Global Server Market Size, Share, Trends, & Growth Forecast Report – Segmented By Size (Micro, Small, Medium, Large), Channel (Direct, Reseller, Systems Integrator), Product (Blade, Micro, Open Compute Project, Rack, Tower), End-user (BFSI, Energy, Government & Défense, Healthcare, IT & Telecom), and Regional - (2024 to 2032)

Global Server Market Size (2024 to 2032)

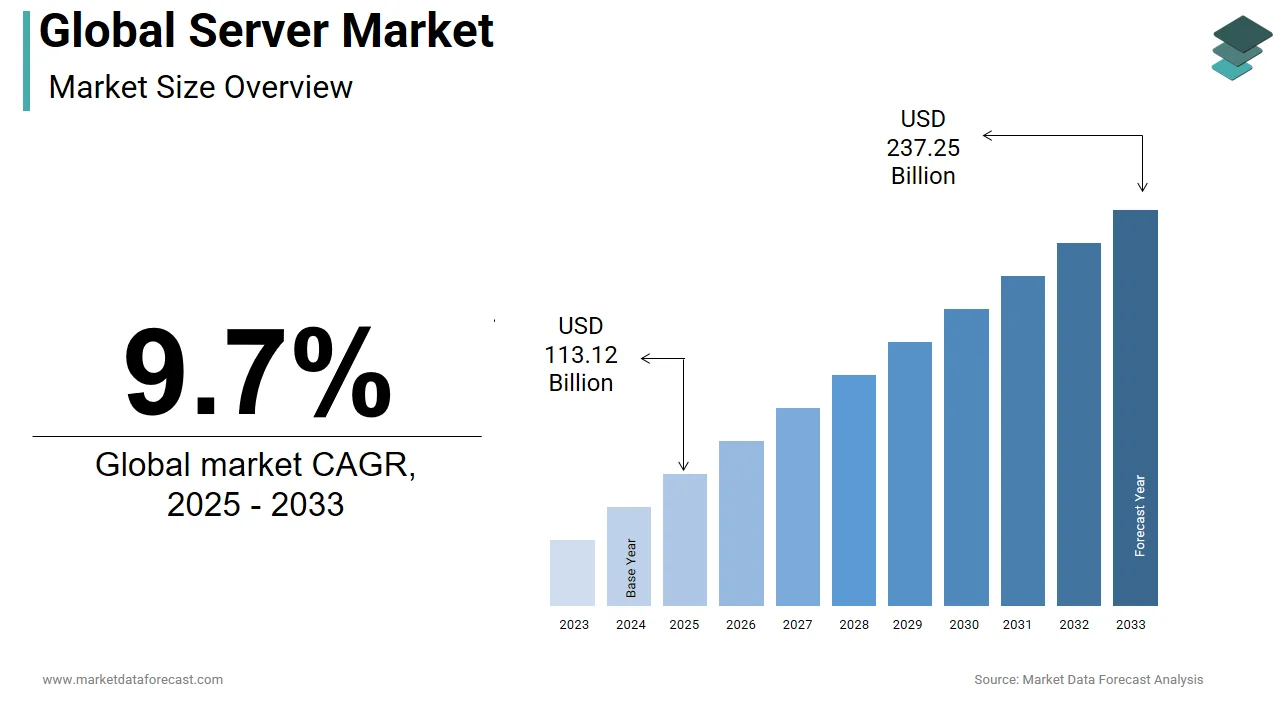

The global server market was valued at USD 94 billion in 2023. The global market is predicted to reach USD 103.12 billion in 2024 and USD 216.27 billion by 2032, growing at a CAGR of 9.7% during the forecast period. This promising trajectory presents a compelling opportunity for businesses, investors, and analysts interested in the server market.

A server is a computer or a system of computers that provides services, resources, or functionalities to other devices or programs, known as clients, within a network. It manages and responds to client requests, offering various services like file storage, data sharing, hosting websites, managing email, or running applications. Servers are designed to be reliable, robust, and continuously operational to fulfill the demands of multiple clients, facilitating communication and data exchange across networks, including the Internet.

