Global Seed Coatings Material Market Size, Share, Trends, & Growth Forecast Report, Segmented By Type Polymers (Polymer Gels And Superabsorbent Polymer Gels), Colorants, Pellets And Minerals/Pumice), Application (Cereals & Grains, Fruits & Vegetables, Flowers & Ornamentals And Oilseeds & Pulses) And By Region (North America, Europe, Latin America, Asia-Pacific, Middle East And Africa), Industry Analysis from 2025 to 2033

Global Seed Coatings Material Market Size

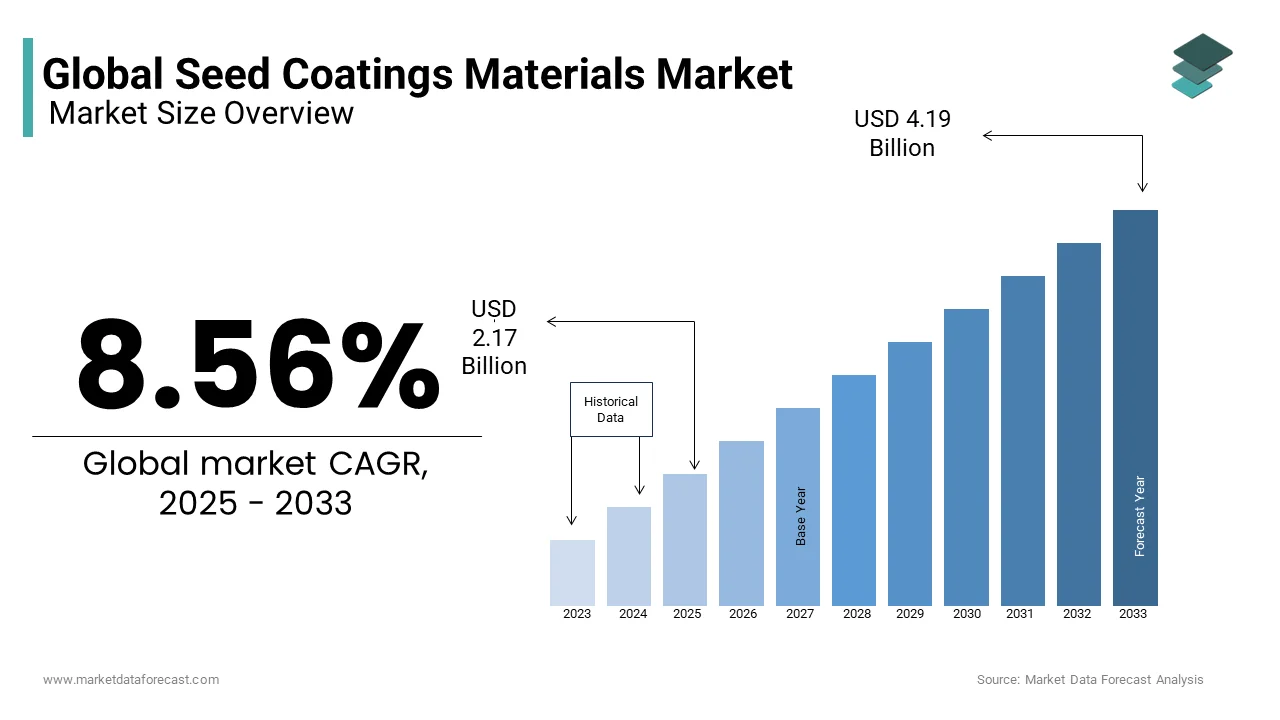

The global seed coatings material market was valued at USD 2 billion in 2024 and is anticipated to reach USD 2.17 billion in 2025 from USD 4.19 billion by 2033, growing at a CAGR of 8.56% during the forecast period from 2025 to 2033.

The seed coatings material market is growing progressively due to the increasing significance of seed technology. Seed coating is the method of coating seeds precisely with several materials such as plant growth regulators, repulsive agents like crop protection chemicals, and fertilizers among many others. The main purpose of seed coating material is to ensure speedy growth and a timely supply of crops at reasonable prices.

Seed coating is the method of coating seeds precisely with several materials such as plant growth regulators, repulsive agents like crop protection chemicals, and fertilizers among many others. The main purpose of seed coating material is to ensure speedy growth and a timely supply of crops at reasonable prices.

