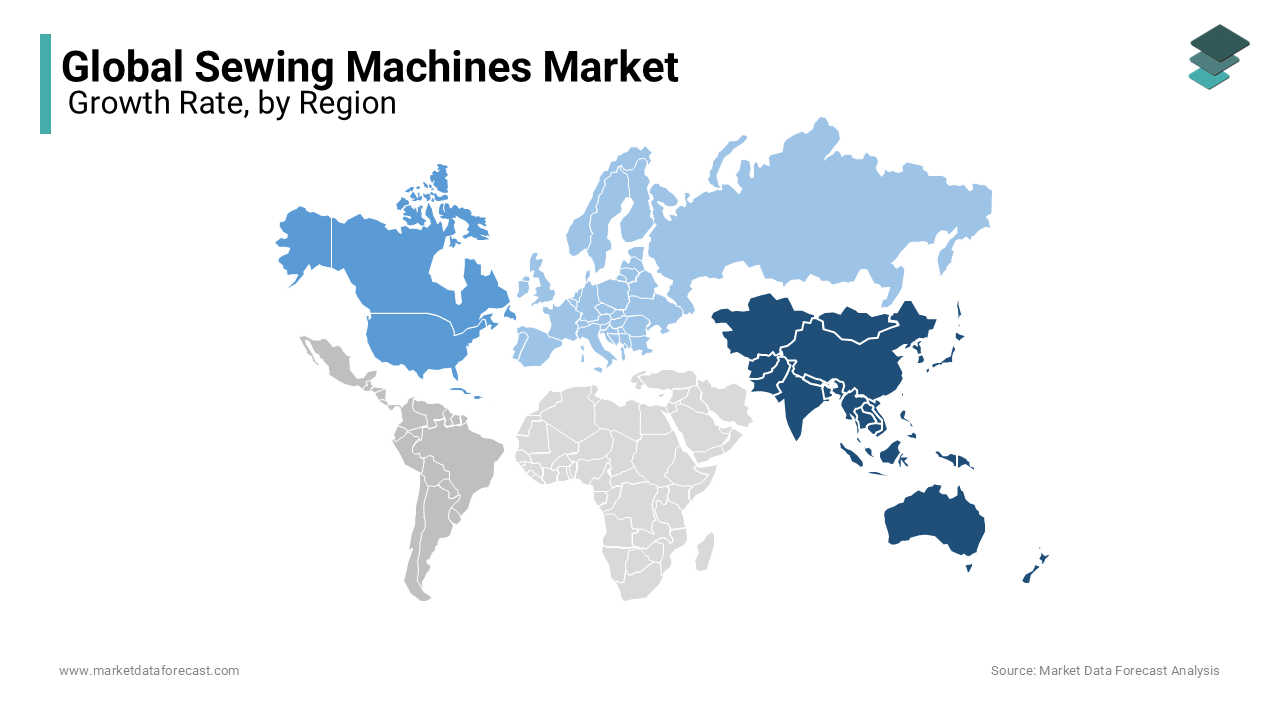

Asia Pacific was the biggest player in the sewing machines market by holding over 40% of the global share in 2024. It is also the fastest-growing region, with a CAGR of 7.5%. China and India are the main contributors, with China being the largest maker and seller of sewing machines worldwide. The region’s strong textile industry, which makes up nearly half of the world’s textile production, according to the World Trade Organization (WTO), is a major reason for its success. Rising labor costs have pushed businesses to use automated sewing machines, boosting their adoption. India’s garment sector, which employs over 45 million people, also adds to the region’s growth, as noted by the Confederation of Indian Textile Industry (CITI). Affordable machines and the rise of small businesses make Asia Pacific very important for market expansion.

North America plays a key role in the sewing machines market, driven by trends like customization and DIY fashion projects. According to Statista, e-commerce platforms like Etsy have increased demand for compact sewing machines. Online retail sales in the U.S. grew by 14.3% in 2022, as per the U.S. Department of Commerce. The region focuses on sustainability, leading to investments in eco-friendly models, supported by the Ellen MacArthur Foundation. Advanced technologies, such as IoT-enabled machines, keep North America ahead in innovation. The National Retail Federation (NRF) reports that spending on hobbies like sewing rose by 8% in 2022, driving home-use machine sales. These factors ensure North America remains an important part of the global market.

