Global Serious Games Market Size, Share, Trends, & Growth Forecast Report by Vertical (Education, Corporate, Healthcare, Retail, Media and Advertising), Application (Training, Sales, Human Resource, Marketing), Platform (Hand-Held, Portable Based, PC-Based, and Online), End-User (Enterprise, Consumer), and Region (North America, Europe, Asia Pacific, Latin America, and Middle East & Africa), Industry Analysis From 2024 to 2033

Global Serious Games Market Size

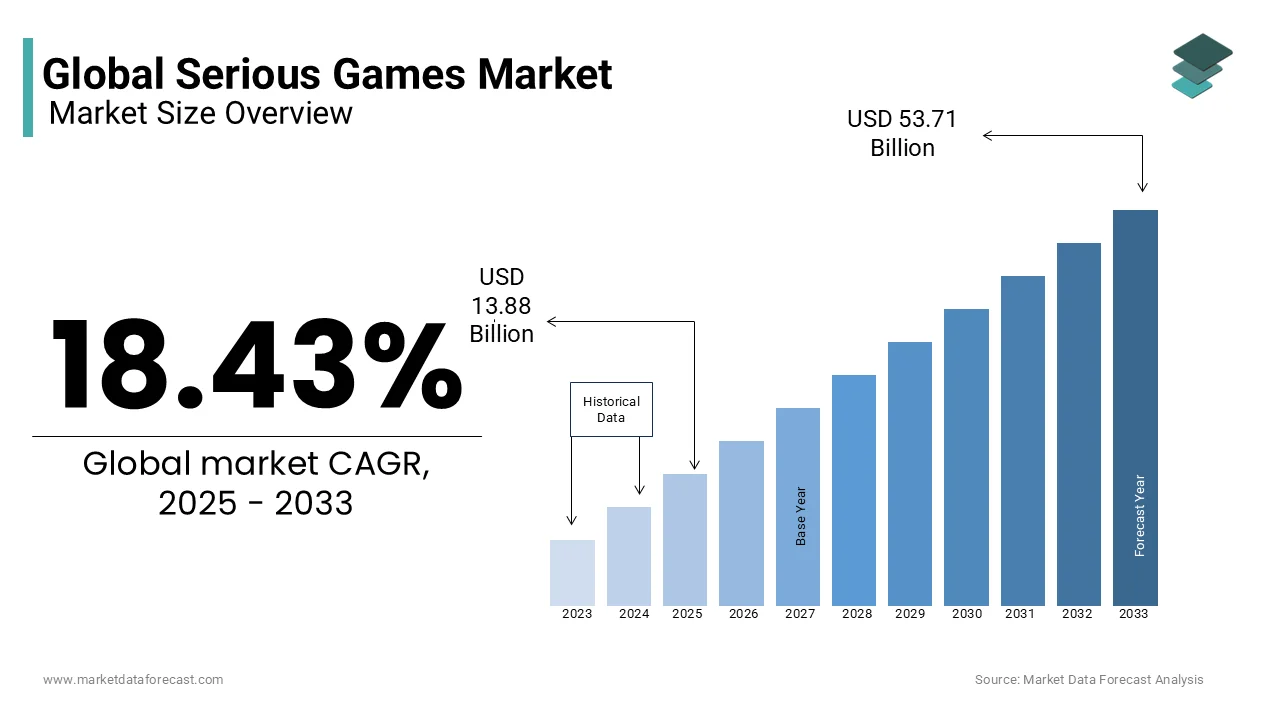

The global serious games market was valued at USD 11.72 billion in 2024. The global market is expected at 13.88 billion in 2025 and is assessed to arrive at 53.71 billion USD in the year 2033, garnering a CAGR of almost 18.43% in the outlook period 2025 to 2033.

Serious gaming frameworks are relied upon to observe significant development during the conjecture time frame. Firms have indicated a hefty tendency toward collaborative frameworks, which don't establish a competitive environment, as they are generally viewed as counterproductive. For example, mint.com effectively tried different things with gaming to drive high-profiled leads. These frameworks are additionally utilized for employee training, similar to the utilization of gaming by SAP to teach their workers on supportability.

Cutting edge innovations are impacting the financial administrations industry to embrace serious gaming also. The goal is to decrease complexity involved in simulation training across investment decision-making. This is made conceivable through making the offers and items intuitive. Besides, the utilization of such innovation in the car business and other technological space for preparing objects is likewise noticed to gain traction. For example, Diginext is offering VR/AR answers for preparing specialized work force with VR innovation.

