Global Sesame Seeds Market Size, Share, Trends, & Growth Forecast Report - Segmented By Product Type (Hulled Sesame Seeds, Roasted Sesame Seeds, White Sesame Seeds, Black Sesame Seeds, Brown Sesame Seeds and others), Category (Organic, and Conventional), End use (Industry, Pharmaceutical Industry, Nutraceuticals, Cosmetic and Personal Care Industry and Others), Distribution Channel (Supermarkets and Hypermarkets, Convenience Stores, Online Retail, Specialty Stores, and Others), And Region (North America, Europe, Latin America, Asia-Pacific, Middle East and Africa) - Industry Analysis From 2025 to 2033

Global Sesame Seeds Market Size

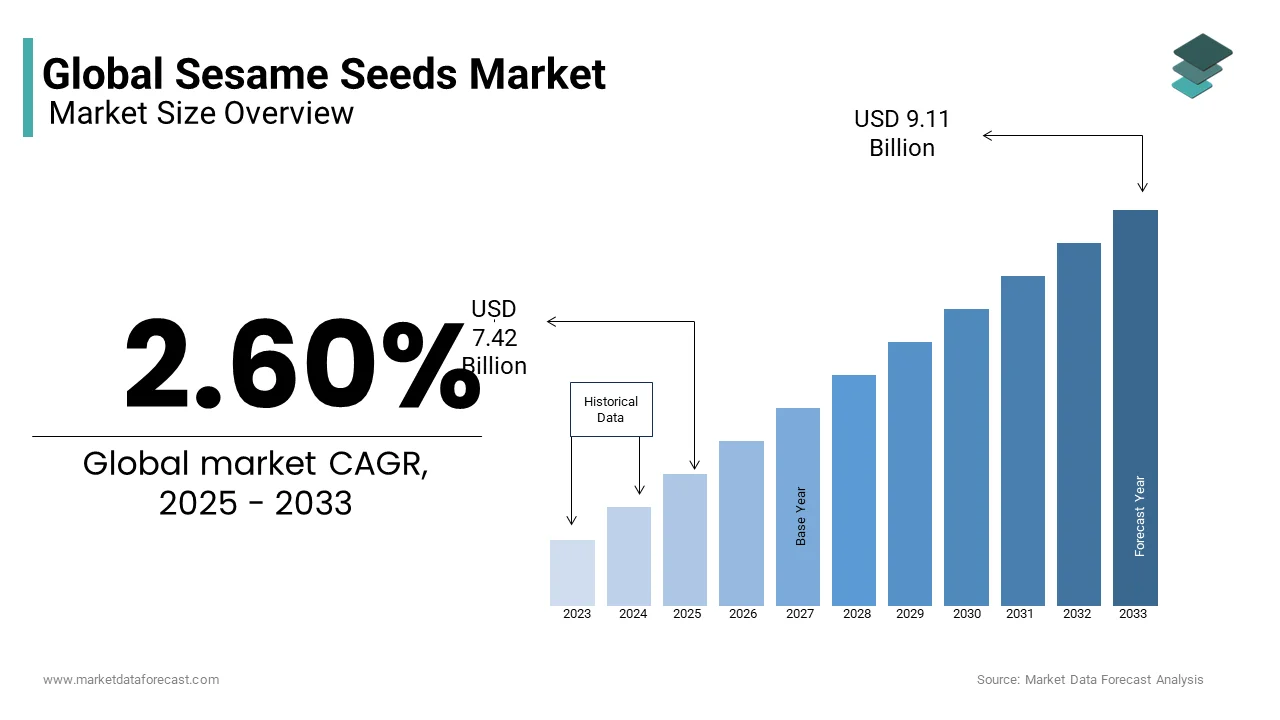

The global sesame seeds market was valued at USD 7.23 billion in 2024 and is anticipated to reach USD 7.42 billion in 2025 from USD 9.11 billion by 2033, growing at a CAGR of 2.60% during the forecast period from 2025 to 2033.

