Global Self-Testing Market Size, Share, Trends & Growth Forecast Report By Product (Diagnostic Kits, Diagnostic Devices and Diagnostic Strips) Sample (Urine, Blood, Stools, Oral Swabs and Others) and Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), Industry Analysis From 2025 To 2033.

Global Self-Testing Market Size

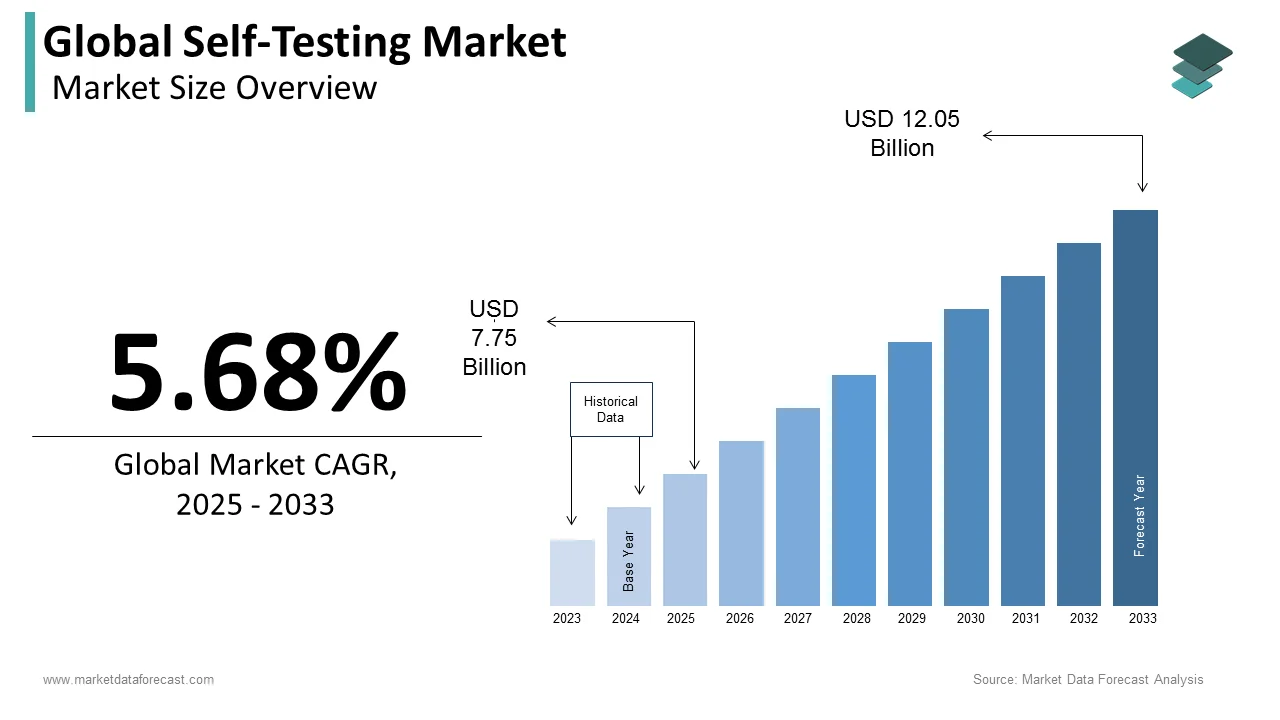

The size of the global self-testing market was worth USD 7.33 billion in 2024. The global market is anticipated to grow at a CAGR of 5.68% from 2025 to 2033 and be worth USD 12.05 billion by 2033 from USD 7.75 billion in 2025.

The self-test is a kind of test that can be performed at the convenience of being at home by oneself with the help of a small kit. These tests are comfortable and easy to take any time and anywhere per the patient's need. The self-test kits also provide flexibility to the user in what way they want to conduct the test. They generally require oral fluid, urine, or blood drops to give results. There are various types of self-test kits available in the market like HIV self-test kits, Pregnancy self-test kits, Infertility self-test kits, and others. Apart from the essential use of self-testing in diagnosing illness, there have been several other advantages over traditional testing like less time, cost-effectiveness, flexibility, and convenience.Kits used for diabetes play a vital role in booming the market for home testing or self-testing kits across the world. These kits are user-friendly and provide instant results to the user. The advancement in technologies and rapid developments in the medical field has also contributed to the formulation of self-testing kits for hepatitis C, colon cancer, urinary tract infections, and monitoring blood pressure. In addition, the COVID-19 outbreak has changed patients' preferences by necessitating social distancing and telemedicine for all, which boosted the growth of the self-testing market recently.

MARKET DRIVERS

The global self-testing market is majorly driven by the increasing prevalence of chronic diseases and the growing demand for self-testing.

The growing geriatric population is significantly accelerating the self-testing market growth. Aged people need to be monitored frequently as there are more prone to various chronic diseases such as diabetes and other diseases. In addition, self-tests are used to diagnose diabetes by measuring blood sugar levels. A blood sugar test determines the amount of sugar or glucose in the blood; high sugar in the blood leads to other major medical conditions like eyesight loss. Market players and governments focus on various strategies, such as investment in R&D and financing, expected to drive market growth during the forecast period.