MARKET DRIVERS

Computerized Games and Simulations have Picked up Popularity

In the recent past years, computerized games and simulations have picked up popularity as the most impressive and exceptionally captivating learning environment, despite the fact that the creation of these serious games requires intricate and dynamic develops with suitable plans of multimodal setting and drawing in collaborations, just as productive pedagogical strategies to preserve the efficacy of learning. Grandel Games built up a serious game that accomplishes behavioural change. For example, 'Garfield's Count Me In' is intended for understudies in essential schooling, which permits them to do repetitive math activities. Furthermore, the government over the world are additionally reassuring the reception of serious games for the learning and training application.

MARKET RESTRINTS

Awareness about Serious Games

Inappropriate game plan and absence of awareness about serious games restricts the development of the global market. Also, the lack of reach of these games into remote areas of developing nations is also acting as a hurdle to the expansion of the industry.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

18.43% |

|

Segments Covered |

By Vertical, Application, Platform, End User, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview of Investment Opportunities |

|

Regions Covered |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Market Leaders Profiled |

BreakAway, Ltd., Designing Digitally, Inc., DIGINEXT, IBM Corporation, Intuition, Learning Nexus Ltd, Nintendo Co., Ltd., Promotion Software GmbH, Revelian, and Tata Interactive Systems and Others. |

SEGMENTAL ANALYSIS

By Vertical Insights

The global serious game market has been sectioned dependent on vertical into Education, Corporate, Healthcare, Retail, Media and Advertising. Of these, the education sector is likely to develop with a notable growth rate in the following years.

By Application Insights

The serious game market has been sectioned dependent on application into Training, Sales, Human Resource, and Marketing.

By Platform Insights

The global serious game market has been divided based on platform into Hand-Held, Portable Based, PC-Based, and Online. Of these, the online games are developing with a significant CAGR, which is estimated to continue over the projection period.

By End User Insights

The global serious game market mainly incorporates two end-users, namely Enterprise and Consumer.

REGIONAL ANALYSIS

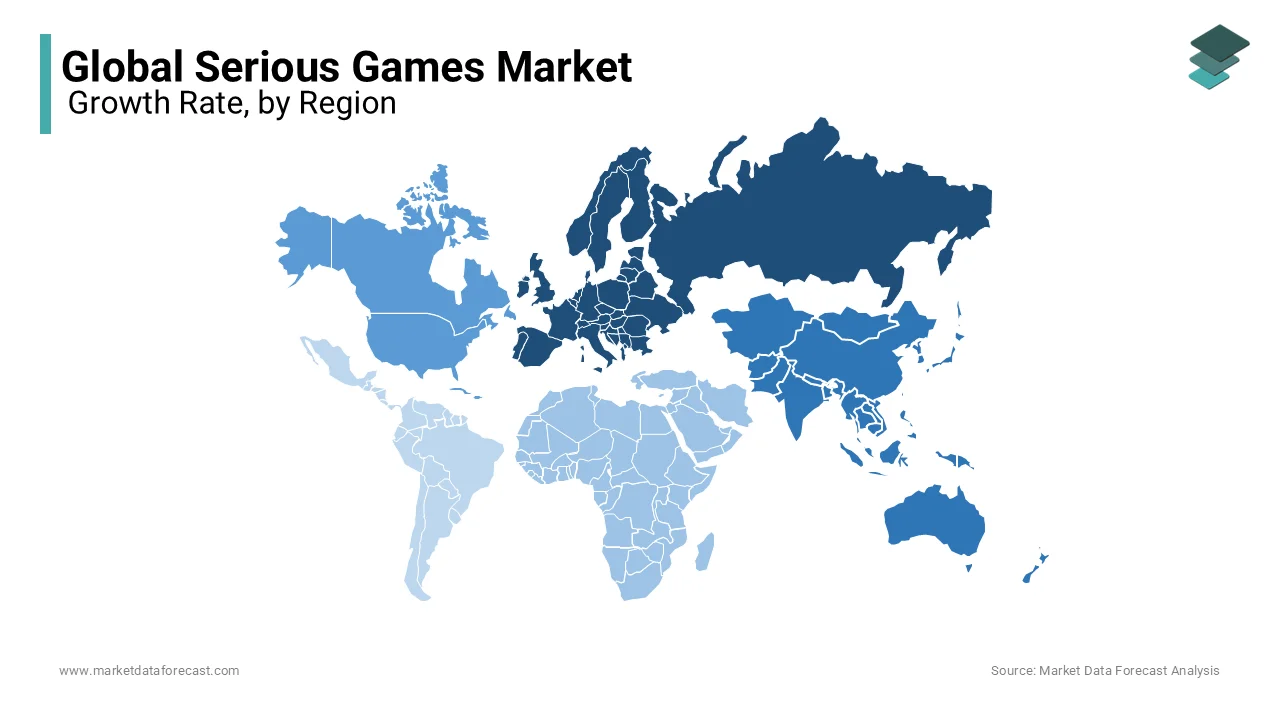

Europe is supposed to record a huge portion of the worldwide interest for serious gaming, and in the locale, Western Europe is relied upon to order noticeable quality over the conjecture period, as a result of the lot of expenditure on the publicizing, retail, car, and medical care ventures.