CURRENT SCENARIO OF THE GLOBAL SESAME SEEDS MARKET

Sesame seed is mostly cultivated in Latin America, Asia Pacific, and Africa. It is one of the most widely used food products from the traditional days across the world. In the modern era, people are inclined to rely on healthy food habits, and they are showing interest in vegan diet-based food options. From traditional to modern days, the demand for sesame seeds is still trending, which is likely to bolster the growth rate of the market in the foreseen years. China is the world’s largest importer of sesame seeds, with almost 42% of total production. According to the National Library of Medicine, African countries are leading in cultivating sesame seeds, surpassing China in 2022. The popularity of sesame seeds has been widely growing owing to the increasing prominence of the use of these seeds in various medicinal and food products since they received Scientific Nutritional Value in China from the Ministry of Health.

Market Drivers

Rising Number of Health-Conscious Customers and The Growing Need for Superfoods

The sesame seeds market is showcasing steady growth due to the rising number of health-conscious customers and the growing need for superfoods. Also, the millennial generation in North America and Europe is incorporating nutritious foods into their diets. They are becoming more interested in these seeds due to their nutritious profile. The supply has grown over time in parallel with consumer demand. Farmers opt for edible oilseeds, available in white, black, and brown colors. This is due to their resistance to weather and minimal care requirements.

Increasing Demand for a Functional Ingredient in Various Meals

Other factors driving the sesame seeds market include the increasing demand for a functional ingredient in various meals. This is because of its benefits, such as lowering blood pressure, aiding in digestion, and being a rich source of antioxidants, polyphenols, vitamins, and minerals. Moreover, its popularity has significantly increased due to the introduction of new products that reflect the changing preference for natural and healthful components among customers. Furthermore, consumer preferences for organically sourced and health-based items are boosting the industry. Therefore, the sesame seeds market will move forward in the future with the increasing use as an antioxidant source in various medicinal formulations.

Consumers and businesses are starting to favor more organic and non-GMO sesame seeds, as well as seeds that come from ethical and environmentally beneficial sources. Moreover, to meet the growing demand for ethical sesame seed products, market actors must adopt sustainable methods and transparent sourcing strategies. Hence, this trend is aligned with broader worries about ethical supply chains, food safety, and environmental effects.

Market Restraints

The sesame seed market growth is hampered by price volatility. Also, the weather is a major factor in sesame seed production, and natural disasters like floods, droughts, and other unfavorable weather conditions have significantly affected crop yield. Also, supply shortages increased the cost in the market due to industrial disruptions. On the other hand, wide harvests may result in overstock and lower prices. Material costs for cultivating sesame, including labor, fertilizers, and seeds, might also change because of market conditions and exchange rate changes. Manufacturers could be obliged to raise the price of sesame seeds to cover rising input expenses.

The growth of the sesame seeds market is hindered by the low yield. When compared to traditional crops cultivated with chemical inputs, the output of organic sesame production is often lower. Lower productivity is also caused by a shortage of farms with organic certification. Price volatility and a gap in supply and demand may result from this. Investing in research and development for organic sesame seed types with high yields that are suited for varying climatic conditions can aid in increasing production and overcoming this limitation.

Another factor limiting the market expansion is strong competition. Sesame seeds cultivated conventionally, which are more readily available and less expensive, are a competitor in the market for organic sesame seeds. Normal sesame has an advantage over organic sesame in unexplored markets due to little understanding of its benefits. Changing customer opinions requires both effective marketing and health education. Organic sesame may also compete with ordinary types by developing distinctive value propositions related to nutrition, flavor, and quality.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

2.60% |

|

Segments Covered |

By Product Type, Category, End-Use, Distribution Channel and Region |

|

Various Analyses Covered |

Global, Regional, & Country Level Analysis; Segment-Level Analysis; DROC, PESTLE Analysis; Porter’s Five Forces Analysis; Competitive Landscape; Analyst Overview of Investment Opportunities |

|

Regions Covered |

North America, Europe, APAC, Latin America, Middle East and Africa. |

|

Market Leaders Profiled |

Olam International, Dipasa USA, Inc, Triangle Wholefoods, ETICO Group, SunOpta, Shyam Industries, SHREEJI EXPELLER INDUSTRIES, HL Agro Products, Arvind Limited, ECOM Agroindustrial Corporation |

SEGMENTAL ANALYSIS

Global Sesame Seeds Market By Product Type

The hulled segment held a significant share of the sesame seeds market. They contain high fiber, healthy fats, protein, and minerals. This also includes calcium, iron, and magnesium, and they are vegan and gluten-free. So, they are a preferred option for people who follow strict and healthful diets. Additionally, certain medications and personal hygiene products include them.