The technological advancements in the healthcare sector are expected to support the growth of the global self-testing market.

Furthermore, rapid digitalization has made way for online pharmacies that have also shown positive growth in the e-commerce sector. This indicates that consumers are quickly adapting to buying self-test kits online, compared to the traditional approach of physically buying from a pharmacy after consulting a doctor. Hence, boosting the overall growth of the self-testing market. Moreover, the key players are engaged in product development through partnerships, mergers and acquisitions which is expected to expand the market growth globally. The COVID-19 pandemic has positively impacted the self-testing market because, at the time of the outbreak, the self-testing kits were considered one of the essential measures to control the spread of the infection with masking and social distancing.

MARKET RESTRAINTS

The frequent product flaws in the self-testing kits hinder the market growth of the self-testing market. In November 2024, the US Food and Drug Administration (FDA) recalled approximately 2 million household COVID-19 test kits manufactured by Australian biotechnology. According to federal regulators, manufacturing defects can cause test kits to provide "false-positive" results, misleading the users and impacting the demand for self-testing kits.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

5.68% |

|

Segments Covered |

By Product, Sample, and Region. |

|

Various Analyses Covered |

Global, Regional, and country-level analysis; Segment-Level Analysis, DROC; PESTLE Analysis; Porter’s Five Forces Analysis, Competitive Landscape; Analyst Overview of Investment Opportunities |

|

Regions Covered |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Market Leaders Profiled |

ACON Laboratories Inc., ARKRAY Inc., Assure Tech (Hangzhou) Co. Ltd., Becton Dickinson & Company, Bionime Corporation, Roche Holding AG, Quidel Corporation and True Diagnostics Inc, and Others. |

SEGMENTAL ANALYSIS

By Product Insights

Based on the product, the diagnostic kits segment is predicted to hold the largest share of the self-testing market during the forecast period. The kits have several advantages over traditional testing like less time, cost-effectiveness, flexibility, and convenience, which help in boosting the overall growth of the segment. They also provide freedom to the users in what way they want to use it. The samples used for testing in the diagnostic kits are urine, oral fluid, blood drops, and oral swabs.

By Sample Insights

Based on the sample, the urine and blood segments have held the lion's share in the self-testing market in 2024. Diabetes continues to be a significant driver of the self-testing market worldwide. It continues to be a common illness in high-income countries and is now prevalent in middle-income and low-income countries. It is becoming a major cause of blindness, heart attack, kidney failure, and stroke. Apart from this, the easy accessibility and accurate results from pregnancy kits have also increased the demand for self-testing kits.

REGIONAL ANALYSIS

Geographically, North America accounted for preserving the highest share of the global self-testing market in 2024 because of the developing range of healthcare companies that use those self-testing kits or home kits to diagnose several contagious illnesses resulting from viruses and bacteria. In addition, the market in this region has a compelling government regulation supporting domestic investment, which contributed to the growth of the American market. According to the Centers for Disease Control and Prevention, obesity is also an expensive and dangerous condition in the United States, with complications such as high cholesterol and heart problems. As a result, the USA has become the center of a self-testing market. Disease prevention can save on medical costs in certain situations, and self-test kits are a cheap way to reach this goal.

The high prevalence of diabetes in the region has also boosted the demand for cost-effective and time-effective self-testing kits in Europe. In addition, using self-testing kits during the Covid19 outbreak has also helped fuel the self-testing market in this region.

The Asia Pacific region has also emerged as a promising market for the self-testing market due to key players' technological advancements and presence. However, due to high competition in the market, manufacturers try to develop advanced self-test kit solutions with more accurate results, boosting the overall growth in the market.

KEY MARKET PLAYERS

ACON Laboratories Inc., ARKRAY Inc., Assure Tech (Hangzhou) Co. Ltd., Becton Dickinson & Company, Bionime Corporation, Roche Holding AG, Quidel Corporation and True Diagnostics Inc. are a few of the noteworthy players operating in the global self-testing market profiled in this report.

MARKET SEGMENTATION

This market research report on the global self-testing market has been segmented and sub-segmented based on the product, sample, and region.

By Product

- Diagnostic Kits

- Diagnostic Devices

- Diagnostic Strips

By Sample

- Urine

- Blood

- Stools

- Oral Swabs

- Other

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

Frequently Asked Questions

Which are some of significant participants in the self-testing market?

Companies playing a major role in the global self-testing market are ACON Laboratories Inc., ARKRAY Inc., Assure Tech (Hangzhou) Co. Ltd., Becton Dickinson & Company, Bionime Corporation, Roche Holding AG, Quidel Corporation and True Diagnostics Inc.

Which region led the global self-testing market in 2024?

Geographically, the North American was dominant in the global self-testing market in 2024.

How big is the global self-testing market?

The global self-testing market size is growing rapidly and is estimated to be worth USD 12.05 billion by 2033.

What is the growth of the self-testing market?

From 2025 to 2033, the global self-testing market is expected to grow at a CAGR of 5.68%.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2500

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]