CURRENT SCENARIO OF THE GLOBAL SEED COATING MATERIALS MARKET

The seed coatings material market is growing progressively due to the increasing significance of seed technology. The market is also experiencing rising advancements in technology and surging investments in R&D projects. Like, around the world research is being carried out to gain a deeper understanding of the impacts of nanoparticles on the environment and people. The application of these particles in agrochemical items is intended to boost the efficiency and sustainability of farming output by maximising the usage of chemicals and at the same time lowering environmental effects.

Moreover, today’s agricultural landscape prioritises efficiency as essential for tackling the rising global food requirements. Seed coating has become a key innovation, which is greatly improving agricultural sustainability and productivity. Apart from these, North America and Europe are commanding this market owing to their higher adoption rate of technology, innovative products, etc.

MARKET DRIVERS

The seed coatings material market is driven by factors such as the growing demand for coated seeds by innovative agricultural skills, increasing awareness among the farmers about the profitable use of seeds, and the growing need for seed treatment, directing towards an augmented agricultural output. Further, the strive to boost food and agricultural product yields in an environmentally friendly manner has encouraged researchers to investigate the potential of green and sustainable materials for agricultural production. This growing interest is fuelled by the urgent need to resolve the difficulties associated with the rapidly increasing global population and the worsening problem of carbon emissions.

Another key factor propelling the market growth rate is the surging application of precision agriculture to achieve higher crop production. This coating technology improves the seed performance, which results in an improved rate of germination, consistent growth of crops, and higher yield potential. Additionally, the growing population around the globe has created the necessity for the greater production of agricultural crops, which is estimated to fuel the seed coatings material market.

MARKET RESTRAINTS

The presence of microplastics is one of the key issues companies and other stakeholders face in the seed coatings material market. It clogs pores, alters plant growth, contaminates the food chain, etc. Once they enter the environment, degradation of them becomes slow which raises questions about health and ecological concerns. Seed treatment items are used on the seeds together with polymers, few are even regarded as microplastics.

- According to the International Seed Federation (ISF), it is estimated that seed treatments currently account for about 1 per cent of microplastic discharge into the environment, with the agriculture sector aiming for a zero-emission target.

Other factors hindering the growth of this market are restricted usage, such as greater dependence on seed surface, compatibility with active ingredient and dye, and application temperature, which may hamper its growth during the forecast period.

MARKET OPPORTUNITIES

The shift towards microplastic-free seed coatings presents potential opportunities for the expansion of the seed coatings material market. The transition to these substitutes needs regulatory approval, authentication of functionality, and adequate time for development. As per a study published in the MDPI, the meta-analysis of 40 studies regarding the types of plastic polymers distributed in marine environments discovered that 24 several polymer types, with acrylics (PP&A), polypropylene, and polystyrene, polyethylene, the group of polyesters, and polyamides are being the most plentiful. The different incidence of polymer type was noticed. For instance, in the deep sea, PP&A polymers were more common, i.e. 77 per cent.

- As per research published in the New Phytologist Foundation, the reported concentration of microplastic in agricultural soils or land all over the world varies from 0.3 to 26,630 counts per kilogram of soil.

MARKET CHALLENGES

Climate change is one of the biggest challenges decelerating the growth rate of the seed coatings materials market. With global warming on the rise, farming methods or techniques must adjust to fresh obstacles. Weather variation is likely to surge the incidence of droughts, and a bit of land can never be used or suitable for growing crops, which will affect the market growth. Currently, agriculture worldwide is under huge pressure to cultivate sufficient food for the increasing population.

- According to the World Population Prospects under the United Nations, the global population will surge to 9.7 billion in 2050 and 8.5 billion in 2030.