Global Sesame Seeds Market By Category

The conventional segment is leading under this category of the sesame seeds market and is believed to propel at a faster rate. It is more affordable and accessible. This market is bigger than that of organic sesame seeds. In addition, herbicide and fertilizer residues from contemporary farming practices are also present in these. On the other hand, regular sesame seeds are a great source of nutrients and might be a beneficial addition to the diet.

Global Sesame Seeds Market By End-use

The food industry accounted for a major portion of the global sesame seeds market share. There is a strong need in the industry because of their versatility and health benefits. Also, these are used in various culinary products. For example, breads, snack bars, and dressings. Moreover, their demand is further increased using international and fusion cuisine and the growing popularity of plant-based and gluten-free diets. Furthermore, food manufacturers are creating products with sesame seeds. This is because sesame seeds are a versatile component that works well in a variety of products. It includes sauces, baked goods, and snacks.

Global Sesame Seeds Market By Distribution Channel

The Supermarkets and Hypermarkets segment is growing at a faster growth rate in the sesame seeds. The demand for convenient, one-stop shopping experiences has significantly increased due to the wide variety of brands and types of sesame seeds available from these retail establishments. Moreover, the rising demand for sesame seeds in supermarkets and hypermarkets is primarily driven by their strong shelf presence and consumer preferences for grocery purchases.

REGIONAL ANALYSIS

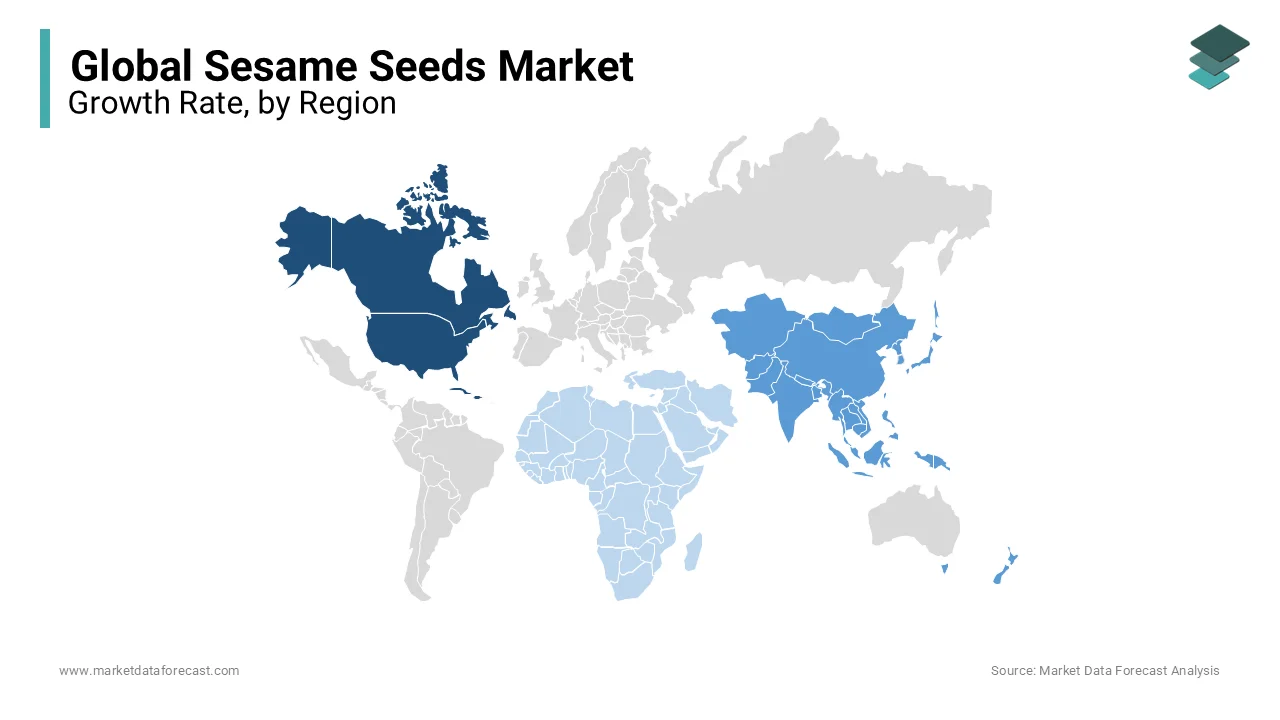

North America is propelling at a steady pace and is expected to expand during the forecast period. The demand for sesame seeds is increasing due to increased awareness of their nutritional benefits, their use in popular food products, and the growing preference for healthier, plant-based diets. Additionally, the regional market growth is supported by the shift towards clean labeling and non-GMO options, which makes sesame seeds an appealing choice for health-conscious consumers.