Europe has a strong position in the sewing machines market due to advanced manufacturing and strict environmental rules. The European Union’s Eco-Design Directive requires energy-efficient machines, encouraging the use of smart sewing machines. Germany and Italy lead the region, known for their precision engineering, as noted by the German Engineering Federation (VDMA). The rise of sustainable fashion, highlighted by the Global Fashion Agenda, has increased the need for eco-friendly solutions. Europe’s focus on innovation ensures steady growth, supported by government incentives for green manufacturing practices.

Latin America is becoming an important market for sewing machines thanks to the growth of its textile and garment industries. Brazil leads the region, contributing over 50% of its textile output, as per the International Labour Organization (ILO). Small and medium businesses dominate the market, relying on affordable yet efficient sewing machines. Rising urbanization and higher incomes have increased interest in DIY fashion projects, boosting home-use machine sales. According to Statista, the region’s textile exports grew by 6% in 2022, increasing demand for industrial machines. Latin America is becoming a key hub for market players, driven by economic recovery post-pandemic, as noted by the Inter-American Development Bank (IDB).

The Middle East & Africa region is gaining importance in the sewing machines market due to efforts to diversify economies and grow the textile sector. According to the African Development Bank (AfDB), the African textile industry is expected to grow at a rate (CAGR) of 9.2% through 2025. Countries like Morocco and South Africa lead production, supported by government initiatives to boost local manufacturing, as noted by the United Nations Industrial Development Organization (UNIDO). Rising demand for affordable clothing has increased the need for cost-effective sewing machines. Additionally, the popularity of handmade crafts and online platforms like Jumia has increased demand for compact machines. This region’s untapped potential makes it a promising area for future growth, supported by rising investments in industrial infrastructure.

Top 3 Players in the market

Brother Industries, Ltd.

Brother Industries is one of the leading players in the global sewing machines market, holding a significant market share of approximately 25%. The company’s dominance stems from its wide range of products catering to both home users and industrial clients. Brother is renowned for its innovative computerized sewing machines, which incorporate IoT-enabled features like remote operation and automated stitching patterns. Brother has capitalized on this trend by offering advanced models that align with the growing consumer preference for customization and automation. Additionally, Brother contributes significantly to the global market by focusing on sustainability, aligning with global eco-friendly manufacturing standards. Its strong distribution network across Asia Pacific, North America, and Europe ensures consistent growth, making it a key driver of innovation and expansion in the sewing machines market.

Juki Corporation

Juki Corporation is another major player, particularly excelling in the industrial sewing machines segment. The company holds around 18% of the global market share. Juki’s leadership is driven by its cutting-edge technology and heavy-duty machines designed for large-scale garment production, addressing the needs of the global textile industry. Juki plays a vital role in meeting this demand by providing reliable machines for industrial applications, ensuring efficiency and precision in garment manufacturing. The company has also expanded its presence in emerging markets like India and Brazil, where small-scale garment businesses are thriving. By introducing energy-efficient and cost-effective models, Juki contributes to the global market by promoting sustainable manufacturing practices and supporting the growth of developing economies, further solidifying its position as a leader in the market.

Janome Sewing Machine Co., Ltd.

Janome is a prominent name in the sewing machines market, particularly known for its high-quality residential and computerized sewing machines. The company holds approximately 15% of the global market share. Janome’s success lies in its ability to cater to hobbyists and DIY enthusiasts, who are driving the demand for compact and user-friendly machines. A report by the National Retail Federation (NRF) states that consumer spending on hobbies increased by 8% in 2022, benefiting Janome’s sales. The company has embraced technological advancements, offering machines with programmable features and real-time error detection, contributing to the global market’s shift toward smart and innovative solutions. Janome’s strong brand reputation and focus on accessibility have made it a trusted choice for both home users and small businesses, enabling it to play a pivotal role in expanding the residential sewing machines segment and fostering creativity among consumers worldwide.