Apart from warmer oceans, unpredictable weather, rising sea levels, and melting ice caps, the implications of climate change will be even more adverse for developing economies in the world. For instance, agriculture or allied industries are extremely important for India as 60 per cent of its population is dependent on them. Additionally, weather variations also affect the quality of seeds which continues to decline year on year basis.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

8.56% |

|

Segments Covered |

Polymers, Colorants, Pellets, Minerals/Pumice and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regions Covered |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Market Leaders Profiled |

Specialty Products Corporation (U.S.), Croda International PLC (U.K.), Precision Laboratories LLC (U.S.), INCOTEC Group BV (The Netherlands), BrettYoung Seeds Limited (Canada), Keystone Aniline Corporation (U.S.), BASF SE (Germany), Clariant AG (Switzerland), Bayer CropScience AG (Germany) and Germains Seed Technology Inc. (U.K). |

SEGMENT ANALYSIS

By Type Insights

Polymers type is further sub-segmented into Polymer Gels and Superabsorbent Polymer Gels. Polymers are used on a big measure owing to their practical qualities, which help in the germination of seeds and improve the speed performance, leading to greater crop yield. In addition, they are integral to seed coating formulations, supplying the adhesion and cohesion qualities vital for achieving uniform seed coverage. Commonly used types under this segment are cellulose derivatives, polyvinyl alcohol (PVA), and polyethylene glycol (PEG).

On the other hand, the superabsorbent polymer (SAP) gel segment is expected to witness swift growth in its market share in the coming years. The use of SAP on land has advantageous outcomes for soil water retention and soil rehabilitation in arid and semi-arid areas, contributing to the expansion of the segment’s market size. However, the high cost of its use is one of the key challenges impeding its market growth.

By Application Insights

Based on application, the market is bifurcated among Cereals & Grains, Fruits & Vegetables, Flowers & Ornamentals, and Oilseeds & Pulses. The seed coating materials market is led by the cereals & grains segment, the demand for cereals and grains is endlessly increasing as it is a vital part of the everyday meal of the rising population.

- As per a meta-analysis published in the MDPI, superabsorbent polymers were mainly used in growing maize, i.e. 27 percent, and wheat, i.e. 39 percent.