As per GroupM, during 2018, the media promoting consumption in Western Europe and Central and Eastern Europe remained at USD 103.29 billion and USD 16.69 billion, individually. By 2023, media publicizing spending in Western Europe is expected to arrive at USD 117.99 billion. Such development in the area are foreseen to be driving the interest for new innovations. Moreover, government activities in the locale are receiving gaming solutions for educational purposes. For example, the LUDUS venture targets making a European network for the exchange of information and best practices with the assistance of serious gaming.

The Asia Pacific (APAC) is estimated to be the quickest developing region in the global serious game market, recording a CAGR of 18.06% during the forecast period. In APAC, China represented a significant market portion of over 40% and nations, for example, India and South Korea are likely to develop with the most noteworthy CAGR over the envisioned period. The developing interest of manufacturers in serious games and the expanding emphasis on the improvement of serious games are driving the expansion of the market in the APAC nations.

KEY PLAYERS IN THE MARKET

The key players operating in the global serious games industry include BreakAway, Ltd., Designing Digitally, Inc., DIGINEXT, IBM Corporation, Intuition, Learning Nexus Ltd, Nintendo Co., Ltd., Promotion Software GmbH, Revelian, and Tata Interactive Systems.

RECENT DEVELOPMENTS IN THE MARKET

-

April 2020 - Kahoot! launched its reading application Poio in the United States, adding to its instructive numerical studio DragonBox, subsequently, enabling huge number of kids to learn at home. Poio by Kahoot! was designed for ages three to eight, and immersive learn-to-read adventure game designed to permit youngsters to learn through their own investigation, setting off their interest and inspiration to work on spelling and phonetics without the requirement for help.

-

April 2020 - The Indiana Department of Education, in the United States, declared the Rose-Hulman's PRISM program to give teachers over the Indiana state with significant e-learning assets and summer proficient improvement workshops. The program is pointed toward making an online library with more than 6,000 free online teaching resources, empowering the teachers to share exercise plans with other school regions with the assistance of advanced apparatuses, for example, serious gaming, among others.

-

In September 2019, The University of Canterbury, New Zealand, reported to contribute over USD 4.5 million, alongside USD 3.2 million from the public authority, for the exploration on its new Applied Immersive Gaming Initiative. The activity is pointed toward giving help to handle assignments that may somehow be exhausting or troublesome, for example, learning at school, picking up virtual spiders, or practicing piloting skills.

MARKET SEGMENTATION

This research report on the global serious games market has been segmented and sub-segmented based on the vertical, application, platform, end-user, and region.

By Vertical

- Education

- Corporate

- Healthcare

- Retail

- Media and Advertising

By Application

- Training

- Sales

- Human Resource

- Marketing

By Platform

- Hand-Held

- Portable Based

- PC-Based

- Online

By End User

- Enterprise

- Consumer

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East and Africa

Frequently Asked Questions

What are the primary factors driving the growth of the global serious games market?

The increasing adoption of gamification in various industries for training and educational purposes, coupled with advancements in technology such as virtual reality (VR) and augmented reality (AR), are the major drivers of market growth. Additionally, the growing emphasis on employee engagement and skill development further fuels the demand for serious games.

What are some of the challenges faced by the global serious games market?

Despite the growing popularity of serious games, challenges such as high development costs, technical limitations, and the need for specialized skills in game design and development pose hurdles to market growth. Moreover, concerns regarding data privacy and security, especially in sectors like healthcare and defense, remain significant challenges for serious game developers and users.

How are demographic trends influencing the global serious games market?

Demographic trends such as the increasing prevalence of digital natives, who are more accustomed to interactive and technology-driven learning experiences, are driving the demand for serious games. Additionally, the aging population in many countries is creating opportunities for serious games in areas like cognitive training and rehabilitation for older adults.

What are the key strategies adopted by companies in the global serious games market to gain a competitive edge?

Key strategies adopted by companies in the serious games market include partnerships and collaborations with educational institutions, technology providers, and industry stakeholders to enhance product offerings and reach new markets. Additionally, investments in research and development to innovate new gaming solutions and expand market presence are common strategies employed by market players.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2500

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]