Top strategies used by the key market participants

Product Innovation and Technological Advancements

Leading companies like Brother Industries and Janome have heavily invested in research and development (R&D) to introduce advanced sewing machines with cutting-edge features. For example, Brother has launched IoT-enabled sewing machines that allow remote operation and automated stitching patterns, aligning with the growing demand for smart home devices, as highlighted by Deloitte. Similarly, Janome has introduced user-friendly models with programmable settings and real-time error detection, catering to hobbyists and DIY enthusiasts. These innovations not only enhance customer experience but also help these companies capture higher-value segments of the market, such as customization and industrial applications.

Geographic Expansion and Market Penetration

Key players are expanding their presence in emerging markets to tap into untapped potential. Juki Corporation, for instance, has focused on strengthening its footprint in countries like India and Brazil, where small-scale garment businesses are thriving. According to the International Labour Organization (ILO) , micro, small, and medium enterprises (MSMEs) account for over 90% of global businesses, making these regions lucrative for growth. By establishing local manufacturing units and distribution networks, Juki has been able to cater to regional demands effectively. Similarly, Brother has expanded its operations in Asia Pacific and Latin America, leveraging the rising demand for affordable yet efficient sewing machines.

Strategic Partnerships and Collaborations

Collaborations with e-commerce platforms and other stakeholders have become a key strategy for market players. For example, Janome has partnered with online marketplaces like Etsy and Amazon to promote its compact sewing machines among DIY enthusiasts and home-based entrepreneurs. Additionally, Brother has collaborated with technology firms to integrate artificial intelligence (AI) and machine learning into its products, ensuring it stays ahead in the smart sewing machines segment.

KEY MARKET PLAYERS AND COMPETITIVE LANDSCAPE

Aisin Corporation, AMF Reece - Cars s.r.o., Bernina, Brother, Dürkopp Adler, Elna International Corporation, Jack Sewing Machines, Janome Corporation, Seiko Sewing Machine Co., Ltd., and Pegasus Co., Ltd. are some of the key market players.

The sewing machines market is very competitive with many big and small companies trying to grow their share. Big brands like Brother Industries Juki Corporation and Janome lead the market because they make high-quality machines for different uses. These companies work hard to stay ahead by making new products and using modern technology. For example, Brother makes smart sewing machines that can connect to the internet. This helps them attract customers who want advanced features.

Juki focuses on industrial sewing machines which are used in factories to make clothes quickly. They are popular in places like India and Brazil where garment businesses are growing fast. Janome makes machines for home users and hobbyists. Their machines are easy to use and affordable which makes them a favorite for people who sew for fun or small projects.

Smaller companies also compete by offering cheaper machines. They target customers who do not want to spend too much money. To stand out all companies try to improve their products and offer better services. Some partner with online stores like Etsy and Amazon to reach more customers. Others focus on being eco-friendly to attract people who care about the environment.

The competition is tough because there are so many choices for buyers. Companies must keep innovating and marketing their products well to stay ahead. This competition benefits customers as they get better machines at good prices.

RECENT MARKET DEVELOOPMENTS

- In February 2024, Bernina International introduced the Bernina 990, a state-of-the-art sewing and embroidery machine. This model features advanced technologies such as a scanner, camera, touchscreen, and laser, enabling precise placement of embroidery designs. The machine offers a spacious 356mm area to the right of the needle and achieves sewing speeds of up to 1,200 stitches per minute. Additionally, it supports an embroidery hoop size of 410 × 305mm, catering to both sewing enthusiasts and professionals.

MARKET SEGMENTATION

This research report on the sewing machines market is segmented and sub-segmented based on categories.

By Type

- Electric

- Computerized

- Manual

By Use Case

- Apparel

- Shoes

- Bags

- Others

By Application

- Industrial

- Commercial

- Residential

By Country

- UK

- France

- Spain

- Germany

- Italy

- Russia

- Sweden

- Denmark

- Switzerland

- Netherlands

- Turkey

- Czech Republic

- Rest of Europe

Frequently Asked Questions

What are the challenges in the sewing machines market?

Challenges include high manufacturing costs, fluctuating raw material prices, and competition from low-cost manufacturers.

What is the future outlook for the sewing machines market?

The future outlook includes growth driven by increasing demand for customized fashion, advancements in sewing technology, and rising adoption of automation in garment manufacturing.

What are the trends in the sewing machines market?

Key trends include the use of automation and robotics, 3D printing for textiles, and the increasing popularity of smart and computerized sewing machines.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2500

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]