REGIONAL ANALYSIS

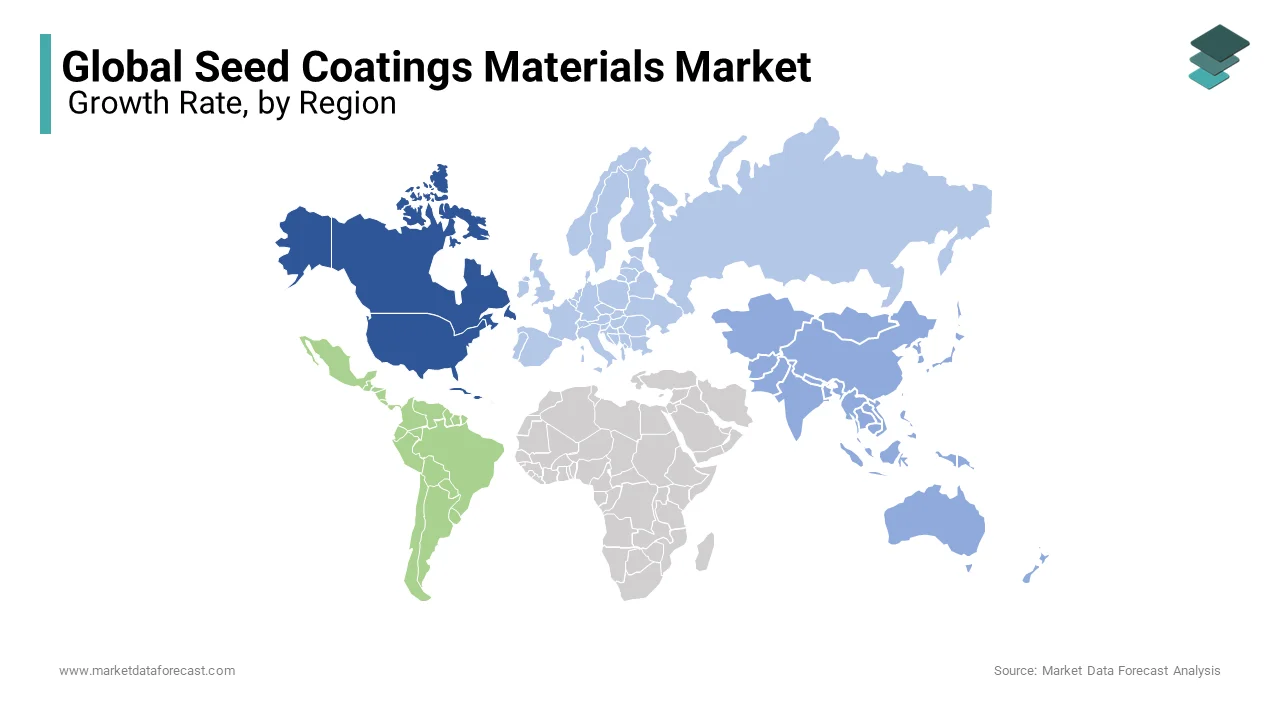

North America is the biggest user in the seed coatings material market and is expected to drive further at a steady growth rate during the forecast period. The United States holds the largest market share.

The seed coating materials are becoming prevalent with seed industrialists in the emerging regions of Asia Pacific and Latin America, mostly due to the increasing demand for treated seeds by the farmers, as an outcome of growing awareness about the aids of treated seeds. Asia Pacific is anticipated to grow rapidly throughout the estimation period for the seed coatings materials market. The market growth of the APAC region is driven by China and India. As per 2023 data, it showed that nearly 1.4 billion mu (1 mu = 1/15 hectare) of crops in China were covered by seed treatments, which contributes 30 percent of the country’s agricultural planting area and 24 percent of the area dedicated to pest control.

Europe holds a distinct position in the seed coatings material market and is expected to remain on the growth course during the forecast period. This can be attributed to its commitment and strict regulation concerning the quality of agricultural products, as well as their environmental impacts. For instance, legislation aimed at restricting or banning the intentional addition of microplastics in seed treatments took effect in this region in October 2023. This allows for a transition period of 5 to 8 years depending on the legal status of the products used. Other regions are beginning to assess similar rules and guidelines and may adopt measures akin to those of the European Union. Such legislation should outline a shifting time period for microplastics incorporated in seed-applied polymers and treatment products.

KEY MARKET PLAYERS

Major companies known in the seed coating materials market include Platform Specialty Products Corporation (U.S.), Croda International PLC (U.K.), Precision Laboratories LLC (U.S.), INCOTEC Group BV (The Netherlands), BrettYoung Seeds Limited (Canada), Keystone Aniline Corporation (U.S.), BASF SE (Germany), Clariant AG (Switzerland), Bayer CropScience AG (Germany) and Germains Seed Technology Inc. (U.K).

RECENT HAPPENINGS IN THIS MARKET

- In July 2024, Bee Vectoring Technologies (BVT), via press release, reported the signing of a research and development contract with Syensqo (2NF.F) (SYENS.BR) to devise and create its proprietary biological control agent Clonostachys rosea strain CR-7 (CR-7) into the treatment formulation of seed for the multi-billion soybean market. Moreover, the agreement with Syensqo is a big expansion of its R&D capabilities. Also, soybeans represent a major business potential for BVT. Further. it projected that around 80 per cent of soybeans in the United States receive a seed treatment before sowing.

- In November 2024, researchers at the Massachusetts Institute of Technology are engaged in the development of unique agricultural technologies like protective seed coatings, microbial fertilizers, and stress-signaling plants to adjust farming to augment food security and climate change.

MARKET SEGMENTATION

This research report on the global seed coatings materials market is segmented and sub-segmented into the following categories.

By Type

- Polymers gels

- Superabsorbent polymers gels

- Colorants

- Pellets

- Minerals/Pumice

By Application

- Cereals and Grains

- Fruits and Vegetables

- Flowers and Ornamentals

- Oilseeds&Pulses

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle-East and Africa

Frequently Asked Questions

Why are seed coating materials important in agriculture?

They enhance germination, protect against pests/diseases, and improve nutrient uptake for higher crop yields.

What drives the growth of the seed coating materials market?

Rising demand for high-yield crops, advanced seed technologies, and increasing adoption of sustainable farming.

What are the main types of seed coating materials?

Polymers (flowability), colorants (identification), binders (adhesion), and fertilizers (nutrients).

How do regulations impact the market?

Compliance with EPA, EU REACH, and FAO guidelines affects product approvals and market expansion.

Who are the key players in the market?

Major companies include BASF, Croda, Clariant, Sensient Technologies, and Bayer AG, focusing on eco-friendly innovations.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2500

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]