MARKET DRIVERS

The growth of the server market is primarily driven by the expanding cloud computing services. This trend, fueled by businesses' ongoing adoption, is significantly influenced by cloud service providers.

These providers are consistently investing in robust server infrastructure to meet the escalating demand for cloud-based services. As organizations increasingly migrate to the cloud, the need for scalable, reliable, high-performance servers becomes paramount. This shift towards flexible and agile computing solutions underscores the pivotal role of servers as the backbone for hosting and managing diverse workloads. The server market's trajectory is intricately linked to the growth of cloud computing, reflecting a symbiotic relationship where advancements in server technologies are crucial to sustaining the ever-evolving landscape of cloud-based solutions and services.

The server market is experiencing a significant boost from the integration of artificial intelligence (AI) and machine learning (ML) across diverse applications. This paradigm shift has led to a discernible demand for specialized servers meticulously optimized to cater to the unique computational demands of AI and ML workloads. As businesses leverage data-driven insights and automation, high-performance computing infrastructure becomes a necessity. These advanced servers, equipped with accelerators like GPUs and TPUs, are designed to efficiently process the complex algorithms underpinning AI and ML applications. This redefinition of the server market, with a pronounced emphasis on architectures that enhance processing capabilities, is paving the way for innovative and intelligent solutions in the ever-evolving landscape of AI and machine learning technologies.

MARKET RESTRAINTS

The server market is intricately tied to economic dynamics, and economic uncertainties can profoundly impact its trajectory. During periods of economic downturn, businesses often exhibit caution in their financial allocations, resulting in a potential reduction in IT spending. This cautious approach reverberates through the server market, influencing the demand for new servers. Organizations facing budget constraints and a focus on cost-cutting measures may delay or scale back their server infrastructure investments. This cyclical relationship between economic conditions and IT expenditure underscores the server market's vulnerability to global economic fluctuations.

The server market confronts a critical juncture as the specter of cybersecurity threats escalates. The pervasive and evolving nature of these threats demands heightened investments in robust security features, adding a layer of complexity and cost to server deployments. Organizations grappling with the imperative to safeguard sensitive data and ensure the integrity of their digital infrastructure are compelled to allocate additional resources to fortify server security. This evolving landscape necessitates advanced encryption, authentication mechanisms, and proactive threat detection protocols, driving up the overall cost of server deployment.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 to 2032 |

|

Base Year |

2023 |

|

Forecast Period |

2024 to 2032 |

|

CAGR |

7.8% |

|

Segments Covered |

By Size Outlook, Channel Outlook, Product, End-Use System, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regions Covered |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Market Leaders Profiled |

Hewlett Packard Enterprise (HPE), Dell Technologies, IBM, Lenovo, Cisco Systems, Inspur, Super Micro Computer Inc., Oracle Corporation, Fujitsu, Huawei Technologies, and others. |

SEGMENTAL ANALYSIS

Global Server Market Analysis By size outlook

Micro enterprises' growth is most dominating in the server market, which typically consists of fewer than ten employees. In this segment, the demand for servers may be modest, often driven by basic computing needs. Cloud services might be preferred over investing in on-premises server infrastructure due to cost considerations.

Small enterprises hold the second-largest market share. As these businesses grow, their IT requirements expand, leading to increased adoption of servers for various applications such as file storage, email, and basic business operations.

Medium-sized enterprises, with workforces ranging from 50 to 249 employees, often witness a substantial increase in server demand in the Server Market. This segment frequently requires more advanced server configurations to support growing data storage needs, application hosting, and collaboration tools.

Global Server Market Analysis By channel outlook

Direct sales are leading in the Server Market growth as they involve manufacturers or vendors selling servers directly to end-users. This channel offers a close relationship between the supplier and the customer, allowing for better customization, support, and direct communication. Large enterprises often prefer direct engagement with server manufacturers for tailored solutions and direct technical support.

Global Server Market Analysis By product

Blade dominates in the server market growth as servers are compact, modular servers that share a common chassis. They offer high-density computing, enabling multiple servers to be housed in a single enclosure. Blade servers are favored for data centers with limited space, providing scalability and efficient cooling. Their modular design allows for easy upgrades and maintenance.