Asia Pacific holds the largest portion of the sesame seeds market share in 2023. Growing health consciousness and the growing food processing industry in developing nations like China and India are the main factors driving market share in the Asia-Pacific region. The output of sesame seeds in India reached 817 thousand tonnes in 2021. In contrast, Japan produced about 14 tonnes of sesame seeds in 2021.

Europe is the second biggest industry and is growing at a rapid pace in the sesame seeds market. The broad food and beverage sector in the area is driving the market's expansion with its high demand for natural and organic ingredients. Sesame seeds are produced in very tiny quantities in Greece and Italy, making up the entirety of Europe's output. In 2021, 144 thousand tonnes of sesame were imported into the European Union to meet market demand.

Latin America is projected to grow at an exponential growth rate in the sesame seeds market. The two main markets in this area are Brazil and Mexico. Brazilian import costs are a competitive option for Indian local providers, and the country's fresh crop is posing a threat to Indian exporters. Growth of the pharmaceutical sector, including traditional treatments and natural therapies using sesame seeds to treat a range of ailments.

Middle East and Africa is an emerging area in the sesame seeds market. These are widely produced and consumed in nations like Nigeria, Sudan, and Ethiopia, where there are deep-rooted culinary traditions. Sudan was Africa's top producer of sesame seeds as of 2021. The nation generated more than 11.19 million metric tonnes of seeds. Following with output quantities of 700,000 metric tonnes and 440,000 metric tonnes, respectively, were Tanzania and Nigeria. More than 3.77 million metric tonnes of sesame seeds were produced in Africa in the aforementioned year.

KEY MARKET PLAYERS

Olam International, Dipasa USA, Inc, Triangle Wholefoods, ETICO Group, SunOpta, Shyam Industries, SHREEJI EXPELLER INDUSTRIES, HL Agro Products, Arvind Limited, ECOM Agroindustrial Corporation. Some of the market players dominate the global sesame market.

RECENT DEVELOPMENTS IN THIS MARKET

- In January 2023, new rules were implemented by the Kenyan government to enhance the availability and quality of different vegetative reproducing seeds.

MARKET SEGMENTATION

This research report on the global sesame seeds market has been segmented and sub-segmented based on product type, category, end-use, distribution channel, and region.

By Product Type

- Hulled Sesame Seeds

- Roasted Sesame Seeds

- White Sesame Seeds

- Black Sesame Seeds

- Brown Sesame Seeds

- Others

By Category

- Organic

- Conventional

By End-use

- Food Industry

- Pharmaceutical Industry

- Nutraceuticals

- Cosmetic and Personal Care Industry

- Others

By Distribution Channel

- Supermarkets and Hypermarkets

- Convenience Stores

- Online Retail

- Specialty Stores

- Others

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

Frequently Asked Questions

What are the primary applications of sesame seeds in the food industry?

Sesame seeds are widely used in various food products such as bakery items, snacks, confectionery, and dressings due to their nutty flavor and nutritional value.

What are the main challenges faced by sesame seed farmers?

Challenges faced by sesame seed farmers include fluctuating prices, pest and disease outbreaks, limited access to modern farming technologies, and lack of proper infrastructure for storage and transportation.

How does sesame seed agriculture contribute to the economy of producing countries?

Sesame seed agriculture plays a significant role in the economy of producing countries by providing employment opportunities, generating export revenue, and contributing to rural development.

Which Asian country is the largest exporter of sesame seeds?

India is the largest exporter of sesame seeds in Asia, accounting for a significant share of the global sesame seed trade.

How does sesame seed cultivation contribute to sustainable agriculture in Latin America?

Sesame seed cultivation in Latin America promotes sustainable agriculture by requiring less water and inputs compared to other crops, thus reducing environmental impact and conserving natural resources.

What are the quality standards for sesame seeds in the Middle East?

Quality standards for sesame seeds in the Middle East are regulated by regional organizations such as the Gulf Cooperation Council (GCC) and national food authorities.

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2500

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]