Micro servers are small, energy-efficient servers designed for specific workloads like lightweight applications, web hosting, and content delivery. Their key traits include low power usage and a small form factor, which makes them ideal for spaces prioritizing energy efficiency and limited area. These servers excel in environments where optimizing both space and power consumption is crucial, offering tailored solutions for specific computing needs.

Global Server Market Analysis By End-use System

The BFSI sector is a major consumer in the Server Market share of server technology, relying on robust infrastructure for secure transactions, data analytics, and risk management. Servers in BFSI support critical applications such as core banking systems, customer relationship management (CRM), and financial analytics.

The energy sector leverages servers for various purposes, including data analysis, exploration, and managing complex operational processes. Servers play a crucial role in optimizing energy production, monitoring infrastructure, and supporting applications related to smart grids and renewable energy initiatives.

REGIONAL ANALYSIS

North America dominates the server market size, led primarily by the United States. The Region benefits from a robust technological landscape driven by continuous innovations in cloud computing, data analytics, and IoT. Major tech giants and enterprises in various sectors contribute significantly to the demand for servers, fostering consistent growth in this market segment.

Europe maintains a significant position in the Server Market, driven by countries like Germany, the UK, and France. The Region prioritizes digital transformation across industries, driving server adoption in cloud services, data centers, and enterprises. The push towards sustainable data solutions also influences server choices, promoting energy-efficient and eco-friendly server infrastructure.

Asia-Pacific exhibits substantial growth potential in the Server Market, led by technological advancements in countries like China, Japan, and India. The region is experiencing rapid cloud adoption, digitalization across industries, and increasing internet penetration. Growing economies and the emergence of startups further contribute to the demand for servers, particularly for cloud services and data storage solutions.

Middle-east and African countries demonstrate a growing interest in server technologies, primarily driven by digital transformation initiatives in the banking, healthcare, and telecommunications sectors. Although the market share is smaller than other regions, investments in data centers and technological modernization are steadily increasing the demand for servers.

Latin America is witnessing gradual growth in the Server Market, with countries like Brazil and Mexico leading the charge. The Region is experiencing increased demand for servers driven by expanding internet connectivity, the digitalization of businesses, and the adoption of cloud-based services across various sectors.

KEY PLAYERS IN THE GLOBAL SERVER MARKET

Major Key Players in the Server Market are

- Hewlett Packard Enterprise (HPE)

- Dell Technologies

- IBM

- Lenovo

- Cisco Systems

- Inspur

- Super Micro Computer Inc.

- Oracle Corporation

- Fujitsu

- Huawei Technologies

DETAILED SEGMENTATION OF THE GLOBAL SERVER MARKET INCLUDED IN THIS REPORT

This research report on the global server market has been segmented and sub-segmented based on the size outlook, channel outlook, product, end-use system, and region.

By size outlook

- Micro

- Small

- Medium

- Large

By channel outlook

- Direct

- Reseller

- Systems Integrator

- Others

By product

- Blade

- Micro

- Open Compute Project

- Rack

- Tower

By End-use System

- BFSI

- Energy

- Government & Défense

- Healthcare

- IT & Telecom

- Others

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East and Africa

Frequently Asked Questions

What are the major types of servers dominating the market?

Currently, rack servers, blade servers, and tower servers are the major types dominating the server market, with rack servers holding the largest market share due to their scalability and cost-effectiveness.

How is the server market influenced by technological advancements?

Technological advancements such as the emergence of edge computing, AI (Artificial Intelligence) integration in servers, and the development of advanced semiconductor technologies like ARM-based servers are shaping the server market landscape and driving innovation.

How are emerging technologies like edge computing impacting the server market?

The proliferation of edge computing applications is driving the demand for edge servers, which are designed to process data closer to the point of generation, leading to increased deployment of servers in edge locations and fueling market growth.

What are the competitive dynamics in the global server market?

The server market is highly competitive, with key players such as Dell Technologies, Hewlett Packard Enterprise (HPE), IBM Corporation, and Cisco Systems dominating the market through strategies such as product innovation, partnerships, and mergers & acquisitions.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2500

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]